Or more correctly, in Mr. Trump. As reported by Bloomberg, Mr. Trump has said:

“a gentleman that likes raising interest rates in the Fed, we have a gentleman that loves quantitative tightening in the Fed, we have a gentleman that likes a very strong dollar in the Fed.”

I think Mr. Trump is partly himself to blame for the strength of the dollar. To show this, I estimate the following relationship over 2014Q1-18Q3, with r the log real trade weighted value of the US dollar, EPU world economic policy uncertainty as measured by Baker, Bloom and Davis, y is log real GDP, i is the policy rate (shadow Fed funds for US), and “RoAdv” denotes rest-of-advanced economies.

r = -0.123 + 0.054EPU + 2.209(y-yRoAdv) + 1.227(i-iRoAdv) + u

Adj.-R2 = 0.86, N=19, DW = 0.89. bold denotes significant at the 5% MSL using HAC robust standard errors.

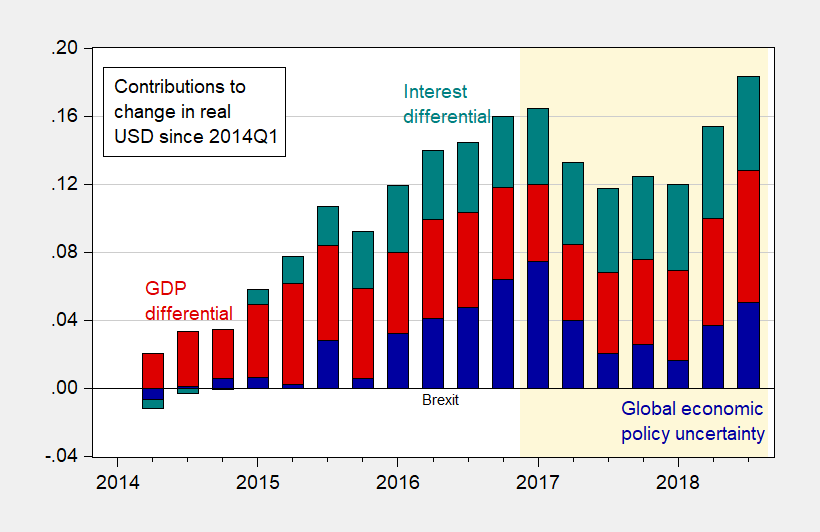

Using these estimates, I can decompose the movement in the real US dollar since 2014Q1.

Figure 1: Contributions to change in real value of trade weighted US dollar since 2014Q1 (up is appreciation), arising from the policy interest rate differential (teal), from GDP differentials (red) and from global economic policy uncertainty (dark blue). US interest rate is shadow Fed funds. Orange shading denotes Trump administration. Source: Federal Reserve Board, Xia-Wu, Dallas Fed, Baker, Bloom and Davis via policyuncertainty.com, and author’s calculations.

Notice that the Brexit induced a substantial increase in the dollar’s strength. But since the election of Mr. Trump, a substantial share of the increase in the dollar’s value has come from the growth differential in favor of the US (of which at least some comes from the TCJA and the relaxation of spending restrictions in the budget bill), and since 2018Q2 — with elevated global economic policy uncertainty. As I’ve noted elsewhere, this event has coincided with an elevation of US trade policy uncertainty, as measured by the BBD categorical index for this category. Here, Mr. Trump has only himself to blame.

Hence, we can say that at least some of the dollar’s strength is due to Mr. Trump’s own actions.

I agree that with very high probability Trump’s actions have tended to push the dollar up rather than down, and I think you have accurately pointed out main reasons why this is the case. I also applaud your efforts to pin this down more precisely econometrically. I also applaud the efforts of both you and Jim to try to forecast when recessions will arrive.

I have already made this point, but I have recently been bombarded by lots of incoming studies of various sorts reminding me of something I have said here previously: that predicting either forex rates or turning points in business cycles is very hard. I know, Menzie, that you have published some papers showing the possibility of maybe beating the random walk on forex forecasting, contraditcing Meese and Rogoff from 1975, although the dirty secret rarely mentioned contained in that famous paper is that even the random walk did not do a very good job forecasting forex rates. So, it is a low bar.

