From CNN Business, Dollar doldrums are back as inflation worries heat up:

The US Dollar Index, which measures the greenback versus the euro, yen and several other major global currencies, has fallen about 2.5% in the past three months -— and it’s now down more than 7% in 2021. Fears of rising inflation are taking a bite out of the dollar, as are expectations that the Federal Reserve will keep interest rates near zero for the foreseeable future despite inflation concerns. Both inflation and historically low interest rates lower the value of a currency over time.

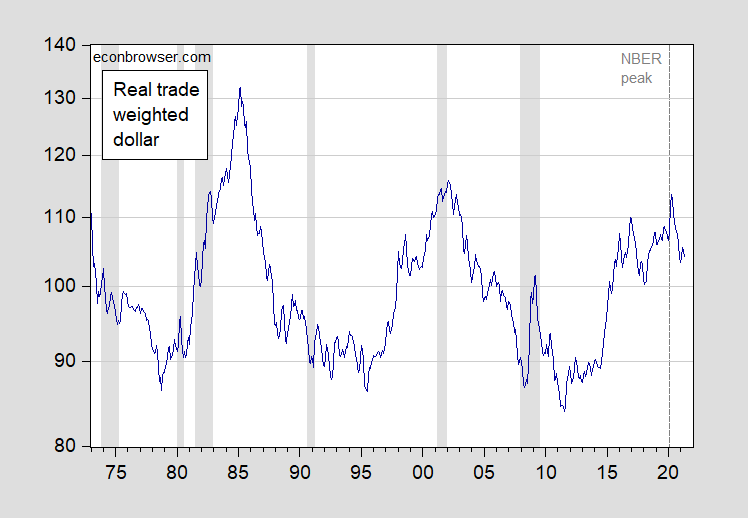

And yet, here is the real value of the US dollar measured against a broad basket of currencies the US trades with.

Figure 1: Real trade weighted value of US dollar, against broad basket of currencies. Trade weights for goods through 2005, for goods and services 2006 onward. Source: Federal Reserve via FRED.

The dollar is down, and down relative to the NBER peak of 2020M02; but it’s still up 15.4% since 2014M05, when the dollar started surging upward, resulting in the 2015-16 tradable goods slowdown (changes in log terms).

The Gold Council wants us to buy gold so much they are featuring some dude who has saved the world from every financial crisis since the Tulip mania. Seriously – that dude. One of their claims is that every currency is devaluing. Let that sink in – how can every currency devalue against other currencies. Glenn Beck level of stupidity!

Remember how Dark Side got Colonial Penn to buy them big bucks in crypto currency? It seems the US government has figured how to capture most of these funds away from Dark Side. Maybe this is Biden’s way to pay for infrastructure – use technology to screw Russian hackers. Of course Donald Trump will call out this trick as someone cheating him on the 2020 election.

I guess this will help the trade deficit a little bit?? It’s ok, Larry Summers gets all his books at overseas airports anyway.

“Everything is relative”? Oh, this triggers me to provide a bad old joke.

So, Moses said “everuything is in your head. Jesus said “everything is in your heart.” Marx said “everything is in your stomach.” Freud said that “everything is in your loins.” And, of course, Einstein said “everything is relative.

Then….. donald trump came a long on radio and TV infomercials and said “Everything is in trump”. Great oceans parted and the world was saved from literacy, public education, and independent thinking. THE END

https://www.nytimes.com/2021/06/07/opinion/yellens-new-alliance-against-leprechauns.html

June 7, 2021

Yellen’s New Alliance Against Leprechauns

By Paul Krugman

Over the weekend, largely at the urging of Janet Yellen, the Treasury secretary, finance ministers from the Group of 7 — the major advanced economies — agreed to set a minimum 15 percent tax rate on the profits of foreign subsidiaries of multinational corporations. You may wonder what that’s about, or why you should care.

So let me tell you about Apple and the leprechauns.

Apple Inc. has vast global reach. Its products are sold almost everywhere; it has subsidiaries in a number of countries. It is also, of course, immensely profitable.

But where are those profits earned? Apple does very little manufacturing, mainly contracting production out to other companies, mostly in China. Much of its profits comes from licensing fees, reflecting the company’s intangible assets — its patents, trademarks, brands and trade secrets. And where are those intangible assets located? From an economic point of view, that’s not even a meaningful question.

