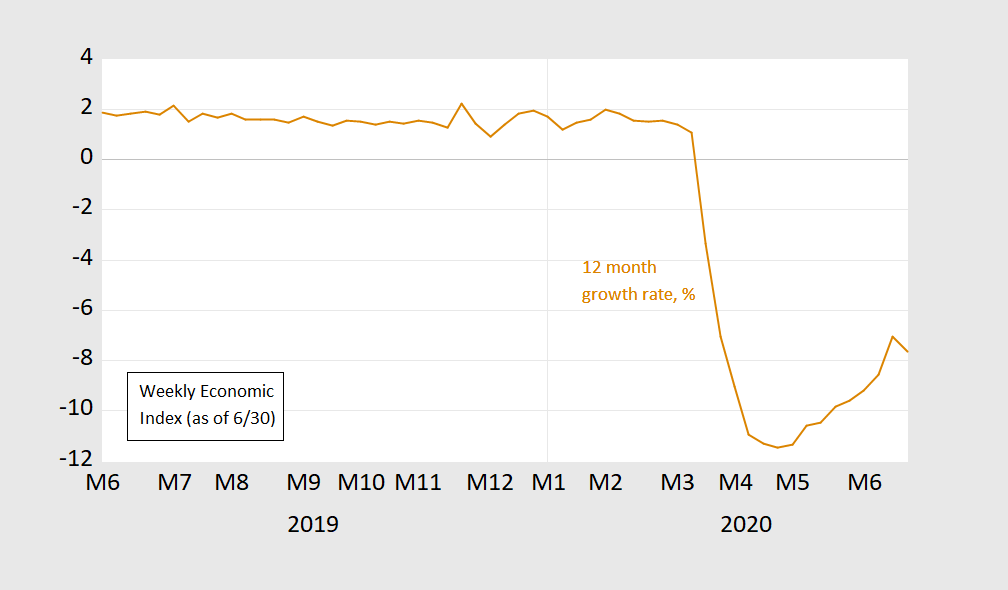

The New York Fed’s Weekly Economic Index suggests yes.

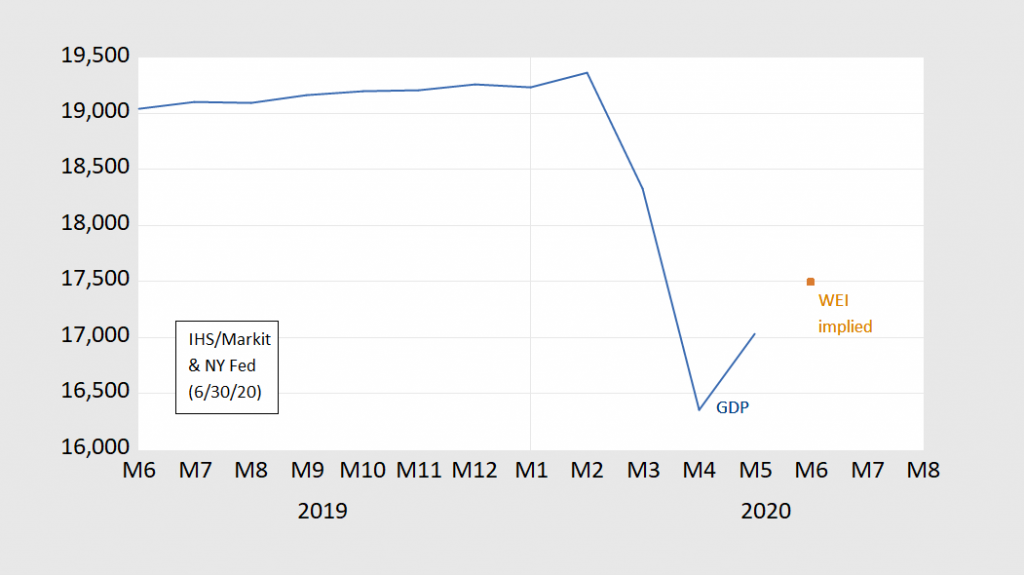

Applying the June WEI (12 month) growth rate to the IHS/Markit (formerly Macroeconomic Advisers) monthly GDP series, one obtains the following picture:

Despite this, output will be lower in Q2. The implied Q2 q/q growth rate is -36.2% (SAAR).

See that shows I’m losing touch a little bit. Mind not as agile as it used to be–at least not on Finance things. I had no idea Macroeconomic Advisors had changed their moniker to IHS~~although I did notice IHS was being quoted a lot recently on different sites, so maybe that should have been my big tip-off.