I simply not that the incoming stuff to me is dragging in all these old arguments that “econ should not be about math,” blah blah blah, some of this from usual suspect sources. On that I note that in econ there reallly is no escaping math, with those supposedly most opposed to it usually eventually citing data at some point, which is using math, if not necessarily very fancy math. Much of this is a matter of figuring out which math is most appropriate for which problem.

In any case, you and Jim are trying to do things that are extremely difficult, whatever level or sort of math one employs, and I applaud you for your efforts.

More from that CPAC rabbling that included 104 lies?

“I want a strong dollar but I want a dollar that does great for our country, not a dollar that’s so strong that it makes it prohibitive for us to do business with other nations and take their business”.

Good grief! He wants a strong dollar but then he tweets:

“The only problem our economy has is the Fed. They don’t have a feel for the Market, they don’t understand necessary Trade Wars or Strong Dollars or even Democrat Shutdowns over Borders. The Fed is like a powerful golfer who can’t score because he has no touch – he can’t putt!

Never mind the partisan babbling. Never mind how he claims trade wars are necessary. Trump does not understand exchange rates. And the real problem with the economy is not the FED but it is the Idiot in Chief.

Why would anybody pay attention to what Trump says, especially about anything economic? He never had to learn about the economy, never had to face consequences, and has never had to operate without a gilded safety net. The Fed is not so insulated. What they do may be right or wrong, but at least it will be rational.

Trump and the stock market were correct last year the Fed was tightening the money supply too much and too fast.

Also, Trump was correct to create a bargaining chip with tariffs to deal with the unfair and illicit Chinese trading.

Many “experts,” the mainstream media, and many Democrats are fueling confusion and hysteria.

No matter how much they undermine him and no matter how many personal investigations they launch, Trump plows ahead to make America great again 🙂

I guess the kindergarten class where Peaky learned his economics never informed him that fiscal stimulus tends to drive up real interest rates as well as leads to a stronger currency.

Pgl, when you finish your kindergarten Econ class, you’ll realize a higher a nominal interest rate to preempt inflation increases the real interest rate and the value of the currency.

And, so, Trump understands economics more than you ever will. After all, he has a degree in economics (and it wasn’t from kindergarten).

Oh why Peaky finally passed preK! Gee Peaky tell us what the sum of 2 and 2 is!

Have you noticed how Peaky never provides actual data? FRED makes this SO easy. 10-year government bond rates (nominal) have risen by 1% since Trump was elected. But how much of this was higher expected inflation v. higher real rates? Peaky cannot say because he has never cited a reliable source of data in his entire life. Hey Peaky – here you go:

https://fred.stlouisfed.org/series/DFII10

Real rates are up. But how much? OK Peaky flunked basic graph reading so let’s help him out. Real rates have risen by 0.5%. So that means expected inflation has also increased by 0.5%. Now I bet Peaky is confused how I got the latest number so could someone send Peaky a textbook in preK arithmetic?

“After all, he has a degree in economics (and it wasn’t from kindergarten).

peak, i have seen no college transcripts that indicate he passed and completed a college degree. he does claim that he attended college. show me the college transcript, and i will believe your statement.

Peaky’s comment is really dumb. Yes Trump got a business degree from Wharton but that is not the same as an economics degree. They asked his fellow students about Trump’s time at Wharton and even then he was not the sharpest pencil in the box!

https://www.thedp.com/article/2017/02/trump-academics-at-wharton

PT,

And Michael Cohen has testified how at Trump’s request he strong-armed all the schools he went to not to release any of his grades or test ascores. No, he does not seem to know much about economics. He delusionally thinks that bilateral trade balances with other nations mean something and should be a focus of policy attention. No economist believes that, not even Trump’s own mouthpieces, who simply avoid talking about that claim.

and when trump was complaining the fed was too loose back when obama was in office, trump was correct on the economics then as well? when the economy was weaker, the fed should have raised rates? that appears to be the position of trump and his entourage peakloser.

when trump demands the justice department block the att merger, politically because he has a gripe with cnn, and financially to protect his buddy murdoch at fox via crony capitalism, peakloser sees nothing wrong.

i find it fascinating how much garbage peakloser can present and still keep a straight face.

