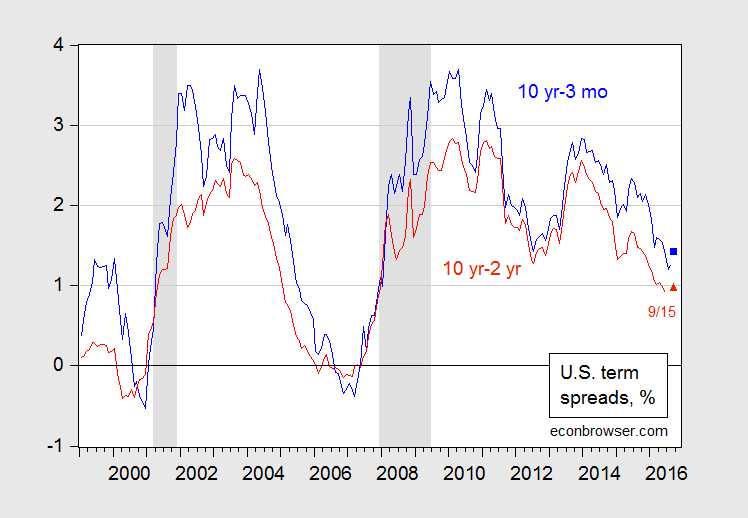

A couple months ago, we were worrying about a yield curve inversion signalling recession. Now there are anxieties about surging long yields, as — apparently — inflation fears loom. It seems to me a little perspective is necessary.

Figure 1: Ten year-3 month Treasury spread (blue), and ten year-2 year Treasury spread (red), in %. September observations for 9/15. NBER defined recession dates shaded gray. Source: Federal Reserve via FRED, finance yahoo, NBER, and author’s calculations.

One Bloomberg article notes that it’s the events associated with the steepening that are unwelcome, rather than the steepening itself.

“…this isn’t the type of steepener Fed officials are hoping for as it’s coincided with the U.S. dollar rallying, and stocks sinking.”

It’s true that since 1986 (beginning of the Great Moderation), increases in the term spread are associated with dollar weakening (measured by Fed real broad dollar index, on a monthly data basis). To me, this is interesting as a real dollar strengthening is inconsistent with higher expected inflation, as posited in the first article.

My observation: Yield curves remain remarkably flat. I’d worry more about a slowdown than an imminent inflationary surge.

The predictive power of an inverted yield is pretty well known, but is there a spread that’s most correlated with a strong economy?

In an open economy with a current account deficit the equilibrium or market clearing interest rate is the one that attracts sufficient foreign capital to finance the deficit with a stable currency. If the exchange rate is rising it implies that rates are too high and if the currency is falling it means rates are too low.

The trade weighted dollar index has been on the rise since 2012, although it is flat in 2016. Does that imply that rates are still too high?

Is the Great Recession over?

Bill McBride has an interesting post today about Mortgage Equity Withdrawal Slightly Positive in Q2

Read more at http://www.calculatedriskblog.com/#Xu7Dz8LzST2HMa1d.99

If we take an R&R view of the Great Recession, one potential end point of such a downturn would be an increase in mortgage equity withdrawals. By at least one measure, that would constitute the end of deleveraging.

I would certainly welcome a related post by Menzie or Jim.