Doing some night owl reading, thought this was something that need to be said very badly. Made me pine slightly for the good old days when James Kwak was throwing in his 2 cents pretty regular:

https://ftalphaville.ft.com/2020/06/25/1593080581000/If-the-Fed-puts-its-stress-test-results-in-the-shadows–it-will-backfire/

PMI number is coming out soon, yes?? I wonder how much weight we should put on that number if it comes in just slightly under 50??–I certainly have no idea—although FT seems to say it’s getting misleading as a general indicator, not as reliable in the current context.

Hmmmmm, some gems to be found here for the wandering eye. Even in these short posts you are a fountain of knowledge Menzie. I’m kinda rotten green jealous of your students. If I lived near Madison I think I would beg like a sad street urchin to audit your class.

Wondering what your European “AI” friend is thinking on 2nd Quarter USA numbers?? I imagine he charges for that as proprietary. Can’t say as I blame him.

“Today’s decline in the WEI for the week of June 27 (relative to the revised value for June 20) is driven by a decrease in consumer confidence, which more than offset small increases in retail sales and steel production. We anticipate upward revisions as more data become available. The WEI for the week of June 20 was revised upward as a result of the staffing index release providing a more positive signal than previously available data.”

So this index is saying we have recovered a mere 30% of what was lost. With such good news – we may be back to full employment by 2025.

Maybe we get some growth in June. I’m not holding my breath for it to continue in July and August as the pandemic continues to explode. As a nation, we are going to have to do what we failed to do early on in order to contain the virus. Unless the goal is to radically reduce the American population over time. Letting it go would probably to that quite well.

I’m going to say what very few on this blog or people of “polite company” are willing to say. That is, a significant portion of Americans don’t care when old people are dying—certainly not old people they have no family relation to. And that is why some people want to carry on. Now some just wanna pay their utilities, and I get that. But if there was the public will for a shutdown and Congress knew the electorate demanded that, there would be “a work around”.

as i have stated before, the conservative party has no problem with letting the “other” old people die off. it is a positive for social security and medicare in the long run, as it reduces our entitlement liabilities. remember, dead people don’t vote. this keeps them from cutting benefits to those that survived the pandemic. and those folks will vote.

I think they call it “the salt of the Earth”

https://twitter.com/scottygb/status/1278358989147967489

It was in some book, er something.

It is entirely possible that after the spring plunge that we get some sort of

dead cat bounce before the economy really decides what to do.

Just keep your mind open to all kinds of possibilities.

Paul O’Neill and Alan Greenspan decided they needed the shortest of short-term economic indicators back in the last giant economic downturn. So they put their respective staffs to work devising a weekly economic index. They thought that aggregating already available data into a single index would tell them something they did not otherwise know. Or maybe they thought that having a data series that satisfied other peoples’ desire for “information” would give them leverage in discussions of the economy.

Well, we are back in the soup, and back to looking at short-term aggregations of data. As with tea leaves, numerology, astrology, goat entrails, rooster pecking, Gann lines, Fibonacci numbers and palmistry, short-term economic data provide us the opportunity to discern patterns that we use to attempt to predict the future. We can associate wiggles in the data with wiggles in infection rates and feel that we know something we did not know before.

All of which is highly suspicious. Routinely, economists urge users of economic news to average a series of monthly data over a few months to correct for noise in the series. Just as routinely, data for a single month will be used to argue that the economy is heading in a new direction. Here, we’re looking at weekly data, for goodness sake.

My sense of “the pattern” is that the WEI went up in the prior week and down in the latest week, noise in a time of economic volatility. Is my sense correct? How the heck should I know? Nobody will ever know whether the pattern they think they see in a weekly aggregation of weekly and daily economic data is signal or noise. Upon request, I will happily identify some other pattern, with just as much justification.

I am not arguing against the collection and aggregation of short-term data. We should just avoid telling ourselves stories based on short-term wiggles in the data. As soon at we allow for story-telling based on short-term wiggles, the worst sort of people will get involved:

“Today is probably, if you think of it, the greatest comeback in American history.”

@ macroduck

I agree with you, but I don’t agree with you. Uuuuuuhh, yeah it’s kinda grasping a little. But “grasping” at data isn’t “always” bad. I think in this context, grasping and straining a little for data can be good. And although I agree, WEI is apt to have shortcomings. But some data is better than no data. I would also argue this technique, taking data over a short starting and ending time frame is similar to “sampling” in statistics. You are taking a small amount (“sample pool”) of data in order to “extract” a rough idea of what the larger data looks like.

