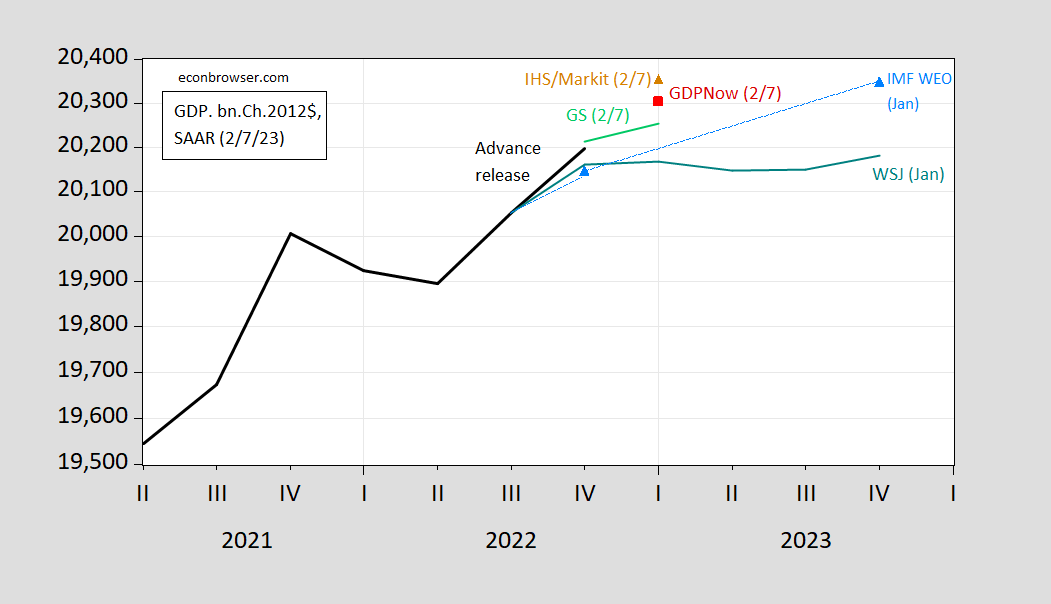

Here are several nowcasts of 2023Q1 GDP, placed against the January WSJ mean forecast and IMF WEO projection of 31 January.

Figure 1: GDP (bold black), GDPNow (red square), IHS Markit/S&P Global (tan triangle), Goldman Sachs (light green line), WSJ January survey mean forecast (green line), IMF WEO projection (sky blue triangles). Source: BEA 2022Q4 advance, Atlanta Fed, IHS-Markit/S&P Global, Goldman Sachs, WSJ January survey, IMF WEO update, and author’s calculations.

These estimates now incorporate the latest available trade data (i.e., for December).

Interestingly there’s quite a dispersion in nowcasts/tracking estimates for Q1 growth, ranging between 0.8% SAAR (GS) and 3.1% (IHS Markit), with GDPNow at 2.1%. IHS Markit baseline is for a mild recession starting at Q1 and recovery at Q3 (so I’d guess they’re saying peak at Q1, trough at Q3). Deutsche Bank baseline is for mild recession in 2023H2, arguing that strong employment growth argues against imminent recession. Jan Hatzius at Goldman Sachs yesterday indicated a recession probability of 25% (versus consensus around 65%) in the next 12 months.

For once my mind went the same place Menzie did. 2%+ seems like a large difference between IHS and GS. Which I guess shows that very reasonable people can disagree, without getting to wild about it. I’ll filter myself on other thoughts/numbers that entered my mind. Consumer expenditure, SAAR, and all that…….. not really relating to now, but anyway……..

*too wild. Can you believe I took college level English classes?? I’ll protect the innocent and not give the names of my teachers.

The beginning of the quarter offers lots of room for imaginative assumptions.

Checking with the Blue Chip survey range at the GDPNow site, IHS is the most disperse in the dispersion. The top-10/bottom-10 Blue Chip range is something like -1.6% to 0.9%. GDPNow was at 0.7% until the latest batch of inputs lifted it to 2.1%. Those inputs were not available when the Blue Chip survey was done, and there may be some upward drift in the general run of forecasts in the next round.

