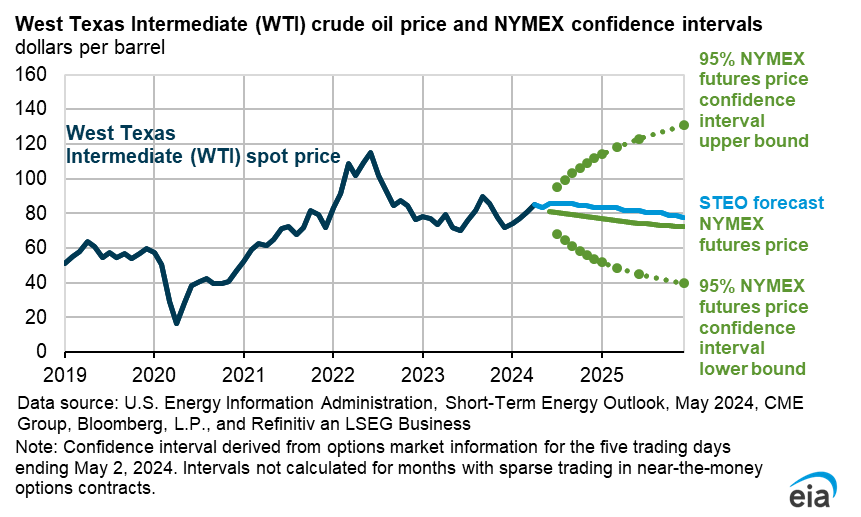

From EIA (May 7, 2024):

Source: EIA, STEO (May 2024).

Note that the forecast is slightly above futures. See Chinn and Coibion (2014) on oil futures forecasting performance.

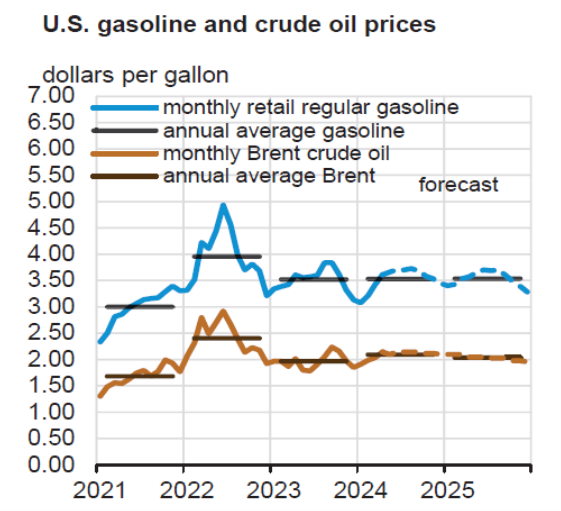

Here’s the gasoline forecast:

Source: EIA, STEO (May 2024).

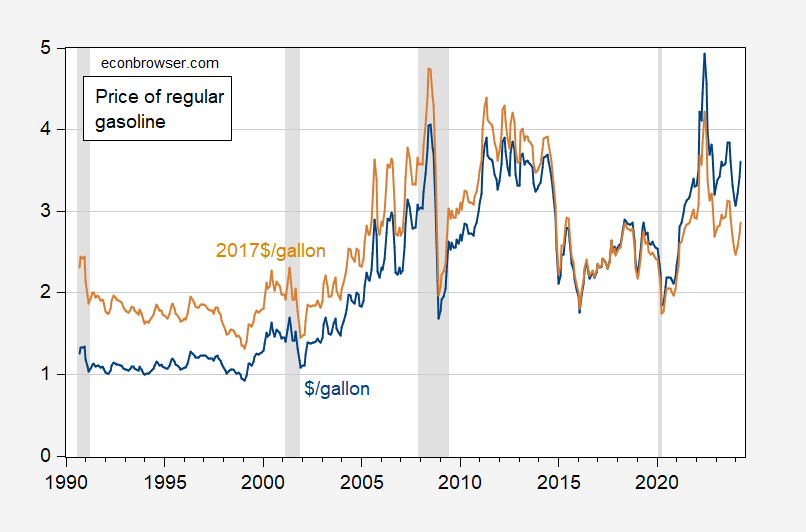

For context, here’s regular gasoline prices (nominal, real) in the US:

Figure 1: Price of regular gasoline in $/gallon (blue), and in 2017$/gallon (tan). Relative price calculated by dividing gasoline price by core CPI; April core CPI based on Cleveland Fed nowcast of 5/8/2024. NBER defined peak-to-trough recession dates shaded gray. Source: EIA, BLS, via FRED, Cleveland Fed, NBER, and author’s calculations.

