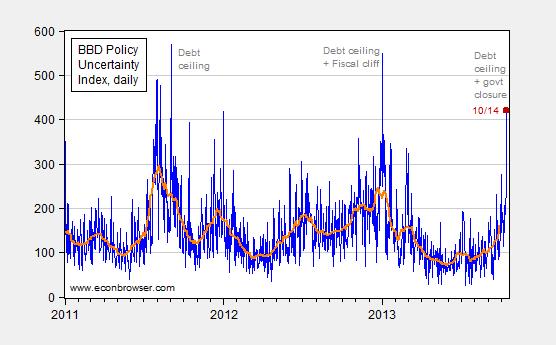

Policy uncertainty, as measured by the Baker, Bloom and Davis index, is skyrocketing.

Figure 1: Baker, Bloom and Davis Policy Uncertainty Index (blue), 31 day centered moving average (orange), and observation for 10/14 (red square). Source: Baker, Bloom, and Davis, accessed 10/14/2013.

If one thought that policy uncertainty was slowing the economy, would this be any way of conducting policy?

Think Superbowl. This is the politics of fun – the prognostications, the anticipation, the parade of the teams.

And there will be another game…

Welcome to bread and circuses. We are Brazil Norte. Enjoy.

There are two types of economists. Those whose ideology drives their economics and those whose economics drives their ideology. In the former, doctrine, myth, and belief circumscribe and direct attention to those aspects of the world that conform with and confirm ideology. In the latter, the application of science throws open the field focusing attention on graver matters. It is as though in the one case, the net of science continuously cast into the sea permits smaller creatures to drop through retaining only the larger ones. Where in the other, the net is woven to catch just one species making the world poorer for that. Just as larger creatures have greater spatial range, so science does not play favorites between present and future time. Ideology, though, expends its energy in myopic focus on the near-term so as to perpetuate itself no matter what the cost down the road. Those costs are only dimly seen by ideological economists, to the extent they are seen they are downplayed, and in the final event get offered up in sacrifice to the narrow god of that ideology.

WSJ: Uneasy Investors Sell Billions in Treasurys

Inquiring minds want to know why we allow “policy makers” (aka central planners) to so dominate the economy in the first place.

Following is a link to a hilarious Daily Show segment, where a former FBI hostage negotiator helps Jason Jones try to interview a member of the Tea Party. The former FBI guy said it’s important to understand that delusional people believe that they are acting rationally, within the framework of their delusion (at the end of the interview though, even the former FBI guy gave up).

So, if virtually all Tea Party members think that Obama is literally or figuratively the Antichrist, they are therefore doing God’s work in opposing Obamacare any way they can. In other words, from the point of view of the Tea Party folks, they are acting rationally, and everyone else is crazy.

The only way I see out of this mess is for a couple of dozen or so Republicans to join with Democrats and bring a series of discharge petitions to the House floor, unless Boehner elects to bring some clean Senate bills to the House floor.

http://m.comedycentral.com/tds_video.rbml?id=republican-hostage-negotiation&weburl=http%3a%2f%2fwww.thedailyshow.com%2fwatch%2ftue-october-8-2013%2frepublican-hostage-negotiation%2f&alt=http%3a%2f%2fm.comedycentral.com%2ftds_video_index.rbml&cid=300

For ‘Tea Party’ think of the Abolitionists or John C. Calhoun.

Every other country in the world – even Russia and Brazil – managed to end slavery without a war.

Political craziness is nothing new in the US. Might be worth assuming that the Tea Party won’t go away and trying to humor them. Some entitlements are going to be capped over time. Why not start now?

Jeffrey Brown, I hope you realize that this is just comedy!? Worse, it confirms your own extraordinary bias against those trying to do what they consider the proper thing for the future. Dems aren’t doing the same?

BTW, why are you so against religion? Kinda puts you in a super minority, doesn’t it?

jeff brown,

i tried to point that out to tj in a previous post, but appeared to get a blank stare in response. the yields on treasuries may not rise significantly, but those items are used as collateral in many financial transactions. this may put significant pressure on those other asset classes. the treasuries will maintain their value, because at the end of the day they will be paid back. you will simply see some arbitrage as a 30 day is not paid back until 60 days-so it will be valued as a 60 day instead. but underlying assets backed by treasuries may not be so lucky.

this is where a credit crunch could happen again. what other safe asset out there has enough volume to act as collateral during the default? unless businesses decide they will allow defaulted treasuries as collateral-what a slippery slope that becomes!

