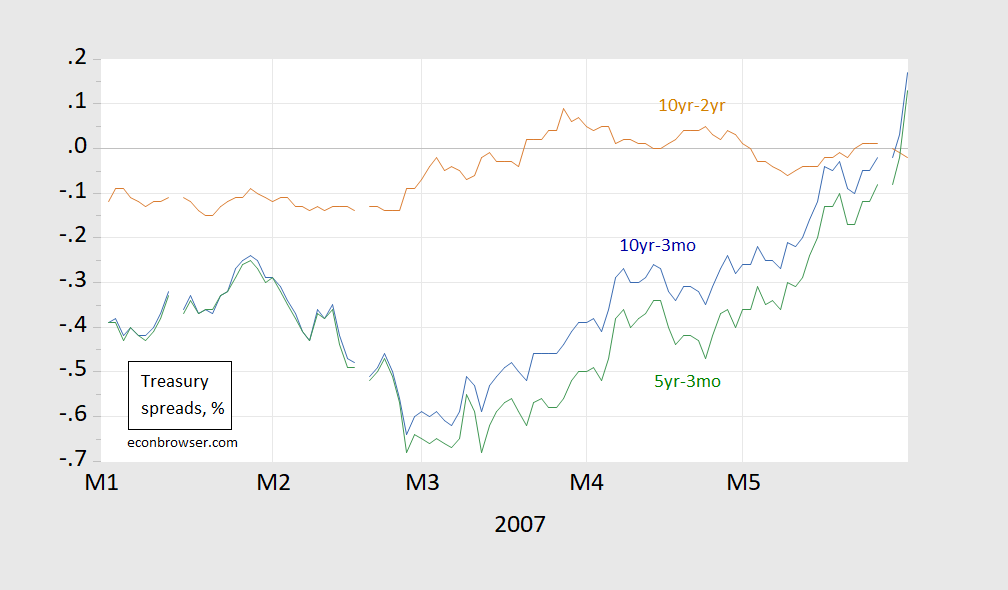

Figure 1: 10 year-3 month constant maturity Treasury spreads (blue), 10 year-2 year (red), 5 year-3 month (green), in %. Source: Federal Reserve, Treasury.

Maybe not…Here’s the same graph with the dates:

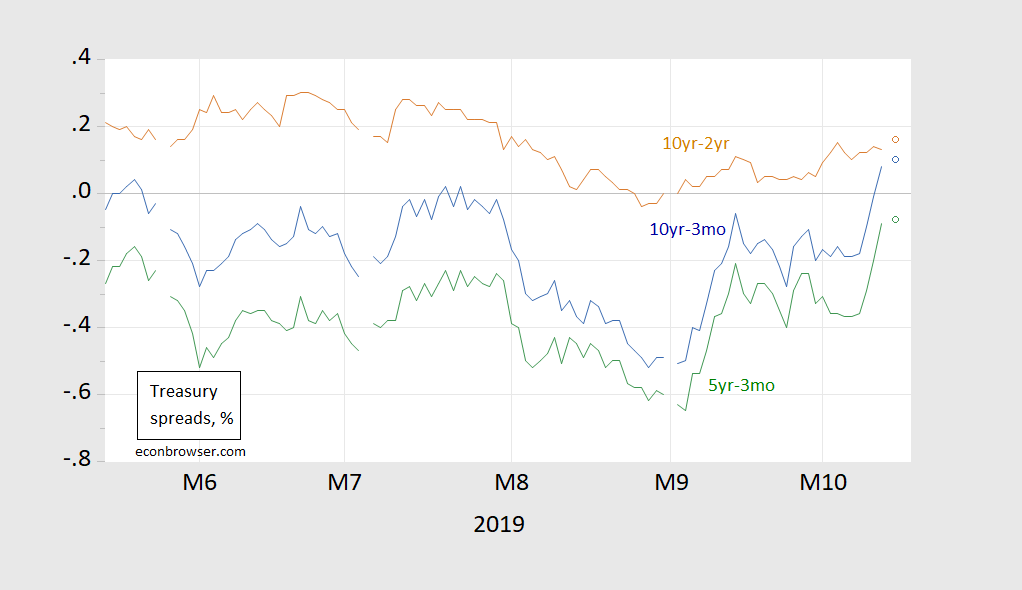

Figure 2: 10 year-3 month constant maturity Treasury spreads (blue), 10 year-2 year (red), 5 year-3 month (green), in %. Source: Federal Reserve, Treasury.

The recession began (as dated by NBER) in December 2007.

What does the current situation look like?

Figure 3: 10 year-3 month constant maturity Treasury spreads (blue), 10 year-2 year (red), 5 year-3 month (green), in %. Source: Federal Reserve, Treasury.

By the Second Law of Shamelessly Non-Mathematical Analysis, we will have a recession in about six months. That is what this means.

