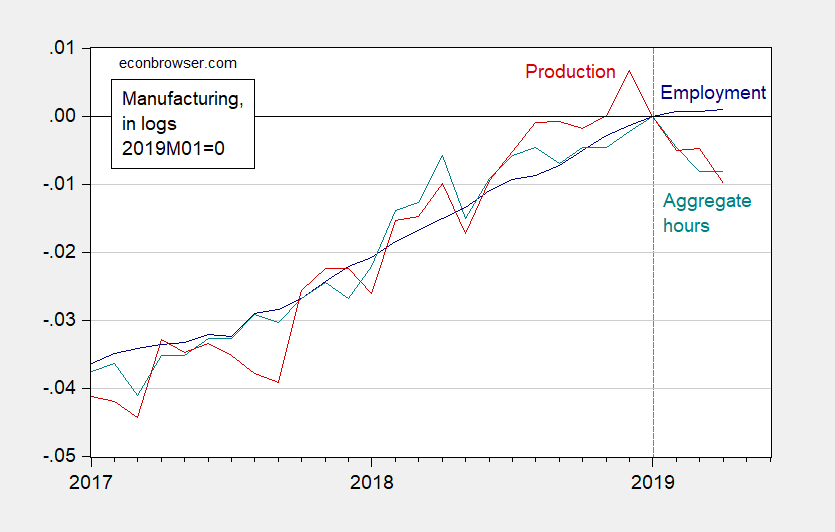

Some NBER BCDC key indicators have peaked, as noted in this post. The more volatile manufacturing sector is showing stress as well.

Figure 1: Employment in manufacturing (blue), aggregate hours of nonsupervisory and production workers in manufacturing (teal), and manufacturing production (red), all in logs, 2019M01=0. Source: BLS, Federal Reserve via FRED, and author’s calculations.

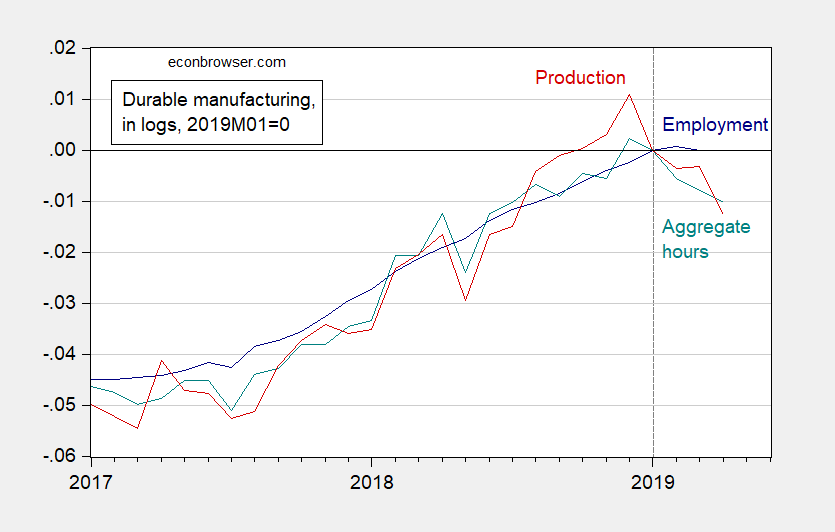

Durable manufacturing has witnessed an even more precipitous decline.

Figure 2: Employment in durable goods production (blue), aggregate hours of nonsupervisory and production workers in durable goods production (teal), and durable manufacturing production (red), all in logs, 2019M01=0. Source: BLS, Federal Reserve via FRED, and author’s calculations.

Returning to overall manufacturing, it seems that sector data compiled by BLS confirms the downturn (value added by industry data is still rising as of 2018Q4).

Figure 3: Real output in manufacturing (blue) and real value added (red), in logs 2018Q4=0. Source: BLS productivity and costs release, and BEA GDP by industry release, and author’s calculations.

