Relative to before.

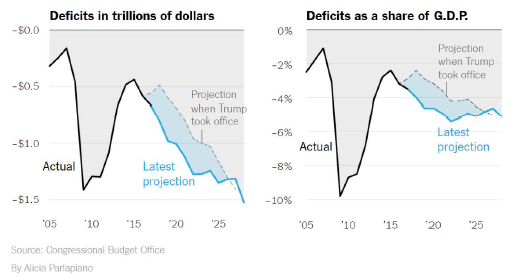

Source: CBO, Budget and Economic Outlook, April 2018 via Kaplan/NYT.

these estimates include macro feedback effects (i.e., dynamic scoring). So much for tax cuts paying for themselves (if anybody ever really believed that).

Relative to before.

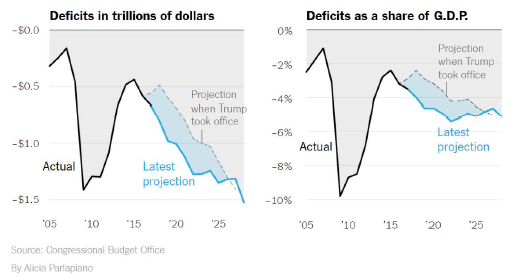

Source: CBO, Budget and Economic Outlook, April 2018 via Kaplan/NYT.

these estimates include macro feedback effects (i.e., dynamic scoring). So much for tax cuts paying for themselves (if anybody ever really believed that).

Republicans’ pretend concern over the budget has been a boldfaced lie since the days of Reagan. But the majority of Americans showed they prefer lies back in 1984. Mondale told them the 100% truth, and as a “reward” for telling the American people the truth, Mondale got electorally body-slammed on national television and excoriated by the pretty people with broadcasting degrees:

https://www.youtube.com/watch?v=07m39CQRJXw

When you bitch about “politicians always telling lies”, look in the mirror. If you voted for Reagan, you got exactly what you F’ing asked for. Mondale’s political mentor was Hubert Humphrey, a man who also believed patronizing voters (or the village idiot, as the case may be) was a mistake. 34 years later, literally over 1/3 of a century, the American people have proven they haven’t learned jack-sh*t in the interim when they voted for the philandering, lady-parts grabbing, money launderer, with the orange squirrel on his head.

Save these animals—>> https://www.youtube.com/watch?v=bn7NcJIhmUg don’t vote for subhumans who wear dead orange squirrels on their forehead.

Menzie,

Your statement “So much for tax cuts paying for themselves (if anybody ever really believed that).” seems to suggest that you unequivocally do not believe (nor do you think that anyone has ever believed that) tax cuts can ever, in any circumstance , pay for themselves. Is this your assertion?

rtd: In the context of personal and corporate income, payroll, taxes, I do not believe that (at levels observed in 2017) tax rate reductions will result in revenue increases. In other words, I meant this in the context of the TCJA, as well as the EGTRRA and JGTRRA, and the Reagan tax cuts of the early 1980s.

That seems to be a bit more specific than the outright denial that your or “anybody ever really believed” in a single conceivable example whereby a country could experience “tax cuts paying for themselves”. I suspected you would qualify your statement when pressed to provide thought.

rtd: I thought it would be understood by the context, but clearly I have overestimated some of my readers. For instance, I do believe tax rate reductions in 1980 Tanzania would’ve probably led to an increase in tax revenue. But I wasn’t writing in the context of Tanzania.

Rather, you have clearly overestimated your writing ability. To me the context (as always) was your partisan blogging which skews towards favoring normative economics over positive economics.

Quantity blogging < quality blogging.

Menzie, since we are talking context, tell us what was going on in the charts, 2005 & 2006, just prior to the deep recession. The EG/JGTRRA were passed in 2001 & 2003 respectively. It would seem contextually the charts should show their economic impacts.

RTD, please stop embarrassing yourself. Take your own advice: quantity trolling < quality trolling.

@ rtd

“rtd”, You could always start a blog of your own and “show us how it’s done”. Unfortunately for us (or unfortunately for you), your only specialty skill seems to be knocking down others whose ability, accomplishments, and writing far outshines your own.

Don’t feel sad though “rtd”. Every Hollywood film and every economics blog should have a TaserFace. You fill the TaserFace role perfectly

https://youtu.be/_7tP-R-90SU?t=4s

Moses,

Thanks for playing & providing additional bold typeface!!!

https://www.investors.com/wp-content/uploads/2018/03/EDITrevs031318.png

Perhaps the problem is not so much revenues as spending.

https://www.washingtonpost.com/news/powerpost/wp/2018/03/22/heres-what-congress-is-stuffing-into-its-1-3-trillion-spending-bill/?utm_term=.f6e7a5aafc54

Nah. All you have done is cite an article about one side of the issue and claim it proves which side of the issue is the “problem”. That is merely a statement of your bias.

Two facts to keep in mind:

1) The budget balance is a balance – revenues and outlays jointly determine that balance.

2) Government spending as a share of GDP has been on a downward trend and is now quite low relative to the post-WWII norm. The same is true of government revenue.

Based on those facts, the problem appears to be that revenue has fallen faster than spending as a share of GDP.

rtd Almost 50 years ago Nobel laureate James Mirrlees started writing papers on the “optimal” income tax rate. By “optimal” he meant revenue maximizing. He argued that tax revenues would not begin to fall until the marginal rate exceeded 50 percent. Mirrlees analysis was largely theoretically based. More recent empirically based estimates by Emmanuel Saez suggest that the revenue maximizing rate is considerably higher…around 65 to 70 percent. No serious person believes that tax cuts pay for themselves with anything like current rates.

Menzie tax rate reductions will result in revenue increases

I don’t think that’s quite what you wanted to say. I believe that it is possible under some circumstances for revenues to increase; however, rtd asked if tax cuts could pay for themselves. Revenues could increase, but they would not increase enough to pay for the tax cut. You could get that result from the aggregate demand/fiscal multiplier effect. Of course, that’s quite different from supply side tax cuts which are supposed to work through income and substitution effects.

2slugs, I well remember the discussions with you and the other BDS sufferers who could not admit we were nearly at a balanced budget. From the calculations of that era the Fed Budget was < 2 years from balancing, except for that pesky recession.

"Federal Deficits were declining in the mid 2000s as the nation climbed out of the 2000-02 recession, down to 1.1 percent of GDP in 2007. But the recession that started late in 2006 drove deficits higher, with a deficit of nearly 10 percent of GDP in FY 2009, driven mainly by bank bailouts under the TARP program. "

https://www.usgovernmentspending.com/federal_deficit_percent_gdp

Those 3 Acts, TCJA, as well as the EGTRRA and JGTRRA, resulted in a budget surplus, under Cinton's administration and getting us out of a shallow recession and near budget surplus under the Bush administration. Clinton's results are pointed to as the (fill in the Dem claim here), even though the Act was bipartisan passed under a Republican Congress in a Democrat administration.

Actual data is always better than hypothetical/theoretical. Well almost, except for Climate data, where the actual raw data is seldom used.

That TCJA reference should have been the Taxpayer Relief Act coupled with the Balanced Budget Act of 1997. My dyslexia reared its ugly head again.

“But the recession that started late in 2006 drove deficits higher”.

No – NBER says the recession began in Dec. 2007. Of course Menzie would note that Donald Luskin was writing as late as September 2008 that we were not in a recession!

I have no clue where CoRev gets his numbers but I’m looking at the 2006 figures in Table 3.2. Federal Government Current Receipts and Expenditures of the NIPA tables over at http://www.bea.gov. During CoRev’s year of choosing Federal spending was 19.91% of GDP while tax revenues were 18.28% of GDP. In other words during CoRev’s year of choosing the Federal deficit was over 1.6% of GDP. The deficit/GDP ratio was higher in 2007. So CoRev’s 1.1% of GDP figure seems to be very off.

Only pgl could say this: “I have no clue where CoRev gets his numbers …” Then follow with this: “I went to your link.” Just more meaningless drivel.

CoRev got his numbers from the same place he gets most of his takes. His backside.

Anyone with an ounce of honesty knows that tax cuts have not “paid for themselves” for at least 40 years in the US, once the top tax rate was cut past 50 percent. And this is even more so in these days, when corporations care about “shareholder value” over actually making stuff or adequately paying workers.

Here’s the even scarier part about those graphs Professor Chinn put up – it includes the CBO’s assumptions of 3.3% growth in 2018 and 3.3% unemployment next year. Given the rising inflation and rising deficits, that likely means higher interest rates, and I’d be very skeptical of those rosy growth figures being reached.

Just like Paul Ryan, you’re a joke outside of Bubble World. Get some pride and admit the failure.

I went to your link. I was impressed by all the flashy ads and how they made the page all colorful. But this looks like the data was compiled by a 3 year old. There are better sources of data than your piece of junk which clearly gets the date of the recession wrong and has made mistakes about the deficti/GDP ratio.

>b>CoRev I don’t think you remember things nearly as well as you imagine. For starters, the Great Recession did not start in late 2006, as your link claims. NBER is the authority for dating recessions, and NBER says it began in Dec 2007. So you’re at least a year off. As to the deficits, the unified budget deficit did get down to 1.1% in FY2007; however, that’s not a particularly good performance considering that the economy was operating at and slightly above potential GDP by then. Pretty poor, especially considering how mild the 2001 recession was. But the on-budget deficit, which is the part that the Executive Branch controls, was 2.4% in FY2007. That was Bush’s best. That’s a piss poor performance and barely better than the FY2015 on-budget deficit of 2.6%.

The 1997 Taxpayer Relief Act was largely a mistake given that the economy was running pretty hot. As a result, the Fed increased interest rates. It was likely those interest rate hikes that pushed the economy into a shallow recession in 2001. The EGTRRA might have helped the economy recover from the 2001 recession, but the bad things that went with it almost certainly made things worse over the longer run. The 2003 JGTRRA was a complete disaster, as you can easily see if you look at the on-budget deficits in the OMB historical tables.

Yes, actual data is best. You should try it sometime.

CoRev relies on http://www.usgovernment.com which is not a government web site clearly. Its data is all garbage. Of course it seems to be affiliated with the Tea Party which explains how it got so many things so wrong.

Wow! The same BS arguments as 2006/7. Of course the Clinton budget surplus was soooo different

CoRev: According to the January 2017 CBO estimates, full employment budget surplus in 2000 was +1.8% of potential GDP; in 2006, it was -1.9%. See CBO.

CoRev The Clinton budget surplus was due to a combination of good luck and the 1993 tax hike, and to some extent Bush 41’s decision to not read his own lips and raise taxes in FY1991. Clinton doesn’t deserve a lot of credit for his good luck, but he does deserve credit for raising taxes in 1993. It cost him dearly in 1994, but that’s because off year voters are not terribly bright about economics.

I was not a fan of Clinton’s 1997 tax cut. I thought it added stimulus at a time when the economy didn’t need any. It also had the distorting effect of pulling forward tax receipts from capital gains. That was a temporary blip and sent false signals.

Menzie, what? We already know the 2006 budget was in a deficit. If you are trying to point out the difference 1.1 or 1.8% in the article referenced, OK. Take it up with the artice’s author(s).

My point was that the Bush deficits had been falling, and in 2007 it bottomed at 160,701 before that pesky recession. The two Bush tax cuts were lowering the deficits after the early recession.

CoRev uses a Tea Party source for Federal data?

https://www.dailykos.com/stories/2013/1/19/1180307/-Nate-Silver-s-data-sourceing-leaves-me-speechless

“Let me say after reading the post, his conclusions, and looking at his sources, I was in shock. Let me re-state that, total shock! Here is Nate Silver –whose book says over and over again “to always check your data sources” — using a site that quite frankly seems to have pretty shifty data. As I was looking through the source site usgovernmentspending.com I stumbled on a link specifically for Tea Party people, probably to reload the old data cannon.”

pgl

CoRev uses a Tea Party source for Federal data?

That’s because CoRev was an early and active supporter of the Tea Party. He still has not repented of his sin.

Pgl, dailyKos???????

rtd, you put the word “unequivocally” into the argument and then attributed it to menzie.

i guess i could surmise, based on the comments of rtd, “seems to suggest that you unequivocally DO believe tax cuts will always, in all circumstance , pay for themselves. Is this your assertion?”

i am rather surprised by your belief rtd, i thought you had a better understanding of economics.

Not quite…

1) I never attributed that word to Menzie. I said Menzie’s comment “seems to suggest…” where “seems to suggest” is important here.

2) I haven’t made any claim in this post about my beliefs regarding tax cuts (conta- Menzie). This seems to be a common interwebz mistake where someone (baffling) makes an assumption of another’s (rtd) belief based on that person (rtd) critiquing someone’s (Menzie) comment. Just because one (rtd) questions another’s (Menzie) comment, this in no way necessarily implies agreement/disagreement with core thesis of said comment. You’re extrapolation isn’t based on any assertion I’ve made (contra- my extrapolation being directly based off of Menzie’s hasty blogging).

3) I’m rather surprised by your comment baffling, I thought you had a better understanding of reading comprehension and debate.

RTD, nope! Baffled does it all the time. With me most often with Climate Change does he show his lack of reading comprehension.

It’s baffling how baffling baffaling baffles.

rtd, “seems to suggest” is your way of putting words into menzie’s mouth. you did not like it when i did the same thing to you. perhaps you should reconsider your comments towards menzie. this was simply a lesson for you to learn from rtd.

But his comments did “seem to suggest”. You’re trying to make a point, i get it, but doing so on a faulty premise as there was nothing that I said that suggest how I feel about the impacts of changes in tax law. See?

“seems to suggest” the term “unequivocally”? no. “seems to suggest” the term “many” or “most”? that would be a much better interpretation, than your interpretation of an extreme position. if an extreme position has not been explicitly stated, it is probably inappropriate for one to assume that is the position taken. somebody assuming an extreme position is usually trying to set up a straw man argument.

“Seems to suggest” to those having poor reading comprehension skills I suppose.

“So much for tax cuts paying for themselves (if anybody ever really believed that).”

is different than

“So much for THESE tax cuts paying for themselves (if anybody ever really believed THESE TAX CUTS WOULD DO that).”

Also, any reader of this blog knows how Menzie is keen on trying to play “gotcha” when readers make similar omissions and/or are not 100% specific in what they mean – I’m just playing the same game as our host.

Republicans love deficits. Reagan and Bush Jnr were as bad as the present incumbent.

When out of government they castigates democrats for the said deficits.

Groundhog day all over again.

The key will be to stop playing this silly game the next time the legislatures flip.

Randomworker and Not Trampis, ignoring history: “The key will be to stop playing this silly game the next time the legislatures flip.” andn

“Republicans love deficits. ”

You seem to forget we just had 3 administrations of experience, Clinton, Bush, and Obama. Two out of three of those administrations had a surplus or near budget surplus. Only the Obama yuuge legislative flip set the budget deficit record.

CoRev, Apparently you do not understand the concept of ‘the deficit as a percentage of GDP’. Just because the deficit was 1.1% of GDP in 2007 does not mean we were anywhere near a balanced budget. The (bubble) growth of the economy simply made the deficit look smaller in percentage terms. The Obama years look bad in comparison because GDP decreased ‘yuge-ly’ while at the same time economic stabilizers (unemployment insurance, SNAP, other transfer payments) increased.

Not Trampis is correct. When Republicans are in power they love deficits and when a Dem is president they hate them. It all plays to their efforts to dismantle Social Security, Medicare and Medicaid. Here’s their playbook:

IN POWER

1. Cut taxes (increase deficit)

2. Increase spending (defense, Homeland security, border patrol, the wall)

3. Say ‘welfare program spending is out of control’.

4. Attempt to cut said programs to control deficit.

OUT OF POWER

1. Say ‘Deficits matter’

2. Say ‘welfare program spending is out of control’.

3. Attempt to cut said programs.

4. Obstruct any attempt by Dems to raise taxes, because only ‘cutting spending’ solves deficits.

When all else fails, start a war.

It was higher than 1.1% of GDP in 2006 and even higher in 2007. CoRev is relying on a bogus web site run by some Tea Party fool.

but in your world, the obama deficits had nothing to do with the collapsing economy bush handed off? and clinton had nothing to do with the good year of bush?

Sorry CoRev but no one should ever trust what you say on this issue. http://www.governmentspending.com puts out bogus data. Then again – it does seem to be linked to the Tea Party.

Try using http://www.bea.gov for reliable data next time.

Pgl, and baffled, I sure will try to go to BEA. But who to believe? Pgl, relying on a dubious source, Dailykos, with no link for his “you’re wrong” because you site may be agenda driven or 2slugs: “As to the deficits, the unified budget deficit did get down to 1.1% in FY2007”

CoRev or 2slugs: “As to the deficits, the unified budget deficit did get down to 1.1% in FY2007”

The 1.1% unified budget deficit is from the OMB historical tables. Keep in mind that OMB organizes data around the fiscal year, while BEA organizes data around the calendar year. Both OMB and BEA data are available online.

2slugs, organizing Federal fiscal data outside the Federal Fiscal Year, and then using those calendar year

results as proof is as disingenuous as can be.

CoRev 2slugs, organizing Federal fiscal data outside the Federal Fiscal Year, and then using those calendar year

results as proof is as disingenuous as can be.

You’ll have to explain further. I don’t understand what you’re trying to say. BEA reports data both quarterly and annually. BEA’s annual GDP is an average of the four quarters of quarterly GDP. Remember, GDP is a flow variable, so the quarterly GDP represents GDP expressed at an annual rate. OMB summarizes the deficit as a percent of GDP. They just take the average of BEA’s quarterly GDP measured over 4QFY thru 3QFY+1 in order to align it with the fiscal year. It’s pretty simple arithmetic and pretty transparent, so I don’t see how it’s “disingenuous”.

BTW, this is a fairly common transformation throughout government. For example, DoD operating tempo is frequently captured by private sector data collectors as calendar year; but budget execution actions follow the fiscal year, so you have to reconcile the data to a common baseline. If you don’t, then you’ll find yourself using 1QFY (i.e., Oct-Dec) data alongside 1QCY (i.e., Jan-Mar) data.

2slugs, when you see how corev fails understand how raw temperature data has to be modified for usefulness, then you can appreciate how he could fail to understand your simple explanation of data transformation on gdp data for equivalent comparisons.

Matey Obama cut the deficit something fierce. He inherited one of 10% of GDP and what was it when he finished?

Bush Jnr inherited a surplus and blew it on tax cuts.

When I read the Hoover Five’s frantic fear of deficits and their call for slashing “entitlements”, I often ask why not raise tax rates. Then I re-read the Hoover Five’s writing which strongly suggests that the most we can get Federal revenues to be is near 20% of GDP. Of course this is a silly assertion which begs the question why do they write such nonsense. Paul Krugman recently suggested an answer – they have to serve their political masters so as to get a seat at the table along side of nut jobs like Lawrence Kudlow.

Here’s what GOPers think fiscal conservatism means:

Revenue will rise by 4.8% per annum in 2018-23, down from 6.2% p.a. in the previous (2013-17) five-year period. That’s despite a bump up in nominal economic growth from 3.5% p.a. to 4.1% a year.

Spending will rise 5.8% a year, after five years of average 2.4% p.a.. And, after dropping 9.3% each year, the deficit will rise by 9.6% in 2018 and the four subsequent years.

Menzie

There are two components to deficits, income to the government and outlays by the government. You have described the bad news of increase deficits and debt due to increase outlays. But lets describe the good news of increase GDP, increased income to the government caused by the recent tax act., as described by the CBO.

“CBO’s current economic projections differ from those that the agency made in June 2017 in a number of ways. The most significant is that potential and actual real GDP are projected to grow more quickly over the next few years.As a result, the levels of those measures are 1.6 percent higher than CBO previously estimated for 2027 (the last year in the previous projection period).

Projected output is greater because of recently enacted legislation, data that became available after CBO’s previous economic projections were completed, and improvements in the agency’s analytical methods. Also, because inflation is now anticipated to be higher, the level of nominal GDP is projected to be 2.4 percent higher in 2027 than previously estimated.”

Recognize good news as it happens. Marginal income rates are lower. Corporate income tax is lower.

Over the next decade, the unemployment rate is lower in CBO’s current projections than in its previous ones— particularly during the next few years, when economic stimulus boosts demand for labor. Also, both short- and long- term interest rates are projected to be higher, on

average, from 2018 to 2023—by roughly 0.7 percentage points and 0.4 percentage points, respectively—than projected in June. That faster rise in interest rates primarily reflects stronger overall demand.

Interest will rise for the good reason, increase demand.

The above good news describes half the way tax cuts can pay for themselves. The other half has not been done, that being reform of 77% of the budget, nondiscretionary spending. Tax reform has done its job, higher growth, larger income to government, lower unemployment. greater demand.

Now it is the time for spending reductions. Unfortunately, little chance for that with current appropriators in charge, but really unfortunate, no chance if a new crop of democrat appropriators are put in charge.

Ed

Ed? Did you read this before posting?

“the levels of those measures are 1.6 percent higher than CBO previously estimated for 2027 ”

In other words, they are saying potential GDP will grow by less than 0.2% per year faster per this very optimistic forecast. Given that a lot of economic models show that gross national income will fall relative to GDP, it is quite possible that gross national income growth will suffer as a result of this tax cut. Paul Krugman has discussed this extensively.

You see something you think confirms the Laffer curve nonsense from the Trump White House but it clearly does not. Please think this through more carefully before lecturing Menzie!

Ed Hanson I think you’re confusing GDP and the deficit. CBO says that GDP will increase due to the tax cuts. It does not say the increase in GDP will offset the revenue losses. In fact, CBO says that revenues as a percent of GDP will fall, so I don’t understand why you claim “larger income to government.” That’s why the deficit increases. Revenues don’t begin to increase until the tax cuts start phasing out. It sounds like you’re in search of a free lunch. Also, note that the higher GDP projected over the next few years implies actual GDP is greater than potential GDP. That’s not sustainable. It’s also a bit implausible that the Fed will not react, which puts the CBO’s interest rate projections in some doubt.

The other half has not been done, that being reform of 77% of the budget, nondiscretionary spending.

I’m not sure what you mean here. Are you suggesting that the government default on the non-marketable bonds that have been restraining the amount that the Treasury has to borrow from the public? I suppose default is one way of improving the government’s fiscal position, but I wouldn’t recommend it.

An increase in the annual growth rate of only 0.16% has no chance of offsetting the revenue losses. If Ed does not get that, he needs to get his preK teacher help him with 2 plus 2.

Martin Neil Baily, Jason Furman, Alan B. Krueger, Laura D’Andrea Tyson and Janet L. Yellen” “A debt crisis is coming. But don’t blame entitlements”

https://www.washingtonpost.com/opinions/a-debt-crisis-is-coming-but-dont-blame-entitlements/2018/04/08/968df5c2-38fb-11e8-9c0a-85d477d9a226_story.html?utm_term=.76dd4ef7dcd7

It is a good discussion taking down the nonsense from the Hoover Five. Mark Thoma featured it over at his place. Of course the left wing trolls who are still mad that Sanders did not win the Democratic nomination decided to attack it. Why? Because these trolls think the long-run government budget constraint is a “hoax”.

Can you give us some examples of these Sanders supporters who are trolls?? I’m honestly curious. Troll usually has a derogatory tone to it. Is support of a woman who is a pathological liar mandatory, in order not to be dumped into the trolls camp??

Some breaking good news for a change – Paul Ryan (the most dishonest Speaker of the House ever) has decided not to run for reelection!

@ pgi

Are you implying that Republican Paul Ryan is not one hell of a guy?? Or that Ryan is not the genius “technocrat” that David Brooks has been trying to rote style teach us?? I always thought it was super cool when Ryan was talking to his constituency like they were 12 years old and that the “job creators” are the next closest thing to Jesus. Watch his keen sense at interpersonal communication:

https://youtu.be/h5kgnE1Xvec?t=26s

Here’s another hit single from “Paul Ryan’s Greatest Hits” album. Ryan’s main problem here was AARP keeps its members well educated on when U.S. Senators are trying to take a large crap on their head (a “legislative crap” on seniors’ head, if Menzie will allow me to be so bold). So Paul Ryan just showing up in a suit, smiling, and saying “David Brooks says I’m….. like, a technocrat genius and stuff” isn’t going to cut it for that crowd

https://www.youtube.com/watch?v=nBmCrtqjPwg

Really? Most dishonest? That’s like saying the worst movie ever. It’s a crowded field.

you do understand the increase in deficit caused by the conservative economic policy is exactly what is wanted. because the problem is not the tax cut, it is the out of control entitlement spending that is causing this deficit problem. this is how you starve the beast. conservatives do not want any policy which reduces the deficit, as it keeps them from attacking the social safety net. they need an excuse.

I provided a link to the latest long winded intellectual garbage from John Cochrane of the Hoover Five. He seems to say we can afford entitlements but only if we tax the little people. After all – he thinks we already have the most progressive tax system ever. Wait it gets better. He says we cannot tax rich people lest economic growth goes to hell.

It is a very long winded rant but read it if you have the time. Cochrane truly has gone off the deep end!

Here’s California’s example how to pay for a bloated government:

http://adrianvanceshow.blogspot.com/2014/01/normal-0-false-false-false.html?m=1

The author of your fluff describes himself as “a California resident and victim of their Franchise Tax Board, a mini IRS, Gestapo and KGB, fighting back”.

It looks like he has been evading sales taxes just like you have!

Adrian Vance has a lot of nut job blog posts! No wonder you cite him as some sort of authority! Geeesh!

You believe the mainstream media will be all over it? – good luck – you’ll remain ignorant.

This is even more incoherent than that gibberish from Adrian Vance. Seek professional help!

We need to keep an open mind to the possibility that hysteresis is real and that it can be reversed. US labor force participation is falling; everyone else’s is rising. Lots of workers can return. CBO has been consistently wrong about the depth of stagnation. Why believe them now?

John Cochrane responds to the critics of the Hoover Five. Warning it is a very long winded rant even for Cochrane:

https://johnhcochrane.blogspot.com/2018/04/why-not-taxes.html

I endured this long winded rant to see if he had any point to all of his huffing and puffing. Here is the Cliff Notes version. We can raise the tax/GDP ratio but only if we pass more regressive taxes. After all – the US supposedly has the most progressive tax system ever. OK – I will wait until you get off the floor from laughing so hard.

His other argument is that progressive taxes are so distorting that they will kill the golden goose of growth. After all – Art Laffer deserves a Nobel Prize I guess!

Remember The So-Called’s tax cut promised growth that would swamp any growth in SS or Medicare.

Entitlements will be not a problem.

Two different questions:

(1) Can tax cuts increase revenues?

(2) Can tax cuts pay for themselves?

Those are two very different questions, but sometimes they get conflated. The first thing to note is that tax cuts can have demand effects and supply side effects. The supply side effects hinge on a trade-off between substitution and income effects. Under some conditions supply side tax cuts can increase revenues and in a sense pay for themselves; however, those conditions are only true if the current tax rate is at least twice as high as today’s top marginal rate. They might have had some relevance when talking about the JFK/LBJ tax cuts that brought the top rate down from 90% to 70%, but it’s a waste of breath when talking about today’s tax rates. So that leaves us with tax cuts that affect aggregate demand. Can AD tax cuts increase revenues? Can AD tax cuts pay for themselves? Let’s work with a few very simple and very naïve example. Suppose:

Autonomous demand is $100B

The marginal propensity to consume (MPC) is 0.9

The tax rate is 50%

Assume a naïve fiscal multiplier model with no import parameter and no Fed reaction.

The initial baseline output equals:

[1 / (1 – MPC(1 – T)]*$100B

= [1 / (1 – .9(1 – .5)]*$100B

= [1 / (1 – .45)]*$100B

= [1 / .55]*$100B = $181.82

Tax revenues = $181.82 * 50% = $90.91B

Now suppose the tax rate falls to 45%:

Output = [1 / 1- .9(1 – .45)]*$100B

= [1 / (1 – .9(.55)]*100B

= [1 / (.505]*$100B = $198.02B

Tax revenues = $198.02 * 45% = $89.11B

But suppose the tax rate only falls to 47%

Output = [1 / 1 – .9(53)]*$100B

= [1 / 0.523]*$100B = $191.20B

Tax revenues = $191.20B * 47% = $89.87B

Notice what’s going on here. GDP is increasing, but not enough to increase revenues. In order to increase revenues you need an additional supply side effect that would increase GDP beyond the aggregate demand effect. But in order to get that additional supply side effect the substitution effect would have to outweigh the income effect on labor, and the empirical data tells us that this only happens at VERY high marginal rates. So the bottom line is that under current rates, tax cuts will not increase revenues and will not pay for themselves even in an extremely simple model. Adding other complicating factors only reinforces the point. Tax cuts might increase GDP, but they do not pay for themselves.

If one includes a high marginal propensity to invest, one can get larger aggregate demand effects. But of course we are assuming no increase in real interest rates which would be feasible only if we were still FAR from full employment. That might work in 1933 but not in 2018.

Of course we are doing actual economics here which is going to be totally lost on Ed, CoRev, and PeakIgnorance.

Right. And I wanted to emphasize that I used a VERY simple and VERY naïve fiscal multiplier approach with no Federal Reserve reaction. And I used very high tax rates. In other words, I deliberately used data that presented the very best possible case for the argument that tax cuts pay for themselves. I put my thumb on the scale to try and make things work out their way. And even after putting my thumb on the scale the numbers still don’t work for the Tea Party/Laffer argument.

Pgl, more high school economics – time to cut & paste.

If the country is at full employment, why did it create an average of 190,000 jobs per month over the past 12 months?

And, how do you explain the expensive L-shaped recovery from the severe recession, which I’m sure you voted for and would continue to support?

https://www.advisorperspectives.com/dshort/updates/2018/03/28/q4-real-gdp-per-capita-2-09-versus-the-2-89-headline-real-gdp

Funny that you call 2slug’s Keynesian multiplier model high school economics. Let us know when you finally pass kindergarten arithmetic!

Pgl, 2slugbaits knows a lot more about economics than you.

“If the country is at full employment, why did it create an average of 190,000 jobs per month over the past 12 months?”

should there be no job creation at full employment?

Full employment is something of a slippery concept. In theory, it is the maximum employment rate which does not cause inflation. But who knows what that is today?

In practice, the notion of full employment depends on 1) what labor force participation rate one considers a maximum, and 2) what unemployment rate one considers sustainable.

It also depends on labor supply growth, ie, if the labor force were growing by 2.4 million per year, then the economy could add 200k jobs per month and still technically be at full employment.

Peak’s view has been that the labor force participation rate has been weak and thus contains hidden reserves. This view is not entirely without merit, but it depends on the assumptions one makes.

https://4.bp.blogspot.com/-OZcoP4FwNYI/WqKOqko7MEI/AAAAAAAAuHg/mnQRTPK7zlcZ31aXNfxAz1fGvhw_sy5AQCLcBGAs/s1600/EmployPopFeb2018.PNG

Well, it’s worse than that.

The share of federal taxes in GDP is 18.2%.

The share of investment in GDP is not more than 20%.

Therefore, a $100 bn tax cut will lead to an immediate increase in consumption of about 70% of the amount, and another 10% or so ‘other’. Clearly, in an economy operating near full employment, a big chunk of that tax cut goes to support consumption of imports — hence the blowing out of the trade deficit.

Revenues-to-assets is about 60% for a company like Ford. Therefore, a $100 bn tax cut will lead to $20 bn investment which raises GDP by $12 bn. Of this, 18.2% will end up as federal tax revenue on average, which represents an additional $2.2 bn in tax revenue. A US govt 10 year note today carries an interest rate of 2.8%, which the government will have to pay for the funds it borrows to offset the tax cut. Thus, a $100 bn tax cut, far from paying for itself, may actually make the incremental deficit greater than the $100 bn cut, at least in the short run.

There are not a lot of scenarios in which a tax cut even remotely pays for itself.

Steven, don’t forget the multipliers. Y’ano there’s gotta be multipliers. Probably near double digits. 😉

A man who would have made a great American President wrote an editorial in the hardcopy NYT today. He was an SJW before people did it just to be cool and before limp-wristed teens and twentysomethings became SJWs to get sex from some girl:

https://www.nytimes.com/2018/04/10/opinion/walter-mondale-fair-housing-act.html

“Fifty years ago on April 11, Congress enacted the Fair Housing Act, the last of the three great civil rights laws of the 1960s. Along with the Civil Rights Act of 1964 and the Voting Rights Act, it was an attempt by Congress to translate the movement led by the Rev. Dr. Martin Luther King Jr. and others into enduring statute. But it also has the more dubious distinction of being the most contested, most ignored and, at times, most misunderstood of those laws.”

We have made a little progress here but not enough.

When we pointed out to CoRev that his source for Federal fiscal information is a Tea Partier who has misrepresented the information badly, how does he respond?

“Pgl, dailyKos???????” and “”Just more meaningless drivel”.

Seriously? DailyKos knows that http://www.usgovernmentspending.com is not a reliable source. We also know CoRev takes zero responsibility for posting bogus information here.

CoRev also wrote this nonsense:

“I sure will try to go to BEA. But who to believe? Pgl, relying on a dubious source, Dailykos, with no link for his “you’re wrong” because you site may be agenda driven”

My source for information was simply BEA which is reliable. DailyKos was not a source for data. DailyKos was at least smart enough to recognize what I already knew – the information on http://www.usgovernment.com was bogus. A simple point that CoRev now wants to evade. If anyone posts bogus information here – they should take at least a little responsibility for misleading us. That is not agenda driven. Unless one thinks reliable information is some sort of left wing agenda. So be it.

Pgl, again who to believe? 2slugs: “The 1.1% unified budget deficit is from the OMB historical tables. Keep in mind that OMB organizes data around the fiscal year, while BEA organizes data around the calendar year.”

versus pgl

“…”I’m looking at the 2006 figures in Table 3.2. Federal Government Current Receipts and Expenditures of the NIPA tables over at http://www.bea.gov”

While disputing a source’s data may be valid in a debate but why the need to lie to make a point? Are the NIPA tables pgl used CY or FY? I dunno because other than his general reference there was no link to the actual data he used.

“Unless one thinks reliable information is some sort of left wing agenda. So be it.” Dailykos?????

“again who to believe?”

Do you have a reading comprehension problem or what? Two websites have been noted here. I rely on http://www.bea.gov

You try to tell us that the Tea Party site http://www.usgovernment.com data is reliable. It clearly is not.

At this point you should apologize to everyone that you have used clearly bogus data. But yea – you will not as you have zero integrity.

CoRev The BEA creates the NIPA tables. They are based on calendar year data.

CoRev recently wrote this in reply to something Menzie pointed out:

“My point was that the Bush deficits had been falling, and in 2007 it bottomed at 160,701 before that pesky recession. The two Bush tax cuts were lowering the deficits after the early recession.”

Of course this is based on his bogus http://www.usgovernmentspending.com numbers. He is not paying attention.

Pgl makes a bigger fool of himself. “2007 2,567,985 2,728,686 -160,701” Table 1.1 – SUMMARY OF RECEIPTS, OUTLAYS, AND SURPLUSES OR DEFICITS ( – ): 1789 – 2023 https://www.whitehouse.gov/omb/historical-tables/

Out of curiosity what were the BEA deficit umbers for FY 2007? In case you might have missed it, I highlighted the deficit, to help with your reading comprehension.

Dailykos is pgl’s reliable source????

Can I just add economists whether it be of a Keynesian or classical persuasion all agree that the deficit should be falling given where the USA is in terms of the business cycle.

Speaking from down under I would have thought it would involve both spending cuts and tax rises.

PGL I much prefer pro growth liberal

I am pro-growth and yea liberals realize you can have growth and a more progressive distribution of income. OK John Cochrane disagrees with me but then he writes long winded rants that turn out to be embarrassments!

PeakTrader asks If the country is at full employment, why did it create an average of 190,000 jobs per month over the past 12 months?

It’s a fair question, but I think it’s based on a fundamental misunderstanding. What we’re talking about is output relative to potential GDP. The fact that we’re still seeing strong job growth does not mean the economy is not operating near potential GDP. For example, look at the BLS employment numbers in 1998 and 1999 when almost everyone would agree the economy was smoking hot. Those monthly employment gains were a lot larger than 190K per month. Potential GDP does not mean actual GDP cannot run hotter than that. Potential GDP is not a theoretical maximum that cannot be exceeded. Potential GDP simply reflects the long run steady state output level that is achievable without increasing inflation and without running capital into the ground and without routine overtime. The latest CBO analysis projects that actual GDP will exceed potential for a couple of years before it comes down to the steady state.

Of course, it’s possible that CBO and the Fed are both wrong about potential GDP. But this seems unlikely. They estimate potential GDP using two different approaches, but they come to the same conclusion. So if you disagree with CBO and the Fed, then you better have some pretty good arguments.

Finally, even if you are right and the economy is not at potential GDP, that does not mean tax cuts would be appropriate. Ever hear of something called monetary policy? We’re no longer at the ZLB, so monetary policy is a viable option. And even if it’s not, deficit spending gets you more bang for the buck than tax cut deficits. And better yet, how about a balanced budget multiplier?

Two estimates….

you continue to have observer error as well as instrument error. Worse in the soft science statistics.

In terms of employment statistics the new definition of full employment does not have a high [enough] EPOP?

Do two or more GDP “potential” models write off what % of prime.

Are model prejudices observer or instrument twists [not error]?

2slugbaits, it’s a fundamental misunderstanding that actual output is near or on the verge of exceeding potential output. In the late ‘90s, firms just wanted “warm bodies” and hired bag ladies and guys sleeping in parks. Also, more people were hired each month, e.g. fewer retirements. There were many other factors, e.g. oil prices falling to $10 a barrel, which contributed to strong disinflationary growth. Of course, you can’t explain the sharp, sudden, and sustained downshift in growth, since the recession – over a trillion dollars a year of potential output disappeared. Ever hear of something called accommodative monetary policy? It’s still highly accommodative. You also have a misunderstanding of the balanced budget multiplier. Saving can raise discretionary income. For example, a $5,000 tax cut can pay off a car loan to raise monthly discretionary income. Note, it not only strengthens household balance sheets, it strengthens the banking system. Since the last recession, we squandered trillions of dollars, including paying people not to work with unemployment benefit extensions. That helps explain why we had an expensive L-shaped “recovery.” We would’ve got much more bang for the buck on defense spending, including R&D and spin offs. Instead, we have a significantly weaker defense with the expensive depression. We’re now on the right track with middle class tax relief, lower corporate taxes (to spur private investment and consumption), and defense spending. There’s been crowding out from all the wasteful government spending. We need a massive overhaul of entitlement spending to get much more bang for the buck.

” it’s a fundamental misunderstanding that actual output is near or on the verge of exceeding potential output.”

Our host would disagree with you on this one. Of course he relies on published information put forth by actual economists such as those at the CBO. Too bad he is not hanging our with those bag ladies who seem to be your source for superior metrics!

CoRev My point was that the Bush deficits had been falling, and in 2007 it bottomed at 160,701 before that pesky recession. The two Bush tax cuts were lowering the deficits after the early recession.

The deficit as a percent of GDP steadily increased from FY2001 through FY2004. In other words, the deficits kept getting worse after the tax cuts were enacted. The deficit did begin to turn around (as a percent of GDP) until FY2005. So what this should tell you is that you’ve got cause and effect all backwards. You seem to be engaging in magical thinking. In your world running large deficits is what you do when you want to reduce deficits. Frankly, that’s crazy. The Bush tax cuts were not lowering the deficit; they were tending to widen the deficit. What lowered the deficit after 2004 was increased economic growth. A return to trend growth. There’s a pretty good chance that FY2007 would have seen an actual surplus if the 2001 and 2003 tax cuts had not been enacted.

Ah, 2001-2007, the halcyon years for conservative Republicans. The time when Republicans controlled the executive and legislative branches and showed Americans what fiscal prudence could accomplish when left in competent hands. All that was lacking was fiscal prudence and competence.

The national debt–the cause of much Republican wailing and gnashing of teeth for decades– increased only 55%. Dick Chaney assured the treasury secretary that Reagan had conclusively proved “deficits don’t matter.” The federal bureaucracy grew. Again. A Medicare drug program was passed with little thought of how to finance it, thus assuring the need for future entitlement reform.

140,000 American troops were stationed in Iraq and Afghanistan, where-in the case of Iraq–VP Chaney said we would be greeted as liberators (before thousands of American service personnel were killed or wounded).

While those service personnel were abroad, conservatives proudly passed not one, but two, tax cuts, a feat never accomplished –or even attempted–by any previous Congress or President in our history. (Perhaps if Lincoln had acted similarly in 1862, that war could have been significantly shortened and we would have been greeted as liberators to the oppressed planter class in the Deep South…) The children who are always the focus of Republican debt discussions will be paying for those tax cuts and war costs for decades. As will their children and their children as well.

Fiscal hawk Paul Ryan never saw a Bush budget he didn’t like or could not support. He did, however, awaken from his Van Winkle-like trance in Jan. 2009 and along with visionaries like Orrin Hatch resumed the wailing and teeth gnashing of “trillion dollar deficits as far as the eye can see…”

Yes indeed, those were the days, my friends. For Republicans too bad they had to end. The old majorities were loved, everybody pulled his weight, our old gas guzzlers ran great…We could use a man like Tom DeLay again…

Of course CoRev’s bogus source for “data” had the recession starting in 2006!

2slugs, careful with your term, magical thinkings: “There’s a pretty good chance that FY2007 would have seen an actual surplus if the 2001 and 2003 tax cuts had not been enacted.”

coupled with this:

” In other words, the deficits kept getting worse after the tax cuts were enacted. The deficit did begin to turn around (as a percent of GDP) until FY2005.”

Conveniently forgetting one of the main reasons for passing the EGTTRA was the 2001 recession. So when he makes foolish statements like: ” What lowered the deficit after 2004 was increased economic growth. A return to trend growth. ” is an indicator that both tax cuts, 2001 EGTTRA and the 2003 JGTTRA, worked to get us out of a shallow recession and then to further stimulate the economy and gaining revenue.

Since the economy is a flow, tax changes measured quarterly and annually are lagging indicators, for optimum impact. Which he must believe was some time after 2007, because the actual FY06 Federal deficit of 160,701 was within 1-2 years of reaching another balanced budget. Clinton’s “good luck” (both 2slugs and I agree) allowing for budget balances late in his term was coupled with Bush’s poor luck with bookend recessions during his term as president.

Good luck and bad luck are solid economic terms and not magical thinking. Thinking the E/JGTTRAs were not stimulative are even more magical thinking. Had the 2007 recession not occurred, bush’s term would surely have ended with a surplus.

CoRev: Take it from somebody who was working on CEA staff at the time — a recession was not the motivation for EGTRRA. It was built into the campaign promises of GW Bush, and a recession was not declared by NBER as having started in March 2001 until a couple years later.

2slugbaits, it should be noted, the Bush economic expansion was on top of the 1982-00 economic boom and budget deficits shrunk even with the wars in Afghanistan and Iraq. Of course, Democrats never keep their promises to reduce spending, including under Reagan. The Republicans went along with the Democrats to win re-election in 2004. The permanent (or 10 year) Bush tax cuts spurred economic growth.

The real problem wasn’t so much the housing crisis created by Congress, it was the inappropriate fiscal response to the recession. The small and slow tax cuts didn’t refund households for the consumption boom of the 2000s – U.S. consumers bought foreign goods and foreigners bought U.S. Treasury bonds. The government selfishly spent and squandered too much money.

Let’s piece together key portions of PeakIgnorance’s last 2 comments:

“Democrats never keep their promises to reduce spending”

AND

“it was the inappropriate fiscal response to the recession”

Most economists argue that the 2009 fiscal stimulus should have included more spending but not our resident “genius” who argues that if we had cut government spending, the recession would have ended sooner!

Herbert Hoover would have appointed PeakIgnorance the head of his CEA!!!

“the Bush economic expansion was on top of the 1982-00 economic boom”.

WTF? I guess PeakIgnorance has a memory lapse with respect to what happened in 1990. Of course the Bush41 recession is what gave us Bill Clinton!

BTW – the average growth rate from 2000 to 2007 was a mere 2.5%. Did PeakIgnorance also forget about that pesky 2001 recession?!