Update, 10/20 12PM Pacific

After the failure of the Republican effort to defund the Affordable Care Act, what is the net macro effect? According the IHS-Global Insight, and S&P [1], 0.6 ppts were shaved off 2013Q4 GDP growth (SAAR). S&P puts a dollar figure to this impact — $24 billion in lost output.

As IHS-Global Insight notes [not online], while Treasurys are rallying, “yields on 1-, 3-, and 6-month T-bills could stay elevated (relative to September levels) since the debt-ceiling will have to be raised again in February.” Moreover, “We further estimate that the spike in short-term yields this week will add another $114 million to the federal debt in higher interest costs from this week’s T-bill auctions.” (That’s the instantaneous effect; recall that GAO estimated that pulling to the brink in 2011 cost $1.3 billion in elevated interest costs in FY2011 alone. [2] The Bipartisan Policy Center estimated the ten year cost of that event at $18.9 billlion. [3]

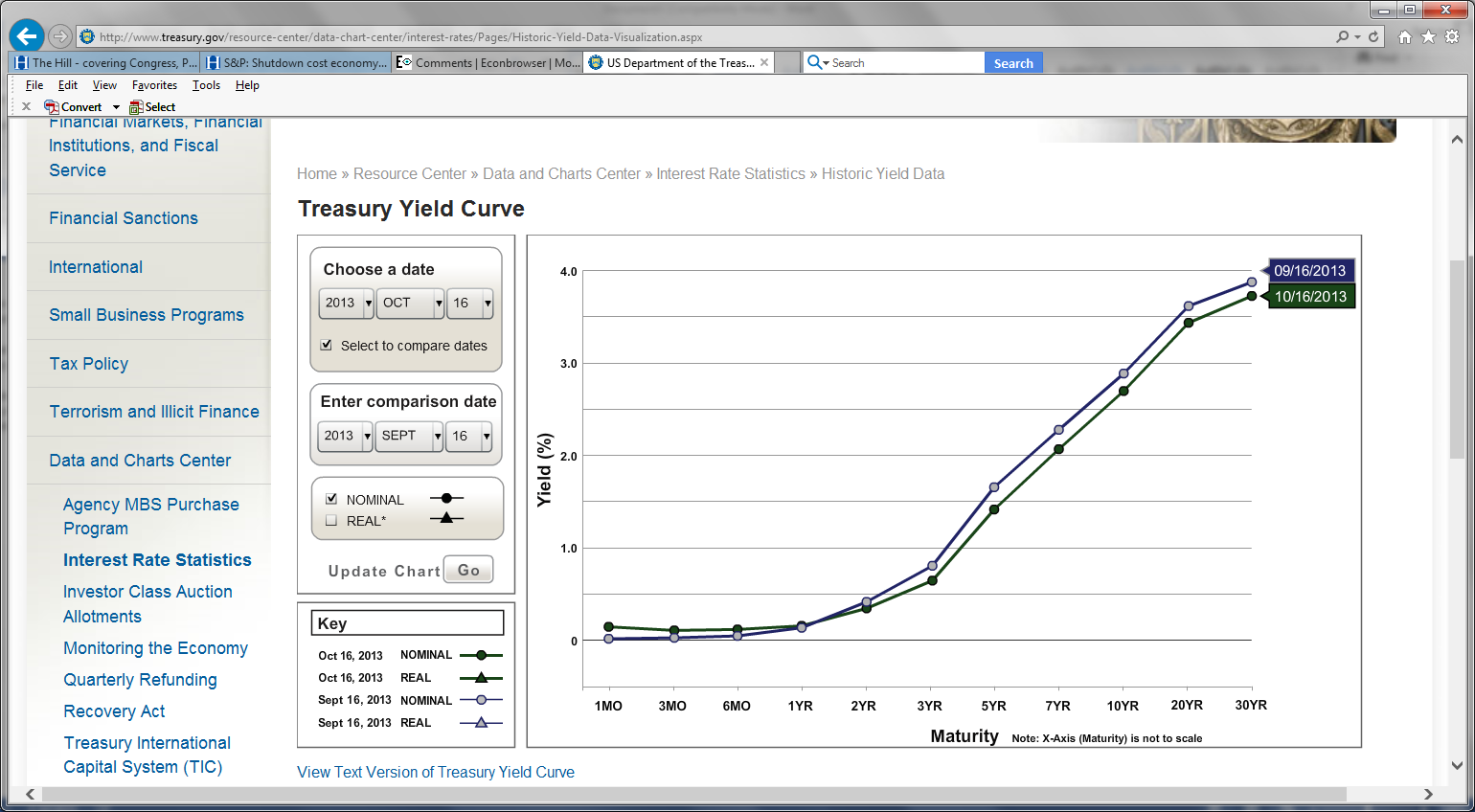

Figure 1: Yield curves on Oct 16 and Sep 16. Source: US Treasury.

Note that the short rates are indeed higher than they were a month ago. Not surprising, since in February, we’ll be back at (roughly) the same place.

If indeed we face a similar bout of brinksmanship (perhaps it’ll be about defunding Medicare next time), then this will not augur well for the future.

Update, 10/17, 7:45AM Pacific: Macroeconomic Advisers has estimates of 1% off growth for three years, due to crisis-driven fiscal policy overall; Paul Krugman critiques and provides his own estimates.

Note that in Macroeconomic Advisers’ latest outlook (dated Oct 16, not online), the shutdown alone (apparently no uncertainty effects, no spillover effects) trimmed 0.2 ppts off of 2013Q4 growth.

Sudeep Reddy at WSJ RTE surveys the estimates of the damage.

Update, 10/20 noon Pacific: My view on China’s reaction to the self-inflicted fiscal crisis, in today’s International NY Times.

Can’t we take the costs of the shutdown out of money for the poor? For the disabled? For feeding children? There must be some way we can inflict more pain. As a senior fellow of the Family Research Council said last week, there is “nothing more Christian” than cutting food stamps. And the head of the same group this week said in a remarkable bit of logic and in nearly consecutive sentences: “As Christians, we’re responsible for the policies of this government because it’s us,” along with this, “[Jesus] never said to Rome, to the Romans, ‘Hey, you guys need to make sure that you’re taking out of one person’s pocket to put into another.'” So we really need as a Christian nation to be kinder to the poor by taking away what little they have.

I go through this exercise because in the aftermath of these weeks of utter stupidity, two things have truly become clear: “libertarianism” is nothing more than a way for nominally Christian moralists to justify non-Christian selfishness and the message of Jesus has failed in America, where the most selfish and self-interested most loudly proclaim themselves to be what they are not.

Bad defeat for our side, simple as that.

so the republicans and tea baggers basically extorted $24 billion from the economy to gain absolutely nothing in the budget deal. they basically passed a clean extension, although short in duration-kick the can so to speak. and they added to the debt with slight increases in bond yields.

but how much money did ted cruz put into his campaign coffers during this bit of extortion. if he was the true maverick he proclaims, he would have shut down this bill. but he got his cash, his media attention, and will live to cash in again in a few weeks. and the tea baggers fell for it!

Obamacare sucks for those people that are young and healthy and don’t need or want health insurance. These people are overlooked by every pro-Obamacare person on this blog and other blogs, and its shocking how liberals don’t realize that when someone receives a great benefit from the government, there is always some person that is worse off.

If you believe young healthy people should have the same freedoms that other people have than you should also support repealing the mandate portion of Obamacare. If that makes the rest of the bill useless (which I don’t think it would) than so be it. That’s better than taking money from innocent, young healthy people to put more money in older people’s pockets.

Anonymous: I have two words for you: “pooling equilibrium”.

Glad to see the stock market take off in the wake of ‘Funding in our time’.

Anonymous, do you mean the same young people that show up in the emergency room and expect free emergency room treatment?

anonymous,

should i be forced to buy auto insurance, when i have never been in an accident and have no moving violations? insurance only works when everybody pays into the pool to reduce the risk.

health insurance is exactly that, insurance. it is there to cover you for expenses you could not plan on, and would otherwise bankrupt you. as a young person, you can buy cheap high deductible insurance that basically covers you for these rare, high cost events. you do not need to buy the gold plan.

otherwise, you need to agree to allow the emergency room to turn you away when you suffer catastrophic injury or disease-since you chose that option. but if you come into the emergency room unconscious, and cannot tell the doctor you don’t want treatment because you have no money or insurance, the doctor must treat you because legally and morally he cannot just let you die. and i pay the cost of that endeavor. so your selfish view of how the government is taking money out of your pocket and putting it into others pocket is hocus. because you are taking money from my pocket as well.