Baffling, the reason you’re a simpleton is because you explain things in the most ignorant way.

Under Obama, when Trump complained about QEs, we had failed expansionary fiscal policy, which was completely unnecessary.

For someone, who complains about “garbage,” you’re near the top of the heap.

#1 – you failed to even address his question. #2 this statement is utterly ridiculous: “we had failed expansionary fiscal policy, which was completely unnecessary.”

Fiscal stimulus was necessary and it worked to the degree that your team of economic illiterates on the GOP side let it happen. C’mon Peaky – your comments have gone from really dumb to incredibly bozo.

peakloser, please explain what is so ignorant about my statements. trump wanted to raise interest rates during a weaker economy, and drop interest rates during a stronger economy. the ignorance here is trump. your defense of his positions is also ignorant. my statements are factual.

peakloser, you don’t see the crony capitalism at play with the games trump played in the att merger? simpleton.

peakloser, rather than respond with knee-jerk political hackery, come up with a legitimate response next time.

“peakloser, rather than respond with knee-jerk political hackery, come up with a legitimate response next time”.

That goes beyond the abilities embedded in his Russian bot programming!

YUP! “… substantial share of the increase in the dollar’s value has come from the “b”growth differential in favor of the US (of which at least some comes from the TCJA and the relaxation of spending restrictions in the budget bill), and since 2018Q2 — with elevated global economic policy uncertainty. ”

And that growth differential is the rub. Especially since it confirms the economic failure of the previous 8 years, and how easy that growth was obtained.

Dems are left with their hatred for Trump’s successes and rationality of the failures of their own policy failures. Wishing and hoping that a timely recession occurs for the 2020 elections is not a strategy, and adds to the economic uncertainty.

“the economic failure of the previous 8 years”.

Never mind the fact that the current recovery began in late 2009. I was afraid that Peaky would have the silliest comment of the day. But no – you win!

You never have to wonder too along about CoRev’s aversion to facts or real numbers.

Less than two months after Obama took office, the Dow–mentioned often by CoRev as a current raging Trump success–bottomed out at a recession low 6507. In November, 2016, the Dow topped the 19,000 mark for the first time. That’s a 175%+ increase, as any attentive seventh grade math student might understand.

In the same time period, unemployment numbers dropped from 10.2% to 4.8%, a drop of approximately 52%.

Lest we forget, the wailing and gnashing of teeth over deficits during the same period, the final Bush FY deficit was a bit over $1.4 Trillion. The final Obama deficit came in at $665 Billion, another 50%+ decrease. Next year’s Trump deficit will close in on a Trillion( But, rest assured, deficits will soon be a thing of the past, and the national debt will vanish, c. 2024. Tax cuts, you know.)

All of which leads one to wonder about “failures”: those of policy or CoRev’s inability to separate fact from fiction?

CoRev Huh? In case you forgot, you were one of those Tea Party protesters pitching a hizzy fit over the deficits from the already inadequately sized ARRA. Remember how you insisted Keynesian economics was all bunk and deficits couldn’t increase GDP? And yet now you’re quite relaxed about huge deficits when the economy is at full employment. In your world deficits during a deep recession are bad, but deficits during full employment are good. Unbelievable. But then again, you pride yourself on never having read a macroeconomic textbook. So tell us. Was your opposition to the ARRA out of sheer ignorance about macroeconomics, or was it because Mitch McConnell vowed to sink anything Obama wanted to do in order to make him a one term president?

BTW, GDP growth is pretty much following the CBO’s projections from late 2017. The tax cuts would stimulate growth in 2018 and then start to fade in 2019. Then things start to go to hell after 2020 as structural deficits become less manageable and the tax cuts for lower & middle income folks start to phase out. But just as Humphrey Bogart and Ingrid Bergman will always have Paris, so lower and middle income folks will always have deficits and interest payments to remember those halcyon days in 2018. If you’re a plutocrat, Trump could be the beginning of a beautiful friendship.

Menzie Perhaps this is a dumb econometrics question, but how should we interpret the DW = 0.89 statistic in your regression output given that you used HAC robust standard errors? What does the DW mean here?

