Linda Goldberg and Signe Krogstrup have a revised version of a paper entitled “International Capital Flow Pressures and Global Factors”. They write:

we revisit these issues by recognizing that the observed responses of quantities of capital flows, exchange rates, and domestic monetary policy to global factors are interdependent and in many countries cannot be studied in isolation. In countries with fully flexible exchange

rate regimes, exchange rates move quickly in response to incipient changes in capital flows, supplementing or even obviating the adjustment observable in capital flow volumes (Chari, Stedman and Lundblad, 2021). In contrast, in fixed exchange rate regimes, managed floats, or even in some de jure flexible exchange rate regimes, central banks use policy interventions such as domestic interest rate changes and official foreign exchange interventions to reduce the realized exchange rate response to global factors (Ghosh, Ostry and Qureshi, 2018).1 In such cases, capital flow pressures may show up in foreign exchange interventions or in policy rate changes rather than in exchange rates. Accordingly, viewing capital flow responses to global factors separately from the exchange rate or policy response will provide an incomplete picture of the actual capital flow pressures at play.To account for the interdependencies between capital flows on the one hand, and exchange rate changes, foreign exchange interventions and policy rate changes on the other, we first present a new measure of international capital flow pressures, which is a revamped version of an Exchange Market Pressure (EMP) index. EMP indices are weighted and scaled sums of exchange rate depreciation, official foreign exchange intervention, and policy rate changes. Earlier versions of exchange market pressure indices have been used in a broad range of applications in the literature, from studying balance of payments crises (Eichengreen, Rose and Wyplosz 1994) to monetary policy spillovers (Aizenman, Chinn and Ito 2016b) and classifying exchange rate regimes (Frankel 2019). However, the weighting and scaling of the inputs have problematic features, leading those indices to mischaracterize the patterns of pressures across countries and over time, as discussed more extensively in the Appendix.

Our construction instead derives the relevant weighting and scaling terms within the index through an approach that utilizes key relationships in balance of payments equilibrium, international portfolio demands for foreign assets, and valuation changes on portfolio-related wealth.2 …”

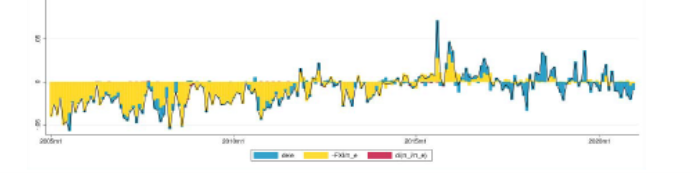

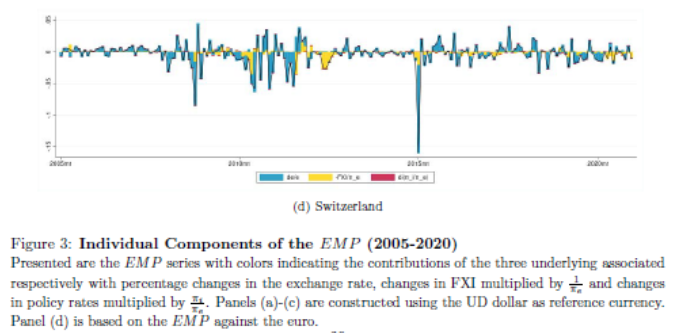

The paper describes in detail the (involved) calculation of their index. Figure 3 in the paper depicts the time series for four countries. I reproduce panel b and d (China and Switzerland, respectively) below.

Source: Goldberg, Krogstrup (2023).

One observation based on their indices:

During the highest stress episodes, countries on average allow more exchange rate variation to absorb capital flow pressures than during normal times and even during otherwise elevated risk sentiment. Some countries might recognize that intervention in the foreign exchange market may not be as effective during periods of extreme stress when currency pressures are large and might entail losing large quantities of official foreign currency reserves, so that they take at least a temporary currency depreciation.