“If you believe young healthy people should have the same freedoms that other people have”

Okay. For the sake of equality, let’s require both the young healthy and the old healthy to have health insurance. Happy now?

baffling:

Auto insurance must be puchased to protect others, not necessarily yourself. Forcing young people to buy health insurance helps older/sicker people, it doesn’t protect older/sicker people from the young (so the car insurance analogy isn’t comparing apples to apples).

Ottnot:

Freedom is not the same thing as equality. Everyone can be equal and not free (as you pointed out) and this obviously is not what conservatives mean when they talk about freedom.

Spencer:

No, obviously they should have to pay for the medical expenses.

Menzie:

Just let people that want insurance support “pooling equilibrium”. Equilibrium can be met with out the mandate.

Steven Kopits: “Bad defeat for our side, simple as that.”

Given that the conservatives’ little temper tantrum has cost the economy $24 billion and shaved about 0.6% off GDP, I wonder how this fits into your FAA plan.

How much money can the US government borrow? How will we know that we are near reaching that limit? With the Federal Reserve doing their quantitative easing, will interest rates on Treasury be a reliable guide? Or, will we wake one day and discover that a Treasury auction failed with no significant interest rate signal?

The AFA has obvious, deep flaws but this debt ceiling play was just as bad.

It felt manufactured and political, the House Republicans narrative was very sloppy. They haven’t been demanding the personal mandate be pushed back until very recently and it’s not even obvious how that helps in the long run anyways.

The terrible thing about this situation is that neither side of the aisle has ever bothered to address the arguments of the other. The Democrats are offended by the cost of this shutdown, the Republicans are offended by the cost of the AFA, but neither have a plan for the long run anyways.

Auto insurance includes payment for your medical costs – at least in my state – because they don’t want your bad driving or your bad luck to cost hospitals money. It also includes a direct social transfer: medical payments to people hurt by your negligence. This and other auto insurance provisions mean when you pay for your insurance, you are paying for the bad acts, the bad driving and the bad luck of others and are transferring your money to pay for those costs so others in turn get paid. Auto insurance, in other words, includes mandatory medical insurance.

Ah, you can do the math, Joseph. It’s simple.

In the FAA, each $100 of incremental GDP (up or down) is worth 25 cents to Congress.

So, the formula is

$24 bn * 0.25% / 537 = $111,000 per member of Congress.

You think they would have shut down the government with the FAA in place? Hell, no.

And that’s the point. People do not cooperate because they like each other. They cooperate because they have interests in common.

I find it amusing that those supporting Obamacare totally ignore John Rawls, the philosopher of redistribution. Obamacare is actually redistribution from the bottom to the top. Those on the bottom even if they have their premiums subsidized still face the daunting task of paying huge deductables, for most greater than their health care costs in any year. Essentially Obamacare charges a premium for making individuals pay their own health care bills.

Does anyone find baffling, baffling?

Let’s assume Ricardo is right that poorer people have to pay for deductibles … that’s a conservative value: we’ve heard for the past years that “people need skin in the game” and that people too poor to pay income taxes are “lucky duckies”. You should be celebrating the idea that poorer Americans have to pay into the health system. Skin in the game.

As for getting the FAA passed, well, it’s not well understood, either in the political or economics sphere.

Remember, I use a three ideology (objective function) model with associated principal-agent issues. Therefore, in my framework, there’s a need for an explicit objective function to align incentives with execution and reduce principal agent problems.

This is very different from, for example, Jim’s view of the issue. I think Jim implicitly assumes a single objective function for government, “good governance”, whatever that means. But for Menzie, it means something completely different. They don’t share the same vision of what government is supposed to do. We argue a great deal here about data and statistics, but in reality, underlying these arguments are differing visions of the very purpose of government. Greg Hill and I, although we appear to share a common liking of good analysis, have vastly different notions of what good governance means.

Further, Jim’s notion of governance depends heavily on the politician to assume the agency role (a conservative notion), that the politician will do the “right thing” for the “people”, whatever that means. A businessman is assumed to maximize his own self interest. But if that businessman is elected to Congress, now we assume he maximizes the people’s interest. Why is that? Did Jim just throw Adam Smith under a bus? Or is there some theory of behavior change following elections that I missed? In truth, Jim has absolutely no reason to think the elected person’s objective function has changed at all. It’s still Smithian. And yet Jim, in his policy prescriptions, will act is if the politician is acting on behalf of the public good.

For example, Jim thinks we don’t need a debt ceiling. In my model, you’re going to need something to control debt, because it’s going to be subject to significant principal-agent problems. So, I strongly disagree with Jim on this matter, because I am using a different framework of analysis.

But I’d happily trade the debt ceiling for the FAA. The FAA would be way, way more effective, and it explicitly assumes that the behavior of elected officials is Smithian–they act in their own self-interest–so that’s how we control them. We align their self-interest with good governance, at least as defined by one of the objective functions of government.

And a final thought:

The FAA would, in round numbers, cost $1 bn per year. If it had averted the shutdown (and it would have), it would have paid for itself for a quarter century in a little more than two weeks.

Now, imagine how many other savings opportunities of this magnitude there are likely to be in the federal budget.

anonymous,

auto insurance is required so that insurance works as designed-to spread risk. auto insurance would not work if it was not required by all participants. it protects against catasrophic risks. as menzie said, its nothing more than “pooling equilibrium.” this is what obamacare enforces. it is apples to apples. auto insurance exists to protect others, but also yourself. at some point you may be the “other” in an automobile accident.

jonathan,

auto insurance covers injury health care bacause that is a risk of driving. and everybody must have the insurance to spread the risk.

ricardo,

“Those on the bottom even if they have their premiums subsidized still face the daunting task of paying huge deductibles, for most greater than their health care costs in any year.”

sorry to break the news, but you cannot pay deductibles which are greater than your health care costs. maybe you need better educated on health insurance. but a deductible is a payment in part on your actual medical bill, until your limit is reached. then you stop paying and the insurance picks up the tab. so no, the low wage earners cannot pay a deductible that is greater than their health care costs.

and even if they have a high deductible plan, they are now protected against major medical. rising healthcare costs are not the result of run of the mill health issues-cold, flu, etc. they are the result of major medical incidents-and now those folks are covered.

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/10/16/if-ted-cruz-didnt-exist-democrats-would-have-to-invent-him/

If Ted Cruz didn’t exist, Democrats would have to invent him

Get your own blog.

“If indeed we face a similar bout of brinksmanship (perhaps it’ll be about defunding Medicare next time), then this will not auger well for the future.”

Let me be an optimist for once. What the result shows is that the Republicans, at least as a party, are not willing to “go there”. If you were bluffing and got called on the bluff, then subsequent bluffs are less likely to be effective. If they try this again in February people will just say “Come on guys. We understand you got to play this game. But you backed off at the last minute last time so you’ll back off again this time. Spare our country the posturing and just conclude the deal already”. And if there are enough smart Republicans who anticipate this then they won’t play the little charade next time to begin with.

I hope.

Reportedly, Tea Party groups are targeting some Republican Senators who did not vote to default. That approach worked well for them in regard to Dick Lugar’s Senate seat.

http://cameinonsaturdays.wordpress.com/2013/09/20/2012-may-18-tea-party-victim-richard-lugar/

2012 May 18 Tea Party Victim Richard Lugar

2013 Update

Mad Tea Party candidates continue to be the GOP “gift that keeps on giving” to Senate Democrats. When Indiana GOP primary voters soundly defeated 6th term GOP conservative Senator Richard Lugar, Democratic Cong. Joe Donnelly had more than a fighting chance to flip that seat “Blue.” GOP nominee Richard Mourdock , Indiana’s State Treasurer, detested “bipartisanship” or any kind of compromise with Democrats. Donnelly went on to win Lugar’s Senate seat in November, 2012.

Menzie

How stupid will Democrats look in 8 weeks when Obama delays enforcement of the individual mandate? Individuals must be enrolled by Dec 16th in order to have coverage by Jan 1 2014, as mandated by the “Law of the Land”.