It’s hard to know how to take these numbers. Though they are all important numbers, and I would say as reliable as such numbers can be (pretty reliable). One thing I noticed someone saying kind of passively recently, maybe it was NYT, that Republicans have’t taken much credit for the supposed “great” economy recently. Maybe this is a strong indication Republicans see a strong shift in winds in the economy on the near term horizon, and don’t want to get caught on their back heals screaming “we did it!!!” right before the number hit a brick wall.

If I was China, I think I’d increase tariffs just to watch Orange Excrement mess his pants on live TV. And just to twist the metaphorical knife into donald trump’s gut, drastically increase the exchange value of their currency. At base donald trump is a coward—notice how he chose a woman for his Fed board after his two male flunkies didn’t pass the flake test. There’s no way he chooses a female as his first candidate, donald trump acquiesces when it’s to his favor. And he nearly ALWAYS delays the tariff threats. Take away his ability to appear as the tough guy, enact the tariffs before trump does and see how he moves. Politically (certainly on a 2 year horizon) China has much less to lose, and if they get him to bite on actually enacting trade tariffs, then the Chinese politburo has rid themselves of a major pain in the ass in late 2020. Go ahead and make donald trump play the pair of threes in the poker hand he’s bluffing with and watch what happens. I say it’s a no lose for China, or at least in relation to donald trump, they lose less.

*heels

*decrease the exchange value of their currency . Wow, it’s been a tough week for Uncle Moses. Can I get a restart?? Or does someone want to crowdfund my “typing while I’m thinking 101” classes??

Figure 2 is consistent with the collapse of Durable Goods in the 2019Q1 Real GDP data, which fell at a 5.3% rate. This was something I highlighted last month when the GDP data was released.

I found this on Youtube and was kinda semi-amazed I hadn’t found it on my own as I had done several searches before, and then just randomly today this was “recommended” by Youtube. It’s semi-old, but still really great stuff. I’m a HUGE fanboy of Miss Gopinath’s. I could use other words than “fanboy” to describe my thoughts on Miss Gopinath, but just to avoid lots of grimacing and awkward seat adjustments of the blog readers we will just use that. She’s an extraordinarily sharp minded woman and it’s brain candy listening to her. That’s as if I need a reason to put a Gita Gopinath link up. The only reason needed is—it’s Gita Gopinath!!!!

https://youtu.be/3SNXVPJvIe0?t=218

Some eccentric type midwest American economist’s name is mentioned in her presentation (at least in her slides) that may look familiar to some.

When you read good quality newspapers, good quality magazines, and good quality blogs (that’s you Menzie) you will occasionally read sentences and/or paragraphs that literally jump out from the page at you. From Monday’s hardcopy NYT. Journalist Steven Erlanger. I will type it out, so cross your fingers I don’t fudge it up or misspell something. Discussing right-wing European politicians and parties:

“But it was telling what they did not talk about: the scandal that erupted this weekend in Austria, which led to the collapse of the nation’s coalition government after the far-right vice chancellor was caught on a video promising favors to a woman claiming to be a Russian investor.

The scandal has rocked Austria. The vice-chancellor, a leader of the far-right Freedom Party, quickly resigned, and new elections have been called for September. But it is also rippling across Europe, only days before the European parliamentary elections, as a reminder that Russia has deep ties to many other populist parties too.

‘What’s strange,’ said Tom Tugendhat, a Conservative Party lawmaker in Britain, ‘is how many of these nationalist movements seem to be in favor of Russia, not their own country.’ ”

Thank goodness we don’t have this same problem in America.

https://www.youtube.com/watch?v=ebanS7YL6V4

Dear Folks,

I seem to be aggravating the entire world at the moment, so let me not leave the EconBrowser readers out. This is a legitimate finding, and I am not disputing it. But you all should be aware that China is not the only country with which the U.S. is trading. See

https://www.census.gov/foreign-trade/balance/c4621.html

especially for the last few months. The U.S. trade figures with Russia are almost identical for 2018 and 2019, and there is a big deficit. Such imports from Russia will tend to have an effect eventually, even beyond the price effect of the increase on tariffs with China for materials imports.