“Foreign exchange intervention accounts for the majority of the EMP that is not attributed to exchange rate movements. The interest rate component accounts for almost all variation for very few countries. The contribution of the interest rate component is most pronounced in countries with high inflation and policy rates that have not been constrained by the effective lower bound and zero lower bound. Central banks in these countries have been able to use the policy rate more actively in response to capital flow pressures. …”

Some contrarian findings regarding safe haven currencies:

“…determinants associated with safe assets found little support in the data, with the size of the public debt and gross foreign positions occasionally and weakly showing significant associations. Financial market development and financial openness changes over time, with country fixed effects in specifications, do not differentiate risk behavior of realized excess returns.”

Some Econbrowser posts on conventional EMPs, and Russia under sanctions, trilemma, managing inflows.

The complexity under study here makes my wee noggin ache. Contrarian findings? There had better be. Foreign exchange markets are rife with contradictions.

I plead ignorance, but I’m willing to hope that a framework like this one, which attempts to capture several moving parts without imposing too many expectations, is going to work out better than an interest rate or PPP or portfolio models.

I’m using up one of my NBER freebies, and its only February. Hope I understand what I read.

You cheated yourself, there was a fed bank “freebie” Menzie was courteous enough and kindly to link. Don’t feel bad, remember I am the king of freebies. I don’t wanna go so far to say I am that guy that grabs 10 free bologna on Ritz cracker “samples” at the grocers and calls it “lunch”—but close to that. I got a Russell Banks book for $1 at a used library book sale this weekend. I almost picked up a James Lee Burke paperback for $1 but it had kind of a lewd neon sign on the cover and I didn’t want the staff at the book sale taking me for a perv or something. Not that I’m not a perv, I just didn’t want them taking me for one.

Plain brown wrapper is among my favorite genres.

: )

“Within the context of a fixed exchange rate regime, the theory-based equivalency formulas take pressures in the form of capital flows, absorbed by foreign exchange interventions conducted to prevent an exchange rate response, and provides the counterfactual exchange rate change that otherwise would have been needed to close the balance of payments gap and prevent the observed intervention flow.”

In other words, the authors got a lucky break, in that fixed exchange-rate regimes provide and easy “all else equal” condition in some markets. Having a variable which, in some real-world cases, doesn’t vary makes estimating the relationship between other variables easier. I think?

“Our evidence about the prevalence of other components in reflecting international capital flow pressures suggests that some empirical analyses based exclusively on observed exchange rate movements may generate results that are both imprecise and subject to attenuation bias, as these miss the fact that many countries respond to currency pressures by intervening in the foreign exchange market or changing the policy rate, in addition to allowing some exchange rate adjustment.”

Swissy is a safe-haven currency *because* the SNB intervenes, just as the SNB is induced to intervene because Swissy is a safe-haven currency.

“Empirically, these features are associated with self-fulling expectations of currency movements based on previous associations between capital flow pressures and risk, as well as interest rate levels, suggesting that carry trade funding currencies tend toward appearing as safe-haven currencies. In contrast, the more traditional macroeconomic determinants typically investigated in the literature are less consistently significant in capturing safe-haven features.”

This seems pretty straightforward. Safe-haven currencies are low-interest-rate currencies, which has two implications. One is that safe-haven countries enjoy low interest rates because of good economc management (or good luck) and so naturally serve as safe havens. The other is that, as risk leads to a withdrawal of credit, money flows back to funding countries. What looks like a flight to safety is a flight from the risk of extending credit. These are two rather different drivers which wouldbe indistinguishable on the surface.

Unless “more traditional macroeconomic determinants” are the very things which hold interest rates down, in which case you can ignore the first implication. “Safe-haven” simply means a funding currency.

