Goldman Sachs (Hatzius et al., May 24):

Ongoing rate hikes are likely to tighten financial conditions, at least gradually, and we expect growth to slow to a trend pace through 2019 even with fiscal stimulus still helping. From 2020, when the fiscal impulse ends, the risk of recession looks set to rise, but the lack of cyclical excesses in borrowing and spending suggest that an outright contraction is far from a foregone conclusion—so long as Fed officials manage to prevent a big overheating.

When I first read of this comment, I was dubious. Then I remembered we were already halfway through 2018, and so only a year and a half remains before 2020… and the yield curve looks like this:

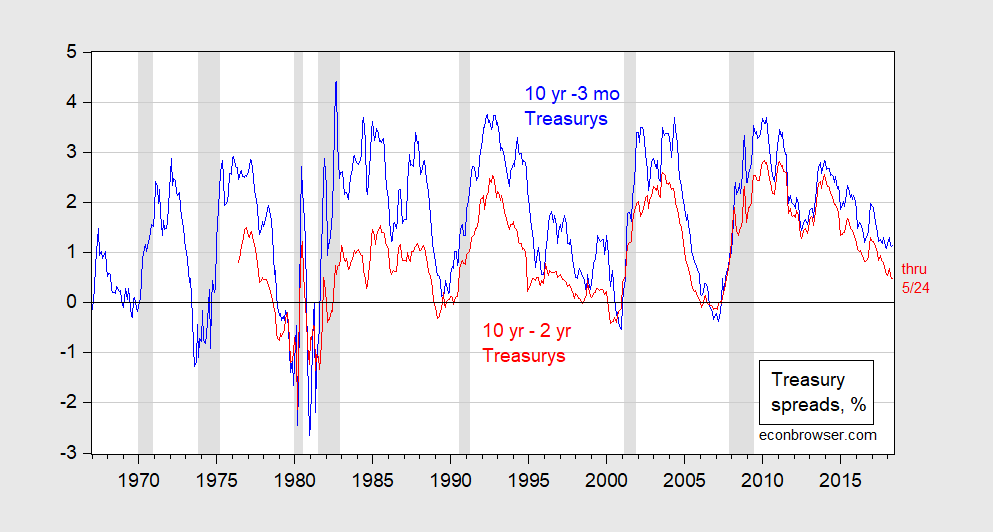

Figure 1: Ten year minus three month Treasury spread (blue), and ten year minus two year spread (red), %. Observations May are through 5/24. NBER defined recession dates shaded gray. Source: FRED, Bloomberg, NBER and author’s calculations.

While no inversion yet (at the 10yr-3mo, 10yr-2yr), there is a definite flattening. The flattening in the 10yr-30mo spread over the last year has come from higher short rates (see this post). As remarked upon in this excellent review of the yield curve/recession literature by Cyrille Lenoel at NIESR:

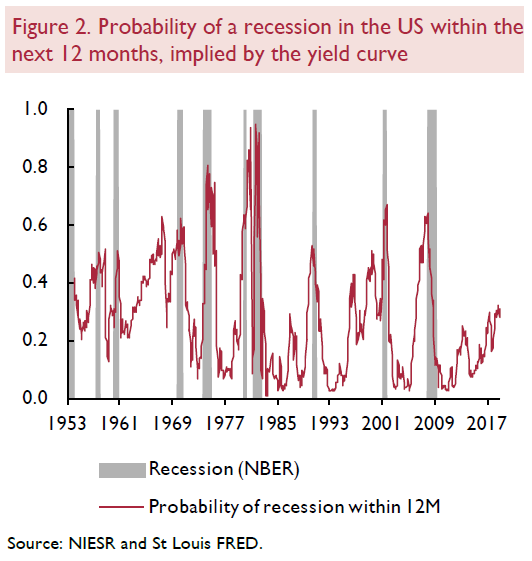

[U]sing the yield curve to predict upcoming recessions is an easy and model-free way of extracting some of the information contained in the government bond market to forecast an event that is otherwise very difficult to predict. Our own research and that of the New York Fed and the San Francisco Fed3 suggest that the possibility of a recession in the US has risen somewhat over the past year but it is still far from our central case outlook.

Lenoel uses the methodology used in Chinn and Kucko (2015), but instead of predicting recession 12 months ahead, he forecasts the onset of the recession within the next 12 months. This leads to the following recession onset probabilities (through March 2018):

Source: Lenoel (2018).

The implied probability of recession onset within the next 12 months is nearly 31%, for a March 10yr-3mo spread of 1.1%. The spread in May was essentially the same (while the 10yr-2yr spread has shrunk).

See also the SF Fed discussion of alternative spread and asset price based predictors of recession.