Since the topic is energy, I am a bit concerned about energy inflation for April 2024. It looks like the M/M % change could be as much as 2.8% using a model with seasonally adjusted FRED series: GASREGW_d11(EViews nomenclature).

A simple model using dlog(cpiengsl) c dlog(gasregw_d11) AR(1) MA(1) indicates that about 61% of the increase in the percentage change in gasregw_d11 flows through to FRED energy inflation series: CPIENGSL. The monthly % change in gasregw_d11 for April was 4.6%. Below shows comparison of reported and forecasted CPIENGSL M/M 5 changes.

*************CPI Energy****

*********Reported**Forecast

2023M08***** 4.3**** 4.6

2023M09***** 1.1**** 1.5

2023M10***** -2.2*** -2.4

2023M11***** -1.6*** -2.6

2023M12***** -0.2*** -0.1

2024M01***** -0.9*** -1.2

2024M02***** 2.2**** 2.2

2024M03***** 1.1**** 1.1

2024M04***** ****** 2.8

Prices have been kept remarkably close to where we need them ($70-90). These price levels are supporting a reasonably fast transition to alternative energy. China seem to be making that shift faster than anybody – but they have strong national security interests at stake. For global warming it doesn’t matter what country takes the biggest % of new alternative sources. More important is that the alternatives keep growing every year at a fast pace.

In thinking about the shift, you would expect the United States to be going all in on alternative sources of energy. Those technologies are going to spin off into other uses, no doubt, and build powerful industries in whatever country gets a jump on them. Why would a country like the US hand the lead to a rival like China without even thinking about it for a moment?

In hindsight we will look back a Reagan pulling the solar panels off the White House roof, as the beginning of the strategic error that began the downslide of US super power status. Nobody ever questioned that energy is at the center of all societal progress and economic growth. However, we allowed a greedy and short term thinking oil industry to put us behind rather than in front of the pack chasing the future. Many wars and huge sums of US money got wasted on trying to secure oil deliveries, rather than develop independence of foreign oil (and securing supply chains for resources needed to make us oil independent).

The big arguments in favor of alternative energy are: 1) unlimited domestic supply, 2) potential “free” energy (after the hardware has been produced and deployed), 3) no green house gas release. Although I agree the last is the most important, it has been a huge strategic mistake to exclusively focus on that issue, because the first two have clear appeal to right wing and business interests. We allowed the oil industry to push their agenda into the culture war when the whole thing could easily fit into a narrative of “isolationist independence/energy security/low cost harvesting” that hits all the right wing buttons.

MTG humiliated after effort to oust Mike Johnson spectacularly fails

https://www.msn.com/en-us/news/politics/mtg-humiliated-after-effort-to-oust-mike-johnson-spectacularly-fails/ar-BB1m3HC0?ocid=msedgdhp&pc=U531&cvid=664c9fedcc694dd585c2ccda1bc4f563&ei=8

Marjorie Taylor Greene’s bid to oust Speaker Mike Johnson failed roundly, with only 43 House members voting to move it forward. A vote to ‘table’ or kill, the motion succeeded 359 to 43, with only 11 Republicans voting to move forward with booting the speaker. Only thirty-two Democrats voted against the effort to move the motion forward, a spectacular reversal from months ago when all Democrats voted with eight Republicans to kick out Speaker Kevin McCarthy. The Georgia Republican had been met with boos and eye rolls as she called up her motion during votes on Wednesday. Members of the GOP accused her of throwing a ‘tantrum’ and attention-seeking as she brought her motion to vacate to the House floor on Wednesday night.

OK – this will have no impact on the price of gasoline but it did make me laugh out loud!

My region of the country is spoiled (lucky) by comparison to the rest of the U.S. on gasoline prices. Got it for $2.97 a gallon around 4pm today. Random data point for whoever.

Did I get this right? The OK state tax on gasoline is only 19 cents per gallon? California gets 63 cents per gallon.

Oh well your team is doing better in the playoffs than any Cali team and SGA is really good.

But HOW do “we” OKlahoma, spend the state Money?? ~~~I don’t know the answer, but I highly suspect, not in such a good way as Cali.

I do know how NJ spent the money under Krispie Kreme Chris Christie. Yea he kept state gasoline taxes low until he got his tax for rich people and so underfunded road repairs that even Republicans were upset given the damages to their cars. But Christie did abuse MTA money to make up the difference which is why the NYC subway system began to suck.

And Krispie Kreme wants to run the Federal budgets? No thank you.