SNB was quite the soap opera back in the day, or really not that long ago. I used to have some interesting convo with a blogger named Bruce Krastings about that, who was quite the currency trader back in his day. I can try to find the old links if you’re curious, but it’s not that exciting I guess, you’d probly feel disappointed in the melodrama. But I think some big cheese at SNB got fired over the deal. It was one of those messes weirdo sadists like me get a chuckle out of.

Trump and now his NSA director are denying any knowledge of Chinese spy balloons under their watch?

https://www.dailymail.co.uk/news/article-11718413/Chinese-spy-balloon-John-Bolton-Pentagon-Trump.html

John Bolton says it would be a ‘serious problem’ if Pentagon didn’t tell Trump about Chinese spy balloons: Asks if the Biden administration used a ‘time machine’ to claim Beijing surveillance airships were detected under former President

Bolton is effectively saying he and Trump were asleep at the wheel. Now that is a derelection of duty. Then again maybe DoD did not communicate this to Trump out of fear that the Idiot in Chief would have started WWIII.

Based on the fact it was originally spotted by a “small-time” journalist, who then told a Montana newspaper photographer who made the story then broadly reported, I think intelligent people (or those more neutral minded) can categorize this as a systemic problem with American airspace security and our military, rather than a problem tied to any presidential administration. And that it needs to be fixed instead of making chin music about.

that was beyond my pay grade in the day, now Iam way out of it…..

You know the only thing that makes me believe you might be retired Air Force?? Guys like General Flynn or that 12 year Navy guy wacko, I forgot his name now. Anyone remember??–he’s a former 12 year Navy man who’s a white supremacist fruitcake now?? Maybe I can find it later, I don’t have the energy tonight. You’re a fruitcake dude.

dude, tx

Close. Guess again Iceman. Or is it Rooster?? What’s your favorite Kenny Loggins track while flying sorties?? “Playing With the Boys”?? Abort!!! Abort!!!!

Bunch of hot air. Gassy exhalations. Balloon juice.

Massive job gain? Turkish earthquake? State of the Union Address? Must have missed it. Oh, look! A shiney balloon!

Heh, I mean I hope you know I’m not taking Republicans’ side on this. But I do still think it’s a problem that should be solved. I sure as heck didn’t think President Biden handled it wrong. I think it was the correct move to wait until it was over ocean waters to take it down. But nor do I think the spy balloon is “trivial”. It could even be a Chinese ploy to use as a later excuse for taking down a US space satellite. A bait to play “injured party”. And Beijing is not “above” such a move and then saying it “equates” to the spy balloon strike.

I know. “Balloon juice” was just too tempting.

I’m just actually wondering how many mainland Chinese believe it was a weather balloon. I know mainland Chinese to be very clever folks, but I’ve heard them repeat line-for-line so much propaganda insistently that I’m left to believe they’ll buy all of it.

how objects used to be track over norad airspace, albeit 40 odd years ago.

an airman on a scope, now you call it a X workstation, sees an unknown. even in my day we knew who faa had flight plans….

the bogey is highlighted on a supervisor scope, who could order more target data…..location speed bearing etc.

in rare case an alert fighter could go up. it better be worth the gas!

balloon flight characteristic and reflectivity of material made trouble for surveillance.

balloon air travel data and altitude may not have passed criteria to wake the duty general officer…..

that was as I could see it from a site in the olden day.

Steve Schmidt roasts little Marco Rubio over the latter’s comments on the balloon matter:

https://steveschmidt.substack.com/p/marco-rubio-fears-the-chinese-balloon

Maybe the “decline” Rubio is talking about is evidenced by Rubio talking. Maybe the “decline” that the Chinese were watching was America’s political and media ‘decline.” Maybe they wanted to see the stupidity play out second by second like an MRI scanning a body injected with contrast dye. Maybe they wanted to settle a debate between two factions of American observers and predictors who disagreed on how we would respond. One thing is for sure: whatever side bet on stupid, won big.

