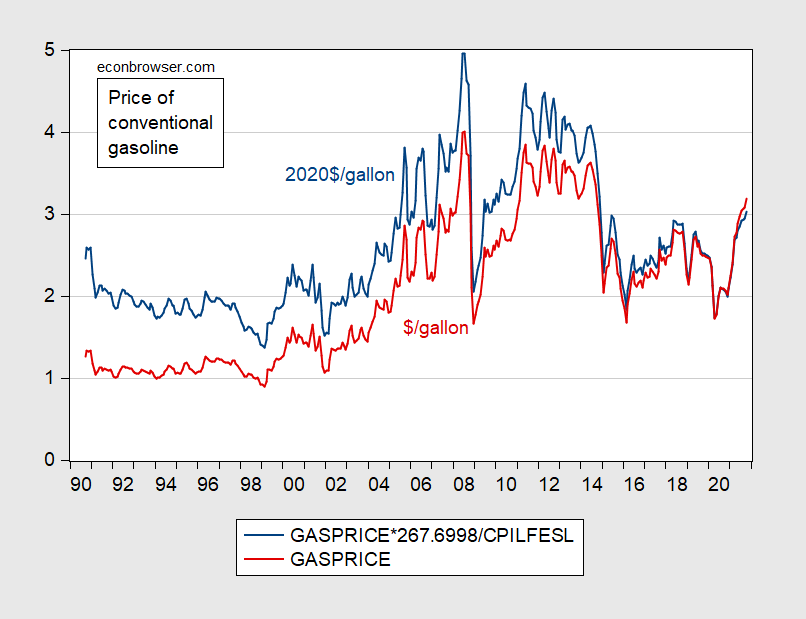

Conventional gasoline price since 1990.

Figure 1: Price of gasoline in 2020$/gallon (blue), in $/gallon (red). Conventional gasoline, monthly averages of daily prices, deflated by core CPI for 2020$. Source: EIA, BLS via FRED, and author’s calculations.

Deflating by CPI-all would lead to a similar picture.

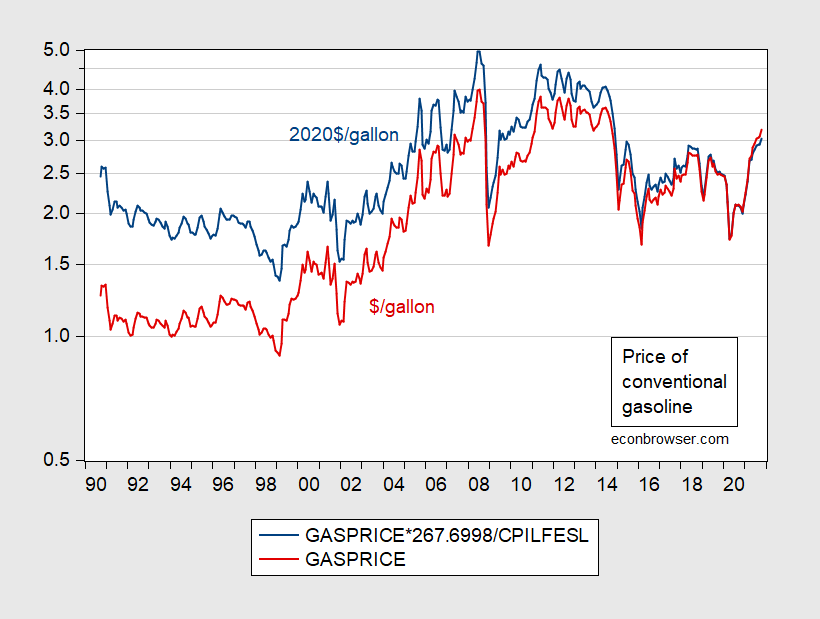

Figure 1, on a log scale:

Figure 2: Price of gasoline in 2020$/gallon (blue), in $/gallon (red), both on a log scale. Conventional gasoline, monthly averages of daily prices, deflated by core CPI for 2020$,. Source: EIA, BLS via FRED, and author’s calculations.