Democrats have stepped in their own pile on this one. Republicans would have ended the shutdown had Obama and Senate Democrats agreed to delay enforcement of the individual mandate.

There is no way everyone that doesn’t have coverage will be enrolled by Dec 16th.

My bet is that Obama will enforce the individual mandate the same way he enforces immigration and drug laws…by decreeing that it won’t be enforced.

‘ auto insurance is required so that insurance works as designed-to spread risk.’

Except that the only auto insurance that is required by law is LIABILITY insurance. Which only protects someone you might injure, not yourself.

Don’t feel too bad about the error though. Barack Obama betrayed his ignorance of the concept during his Health Care Summit, in 2010, too.

The conservatives, of which I count myself one, have just cost the country on the order of $24 Billion.

Not a small piece of change, but on the other hand not a debilitating amount either. Yet, all told, a pretty stupid waste of money.

Why do the Republicans, and, to a lesser extent, the Democrats have to go for these grandstanding events?

Why not go after known waste? Defense, farm subsidies, over priced medical services, ethanol market rigging, etc. just to name a few.

Yes, you may not get to avoid the apocalypse, but, on the other hand, you might just be able to accomplish something.

My suspicion is that the answer is that the political parties, both of them, do not care what happens as a result of their power games. I do not think they understand that what they do has real consequences.

The administration and its allies are spiking the football right now. Menzie is relishing calculating the alleged lost output. Never to be outdone, Krugman’s got some truly hysterical analysis that claims that the Republican takeover in 2010 is responsible for an additional 2 percentage points in the unemployment rate and 4% in lost output. Let them have their fun while we look to the future.

They may have won the battle but not necessarily the war. Republicans took a shellacking in the polls it’s true but there are some bright spots. First, Republicans made it clear that they are opposed to the orgy of spending. Second, they again made it clear that they are opposed to Obamacare. That should help in the 2014 election season when this shutdown is forgotten.

Moreover, blue senators in red states seem to have been damaged, according to this politico report:

“– Quick hits: The Democratic incumbents in Alaska, Arkansas and Louisiana lead their nearest Republican opponents but are within the margin of error, the polls found. Capito, a Republican House member, enjoys a 17-point lead for the open West Virginia seat. President Barack Obama’s job approval rating is underwater in all four states.”

So, there might be a good opportunity to pick up some seats in the Senate.

The fact that Obamacare was not delayed might be a blessing in disguise. The furor over the shutdown obscured the fiasco of the unveiling of the website. Now people can focus on it.

The Obamacare website is a perfect mirror of Obamacare itself. It appears to have been rushed through with politics rather than analysis driving all the major decisions. According to press reports, the coding didn’t begin until early spring, even though this major application was due in October. Why? The administration did not want to write rules and specs before the election, since they knew how unpopular Obamacare is and didn’t want to provide fodder to Romney during the election.

What website requires you fully create an account with all kinds of data that they will keep permanently before you are allowed to “shop?” Does Amazon do that? This requirement is driven by politics again. The administration does not want to allow people to see the true prices. They want to calculate the subsidy first so that it appears like an incredible bargain. No doubt they want the data for data mining purposes to help them register voters too. But that introduces great complexity on the backend.

You can see a lot of the problems in the front end code, which was posted and then mysteriously yanked after all the problems. The main page loads 11 CSS files and 62 javascript files upfront, just to slow things down more. The javascript is not minified or de-linted. It looks like a true rush job. Obviously, the web site was not tested before it went into production

According to reports, the administration was repeatedly warned that there were problems with the website. It’s so ironic that House Republicans wanted a delay in Obamacare but the Administration was so determined to avoid a delay that they played chicken with the government’s finances while putting out a website that they knew might have significant problems. If they had been responsible, they could have agreed to the delay that they knew they needed and avoided the problems. But politics trumped good government.

We don’t know for sure but the website might have significant architectural problems that will make it impossible to keep the schedule they want. So another huge irony here is that the Administration may be forced to delay it, even though they refused to consider that during the shutdown. Of course, if they do need to delay it, they won’t go to Congress as the constitution demands. I would expect that they will just unconstitutionally delay the individual mandate just as they’ve already delayed the business mandate and provided subsidies to Congressional employees.

All of this may make a very interesting election year for Republicans in 2014

Re: tj

My understanding is the ACA deadline is the end of March, 2014, but to make sure you are covered, one should be signed up by February 15th.

pat sullivan says

“Except that the only auto insurance that is required by law is LIABILITY insurance. Which only protects someone you might injure, not yourself.”

you need to think about the big picture. by requiring all to have the insurance, you are also covered in the event somebody hits you-since the other person is required to have liability. in addition, some states like Florida require PIP insurance, to avoid medical fraud in accidents.

you need to think of the big picture instead of the radio show talking points. and you should feel bad about your error kiddo!

Good news for the GOT:

http://www.campusreform.org/?ID=5168

Re: tj

My understanding is the ACA deadline is the end of March, 2014, but to make sure you are covered, one should be signed up by February 15th.

Posted by: Jeffrey J. Brown at October 17, 2013 03:43 PM

Jeffrey,

From the IRS –

Individual Shared Responsibility Payment: Starting January 2014, you and your family must either have health care coverage, have an exemption from coverage, or make a payment when you file your 2014 tax return in 2015.

http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions-for-Individuals-and-Families

If you don’t have insurance by January 1st, 2014 or obtain an exemption you will be charged a per month fee on your year-end tax returns.

http://obamacarefacts.com/obamacare-health-insurance-exchange.php

The date you cite is the last date you can buy coverage in 2014. If you don’t have it by then you have to wait until the next year to begin coverage.

After open enrollment ends on March 31, 2014, they won’t be able to get health coverage through the Marketplace until the next annual enrollment period, unless they have a qualifying life event.

https://www.healthcare.gov/what-if-someone-doesnt-have-health-coverage-in-2014

I’m sure that baffled kid knows all this already. I thought everybody else might like a head’s up that Obama and Democrats are going to look like idiots when Obama has to delay the individual mandate after failing to consider Republican requests to delay the individual mandate. It will be clear at that point who was responsible for the shut down.

This article has some shocking facts about the design of the obamacare website. Quoting contractors, it notes that the Center for Medicare and Medicaid Services acted as the overall project manager for the software. If that’s true, then this will be an even bigger disaster than anyone could have imagined. IT projects of this magnitude have to be run by professional developers. Even more startling, the government officials running the project only allowed 4-6 days before the Oct 1 launch for testing. If this is even close to being true, the website probably has to be completely rebuilt.

Here is a hidden camera video done by powerline of Hitler finding out on Oct 1 that the Healthcare.gov site is not working. As you can see, he’s not happy about it.

Rick Stryker: And here I thought it was low taxes on medical device manufacturers the Republicans were most willing to stand for. So much so they were willing to use lobbyist text (at university, they would expunge someone for this).

Since we are talking politics, from the Cook Political Report:

tj,

I suspect that the IRS statement may be poorly worded. I suspect that the intent is that starting in January, if you don’t get coverage by the end of the enrollment period, you will have to pay a fee. Here is info from CNBC:

http://www.cnbc.com/id/101065523

Obamacare deadlines you need to know

Dec. 15, 2013—This is the date you need to enroll for insurance on the exchange and pay your first premium in order for your health coverage to go into effect on Jan. 1, 2014. After Dec. 15, you still can enroll, but your start date for coverage will be delayed by between two and six weeks, depending on what day of the month you enroll.

Jan. 1, 2014—Insurance coverage from plans sold on the health exchanges begin.

Feb. 14, 2014 (or thereabouts)—The date by which most people must sign up and pay for coverage so that it kicks in by the next deadline—March 31—to avoid facing a a tax penalty of $95 for individual adults or 1 percent of their income, whichever is higher. The Valentine’s Day deadline is approximate because it can take as much as 15 days to process enrollment applications for coverage to begin the first day of following month.

March 31, 2014—The end of open enrollment on the exchanges. After that, you can only enroll in the exchange’s insurance if you have a so-called qualifying life event, such as losing your job, having a child or getting divorced.