Julian

Census also breaks down our exports to Russia by product category:

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c4621.html

“You have to wonder how many tractors Russia is going to need”. The tractors Russia buys from John Deere are made in Germany and the equipment they buy from Caterpillar is made in France. Yea both multinationals pay the U.S. parent royalties but that does not increase US employment.

Trade with our top 15 trading partners:

https://www.census.gov/foreign-trade/statistics/highlights/top/top1812yr.html

Russia does not make this list but Germany, Ireland, Japan, and Mexico do and we are running large trade deficits with them as well. Ireland? What do we buy from them besides good beer and overpriced pharmaceuticals?

Perhaps it is time to aid in the enrichment of other places in the world other than China.

@ Julian Silk

When Menzie has written a litany of posts differentiating the importance between bilateral and unilateral trade, what exactly were you under the impression Menzie was referring to, the first sighting and picture of a black hole??? And you want to make us “aware” of something. Do you come this blog once very 6 months??

And you’re surprised our trade with Russia has remained about the same when donald trump has done everything in his power to wipe clear President Obama’s punitive actions towards Russia for Putin’s adversarial behavior towards the USA??

You might want to take an undergraduate “Comparative Economics” class, or just read a damned newspaper once every week. I’d say read a newspaper daily but one can only hope for so much from some people.

P.S. Just a brief addition to this. The actual goods traded are in

https://www.ustradenumbers.com/country/russia/

You have to wonder how many tractors Russia is going to need, and what the tariffs are doing to other trading partners.

Your source and my Census link shows that a lot of U.S. exports represent this product category:

(22090) Civilian aircraft, engines, equipment, and parts

That would be Boeing which does hire American workers to manufacture their products. Average annual sales for 2017 and 2018 topped $2 billion. Of course that was before the bad news on the 737.

*bilateral and multilateral I should have stated. I think some of these moronic commenters are starting to rub off on me. It’s like going to a flat-Earthers convention and conversing with them for 3 straight weeks.

This may be a fair representation of what is going on in parts of the manufacturing sector:

• https://www.marketwatch.com/story/ford-plans-new-wave-of-layoffs-to-shed-10-of-its-workforce-by-august-2019-05-20

• https://www.chicagotribune.com/business/ct-biz-layoffs-chrysler-plant-belvidere-20190429-story.html

• https://beloitdailynews.com/article/20190510/AP/305109919

• https://www.wave3.com/story/36738761/jeffboat-laying-off-278-workers/

• https://www.marketwatch.com/story/manufacturers-grow-at-slowest-pace-in-april-since-president-trump-elected-ism-finds-2019-05-01

However:

• https://www.marketwatch.com/story/jobless-claims-stick-to-3-month-high-of-230000-after-easter-holiday-spring-break-2019-05-02/print . Ignoring the seasonal distortions, the level of layoffs remains exceedingly low, underscoring the strongest labor market in decades. Claims are likely to subside a bit in the coming weeks.

• https://www.marketwatch.com/story/productivity-soars-36-in-first-quarter-drives-fastest-yearly-gain-since-2010-2019-05-02

So, this may be a turning point or a plateau. From a historical perspective, the changes are fairly slight.

It is amazing how Bruce Hall relies on the press when discussing a company without bothering to read its SEC filings. Take Ford for example:

https://www.marketwatch.com/story/ford-plans-new-wave-of-layoffs-to-shed-10-of-its-workforce-by-august-2019-05-20

“Ford Motor Co. plans to eliminate more salaried jobs worldwide as part of its redesign, according to an email sent to employees that was published by Automotive News.”

