Since January of 2017, Republicans have controlled both houses of Iowa legislature and the governorship. This month, the legislature passed tax cut legislation sharing elements of the Kansas tax cuts. Are we seeing another Kansas disaster in the making?

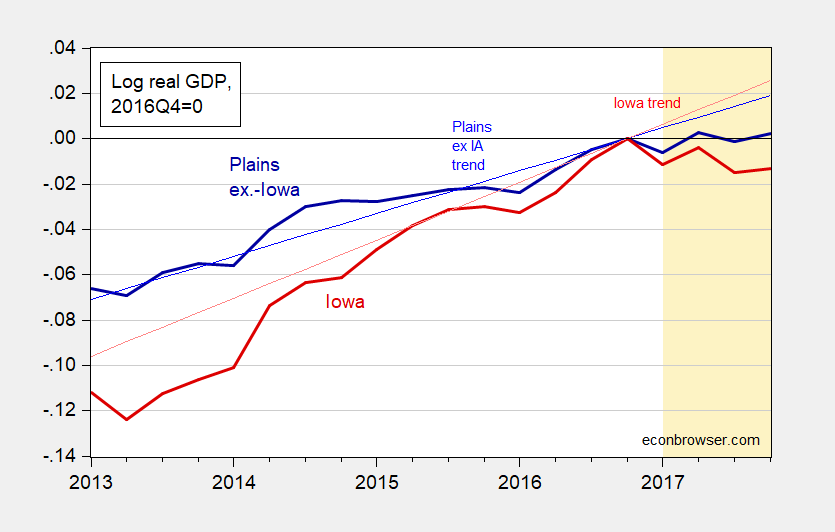

Iowa GDP has decelerated in the past year. So too has BEA Plains region. But Iowa GDP has both decelerated more than Plains ex-Iowa, it’s decelerated more relative to pre-2017 trend.

Figure 1: Log Iowa GDP (red), and BEA Plains region ex.-Iowa (blue), both 2016Q4=0. 2009Q2-2016Q4 log linear trend for Plains ex.-Iowa (light blue), and Iowa (light red), both normalized to 2016Q4=0. Orange shading denotes unified Republican control of Iowa state government. Source: BEA and author’s calculations.

Rather depressingly, Iowa GDP is down 1.3% (log terms) over the course of the last year, through 2017Q4, while the rest of the Plains is essentially flat. (The US in contrast rose 2.55% over the same period). However, since there are no two consecutive quarters of negative growth, Iowa’s performance does not meet the rule-of-thumb criterion for a recession.

The tax cuts amount to $2.2 billion worth of reduction, contingent on tax revenues rising sufficiently. Aside from triggers to prevent revenue collapses, the legislation emulates certain aspects of the Kansas program, including reduced tax rates on income and pass-through business entities [1] (the latter a large part of the Kansas debacle). We will see if the tax cut “shot of adrenaline” has the same effect as it did in Kansas.

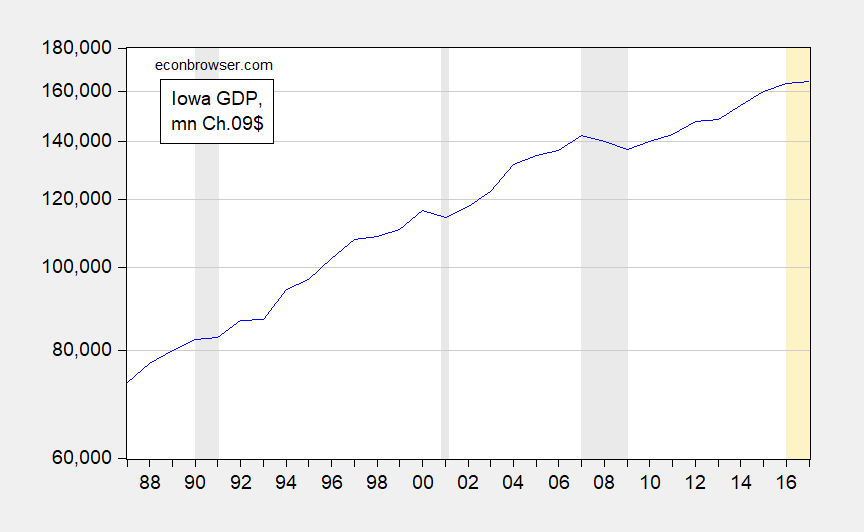

Update, 5:45PM Pacific 5/30: Ed Hanson claims I am manipulating the data depiction to put in a poor light the last year’s performance. So, without further ado, I present the longest span of data for Iowa real GDP I can obtain, and allow the reader to assess whether I have manipulated the data as Mr. Hanson asserts.