Real private non-residential investment less private employment, and real final sales per capita:

http://research.stlouisfed.org/fredgraph.png?g=nmr

Real final sales per capita:

http://research.stlouisfed.org/fredgraph.png?g=no0

Change rate below 1%, which has been recessionary historically:

http://research.stlouisfed.org/fredgraph.png?g=no1

Real personal income less transfers:

http://research.stlouisfed.org/fredgraph.png?g=no3

Well before the DC “shoutdown” occurred, the annual change of real private investment less the growth of private employment was rapidly decelerating to the point of no growth by Q2; and this is despite the energy sector boom/bubble.

Business and household demand is no longer growing sufficiently to permit growth of private investment, production, and employment hereafter, implying further reduction of capacity and costs is ahead for ’14, i.e., a “banana”.

That the trend rate of real GDP per capita since ’08 is ~0%, and at just one-third the long-term 2% trend rate since ’00, the US GDP estimates are within the margin of error of the reported estimates of the deflator, inventories, and import prices.

Thus, the US economy is in a perpetual condition of stalling out and contracting on a quarterly annualized basis, not unlike Japan since the late ’90s and the onset of the country’s debt-deflationary regime.

These conditions persist despite more then $3 trillion in no-cost bank reserves by the Fed, over $6 trillion in cumulative federal deficit spending and gross public debt at 100% of GDP, and the US equity market capitalization adding back over $12 trillion in “value” since ’09.

What do the banks, Fed, and White House do for an encore? No, please don’t tell me.

It’s a good thing the relationship between policy uncertainty and output is tenuous at best.

Would uncertainty be reduced if the federal government were less pervasive in our lives? Is a federal government too large when privately owned restaurants like the Cliff House must be closed during government “shutdowns” just because the restaurant is on federal land?

As of October 12, the federal government approved reopening, but the restaurant lost $70,000 while closed. http://insidescoopsf.sfgate.com/blog/2013/10/12/cliff-house-reopens-despite-government-shutdown-again-with-federal-permission/

This is just one example of what seems to be excessive overreach by the federal government. I am sure others can think of many more examples of what seems to be federal overreach or over reaction.

Re: CoRev

I actually think that the Tea Party folks are substantially correct about their concerns about long term government finances, and personally I don’t think that we can afford our current and projected levels of government spending.

However, for libertarian leaning voters, i.e., socially liberal and fiscally conservative, the Tea Party Express brings a lot unpleasant baggage along, and most of these people make my skin crawl, whether as noted above it’s an irrational hatred for Obama, or an Apocalyptic viewpoint, or a generally wildlly irrational view of evolution, or whether it’s the weird desire by middle aged males to control women’s bodies, or the firm belief that there is no problem with an infinite rate of increase in our consumption of a finite fossil fuel resource base.

It’s almost as if the Tea Party is designed to drive social liberal/fiscally conservative voters straight into the arms of the Democrats, and it’s instructive to remember how Tea Party candidates fared in the 2012 senatorial elections. Case in point, I saw a video clip yesterday where a US Congressman, and a Tea Party member, called John McCain an Al Qaeda supporter.

I have therefore only half-kiddingly suggested that Ted Cruz may be on the payrolll of the Democratic National Committee.

AS,

why are you complaining about a private business on federal land being forced to close during the shutdown? since it is on federal land, it should be lucky it even exists! this was the risk the restaurant took when it knowingly opened on federal, not private, land.

but perhaps you would rather the site be sold by the feds to a private developer for condos? we can do the same with yellowstone. the views of the geysers would be great from your own condo. but most people in this country want certain tracts of land preserved for everybody-hence the park service. and in order to preserve this land, certain restrictions on the market inside of these lands need to be enforced. federal lands are not a free market capitalist zone!