The silliness and vapidity of Marco Rubio and his colleagues were certainly exposed by the balloon. They absolutely demonstrated a lack of capacity to measure up in a real crisis. They also demanded a response that will give the Chinese a chance to reciprocate the favor. That happened in 2001, in the months before 9/11. Like now, the event was regarded as a distraction, but was it?

The Western Pacific Ocean would be the battleground for the largest naval action since World War II if the Chinese invade Taiwan. It would mean the Chinese Navy and the US Navy would be engaged in a short, violent confrontation at sea before the matter escalated or calmed. It will not involve balloons, and that is the main point.

Once again, a serious matter has been taken and twisted into kernels of imbecility by an American politician who routinely lies, dissembles and accuses his opponents of being enemies, while treating adversaries with delusion and disregard. Marco Rubio must astound the Chinese government, which can’t imagine that he would be a person who leads a committee on which the most sensitive secrets of the nation are required to be disclosed. No doubt, they won’t be the first to be amazed by the reality that, in America, anything is possible.

Sometimes, politics feels like a reality show. When it does, it’s important to remember that it is, and that on any given day, it’s the dumbest one on TV — by far.

Rubio as the same as Ted Cruz. A man, who after donald trump insults his manhood and his own wife, turns around and kneels in obeisance to the orange one. Rubio has ZERO self-dignity. So exactly what issue would we expect Rubio to take leadership in, after the man pukes on his own shoes??? Rubio also hates his own race, which is rather strange. The man has psychoses on his psychoses.

SNL’s coverage of balloon gate was awesome.

https://news.yahoo.com/china-spy-balloon-turns-bowen-061125870.html

“Americans for Prosperity” (aka the Koch Brothers or America is only for really rich people) has decided it is anyone but Trump:

https://www.huffpost.com/entry/koch-brothers-americans-for-prosperity-turning-page-on-trump_n_63e07077e4b07c0c7e0af61b

Oh well, the party of racists and ultra-elites has been split into.

Off topic, Jobs, Wages, Inflation, Fed Stuff –

The Sahm rule turned negative in January, not only a sign that the U.S. isn’t in recession, but a fair sign we aren’t coming up on one immediately:

https://fred.stlouisfed.org/graph/?g=ZIFH

As often as not, the Sahm index is positive and rising a few months ahead of recession. Falling below zero now fits in with recent doubts about the 2023 recession call. There is growing hope that the Fed will avoid screwing things up. Let us all now bow our heads…

The Fed sounds like it’s still wed to the Phillips curve, even though the crude Phillips curve isn’t working out lately. The brief period in which the curve appeared to be back in business is now looking sort of random:

https://fred.stlouisfed.org/graph/?g=ZIIC

Wages are the link between the tightness of the labor market and inflation in Phillips curve thinking, and wages (average hourly earnings) aren’t behaving according to the model, either:

https://fred.stlouisfed.org/graph/?g=ZIRT

The composition of labor demand is an obvous reason for the weirdness of wages:

https://fred.stlouisfed.org/graph/?g=ZIN3

The big winners from the recession and from Fed rate cuts tended to be more highly paid, and are suffering job cuts. The big winners from the recovery, vastly more numerous, are less well paid and are gaining jobs rapidly. Broad averages are deceiving in this situation.

The Phillips curve was a poor guide to inflation forecasting prior to the pandemic. It’s proving to be a poor guide after the pandemic. The Phillips curve and backward-looking (12-month) inflation averages have been a large part of the Fed’s argument for rapid rate hikes. Neither is justifiable.

A recent addition to the argument for rate hikes is that prices of core services are rising faster than inflation overall. Core services are also the greatest source of job growth, which means this new Fed story may be a Phillips curve argument. So now, the Fed is arguing for rate hikes based on a sectoral Phillips curve?