Menzie,

I’m not worried about the House. Remember that after the government shutdown of 1995 the Republicans lost a net 3 seats in the House in 1996 but picked up 2 seats in the Senate. I’m hoping that we can do better this time, especially given the coming Obamacare debacle.

Rick Stryker: But what about poor oppressed medical device manufacturers? Have you no pity for them?

Medicaid expansion is part of ACA.

California already has 600,000 people enrolled and ready to receive ACA coverage on Jan 1.

I wonder what the impact will be on the state economy. There will be an increase in disposable income (due to the reduction in out-of-pocket spending on health care), the increased revenue to the healthcare profession, and the indirect economic benefits realized when people are able to seek treatment for illness and injury that might otherwise have gone untreated due to lack of funds.

Mr Brown, do you think the Teaers are going to get every election right.

Lugar, a lifer and a RINO needed to go – and now he is gone…

Professor Chinn – this just released from the DEMCO planning board – gee, let’s add a group of taxes onto CommieCare and then use them as offering of compromise..

jonathan wrote:

Let’s assume Ricardo is right that poorer people have to pay for deductibles … that’s a conservative value: we’ve heard for the past years that “people need skin in the game” and that people too poor to pay income taxes are “lucky duckies”. You should be celebrating the idea that poorer Americans have to pay into the health system. Skin in the game.

jonathan,

First, I am not a conservative but a liberal so I probably shouldn’t speak for them but since you addressed this to me let me respond as a liberal.

People paying for their own health care is a liberal idea, but that does not preclude institutions coming together to help those in need. Liberalism does not say that all must pay their on health care only that people should have the right to choose. Liberals oppose government coercion forcing one individual to pay for another.

Second, you fall into a typical Progressive trap. Progressive policies destroy services and increase prices due to their policies of inefficiency. They then throw the poor out on the streets and point to them as proof that the market doesn’t work.

If the government wan not pumping massive amounts of money into the health care industry prices would fall and services would improve and expand. Low cost alternatives would spring up and nearly everyone would be able to afford to pay for their own health care. As it is today with Obamacare the government has made health care so expensive that even the middle class cannot afford to pay for their deductible and that is only a part of the cost.

I heard yesterday of a single man raising a young daughter. He makes a middle-class wage, near the average, so he does not qualify for a government subsidy. He has a $17,000 deductible!

In 2013 it is estimated that for the first time in the Obama administration the federal deficit will fall below $1trillion to $650billion. Concider where we would be if the voters did not vote in a Republican House. The election of a Republican House forced sequestration and has held down spending bills going to President Obama.

But this is nothing to shout about. This is still higher than any president prior to President Obama. Also we must consider the most stupid statement made supporting increasing the debt limit. “We must increase our debt limit so that we can pay our bills.” News flash: if you have to borrow money to pay your bills, you aren’t paying your bills.

The health system is collapsing under its own weight. That’s what the high deductibles are about. In essence, the deductible share of the insurance becomes a free market again. The bigger the deductible, the bigger the voluntary part of the market. It may ultimately prove the most important change from Obamacare.

And, Ricardo, we shall use the term ‘liberal’, shall we?

Hans,

Empirically, it seems that the Tea Party can win gerrymandered House districts, but it seems that they are going to have problems winning a lot of statewide Senate seats.

Ricardo wrote: “Second, you fall into a typical Progressive trap. Progressive policies destroy services and increase prices due to their policies of inefficiency. They then throw the poor out on the streets and point to them as proof that the market doesn’t work.

If the government wan not pumping massive amounts of money into the health care industry prices would fall and services would improve and expand. Low cost alternatives would spring up and nearly everyone would be able to afford to pay for their own health care.”

Sorry, that is a claim that survives not even a very easy smell test: German or Austrian data clearly show that the private insurance companies do much worse than the “mandatory”.

IMHO your basic assumption is wrong that a free market works if you have a “triagle” of customer (patient, fixed payments)- payer (insurance company) – provider of service (physician, hospital).

I do not claim that Obamacare is good, but I know for sure that non private alternatives easily beat your suggestion.

Jeffrey,

You may be right, but you are putting more weight on CNBC, a secondary source, than the IRS, the primary source.

I can provide other secondary links that agree with the IRS.

There is another interesting question to be resolved – Can the Federal government tax State governments? If a state(as an employer) does not offer qualified insurance to state employees, or if even one state employee qualifies for Obamacare, then the state (as an employer) is subject to the employer mandate and must pay a ~$2000 to $3000 tax-penalty on all it’s employees (less 30). (Recalling that the Supreme Court ruled that the Obamacare penalty fee is a tax.)

Do States(as employers) have to pay the Obamacare tax related to the failure to satisfy the employer mandate?

I’m hoping that baffled kid can help us with this question too.

A short piece on Alaska.

http://www.energyglobal.com/news/exploration/articles/Alaskan_Oil_Sunset_or_New_Dawn.aspx#.UmFI6ozD_IV

I’ll have a long version of this coming out in, I believe, the next issue of Oil and Gas Journal.

rick stryker,

you sound alot like karl “the architect” rove on election night, when he knew, just knew, romney was going to win! but he also never acknowledged how wrong he was, just like you!

obamacare has bugs, but it will be fixed. people will be able to sign up. and they very much will like the fact they can now afford health insurance. learn to deal with it.

you probably shouln’t denigrate Krugman’s analysis. he is a professional economist, with a nobel prize, who understands what he is talking about. you are an amateur economist at best.

ricardo

“If the government wan not pumping massive amounts of money into the health care industry prices would fall and services would improve and expand. Low cost alternatives would spring up and nearly everyone would be able to afford to pay for their own health care.”

just like the confidence fairy, you now think the medical fairy will appear and save the day!

“As it is today with Obamacare the government has made health care so expensive that even the middle class cannot afford to pay for their deductible and that is only a part of the cost.”

complete lie and BS. you show me EXACTLY how obamacare has increased your health care cost. conservitives have been saying for three years how obamacare has increased medical cost-and the law was not even in EFFECT. this is a prediction, and poor at best, rather than fact as you state it. you get no respect when you lie.

Ignoring all those countries with government programs providing universal health care at far lower cost than the US’s mixed system does, Ricardo writes:

“If the government wan not pumping massive amounts of money into the health care industry prices would fall and services would improve and expand.”

Clown.

‘you probably shouln’t denigrate Krugman’s analysis. he is a professional economist, with a nobel prize, who understands what he is talking about. you are an amateur economist at best.’

Guess what, there are plenty of professional economists, some with Nobel Prizes, who think Krugman is a sloppy economist. Even some people who are ‘amateurs’ have undressed him occasionally, say;

http://online.wsj.com/article/SB888359975534853500.html

‘But many other economists say they’ve been persuaded by Profs. Liebowitz and Margolis and their detective work. Among them is Prof. Krugman. “QWERTY is a great metaphor,” the MIT economist says. But he concedes that evidence of being locked into a bad technology “turns out to be fairly weak.”

‘….”Really large mistakes offer profit opportunities,” Prof. Krugman says. “If there is a really crummy technology out there that we have locked into, then it will be worth it for someone to pay the cost” involved in getting people to switch.’

In spite of this admission (in 1998) that he’d been wrong about QWERTY, Krugman is still peddling the story in Krugman and Wells (misinforming how many thousands of undergrads?).

Ulenspiegel, please compare apples to apples. German centralized care is not Obamacare and certainly was not US healthcare pre-Obamacare. Moreover, when you make sweeping general comparisons at least definnthe terms you are comparing, i.e. (over all costs, patient costs, hospital stay costs, life expectancy, etc.) so that the actual differences in the systems may be examined.

(perhaps it’ll be about defunding Medicare next time)

Menzie, you nailed it. We can’t afford unlimited healthcare for old people in the last 3 months of their lives.

That baffled kid is easily baffled.

ottnot, if you are going to call others names and make generalized claims at least give us examples so they may reviewed. Otherwise you are being disingenuous and ideological.

Nor is Casey Mulligan overly impressed with Krugman’s credentials;

http://caseymulligan.blogspot.com/2013/10/aging-taxes-and-state-of-labor-market.html

‘Marginal tax rates have increased five percentage points since 2007 and will increase another five percentage points over the next 15 months, a trend attributed especially to expansions in health and other safety net programs. By 2015, a typical worker will keep only half of the value created by employment, compared with 60 percent kept before the recession.