An very informative chart. The 1990’s was a period when the real price of oil and the real price of gasoline were low. At the beginning of the pandemic, real prices fell to low levels.

As the chart shows we have seen a real price of gasoline between $4 and $5 per gallon. Yes that is high. But the price today is around $3 per gallon, which I’m sorry folks is not that high in historical terms.

AdvisorPerspectives has a more insightful take on rising energy costs than pgl’s just shrugging it off: “ The universal response is to moan over price increases and take delight when prices are cheaper. But in reality, households vary dramatically in the impact that inflation has upon them. When gasoline prices skyrocket, a two-earner suburban family with long car commutes suffers far more than the metro family with short subway commutes or retirees with no commute. And the pain is even more extreme for low-income households whose grocery money shrinks when gas prices rise. And remember, Uncle Sam excludes energy costs from Core Inflation.”

https://www.advisorperspectives.com/dshort/updates/2021/11/10/components-of-the-cpi-october-2021

pgl probably just takes the subway to work, so he can afford to just shrug it off.

carbon tax simulation is going on now:

usa cut crude oil production to 11007 mbbl/day from 11581 in 2020, a 5% or 574K/day output reduction

the delta is made up by increasing import 408K/day in 5 Nov report (+14.5%) opec adding nominally 400K, actually a lot less… and not lowering prices as granholm expected (?) which is why she laughs when asked.

pgl’s just shrugging it off??? You really need emotional help.

Could you just once post a comment without some childish misrepresentation of what I said? Oh no – you are nothing but a petty little child so I guess this garbage will continue.

JohnH: When one divides by a price index with a basket that excludes the item’s price being divided by, that is a relative price. In this case, however, dividing the CPI-all would lead you to a picture that you could not eyeball the difference between.

People’s complaints about rising gas prices is a clear indication of what will happen if governments actually start to get serious about enacting taxes on carbon.

Of course, the obvious solution would be to start selling people on the idea compensation for higher energy costs…with the bulk of the money going to those hardest hit. This is how Mahmoud Ahmadinejad just successfully raised prices at the pump in Iran.

Of course, advocacy for this kind of solution is basically nowhere to be found, except perhaps for CYA mentions buried at the end of paragraphs deep within articles about carbon taxes.

It appears that Ahmadinejad was smarter than US policy makers…or perhaps just more serious about reducing gas consumption. Or perhaps as we saw with “free” trade, the US government just doesn’t do compensation to those afflicted by government policy.

Gee you made this type of comment as a criticism of Jeff Frankel’s excellent post without realizes that Jeff had recommended to same rebate of the carbon tax to the poorest households. You really do need to learn to actually READ!

Frankel didn’t recommend anything. He merely floated the idea that compensation might be considered. It was buried at the end of a paragraph well into the piece…an afterthought to his principle line of argument.

But that somehow is pgl’s idea of strong advocacy!!!

You do have a talent for making really pathetic comments. It was an excellent discussion which of course you failed to read.

That JohnH thinks Iran handled higher prices well is laughable – just check out the news coverage at the time:

https://www.wsws.org/en/articles/2010/12/iran-d24.html

pgl might be interested in a less sensational, more measured report from the IMF that looked at Iran’s reforms.

“The government made long and careful preparations to ensure the success of the reform and

its support by the public. In particular, decisions had to be made about the timing and speed

of the price adjustment, the distribution—size and form—of compensatory payments to the

population and the corporate sector. Macroeconomic policies prepared the ground for the

reform by helping reduce inflation in the period preceding the reform. Ensuring that the

banking sector could distribute the compensatory transfers was also a key aspect of the

preparation of the reform….