A particular problem in basing an argument for continued rate hikes on core services prices is that housing is a very large component of that aggregate. Remove rent of shelter from core services CPI and disinflation rears its pretty head:

https://fred.stlouisfed.org/graph/?g=ZIPv

Powell is grasping for hawkish arguments. The deceleration in rate hikes suggests the Fed is nearly done, and that’s what’s priced into markets. Letus all now bow our heads…

“The big winners from the recovery, vastly more numerous, are less well paid and are gaining jobs rapidly. Broad averages are deceiving in this situation.” Yes, more jobs at lower real wages.

Economists at the Dallas Fed who have actually studied the situation in some detail have different findings: “Despite the stronger wage growth due to the tightness of the labor market, a majority of workers are finding their wages falling even further behind inflation. For workers who experienced a decline in their real wage in second quarter 2022, the median decline was 8.6 percent.

While the past 25 years have witnessed episodes that show either a greater incidence or larger magnitude of real wage declines, the current time period is unparalleled in terms of the challenge employed workers face.”

https://www.dallasfed.org/research/economics/2022/1004

If Corporate America won’t raise real wages in tight market like we’re experiencing, will they ever? Probably not…which makes real wage gains during a period of disinflation more important than ever.

Johnny? Johnny, they don’t have “different findings”. They were studying a different issue.

I understand that this is the best you can do, misconstruing what others have written in an effort to score sad little debating points. Maybe, though – think about it – maybe, if you stop trying to score sad little debating points, you’d stop making such silly mistakes.

Jonny boy once again reads a headline and that’s it. Which is why he decided to write:

“If Corporate America won’t raise real wages in tight market like we’re experiencing, will they ever?”

But wait – the authors did write:

‘Because we cannot follow individuals for longer than a year, our analysis does not allow us to say anything about the nature of real wage growth over workers’ careers.’

So their research is not capable of ascertaining what Jonny boy thinks it implies.

“JohnH

February 7, 2023 at 5:51 am

Yeah, I realize that real wages for average Americans don’t carry much weight in your thinking or in macroeconomic policy discussions in general.”

This kind of dishonest BS is why no one gives a damn what Jonny boy has to say. Macroduck’s progressives creds are far superior to yours. And I have actually written on things like monopsony power publishing one of my pieces in the Journal of Labor Economics.

So tell us Jonny boy – WTF have you published on this topic? Cliff Notes version for a Dr. Seuss book does not count.

Listen dude – everytime you try to claim smarter people than you do not care for workers – all you accomplish is to show you are dumber than a dead rock.

Yeah, I realize that real wages for average Americans don’t carry much weight in your thinking or in macroeconomic policy discussions in general.

Maybe it’s time to start factoring in the prosperity of average Americans and not just the welfare of stock market investors who benefit enormously from lower interest rates. Of course, others prosper when GDP grows, but once again it is the wealthy and very affluent who siphon off most of the benefit of that growth.

Yes, I am guilty of raising a different, but related issue…one that needs to be addressed but is mostly ignored.

No, Johnny, you don’t “realize” what I or anyone else thinks. That’s just one of your cheap tricks. You pretend o know what economists think, pretend to know what other commeters think. You attack strawmen. You assign views to people at your own convenience.

You have neither the courage nor the intellect to deal with actual ideas.

‘one that needs to be addressed but is mostly ignored.’

No clown – there is all sorts of smart people writing on these topics. OK you are too dumb and lazy to realize that. But please pay attention to the other 3 year olds in your play school and try to understand why they are all laughing at you.

“You have neither the courage nor the intellect to deal with actual ideas.” Yep Macroduck has Jonny boy’s stunts down to a tee.

Jonny boy says the issue of real wages needs to be addressed. Everyone may agree with that but everyone with a brain (which excludes Jonny boy) also knows addressing an issue requires actually understanding the issue. And it is very, very clear that Jonny boy knows even less about labor economics than a retarded rock.

Now I shudder if we had village idiots like Jonny boy (or those clowns who worked for Trump) acting like they gave a damn about workers. Their incompetence would very likely lead to a steep decline in real wages. Sort of like we had in the UK under Cameron – who just happens to be Jonny boy’s hero. Go figure!