I seem to need the same tutoring about the DW statistic. Also, I thought that HAC se needs a “large” sample to be valid.

Durbin Watson:

https://www.investopedia.com/terms/d/durbin-watson-statistic.asp

pgl Right. I guess my question wasn’t clear enough. The point of the DW test is to check for autocorrelation, and a value of 0.89 is evidence of positive autocorrelation. But the “A” in the HAC robust standard error correction is supposed to correct for autocorrelation. So I’m wondering how to interpret the 0.89 value. Does it mean there’s still significant autocorrelation in the residuals even after HAC? Or does it mean EViews always displays the DW value even when it might not mean anything? And like AS, my understanding is that HAC performs best with large sample sizes…but then again, so do most things.

They’re saying Rand Paul is most likely going to to be against this “Emergency” Declaration, so one of the rare times he will be wearing a white hat:

https://www.youtube.com/watch?v=aPdAnTRy5fE

no-one as far as I know has shown a structural break in the stats between Obama’s years and Trumps years. This means that little has significantly changed.

What is the counterfactual?

Slower growth and a recession?

Followed by weaker growth?

Pro-business policies, along with higher consumer confidence, even with many trillions of dollars of additional debt and a declining military under Obama, has a positive effect.

Amazing! This Russian bot is spewing out gibberish that it does not comprehend. Hasn’t someone pulled your plug before you embarrass yourself even more?

Yeah, “no structural breaks”. Nothing that I can find:

https://www.nytimes.com/2019/03/06/us/politics/us-trade-deficit.html

#MAGA

What we need is massive entitlement reform, because entitlements are crowding out other government spending and economic growth.

I doubt the Republicans have good ideas, but they’re much better than the Democrat’s socialist and power grabbing ideas (they need lots of poor unsuspecting immigrants for votes, because they have most of the abortions and few kids – and of course, many people wise up when they get older).

Show your work. Thanks.

“What we need is massive entitlement reform, because entitlements are crowding out other government spending and economic growth.”

This is even worse than the gibberish spewed by the MMT crowd. You get dumber and dumber with each comment.

“What we need is massive entitlement reform, because entitlements are crowding out other government spending and economic growth.”

exactly. fools like peakloser, and other failed bankers, should not be entitled to any social security or medicare. find a free market solution to your retirement and medical care, rather than living off the government like a leech. how much entitlement spending reenters the economy? how much of the wealthy tax cuts reenters the economy? what a loser you are with these intentionally inflammatory comments peakloser.

More MAGA WINNING. Tiger Blood! A stable genius at work.

https://www.cnbc.com/2019/03/06/us-trade-deficit-surges-to-59point8b-in-dec-vs-est-of-57point3b.html

The goods deficit came to $891.3 billion for the year, the highest on record.

The trade deficit with China in December was $38.7 billion, by far the most of any nation. The next highest was the European Union at $15.8 billion and Mexico at $8.8 billion.

Adjusted for inflation, the goods trade deficit rose $10 billion to a record $91.6 billion in December and likely will weigh on the final calculations for gross domestic product. The first estimate for fourth-quarter GDP was 2.6 percent.

Census has a nice summary here:

https://www.census.gov/foreign-trade/statistics/highlights/top/top1812yr.html

Overall trade statistics (exports and imports) as well as statistics with our top 15 trading partners. The trade deficit was yuuuuge with a lot coming with respect to China. Winning? No more like an NBA team tanking to get a high draft pick.

If you are a Economics/Finance blog Junkie like me, then you will know the happy feeling of finding a high quality blog “off the beaten track”. Throw some blog love Professor Zetland’s way, just visit and comment or maybe provide him a link if you have your own blog.

https://one-handed-economist.com

Ozzie Osbourne says it’s very important to “get your Economics/Finance blog fix on”, along with Oxygen, vitamin C, and possibly some adult beverages:

https://www.youtube.com/watch?v=4blmQTd-04w

The post on the Russian “mafia” was penned by Kato allegedly. So why did it remind me of the usual fact free rants from PeakLoser? Oh wait – notice these posts have some image that looks like a Russian bot!