The authorities emphasized the social inequity resulting from cheap energy. Historically, in

most countries, the elimination of subsidies to staple products results in loss of real income

that disproportionately affects poorer households. For this reason, the Iranian authorities

emphasized from the outset that the reforms were not about eliminating subsidies, but

switching subsidies from products to households. The reform would therefore benefit poor

households, who would receive cash benefits, while in the past they were not benefitting

much from cheap energy that was mostly consumed by the richer groups…

While overall the public relation campaign in preparation of the reform proved successful, a

few missteps created some unnecessary confusion and social tension.”

https://www.imf.org/external/pubs/ft/wp/2011/wp11167.pdf

Until policymakers and prominent economists like Frankel recognize that they have to offer people a large carrot in return for increased taxes on carbon, we know that the US is not serious about climate change.

Citing the IMF now? Snicker!

Why did JohnH fail to mention this from the bottom of page 13/top of page 14?

“Who gets what?

The allocation of the cash transfers The Reform Act stipulated that households were to receive 50 percent of the revenues raised in the reform, but did not indicate who should receive the compensation. Initially, the authorities leaned towards targeting the transfers towards the poorer segments of the society. To support such targeted transfers starting in April 2010 the Statistical Center of Iran began collecting information on the economic situation of individual households.8 Officials mentioned the bottom 30 to 50 percentile of the income group, and then the lower 70 percentiles as likely beneficiaries. As time passed, however, it became clear that it would be administratively difficult to identify and properly screen the recipients. Also, denying support for the upper income groups risked triggering public discontent among the group of biggest energy users. In the end, everyone was allowed to apply for the compensatory transfers, which were made equal for all applicants. At the same time, the richest households were encouraged to refrain from applying.”

The discontent of upper income groups drove the government to allow them to get the lion’s share of the compensatory benefits? Mitch McConnell would approve. Jeff Frankel would do better.

This reform program was replaced by 2016 and this story notes why:

https://web.archive.org/web/20161011140732/http://iran-daily.com/News/170018.html

Let’s see – since even the rich got the rebates, these rebates were only $15 a month. Some rebate!

And the goal of controlling inflation was not all that successful. Plus gasoline consumption was not reduced that much either. Of course if JohnH read his IMF and other reports, this was far from a carbon tax as the subsidy reduction was not 100% so Iranians were still paying below world market prices.

I do wish people would understand such basic issues before lecturing “prominent economists”.

As usual pgl shows his ignorance…Iran’s basic income program made a real difference in lower income people’s well-being. It went a lot farther in Iran than in the US, well above universal income proposals being floated in the US.

https://www.weforum.org/agenda/2017/05/iran-introduced-a-basic-income-scheme-and-something-strange-happened/

So now we know that pgl, that self anointed progressive growth liberal, derides not only Iran’s program to reduce gas consumption, but also its universal basic income program.

Obviously pgl is really a centrist, corporate Democrat masquerading as someone who cares about the climate and about reducing income inequality.

‘JohnH

November 12, 2021 at 12:52 pm

As usual pgl shows his ignorance…Iran’s basic income program made a real difference in lower income people’s well-being.’

The link this lying twit provided did not redistribution does not necessarily reduce labor supply. That is fine and most liberal economists would not find that strange. But this is side stepping the original issue. If JohnH does not get this is apples and oranges, do not go grocery shopping with this economic know nothing.

The original issue being the fact that Iran successfully implemented a plan to reduce gas consumption and redistribute the proceeds to low income Iranians…universal basic income.

Meanwhile the US can do no more than yammer about reducing carbon emissions. Economists talk about various forms of carbon taxes but largely punt on the issue of how to get buy-in on higher fossil fuel prices by the general public. Frankel’s contribution was basically a well hidden rumination in an article dedicated almost exclusively to taxation, not to public buy-in.

Until economists and policy makers have a epiphany on the need for public buy to higher carbon prices, we’ll know they’re finally gotten serious about climate change…but it will probably be too late by then.

The Iranian experience could be very informative to US policy makers…but Iran is the bogeyman whose every action is considered threatening.

You likely are right.

Sometimes I see these valuable charts and I wonder how that compared with contemporary median household income levels/moves. Likely, now incomes are higher than when we had $5 gasoline.