For tax purposes, however, Apple needs to report its profits somewhere. Right now that means that it’s basically up to Apple to declare where it makes its money — and what it does, naturally, is claim that its profits accrue to subsidiaries in countries with low tax rates on those profits, Ireland in particular.

In fact, until 2014 it went even further than that: A large share of its global profits was assigned to Apple Sales International, which was registered in Ireland but for tax purposes was located nowhere at all. In 2015, however, some combination of pressure from the European Commission and changes in Irish tax laws induced Apple to reassign many of its intangible assets to its regular Irish subsidiary.

How big a deal was this? On paper, Ireland’s gross domestic product suddenly jumped 25 percent, even though nothing real had changed — a phenomenon I dubbed “leprechaun economics,” a term that has stuck. (Fortunately, the Irish have a sense of humor.)

The thing is, Apple is far from unique in exploiting its multinational status to avoid taxes, and Ireland is far from being the most egregious tax haven, even in Europe.

According to International Monetary Fund numbers, Luxembourg — which has about the same population as Vermont — has attracted more than $3 trillion in foreign corporate investment, roughly comparable to the total for the U.S. as a whole. What’s that about? Almost no real investment is involved; instead, the tiny duchy has offered many companies deals under which they can report their profits there while paying almost nothing in taxes.

So what do we learn from these stories? First, that the current international tax system offers huge scope for corporate tax avoidance.

Second, we learn that when nations try to compete with one another by cutting corporate tax rates — the so-called race to the bottom — they aren’t really fighting about who will get jobs and productivity-enhancing investments. There’s very little evidence that cutting profit taxes actually induces corporations to build factories and expand employment.

No, they’re really just fighting about where profits will be reported and hence taxed. And with tax rates falling and tax avoidance flourishing, the result is that tax revenue keeps dropping.

Back in the 1960s, federal taxes on corporate profits were, on average, about 3.5 percent of G.D.P.; now they average around 1 percent. That’s a revenue loss of more than $500 billion a year, enough to pay for a lot of infrastructure, child care, and more.

Which brings us to that G7 deal….

https://fred.stlouisfed.org/graph/?g=u76m

January 30, 2018

Personal and Corporate Income Taxes * as shares of Gross Domestic Product, 1960-2021

* Federal receipts

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

June 8, 2021

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

By Jesse Eisinger, Jeff Ernsthausen and Paul Kiel

ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.

“Back in the 1960s, federal taxes on corporate profits were, on average, about 3.5 percent of G.D.P.; now they average around 1 percent.”

Before Trump’s tax cut for the rich, this was 2%. So when they said their fancy new international tax complications would bring in more taxes, they lied. Get rid of GILTI, FDII, and just enforce the transfer pricing rules. Simply for multinationals and a tax revenue boom.

Of course, this version of corporate profiteering and particularly the magnitude of the evasion was a highly predictable feature of “free” trade agreements. Yet in the rush to approve these agreements, negotiated by and for multinational corporations for their own benefit, I don’t recall many prominent economists (Stiglitz excepted) acknowledging this. Instead, it was ‘damn the torpedos, ‘ sell the agreements at all costs, emphasise the false benefits for labor unions and disregard the major downsides.

A splendid exercise in propaganda it was. But at least this problem finally gets acknowledged…a even if it is a couple decades too late. It would have been better to deal with offshoring of profits BEFORE the deal was done.

Stiglitz excepted…

[ Please set down a reading reference when possible. ]

https://www.project-syndicate.org/commentary/transatlantic-and-transpacific-free-trade-trouble-by-joseph-e–stiglitz

July 4, 2013

The Free-Trade Charade

By Joseph E. Stiglitz

https://www.project-syndicate.org/commentary/trans-pacific-partnership-charade-by-joseph-e–stiglitz-and-adam-s–hersh-2015-10

October 2, 2015

The Trans-Pacific Free-Trade Charade

By Joseph E. Stiglitz and Adam S. Hersh

Stiglitz excepted…

[ Forgive me for asking, I was interested but I did not understand and still have no idea what the reference was about. No matter, though. ]

@ “ltr”

