I’ve seen the argument that China’s tariffs on soybeans will have no effect because the soybeans will be relabeled so that US soybeans go to Europe, and soybeans that previously went to Europe go to China, evading Chinese tariffs on US soybeans. John Cochrane makes this point. This seems to have surface appeal in a world where transport costs are zero, and there are no set-up costs to establishing new trading links. Still, I sensed that this conclusion must rest on some assumptions, including for instance infinitely elastic supply. I decided to investigate further.

For the sake of argument, let’s assume zero transport costs. What does formal modeling say? This was beyond me, fortunately I didn’t have to re-invent the wheel. From Gardner and Kimbrough, “The economics of country specific tariffs,” International Economic Review (1990):

[W]hen the favored country’s free trade production of home importables is large enough the imposition of a country-specific tariff will alter the pattern of world trade but will not affect relative prices or welfare levels throughout the world economy. When this condition is not satisfied a country-specific tariff has an impact that is equivalent to that of a uniform tariff plus a production subsidy in the favored country that is paid for by a transfer from the home country.

In this context, China is “home” and the “favored country” is Brazil or Argentina. Then Cochrane is correct — if the Brazil or Argentina is a sufficiently large low cost producer, then the country-specific tariff targeting the US merely re-arranges trading patterns.

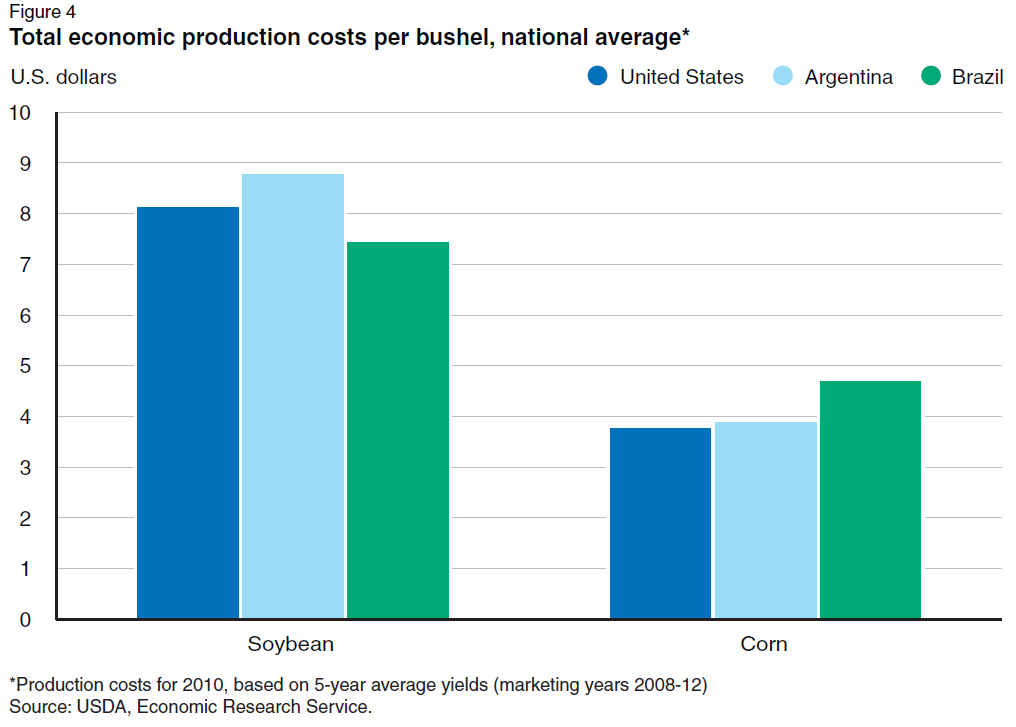

However, if neither Brazil or Argentina are the largest producer, or the US is low cost producer, then the tariff will lower world prices, and raise prices in China. What do the data say?

For costs, this 2016 USDA ERS report suggests that the US is neither the lowest cost, nor highest cost, producer.

Source: Birgit Meade, Estefanía Puricelli, William McBride, Constanza Valdes, Linwood Hoffman, Linda Foreman, and Erik Dohlman (2016).