Trump Media’s audit firm barred from SEC practice over ‘massive fraud’

The company and owner Benjamin Borgers have agreed to pay a combined $14 million to settle the SEC charges.

https://www.politico.com/news/2024/05/03/trump-media-audit-firm-sec-settlement-00155950

The Securities and Exchange Commission has barred the accounting firm for former President Donald Trump’s social media venture from practice for “deliberate and systemic failures” to comply with U.S. audit standards on more than 1,500 filings by hundreds of firms, the agency said Friday. In what the SEC called a “massive fraud,” BF Borgers allegedly skirted accounting standards for more than two years while working on the audits and reviews of public companies, according to the SEC. The Lakewood, Colorado-based firm said it represents businesses around the world, including Trump Media & Technology Group. The company and owner Benjamin Borgers have agreed to pay a combined $14 million to settle the SEC charges. Both the firm and Borgers have been permanently suspended from practicing before the SEC as accountants, effective immediately, the regulator said. “Ben Borgers and his audit firm, BF Borgers, were responsible for one of the largest wholesale failures by gatekeepers in our financial markets,” SEC Enforcement Director Gurbir Grewal said in a statement. “They not only put investors and markets at risk by causing public companies to incorporate noncompliant audits and reviews into more than 1,500 filings with the Commission, but also undermined trust and confidence in our markets.” BF Borgers did not immediately respond to requests for comment. Shannon Devine, a spokesperson for Trump Media, said in a statement that the company “looks forward to working with new auditing partners in accordance with today’s SEC order.” BF Borgers has been Trump Media’s auditor since 2022, according to a company filing.

OK – Trump Media needs another set of sleazeball accountants to lie for them. Wait – didn’t Princeton Steve claim he worked for an accounting firm at some point. He’d be perfect for this assignment!

Whoever Trump chose make sure not to invest in any company they also audit. You know that anybody he use will be ready and willing to cook the books for the big daddies, and cook the goose of investors.

Only a fool would own Trump Media stock. Apparently there a lot of fools as the stock price is hovering near $50 a share.

Trump Media & Technology Group Corp. (NASDAQ: DJT) (“TMTG” or the “Company”) today announced the appointment of Semple, Marchal & Cooper, LLP (“SMC”) as its independent registered public accounting firm, effective May 4, 2024.

I have never heard of Semple, Marchal & Cooper.

I think Trump is stuck not being allowed to sell for the first 6 months. At that point I am sure he will unload and take some if not all the money. I would not bet against the ability of Trump to con the rubes and leave them holding the bag. At this point he can get them to stay by simply pointing to “all the liberals want you to sell”. It doesn’t get any easier than that.

Semple, Marchal & Cooper is affiliated with 2nd tier accounting firm BDO.

“Those who know, avoid BDO”!

I think a more interesting topic would be the banning of Pioneer founder Scott Sheffield from the board of Exxon. He is accused of ‘collusion’ with OPEC, which on the face of it is odd. Pioneer’s oil production is only 0.7% of the global total, and only 3% of global output even including that of Exxon. Not too often 3% of the market can dictate prices. Nevertheless, US shales set the marginal price from 2014 through 2021, but no longer.

How would an economist think about the FTC’s position?

https://www.ftc.gov/news-events/news/press-releases/2024/05/ftc-order-bans-former-pioneer-ceo-exxon-board-seat-exxon-pioneer-deal

Now why would your little story be more interesting than our host’s blog post? Cause the most incompetent consultant ever said so??

But OK, I’ll bite:

“The proposed consent order seeks to prevent Pioneer’s Sheffield from engaging in collusive activity that would potentially raise crude oil prices, leading American consumers and businesses to pay higher prices for gasoline, diesel fuel, heating oil and jet fuel.”

I guess little Stevie does not mind collusive activity as little Stevie wants his forecast of much higher oil prices to become a reality. Dude – your knowledge of basic industrial organization is even worse than your understanding of basic macroeconomics or even international law.

CNN tells the story that the world’s worst oil consultant forgot to tell us:

https://www.cnn.com/2024/05/02/energy/oil-ceo-opec-scott-sheffield/index.html

Scott Sheffield, founder and longtime CEO of a leading American oil producer, attempted to collude with OPEC and its allies to inflate prices, federal regulators alleged on Thursday. The Federal Trade Commission said Sheffield, then CEO of Pioneer Natural Resources, exchanged hundreds of text messages discussing pricing, production and oil market dynamics with officials at the Organization of the Petroleum Exporting Countries, or OPEC, the oil cartel led by Saudi Arabia. Regulators say Sheffield used WhatsApp conversations, in-person meetings and public statements to try to “align oil production” in the Permian Basin in Texas with that of OPEC and OPEC+, the wider group that includes Russia. “Mr. Sheffield’s communications were designed to pad Pioneer’s bottom line — as well as those of oil companies in OPEC and OPEC+ member states — at the expense of US households and businesses,” the FTC complaint said. Unlike with OPEC nations, US oil production is supposed to be decided by the free market, not by coordination among the major players. Sheffield retired in December 2023 as CEO of Pioneer. The company he founded is the biggest producer in the Permian Basin, the abundant oil field that has helped make the US the world’s top producer of oil and gas. The FTC gave the green light on Thursday for Pioneer to be sold to ExxonMobil for $60 billion — but only under an agreement that prevents Sheffield from sitting on Exxon’s board or serving as an adviser.