I for one am glad Menzie has shared this with us, and I found some other links in the Fed page quite interesting as well. Because I think I have a very vague idea of how Menzie’s mind works, and I can imagine him not sharing or posting this, on the very basis of what your criticism was. I think, for me, hopefully not sounding like a sycophant, if it’s good enough for Menzie to look at, it’s good enough for me to look at.

macroduck: Jim Stock, one of the world’s most pre-eminent time series econometricians, developed this WEI while a member of the CEA. If it’s good enough for him, it’s good enough for me.

I’m aware of Stock’s involvement. It does not follow that a presumably well constructed index overcomes the problems inherent in viewing the performance of the economy through the lens of weekly wiggles.

To repeat, I have no quarrel with the collection and aggregation of short-term data. I object to telling stories about short-term wiggles in those data.

Professor Chinn,

A question about the WEI GDP forecast calculation using the NY Fed definition of WEI from one of the slow blog readers. I am not certain if I am using the definition below to correctly calculate the estimate of the annualized GDP decline for 2020Q2.

“The WEI is scaled to the four-quarter GDP growth rate; for example, if the WEI reads -2 percent and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2 percent lower than a year previously.” https://www.newyorkfed.org/research/policy/weekly-economic-index

If I understand the above definition of WEI, and we assume that the June 27 WEI index of -7.64% applies to the whole second quarter, then would we multiply the 2019Q2 GDP of 19,022 by .9236 (1-.0764) to derive an estimate of 2020Q2 GDP = 17,568? To annualize the 2020Q1 to 2020Q2 GDP percent change, then would we derive this by (0.9236^4-1)*100 = -27.2%?

If I average the WEI for 2020Q2, I find an annualized change in GDP of -33.1%.

I seem to be doing something wrong.

I don’t understand how the HIS/Markit data is used in the calculation.

AS: My understanding is a WEI number like -7% means that over the course of 4 qtrs/1 yr activity is down -7% relative to a year ago. That calculation matches the IHS/Markit m/m GDP growth for May.

I used the IHS/Markit – MacroAdvisers GDP number for June 2019 to get the level of GDP implied for June 2020.

Thanks for your response.

Hmmm. So, what looks like 18,300 at end of March estimated to be 17,500 at end of June comes out to be a net decline of -4.57%. That translates to a -36.2% annualized rate? Maybe.

It does look like definite slowdown coming this month, in any case, if not an actual reversal back into negative growth.

I have double checked some numbers. Highly official BEA on 6/26 issued numbers on consumption growth by month, with these apparently actual percent changes per month, not annualized rates (Moses, feel free to ridicule me all you want for getting these confused, although some sources are vague about which kind of rate they are reporting). According to BEA, C rose 0% in February, declined -6.6%, then declined -12.6% in April, but then rose 8.2% in May, no report on June yet.

An example of a source with apparent disjunctute between numbers in tables and figures is the latest report from Conference Board, now several weeks old. Anyway, looking at GDP, in their tables they forecast a -39.6% decline for the second quarter. But then they show a figure that assumes a “swoosh” pattern with a bottom point at Aprile 20 at 83.2% of the figure for January 1 (with a slight increase into February before the March plunge). It is a bit hard to identify the exact boundaries of the months, but the figure appears to have the projected end of June level at about the same as the end of March level, at around 90% of the opening year level. This is a very fuzzy call, but I have to say that it is very hard to see something that would amount to an annualized decine of 39.6% from that. This is a contrast to the figure posted here by Menzie.

@ Barkley Junior

Did you want to share with us which BEA page/link you thought was “confusing” on which GDP or growth number they meant, monthly or SAAR?? You know, if you could give examples of said explanatory lapses it would give me much less excuse to tell you you’re full of crap nearly all the time.

Oh wait, you’re the only guy online that has a PhD but can’t figure out how to copy/paste a link. Sorry, never mind.

Yes, I am bad at providing functioning links as has long been noted here, and I apologize for that yet atain.

However, looks like you are having trouble reading here, Moses. It is not the BEA that has this odd apparent issue. It is the Conference Board. Just google “Conference Board second quarter 20020 forecat” and it is the top hit. It is not that hard, really, although whenever I provide a wa y to find something easily by googling it is never good enough for you, Moses, you need to whine about the lack of a link.

Yes, for the ten millionth time you can dump on me for this matter. Make you feel good? I guess it must.