‘….Perhaps the economists who are silent about marginal tax rate hikes are worried that acknowledging the new rates would overshadow their well-intentioned origins: helping the poor, the unemployed and people without health insurance.

‘Professor Krugman, for example, says life is too short for him to look closely at my criticism and at the marginal tax rates I’ve measured, and doesn’t indicate that he’s looking at anyone else’s measures either. He’s not the only one: I have visited several Federal Reserve banks since 2009, and hardly any of the economists there seemed to be aware of what’s happening to marginal tax rates.

‘The Federal Reserve cannot reverse the tax rate increases any more than they can reverse the aging process. Perhaps Congress should ask Janet Yellen, nominated as chairwoman of the Federal Reserve, what she knows about changes in tax and retirement rates, and what they say about the future of the labor market.’

Look forward to it.

tj: “Individual Shared Responsibility Payment: Starting January 2014, you and your family must either have health care coverage, have an exemption from coverage, or make a payment when you file your 2014 tax return in 2015.

You can read the final IRS ruling here:

https://s3.amazonaws.com/public-inspection.federalregister.gov/2013-21157.pdf

The IRS defines one of the exemptions as what is called a “short coverage gap” of less than three calendar months. You can have one continuous three-month period per year without coverage. This exemption is primarily to accommodate people who change jobs, but it also applies to people who are covered with insurance by the end of March, 2014 and remain covered for the rest of the year.

Additional months of missed coverage are prorated at 1/12 of the penalty penalty per month. A month is considered covered if you have insurance for at least one day in that month.

ricardo

“In 2013 it is estimated that for the first time in the Obama administration the federal deficit will fall below $1trillion to $650billion.”

you intentionally insinuate the deficit is a direct result of increased spending. not true in any sense. it is a direct result of the difference between revenue and expenditures. a major driver in the difference was a collapse of revenue brought on by the bush created financial crisis and recession to follow. couple that with a decrease in revenue brought about by the bush tax cuts, and of course you will get a big deficit.

but lest you get too excited, the first trillion dollar deficit was owned by……..wbush. for the reasons cited above.

Ott –

Without government intervention, I would guess healthcare spending would fall by 1/3-1/2. Unit costs would fall by 1/4-1/3. Some existing and reimbursed products and services would be discontinued (eg, the $10,000 calcium shot they wanted to give my mother).

Society as a whole would be better off, with highly differentiated results by demographics. Less would be spent on the elderly, in many cases, much less. Somewhat less would be spent on adults and children, but with some increase in services accompanied by lower unit costs.

It’s not hard to see why this is politically challenging, and why healthcare spending is politicized across the globe. Thus, we see stealth reform in the guise of higher deductibles. That’s privatization, make no mistake, but with the veneer of extended health coverage.

pat sullivan,

you really put much credibility in Casey Mulligan? not impressed in the least by his blogging and writings. follow at your own peril.

but not sure how you can take a little topic like qwerty and extend it anywhere today. he was wrong when he stepped on the spider five years ago as well, who cares?

he has been far more accurate about how the economy would behave from 2008-present than any conservative freshwater economist. how did you predict the effect of large deficits and quant easing on inflation and treasuries?

anonymous

you want to defund medicare, have at it. shout that out.

but what are you going to do with the 65year olds who cannot get health insurance? because they cannot afford to buy it in a free market health care system? what insurance company in their right mind would insure the elderly, without a mandate? or you want only the old rich to survive?

“We can’t afford unlimited healthcare for old people in the last 3 months of their lives.”

then go talk to palin and own those death panels.

skopits wrote:

“Without government intervention, I would guess healthcare spending would fall by 1/3-1/2.”

You’ve shifted the topic from prices to spending.

Nobody disputes that there are many millions of Americans – elderly, students, veterans, low-wage workers, females of child-bearing age, etc. – who could not afford healthcare without government intervention and who either could not afford health insurance or would be denied insurance without government intervention.

But, if you want to talk about spending, we have your assertion that eliminating government intervention would cut spending and benefit society as a whole, and we have the empirical evidence from other nations showing that much greater government intervention (relative to the US) provides excellent health care with much less spending (relative to the US).

Going in the no-intervention direction, you concede “highly differentiated results by demographics”. Do you think?

I’m not sure how this outcome is better off for society as a whole, given that change mostly involves leaving more money in the hands of the wealthy by taking needed health care away from the poor and the medically unlucky. I get the part about saving a lot of the money spent on the elderly in their last few months of life, but I don’t get why that beneficial change requires us to take needed care from the poor and unlucky.

In the more-intervention direction, the empirical evidence is that you can have less spending and better coverage.

If you want less spending, why gamble on the cruel and risky no-intervention option?

steven kopits,

healthcare increased significantly beyond inflation during the bush years 2000-2008. what government intervention drove this price increase? what government intervention are we removing? those increases, which we see until this day, are the result of the private marketplace!

large self insured businesses had increased health care costs, which were also passed on to the employees as higher premiums and deductibles. we were not subject to government intervention. private enterprise. your government intervention argument is simply wrong. there is nothing in the data to say removing intervention would drop healthcare spending by 1/3-1/2-simply a fiction you made up to try and make a point. costs should have fallen, not risen, in the past decade without your imaginary government intervention.

Baffling –

Healthcare is a complicated matter. However, a number of issues stand out.

1. By making healthcare premiums deductible to businesses, it has encouraged increased pay to be in the form of increased insurance. That drives up usage and cost, and importantly separates the consumer from the service provider regarding payment for services.

2. Medicare and Medicaid have expanded substantially. Essentially, you can ration by price (buyer pays, with no insurer) or by volume (death panels). We don’t really do either in this country, so we tend to run an open-ended tab. That increases usage and cost. You should hear the nurses at the oncology unit here in Princeton talk about the horrific costs of chemo for elderly patients. It can cost $50,000 a visit, with many visits, and prolong life by a year or less. Our unwillingness to employ death panels (rationing) for such services leads to huge costs.

3. Regulation. The healthcare industry is unbelievably regulated. It’s very difficult to compete as a low cost producer. (It does, however, happen for things like lasik and dental work. See below.) Heck, it’s difficult to find out how much a procedure actually costs.

4. Legal liability: A huge cost for many physicians.

Here’s an example of price competition: http://www.dailypaul.com/292053/oklahoma-city-hospital-posts-surgery-prices-online-creates-bidding-war-prices-drop

And here’s a piece from Marginal Revolution on costs declining for lasik surgery. http://marginalrevolution.com/marginalrevolution/2004/11/seeing_is_belie.html

On how hard it is to get pricing on procedures.

http://www.nbcnews.com/id/50748682/

It took me all of two seconds to find these articles. You know, Google search works on your computer, too.

Kopits, i give you credit. you argue more rationally than many of the boneheads i hear from. But i would disagree on several items as government intervention.

we require regulators to ensure safe and effective healthcare. do you want to be the guinea pig to see if the blood thinner sold from xyz underground corp will thin your blood, or bleed you to death? regulations are needed in this type of market. poor product does not let you take your business elsewhere-it kills you. you absolutely need regulation-an alternative world does not exist.

legal liability. putting a cap on liability is actually government intervention. if the medical field actually booted out the doctors committing malpractice, liability costs would drop. correct me if i am wrong, but my understanding is the vast majority of malpractice $$ are consumed by a very small minority of doctors-many repeatedly. remove their license and reduce your insurance cost.

healthcare premium deductible for business. one idea of obamacare is to minimize this, so that people can actually shop for insurance without the context of employer based insurance (ie distinction between employer and personal policies should be minimal). i agree we should move in this direction. not sure i buy your argument this results in increased medical cost-lots of hand waving magic in your argument there.

medicare and medicaid. of course the programs have expanded, the country’s population is increasing yearly. but this does not directly affect my yearly increases in health insurance-i am not on medicare or medicaid but private insurance. and i do agree with some caps, but we currently do not have them. and would that not be government intervention bringing cost down? give palin a call about those death panels for me.

two major problems exist in the health care system. price discovery does not really exist-as you noted the difficulty in obtaining procedure pricing. in addition, alot of healthcare involves life and death type decisions with no time/info on price discovery, effectiveness, choice. market participants are blind-this is not an efficient market at all.