The GDPNow series of estimates ran from 2.6% to 4.4% for Q4, 1.8 ppt wide. For Q3 the range was from 0.3% to 3.1%, also 1.8 ppt wide. The top-10/bottom-10 range from Blue Chip is 2.5 ppt wide. I’m unable to find records of previous quarters’ Blue Chip ranges – I assume the Atlanta Fed has ’em somewhere – but the current range strikes me as fairly normal.

Anyhow, the big rise in ISM’s non-factory index and and auto sales, along with the drop in new claims, fit with other recent economic news – they are what have lifted the latest GDP estimates.

Macroduck: I guess I make a distinction between nowcasts (which are more mechanical) and forecasts as in the Blue Chip (which probably incorporate a lot more subjective judgement). I take the Atlanta Fed GDPNow as one of those bean-counting exercises, much like the IHS Markit and GS tracking estimates. There I find it interesting that these nowcasts, relying on much the same inputs, but different approaches to compiling the data, come to such disparate results.

Agreed.

Bean counting still requires assumptions to make up for missing information, and the difference between the Goldman and IHS bean piles, the result of different assumptions, is notable. The sources of those differences would be informative, if they were available.

Today Neel Kashkari said in an interview that he is pushing for at least 5.4% for the federal funds rate. And how did he come to this conclusion? He says that his measuring stick is the price of his favorite tray of lasagna at the supermarket which went from $16 to $21.

I’m not kidding. The Fed has all these PhDs collecting data and running models but it really just comes down to gut feel and anecdotes by the board members.

And he goes further and says that the reason rates need to go higher is because the rate increases so far haven’t had any effect. Apparently none of those PhDs at the Fed have told him about the 12-month lag on rate increases that the Fed started less than 12 months ago.

The Federal Reserve. They’re all effing monsters.

I’ve made my feelings about Powell pretty clear here. But “They’re all…….. ” ?? I think I would be one of your biggest sympathizers on this train of thought of the readers here on the blog, but, a little extreme there. And when a borderline melodramatist like me calls you extreme, it’s time to recalibrate your internal measuring gauges.

Kashkari is one of the worst in the group. I wouldn’t equate the morality/empathy of the rest of the FOMC with Kashkari—honest I wouldn’t. Even by Fed standards Kashkari is a predatory/amoral animal of a different breed.

I should rephrase what I said there (I’m probably just exacerbating my error), Uhm, sometimes I’m a poor communicator, I am not labeling you extreme Joseph just your words in this particular instance as extreme. I just wanna be clear on that. This will probably frighten you but on many things I find you and me line up the same. But I just wanted to be clear what I was saying.

He needs to learn that the feeling of rumblings in his gut is shi*. [edited MDC] He should listen to the brain.

Looks like Beijing needs a fresh supply of adult diapers:

https://www.politico.com/news/2023/02/07/chinese-defense-minister-u-s-balloon-downing-00081638

I guess they miss the good ol’ days under the orange abomination when the ballons flew over American air space completely unchallenged

https://www.politico.com/news/2023/02/06/military-chinese-spy-balloon-00081371

Rep. Michael Waltz (R-Fla.) said in an interview Monday that the Pentagon told him the military had actually tracked eight such incidents, although the timeframe of those flights was unclear.

“I had a conversation with someone at the Joint Staff that used the number eight,” said Waltz, a member of the House Armed Services Committee, in a Monday interview.

Two of the Trump-era incidents occurred over Florida, and one over Texas, Defense Department officials told Waltz separately by phone on Sunday. Officials declined to provide details about the other incidents, he said, including under whose administration they occurred.

I think Bruce Hall is at some local Michigan watering hole, tearing up, as he tells the bartender he really can’t believe donald trump did nothing about Chinese spy balloons~~and his complete faith in Republican chicken hawks has been broken.