Did gasoline hit $5 close in time to the beginning of the great recession in 2008? I don’t see causation.

Personally, where to cut back? I haven’t had a drink in months and no cigar in a longer interval.

Thank God the prices of Lotto tickets haven’t risen!

T.S.,

These prices are in 2020 dollars.

As it is, the all time nominal high West Texas crude was in June-July 2008 at $147 per barrel, way above the current $80 or so. Those prices then proceeded to crash down to around $30 per barrel by November, 2008, just one among many examples of dramatic price volatility in the oil industry.

B.R.,

I went to FRED to answer my question re: real median household incomes.

Thanks for the input.

T.Shaw: What’s your point? It took 10 seconds to type fred.stlouisfed.org and “median household” to get:

https://fred.stlouisfed.org/series/MEHOINUSA672N

Real median household income in 2020 was more than 10% higher than in 2008.

Professor Menzie,

My point was that Professor BR has an infantile “hard on” for me [it means less than nothing] and his off point input was a waste of his and my time.

T. Shaw: I hardly think you should be characterizing anybody as infantile. Please be apprised that your use of language invites editing should you repeat that term.

OK, T.S., I have suspected that various of your comments here were sarcasm, but at times it seems like you are playing it straight. You ask a question about gasoline prices in 2008. I take it seriously and provide an answer, I think without any snarky remarks or whatever. You than appear to thank me for doing so.

But then we learn that you think all this was a waste of both your and my time. Oh, well, if so, then why did you waste everybody’s time by even raising the original question about gasoline prices in 2008?

As for having a “hard on” for you, forget it buster. Gag.

Right wingers are grossly misrepresenting what Larry Summers is saying about fiscal policy. Yes he warned that the past fiscal stimulus might increase inflation a bit. But listen to what he said to Andrea Mitchell about the current fiscal stimulus programs – he thinks they are good ideas:

https://www.msnbc.com/andrea-mitchell-reports/watch/summers-tragic-error-if-we-spent-too-little-on-biden-agenda-because-of-covid-recovery-125986373614

Energy Info Admin report for 5 Nov

motor gasoline inventory: 212 million barrels, down from 225 Mbbl or down 5.4% from last year and the now economy is much “hotter”.

have to see what the ‘at pump’ prices look like on nov 22….

i track distillate fuel oil as heating is much more for me than driving, i also have a wood stove and the same wood inventory as last year, \

distillate fuel oil: 125 Mbbl, down from 149 Mbbl’s down 16% from last year and economy not much effect on home heating.

there is risk if winter cold in usa nd/or in europe, that natural gas prices rise too.

Note natural gas is mostly “just in time”…..

some bankers estimate north of $110 for wti if the winter is cold…..

amazon sells these:

https://www.amazon.com/Stickers-Thats-Decal-Sticker-Motorcycle/dp/B09K7LQXZP/ref=sr_1_1_sspa?crid=B7LMQDDJY4S8&keywords=i+did+that+stickers&qid=1636664881&sprefix=i+did+%2Caps%2C260&sr=8-1-spons&psc=1&spLa=ZW5jcnlwdGVkUXVhbGlmaWVyPUEyRk1OQ0FISVk3VldYJmVuY3J5cHRlZElkPUEwMDE0NTA4MTlWQ004VEY3TUxKNSZlbmNyeXB0ZWRBZElkPUEwMDQ0MjQzWVJKN01KUzJKWjI1JndpZGdldE5hbWU9c3BfYXRmJmFjdGlvbj1jbGlja1JlZGlyZWN0JmRvTm90TG9nQ2xpY2s9dHJ1ZQ==

seen at two stations’ pump in the past week

Crude oil prices down again today. Barely above $80 per barrel. Where I am, gasoline prices have been flat since end of October, with a few stations actually cutting prices. The gasoline price freakout may about to be over.