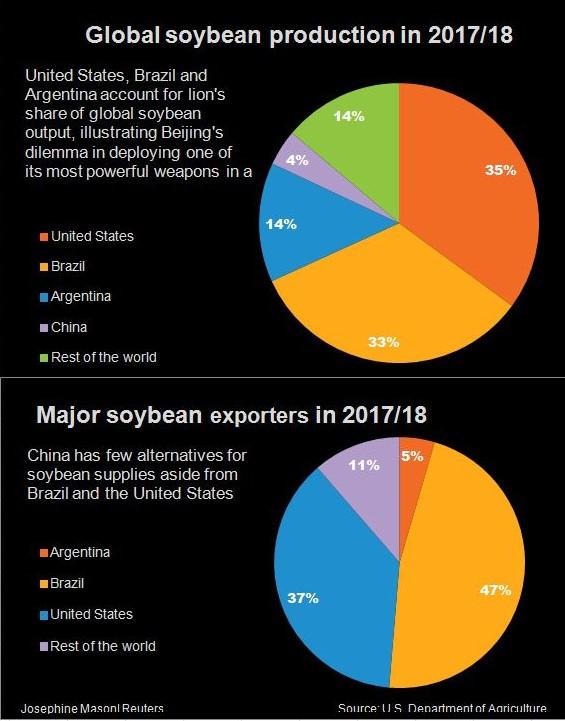

For production, it’s also close; from Reuters via The Burning Platform.

The data suggest that it’s entirely possible that the Chinese tariffs have will have an impact on US soybean export prices, Chinese import prices inclusive of tariffs, and US and Argentine/Brazilian soybean export prices.

Cochrane’s post was about country-specific tariff indeed and good catch that there was that excellent 1990 paper that did a proper analysis. Too bad Cochrane was not so careful in re both the proper terminology and doing a literature search. Speaking of searches – does anyone know where he got that analogy to a subsidy on skunks giving us more cats with white stripes?

Now one would have to wonder why the White House does not do steel tariffs on all imports – not just those from China. Maybe we should ask Kudlow and his trade coalition of the willing.

Pepe Le Pew – I think Cochrane is a fan:

https://www.youtube.com/watch?v=1lsQfTaStcs

I think we have an “implied” future “event study” on our hands. How many months into the future??

It’s time for the main event. It’s time for Johnny “Hellraiser” Cochrane’s cup of coffee in the bigtime!!!! My bet is on what Menzie “The Macho Man” Chinn says. But all commodities are important. Some people in China like coffee over tea. I was always kind of an oolong tea guy myself (When alcohol wasn’t handy, but that’s obvious without typing). Cup of coffee in the bigtime!!!! Ohyeeeeeeeaaaaaaahhh!!!!!

https://www.youtube.com/watch?v=xaE_6rRHmd0

Menzie, we need another graph for importers to show if the anticipated re-branding occurs.

Cochrane addressed this:

“Well then, why not park the ships overnight in Vancouver, or Tokyo, fill out some paperwork, and say steel is imported first from China to Canada, and then Canada to the U.S., and vice versa? Trade bureaucrats are smart enough to catch that.”

Maybe: https://www.theice.com/products/5241941/US-Soybean-Futures/data (select 3 months and 1 year).

And then there is the intended political impact: https://www.reuters.com/article/us-usa-trade-china/chinas-xi-renews-pledges-to-open-economy-cut-tariffs-this-year-as-u-s-trade-row-deepens-idUSKBN1HH084

… if you can believe these “reiterations of previously announced reforms”.

…“But of course actions speak louder than words. We will keep an eye on the progress of those opening-up measures.”

Menzie

There is one separate event that you so far have not accounted for. Argentina is suffering from severe drought. and will not have soybeans available for export near the amount it has had recently. Before the China proposed tariff on soybeans and soybean products, the world did not have much in carry over 0f soybeans, so the reduction of Argentina would created a world shortage in soybeans. The remedy of the shortage in terms of price can only be a reduction of imports by China.

Any increase of transaction cost will be less than the increase of price do to the shortage and China import of non tariff soybeans from Brazil. And one other fact that is effecting worldwide soybean price is the large increase of price by Brazil do to its additional premium charge on its export. That premium is approximately $1,00 above the world price. China because of it central planning Is letting politics dictate where is buying from not price. This high price purchase indicates that China central planners are attempting not to reduce soybean consumption. Because of this, China will be unsuccessful in affecting IS soybean producers’

I expect that this will result in US price will not be less than contemplated before the future tariffs affecting short term price distortion. In fact, there is a good chance the US price will be higher than predicted..

Ed

Ed

This falls under what we called our “ceteris paribus” moment the other day.

Ed Hanson: Yes, as pgl noted, it’s all ceteris paribus. The drought was known as of March 4 when Mr. Trump started threatening sanctions, so in an event study, you would attribute most of the price decrease to news regarding trade policy.

On a more substantive note, a drought in Argentina makes it more likely that for the current crop year, the US is a low cost producer, so that Chinese tariffs on US soybeans is effective.

I think I posted this link of soybean prices over time but just in case it was missed – here it is again:

http://www.macrotrends.net/2531/soybean-prices-historical-chart-data

pgl, other than a lot of volatility, what are you getting at?

Above, I posted a comment with a link to the futures chart also showing some volatility, but nothing extraordinary.

