Today, we are pleased to present a guest contribution written by Valerio Ercolani, from the Directorate General for Economics, Statistics and Research at the Bank of Italy. The views expressed in this note represent that of the author and not necessarily reflect those of Bank of Italy.

Last months saw an unprecedented rise in the US saving rate. Most of the accumulated saving was undoubtedly generated by the social distancing and lockdown measures imposed by the government, however part of it could also have been driven by precautionary motives due to grim labor prospects. Some back-of-the-envelope calculations show that the dynamics of the unemployment rate alone can induce a large increase in (precautionary) saving for this year, which can raise the prospect of a new saving glut.

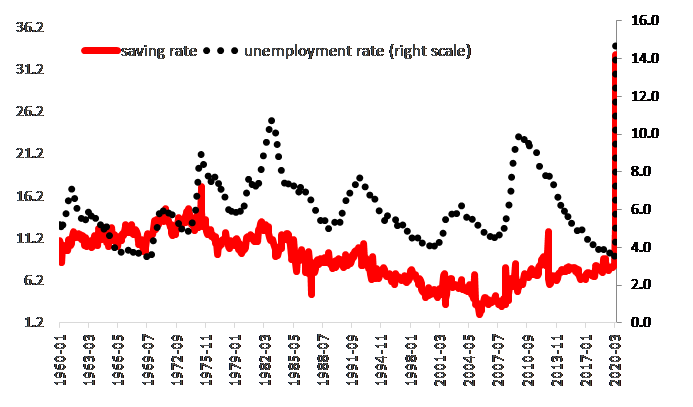

The economic effects of the Covid-19 outbreak have become manifest in official data. In the US, GDP contracted by 5% in Q1, at an annual rate, with service consumption contributing the most to the contraction. During the last three months, employment fell by roughly 19 million units with unemployment rate settling at almost 14% in May. In fact, the latter can be underestimated, for example, Hamilton (2020) shows, through some back-of-the-envelope calculations, that the actual unemployment rate could be even larger, around 20%. In April, the saving rate rose 20.3 percentage points (to 33%), the largest monthly increase since the 1960s (Figure 1). In May, it retreated to a still high 22.3%. Personal saving skyrocketed itself: it almost tripled from February, moving from roughly 1400 to 4100 billions of dollars.

Figure 1: Saving rate and unemployment rate (monthly frequency, US). Source: Bureau of Economic Analysis and Bureau of Labor Services

Most of the accumulated saving was undoubtedly generated by the social distancing and lockdown measures imposed by the government during the emergency, which significantly limited the households’ ability to spend. However, part of it could also have been driven by precautionary motives, related to both medical and economic concerns, and even after the economy fully reopens and the effect of the lockdown on the savings rate wanes, those other factors may well continue to be an important driver. On the health front, the virus may not disappear until a vaccine is developed, produced and distributed on a large-scale; indeed, recent studies show that the pandemic could last between 18 and 24 months, because the virus won’t be halted until about 60-70% of the population is immune (Barry et al., 2020). If this is the case, fear of contracting the Covid-19 may continue to drive people’s behavior even in the post-emergency phase. Hence, demand for physical-proximity services will be subdued and, in some extreme cases, may not resume completely (e.g., in tourism-related or in transport sectors). At the same time, the supply side will likely remain an issue: in order to curb the probability of new outbreaks, several US States, including Florida, Texas, New York and California, are imposing on businesses some forms of social distancing that, while looser than during the emergency, will inevitably constrain their ability to produce and deliver goods and services. All that increases the likelihood of business defaults or resizing, amplifying the risk of income losses or layoffs and hence stimulating households’ precautionary saving (see, among others, Hugget, 1993).

Indeed, labor prospects are grim. Barrero et al. (2020) look at Covid-19 as a reallocation “labor” shock and conclude that almost half of the recent layoffs will be permanent. This is consistent with the results by Coibion et al. (2020) which reports that expectations about the level of unemployment have increased not only for the short term, but also over a medium horizon (three to five years).