Baffling,

You are obviously suffering from Stockholm Syndrome, a common affliction of the Left. You think that just because your guru got a prize in Stockholm, you can stand on Nassau Street waiting for the white smoke to rise from Princeton University, signalling that your leader has spoken infallibly on yet another topic. But you don’t need to be a professional economist to realize how fallible Krugman really is. You just have to look at his record.

Krugman has a long and consistent record of being wrong on the major economic issues of the day. I documented some of it in previous comments about Reinhart and Rogoff, starting with his call during the Reagan administration that inflation would return in a big way. However, I didn’t focus on his wrong calls and analysis after 2007. Fortunately, the Harvard historian Niall Ferguson has documented all of Krugman’s more recent wrong calls and analysis more. They are available in a 3 part series at the Huffington Post, here, here, and here.

What evidence do you have that I’m an amateur economist at best?

rick styrker

“What evidence do you have that I’m an amateur economist at best?”

you are correct. you are not even an amateur economist.

“However, I didn’t focus on his wrong calls and analysis after 2007.” and what has he gotten wrong about the performance of the US economy since 2007? As opposed to the inflationistas?

and Niall Ferguson produced a very long winded document of mostly pettiness and no substance. he was angry somebody crapped on his record-which is poor. what makes you think he is now right about Krugman? after his attack on Keynes and homosexuality, there is not much credibility coming from Ferguson.

‘you really put much credibility in Casey Mulligan? not impressed in the least by his blogging and writings.’

Could you point out the flaw in Mulligan’s reasoning in the quote I provided?

‘[Krugman] has been far more accurate about how the economy would behave from 2008-present than any conservative freshwater economist.’

In July 2008, in the NY Times, he claimed that Fannie and Freddie had nothing to do with the housing bubble because they were prohibited by law from dealing in subprime mortgages.

At the time, they were holding over a trillion dollars of such. Also, you don’t find it odd that you can read in Krugman’s textbook, a claim he has admitted in 1998 is much ado about nothing?

Stryker is baffling,

Yes, you have a clear case of Stockholm Syndrome. Even when given documented evidence of Krugman’s mistakes, you respond with ad hominem attacks on Ferguson.

Ferguson demonstrates that Krugman was wrong about 2 major issues. He wrongly expected Greece to exit the EMU and he wrongly expected the EMU to break up. Also, Ferguson demonstrates that despite all of Krugman’s criticisms about economists’ failure to predict the financial crisis, Krugman himself failed to predict it.

You ask what did he get wrong about the US? When the Administration put out a very optimistic forecast in 2009, Greg Mankiw questioned it. Krugman attacked Mankiw for his skepticism. Mankiw replied by offering to bet Krugman that the Administration’s forecast would not come to pass. Krugman never responded, since he was too cowardly to back up his analysis on the record with money at stake.

Good thing Krugman didn’t. He’d be poorer today. The Administration predicted that real GDP would be 15.6% higher in 2013 than it was in 2008. 2013 is not over yet but Krugman would have lost the bet massively. According to FRED, real GDP was 14,833.6 in 2008 and 15,470.7 in 2012, which is 4.3% higher. By the end of 2013, Krugman will have been wrong by over a factor of 3.

Krugman relies on his followers to forget these details about his record. One of his favorite techniques is to pretend that other people are forecasting something different so that he can contrast himself with them. For example, most people who were raising questions about quantitative easing were not predicting that inflation would accelerate in the near term. They were arguing that the risk of inflation created by quantitative easing was not worth the very small benefits of the program. However, Krugman always implies that these people he disagrees with were in fact predicting inflation, so he can claim credit for being right.

The reality is, if you care to look, that Krugman’s record is quite bad. I find it amazing that he still has so many followers. It just shows once again the unimportance of evidence to so many people on the Left.

Speaking of evidence, you still haven’t provided any that I’m an amateur economist at best or not an economist at all. Clearly evidence doesn’t matter to you.

Patrick asked baffling:

“Could you point out the flaw in Mulligan’s reasoning in the quote I provided?”

Before I do that, I’ll note that Mulligan has disqualified himself from being taken seriously as an economist by making the remarkable claim that businesses don’t benefit when customers buy more goods/services, because the businesses will see an increase in expenses to provide the additional goods/services.

I kid you not.

I first encountered the claim in a comment he made in response to reader comments on one of his Economix posts. I’ve not been able to dig up that specific comment, but I found another Economix post where he wrote:

“You might think that more spending on, say, groceries would benefit grocers and the farmers who supply them. It’s true that a grocer receives funds when a new customer comes to his register. But he also has to provide more groceries or have one of his other customers get by with fewer groceries, and groceries are not free to supply. The funds a seller receives from a new customer may just offset the total costs of the goods provided to the customer, so the seller is hardly better off.”

http://economix.blogs.nytimes.com/2012/08/15/trickle-down-fairy-dust/?ref=business

Steven,

You are right on point in your list of factors driving up the cost of health care. Since Obamacare is making worse each of the factors you mention, costs will go up even more as a result.

We do not need to and should not try to emulate European countries. We should go in the opposite direction. We need much less government intervention in the health care sector.

“We require regulators to ensure safe and effective healthcare. do you want to be the guinea pig to see if the blood thinner sold from xyz underground corp will thin your blood, or bleed you to death? regulations are needed in this type of market. poor product does not let you take your business elsewhere-it kills you. you absolutely need regulation-an alternative world does not exist.”

The issue is not necessarily no regulation versus suffocating regulation. It’s balancing too much (Type I errors) with not enough (Type II errors). Government focuses on Type I errors, preventing bad drugs from getting to market. No one was ever fired for not allowing a new drug to market fast enough. The criticism of the FDA–that is killed more people by protracted approval than bad drugs on the market ever did–is likely to be true.

The excessive focus on Type I errors drives liberals like myself crazy. And it happens because there’s no equivalent of a profit motive in government. There is no benefit to the bureaucrat for avoiding an opportunity cost. In business, it’s foregone revenues and profits.

That’s what the FAA is intended to address. It provides an upside to decision-makers for being efficient, to better balance Type I versus Type II errors in policy-making.

“Empirically, it seems that the Tea Party can win gerrymandered House districts, but it seems that they are going to have problems winning a lot of statewide Senate seats.”

Mr Brown, this is really true when applied to the members of the CBC, some thirty-two of them…

CovRev wrote: “Ulenspiegel, please compare apples to apples. German centralized care is not Obamacare and certainly was not US healthcare pre-Obamacare.”

I did not claim that (Strawman). The point is, that in Germany many people can in principle choose/ could have chosen between compulsory health insurance fundsand private ones, the latter are more expensive, i.e. free market did not have the effect claimed by R.

We have hundreds of compulsory health insurance funds, they are not central, the raining of money in centrally done by the federal tax office.

“Moreover, when you make sweeping general comparisons at least definnthe terms you are comparing, i.e. (over all costs, patient costs, hospital stay costs, life expectancy, etc.) so that the actual differences in the systems may be examined.”

If I pay only 70% compared to you but get a product that is in most fields better than the product you get, I do see the point of detailled discussion, you find enough good internaional studies in English. BTW life expectancy is not a result of health care system, it actually does not correlate with health care expenditures. 🙂

YOU have to provide a reasonable arguments why a slightly better performance of your system in case of some cancer treatments justifies 50% more costs and much worse performance in other fields.

‘Before I do that, I’ll note that Mulligan has disqualified himself from being taken seriously as an economist by making the remarkable claim that businesses don’t benefit when customers buy more goods/services, because the businesses will see an increase in expenses to provide the additional goods/services.’

Mulligan is correct. As any businessman knows.

But, as to your; ‘Before I do that’, when can I expect you to point out the flaw in Mulligan’s reasoning in the quoted text?

Steven Kopits Okay, I’m a little confused about where you stand on Obamacare. I agree with several of you points. I agree that making health insurance premiums tax deductible for employers tends to drive up healthcare costs. Of course, one of the things that many hate most about Obamacare is that it removes this incentive for “Cadillac” plans. If you currently have employer provided health insurance and you are losing some of your benefits, then chances are very good that you have the kind of gold plated plan that Obamacare is trying to penalize. So you should approve of this feature, right? You also said that we need to ration healthcare for the elderly. Well, didn’t Obama argue for restricting Medicare payments for only medically proven procedures? And isn’t that what had CoRev and his ilk the most riled up on this blog? So again, you would seem to approve of Obamacare.