Crude oil prices down again today. More importantly, this is the third week in a row that crude oil prices have declined. How many media outlets have reported on that rather than headlining how rising gasoline prices are leading inflation numbers higher than any in 31 years?

Oh, Julian Silk, (good to see you here again after awhile, Julian) noted my point. But the rest of you are completely ignoring this, including supposed oil sector expert, Steven Kopits. Hey, Steven, when are you going to comment on the now three week long decline in oil prices? Is this about to turn around next week and start zooming to $100 per barrel by the end of the year? Hey, I still do not rule that out, unlike a lot of others here. But as of the last three weeks it has been going the other way with almost nobody noticing this, certainly here nobody here besides me and Julian Silk.

So, have a nice weekend, you all. I just had my booster shot and am a bit out of it.

Thank you for putting this together.

I have downloaded them for future reference.

A conclusion I’m tempted to draw from the graphs is that everything started to go to hell after the 90’s, but if the time series were carried back to 1950 it would reveal how the 70’s were the real nightmare. Growth and inflation ran a bit hotter from 1991 through the early 2000’s, but because energy was so consistently cheap, we didn’t pay attention to higher prices in other areas. For example, 30 year fixed rate mortgages were mad high during that period compared to what we’ve had for the last decade.

I’m just generally annoyed at people who drive these absurdly large pickup trucks and SUV’s anyway.

People who know the history of commodity prices talk about a boom in the 70’s, a bust in the 80’s and 90’s, and then another boom starting about 20 years ago. Of course people like Sammy are incapable of going back more than 5 years or so.

What is worse? That Trump thinks he is still President? That Trump does not know the difference between an ambassador? Or he choose Grenell again?

https://www.lgbtqnation.com/2021/11/trump-announces-envoy-ambassador-course-gay-sycophant-ric-grenell/

China and US reached an agreement to address climate change:

https://www.msn.com/en-us/news/world/china-us-announce-agreement-on-climate-crisis-at-cop26/ar-AAQyeOU?ocid=uxbndlbing

Correlation is not causation, but these graphs may disprove that in terms of energy policies. Just pointing that out for a friend. 😉

Since this is an economics blog, therefore supply and demand are critical factors to determining the prices shown in the above charts, are there any policies which impacted either? How about since Jan 20, 2021?

WTF? Menzie was simply plotting real prices over time. Nothing to correlate here as in Y and X are correlated but of course you have only one variable so only in your warped mind can correlation be implied. And no mention of causation by our host but leave it to a Trumpian brown shirt like you to say Biden caused higher oil prices.

Now CoRev – we know you have to chirp the most pathetically stupid things, but this one was beyond dumb.

Blatantly advertising your nation is a tax haven – way to go Cyprus:

https://www.linkedin.com/pulse/cyprus-yes-please-why-multinationals-should-re-consider-/?trackingId=y4nxoSIF2G%2BH%2FZW4OcUV0g%3D%3D

If you are not into international tax legalesse, this basically says forget our already low 12.5% tax rate – we will put the effective tax rate at 2.5% if you park your profits from intangible assets with us.

They mention their past banking crisis which Krugman commented on back some 8 years ago or so. It seems the Russian oligarchs were parking a lot of profits in Cyprus. Now Putin did put in place new transfer pricing rules in 2012 and it seems the high price slime balls at the Big Four accounting firms had seminars on Russian transfer pricing on the sunny beaches of Cyprus! Go figure!

a popular description of the publics reaction is when pump prices increase, they change their habits by reducing car time. and this makes sense. most people fill up a tank at least once a week, and see the price per gallon and average cost to fill a tank of gas. as we transition to the electric car, i wonder how the people will react to cost changes. electric prices do not fluctuate as much as gas prices. in addition, if you are charging up at home you lose track of the cost of a charge since it is not given to you as a receipt, but in an aggregate bill at the end of the month. how will the economy respond when the days of gasoline led pullbacks disappear? it seems more psychology than economics, to a point.