I honest to God don’t know why I am answering you, but he’s written entire books on the topic, it’s more the general message Stiglitz has stated than a specific reference:

https://www.amazon.com/Making-Globalization-Work-Joseph-Stiglitz/dp/0393330281/ref=sr_1_2?crid=2W7VPQUHNEGSJ&dchild=1&keywords=making+globalization+work&qid=1623552278&s=books&sprefix=making+global%2Cdigital-text%2C175&sr=1-2

https://www.amazon.com/Globalization-Its-Discontents-Revisited-Anti-Globalization/dp/0393355160/ref=pd_sbs_1/137-6382669-8047432?pd_rd_w=wzhXy&pf_rd_p=f8e24c42-8be0-4374-84aa-bb08fd897453&pf_rd_r=2E6Z1H2ZVPFTRPXYR6WF&pd_rd_r=d8e3ae50-f304-462d-b125-954b3c07bf50&pd_rd_wg=wIZA7&pd_rd_i=0393355160&psc=1

perhaps this is why the usa has been less than aggressive at protecting ip theft in nations like china. if the technology company wants to call another nation home, regarding its profit on that technology, then why should the us defend that company if somebody else thieves the technology? perhaps we should make this more clear. if nations want the usa to protect their patent rights, then the profits from those patents should be housed in the usa, not overseas?

Excuse me but free trade was not what led to the transfer pricing games that Krugman noted (see ltr’s comment). If you want to pretend you are a progressive and not just a carnival barker, please read that discussion is it is very crucial (even though I doubt you will get it).

No, transfer pricing games have been played for decades, well before NAFTA and China PNTR. It was entirely predictable that they should grow exponentially with free capital movement under “free” trade agreements. Enabling legislation for Ireland and Luxembourg was bound to happen.

But corporations taking advantage of this was never part of the public debate in major news outlets…only how much American workers would benefit. (Anytime the corporate media starts to tout benefits for workers, you know there’s a rat and should start sniffing for the smell!)

@ JohnH

Your last sentence in parenthesis certainly hit the nail on the head. ANYTIME……..

“But corporations taking advantage of this was never part of the public debate in major news outlets”

Well Fox News never discussed these issues but your incessant claims that no one else did is your usual boring stupidity.

Thanks for the memory jog – “Transfer Pricing”.

Back in the day, some time just after 1986, a co-worker told me he and the wife were moving to Oregon. His wife was going to work at Intel. She was going to work on “Transfer Pricing”. Been a long time ago.

Bob Perlman was likely her boss. I’ve been in meetings with that character who yells more than even Trump.

I don’t recall that ” … this version of corporate profiteering and particularly the magnitude of the evasion was a highly predictable feature of “free” trade agreements,” because I don’t recall that these taxing regimes were in place when the trade agreements were being discussed. Hell, the race to the bottom among US states had barely begun at the point that I recall trade discussions (not negotiations but before that) starting.

Given your record here of misstating actual history, bollixing up econ theory, and making a complete hash of economic practice (in your case, gross malpractice), I think you owe us a rather detailed timeline of trade negotiations versus the adoption of the various transfer pricing rules. In other words, I’m willing to accept your generalized mumbo-jumbo of fauxgressive opinion if you can back it up with hard facts. Prove your case.

Transfer pricing abuse was well in place long before the negotiation of “free” trade agreements, as documented in this paper.

https://repository.law.umich.edu/cgi/viewcontent.cgi?article=1074&context=law_econ_archive

Increasing abuse and tax evasion was an entirely predictable feature of trade agreements and destined to increase exponentially with increased globalisation. But it was only one of the major features of “free” trade agreements that were largely swept under the rug by economists who were gung-ho for free trade and not very fussy about the particulars of the deals.

Reuven S. Avi-Yonah? I’ve read this paper. The author is so overrated and so behind the times. This is the best you can find? Damn – your research skills are worse than I thought.

@ pgl

What was your specific beef with the paper?? Or does specifying errors or inaccuracies kill off a chance for “hit and run” put downs and insults and take all the fun out of it for you??

“Moses Herzog

June 9, 2021 at 4:33 pm

@ pgl

What was your specific beef with the paper??”