Menzie,

Because Brazilian soybeans have increased in price so rapidly [https://www.cnbc.com/2018/03/27/reuters-america-brazil-soybean-prices-surge-as-u-s-china-trade-spat-deepens.html], that has opened up European markets to the U.S. Given the supply issues with Argentina as Ed Hansen noted, shouldn’t the U.S. farmers be able to sell their crops at a reasonable [profitable] price? https://seekingalpha.com/article/4162033-u-s-soybean-exports-fungible

Chill out Bruce – I was just posting the data. Provide your interpretation for whatever it is worth.

BTW – farmers would get even more profit if we had avoided this stupid trade war. Should I repeat? Ceteris paribus!

Much of this discussion confirms what Menzie is saying but there is one line that strikes me as wrong:

“Brazil is the world’s top producer of soybeans”.

I don’t think so.

Menzie linked to this and provided the graphs:

https://www.theburningplatform.com/2018/04/04/why-chinas-soybean-tariff-changed-everything/

We produce more but Brazil exports more.

pgl, I’m “chill”; I thought you might have had a point.

Let’s see how prices evolve. Tariffs will only be effective if 1) country of soybean origin can be reasonably determined and 2) Chinese customs is actually motivated to enforce the tariffs.

Otherwise, per Slugs, I think it comes down to incremental logistics and administrative costs.

With Kudlow in charge – it may be the case that this whole thing blows up with God knows what will end up happening. After all – he predicted $12 a barrel oil prices some 15 years ago. How did that work out?

Oh, Larry, get out!

@Kopits

#2 is going to take the cracking of the whip by the “higher ups”. China’s customs staff is pretty well known as being the most corrupt on planet Earth. Do the “higher ups” have motivation to crack the whip if not cracking the whip keeps food prices stable for the masses?? I’m actually not sure the answer on this (not willing to argue this particular point) but I lean towards customs “rank and file” are going to have the leeway to do whatever the hell they want.

Well, there is no doubt some aspect of theater in all this.

Having said that, because China is — and always was traditionally — a major exporter of manufactured goods, it is vulnerable to restraints on its trade. Again, this is a reason why China is in fact dependent on the rule of law and due process. As I have written elsewhere, as a functional matter, China is a status quo power. Like the Americans and the British before them (and before them the Romans), China depends on open, stable and predictable trading rules.

Right now, Xi is playing from the T-line; neither at the net nor at the baseline. That’s not a defensible position in the long run. So either China must progress to more codified rules independent of the ruling leader or political party, or it must regress away from open trade.

Hence my piece on China governance options. https://www.princetonpolicy.com/ppa-blog/2018/4/8/chinas-governance-options

@ kopits

I’m glad you said “my piece” and not “my research paper”. As your base argument is incredibly flimsy. You’re basically arguing that if China’s GDP rises at a certain speed Xi Jinping will lose his authoritarian leadership. It’s ridiculous on the face of it and it’s going to be entertaining watching you try to backpedal this, if you haven’t made every attempt to conceal your internet footprint when 2025 roles around.

@ Steven Kopits

I’d also like to repeat a question from another comment thread. Would be interesting to know how you came up with the name “Princeton Policy Advisors”??? As far as I can tell you have no connection to the University. You live in the town??

Menzie

For all your cute Latin, all things are not remaining the same. Since March 4, the projection for Argentina has been further reduced as has India and Uruguay. Offsetting production increases of Brazil and Ukraine is not enough to further reduce total worldwide soybean production. Global soybean production is projected down further 6.1 million tons (reminder, all post March 4 projection). Soybean crush oil and meal are also projected further down. Global soybean stocks are also down another 3.6 million tons.

What does all this mean, well it is confirmed by your favorite July futures, Menzie. Your attempt to encourage panic failed miserably. Today the future piece has been fluctuating from 10.60 and 10.70. Far above your last post’s prices, the day of slight panic. But since then calmer heads prevailed, as the real facts come out. Need I say that the price is now the 50 day moving average.

Ed

Get a clue. Yes – the soybean market has a lot of players with all sorts of events impacting the world market. Yes – a fall in Latin American production ceteris paribus raises prices. And a drop in Chinese consumption raises prices – ceteris paribus.

BTW – even if one does not know Latin, this concept appears in ever Principles of Microeconomics ever written. May I offer to buy you one? I’d be glad to pay the fee if you actually bothered to read it! Lord!

pgl: My impression is that Ed Hanson has not taken a formal econ course as would be taught in undergrad these days.

Menzie.

The price of soybean in the US and the world is rising So which of the options you give is correct. China purchase of Brazil soybean was made at a high premium. So the price that China pays is up, substantially up. The price for the ROW is up modestly. The price to the producer is nicely up and looks like it will continue to rise.

All you theoretical research pales to basic real world price. China is shooting itself in the foot. Not the US. All this is now. I suspect when and if the tariffs actually go into effect, I suspect that China and more so its people will feel the most pain.