The rest of the article translates this into something simple – Ford realizes its upper management is bloated. But Ford is having record sales not only worldwide but also in the U.S. Oh wait – its operating margin is down worldwide as well as in the North America. How do I know this? Simple – I can read something called its Management Discussion which is rather detailed by region.

Ford blue collar workers are not being laid off but their overpaid empty suit bosses are. Hey Bruce – the website is http://www.sec.gov. Check it out!

pgl, I think nearly everyone who reads is aware of the changes going on at Ford. Regardless, the effect of the reorganization (and lower sales volumes) make employment changes necessary. But, you are correct. So far the thinning at Ford has been aim at the management ranks (“overpaid empty suit bosses”). But I suppose, in your world, those jobs are not related to manufacturing. Only blue collar jobs or jobs in China qualify for “manufacturing”. Come on. You can do better than that in your effort to pick nits. Your labor theory of value is just a bit dated.

But given your labor theory of value bias, I presume you had no issue with the four links that followed the one about Ford.

Bruce Hall But given your labor theory of value bias

As Menzie might say, the labor theory of value does not mean what you seem to believe it means.

Like Bruce has never noticed that I just ignore the return to capital. Of course if he ever bothered to read a 10-K filing, he might get why I mention operating profits. Of course if he is really trying to emulate CoRev, he would not understand what this means either.

2slug,

It was in response to pgl’s snarky “overpaid empty suit bosses”. https://fee.org/articles/were-still-haunted-by-the-labor-theory-of-value/

Those “overpaid empty suit bosses” make analyses, plans, and decisions that keep those so-called labor-value resources working. But what about when there are no factory workers and only “overpaid empty suit bosses” and a few maintenance engineers? https://futurism.com/2-production-soars-for-chinese-factory-who-replaced-90-of-employees-with-robots

“But given your labor theory of value bias”.

More absurd childish insults? C’mon Bruce – you have become the new CoRev.

“Those “overpaid empty suit bosses” make analyses, plans, and decisions that keep those so-called labor-value resources working.”

Ah Bruce – I get that companies need management. But one can have too many managers. I tell you what – let me know when a large company hires you in upper management so I can short sell its stock and make a fortune.

pgl,

Ah Bruce – I get that companies need management. But one can have too many managers. I tell you what – let me know when a large company hires you in upper management so I can short sell its stock and make a fortune.

That seems like value-added to me, ahem. No, wait. That’s more like “rent seeking”.

For all the talk of US tractor exports to Russia, I must note that the USSR and since its demise, Belarus, has been exporting tractors to the US since 1977. These have always been called Belarus tractors, made in Minsk, Belarus, since 1950 in the MTZ factory originally named for Joseph Stalin. They are very large, tough, simple, and cheap. My oldest friend the farmer owns one. It looks like a hunk of junk, but it works..

Here is the real hoot. Their main outlet in the US since 1977 has been on Faulkner Road in Milwaukee, Wisconsin, still operating. You should check it out some time, Menzie, :-).

Barkley admits: ” It looks like a hunk of junk, but it works..” Most owners have sold them, and they are JUNK, when they do work. They were popular ~20 years ago, and most sellers dropped them. Congrats on your friend on getting a good one. Tractors should last for decades in normal use. My previous was ~40+ before it dropped a valve, I sold it, and it is still operating. My current one is ~15 YO.

Both the Belarus and various Chinese tractors have the same reputation as the Yugo has.

Most people don’t know that most of the small and medium sized tractors are made in Japan and India.Think kubota, Mahindra, and Kioti and Yanmar who made most of Deere smaller tractors until the 90s

Wow. Does this mean we should also place high tariffs (if we have not already done so) on those darned Chinese tractors? Well, at least they are probably not a threat to US high tech dominance the wei Huaway is!

Actuallly, CoRev, my friend’s Belarus is pretty clunky and he only uses it for land very near his house, partly for it to sit in his yard as a bizarre showpiece. He owns four large and separate farms where the tractors in use are more expensive and higher quality.