Gee Moses – now that you demonstrated your complete lack of knowledge of basketball, you want to comment on transfer pricing? OK let’s start that this arrogant legal babble is 62 damn pages long going on and on about rules and regulations. As an economist I say screw all these stupid rules and regulations and focus on the specific issue and facts.

Now he does in a breezy way cover a few cases but even there his arrogant legal babble misses the damn point.

Maybe I should write a paper half this long that covers in an understandable way 10 times the number of cases he addresses.

But then you are too busy even for that as you falsely accuse Trae Young of not passing the ball. Yes – you are dumber than rocks when it comes to basketball so I doubt even basic transfer pricing is something you would ever get.

JohnH,

Actually it looks to me that this paper establishes just the opposite of what you claim it does. It seems to show that the main system for using transfer pricing systems was in place by 1988 completely unconnected from any trade agreements. The trade agreements were not what brought this about or did anything to increase it.

As it is, you do have a case, but you have misdirected it. Some trade agreements have had elements of them that have encouraged investment across borders, and such investment has occurred, although in some cases such elements have led to foreign businesses investing in the US thus increasing jobs in the US, such as in the auto industry. So you need to pinpoint the parts of the trade agreements in question that have led to more outsourcing by US companies leading to job losses here. The article you link to does not deal with that or show that. It shows transfer pricing setups having nothing to do with trade agreements, just the opposite of what you seem to think you are claiming.

was listening to bloomberg radio recently. they had an irish treasury guy on the line (not sure if he was active or former). his interesting comment related to the funds relocated to ireland:

ireland has foreign money because nations like the united states have a tax structure that encourages offshoring profits. if those rules did not exist, ireland would not be considered a tax shelter.

i think he has a point. none of these tax shelter nations would exist if we did a better job closing our tax loopholes. this was his argument against a global minimum corporate tax. yes, it was a biased perspective and i don’t completely agree with him. but he has a point that we should clean up our own acts before blaming others from gaming the system.

he made no comment that the issue was caused by trade agreements. it was caused by tax laws.

http://www.xinhuanet.com/english/2021-06/08/c_139996203.htm

June 8, 2021

Over 794 mln COVID-19 vaccine doses administered across China

BEIJING — Over 794.1 million doses of COVID-19 vaccines had been administered across China as of Monday, the National Health Commission said Tuesday.

[ China is administering 5 vaccines domestically at a rate of about 20 million doses daily. More than 350 million Chinese vaccine doses have been distributed internationally. ]

Kevin Drum reports on a war between the moron who is the governor of Florida and the Cruise Lines. It seems the governor is demanding that the Cruise Lines let on to their ships people without vaccinations. Floating death camps sanctioned by the state?

https://jabberwocking.com/the-great-cruise-line-war-is-coming-to-a-head/

Two of the Cruise Lines have told the governor to eff off but Royal Caribbean has caved in. Now one has to be a MAGA hat wearing idiot to take a Royal Caribbean cruise.

Are you feeling it yet?? Bad night for Trae Young:

https://www.youtube.com/watch?v=tumj108VOZY

Sub 25 points and a loss for the Georgia rednecks’ hero

Oh my – he is bald too. Hey they lost game 2 to the Knicks too. What happened after that? Oh yea – you think Westbrook is their point guard!

What? Celtics v. 76ers. Do you understand anything about basketball???

@ pgl

I bet that a good 16+ hours after the game ended it still hasn’t dawned on you yet who was playing defense against 1-for-7 on 3PA Trae Young, has it??

Are you saying Ben Simmons is not a great defensive player? You are Max Kettleman (aka dumber than a rock). What’s the problem you have here. Oh yea – the coaches are both black so neither Nate McMillan nor (future hall of famer) Glenn Doc Rivers do not know basketball the way you do?

Hmmm – Westbrook is short and black and Ice Trae is short and black so in your warped mind they are the same person.

@ pgl

I see you’ve reverted back to (or did you ever stop??) your patented “I have no argument, so I will mis-quote and mis-represent the words of my adversary” style of awkward slugging. Are you really so unbelievably dumb, that you think when I put up a 5-minute video of Ben Simmons defensive highlights, I posted BEFORE Tuesday night’s game I might add, that I am “highlighting the Celtics” ?!?!?!?! Then even over 42 hours after the game was played, you still haven’t figured out that Ben Simmons’ video highlights link was not about the Celtics?? Even by you and Barkley’s standards of obfuscation and muddying the waters that’s a doozy. If you’re too slow to recognize Ben Simmons’ gait and facial features, you’d think you could at least notice what number he wears.