Figure 2: Real Iowa GDP in millions of Ch.2009$, with pre-NAICS data spliced to NAICS data using the 1997 ratio, on a log scale. NBER defined recession dates shaded gray. 2016-2017 shaded orange. Source: BEA, NBER, and author’s calculations.

Yes, Iowa GDP does flatten out on occassion, but it’s only done that in the absence of a nationwide recession twice over the past 30 years.

“Iowa GDP has decelerated in the past year. So too has BEA Plains region.”

Oh wait – let me guess. The defenders of supply-sidism here will say the tax cuts would have worked by the Plains region relies a lot on agricultural prices which are down. Of course the same Usual Suspects will absolve any blame for the fall in farm prices on Trump’s trade wars.

Look out Kansas! Here comes Iowa! Another shot of Adrenalin into the heart of a state economy?

so the republican attack on education has already made kansas dumb. looks like iowa will complete the movie, dumb and dumber.

Iowa, up and until very recently has had one of the best public school systems in the nation. And with all the pig farmer jokes made by other states (especially during college football season), it’s “a very well kept secret”. That’s not to defend the tax cuts. How long they can maintain one of the best pubic school systems with a state tax code designed for starvation of revenues is a question with a grave and heartbreaking answer.

Interesting. If memory serves, you’ve used the Philadelphia Fed’s Current Economic Activity Index to make these state comparisons. For Iowa, this series is showing stronger growth in 2017 than 2016 thought growth is off to a somewhat slower start in 2018.

Neil: Am currently working on a paper tracking state economic performance. Correlation of annual growth rates of coincident indicator and state GDP 2005-2017 is not statistically significant; regression coefficient of growth of GDP on growth of index is only significant at 10% msl, at 0.25. Hence, am not relying on coincident index for Iowa.

Iowa unemployment rate: 2.8%, tied for 5th with Wisconsin.

Which, Mr. Kopits, is part of a long downward trend since the state’s recession high of 6.6% from 5/09 to 9/09.

In Nov. 2016, the Iowa unemployment rate was 3.1% before dipping to 2.9% one year later. Now, it’s a tenth of a per cent lower; but there’s a need(?) for Kansas style tax cuts?

Unless I’m misreading data, the Iowa unemployment rate is consistently lower than the national rate; that high of 6.6% was well under the national rate of 9.8% in 9/09.

If the action is stimulative, that begs the question: stimulate what?

Look out Texas. Here comes Iowa! Where have we heard that before?

Before I join in blaming the Republicans for all of this, farm commodity prices, in particular the prices Iowa depends on corn and soybeans, have been soft since 2013, and getting softer (of course, Trump and his trade war drums against China and Mexico has probably made this worse). Iowa has been hurt also by a continuing decline in manufacturing. Nevertheless, the austerity for the poor, education, and infrastructure well cutting taxes for the rich probably hurts growth in state an extra touch. Finally, since Republicans dominate the surrounding or nearby Plains states (Oklahoma, Nebraska, the Dakotas, Missouri and, of course Kansas) so the policies don’t stand out to much. Minnesota, of course has been the bright light of economic growth in the Plains and Midwest, with its Democratic Governor and at least partial Democratic control in the legislature. Illinois has its own divided Government malfunction (a corrupt Democratic Party in Illinois, which has always been at war with its own liberals and progressives, does not help), but the its been a close run thing in several elections as significant number of whites vote Republican and believe in the Fox Nation narrative that Democrats give all the good welfare to the “Blahs and Browns.” The rest of the Midwest has been in the grip of extreme Republicanism for almost 8 years now and apparently people are sullenly satisfied as long as the “Blahs and Browns” get thumped worst by Medicaid and food stamp cuts and they get a couple of dollars in tax cuts while the roads, schools, water, and sewage all collapse..

So this is doing being a bad house in a bad neighborhood.

The NYT has an article on the road map from the UK that is being followed: https://www.nytimes.com/2018/05/28/world/europe/uk-austerity-poverty.html

I guess as long as it is the Paks and Jamacians that are getting hurt the Brexit crowd is happy. Funny cause the areas getting hurt voted yes.

I have a lot of affection for the state of Iowa. Many of my roots are there, and many characteristics of the state are dear to my heart, and I regard it as one of the top 5 states in the nation (though a large degree of that “Top 5” ranking is due to sentimental factors I will confess). I now reside in a southern state, one with lower rates of literacy (literally lower rates of literacy, that is not my usual sarcasm). It wouldn’t be hard to piece together what literal sh*thole state I live in if you read this blog regular. I expect the type of poor legislative decisions/management that Menzie describes above from the state I reside in now. I expect better signs of intelligence from the Iowa electorate.