It looks like a game of chicken between House Republicans and Senate Democrats:

http://www.politico.com/story/2013/10/government-shutdown-debt-ceiling-default-update-98317.html?hp=t1_3

As noted above, I think that the former FBI negotiator had a good point, that from the Tea Party’s point of view, i.e., that Obama is evil incarnate, they are acting rationally in doing anything they can–up to and including forcing a default–in order to oppose Obama’s policies.

And as also noted, it seems to me that the only way out of the mess, if the Senate and Obama don’t give in to the Tea Party, is for some Republicans to join House Democrats in bringing Discharge Petitions to the House floor. It may be that this is what Boehner is hoping for.

Perhaps we need to start cataloguing headlines we thought we would never see. Here’s another one from the WSJ:

WSJ: Tepid Demand for Short-Term Debt

Investors showed tepid demand in two short-term U.S. debt sales, as many have chosen to avoid debt they believe could be hit in a potential default.

The index itself is the equivalent of a twitter hashtag and “trending now”. I wouldn’t glorify it as they do with the label “index” because all its reporting is the popularity in news articles of a few words, sometimes in combination (though the extent isn’t clear from a casual reading).

I mention this because I wonder how much noise enters. I don’t know if they filter for the kind of mindless refiling of stories – which has grown as papers have laid off their own staff. I see they adjust for changes in the number of papers but it looks like a fairly crude measure that doesn’t, for example, take into consideration how the rise of the internet and social media has increased bursts of “fame”, of massive attention focused on this or that thing.

For example, back in the past, the nation focused on a man trapped in a hole with newspapers all over the country following the story. (He died, btw.) That is still remembered because it was odd the story became such an obsession. Now we have massive blowups of attention and obsession, sometimes over nonsensical twitter arguments. A video can spark an explosion of interest. An actual index would need to adjust for these changes … something I don’t see being done and which I would think is quite difficult to do well (though I haven’t thought it through).

Baffled by so much,

Since the federal government is not a free market zone that is exactly why its scope should be limited in a free market society. The federal government (regardless of the party in power) has too much power and scope that can be manipulated by those in power for pet projects and cronies as we have seen during the current shutdown. Next time the other party has the power to close the government, you may not be so smug.

AS,

why are you complaining about a private business on federal land being forced to close during the shutdown? since it is on federal land, it should be lucky it even exists! this was the risk the restaurant took when it knowingly opened on federal, not private, land.

but perhaps you would rather the site be sold by the feds to a private developer for condos? we can do the same with yellowstone. the views of the geysers would be great from your own condo. but most people in this country want certain tracts of land preserved for everybody-hence the park service. and in order to preserve this land, certain restrictions on the market inside of these lands need to be enforced. federal lands are not a free market capitalist zone!

Jeff J Brown

These people are really the extreme members. It’s just that the media loves to splash them all over to discredit the movement.

Baffled by so much,

Continue to be baffled, seems you like broken-records. The complaint is the uneven enforcement of questionable regulations at the expense of the economy and at the expense of uncertainty. I don’t recall the same degree of what seems to be capricious enforcement of regulations during any of the past government shutdowns.

When the weird get going, the going gets weird.

Here’s the 1-month TED Spread (the 1-month LIBOR minus the 4-week T-Bill):

http://research.stlouisfed.org/fred2/graph/?graph_id=141775&category_id=0

It’s gone negative for the first time in history.

(Does this mean we’re having an anti-financial crisis?)

The Republican Party: making financial markets do things you didn’t even think were possible.

Mark, thanks for that timely data. Actually, a similar phenomenon DID OCCUR in the late 1830s, 1890s, and 1931, i.e., Wall St., London, Paris, Frankfurt, and Tokyo commercial rates, banker acceptance, and short-term gov’t yields before bank panics and debt-deflationary wipeouts.

We have NOT learned from history because we are supposed to believe that history is dead and the banksters have it all covered via the Fed, which THEY DO …for THEMSELVES AT THE EXPENSE OF THE REST OF US.

Dumbya Bush said, “This sucker’s goin’ down.” He was right then . . . and now.

P.S. Foreign markets’ banking and financial system meltdowns will be the trigger this time, specifically the EZ, Japan, China, Hong Kong, and Singapore.