Just only that, could you try??? ~~~ I know you’re not good at much but put downs, but could you at least recognize Simmons’ number if his face and body gait in a 5 minute video don’t ring bells for you??

@ pgl

So far tonight, Trae Young is 0-for-5 from 3 point land. Remind you of anyone?? Hint His initials are R. W.

He could have passed the ball all of those 5 attempts. Nevermind, some people like playing “Hero Ball”.

At least you admit you do not know Ice Trae from Russell Westbrook. Hey Moses – your game must be checkers.

Since you watched only the 1st quarter – here’s the box score:

https://www.espn.com/nba/boxscore/_/gameId/401332953

Check it out – Trae had 11 assists not the 5 some idiot keeps claiming. I’m so glad you are not the coach as they would have never made the playoffs. BTW – don’t bother to apply for the head coaching job as McMillan has that locked up. He knows basketball – you clearly don’t.

But could you please appear on First Take and repeat your stupid rants as I would love to see Steve A. Smith dress you down as only he can.

pgl

Steve A. Smith is who you defer to on basketball knowledge?? This explains a lot about you pgl. I thought New Yorkers were sharp-razored at argumentative retort?? You can take the man out of the South but you can’t take the redneck out of the transported Brooklynite.

ESPN is telling you 1-for-7 from three point land is great point guard play?? I’m sorry I missed that.

You know if you stopped your stupid and pointless bad mouthing of people who know a whole lot more than you ever will – you might enjoy a game. Here’s a hint – listen in when they let you to the coaching of Nate McMillan. He gets this game. You don’t.

Trae Young just substituted by Snell with about 2 minutes left. Total of 21 points. 1-for-7 from three point land, making Trae Young 14.3% shooting from 3-point range. Commenter pgl will update later in this blog thread on the stat New Yorkers love the most: dead hair follicles divided by minutes per game.

Yep – you clearly watched the first quarter and that’s it. Hey Moses – it is a 48 minute game. Too bad your attention span cannot go past the first 12 minutes.

This is really funny. Larry Bird has his off days. Magic Johnson had his off days. Even Stephen Curry had his off days. And according to the greatest coach since John Wooden – all three of them suck.

Moses – please keep proving you would not even know what to do with a basketball in a pickup game – which BTW is a favorite sport in Brooklyn. I would challenge you to one but I do not want to embarrass the mentally retard.

Let’s see. 11 assists but only 7 3-point attempts. This is Moses’s definition of a ball hog? Damn – even Bruce Hall is not THIS stupid. BTW – is your real name Max Kettleman?

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2021

(Indexed to 1994)

Apple pays Foxconn $250 for the same phone you pay $1200 for. And as Krugman notes, they park their obscene profit in tax havens. btw – Uber has incurred losses so far but I bet they will be rolling in the dough down the road. I will not use then as Brooklyn has local competitors that are really cool.

I’ve heard “Lyft” is a little more socially conscious than Uber. Whether that is true in fact I have no idea. Probably also a kind of PR con-game.

I used to go by a Foxconn factory nearly everyday taking the public bus to different places. They were not whistling to work Seven Dwarfs style. Not that you needed to see it first person to know. Just saying…….

https://news.cgtn.com/news/2021-06-09/China-s-CPI-up-1-3-in-May-10WFJAhFok0/index.html

June 9, 2021

China’s CPI up 1.3% in May

China’s consumer price index (CPI) increased 1.3 percent in May year on year, according to data from the National Bureau of Statistics (NBS) on Wednesday.

[ The sector by sector emphasis on limiting problematic price increases again appears to be working. The effects of international commodity price increases are being limited. ]

Time for Nixon price controls? Seriously? BTW – a lot of people think the PRC is cooking the books on CPI reporting. I bet you are helping them do so.

my recent conversations with people from mainland china are those cpi numbers do not accurately represent inflation as perceived by the people in china. ltr, i can say that people from mainland china dispute the numbers you are publishing as either inaccurate or fraudulent.