I have suggested little Stevie has been less than honest before but DAMN!

https://www.ftc.gov/system/files/ftc_gov/pdf/2410004exxonpioneercomplaintredacted.pdf

COMPLAINT

Pursuant to the provisions of the Federal Trade Commission Act (“FTC Act”), and by virtue of the authority vested in it by the FTC Act, the Federal Trade Commission (“Commission”), having reason to believe that Exxon Mobil Corporation (“Exxon”) has executed an Agreement and Plan of Merger (the “Merger Agreement”) to acquire Pioneer Natural Resources Company (“Pioneer”), with Exxon remaining the surviving entity (the “Proposed Acquisition”) in violation of Section 5 of the FTC Act, 15 U.S.C. § 45, which if consummated would violate Section 7 of the Clayton Act, as amended, and Section 5 of the FTC

Act, 15 U.S.C. § 45, and it appearing to the Commission that a proceeding by it in respect thereof would be in the public interest, hereby issues its Complaint, stating its charges as follows:

NATURE OF THE CASE

1. Through public statements and private communications, Pioneer founder and former CEO Scott D. Sheffield has campaigned to organize anticompetitive coordinated output reductions between and among U.S. crude oil producers, and others, including the Organization of Petroleum Exporting Countries (“OPEC”), and a related cartel of other oil-producing countries known as OPEC+. Mr. Sheffield’s communications were designed to pad Pioneer’s

bottom line—as well as those of oil companies in OPEC and OPEC+ member states—at the expense of U.S. households and businesses.

Read the rest – The FTC made its case quite well.

This corresponds to my view:

https://www.wsj.com/articles/federal-trade-commission-scott-sheffield-pioneer-exxon-mobil-opec-lina-khan-cbfaeba4?mod=hp_opin_pos_5#cxrecs_s

The FTC Smears Scott Sheffield

Lina Khan’s agency trashes an oil executive on dubious evidence.

Seriously? Oh right – blatant price fixing is OK by little Stevie. Hey Stevie – since you fancy yourself some big hot shot when it comes to the law – offer Sheffield your legal services. This should be a laugh.

I bet you will also defend how Trump asked Exxon et al. for $1 billion to undermine climate change. You are definitely that kind of person.

The FTC Move Against Scott Sheffield Goes Too Far

https://www.forbes.com/sites/michaellynch/2024/05/03/the-ftc-move-against-scott-sheffield-goes-too-far/

Gee Michael Lynch defends Scott Sheffield with the same neat trick used by Princeton Steve and the WSJ. Ignoring the facts. Then again Stevie has to coddle up to the interests of Big Oil to have any consulting fees (for worthless analysis) so defending blatant violations of the anti-trust laws is no surprise.

Liz Hoffman of Semafor Business gets it:

https://www.semafor.com/newsletter/05/02/2024/ftc-plans-to-recommend-possible-criminal-case-against-ex-pioneer-ceo

Scott Sheffield has spent the past five years shouting from the rooftops that companies like the one he used to run, the Texas shale driller Pioneer, needed to stop drilling so many wells. The industry spent itself into ruin in the early 2010s. It was great for the US economy, which enjoyed cheap energy and became a net exporter for the first time since the 1950s. It was terrible for investors, who shouldered billions of dollars of capital expenditures with little to show for it.

“All the shareholders that I’ve talked to said that if anybody goes back to growth, they will punish those companies,” Sheffield said in 2021. When pushed to increase production after Russia invaded Ukraine, he said “we’d have to go to our shareholder base and ask what their thoughts are.” And when a White House official criticized the industry as “un-American,” Sheffield defended it in starkly capitalist terms: “If we end up doing what he’s asking us to do, we’ll end up back at the bottom of the S&P 500,” he said.

Sheffield now faces a potentially criminal case for saying those things privately, to his competitors. Context is everything, and it’s not hard to see how a singular focus on profits — not unique for any CEO, or any industry, but particularly acute among wound-licking wildcatters over the past few years — looks very different to Sheffield than it does to Lina Khan.

It seems Semple, Marchal & Cooper is listed as the 15th largest audit firm in the Phoenix area. Given Phoenix is not exactly a large city, it seems Trump Media once again reached to the bottom of the barrel to be their financial auditors.