I’m going to give you the benefit of the doubt and assume you replied to the wrong comment. You’ve done this more than once, and you might try to be more careful with which reply link you are hitting. Zetland has a Phd from UC Davis and his area of specialty is sustainability and water scarcity. Not sure how that qualifies as a Russian bot. Are you using the same meth dealer as Barkley Junior??

This Kato aka PeakLoser included a link about Russia’s aluminum wars – something I know a bit about:

https://day.kyiv.ua/en/article/economy/aluminum-wars

Interesting discussion. Let’s note one thing about this 2000 discussion. The messy episode of crony capitalism and price dumping on world markets occurred under Yeltsin not under Putin. I’m no fan of Putin either but if anyone thinks Yeltsin run a perfectly competitive set of ideal market policies – that person knows nothing about what happened in Russia during the 1990’s.

Was the 2018 trade deficit the largest ever when adjusted for inflation? Not quite:

https://www.reuters.com/article/us-usa-economy-trade/us-trade-deficit-jumps-to-10-year-high-in-2018-idUSKCN1QN1M4

“WASHINGTON (Reuters) – The U.S. goods trade deficit surged to a record high in 2018 as strong domestic demand fueled by lower taxes pulled in imports, despite the Trump administration’s “America First” policies, including tariffs, aimed at shrinking the trade gap…The Commerce Department said on Wednesday that a 12.4 percent jump in the goods deficit in December had contributed to the record $891.3 billion goods trade shortfall last year. The overall trade deficit surged 12.5 percent to $621.0 billion in 2018, the largest since 2008…When adjusted for inflation, the goods trade deficit surged $10.0 billion to a record $91.6 billion in December.”

I skipped the usual and appropriate bashing of Trump’s economic stupidity to get to the key term here. Ah but Reuters did not finish the thought. TalkingPointsMemo did:

https://talkingpointsmemo.com/edblog/trump-sets-record-with-highest-trade-deficit-ever

“The Post reports that the overall number tops the previous record of $838 billion in 2006, but it doesn’t seem like those numbers are adjusted for inflation or judged relative to the overall size of the economy. So possibly there should be an asterisk after biggest ever. (This Reuters article says biggest since 2008 when adjusted for inflation.) Still however you slice it, for all President Trump’s yakking and fairly disruptive trade wars, the problem has actually gotten worse.”

Of course the mental midgets that Trump relies on for economic advice likely missed this point as they always report items in terms of nominal rather than real growth.

Lately USD tends to be a lot influenced by (risky) rates differentials, and stock market volatility indices.

It’s a “trick of language” (or “undecidable”) if we should pinpoint the cause as “stock market volatility index” or “policy uncertainty”. Because “policy uncertainty” is such a grand-level variable summarising everything, like GDP, personally I’d prefer we use clearly-identified root-level elements for studies.

It may also be interesting to directly study and teach the readers about the economic history, Rome Republic, Meiji Era, … how they sustained/collapsed.

japan is no longer in “the Meiji Era”. Japan is doing exceedingly better per capita than China right now. Japan also can vote for their own leaders. What a strange coincidence.

I could also say Taiwanese with the ability to cast a vote for leaders are generally much happier than those residing in China, but I wouldn’t want to hurt your feelings or leave you feeling sore around the 肛门

And Hong Kong people were quite happy until the transfer of power (or certainly happier on a relative basis than they are now with Beijing sticking their grimy virus infected fingers into HK fruit pie).

Don’t be sad—support pro-democracy movements in China and maybe you can eat more than just the small crumbs of pie crust that inadvertently fall off Beijing’s table.

AS,

You and 2slugs asked about the DW statistic and HAC standard errors and I noticed that no one really answered your questions.

The DW is one of those statistics that people often get wrong. The link that pgl posted is really wrong. It’s not at all true, as pgl’s reference states, that a DW below 2 indicates positive serial correlation and above 2 means negative serial correlation. The DW is a statistic that has a sampling variation. It’s properties make it useful as a quick and dirty guide, but you have to be careful about the particular situation.

The DW statistic is a test for first order serial correlation of the residuals. First order serial correlation means the error term can be written as a linear function of itself lagged. The DW stat is not a test of more general serial correlation.

