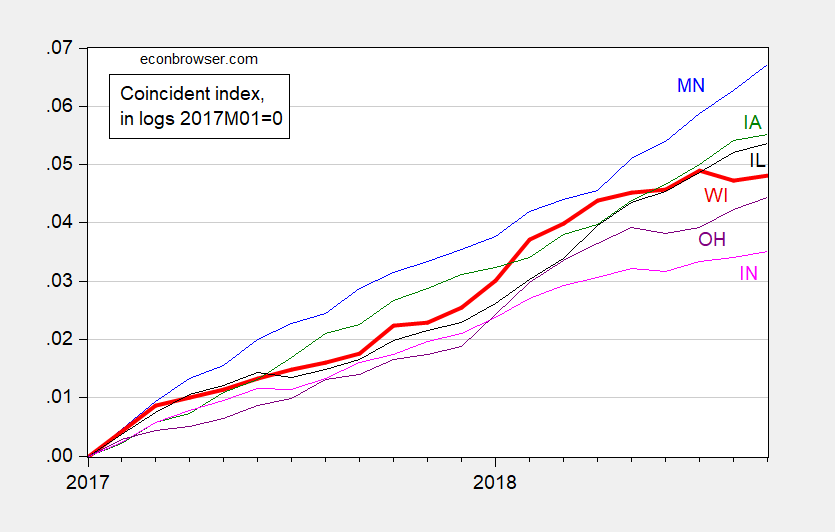

Cumulative growth in Wisconsin since 2017M01 lags Illinois, according to estimates released today. And the 2018M09 Wisconsin index is below peak (nobody else in the region is).

Figure 1: Coincident indices for MN (blue), WI (red), IA (green), IL (black), IN (pink), and OH (purple), in logs, normalized to 2017M01=0. Source: Federal Reserve Bank of Philadelphia, and author’s calculations.

For a comparison using employment, see this post.

Whut??? Give us an update on the Brownback Kansas story.

Now if Bruce Hall turns your graph upside down – he can spin this in Wisconsin’s favor!

Bomber caught – and his van shows he is a right wing nut job and yuuuuge Trump supporter:

https://talkingpointsmemo.com/edblog/vehicle-covered-in-trump-stickers

@ pgl

If someone comes to your door on Halloween with a Steve Bannon mask and attire (and I don’t mean the SNL Grim Reaper version of Bannon) call the local police immediately and ask them to do an ID check. As you wait for the police to arrive, hold up a clear picture of Martin Luther King in the potential assailant’s direction as you would a crucifix to a vampire. Remember your children’s life is at stake.

Menzie, sorry, I’m not seeing what you are seeing in the data.

From the Philadelphia Fed – Sept. 2018:

https://www.dropbox.com/s/nmilummf808yma6/State%20Coincident%20Indices%20-%20Philadelphia%20Fed%20-%20September%202018.pdf?dl=0

Source data: https://www.philadelphiafed.org/-/media/research-and-data/regional-economy/indexes/coincident/coincident-revised.xls?la=en

Wisconsin is higher than:

• Indiana

• Michigan

• Ohio

• Total U.S.

I’ve shown the indices as reported by the Fed and then restated to Jan 2017 = 1.0

Perhaps that is not the way you would have done it, but it seems to make sense.

Regardless, most of the differences are exceedingly small… not sure at what point the differences are significant.

This is another really dishonest post.

The whole point of the scheme of gutting business tax was to generate GDP *above* that of States with higher corporate tax rates. According to the hypothesis this was supposed to magically close the government revenue gap created by eliminating corporate revenue.

GDP growth was FAR lower than the failed model. Revenues did not increase. Conveniently, all of these failed claims are forgotten and “Not that bad.” is a win.

Given this kind of thinking is more religion than science, I’m sure it will be tried again and fail, again.