Barkley, his use is appropriate for that brand tractor. There were stories that it actually leaked/seeped oil through the block casting they were so porous. As far as Huawei, I do own one of those and it was cheaper than other brands. But, is it backdoored to the Chinese intel community? Dunno and don’t care for my use. You might and the US Govt obviously does care.

This would be funny except Ben Carson is supposed to be the Sec. of HUD. The man is clueless:

https://talkingpointsmemo.com/news/katie-porter-ben-carson-mortgage-hud

Real Estate Owned (REO). Oh – I love Oreos!

If you look at my post on the real trade balance

https://angrybearblog.com/2019/05/real-trade-balance-2.html

you will see that the monthly changes in trade have become extremely volatile in recent months.

Remember, the trade balance is the difference between two very large numbers so small changes

in either of both exports or imports can generate very large changes in the balance.

But I cannot help but believe that Trump’s trade war is already distorting trade patterns.

Found this over at FT and thought it was worth posting. I wouldn’t rank this writer in the “superstar” category, but as a former member of the Treasury Dept probably has respectable opinions:

https://www.omfif.org/analysis/commentary/2019/may/renminbi-weaponisation-talk-overblown/

I’ll be honest, at this point I wouldn’t mind seeing China devalue their currency, just for the entertainment of watching donald trump squirm as his economics barometers get hit. But I agree with Sobel, it just doesn’t add up from their viewpoint, with problems such a “capital flight” which is what would happen as Chinese will be resourceful to get rid of their own currency for a more stable holding of value. You could make an argument that as a short-term move (18 months horizon) devaluation might work in the sense it would help eradicate donald trump from their list of problems the following 4 years. But the Chinese Politburo probably don’t view it that way.

Some reality to this silly charge by the ‘we hate China’ crowd:

“Over a period of more than a year, Beijing has consistently resisted downward renminbi pressure against the dollar. The authorities have used means ranging from modest intervention – including through actions at the daily renminbi fixing, and combating short-sellers on the money markets – as well as public statements supporting currency stability. Previous OMFIF commentaries have noted that there is no case to assert China ‘manipulates’ the renminbi or has engaged in ‘competitive devaluation’.”

Let’s look at the Real Broad Effective Exchange Rate for China (indexed at 100 for year 2010).

https://fred.stlouisfed.org/series/RBCNBIS

General real appreciation from 1994 to 2002 followed by a modest devaluation over the next few years but more appreciation since. In fact the appreciation since 2006 has been almost 50 percent. Any one accusing China of competitive devaluation is looking at the graph turned upside down.

Regarding possible capital flight from China, there has recently been a major surge in the cryptocurrency markets with the major ones up well over 50 percent in the last month or so. One never knows what is what in those markets, but there are rumors that this surge is largely being driven by Chinese flying their capital out of China.

Are we sure this is not a surge of capital into Wilbur Ross’s Swiss bank account?

it is quite possible the chinese can marshal their folks to accept a short term (say through the next presidential election) devaluation without capital exodus, with the goal of damaging trump politically. they could let it be known the devaluation, which probably would happen naturally, will not be fought by the central bank until after the next election. they may be able to do this with patriotic persuasion and less on capital controls. just a theory. not sure how trump would respond to this approach…but i think he would be hurt politically and we would suffer economically.

Professor Chinn,

I added real personal consumption(FRED series PCEC96) to figure 1. PCEC96 log normalized to 2019m01 seems more optimistic than the employment and production indicators. Is personal consumption considered a lagging indicator compared to the indicators used in figures 1 & 2?

Thanks

From what I can determine, it seems like real personal consumption (dlog(PCEC96)) granger causes manufacturing production (dlog(IPMAN)), using FRED data series. Does this give some room for optimism amongst the various declines in production indices?

AS: Maybe. But I think it’s stronger that *durables* consumption Granger causes industrial production (1967-19Q1). And durables consumption is going down faster than overall consumption.

Thank you very much! I appreciate learning from you.