No, MacroDucky, I cannot know what you think. But I do observe what you write about and what interests you…and it sure isn’t the prosperity and wellbeing of average Americans.

Let’s quickly dispense with the nonsense that a rising tide lifts all boat That silly notion has been soundly disproven: https://www.epi.org/publication/inequality-2021-ssa-data/

In fact a growing economy has primarily been lifting all yachts…for decades.

Kudos to the precious few economists, like Saez, Zucman, and Gould, who do write about inequality and try to call Americans’ attention to the problem. They are anomalies in a world dominated by business-friendly economists.

“Kudos to the precious few economists, like Saez, Zucman, and Gould, who do write about inequality and try to call Americans’ attention to the problem. They are anomalies in a world dominated by business-friendly economists.”

Jonny boy thinks he is schooling Macroduck. Of course Jonny boy does not know the difference between the tax code (Saez Zucman etc) and labor economics. If Jonny boy had any real interest in labor economics, he would be reading this:

Contemporary Labor Economics, 12th Edition

By Campbell McConnell, Stanley Brue and David Macpherson© 2021

I read the first edition which came out in 1986. An excellent discussion of labor economics at the time. Every 3 years ago this leading class text is updated. Also the first two authors have passed away but I got to meet David Macpherson years ago. First rate economist who I’m sure if working on the 13th edition.

But I guarantee you Jonny boy has never read a single page of any of these editions. If he had – he would not be writing his usual BS. Now maybe Jonny boy should start reading so he might send David (who lives in Dublin Ireland) some of his concerns for the 13th edition. I’m sure David will have a hearty laugh at the idiotic garbage comes up with.

Jonny boy now cites an interesting EPI discussion that begins with

Rising wage inequality and slow and uneven growth in real (inflation-adjusted) hourly wages for the vast majority of workers have been defining features of the U.S. labor market for most of the last 40 or so years. In only about 10 years since 1979 did most workers see any consistent positive wage growth: in the tight labor market of the late 1990s and in the five years leading up to the pre-pandemic labor market peak in 2019 (Gould 2020). Some low-wage workers have experienced disproportionate wage gains in the current business cycle—gains that even beat out high inflation (Gould and Kandra 2022). However, the latest data on annual earnings from the Social Security Administration (SSA 2022a) show that the very top continues to pull away and amass a larger share of the earnings pie, while the bottom 90% continues to fall further behind.

Yea this has been noticed by a LOT of economists. Jonny boy clearly has not been paying attention. What’s new? Now Jonny boy pulls some quote from Jamie Galbraith over corporate profits and inflation where Jamie did not do the research – Josh Bivens did. Of course Jonny boy could not be bothered to read how Bivens read the data he compiled. On that particular issue – Bivens noted the past couple of year were very different from the previous 20 years.

But on the issue EPI is noting – which is a different issue – the past couple of years is similar to the previous 20 years.

Of course Jonny boy cannot grasp these differences as he just babbles incoherently from this soap box on topics he never understood.

No worries, NPR can take any story positive for Biden and the Democrats and turn it into “The Hellish Bird Flu Apocalypse Will Be Here Tomorrow Afternoon”

https://www.npr.org/sections/health-shots/2023/02/05/1153434486/eggs-prices-drop-but-the-threat-from-avian-flu-isnt-over-yet “Oh God!!!! Oh God!!!! The Humanity!!!”

[ insert stock video footage of the Hindenburg landing and the blow up of planet Alderaan here ]

Unfortunately NPR’s corporate wolves in liberal clothes staff don’t mind spreading panic for website clicks, when it hurts the Democrat party. NPR snob accent douches didn’t get the memo that mainstream economists like Carl Walsh will carry Jerome Powell’s lunch tray and pull back Jerome’s seat at the lunch table, no matter if Georgetown Jerome takes a machete to American economic growth and American jobs. “He’s doing the mandate!!!” “He’s doing the mandate!!!!” repeat in monotone voice like you’ve been assimilated into the Fed Jobs Cronyism Borg from the womb.