We are growing, and one day, we will rule the world!!!!! (I’m joking, I like to use mathematics, but sometimes I am slow or lazy)

This is because of the Fed’s purchase of T-bills?? Yes?? This artificially changes the spreads, adds some short-term liquidity. Doesn’t change the underlying economic picture. OK, I confess, I copied off of Bonkers Bloomberg’s essay sheet who sits in the classroom desk to my left. Does this count as academic misconduct??

Oh my – you forgot to mention DEMOGRAPHICS. As Princeton Stevie will surely note – you know nothing about macroeconomics.

If you check your graphs, Menzie, you’ll see this phenomenon right at the beginning of the recession.

https://econbrowser.com/archives/2019/05/yield-curve-inversion

I believe it is sort of a rule of thumb that a steepening of the curve after inversion is a sign that recession is right around the corner. Doubt that is the case this time, but what do I know?

One chart further down in the link Steven provides is picture of term premium against recessions. The tendency is for term premium to rise ahead of recessions, just as the curve tends to re-steepen. Term premium is now higher than at the end of August, but still quite negative. Timing, for both the curve and term premium, suggests uncertainty over trade policy is the driving factor.

Another convert to the Shameless Willie School of Purely Visual Analysis. I see patterns and if they look the same when charted, they must be true.

For recessions before 1983, yes, we would be safe.

For recessions since 1983, no we are not, by on average of 4 months.

I suspect the difference in how the economy has reacted before vs. after 1983, has to do with how much or how little manufacturing was the main driver of the economy.

Manufacturing hasn’t been driving nothing since 1925. Try again.

Trump is delusional:

https://www.nbcnews.com/politics/donald-trump/trump-says-turkey-s-incursion-syria-not-our-problem-calls-n1067391

President Donald Trump said on Wednesday that Turkey’s incursion into Syria is “not our problem” and downplayed the escalating tensions in the Middle East in the aftermath of his abrupt withdrawal of American troops from the region.

“It’s not our problem,” Trump said speaking to reporters in the Oval Office, referring to Kurdish forces that, until recently, fought side by side with the United States forces as “no angels.”

“If Russia wants to get involved with Syria, that’s really up to them,” Trump continued. “We shouldn’t be losing lives over it.”

“We’re watching and we’re negotiating and we’re trying to get Turkey to do the right thing,” the president added, describing the U.S.’s decision to leave the area as “strategically brilliant.”

US does not need a “who lost some breakaway county in Syria” witch hunts.

A lot of things the US “could” do about NATO ally Turkey acting to secure itself in the non government organization run area of NE Syria. The US tried “Libya style nation building” in Syria using radical Islamists. A “could” of which Obama, Kerry and Clinton ignored the “should”. How US get so many miserable consequences!

How is it delusional to have a different view of the “should” than Bill Kristol and Nancy Pelosi?

ilsm,

The US has certainly (and unwisely in my view) supported Sunni Islamist factions in Syria, including some linked to al Qaeda, mostly in Northwestern Syria, including I think still in Idlib province where the last of these folks are still holding out against the Syrian government.

But in the Northeast the Kurds have had a secular government following “post-socialist” Bookshinite ideology stressing cooperatives. It is the Turkish invaders who have a quasi-Islamist regime, with Erdogan feeding Trump the line he put out that the Syrian Kurds are “communists,” which was one of several awful things he said , including that they are “no angels” and are “worse terrorists than ISIL,” a flagrent lie pushed by the Turks.

JBR,

To Turks Kurdish rebels have not been “angels” for decades, I had a missed chance a few years ago to do a short term job at Incirlik AB in SE Turkey.

https://en.wikipedia.org/wiki/People%27s_Protection_Units

Trump has been guilty of hyperbole……

“Kurdish rebels.” ilsm, the Syrian Kurds are not “rebels” against Turkey. That is not Turksy territory, and the claims by Turks those people have been involved in terrotist attacks against Turkey is just an outright screaming lie.

So, you support “the ultimate solution” of moving Syrian Kurds out of territory that is not Turkish and in which they have been living for 4,000 years? Do you also agree with Trump that they are worse terrorists than ISIL/Daesh?

I suspect you have been giving the yield curve inversion more attention than it deserves.

Yes, it is a very good leading indicator and it did turn negative.

But I suspect the inversion is too short lived to be meaningful.

I did turning point analysis for some 30 years on the stock market and the relative performance of the S&P stock industries and found that it was surprisingly easy to get false signals when you mechanically applied such decision rules to the stock market and/or the economy.

At a minimum I preferred to use monthly data and often even smoothed the monthly data. The inversion may yet turn out to be a valid signal, but I believe it is to soon to draw strong conclusion from it.

Dynamic Mechanism modeling

of complex simulated market systems

Are for insight not foresight

Kopits: “If you check your graphs, Menzie, you’ll see this phenomenon right at the beginning of the recession …”

Patience, folks. Steven is a little slow on the uptake.

He had another comment that did not mention his magic word – DEMOGRAPHICS????!!!!