Dear Folks,

I think Barkley Rosser is right in that oil prices may fall, and this may lower gasoline prices. But it would be useful to have gasoline taxes on the same chart as the prices, so one could get a sense of the highest real (inflation-adjusted) gasoline tax, to get some indication of what effective carbon taxes might do.

J.

EIA has a cool thing called the gasoline pump which shows the average retail price by month and how it is broken down between cost of oil, refinery margins, distribution margins, and excise taxes. I bet Menzie can get Professor Hamilton to tell us the link as he uses this data in some cool research.

The pictures on the bottom of this link shows the clever chart EIA uses to show how much of the price of a gallon of gasoline goes to things like excise taxes and other components (oil, distribution margin, refinery margin):

https://www.eia.gov/petroleum/gasdiesel/

This is only the latest week reported. Their monthly data goes back to January 2000. EIA has changed its website such that I do not know how to access the historical data but I’m sure someone else can figure that out for us.

It is bad enough that Judge Bruce Schroeder has tilted his rulings so much that Rittenhouse will get away with his little act and walk free as the jury is being conned. But now the judge makes a pointless and insulting joke about Asian food?

https://www.cnn.com/2021/11/11/us/kenosha-judge-bruce-schroeder-asian-food-comments/index.html

Can we have this clown retired from the bench?

When thinking about the impact of gasoline prices on people, expenditure share is an important consideration. Price is easy to think about, and often is used as an informal proxy for the effect on household budgets, but we can do better than price.

From the Consumer Expenditure Survey: https://www.bls.gov/cex/tables/top-line-means.htm

In 2000, gasoline accounted for 3.4% of median household expenditure. In 2025, it was 4.3%. In 2013, 5.1%.

In 2020, gasoline accounted for 2.6% of household expenditure. So we started from a fairly low base when gasoline prices jumped. There won’t be Consumer Expenditure Survey data for 2021 for some time yet, but Menzie’s charts suggest that gasoline’s expenditure share is in the same range as in many recent years.

The good news is that wages at the bottom have been rising quickly. So while it is true that those at lower incomes are most affected by riseng prices of necessities, it is less true now than in much of the recent past.

It is also true that higher energy prices are the quickest way, other than pandemic, to reduce CO2 and methane emissions. In the near term, there is a drag on growth from higher energy prices, but adjustment to higher prices means the economic impact will lessen over time, while the environmental benefit of higher prices will increase.

Yikes. “2025” should have been “2005”.

By ye way, lest anyone think I was cherry-picking dates (as some commenters tend to do), I simply used the first and last year from a couple of survey tables. My way of randomizing selection.

“In 2025, it was 4.3%. In 2013, 5.1%.”

Forecasting now? OK you corrected this. Gasoline prices were rising back then and are now lower at least in real terms. Isn’t the demand curve for gasoline inelastic?

Statistically indistinguishable from noise, am I right?

No. You’re wrong. That’s not surprising, since you are nearly always wrong. Consistency in being wrong doesn’t really qualify as a virtue, you know.

Menzie,

I think it was baffling who first suggested that rsm is nothing more than an anti-science troll. Mindless repetition of unsupported nonsense (“not even wrong”) is hard to explain in any other way.

I know you have singled out racism as an offense worthy of censorship, but undermining respect for facts can have effects as bad as those of racism. There’s a reason trolls do what they do. remember doesn’t even bother to respond to you or commenters. He/she is just hijacking your blog to make the world dumber. Please block rsm.

I would block rsm too. But he is not the only serial offender.

On an Econ blog he is, clearly a standard deviant.

Good one, noneconomist. As it is I doubt Menzie will ban rsm. Rather I suspect he views him as the new CoRev, somebody he can use as a hilariously negative example to exhibit before students in his classes of somebody who is massively misinformed about statistics and econometrics.

The only noise here is your incessant chirping. Please find another blog to pollute.

Back to the alleged trucker driver shortage. Lots of discussions and some key data ala ltr show that real compensation for drivers is way down from where it was in 1990. And we have firms saying we need more drivers even as real compensation is down. So what gives as the government is not imposing wage ceilings?