It is true that Medicare and Medicaid have expanded. Should this be a surprise? The country is getting older and income is becoming more unequal. Both trends push people into Medicare and Medicaid. Is this trend something that Obamacare has caused?

As to legal liability, a lot of studies have found that there’s a lot less to it than meets the eye. Reducing a physician’s legal liability does not necessarily increase overall welfare. And a new database that tracks actual insurance payouts against malpractice suits rather than just looking at jury awards shows that all is not as it appears on Fox Noise. And claims that umpteen useless tests are needed in order to prevent a malpractice suit are very often just crocodile tears. Physicians very often own the test labs and use the “my insurance company made me do it” excuse because it’s convenient.

Doctors do make mistakes and they should be held accountable for those mistakes. A number of years ago a woman in my office died because of a doctor’s incompetence. She was a single mom with a teenage son. One afternoon at work she felt a lot of abdominal discomfort, so she went to the hospital. They diagnosed it as appendicitis. She had a reaction to the anaesthesia that caused her windpipe to close off. The doctor went into panic mode and ran out of the operating room. She suffered brain damage and was in a vegetative state for over two years before dying. Really, her surviving young son did not feel like the settlement was worth the cost. This was the third time this same doctor had done the same thing, but yet the AMA defended him and he continued to practice. Oh…it turned out that she never had appendicitis afterall…that too had been misdiagnosed.

Some kinds of elective surgeries do lend themselves to competition and price shopping. I don’t think there’s anything in the law or in Obamacare that restricts this kind of competition. But just because lasik surgeries fit the market competition description does not mean all medical conditions do. Kenneth Arrow wrote a famous paper 50+ years ago explaining why healthcare did not generally fit the competitive market solution.

The excessive focus on Type I errors drives liberals like myself crazy. And it happens because there’s no equivalent of a profit motive in government. There is no benefit to the bureaucrat for avoiding an opportunity cost. In business, it’s foregone revenues and profits.

I hear this a lot and I think it reflects some big misunderstandings about how government offices actually work. First, government tends to be risk neutral wherease the private sector tends to be risk averse. Again, see Kenneth Arrow on this point. And while it is true that the government does not have an explicit profit motive, almost every decision/risk model used by government agencies includes some kind of lagrangian or shadow price, so it’s not clear that the absence of a profit motive is all that important. Or at least it’s not important in terms of bias. An explicit profit motive does give the decision maker a more precise estimate of the opportunity cost, but that does not mean government agencies are more biased towards one type of error. And oh, don’t forget that a profit motive in the context of externalities is not a good guide for decision making either.

Finally, I think you might agree that unhinging health insurance from employment is a good thing. Employer based health insurance hurts productivity and wage growth. So to the extent that Obamacare unleashes workers from employment based health insurance, that’s a good thing. Right?

Rick Stryker If that’s your interpretation of the Krugman/Mankiw argument, then I’m afraid you have completely missed it. Krugman was not saying that growth would be “x” percent. He and Mankiw were arguing over whether or not there is a unit root versus a deterministic trend. Krugman was saying that there was nothing wrong with the Administration’s growth forecast provided aggregate demand grew fast enough. This is what Krugman said:

But to invoke the unit root thing to disparage growth forecasts now involves more than a bit of deliberate obtuseness. How can you fail to acknowledge that there’s huge slack capacity in the economy right now? And yes, we can expect fast growth if and when that capacity comes back into use.

Notice the important qualifier. Krugman was saying that we should expect to return to normal fast growth (as determined by deterministic trends) once the output gap is closed. Of course, the output gap is still not closed and we still have excess capacity. That’s an aggregate demand issue, not an RBC unit root problem.

Now it would be fair to argue that Krugman’s Mar 2009 post was not consistent with his posts from Jan 2009. In those earlier posts he made it clear that he did not think the Obama plan was large enough to actually close the output gap. Krugman was arguing for a ~$1.3T stimulus rather than the $0.710T in new stimulus that we actually got. But again, in his argument with Mankiw the issue was “unit roots” not whether the stimulus was big enough.

Slugs –

Forgive, I don’t think I have laid down my views on medical insurance. It’s complex, and parts are “above my paygrade”, as they say.

What I would like, as I have written before, is either i) more care for the same spend, ii) lower spend for the same level of care. Were Obama to ride this horse, I’d come along. He really hasn’t. He’s argued for more care at greater cost.

Now, will Obamacare nevertheless reduce costs? It’s far from clear. Extending coverage to 30 million uninsured and those with pre-existing conditions–well, that is potentially a whopping amount of money.

That can be partially offset with “death panels”, but that it turn implies politicians making choices about what is desirable. Historically, this has i) tended to politicize treatment and ii) been only partially effective in containing costs. Over time, it will tend to lead to a poor allocation of health dollars because it stifles price signals and innovation. How’s Europe doing on the medical innovation front? (Heck, how are they doing on the innovation-of-anything front?) I don’t think healthcare rationing there has led to marked innovation.

On the other hand, the political pressure for public support of healthcare is high across the globe. So the issue is not, to my mind, what is theoretically desirable, but what is achievable given political realities. That tends to lead you to rationing in most countries.

Further, there are changes occurring which Obamacare is only acknowledging, not leading. Thus, the trend to higher deductibles is in effect privatizing the healthcare system in important ways. Like a forest fire burning it’s fuel as it marches up a mountain side, what remains is ashes, from which will spring new market-oriented forms. I’m not sure this is Obamacare, but rather a more general feature of the medical economy.

In the end, I am concerned that medical insurance–whether private or public–is simply not a good bargain anymore, even as it has exploded health costs. Therefore, allocating these costs over a larger pool–as Obamacare is intended to do–simply tries to allocate a non-competitive product over a larger base. No guarantee that will work.

From my point, that’s why I would like the FAA. As the analysis for Joseph (above) has pointed out, the FAA would incentivize politicians to look for savings as little as $10 bn from the federal budget. A Democratic politician has stated that there are potential savings of 4% of GDP from more efficient provision of healthcare. I tend to agree. But we need the motivation to get those savings. That’s what the FAA will do.

Patrick, you merit no time if you agree with Mulligan that “businesses don’t benefit when customers buy more goods/services.”

I wish you luck in your quixotic quest to convince businesses that they should eliminate their marketing and advertising budgets, cut back on their hours of operations, and strictly limit the amount of goods/services they allow their customers to purchase.

Or just go play in your alternate universe where pricing below marginal cost is the norm.

Steven Kopits I support Obamacare because I think it’s better than the pre-Obamacare approach to health insurance. Obamacare is not without its problems, and I’m not just talking about the IT software and integration issues. Obamacare is primarily directed at those too young to be on Medicare, so we shouldn’t conflate Medicare’s problems with Obamacare’s problems. To some extent Obamacare will ameliorate problems with Medicare (e.g., it “raids” the most wasteful and useless pieces of Medicare to pay for some of Obamacare), but we’re going to have problems with Medicare regardless simply because the country is getting older and the rewards to technical innovation in the medical sciences are very large. So in that sense I would dissent from your view that we need more innovation. Maybe we need more innovative thinking (perhaps that’s what you meant), but technical innovation that keeps those at the end of life alive for a few more weeks is not the kind of innovation we should be pursuing.

On the plus side, Obamacare pays for making medical records digital. Obamacare also removes the insurance premium distortions that come from insured people having to subsidize the uninsured. Obamacare also gives workers some limited portability, so they are not so tied to their current employer. Obamacare also compels everyone to contribute something. No free riders. The young and healthy see this as an injustice. What the young and healthy don’t know is that sooner than they think they will be the old and sickly. Obamacare is paying forward for the care you will inevitably demand from society tomorrow even if you’re a rugged individualist in your youth today. Everyone is immortal when he or she is 26. When he or she is 56…not so much. Finally, Obamacare forces insurance companies to change their business model from one that makes its money by not providing a good or service to a business model that adds economic value by pooling risk.

2slugbaits,

No, I haven’t missed it. We have to put this one on the rather long list of what Krugman has gotten wrong.