Trump is not playing the Nordhaus Political Business Cycle ala Nixon? Create a recession in 1969 and then have a recovery from it during the re-election year. Of course no other President would do that – right? Oh wait – St. Reagan began his first term with a massive recession and then ran on “Morning in America”.

Trump is so incompetent that he does not even know how this game! Maybe Kudlow will teach him as we all know Kudlow is nothing but a political hack!

Mate, It wasn’t St Ronnny of Reagan that created the recession it was Volker. Certainly Reagan’s irresponsible fiscal policy made the recovery stronger than otherwise and interest rates higher than should have been.

@ Not Trampis

You’re missing a “c” there, it’s Volcker, but basically you got it right. It pains me to say it but you’re about 7/8 correct there on the policy part of it.

Also missing a cap C. Carter. I have a dim memory that Carter appointed volcker.

I guess, you don’t believe in V-shaped recoveries.

Yes – you would excuse a massive recession this way. As always – our #1 troll!

Jerome Powell, the Fed Chairman, is expecting strong growth over the next two years. Monetary policy remains highly accommodative in the ninth year of the expansion. And, we had a fiscal expansion, along with other pro-growth policies, which may be timely to achieve a “soft-landing,” although the excesses don’t seem to be in place that would lead to a slowdown or recession.

The Fed Funds Rate is about 1.75%. Perhaps, by the end of 2019, it will be at 3% with core PCE around 2% and no inverted yield curve. The Fed may pause in 2020, since inflation would have been preemptived and remain around 2%. Some economists are predicting the Fed will lower the Fed Funds Rate in 2020.

“Some economists are predicting the Fed will lower the Fed Funds Rate in 2020.”

Yep -that is what the FED does during recessions. Oh wait – Trump is about to fire you!

“Monetary policy remains highly accommodative in the ninth year of the expansion.” Don’t think so:

https://fred.stlouisfed.org/series/FEDFUNDS

Seriously PeakDishonesty? Is your real name Kelly Anne Conway?

Well this important day, Memorial Day, to remember both those who died and those who put their own lives at risk and came home to their families a changed person, we should remember the ones who weaseled their way out of any personal involvement. Let us take some time for tribute to the 5-time draft dodger— Cadet Bonespurs

https://www.youtube.com/watch?v=4FVUB-oOqn0

https://www.youtube.com/watch?v=jVrc_DfZL04

https://www.youtube.com/watch?v=tSxwR9kCbZ0

https://youtu.be/-WxaONm7ZZw?t=32s

Father of U.S. Army Captain Humayun Khan , who was killed in service to his country in 2004. Which probably seems like yesterday to Khizr Khan.

https://www.youtube.com/watch?v=Xzkkk-oJ6bo ( 6 minutes )

Khizr Khan, Father of U.S. Army Captain Humayun Khan , explaining the great responsibility he took raising his children the right way:

https://www.youtube.com/watch?v=1w1Jz9A8jEw (A must see for just 4 minutes in my opinion)

I guess Humayun Khan didn’t have “bonespurs” when he was asked to serve his country. Nor did Khizr Khan teach his son to tell such LIES

Hopefully as they view these things, it will help MAGA people understand who they voted for, as there is video and spoken word, so the 98% of MAGA people who are illiterate may be able to understand the information presented.

They are saying the Italian 10-year yield increased 22 basis points, to 2.684 and long-term political uncertainty (seems I heard this term used somewhere before??) is increasing. On the same day the German 10-year went down 6 basis points.

French bank SocGen released a report on American rates, medium-term chances of recession, and Fed hikes. They gave a synopsis on Bloomberg, but I wish we could see the actual SocGen report itself. I remember in the “golden era” of blogs, when you could pick those up for free on ZH blog, probably less than 48 hours after they put it out. I don’t think ZH does that anymore, maybe the threat of litigation had them thinking better of it. Aaaawww….. the gold old days of blogging, how I miss them. Before the FBI sent Aaron Swartz off to his death and sucked all the fun out of the internet. Trump and Ajit Pai will be the final death nail.

The “shadow rate” SocGen discusses is worth reading about, and if anyone knows where you can get a free DL of the SocGen report without getting themselves into hot water in the process, please put it up in this thread or let me know the blog that has it. Thanks ahead of time.

They are saying the Italian 10-year yield increased 22 basis points, to 2.684 and long-term political uncertainty (seems I heard this term used somewhere before??) is increasing.

The Italian president rejected the populist alliance that was formed a few days ago, so Italy will have to go to the polls again. As I understand it the finance minister for the new extreme populist coalition government made some noises about exiting the Eurozone. The president then dissolved the coalition government and installed a moderate IMF economists as interim prime minister.