Ed

Earlier, I posted a link to Seeking Alpha where “Ironman”, Menzie’s favorite economist, discussed the fungible nature of soybeans. His position was not new nor unique.

Shortly after Trump was elected, this article regarding soybeans, exports, and fungibility, was published in the Twin Cities Press [yes, an area where soybeans are an important crop]: https://www.twincities.com/2016/12/24/real-world-economics-understanding-the-effects-of-a-trade-war-on-farmers/ . It presents both sides of the debate fairly well.

I like this: “In a hypothetical case where a trade dispute remains strictly bi-lateral, i.e. the United States with China or with Mexico and in which the products are truly fungible, the effects on U.S. agriculture might be less than many imagine. But in the real world, trade disputes between major world economies seldom are so neat.”

Once again, the answer is “maybe”.

Tariffs/embargo? From previous post.

The oil embargo had some interesting long term impacts. Can any thing be learned from those impacts? Asking For A Friend.

That USDA ERS report had some impressive information on the cost structure for producing soybeans. I say this in part because the tax authorities of Argentina and Brazil have argued that Bunge is using abusive transfer pricing to shit income to tax havens. Given the weak metrics the tax authorities often use, their claims leave me cold. But if one really wants to get into a proper analysis of arm’s length pricing, the data in this awesome report would be a nice starting point.

Remember how Sonny Purdue over at Dept. of Agriculture suggested we would support farmers hit by the soybean and hog tariffs. It seems Putin can play that game too!

https://talkingpointsmemo.com/world-news/russia-support-companies-us-sanctions

“MOSCOW (AP) — Russia said Monday it will support companies hit by fresh U.S. sanctions as the ruble and Russian stocks dropped sharply….Prime Minister Dmitry Medvedev ordered his Cabinet to draw up measures to support sanctioned companies in the energy, metals and arms sectors, Russian news agencies reported. Shares in sanctioned aluminum producer Rusal, which is controlled by the billionaire businessman Oleg Deripaska, plunged just over 50 percent on the Hong Kong stock exchange Monday.”

I wonder if Dean Baker has been reading all the nonsense about China stealing our IP as he certainly takes that canard to the wood shed!

http://cepr.net/blogs/beat-the-press/disagreeing-with-krugman-is-china-stealing-knowledge

When I was in China, I want to express that most of my experiences were positive, and most of the people I met on a personal level were good people. But China is no stranger to using “food substitutes”, using the word substitute very liberally. Many/most of these “substitutes” are produced domestically. I had many weird experiences in China (mostly due to culture shock). One of these weird experiences was watching mainland Chinese (northeast region) at a grocery story or even a large supermarket, looking at (really studying) large bags of rice for 5–10 minutes, as if it was a care package they had just received postage-stamped from planet Neptune. I had been there months before really figuring out this phenomenon of Chinese staring at and studying large bags of rice at the supermarket for 5-10 minutes continuous. Then it dawned on me:

https://rendezvous.blogs.nytimes.com/2012/07/23/carcinogen-found-in-chinese-baby-formula

https://www.nytimes.com/2011/01/15/world/asia/15briefs-Milk.html

https://www.nytimes.com/2010/12/29/world/asia/web-briefs-Chinabrf.html

You have to ask a question. “If Chinese are clever enough to fool their compatriots on what a bag of rice looks/feels/tastes like—what other type of food products would they be good at imitating??”

Some American Chinese will read the above and go “this white dude is really funny”. I had highly-educated mainland Chinese tell me on more than one occasion, straight-faced as hell, that this was exactly the case of what the “studying” of large bags of rice at the supermarket was all about.

Yes, a significant part of the change will be in substitution between goods having different tariffs but capable of satisfying comparable ends, some of which won’t be imported at all.

“Return of the Secular Stagnation Jedi”

http://larrysummers.com/2018/02/28/no-obamasclerosis-wasnt-a-real-problem-for-the-economy/

https://www.youtube.com/watch?v=WWtOTc84LkI

My crackpot theory for awhile now (based on nothing empirical) is that If Trump has greater than 1.5% GDP over his term, there will be enough functionally illiterate Americans to re-elect him. If GDP falls below 1.5% things get “hairy” for Trump re-election, and if below 0.5% GDP he’s finished.

Yoda! I bet he turned down Trump’s request for him to serve on the Council of Economic Advisers too!

“[i]f neither Brazil or Argentina are (sic) the largest producer, or the US is low cost producer, then the tariff will lower world prices, and raise prices in China. What do the data say?”

Are your conditions are sufficient to justify the conclusion? For example, the paper you cite uses a three-country model, so wouldn’t the ‘favored nation’ be the sum of Brazil and Argentina (and ROW)? If transport costs are truly insignificant, then current exports are not even relevant to the question, because local consumption currently supplied from local production can be replaced by foreign production….