Speaking of “sh*thole” places, does anyone know if Trump includes Mali in his “evil-axis of sh*thole”??

https://www.theguardian.com/world/2018/may/28/spider-man-of-paris-climbs-four-storeys-to-rescue-dangling-boy

Spiderman’s skin is a smidgeon leaned towards the dark-toned variety, so I assume, by Trump’s litmus test, Mali qualifies as “sh*thole” country.

Gee, let’s all hope and pray Melania doesn’t attempt to show she has a broader mind than her LOSER husband and risk “getting the cooties” by interacting with any Malian people. Why should Melania break away from the low-class benchmark her husband has set for her?? If Melania did something that classy we might start to think she was a little bit more than a mail order bride or just a damned W__re. I don’t know about you guys, but that would just take all the damned fun out of it for me.

If Iowa is slowing down due to tax cuts, shouldn’t Illinois be booming?

Jesse Livermore: The tax cuts were just passed. I don’t know why Iowa under Republican rule has decelerated over the past year. It just has (as measured by BEA).

Menzie

Did you forget to mention that Iowa has one if not the highest marginal income tax rate?

I should know by now, taxes are never high enough for the progressive.

Ed

Imagine that, Ed. A high marginal tax rate AND 2.8% unemployment.

nonec

Of course it is imaginable, but not the point.

Also not hard to imagine that it is time to reduce that high marginal tax rate. Times are good. Better now than when times are bad.

Ed

Ed Hanson: Point is, the marginal tax rates have been high for some time; why the point of inflection at 2017Q1?

Menzie

Iowa goes through periodic flattening of GDP curve. All you have to do look at past years beyond your usual carefully chosen time span. Also, anyone can look up Iowa on FRED and you will see the state is doing quite fine, overall. High time for a decent tax cut and simplification.

Unless of course you are a lefty who never saw a tax rate that was too high, or a tax too intrusive.

Ed

Ed Hanson: Well, I plotted 30 years of data, just for your edification. See the addendum to the post.

“Also not hard to imagine that it is time to reduce that high marginal tax rate. Times are good. Better now than when times are bad.”

usually you reduce rates when times are bad, and raise rates (or at least not lower them) when times are good. even peaktrader subscribes to this philosophy. ed, your ideology is apparent and foolish here.

Baffled, again another ignorant comment: “usually you reduce rates when times are bad, and raise rates (or at least not lower them) when times are good.” This is state level budgeting not Federal, and Iowa like most states have a balanced budget requirement. States “when times are good” usually set aside surplus revenue collections into a “Rainy Day Fund”. The Iowa FY 2017 revenue fell short and they tapped this fund to make up the difference.

Coincidental with a tax reductions Iowa also experienced a reduction in GDP. Surprisingly, Menzie a noted economist, has not looked at the 2017 Iowa state economy to see what changed.

Noneconomist, in arguing against Ed’s point of Colorado doing well under a flat tax you then list two other flat taxes, ” sales, property”. What was your point? Certainly if it was to counter Ed’s, you failed miserably.

corev, your approach cannot support a rainy day fund. it is simply ignorant ideology. and peaky indicates they are in good times. if so, why are they short in revenue to begin with? why tap a rainy day fund during the good days? you guys cannot have it both ways.

Well, gee, Ed, what exactly IS the point? If this legislation is designed to stimulate the Iowa economy, there seem to be some roadblocks: namely, a stagnant labor force and a very low unemployment rate.

Add to that that most of the cuts go to those with higher incomes, who also may elect to shield and lower income with pass through rates. So, I’m missing the point of such legislation unless it’s simply to reward political supporters since the cuts will likely provide little adrenalin to already sufficient economy.

One wonders, however, why the Iowans didn’t gravitate toward a Lafferian flat tax, which-as you previously noted for California–would have replaced every tax in every county and city with overflowing coffers and lowered taxes for everybody–and his brother, sister, and grandchildren–while igniting economic boom times for all. God save the Queen and anybody else who needs to be flattened.

(OK, the last part WAS indeed a joke, much like Art Laffer and his brand of economic terrorism. See Kansas and Louisiana for proof)

nonec

I live in Colorado and it is one of the best performing states in the nation. And guess what, it has a flat income tax rate for all incomes. A flat tax works fine, I do not understand why you think its such a bugaboo.

Also I would advise to quit drinking the Menzie kool-ade, Kansas is not suffering. Only by carefully chosen and not generalized measurements has Menzie painted the state so poorly. Remember one thing, and it is an arrow to heart of the evils of big government and socialist in general, when tax rates are cut, the dollars are not destroyed, they just remains with the earner rather than the government.

Ed

P.S. nonec, look up Iowa on FRED, it is in no way stagnant.