@ 2slugbaits

I noticed Paul Krugman getting a little upset about that on Twitter. Krugman seemed to be taking the new Italian finance minister’s side of it (I think because he felt the voters had made their wishes clear, and there was a legit stance there). This is kind of a game of Cee-lo by Mattarella.

https://www.youtube.com/watch?v=dROIfuWf2Bk

They may find the populists have even MORE power after those early elections (Mattarella’s little Cee-lo game), which could be September. Which is why the Italy yields were still rising on Monday, and probably will rise more on Tuesday. Those 10-year (and obviously shorter term Italian bonds) yields are apt to make other large moves between now and September. I’m leery of the education level and intelligence of the Italian “populist” leaders. However, I think the voters’ choices should be respected and the tactics of Mattarella appear to be underhanded to me.

Is Luigi Di Maio smart enough to know when the dice are “loaded”?? Well, as some people might say, there’s a lot of risk to “bofe” sides.

But then I was a huge Yanis Varoufakis fan long before he was chosen as finance minister of Greece, and continue to be a huge fan of his clear to this very day, so what do I know??

https://www.bloomberg.com/markets/rates-bonds

Bloomberg says this is 3.14% as compared to the German rate of only 0.19%.

This was inside a St Louis Fed paper, but is originally from a 1993 paper by Alberto Alesina. Based on the unsound decision of firing Janet Yellen from a post she had proven more than capable of handling, Menzie and his readers might take an interest in this graph. It is the top graph that should appear at first view of the link, or “Figure 4”.

https://www.stlouisfed.org/publications/regional-economist/first-quarter-2018/why-inflation-so-low#fig4

Some may look at the year of the paper and say the info is “dated”. I tend to agree with that, 25 years does qualify as “dated”. Although I suspect the nation points on that graph haven’t changed as much as a person might guess they would after a quarter of a century. Of course if someone has similar such data (relating Fed independence to inflations rates) in a more recent breakdown, i’d be happy to be outshined in this thread.

In one of the Bloomberg articles (I think it might have even been the same journalist) they describe Cottarelli as a “moderate”. This is Exhibit A on why some people have zero respect for the media. How does that jive with how John Follain finished one article:

“A professor at Bocconi University in Milan, Cottarelli worked at the IMF for more than 25 years. He was nicknamed “Mr. Scissors” for his fiscal rigor. In 2013 under former Prime Minister Enrico Letta, he delivered a plan for saving more than 30 billion euros ($35 billion) over three years. Only part of the plan was implemented and he complained about resistance from Italy’s bureaucracy.”

Follain goes on to say in a separate Bloomberg article:

“Nicknamed “Mr Scissors” for his strict approach to state finances, Cottarelli refused the official car he was entitled to when he was appointed commissioner for a review of public spending in 2013 under then-premier Enrico Letta. He has headed the Observatory on Italian Public Accounts at Milan’s Catholic University since October.”

https://www.bloomberg.com/news/articles/2018-05-28/italy-s-populists-mobilize-in-protest-as-cabinet-list-drawn-up

“WOW!!!” Well, how “special”….. the guy born into privilege and lecturing others about how Italy spends its money refused a FREE car offered him by the government. Does Mr. Cottarelli plan on criticizing the multitudes of Italian officials like him who get use of a free car from the government?? Or only lecturing the working man for wanting a pension etc?? Cottarelli types like to make broad/vague prescriptions about “saving public funds” that nearly always hit the little guy—ask Cottarelli how he feels about high ranking or medium ranking government officials getting perks like free cars from the Italian government and I think you’ll find nearly immediately Cottarelli will become a deaf mute.

If you can tolerate all the garbage advertisements and banners, this story is kind of interesting:

http://www.newsweek.com/democrats-demand-ethics-investigation-trump-over-chinese-loan-and-ban-lift-946276?amp=1

3 days is a pretty small time window related to ZTE. How much ____ can the MAGA people swallow?? I have some strong vulgarity to describe this, but I guess I’ll save Menzie the hassle today.

I wrote this blog on the loan:

http://econospeak.blogspot.com/2018/05/intercompany-guarantee-fees-and-trumps.html

Extending a loan is not a gift or subsidy but extending a loan guarantee without an appropriate fee is. And yes I’m lobbying to be an expert witness on how much this loan guarantee was worth.

Rare wisdom from Trump: “Wilbur Ross is no longer a killer”:

https://talkingpointsmemo.com/livewire/trump-says-wilbur-ross-is-past-his-prime-and-no-longer-a-killer

Which is Trump’s way of saying that Ross’s hell bent mission on having a trade war with China no longer impresses him.

or it means trump is looking to replace ross, a man living on his past. i can hear a “you’re fired” in the future.

What does this chart look like now, given that the 10-year has dropped 20 basis points in the 5 days since you wrote this?

And if we hold off on recession until 2020, we will be lucky. Watch what happens as wages keep stagnating, people don’t get their housing-based deductions in 2019, and companies start laying people off to maintain their earnings numbers” due to the lower corporate tax rate.