P.S.S. See Kindleberger’s 1931 narrative. We’re there.

Fitch puts US AAA credit rating on negative watch:

http://www.cnbc.com/id/101093033

baffled

i tried to point that out to tj in a previous post, but appeared to get a blank stare in response.

I replied, you ignored. I doubt you followed the link I provided that showed the 3, 6 and 12 mo treasuries had not budged compared to the first 9 months of the year.

Your collateral issue is genuine. However, according to your logic, congress must always vote to increase the debt ceiling no matter the level of debt, or the rate of growth in debt. To do otherwise is to create a financial crisis.

That’s probably the best reason I can think of for reducing the impact of debt and the debt ceiling on the U.S. economy.

In other words, if issuance of new government debt played a small role in the U.S. economy, these debt ceiling debates would go away and we wouldn’t have to worry about sparking a financial crisis every time we approach the debt ceiling.

The option you support is most baffling of all – spending without limits.

Anonymous: Note that less than 8% of House Republicans would need to break ranks to pass a discharge petition, and that the Republican leadership changed the House rules to avoid allowing the Senate bill to be brought to the floor. This isn’t just about the Tea Party, it’s about the GOP as a whole hurting America.

TJ, you are almost correct with: “… spending without limits.” It should actually be democratic spending without limits.

WSJ Editorial: The Debt Denouement

It’s time to wrap up this comedy of political errors.

Relax Gents, the House action is a side show for political purposes. The real action is in the Senate.

tj,

i did not ignore. you simply pointed to data which confirms my hypothesis. i simply pointed out to you that significant changes in the treasuries-long and short term-need not occur for problems to arise. those issues are in technical default-but everybody except the wacky tea party expects the government to actually pay the bills eventually. any rise will be from arbitrage-not risk premium. in fact, the risk premium drops because they are the safest long term bet of all the asset classes available. but the assets which need/use treasuries as collateral will be hurt. this does not appear in a treasury yield, but it will occur in the underlying asset class after default occurs.

the government has created a budget and defined taxes (revenue) by legal means. the difference by definition must be covered by debt-which legally must be paid. you are adding an arbitrary third step: i will decide later whether to pay for the debt i needed to balance the budget and revenue stream already legally authorized. it is this third step which is basically illegal. if you didn’t want to pay the debt, then you should do one of two things

1. reduce spending

2. increase revenue

Either approach is allowed, but you define yourself at the beginning with a budget and revenue. you can’t cry foul later.

as an aside, if tea baggers can shut down the governmnet over obamacare, can we also shut down the government until the wbush era tax cuts are reversed. the increased revenue will eliminate the need for debt, as we will then run a budget surplus like the clinton years. and for those who remember, the clinton years were much better than the wbush years. no deficit, reduction in debt-isn’t that what you are arguing for?

AS,

you are actually the one encouraging uneven enforcement of the rules. from my perspective, a closed government is a closed government. you can’t have it both ways. dont complain so that a specific segment of government opens, and then say its not fair that only some things are open and some closed. that is a first grader argument!

you take a free market ideology too far. free markets need rules and boundaries in order to operate fairly. you do not want to acknowledge that, because you take an extreme view of free markets. many parts of an economy are not amenable to free markets-which is why the government is involved-pollution, utilities, basic R&D, health insurance for the elderly (and others). in your world, monopolies do not exist because people in the free market are apparently better than those in public sector, and would never form a monopoly!

baffled

you are adding an arbitrary third step: i will decide later whether to pay for the debt i needed to balance the budget and revenue stream already legally authorized.

That’s a strawman, I never mentioned balanced budget, only that the difference between spending and revenue should be smaller. It seems you can no longer form your own thoughts, only mimic what you here from the lunatics you listen to.

Your reference to Bush 10 years after the tax cuts further proves you can’t form your own thoughts. At least some dem’s voted for the Bush tax cuts. You can’t say the same for Obamacare, as no republicans voted for Obamacare. If you insist on using “law of the land” to support Obamacare, then you have to apply your same flawed logic to the Bush tax cuts as well.

Looks like Congress is (reportedly at least) going to kick the can down the road until after the Holiday season.