Krugman had linked to and was supporting Delong’s post in which Delong first attacked Mankiw on the same grounds. Delong’s point which Krugman was repeating is that you have to use the information in the unemployment rate as well as output in the forecast. Delong notes that Mankiw acknowledges this and quotes Mankiw as saying “The CEA may well be right.” Then Delong concludes by saying “And that is certainly the way to bet.”

That was the context of Krugman’s post. Indeed, Krugman does echo Delong’s argument on the unemployment rate saying in his March “Roots of Evil” post:

“For one thing is very clear: variables that measure the use of resources, like unemployment or capacity utilization, do NOT have unit roots: when unemployment is high, it tends to fall. And together with Okun’s law, this says that yes, it is right to expect high growth in future if the economy is depressed now. ”

That’s why Mankiw proposed the bet. He knew that Krugman had linked to and was supporting Delong’s argument and that Delong said “that’s certainly the way to bet.” Delong and Krugman’s unemployment argument implied that the economy had to snap back at some point. So, Mankiw proposed looking at the Administration’s forecast over a longer period–the 5 year period between 2008 and 2013. Krugman was apparently not confident enough to bet though.

Now we are in the fall of 2013, almost at the end of that 5 year period. And we know that Mankiw was right and that Krugman was WRONG, WRONG, WRONG! AGAIN!

Rick Stryker Well, you continue to torture and misunderstand the English language. The entire discussion was about whether or not GDP growth exhibited a unit root so that recessions and growth were manifestations of technology and labor shocks rather than aggregate demand shocks. The old Nelson & Plosser debate had re-emerged in early 2009. Anyone familiar with the English language should know that Krugman’s comment about the Administration’s growth projection was conditional on aggregate demand being strong enough that it would soak up excess capacity and give us a “V” shaped recovery. A statement like “…we can expect fast growth if and when that capacity comes back into use” is a conditional statement. Note the “if” word. Like I said, you really have to torture the English language to interpret Krugman’s statement as an unconditional forecast. In any event, the entire Delong/Krugman/Mankiw exchange was about unit roots.

2slug:

What you say may be true, but R Stryker closed strongly with both ALL CAPS and exclamation marks.

Also, “if” is both a small word and one that often indicates the use of logic. It is not fair of you to expect certain posters to acknowledge its existence and implication.

2slugbaits,

Looks like you need another lesson in macroeconomics. Mankiw and Krugman are not arguing about the short run. I’ll doubt you’ll listen, but for the benefit of others who might be interested:

The unit root hypothesis that Mankiw and Krugman are arguing about can be contrasted with the trend stationary hypothesis. If output has a unit root, that means that deviations from trend are permanent. Thus, if there is a unit root, then an unexpected change in output of x percent should change your long run forecast by at least x percent. However, if output deviations are temporary, so that output returns to long term trend, an unexpected deviation in output of x percent should not change your long run forecast of output. That’s the trend stationary hypothesis.

The Administration, Delong, and Krugman are arguing for trend stationarity. Delong’s argument is that you need to consider more than the univariate regressions that Mankiw and Campbell used. He thinks the information in the unemployment rate is important. Krugman is just parroting this argument.

As Mankiw knows, the way to tell who is right is to look over some longer term period, such as 5 years. If the Administration, Delong, and Krugman are right, output should return to trend and the Administration’s forecast would make sense. If Mankiw is right, it need not.

As usual, you have things backwards. The “if” you are emphasizing in Krugman’s argument is actually Mankiw’s argument. If things turn around, then the economy will recover. Yes, Mankiw agrees with that, but only “if.” Krugman’s argument is “if and when.” The “when” is important because Krugman’s view is that eventually output will return to trend. Mankiw is skeptical of that.

4.75 years of the 5 years are up and its clear that Mankiw was right. Obviously, Krugman did not have a lot of confidence in his argument since he refused to bet.

I’ve been looking at the Obamacare insurance offerings and trying to decide what to do. Can someone give me some advice? I can’t ask my Dad since he’s an evil conservative Republican who thinks Obamacare is a bad idea.

Anyway, I’m 27, so I’m too old to be on my parents plan. I live in Fairfax, Va. If I want to get a standard silver plan, I could go for the cheapest, the IH Classic 5000, which will run me $213 per month or $2556 per year. But that’s an HMO. If want a PPO, I could get the Blue Cross Blue Shield Preferred 1500 for $246.74 per month, or $2961 per year. I could also get a Bronze PPO for $2052, but that will only cover 60%.

I make $35k per year. Since I’m at 469% of the poverty level, I don’t get any subsidy. That silver plan will pay 70% of covered benefits. However, I don’t know what the means since I don’t know what the charge for any benefit is. My out of pocket maximum (excluding premiums) is $6350. I’m sure that I’ll never hit that.

Since I’m under 30, I think the only plan that could sense for me is the catastrophic. I can get the IH basic PPO catastrophic for $1548 per year. With that plan, I will have to cover all medical charges up myself up to $6350.

If I don’t go for a plan, I face a $95 penalty next year, which can only be collected if I have a tax refund coming. I’ve always owed something so I don’t think I’ll have to pay the penalty.

Here’s my question. I’ve had my eye on a big screen tv at Best Buy. It’s $2500. I won’t be able to get it if I buy any insurance. Here’s my reasoning. If somehow the unimaginable happens and I really need the coverage, I can always buy it later, since I can’t be excluded because of pre-existing conditions. I’ve never really been sick and don’t think I’ll use the plan at all next year.

I know the President is counting on me to sign up to subsidize the exchanges, and I voted for him, but that was only because I thought he was going to give me free stuff. Besides, that insurance web site isn’t cool. Kept crashing on me. I thought it was supposed to be like Facebook.

A lot of people I’ve talked to say that they’re thinking about signing up. So, it won’t matter really if I don’t sign up this year. I’ll try to sign up next year. I’ve decided to get the tv.

Am I wrong?

hey stryker jr, since your dad is a loud mouthed conservative, you should agree with citizens taking personal responsibility for their lives.

as a young, stupid drunk kid you were out with friends last night, became a mean drunk and got into a fight. you were angry when you got home and punched out your new tv. now with broken bones and bleeding from the cuts, the ambulance came by to pick you up-passed out from the alcohol. sorry you didn’t get a chance to sign up for health care. are they going to leave you there or take you to the hospital? who is gonna foot your bill?

maybe dad should take away your credit card, deadbeat.

Rick Stryker We agree about unit roots being all about whether shocks are permanent or transitory. So I think we agree on the econometrics. But Mankiw is essentially flirting with the RBC view that (in its extreme variant) denies the relevance of aggregate demand. Unemployed resources are just voluntary labor/leisure trade-offs. Krugman’s argument is that if aggregate demand were strong enough to close the output gap, then growth should temporarily accelerate above trend as it closes the gap and return to its normal deterministic trend. If Mankiw is right and GDP contains a unit root, then the Great Recession as a negative shock will have a permanent effect. Growth will not temporarily accelerate to close the gap and eventually return to trend. But testing both views requires aggregate demand strong enough to allow the economy to close that gap. If Mankiw is right, then giving the economy the needed GDP will result in inflation. If Krugman is right, then increasing aggregate demand will not increase inflation until the economy is back to full output. If Mankiw’s unit root theory is correct, then the economy’s potential GDP was permanently lowered and any stimulus should result in inflation because the economy is already operating near capacity. In other words, Mankiw’s view denies that there is an output gap.

I feel a sense of deja vu. This post from 2009 might be useful to review, including comments by SvN. see also this guest post.

ottnot, I guess we have an answer as to whether you ‘ought’ to have claimed to be able to refute Mulligan’s point about marginal tax rates; ‘Not!’.

My premise is that whatever approach the Swiss have taken to policy issues tends to be the most rational approach. For example, they aren’t burdened with politically correct beliefs that everyone needs to go to college. Only about 30% of Swiss high school students are on an academic track. The other 70% take primarily vocational courses. The vocational students graduate with basic job skills, and they can then go on to higher levels of vocational training.

Regarding health care, it seems to me that Obamacare was an attempt to move toward the Swiss health care system.

2011 Forbes Analysis of Swiss Health Care System: Why Switzerland Has the World’s Best Health Care System

http://www.forbes.com/sites/theapothecary/2011/04/29/why-switzerland-has-the-worlds-best-health-care-system/

Excerpt: