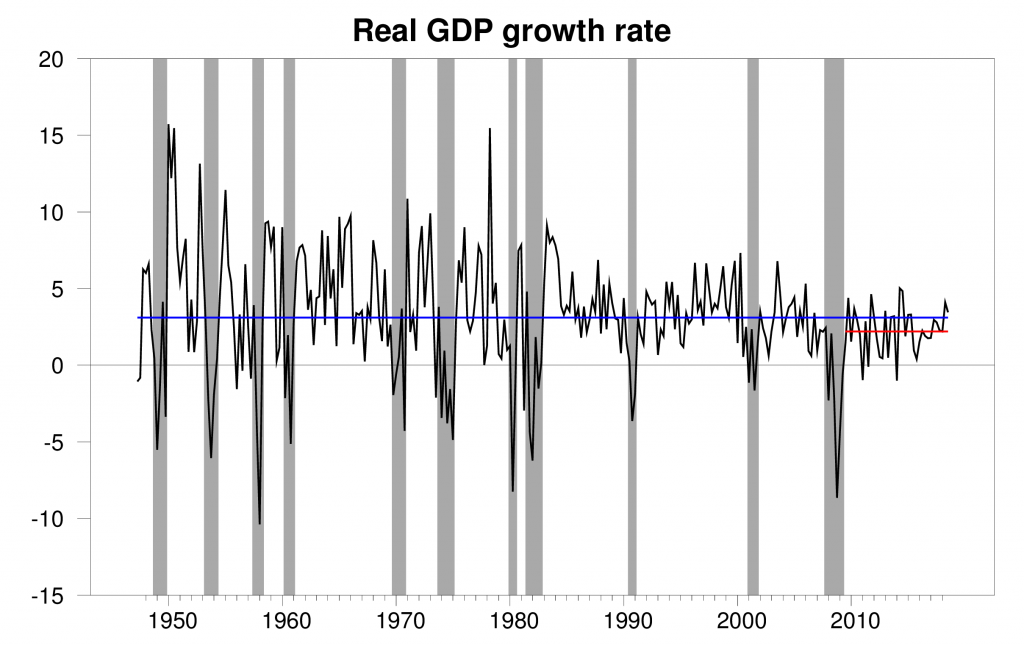

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 3.5% annual rate in the third quarter. That’s the second quarter in a row that the number has come in above the 3.1% average for the U.S. economy over the last 70 years, and is well above the 2.2% average rate since the recovery from the Great Recession began

Real GDP growth at an annual rate, 1947:Q2-2018:Q3, with the 1947-2018 historical average (3.1%) in blue and post-Great-Recession average (2.2%) in red.

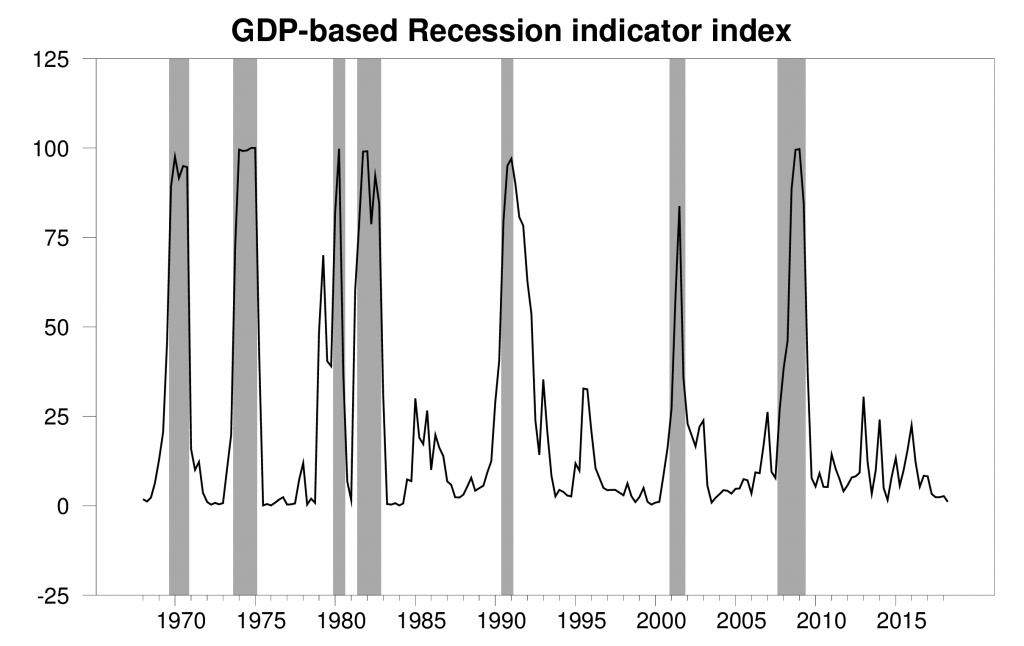

This brings the Econbrowser Recession Indicator Index all the way down to 1.1%, among the lowest levels we ever see. The U.S. remains clearly in the expansion phase of the business cycle.

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2018:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

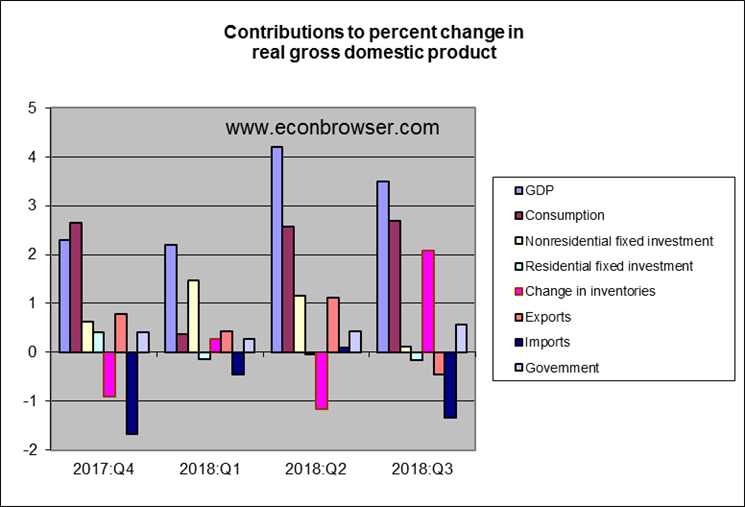

But the details behind that GDP growth concern me a little. Increased government spending contributed 0.6 percentage points to the GDP annual growth rate, with more than half of this coming from state and local government spending. Falling exports were a drag on growth– that much was expected. New Housing construction continued its three quarter decline, and nonresidential fixed investment was also weak.

Most of the growth came from inventory build-up. GDP measures what is produced. If goods are produced but not purchased, inventories accumulate, so GDP can look strong even though spending is weak. Subtracting off inventories, real final sales were only up at a 1.4% annual rate in the third quarter.

I conclude that the fiscal stimulus continues to help give us a favorable headline number. But I am concerned about weak investment spending and final sales.

“The deceleration in real GDP growth in the third quarter reflected a downturn in exports and a deceleration in nonresidential fixed investment. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.”

Weak fundamentals indeed!

And why would companies want to increase nonresidential fixed investment when inventories are piling up? What I don’t understand is how consumption can be so high even though final retail sales were disappointing. What were folks consuming?

Retail sales are by the little guys – who did not get those tax cuts. The rich dudes can shop wherever they want – and they were the ones who made out big time.

For the second quarter in a row services accounted for more than half of the consumption contribution. Health care by itself contributed 0.5 percentage points.

“services accounted for more than half of the consumption contribution”. Services tends to represent 2/3 of total consumption so an equal increase in absolute terms means services grew less in percentage terms.

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

This table shows consumption overall as well as by goods v. services. At least over the last quarter, it shows overall consumption rose by 1% in real terms with services going up by 0.8% and goods going up by 1.4%. Maybe you are right for early changes but at least for the latest quarterly change.

the wsj reported similar data this morning. a lot of our improvement is directly related to increased expenditures in the government-defense in particular. how long is this sustainable? i am glad the economy is growing, but the details don’t support growth from any particular government policy success other than what amounts to government fiscal stimulus through spending. which is also why the debt is growing.

Fiscal stimulus Reagan style. Cut spending for the poor, give tax cuts to the rich, and go-go-go with the military industrial complex!

The guidance on 2020 DoD budget submission is “keep it at $700B”. Which may or may not be a real “cut” in appropriated pentagon buying authority. Also how much of the “cut” is taken from readiness (which is obligated on services and spare parts) or on R&D/Production (longer to get to GDP)? It seem the guidance will be buy new ‘duds’ rather than keep readiness up……..*

“Defense” spending in the GDP is “checks’ written. The orders were often made from appropriations several years before. The bow wave effect on GDP is hard to estimate since DoD spending on “big ticket” equipment and R&D is a process disconnected to current year pentagon news items.

*The panhandle hurricane ‘took out’ nearly a squadron of F-22’s who were too broke to evacuate.

Trump’s trade war: Imports rising, exports falling which hammers GDP.

We now have the highest steel prices in the industrialized world. How is that a good thing?

“But I am concerned about weak investment spending”

This is entirely expected as I have explained here before. Many economists seem to have difficulty with this concept, perhaps because they are thinking in terms of the GDP accounting identity and that tax reductions increase investment.

This is completely backwards from a businessman’s point of view. As a business owner, when taxes are reduced is a great time to take earnings out of a company because you get to put more of it into your own pocket. Higher taxes, on the other hand, encourage reinvestment in the business because reinvested earnings are not taxed. Investments are an expense or depreciation deduction that offsets higher taxes.

Low tax rates favor reduced investment. High tax rates favor increased investment. This is exactly what we are seeing in this report.

However, because of higher taxes, business owners would have to take more money out of the business to pay themselves.

More babble from the Russian bot. Like CEOs are starving to death. Like corporations do not have enough cash flow to invest.

We would ask you to articulate INCENTIVES here but we all know that basic economic concepts are not part of your bot programming.

Send the government a bigger check. So, your business can grow.

You’re the “Russian bot,” who likes to shake down individuals and businesses for more money.

The incentive is it just can’t control its spending.

Blah, blah, blah. I need to apologize – to the Russian bots everywhere. At least they try to write something coherent.

if you don’t want to be called a russian bot, peak, then quit talking like one. repeated talking points and decade old references do not help your cause one bit.

Correct. Tax incidence along the payment chain matters. Within reason, it is possible to tax business in ways that raise revenue while encouraging investment. Naturally, the revenue raised will be reduced to the extent investment is used as a tax-avoidance scheme. That is exactly the tax-avoidance scheme we should favor. Low tax rates on dividends and realized capital gains reduce the incentive to avoid taxes through investment. This is actually not a mystery to practicing economists. It is only a mystery to policy-entrepreneurial economists.

I heard an interesting theory that a recession will begin in 2020 when the Fed tightening peaks by the end of 2019 and the stimulus diminishes into 2020.

So, there should be a slower Fed tightening and an easing in 2020.

Heard from who? The Cookie Monster I bet!

I will keep on saying it. I can I am over 60.

This ‘release’ should never be released. It does not contain enough information for anyone to make a confident statement about. for a start. What is the SAAR growth rate. Fat too many assumptions and forecasts in it.

Annualised is for morons. It means nothing.

Can you yanks catch up with the rest of the world please

A technical question: many fundamental research projects are funded by the army grants. They now have an Innovation Unit to invest in startups . Does all this spending enter the account of Defence?

PeakTrader: “However, because of higher taxes, business owners would have to take more money out of the business to pay themselves.”

You can tell PeakTrader has never run a business. I have and talk to other business owners every day.

With lower taxes, the business owner will just take earnings out of the business and buy a second $100,000 Tesla for his kids to drive.

With higher taxes, the business owner thinks “that $100,000 Tesla is going to cost me $150,000 after taxes” but if I instead invest the $150,000 in growing my business, I get to keep all $150,000 and not pay a dime of taxes.

Lower taxes encourage taking cash out of a business. Higher taxes encourage reinvesting in the business.

Say, a business owner pays himself $200,000 to maintain his lifestyle.

Taxes are raised to where he pays $100,000 instead of $50,000.

He needs to take $50,000 more out of the business to pay taxes.

He’s not going to lower his lifestyle by living on $50,000 less.

OMG. Your dog is even laughing at you!

Someone understands incentives. Good comment! Of course PeakTrader will just ignore this as he rushes off to the next pointless rant. Sort of like Trump and his Twitter!

PeakTrader: “He’s not going to lower his lifestyle by living on $50,000 less.”

Oh, PeakTrader. You poor little silly boy. You don’t know how this business stuff works at all. We aren’t talking about someone who is one paycheck away from being evicted from their apartment. We are talking about a business owner with large amounts of discretionary earnings and how taxes affect decisions on spending those earnings at the margin.

If you have very low tax rates you have an incentive to take those discretionary earnings out of the business and spend them on luxuries. If you have high tax rates, you have an incentive to reinvest those earnings tax-free and growing your business.

Now please go back to your GameBoy and stop embarrassing yourself here.

Joseph, it doesn’t matter if the business owner pays himself $200,000 or $2 million.

In the example, he’ll pay $1 million instead of $500,000 in taxes on $2 million, which means less money for the business.

Conversely, if taxes are lowered by $500,000, he’ll have extra money to either pay himself more or invest in the business (or a combination of both).

He may use that extra money to upgrade capital equipment to increase productivity and lower unit costs.

“He’s not going to lower his lifestyle by living on $50,000 less.”

why not? small business owners effectively don’t work off of salary. they take less when business is bad, and more when business is good. or do you believe that same business owner would still only keep his $200k if the business doubled in a year and he could collect and additional $100k? you certainly like the benefits of asymmetrical risk. further, most small business owners do not make anywhere near $200k a year. in fact, most workers in general do not have that level of income. peak, you lived in an inflated bubble of the finance world for too long-losing touch with reality.

And, saying the same thing, except calling people names, doesn’t strengthen your argument.

https://www.nytimes.com/2018/01/17/technology/apple-tax-bill-repatriate-cash.html

US was essentially collapsed in ’08. China Industrial Production drives all markets. In such a situation US can barely keep on QE or not need repatriated cash.

http://freakonomics.com/podcast/wto/

Great interview with head of WTO

PeakTrader: “it doesn’t matter if the business owner pays himself $200,000 or $2 million.”

Ah, but this is exactly where you don’t have a clue about business. A business owner chooses how much tax they want to pay by choosing how much of the business earnings they want to withdraw. If tax rates are low, they will choose to withdraw more and reinvest less. If tax rates are high, they will choose to withdraw less and reinvest more — tax free.

Someone like you, who has never run a business, doesn’t understand this. In your limited understanding, a business person decides first how much they want to withdraw , say a pre-determined $2 million, and then lets the tax chips fall where they may. But that isn’t the way a business person thinks at all. The business person has great flexibility in deciding how much to withdraw and how much to reinvest tax free. With higher tax rates, they can decide to withdraw less and reinvest more, lowering their tax bill and keeping more of their earnings.

But I’m guessing it is hopeless trying to convince you. You understand nothing about running a business and simply regurgitate mindless Republican talking points that make no sense in the real world.

PeakTrader, if you don’t believe me, you have to at least believe the empirical data. Businesses received an enormous tax windfall this year, yet that money is not being reinvested. Investment spending is flat, as JDH noted. The tax cut windfall is being withdrawn from businesses by record levels of dividends and stock buybacks. Just as I predicted.

Low tax rates encourage profit taking, not capital investment.

PeakTrader THINKS he has some case for the 2017 reduction in the corporate tax rate. Actually all he has is his usual incoherent gibberish but let’s humor this poor fool. If his babbling were correct, then the reduction in the tax rate would allow shareholders to maintain a level of life style without paying as much out in the form of dividends or corporate buy outs. That was they could invest more in new capital equipment. Ok – what does the evidence say so far? Here is a July 10, 2017 discussion:

https://money.cnn.com/2018/07/10/investing/stock-buybacks-record-tax-cuts/index.html

“Flooded with cash from the Republican tax cut, US public companies announced a whopping $436.6 billion worth of stock buybacks, according to research firm TrimTabs. Not only is that most ever, it nearly doubles the previous record of $242.1 billion, which was set during the first three months of the year.”

The article did not some decent news regarding business investment for 2018QI but it went onto to note actual economists (people PeakTrader refuses to listen to) note that the impact of this tax cut on investment is likely not going to be that great. And guess what? The latest from BEA notes investment demand was weak for 2018QII. Now anyone who actually read this post – they would have known that.

But of course PeakTrader continues to babble otherwise. Yes – he knows nothing about economics. He knows nothing about the real world surrounding him. But he does know what his marching orders are from Team Trump.

he is a failed banker. why would you expect him to understand any of this. peakloser is also an advocate of people buying large, gas guzzling and expensive automobiles rather than using cheap public transportation. and large mcmansions living out in the exburbs? why not buy more house than you need, so you can pay more in taxes, mortgages, heating, cooling, etc? simply so show those europeans they live in small houses! he gained from pushing overpriced mortgages onto his clients. it is very clear why he is a failed banker based upon his financial acumen.

My thesis is that the forever Keynesian hypothesis of price/wage rigidity Is slowly changing post-crisis, when 40% of Americans are doing gig work. When one can no longer expect Corporate America to innovate, the buyback could be good in that the tax incentives ‘d allow grassroots innovations. Housing price seems flattening, which helps innovation too.

Aside from the more direct evidence we have about the limp nonresidential investment numbers, there’s also some indirect evidence that supports the claim that the corporate tax cut simply went into the pockets of corporate bigshots. If you compare the Treasury statements for FY2017 and FY2018, you’ll find that there was a big drop in corporate tax revenues in FY2018. There was also a big increase in personal income tax revenues, and that increase was a rough order of magnitude in line with the drop in corporate tax revenues despite there also being a reduction in the income tax rates. Now does this mean the corporate tax cut led to better paying jobs for the median worker, as promised by Team Trump? Well, if that was the case, then we would expect to find something like a corresponding increase in FICA tax revenues, which are a tax on wages and salaries, but not unearned income. Guess what? It turns out that nominal FICA tax revenues were only up slightly, while real (inflation adjusted) FICA tax revenues actually fell. So how do we square these results? The most obvious answer is that that the spike in income tax revenues (which is from both earned and unearned income) was primarily due to a windfall in unearned income for the top 1% that was made possible by the cut in corporate taxes.

“There was also a big increase in personal income tax revenues, and that increase was a rough order of magnitude in line with the drop in corporate tax revenues despite there also being a reduction in the income tax rates. Now does this mean the corporate tax cut led to better paying jobs for the median worker, as promised by Team Trump? Well, if that was the case, then we would expect to find something like a corresponding increase in FICA tax revenues, which are a tax on wages and salaries, but not unearned income. Guess what? It turns out that nominal FICA tax revenues were only up slightly, while real (inflation adjusted) FICA tax revenues actually fell.”

I noted over at Econospeak how the OMB director and the Treasury secretary led a chorus of right wing liars to tout the overall 0.4% increase in total NOMINAL Federal taxes but of course the GDP deflator rose by 2.5% which means REAL revenues FELL by over 2%. But thanks for the details as they are important too.

It’s amazing how the leftists agree with me by disagreeing with me.

The business tax cuts strengthened businesses through stock buybacks and dividends. Firms with strong cash flow may have no reason to increase capital spending. Firms with weak cash flow, particularly with rising interest rates, welcome the tax cuts. Wages, bonuses, and compensation increased at many businesses.

Study: “…following the corporate tax cut, domestically owned firms increased investments to a larger extent than foreign-owned firms. Our results imply that corporate tax changes can increase corporate investment but have heterogeneous investment responses across firms.”

https://ideas.repec.org/p/zbw/arqudp/153.html

“The business tax cuts strengthened businesses through stock buybacks and dividends. ”

peak, please explain how? i can understand that an investor may appreciate the dividend and buyback. but how exactly does a company paying money OUT strengthen its business? this certainly will not grow the company, as the cash leaves rather than is reinvested. i think you are conflating the benefits for a business and an investor.

“The business tax cuts strengthened businesses through stock buybacks and dividends. Firms with strong cash flow may have no reason to increase capital spending.”

I sense that you have no clue what these words even mean. Let me make this easy for you since you are beyond incompetent at economics. Rich people get more cash to consume on Rodeo Drive. The rest of us get the government debt. If there is no reason to increase capital spending, all those Republicans arguing that the 2017 tax cut would raise investment, lead to faster economic growth, and increase real wages. Thanks for admitting your team lied through their teeth. Yep – I agree with that one!

PeakTrader did not read the paper he linked to and Lord knows he cannot even bother to grasp the abstract. I found this link to the entire paper:

https://pdfs.semanticscholar.org/bc82/3cdc535c610b941d54053a72a9237373643e.pdf

Go to the first full paragraph on page two for the authors’ main contribution. Germany before 2008 had a tax rate near 39% so multinationals tend to shift income out of Germany via transfer pricing manipulation. From 2008 onwards, their tax rate was only 29% so the transfer pricing games changed.

Of course one would not expect PeakTrader to understand this was about transfer pricing as he has no clue what that is either.

Pgl, the study shows the reduction in taxes increased investment of domestic firms.

Lord – you are one stupid person. It says domestic based firms saw an increase in investment relative to foreign based firms. Let’s say the latter saw a fall in investment. It could be that total investment fell. Have you done the math? Of course not because you have not read the actual paper. Even if you did – we know your math skills are horrific.

Pgl, what it actually says:

“…following the corporate tax cut, domestically owned firms increased investments to a larger extent than foreign-owned firms.”

Only another idiot believes your nonsense.

“Pgl, what it actually says:

“…following the corporate tax cut, domestically owned firms increased investments to a larger extent than foreign-owned firms.”

Only another idiot believes your nonsense.”

PeakTrader can read only one sentence in a long paper? Of course context and actual numbers are beyond this Russian bot. Me thinks Putin got ripped off with this one as it is extremely defective.

And, it should be noted, the Trump tax cut repatriated $465 billion in cash by the end of the second quarter.

We saw this “repatriation” back in 2005 with the Bush43 tax holiday. Once again you are using words you do not comprehend so let me help you out. 100% of the repatriated funds went to dividend checks for the rich and not a penny for new capital investment. Back then Bush43 said this would increase investment. He LIED!

Speaking of lying – catch what Senator Coryn is tweeting – lying about what Pelosi is saying:

https://talkingpointsmemo.com/news/cornyn-tweets-without-context-pelosi

Hey Peaky – given how you love these outright dishonesty, we expect you to applaud Coryn.

In addition to the fundamentals being weak, what’s going to drive consumption going further? We’ve already seen the Tax Scam hit, wages haven’t risen any more than before the Tax Scam happened, and I can’t think that they’re going to magically pick up any time soon. The agricultural economy is basically in recession, and exports collapsed in the last quarter and likely won’t get better with the dollar being so strong right now. So where’s the extra spending going to come from to replace all of those added inventories.

Then add in the surprise amount of tax payments that will come in the next 6 months because fewer people will be writing off SALT and mortgage interest, and how it’ll likely speed a bursting of the mini-Bubble in the housing market that we are already starting to see in some places. That recession outlook may be near-zero for now, but I’d be surprised if it isn’t much higher in 6 months.

Hello macroecon people,

First-time econbrowser post, long-time econbrowser reader, life-long learner.

I purchased, on ebay, a used “Principles of Economics” textbook by Professor Mankiw. I cannot seem to find the answer in Mankiw.

The Problem:

Professor Hamilton linked to The Bureau of Economic Analysis at the top of this article.

I am trying to calculate the annual GDP from quarterly GDP and get the same results as BEA.

Table 1. Real Gross Domestic Product and Related Measures: Percent Change From Preceding Period

Seasonally adjusted at annual rates Seasonally adjusted at annual rates Seasonally adjusted at annual rates Seasonally adjusted at annual rates

2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018

Line 2015 2016 2017 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

1 Gross domestic product (GDP) 2.9 1.6 2.2 1.9 3.3 3.3 1.0 0.4 1.5 2.3 1.9 1.8 1.8 3.0 2.8 2.3 2.2 4.2 3.5

I picked 2015. The quarterly seasonally adjusted annual rates of GDP for 2015 are 3.3, 3.3, 1.0, and .4.

The BEA shows 2.9 for GDP for 2015. How is BEA calculating 2.9?

For the simple arithmetic average, I get (3.3 + 3.3 + 1.0 + 0.4)/4 = 2.0

For the geometric average, I get (e^(ln(1.033*1.033*1.01*1.004)/4) – 1) * 100 = 1.99

What am I doing wrong? For 2015, BEA shows 2.9 on Line 1. But, when I calculate annual from the 2015 quarterlies, I get 2.0.

Frank The 2.9% rate is calculated as follows:

Table 1.1.6 for 2014 the average LEVEL (not growth rate) was 16,899.8; i.e., the average of the four quarterly levels (not rates) for 2014.

Table 1.1.6 for 2015 the average LEVEL is 17,386.7; i.e., the average of the four quarterly levels for 2015.

Then 17,386.7 / 16899.8 = 1.0288 = 2.9% growth rate from 2014 to 2015.

The thing to notice here is that when BEA calculates the growth rate for the calendar year, they are comparing the four quarter average DOLLAR VALUE (or LEVEL) for one year and comparing it to the four quarter average DOLLAR VALUE for the previous year.

Very often you will see the annual growth rate calculated as the average quarterly growth RATES. And sometimes you will see it calculated as a rolling rate; e.g., 2015Q4 / 2014Q4. There’s nothing especially right or wrong about any of the different approaches, but when you look at the annual rate in BEA they calculate it by comparing the four quarter average levels for each year. Hope this helps.

If you divide 2015Q4 by 2014Q4 the result is 1.028921.

18,354.4 / 17,838.5 =1.028921

Maybe the experts can agree or disagree with this calculation.

My calculation to arrive at the 2.9% used nominal GDP. OOPs.

Frank,

There are to ways to calculate year-over year growth.

One is to calculate the growth rate from the last quarter of each year. From 4th Q 2014 to 4th Q 2015.

((4q 2016/ 4th q 2015)-1)*100

The second is to calculate the growth of the average of one year to the average of the next year.

{( 1q 2016+2ND Q 2016 + 3RD Q 2016 + 4TH Q 2016) / ( first q 2015 + 2nd q 2015 + 3RD Q 2015 + 4th q 2015)-1} *100

What you have to be aware of is the compounding impact of growth.

for example 2nd Q 2016/ 1st q of 2016 does not give you the correct growth rate for first q to second q.

You have to calculate the compound growth rate and you do that by calculating the rate raised to the fourth power.

( (q2/q1)^4)-1)*100

You can also do the same thing by converting the data to logs and than calculating the compound growth rate.

All,

Thank you all very much. That was very helpful. I was stuck.

If I have another question, I will show my work–show I attempted multiple times to solve the problem before posting.

Joseph, say, the business owner’s tax rate increases from 25% to 50% and he withdraws $1.8 million instead of $2 million.

He has to pay $900,000 in taxes instead of $500,000.

And, adjust his lifestyle drastically to live on $900,000 instead of $1.5 million.

HUUUUGE problem, especially in a country where median household income is $59K. Drastic problem indeed. Finding a way to live —to somehow hang on—without harming lifestyle.

Thanks for sharing.

That business owner is so concerned with his periodic owner’s equity withdrawals, it’s amazing his business is generating 2 million in profits every year with no capital investments to fund the capital account in the first place…

“say, the business owner’s tax rate increases from 25% to 50%”

perhaps it is best to keep your hypotheticals in the realm of reality?

Poor guy, being in the 50% (?) tax bracket, he might be forced to sleep in one of his vehicles and might be forced to choose between a Range Rover, a Mercedes, or slumming in a Lexus. Definitely, a 21st century tragedy.

PeakTrader: “And, it should be noted, the Trump tax cut repatriated $465 billion in cash by the end of the second quarter.”

Stupid, in so many ways.

First off, Trump promised that more than $3 trillion would be repatriated. This is a pretty weak response.

Second, Trump promised that repatriated money would be used for capital investment. But as JDH noted, that has not happened. Companies have simply used their windfall for dividends and stock buybacks that further enrich the wealthy.

And third, the repatriation is mostly a charade. Effectively, the money was already repatriated years ago. Companies like Apple and Googly simply borrowed hundreds of billions of dollars at low interest rates using their offshore cash as collateral, using the borrowed cash for dividends and stock buybacks. The money was already repatriated and paid to shareholders. So now, with the tax reduction, they are simply bringing the money home to pay off those loans for dividends previously paid out. There is no net increase in capital investment. There isn’t even an increase in dividends since the already paid them out years ago. They have simply cancelled one liability with another asset, and in the process saved a bundle in taxes.

A very thorough discussion. Many thanks. But do note Peaky has no clue what any of these words mean. The Russians designed his bot programming at a very low IQ level.

Joseph, could you quote how many bonds Apple and Google have issued so far?

To give us a lesson, how do we assert “buybacks enrich the rich”?

Why everywhere, apart from US and China, the real long rates are tanking?

Here is how I see the effects of the TCJA on corporate investments. The corporate tax cuts consisted largely of reducing the statutory corporate income tax tax rate. Since the bulk of corporate profits consist of supernormal profits, and since taxes on supernormal profits do not discourage investment, the tax cuts merely transferred money from the Treasury to the companies, without giving them the incentive to increase investment. So, no surprise that they did not spur investment. But looking at ex post investment is a poor way to judge the effects of the tax changes. I think the bigger factor is business expectations for growth. So I would take the failure of investment to grow more as an indication of business growth expectations than as evidence on the effect of the tax cuts.