Moses, for the monthly PCE changes Barkley cited, go to https://www.bea.gov/data/income-saving/personal-income

select “full release and tables”

scroll down to Table 5. Personal Income and Its Disposition, Percent Change from Preceding Period (Months)

then check line 14: Personal consumption expenditures, which shows the change for October through May as follows 0.3 0.3 0.4 0.4 0.0 -6.6 -12.6 8.2

Barkley, it’s very easy to get annualized declines like that from the 2nd table posted by Menzie…i’m reading M1=19,200, M2=19,300, and M3=18,400; that gives you an average of 18,967 for the first quarter….eyeballing M4, M5, and the projection for M6, i figure the second quarter averages about 17,000..

to figure the annual rate decline from Q1 to Q2 then, you have 1-(17,000/18,967) ^4 = 35.5%

Actually, Moses, I have a PhD and my phone does not like anything I’ve done when I’ve tried to cut & paste. Regardless of what I’ve done, it always goes to the link I’m trying to copy. I must backtrack in order to resume my composition, linkless.

Yeah?? I mean, I get you want to defend someone, but do you really think Barkley Junior is doing that on his mobile phone when after many months time he can’t do a link?? Tell me next time you see a geriatric guy playing/texting on his Samsung phone. As Junior might say, “I’m sorry, but you sound stupid”

NO, DD, Moses is right. I am failing at this on my llaptop. Really do not know what I am doing wrong. Clearly I should simply stop posting here given this weakness of mine. It clearly means that nothing I post here is correct or meaningful. Please do not waste any time tryinig to make any excuses for me. There simply are none. Moses is just totally and completely right about this. It is completely and utterly shameful that I am so incompetent regarding this simple matter. Clearly I should be sent to the nearest nursing home so the coronavirus can finiish me off quickly, and Moses will never have to worry about me correcting him here on anything ever again.

@ Barkley Junior

If you could go to a website~~~BEA, Conference Board, or otherwise, and be able to differentiate the time increments of the data, Q-to-Q or SAAR, which apparently you are admitting yourself you cannot. I’d almost settle for that. Not really, but that would be progress for you.

But even assuming you’re the village idiot, instead of the guy with the PhD, I’m going to give the village idiots the credit of knowing the numbers related to GDP quoted, surveys, predicted are almost always SAAR GDP—so once again, I have to tell you, you’re not getting off the hook on that one.

Well, now we have the June jobs report, and it looks like indeed I am right, and Moses is wrong, who somehow decided to pick a big fight on this matter.

I have been confused about annualized rates versus others in much of these reports, but my main line has been that the main forecasts have been way too negative. So, this morning we got the June jobs report: 4.8 million hired and unemployment rate now at 11.1%. I do not have the hard numbers, but I heard on the radio that this job growth was twice as great as “what was expected by forecasters,” not sure which forecasters those were the radio (CBS) was citing, but probably a lot of them.

Yes, this is mid-month and there has probably been slowing at end of month, as noted by me, but let us do a simple calculation on a HIT figure Menzie posted here. Let us assume that instead of what it assumes as gtrowth for June, the actual number will be twice that, matching the job growth. So, again, the figure looks like it has about 18,300 at the end of March, then down to about 16,400 at the end of April, with this followed by an increase to about 17,000 at the end of May. It then projects to about 17,500 at the end of Jjune, an increase of 500 during June. As I noted previously, that would give a net decline for second quarter of -4.57%.

But now it is clear this projection is too conservative. If instead we assume that the increase in June is twice what was forecast, the moves it up by 1,000 to 18,000;. That remains a net negative for the second quarter, but now of only 300. That comes to a measly quarterly decline of -1.6%.

I do not know what that becomes annualized, but it is certainly not as negattive as a -20% annualized rate. Probably closer to the teen decline projected by the New York Fed on its Nowcast.

Again, when all is said and done the increase for June may not be that great, but it is almost surely going to be noticeably more than the 500 projected in this figure. Looks like I shall be right and you shall be wrong, Moses. Nyah nyah nyah.

This is really a waste of time as I should not have to be doing this, but given that Moses has come roaring in here attacking me even when he agrees with me, I do want to lay out how my position has changed, with indeed Moses’s initial attack that I have been changing my mind as new data has come in.

So way back I was in agreement with most here, including Menzie, that there would not be anything like a V-shaped recovery. But then after last month’s employment report with forecasters projecting decline and there was growth instead I began looking at things closely, and when the strong May consumption growth number came in, I shifted and posted on Econospeak that it looked like we might be having at least a short term V-shaped bounce. The figure posted here by Menzie shows pretty close to that for May, if a bit weaker.