To quote the above WSJ editorial (a very conservative editorial group), “The Beltway budget melodrama rolls on to its predictable and dreary end.”

tj,

apparently you failed elementary math. if you don’t balance the budget, then you have debt which needs to be paid for through borrowing. if you do not raise the debt limit, you cannot pay that debt. it matters not that the difference is large or small, the debt exists and must be paid. if you refuse to increase the debt limit, that does not eliminate your obligation and you become a deadbeat. no strawman, just simple math for a 3rd grader.

i raised the issue of the bush tax cuts to illustrate how stupid of a position you have taken on obamacare. you aren’t even intelligent enough to see that! but i will ask you, what did the bush tax cuts do other than move our budget surplus to deficit and explode the debt? because as you know (or may deny?) bush was the first trillion dollar deficit president.

tj your logic is inconsistent and baffling.

Baffling, what are you smoking??? saying this: “… if you don’t balance the budget, then you have debt which needs to be paid for through borrowing.” Debt??? Nope! Proposed spending/commitments/obligated funds/ etc. but not debt. Debt is accrued when the obligations are actually paid.

Contracts are/can be terminated, so no obligations. Contracts and grants can be NOT awarded, so no commitments. Salaries can be delayed/halted via shut downs, so no obligations.

Appropriation amounts change through out the year causing changes in obligations, spending and payments. It takes that final step, payment to add to the debt, only if there is insufficient funds in treasury to make those payments.

You also make this claim: ” no strawman, just simple math for a 3rd grader.” Yes, it is a strawman. Debt occurs only if there are insufficient funds to cover payments. Some of those funds are available through past borrowing, BUT, no raised debt limit ceiling, future borrowing is seriously curtailed. And, then we see those functions described above implemented to reduce (some use a novel term — manage) payments, which by definition manages debt.

Before chastising others, get your own understanding in order with reality.

corev,

get off your ideologic high horse. once you make an obligation, it is a debt. a debt does not have to result from a treasury bill. a debt is an obligation. the media and tea baggers have tried to convince the public that our debt only exists with treasuries. simply not true.

if you want to operate in a country where contracts are not honored, fine. see how fast your business environment dries up. once you have spent the money, you owe payment. that is why you need to raise the debt limit. to argue any other way simply illustrates stupidity.

so the vast majority of our expenditures come from defense, medicare and social security. ok big guy, which are you going to cut to get expenditures in line with revenue? make a choice or be a coward like paul ryan et al, who won’t actually say what they will cut for meaningful savings. give me a number superman.

Baffling, ideological high horse? That was an operational description. The only ideology is yours, you are truly baffled with your own circular logic: “… once you make an obligation, it is a debt. a debt does not have to result from a treasury bill. a debt is an obligation.” The discussion is about the debt ceiling, which is all about borrowing.

Apparently a list of Federal obligating methods is beyond your snarky understanding. From your commenting your understanding of how the Federal Govt also makes payments, and then handles any left over unpaid bills is lacking. you claim: “…you owe payment. that is why you need to raise the debt limit.”

Really. Treasury can not pay from available funds? That has no impact on the debt ceiling. The only one demonstrating (I prefer) ignorance is you.

You want a number? OK! Since you are calling for “meaningful savings.” Freeze the budget baseline at the 2013 value and hold for at least Obama’s remaining term.

Remember his 2008 campaign promise to review each line of the budget, and use a hatchet????? The fixed baseline strategy would actually force Obama and Congress to do just that.

corev,

return to reality. you may not like the expenditures, but right now they are defined by current law. hence they are to be paid. if your revenue does not exceed expenditures, you need to raise treasuries to pay that remaining debt. it is not the treasuries you are paying for, it is the obligation. the treasuries are simply the instrument to pay that obligation.

you are mixing your fantasy with reality. the reality is we have expenditures which by law are to be paid. again, are you going to welch on money owed? are you a deadbeat? that is what you advocate. you may hate raising the debt limit, but you have no choice unless you are a deadbeat. since you don’t control congress and the presidents office, you cannot change the expenditures at this time. tea baggers do not seem to grasp this FACT!

why would you want the budget freeze to remain during Obama’s remaining term? Ahh, because you want him and the Democrats to suffer the economic consequences before the election. Very political. Try this, win the Congress and Presidency, then enforce your budget cuts. You haven’t earned the trust necessary for action before you control government.

and to be clear, you are freezing the discretionary budget across the board. non discretionary spending, SS and medicare, cannot be frozen so easily. and they make up the majority of your rising costs, along with defense. so now you are either going to gut defense spending or human services. which one? do you really believe the current sequester cuts have been good for the economy?