“The wholesale price of a dozen eggs in the Midwest market dropped by 58 cents to $3.29 a dozen at the end of January, according to USDA data.”

I walked into my neighborhood grocery yesterday and saw the Brooklyn retail price had finally dropped below $5 a dozen for the 1st time in months. I literally started dancing!

Good chance I will go grocery shopping at the tail end of this week (or what I call my “bi-weekly Willie Soke alcohol run”). You can bet I will keep my receipt and report here on the blog what 12 eggs cost me. Gasoline is $2.88 here at the moment. Hoping it will hold there ’til I refuel.

One earthquake is not like another and Turkey’s economy today is not like Turkey’s economy in 1999. That said, the 1999 quake seems a likely cause of the slump in 1999, since the rest of the world didn’t have one:

https://fred.stlouisfed.org/graph/?g=ZJ5L

I haven’t seen any reports of a tsunami, which is good news relative to 1999. No telling whether Turkey’s plates have settle in to a stable configuration or will slip again soon. Turkey’s economy was in bad shape already ahead of today’s quakes.

Turkish inflation had been easing. The quake likely put an end to that due to destruction of productive capacity (supply), destruction of goods and property (demand) and a slide in the lira (import prices).

Turkey’s elections are being touted as the most important for the world this year and the quakes are likely to influence the outcome , how, I cannot say.

Turkey is full of infrastructure that will fail during relatively large earthquakes. The designs are fine. The construction quality control, along with shoddy workmanship, results in large death tolls. Similar outcomes play out throughout the region. These large earthquakes remind folks that investment is risky in turkey. Istanbul is a major catastrophe waiting to happen. I feel bad for the people suffering there. Negligence is contributing to their pain, unfortunately.

This headline was inevitable:

https://www.google.com/amp/s/www.wral.com/amp/bank-of-america-ceo-were-preparing-for-possible-us-debt-default/20706618/

It’s disappointing, though not really shocking, that the CEO of a globally important financial institution thinks the debt ceiling is enshrined in the Constitution. Asked about eliminating the debt ceiling, he said:

“I would be careful about trying to restructure the US Constitution.”

The lords of capitalism strive ever so mightily to seem more than they are. It was apparently Elizabeth Bowen who first described someone as “the stupid person’s idea of a clever person” – Aldous Huxley was her target and she modified her accusation kindly. No need for modification in this case.

https://www.theguardian.com/technology/2023/feb/06/google-releases-its-own-ai-chatbot-bard-after-success-of-chatgpt

Google is releasing its own artificial intelligence chatbot, called Bard, in response to the huge success of the Microsoft-backed ChatGPT. The company is also adding the technology behind Bard to the Google search engine to enable complex queries – such as whether the guitar or piano are easier to learn – to be distilled into digestible answers. Bard will be released to specialist product testers on Monday and will then be made more widely available to the public in the coming weeks, Google says. Like ChatGPT, Bard is powered by a so-called large language model – in Google’s case called LaMDA. Large language AI models such as LaMDA and the one behind ChatGPT are types of neural network – which mimic the underlying architecture of the brain in computer form – that are fed huge amounts of text in order to be taught how to generate plausible responses to text-based prompts.

I tried ChatGPT by asking it a query on some topic I was trying to write on. It spit out some high sounding BS which got just about every aspect of the issue wrong. But hey – it was a lot more coherent than your standard Princeton Steve blog post.

“It spit out some high sounding BS which got just about every aspect of the issue wrong…” Obviously pgl has been copying his responses from ChatGPT and pasting them here for a long time.

This from Johnny, who never met a subject he couldn’t get wrong?

Jonny boy never got past ChatGPT version 1.0.

