As the prospects for a fiscal stimulus fade, and the prospects for protectionist backlash remain, some observers ponder whether growth will stall before it gets started.

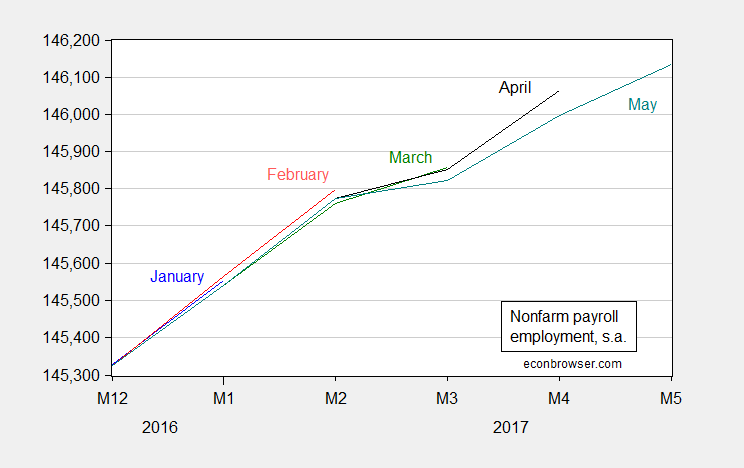

What is true is nonfarm payroll employment growth has slowed, and in fact previous readings have been revised down.

Figure 1: Nonfarm payroll employment for January (blue), February (red), March (green), April (black), and May (blue), in thousands, seasonally adjusted, all on a log scale. Source: BLS, various releases.

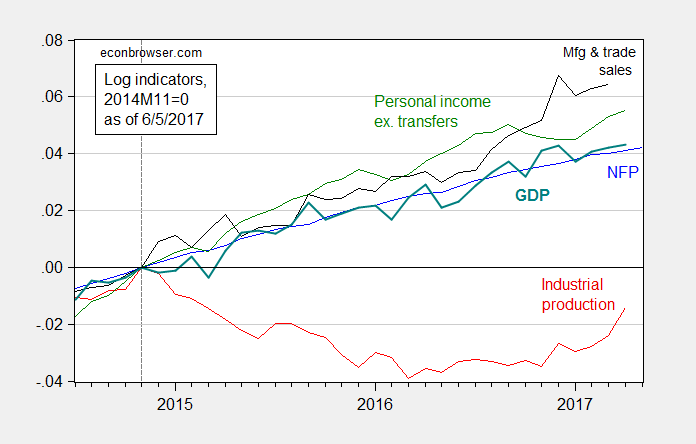

Here are five of the key indicators that the NBER Business Cycle Dating Committee (BCDC) have referred to in the past.

Figure 2: Log nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers, in Ch.2009$ (green), manufacturing and trade sales, in Ch.2009$ (black), and monthly GDP, in Ch.2009$ (bold teal), all normalized to 2014M11=0. Source: BLS, Federal Reserve, BEA, and Macroeconomic Advisers (25 May release), and author’s calculations.

Most indicators are rising, albeit slower in some cases.

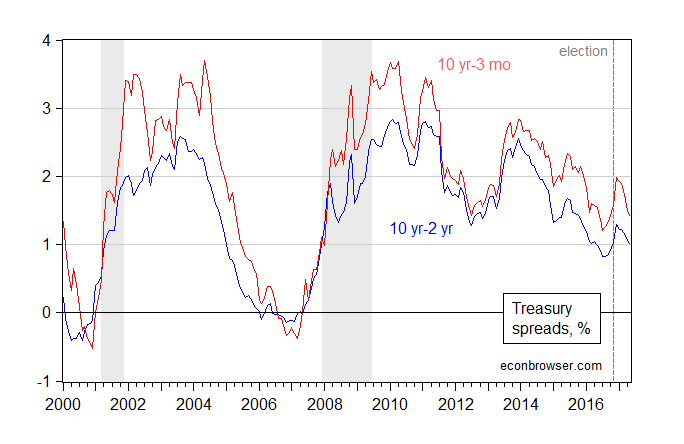

Term spreads are not indicative of a recession.

Figure 3: Ten year constant maturity minus two year constant maturity Treasury yields (blue), ten year minus three month yields (red), in percentage points. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, NBER, author’s calculations.

However, the fact that the spreads have reverted to roughly pre-election levels is indicative of a downward revision of growth prospects.

Oil and base metal prices, particularly copper, have weakened over the past few months. That could be an indicator of slowing aggregate demand growth.

The current US regime has done nothing but dampen real GDP growth prospects since taking office. Political leaders in close allies — military and trade — are increasingly signalling their distance with regards to the current regime. In Canada, some politicians appear increasingly ready to absorb economic losses in order to be seen saliently opposing the regime.

In many respects it is most unfortunate. For example, should the USA and the rich west be at loggerheads with Russia? No. Should the USA have insisted that NATO push into former Soviet block countries in order to sell American grain and American weapon systems? No. Should Americans behave like the high and mighty and draw hard lines around those with whom Americans should not communicate? No.

Moreover, should American elites relentlessly pursue the Trump campaign-Russian connection? Well, to the extent that the Russian state — as opposed to autonomous Russian hackers — did interfere in the election, keeping it on the agenda reminds the world of just how unsophisticated, gullible and easy to manipulate American voters are.

The over-riding message? America is polarized, weak and disoriented. It is hard to imagine how that will be positive for private capital formation.