Then I saw the coronoavirus surge and realized that would eventually kick in to slow things down again, so posted accordingly, warning that the short term V would flatten out. I made comments here about these posts. That was when Moses reappeared and then got on my case for changing my mind.

My view has not changed, but I have continued to point out short term data showing that forecasters were likely overcalling the degree of decline for second quarte, even as there will be a slowdown again.So far this call seems to be completely holding. But Moses sided with the most negative forecasters, even repeating in bolded letters one of these forecasts coming from Menzie’s major prof, for whom I have the greatest respect. I shall not repeat all the ridicule and names he has heaped on me in all this, although much of it is old hat for those who have been around.

Buit now, bottom line, it looks like I am right and you are going to be wrong, Moses. Willing to offer an apology yet?

Barkley Rosser: I concur – nobody who has commented on this post really believes in a Kudlovian “V” (except maybe Peak Trader). The debate is over the Q2 GDP is up relative to Q1, or more broadly, will Q2 q/q SAAR be as bad as -30% to -40%. FWIW, GDPNow — taking into account the employment situation release — is at -35.2% (as is IHS/Markit nee Macroeconomic Advisers), while NY Fed is at -15.2%.

Menzie,

Interesting. Obviously I am leaning more towards the NY Fed estimate than the others.

I would note that while I have been poking at these various estimates coming out of various places, I am not personally critical of any of them, and I am very aware of the problem they face, which goes well beyond the matter of organizational inertia or whatever. Clearly the economy has experienced a massive shock unlike anything we have seen in our lifetimes, and almost surely this has altered the structural and dynamic relations in the economy. This means that indeed the existing models have incorrect parameters and do not do very well, the point I have been poking at for some time now.

However, because these changes are so recent we (and they) lack sufficient data in the situation to make any kinds of reasonable estimates of the parameters in their models so as to revise them. Heck, in many cases they not even be able to figure out which parameters are the ones that have gone blooey, or the wort blooey. In such a situaiont it is not at all surprising that many have simply continued to use their old models for the simple reason that they do not know how to change them in any sort of reasonable or defensible manner. But then that leads to projections that not seem to be all that reliable, unfortunately.

Menzie,

I am looking at the numbers you report here. IHS and NY Fed both make really quite small changes in their projections for Q1 to Q2 GDP growth in response to the new labor market news. Of course neither of us knows how they are making their decisions, but I am struck that this new report is quite far off from what has been reported to have been the projections reportedly made by leading forecasters. I have not seen precise numbers for those projections, but I have now heard from several media outlets that the actual rate of hiring was indeed double, or even more than double, major projections. That seems like a pretty large deviation. So, I guess I am surprised that the adjustments of what will eventually happen for the second quarter seem to be so small.

Barkley Rosser: Jim Hamilton explains part of the methodological differences – GDPNow is bottom up, NY Fed is top down.

Thanks, Menzie. Interesting.

@ Menzie

Menzie, you’re not implying that Barkley Junior is trying to obfuscate the original argument, about 2nd Quarter GDP are you?? I know you’ve had to tolerate a lot of nonsense from me unrelated to this specific topic, but I’m “only asking for a friend”.

A certain Virginian PhD sure was trying very hard (although, yes, this was a side issue to 2nd Quarter GDP arguments) to give credence to a V-shape recovery, a strange manner of operating for a being who now disclaims it. I can link those V-recovery comments if you like, but even I am quite lethargic and, uh fatigeeeeeewwwwwwd on linking back to Junior’s endless self-contradictions and back-pedaling.

Moses,

The immediate bounce has been pretty close to a V-like bounce. Yes, that consumption increase of 8.2% in May, not exactly a reverse of the decline in April, but closer to a V than to anything else. I have been saying this will slow down though since before you returned from your vacation, so no bog deal to me when we see lower numbers for later periods. Heck, Moses, just look at the last figure Menzie posted above. Looks pretty close to a V, and no, I don’t think Menzie put that up to “tolerate” me.

Hey, earlier I was agreeing with Menzie and lots of others that there would not be a V-like bounce. Heck, I argued with Nobelist Vernon Smith on Facebook some time ago when he was pushing a V-shaped recovery on grounds of “pent-up demand” release. But when I saw the growth data coming in for several variables, I accepted that I was wrong and changed my story.

As it is, I am still waiting for that apology from you, Moses, but like people like Bruce Hall you respond when caught dead wrong by doubling down with your nonsense.