Could this be a result of a monopsony market for drivers? Yea I get there are lots of folks on the employment demand side but that does not rule out cartel behavior. Just saying.

As for formal logistics, FedEx, UPS, DHL and USPS * account for about 84% of the industry. Whether that is meaningful in terms of hiring drivers, I do not know.

* Post Office

“JohnH

November 12, 2021 at 4:30 pm

The original issue being the fact that Iran successfully implemented a plan to reduce gas consumption and redistribute the proceeds to low income Iranians…universal basic income.”

I love it when you try to reframe your economic stupidity. Never mind consumption of oil in Iran did not decline that much and the rebates to low income Iranians was a mere $180 a year. Of course rebates went to rich Iranians too.

But you are very confused in your comparison of what Iran did v. a carbon tax. Iran had massively subsidized the cost of gasoline and then decided to cut those massive subsidies. They did not eliminate the subsidies. And they certainly did not increase the price over the market price via a carbon tax.

All of this is quite fundamental but you still do not get it? Gee – I would have a more productive conversation with a dead tree.

1. Completely agree with you in converting to real dollars versus nominal. A $100,000/year salary meant a lot more in 1970 than it does now.

2. Not as crazy about the log transform. I mean you could plot it however you want (loglog, squared, etc.). I see a value in a log scale when there’s a critical thing to extract that is easier done with the graph (e.g. semiconductor behavior). For sound, it’s fine…since we experience sound logarithmically. But dollars in my wallet feels a lot more linear. I guess there’s some regressions you like to run on shocks or the like, so are prone to plotting log. But when just considering experience and graphing it for explication, I think the linear scale is more clear to a casual reader. Don’t have the distortion of the y scale. But we’ve had this fuss before.

3. Think it’s useful to show for longer time periods, really. Back to 1970 or even further. It’s a commodity industry with a cartel that sometimes has control and sometimes doesn’t. James has been pretty wrong with the “hundred dollars here to stay” from 2014. And he’s really in a minority with the down-playing of OPEC and up-playing of peak oil. (Not really even a conservative/liberal thing. He’s just been wrong about OPEC….look at how SA had 8.5 bopd in 2008. And 10+ in 2016. And right now…lots of barrels off line. The thing is if you are really looking at “regimes” of price, you sort of have a lot less data than the time series shows you. Pre-Embargo. early 70s to early 80s. 86-04. Etc. Of course, it is not this simple and there’s some value in looking at 1979 versus 1973 and the like. But also, it’s a time series…not iid. So going back a little more, shows more of the “regimes”.

4. Just a method/definition thing but I’m not clear what conventional gasoline is (87 unleaded? with or without oxygenate? RBOB?) and are the prices before or after tax, at the pump or in the RBOB markets or the like. I’m actually fine with using any of them…doesn’t change the story. But just curious what product and what price we are talking about.

The other issue with a log scale is that you lose a sense of absolute level (there is NO zero on a log scale). Price going from 10 cents to $0.20/gallon looks the same as going from $4 to $8. But surely the implications are not the same. Sure they are both doublings but the the impact is different. I mean if your chance of dying in the next ten years from lightning doubled, it would be a lesser concern than if your chance of dying from cancer doubled. Since the absolute level of risk is different. I don’t mind the fancy semilog scale when doing fancy econ calculations. But if just examing the phenomenon, feel the distortion of nonlinearity is unhelpful to clear communication.

Anonymous: That’s why both graphs are there. But when graphed on a log scale, a constant growth rate shows up as a straight line, which is *not* true for a levels graph.

Jess, jess. CAGR is a flat line. Good point.

Can have similar things on oil well production plots where you want a semilog or log log or log v derivative or the like. Particularly where there’s an implicit decline curve model of the well you are thinking of:

https://shaleprofile.com/wp-content/uploads/2021/11/HA-well-productivity.png