In particular, unemployment rate has been shown to be a crucial driver of precautionary saving, on both theoretical and empirical grounds; see, for example, Carroll et al. (2012) and Mody et al. (2012). The latter shows, for a panel of 27 advanced countries (including US), that a 1 percentage point (pp) increase in unemployment rate – taken as a proxy for labor income uncertainty – raises the saving rate by roughly 0.3 pp. The estimated regression controls for a number of other determinants of saving, including the one-year ahead disposable income to capture for “first-moment effects” stemming from changes in economic activity.

While we know that a careful analysis on precautionary saving would need household-level data (see, e.g., Attanasio and Weber, 1993), we use the above mentioned result to perform some back-of-the-envelope calculations about the effects of unemployment rate on the average US saving rate in 2020, due to precautionary motives (Table 1). We present three scenarios, based on alternative assumptions about the increase in US unemployment during the year. The most conservative one is an increase from the 3.7% observed in 2019 to 10%, in line with the projections of IMF (2020). The worst-case scenario assumes an increase to 20%, more in line with the projections in Petrosky-Nadeu et al. (2020). We take an intermediate of 15% as our benchmark. Using the coefficient estimated by Mody et al. (2012), i.e. 0.3, in the intermediate scenario the saving rate would increase by 3.4 pp, which would represent the largest yearly surge since the 1960’s. Indeed, so far, the largest increase occurred in 1970 and amounted to 1.9 pp.

Applying the same back-of-the-envelope calculation, the observed rise in unemployment during the Great recession period (3.5 pp between 2008 and 2009) would have predicted an increase of the saving rate in 2009 of 1 pp; although other factors have clearly been at play, this prediction is strikingly close to the observed increase (1.1 pp).

Table 1: Precautionary saving and unemployment rate in US. Notes: the table reports the back-of-the-envelope calculations using Mody et al. (2012) and Muellbauer (2020).

The flip side of a saving expansion is a fall in consumption. Muellbauer (2020) estimates an augmented-consumption function for US, finding that one pp increase of unemployment in a quarter generates a fall in consumption of roughly 0.5%, in the same quarter. Back-of-the-envelope calculations, which convert quarterly changes into yearly ones, show that that the intermediate scenario in Table 1 is associated to a fall in consumption of roughly 3%. The implied increase in the saving rate of such a fall in consumption, holding income constant, is roughly 2.9 pp, very close to the figure obtained from Mody et al. (2012).

All in all, the proposed figures depict only part of the story because saving is driven by a number of other factors such as income, wealth and interest rate dynamics (see, among others, Dynan, 2008), on top of the continuation of the social distancing measures. Therefore, a new saving glut could emerge globally to the extent that the saving dynamics observed and anticipated for the US is not an unicum. Indeed, saving rates in the major European countries rose sharply last March as well as bank deposits (Arnold and Storbeck, 2020). As conjectured by Blanchard (2020) and Goy (2020) such a striking surge in (precautionary) saving could be long-lasting, potentially reinforcing some already existing tendencies such as persistently low levels of inflation and of the natural rate.

This post written by Valerio Ercolani.

Anecdotally, I can say that I have friends who joke that they are saving for retirement now that they can’t travel. My wife and I are doing what we can to retire our mortgage in the next few years. I don’t believe we are unique among people who are fortunate enough to have an income throughout this pandemic. My son is busy cutting expenses, since his entire livelihood was wiped out by COVID-19. There is no telling when live music will come back, and there’s no telling what will be left of it when it does. For now, he has state and federal assistance. There’s a limit to that, and he’s preparing for it.

When it comes to a savings glut, the money has to go somewhere. My take is that both bonds and equities are inflated right now because of simple supply and demand. The money that’s being saved has to go somewhere. Even if the economy isn’t productive, cash is chasing around assets that might pay anything in time. I’m not sure what to think about that, or what might happen to the markets in the future if the economy stays unproductive.