Ed Hanson: What data are you looking at? I just posted 30 years’ worth of real GDP data — doesn’t look too fast growing to me…

Ed Hanson: United States Bureau of Economic Analysis, official GDP statistics indicate y/y growth of real Iowa GDP in 2017 was 0.5%.

Ed, is a FLAT 4.63 income tax the ONLY tax levied in the state? No, since there are sales, property and other taxes levied, including potential add ons by city and county. You insisted a flat 6% tax would be the ONLY tax necessary to fund ALL services in California if so adopted. Why not Colorado?

Read carefully. I said labor force numbers are stagnant. Not much growth. In fact, according to Census data, none. You expect a tax cut to fix that? Workers will move to Iowa to take advantage of a layered tax cut? Where have we heard that before?

And, if you failed to notice, middle class taxpayers in Colorado pay more in state income tax than middle class taxpayers in California. A couple filing jointly in California with a $100,000 taxable income would owe about $700 LESS than the same couple in Colorado.

For you, the tax cut has everything to do with ideology and little to do with economic betterment for the state., which is the usual right wing pitch. Tax cut and jobs act. Sure.

Noneconomist, in arguing against Ed’s point of Colorado doing well under a flat tax you then list two other flat taxes, ” sales, property”. What was your point? Certainly if it was to counter Ed’s, you failed miserably.

Talk about failing miserably, CoRev. Your reading comprehension skills–and lack thereof–are in evidence here. Ed had previously noted that Laffer contended a 6% California flat income tax (actually amended by Laffer to 6.5% AT FULL EMPLOYMENT, which Ed forgot to mention or, more likely, didn’t know) would eliminate the need to levy ANY other tax, period. ANY.

I noted that Iowans had not chosen to levy a flat all encompassing tax like Laffer had promoted as an economic cure-all.

Speaking from both sides of his mouth, Ed then cheered Colorado’s flat income tax, conveniently forgetting to mention it isn’t the ONLY tax levied there. There are, of course, sales and property taxes as well as other taxes that may be levied.by special districts. While those may indeed be flat taxes, that has little or nothing to do with the point discussed.

As I also noted, that 4.63% tax is more than a California couple filing a joint return would owe on a TAXABLE income of $100,000 (which is about $30,000 ABOVE the state’s median family income. Of course, that median is higher in San Francisco and Santa Clara and lower in Bakersfield).

And, yes, the cost of living is indeed higher in California, but, no, there aren’t droves of middle class Californians fleeing to Colorado to take advantage of a flat income tax.

In the future, before commenting, you might want to understand the subject before wading in–even to shallow water– without a life a life jacket. That way, even if can’t swim, your ignorance won’t drown you.

Nonecon, how does your detailed history refute my single point that your selected taxes are also flat taxes? My reading comprehension was jut fine, and far better than your examples.

“Also I would advise to quit drinking the Menzie kool-ade, Kansas is not suffering.”

education in kansas has suffered greatly. it has been a missed opportunity for investing in their future. one of the reasons people do not move there, and leave when able. i work with a couple of kansas transplants. they were happy to leave for better opportunities.

Menzie

As you very well know all you have to do is a search ‘Iowa FRED’ and you get 28 pages of statistics. Just a look at the first few.

GDP – rather than the short time graph you prefer to tell your story, FRED has long term graphs. And those graphs tell the story that Iowa has had periodic flattening of the GDP curve. 2000 -2001, 2007-2009,2012-2013. So until this flattening shows so unique qualities, tax law change can not be determined to be the reason.

Unemployment rate – From a leveling about 2015-2016, the rate has been dropping. Now at 2.8%. This is a good thing.

Minimum wage – Same as the Federal rate, as good as Iowa can do.

Resident Population – still growing at a healthy rate, people are not in leaving. This is a good thing.

Per capita income – Not surprisingly, reflects the GDP with periodic flattening the norm. Have to wait and see.

This is what I mean that Iowa on the whole is doing just fine. Why don’t you check the rest of the 28 pages, I am sure you can find something negative to crow about?

Ed

Ed Hanson: GDP is the broadest measure of economic activity. In my second graph, the data goes back to 1987. Isn’t that enough?

Menzie

This may say it better, at least it is from and independent voice.

Iowa ranked #1 state in the country

says the U.S. News & World Report. This from this link:

http://www.kcrg.com/content/news/Iowa-ranked-1-state-in-the-country-475281773.html

Based on 8 categories. This is a good thing.

To all, take this as a lesson. GDP growth is important but does not tell a whole story. And neither does Menzie always tell a whole story. Just learned to put on the correct lens to separate the chaff from the grain or the bias within the use statistics.

Ed