I bet if Bard was asked about the alleged role of profits and real wages since the pandemic, Bard would be smart enough to actually READ what Josh Bivens said about the data he presented. It seems Jonny boy notes the data never have read what Bivens said about his own presentation of the data. So yea this new AI machine is way smarter than Jonny boy. But you knew that already.

Can I get this Bard thing to make me sound incredibly ad lib style witty and old school “Silent Generation” traditional while I’m blog commenting while drunk?? If not, I’ve lost interest.

https://www.texastribune.org/2023/01/20/texas-legislature-china-land-ownership/

texas republicans want to ban Chinese residents from purchasing property. this racist behavior in texas should scare all of you. this is bad. even green card holders would be subject to the law as proposed. really, is this America today? the texas gop still lives with a segregated world view. ltr, this is an example of racism.

Texas is infamous for blatant racism.

https://artandseek.org/2021/09/27/is-this-controversial-history-of-segregation-in-dallas-still-relevant/

The Accommodation is Jim Schutze’s landmark history of racial segregation in Dallas. A new edition comes out today from Deep Vellum. The book was first released in 1987, but the original publisher decided, at the last minute, not to bring it out, and when the book was finally made public, sales were poor. Despite being a pioneering treatment of racial politics in Dallas history, The Accommodation more or less disappeared. Schutze lays out how the city’s powerful white establishment worked for decades to keep segregation in place, long after it was illegal — and long after the 1951 bombings of Black-owned homes in South Dallas had stopped. It was those bombings, Schutze argues, that led to other, less violent-but-still-effective methods to push Black homeowners into designated neighborhoods, to keep Black children out of the Dallas public school system. Such efforts continued as that same establishment made the occasional gesture toward advancing civil rights in an ‘accommodation’ with more conservative Black leaders.

“Gov. Greg Abbott said this week that he would sign a proposed bill banning citizens and foreign entities from four countries, including China, from buying Texas land.”

OK – if he wants his rich fat cat friends to lose property values….

‘Filed in November by Brenham Republican Sen. Lois Kolkhorst, Senate Bill 147 would ban citizens, governments and entities from China, Iran, North Korea and Russia from purchasing land here, part of what she and other Republicans have said will help stem foreign influence in Texas.’

As bad as Xi is – his influence would be far better than that of their junior Senator.

I’m actually not against this law. People who are landowners need “skin in the game” of the country they are located. There’s too much negative influence. I’m too lazy to go hunting down 20-30 links verifying my point. They are easy to find but I get tired of playing internet gofer because nobody reads anymore. So I’ll just give you the “prime example” of what happens when foreigners are handed land and property with no thought process:

https://newrepublic.com/article/143586/trumps-russian-laundromat-trump-tower-luxury-high-rises-dirty-money-international-crime-syndicate

And I should say I was toying with the idea of buying an apartment “house” in China for awhile (Yeah, give me “dumb guy of the decade” award) so in fact I am sympathetic to the idea of foreigners buying land. But I had different reasons than most of these folks do. And it just doesn’t make sense to hand over domestic land to your nation’s ill-willed enemies, it just doesn’t. Sorry.

as written, the law would forbid green card holders. that is not right. the next step in texas will be to make sure that mexicans cannot own land. see where this is headed? soon even legal immigrants from mexico will be banned from owning land. mostly so that a few uptight texans can sleep better at night knowing their state is not going to change due to the influx of latinos. the law was written to deny green card holders the right. that was not done by accident. it was a warning shot of what is to come.

@ baffling

I see your point. Maybe the line to draw would be the size and value of a property?? That is kind of how I might approach it from a middle ground standpoint if there was an insane enough electoral district to put me in.

I just find it fascinating that a state could legally ban from property ownership a person who is legally allowed to live and work in this country full time. today texas will go after green card owners. tomorrow they will go after naturalized citizens. republicans are actively assaulting immigrants from around the world. it is a racist world view.