Most people seem to have forgotten basic Keynesian economics: https://en.wikipedia.org/wiki/Liquidity_preference. Sometimes the best storage of value is to hold cash. Even if you lose value with cash holdings, you still expect to lose less and take much less unnecessary risk than by holding overpriced and artificially inflated risky assets. This is even more true in a deflationary context combined with a multiplication of asset price bubbles. The real economic puzzle is to explain why is it that so many today are still willing to buy stocks or long-term bonds.

This is a very reasonable piece. I have only two caveats on it regarding how strongly its argument will operate to lead to a higher savings rate and thus lower consumption going forward.

One is the “pent-up demad effect,” not a standard item in economic theory, but widely discussed in popular media during the current situation. We have seen a burst of retail sales in May, associated with a now-reported increase in consumption during that month of 8.6%. These may go away in the near future for the reasons given in this post, but the size of the spike in these suggests that indeed many consumers engaged in a fit of consumer purchases as the US economy “reopened.” This main not continue, but many have mentioned that this burst probably had a strong element of a release of the pent-up demand from people getting out of their homes.

The other element, which I think we really do not have sufficient data on, is the impact of the massive fiscal and monetary stimulus amounting to trillions of dollars on all this. A non-trivial portion of the fiscal stimulus has gone directly to some consumers, both as stimulus checks, no longer going out for now, as well as enlarged unemployment benefits, which may cease at the end of July. So an important part of this fiscal stimulus may disappear, and to the extent it has aided this burst of spending, its withdrawal or reduction may lead to a cessation of growth or even reduction of this consumer spending, with the precautionary motives and so on cited in this piece coming to doimnate.

Dr. Ercolani,

Looking at Real personal consumption expenditures per capita (FRED series: A794RX0Q048SBEA), I notice that real personal consumption per capita in the US steadily increased Y/Y from 1947Q1 to 1950Q3 and stayed positive until 1951Q1. Could consumer behavior in the US after WWII give some optimism concerning consumption?

I’m reticent to say this, because I don’t want to discourage questions like this, because I think the questions are beneficial to the blog and beneficial to learning. I bet if Mr Ercolani responds it will provide some sustenance for all. But, I do think this is “apples to oranges” on this comparison.

By the way, I think this is a great post. I been meaning to comment on the Hiro Ito-Frost post, but I wanna read the paper before I comment. Hopefully the comments will stay open a little longer until I can throw my slime on the wall.

Moses,

Why apples and oranges? There was forced saving during WWII and the consumer spent freely after the war. We are in a war with the virus and we have forced savings, not through government controls but due the lockdown. After the war there was concern about unemployment with the demobilization of troops. We now have problems with unemployment due the shutdown. Most analogies are not perfect comparisons, but there may be some similar boost to consumer spending after the virus is controlled, since human nature does not change much.

In addition we did have the “Roaring Twenties” after the 1918 flu and end of WWI. Again, not a perfect comparison, since the growth of industrialization may not be the same now as in the 1920s.

The word ‘precautionary’ gives way, way too much credit to average US intelligence and foresight.

Some people on this blog (I suspect even Menzie, but I do not know) may have found it strange I gave Fauci such a hard time. The deal is he has attended many White House press conferences without a mask, along with Sap Pushover of the Year 2020 Deborah Birx. Fauci has stood there quiet as a little mouse in the middle of night, along with Birx as trump and Pence have told outrageous lies that a 7 year old 2nd grader wouldn’t even dare try. Am I saying these people are the devil?? Well, not quite. But I would say they have sold their own personal ethics down the river, and possibly part of their souls down the river for supporting policies that kill people. I put them right up there with Rod Rosenstein as the same type of individual who has ethics, so long as those ethics don’t require any kind of backbone or endoskeleton at all.

And how do I gauge this?? Well, when two DUMB Okies can figure out the proper course of action, I figure Fauci and Birx can figure it out too.

https://oklahoman.com/article/5665656/two-stitt-cabinet-secretaries-leading-pandemic-response-resign