One drawback of the DW is that you have to look specifically at the number of regressors and the size of the sample to interpret it. Critical values of the test statistic have been calculated (assuming that Gauss-Markov assumptions are true and error term is normally distributed, another drawback) by Savin and White (1977, Econometrica) and others. Another drawback (besides what I’ve already mentioned) is that there are two critical values for combinations of sample size and number of regressors, which are calculated at different confidence levels, 5% and 1%. If the DW is less than the lower critical value, then you can reject the null hypothesis of no first order serial correlation. However, if the DW is between the lower and upper critical value, then the test is inconclusive.

So what about Menzie’s regression? For a sample size of 19 and 3 regressors, the lower critical value is .967 and the upper value is 1.685 at the 5% confidence level. That means that you could reject the null of no first order serial correlation since the DW is 0.89. At the 1% confidence level, the critical values are .742 and 1.415 and the test is inconclusive.

Ultimately, most people just glance at the DW as a quick and dirty guide. If you really want to test for serial correlation, you want to use a more general test such as Breusch-Godfrey, that can test for more general serial correlation than first order and has better properties.

Another thing to look out for is that a high R2 and low DW can be a symptom of a spurious regression. So if you see that, as in this regression, you might want to investigate further.

To answer 2slugs question, HAC is just a different calculation of the standard errors. It doesn’t change the residuals used to calculate the DW statistic.

You are right to worry about HAC in the context of small samples. What’s known from monte carlo and theory is that HAC yields severely oversized test statistics when there is substantial serial correlation and sample sizes are small. Severely oversized means that if you are testing a hypothesis at the 5% confidence level, the probability that you will reject the null can be a lot higher than 5%.

Hope this helps.

I cannot resist a story from UW long predating Menzie Chinn’s arrival there. This is from the RA of a well-known professor (not one of the famous econometricans such as Art Goldberger) but one no longer on the faulty, indeed, no longer among the living. He mostly did cross-section empirical analyses, but also occasionally some time-series. This story also datess from when programs and data were in decks of cards, yeah, a long time ago.

So it came to pass that the RA ran a time-series, and the DW number that came out was bad (the RA actually was an econometrician). The professor then suggested to the RA that he “shuffle the deck” to see if that would improve the DW number. It probably would have, but the RA knew better than to do that. I am not sure what he told the professor in question, however. Those were the days… :-).

Hi Rick,

Thanks for the comments. I was familiar with the descriptions you mention regarding the DW statistic and the HAC standards. The “tutoring” I was referring to was the application of the low DW and the use of the HAC standards to a very small sample, considering that several model coefficients seem to be statistically significant.

Hi AS,

Well, as I mentioned, the DW in small samples is handled by just looking up the critical values for the sample size in a table, as I did for sample size of 19. The DW in this case indicates evidence of serial correlation.

HAC in small samples is oversized. But an important point to realize is that the use of HAC is problematic in much larger finite samples; even if you have 100-200 observations–you still have the problem that it is oversized. For HAC standard errors, the asymptotic distribution is not a good guide to the finite sample distribution even with sample sizes that people typically think of as adequate.

What to do about this? In my view, HAC is overused, without a proper appreciation of the pitfalls. It’s much too easy to check the box for HAC standard errors in econometrics software. Unfortunately, correcting for serial correlation takes more work than that. Serial correlation is typically evidence of model misspecification and it’s better to correct it if you can by changing the model–could be you need dynamics, might be missing an explanatory variable, or might need to change the functional form.

If you can’t get rid of the serial correlation and you want to use HAC, the first step is to ignore the automatic lag length selection in econometric software. Selecting lag lengths a little longer than the automatic procedures would suggest can give you better, but not great, small sample properties.

Beyond that, you have to throw away the software. One way to proceed is to make some of the alternative adjustments suggested in the econometrics literature: KVB (Kiefer, Vogelsang, and Bunsel, Econometrica, 2000), the various estimators of Muller (e.g., Journal of Business and Economics Statistics, 2014), or SPJ (Sun, Phillips, and Jin, Econometrica 2008). I doubt you’ll find these tests in an econometrics software package.

None of those methods is a magic bullet and none will fully get rid of the oversize problem in finite samples. But they may improve the situation. They should be a last resort though. The best thing to do is to try to reformulate the model.

Rick,

Thanks