I remain uneasy abt the inversion indicator. When Cam Harvey came up with the correlation excess reserves paid…….0.0%/yr. Now (9/19) req and excess reserves pay 1.8%/yr So short rates have a positive floor, but longer rates are unrestricted. I smell regime change.

Bob,

Your point about lower-bound constraints on short rates and unrestricted long rates seems very good to this amateur. Is there a way to adjust a probit model to test the resultant probability of recession given your comment? Thanks for your thoughts.

Continuing claims for unemployment insurance are no longer down year over year. They have been flat to slightly up YoY for about eight weeks now. This isn’t an inerrant recession predictor, but it’s unusual to see these numbers cross over this far into an expansion without being followed by recession within a year or so.

Continuing claims are a read on re-employment conditions, the difficulty of finding work, not just the sheer volume of job losses. In areas such as natural resources, agriculture, manufacturing and parts of retail, hiring activity has softened despite unusually low occupational unemployment rates. For recession to ensue, weakness must expand beyond the toehold it has at the moment.

Finance industry professionals can cite all sorts of reasons why yield curve behavior is distorted this time. I wonder whether the economy is smarting for trying to push hiring volumes to unsustainable levels + driving up attrition in the process. The behavior of hiring turnaround times is wholly inconsistent with muted wage inflation (where the influence of retirements is having a smaller-than-expected impact, at least for now).

It’s near a month old now, but I have always been a fan of Mr. Kwak’s writing (disagree on some things like “default” style “choices”) so this is worth reading if you haven’t already read it. He has this uncanny knack for finding issues which badly need to be addressed and addressing those issues when very few others are. And for a man raised in an affluent family, Kwak has a deeper level of empathy than you normally find in people accustomed to life in those higher income brackets.

https://www.washingtonpost.com/outlook/how-economists-turned-all-of-society-into-a-market/2019/09/19/c5e2faac-be0b-11e9-a5c6-1e74f7ec4a93_story.html

Another gift he has is to take problems in different disciplines/fields of life (often complex ones) and partition them out to a detailed view, which shows great intelligence to be able to do that when you aren’t necessarily educated in that field. So in that sense it is logical he would have worked at McKinsey and done all the varying things he has done.

The Fed’s response is the source of the dramatic reversal in the rate differentials in the past, but I’m not so sure that they are reading the current global economy accurately.

I would look to German capital goods production and Chinese manufacturing as the best indicators of the global multiplier-accelerator mechanism. The U.S. economy may be more insulated than either of these countries from the natural business cycles by having a bigger part of the economy in services.

The current state of the global business cycle might also be responsible for a move toward a more conciliatory stance on the part of the EU toward the Brexiteers, as German exporters could face serious losses, at a bad time, if British tariffs are suddenly thrown up against their exports.

Nope, serious losses from what??? The U.S. is feeling it. When the next recession only peaks to around 5% on the U-3, your nostrils will flare.

See

https://www.dw.com/en/german-businesses-already-incurring-brexit-losses-says-industry-boss/a-50725851

https://www.reuters.com/article/us-germany-economy-exports-analysis/its-brexit-not-trump-germanys-export-slump-mainly-caused-by-britain-idUSKCN1VI1IU

https://www.ft.com/content/20c144ec-c7ee-11e9-a1f4-3669401ba76f

for a few views on the effects of Brexit and German exports.

Not impressed. The EU isn’t dealing at all. Boris Johnson’s deal is dead.

Someone’s old writing partner had an editorial in today’s hardcopy of the NYT:

http://news24x7world.com/analysis-comment/opinion-peter-navarro-the-trump-guide-to-diplomacy/

This is not an endorsement of the views in the editorial, just an FYI post. I give the alternative link for those who might not be able to get through NYT’s paywall. ENJOY!!!!

I wonder if Doris Kearns Goodwin ever thought of trying this stunt out?? Could have avoided the bad kink in her neck she must have gotten glancing back and forth copying text:

https://www.cnn.com/2019/10/16/politics/peter-navarro-ron-vara-trump-china-intl-hnk/index.html

https://www.nytimes.com/2019/10/16/us/politics/peter-navarro-ron-vara.html

I was reading comments and “Technical Analysis” popped into my pea brain. I wandered around in the google looking for a link to post. Here it is: https://www.quora.com/Does-technical-analysis-really-work

It matters how we get to the inversion. Old fashioned way- short rates pushed higher (by the Fed)- deflationary. Now- long rates pushed down (by the Fed)- inflationary?

Dear Folks,

Let me give the people who are trying to forecast a future recession one more variable. If you look at the FRED measure of non-performing loans in thousands of dollars, the measure appears to be bottoming out and may gradually turn up higher. This measure sharply rose in 2007 and 2008. So it may be an indicator that a recession is coming but not imminent, despite the reversion of the spread.

You can see it at

https://fred.stlouisfed.org/series/USNP

Julian

Julian,

Y/Y percent is still negative.

Recession prediction

To pre empt or to play

Then there’s recovery path and history

The recovery kicked in last time after

a year and a half

And moved at mollusc speeds

Can’t we do better this time ?

Will we ?