Baffling, do you have a point? You asked a question re: a number. I provided it in traditional political speak. You made some ignorant comment re: “… once you make an obligation, it is a debt. a debt does not have to result from a treasury bill. a debt is an obligation.” which I challenged. You then changed to a strawman: “…you may not like the expenditures,…” I don’t remember making any value judgements just defined federal operations to help you in your ignorance.

I also did not make any claims of the value of my number provided, just that it passed your test of significance.

You are trolling all over this site, and not doing a very good job of it due to your ignorance and ideological blinders. Discuss something other than administration talking points.

Better trolls, please.

corev,

“traditional polical speak.” yeah, meaning you don’t actually answer anything. you provide a paul ryan budget-and its bogus.

you don’t want to increase the debt limit. but you won’t say what you will cut in order to make expenditures equal revenue. if they dont meet, you have a debt to pay. you can’t make vague statements on dollars in a budget. that is what made paul ryan look like a fool months ago. he proposed a budget that could not mathematically exist. when asked for specifics he basically said, trust me it will work, its magic.

you think i lack understanding?

your quote “Really. Treasury can not pay from available funds? That has no impact on the debt ceiling. The only one demonstrating (I prefer) ignorance is you.” and when treasury does not have enough money to pay what is owed, what do we get? debt. payed through borrowing. treasury is only paying what the elected congress approved to spend in the budget. not rocket science.

not a troll, simply calling you and others on your propaganda.

it matters not that the difference is large or small, the debt exists and must be paid. if you refuse to increase the debt limit, that does not eliminate your obligation and you become a deadbeat. no strawman, just simple math for a 3rd grader.

Posted by: tj is baffling at October 16, 2013 11:10 AM

I’m not surprised you cite 3rd grade math, as it appears that’s close to the point at which you dropped out. LOL.

Let me break it down into 3rd grade terms.

Given an income of $3 trillion, would you rather borrow $1.0 trillion every year or $0.25 trillion every year? Which is likely to be seen by both parties as manageable, in an environment in which the average growth rate in tax revenue is no less than the average growth rate in spending?

i raised the issue of the bush tax cuts to illustrate how stupid of a position you have taken on obamacare. you aren’t even intelligent enough to see that! but i will ask you, what did the bush tax cuts do other than move our budget surplus to deficit and explode the debt? because as you know (or may deny?) bush was the first trillion dollar deficit president.

Posted by: tj is baffling at October 16, 2013 11:10 AM

Nonsense, it’s clear you brought up Bush because you can’t form an original thought. I brought up the Obamacare analogy after your post, so you couldn’t have been referring to it, unless you can time travel.

tj, you say

“Given an income of $3 trillion, would you rather borrow $1.0 trillion every year or $0.25 trillion every year?”

you don’t get to choose the amount to borrow. you borrow the difference between expenditures and income. why don’t you understand this concept? Since you don’t control the executive and legislative branches, you ain’t changing the expenditures spanky.

for example, during the Great Recession, other than the year of the stimulus, our budget did not rise tremendously. layoffs at the local, state and federal level offset much of the budget increases due to unemployment and welfare. but our income from taxes plummeted due to the recession. hence there existed a wide gap between income and expenditures-this needed to be covered by treasury selling debt. as the recovery has proceeded, slowly, unemployment and welfare rolls have dropped a bit, but the income from taxes has improved quite a bit. this has significantly closed the gap. in case you were not aware, that is why our yearly deficit has been contracting.

Dr. Chenn,

I was reviewing the daily data at http://www.policyuncertainty.com/us_daily.html.

The 10/14/13 data point is 333.7892. However, your calculations show a data point above 400. What is the difference? Thanks!

Josh

Josh: The BBD daily series is revised daily. That’s why the access date is important to note.