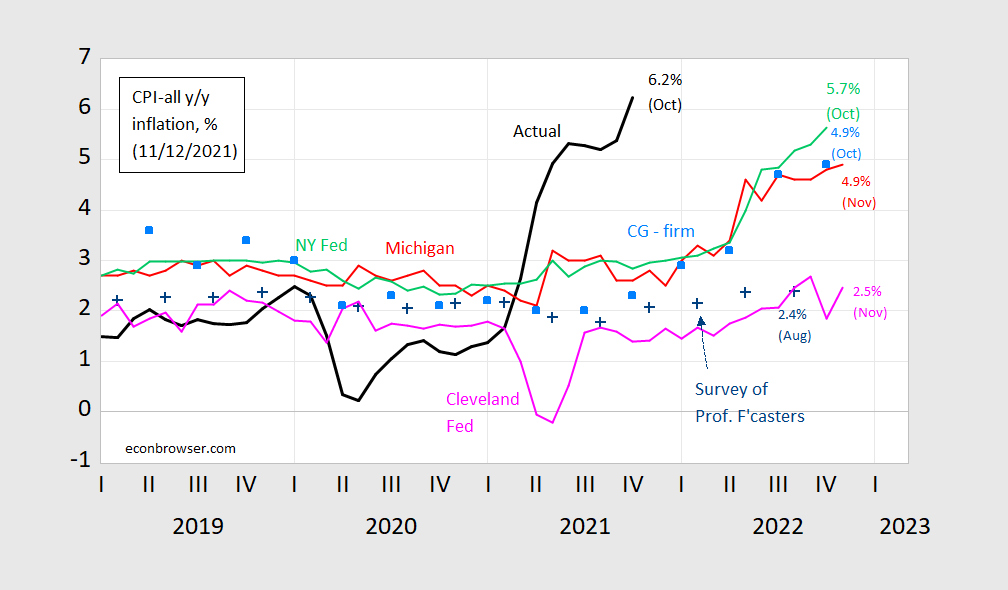

Michigan (preliminary) remains high and NY Fed rises 40 bps; both are consumer based. Cleveland Fed forecast is lower than in September.

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

The Survey of Professional Forecasters will release its 4th quarter results on Monday.

As of today, the 5 year inflation breakeven (unadjusted) is 3.08%. If the gap between the DKW adjusted measure stayed constant at its 10/29 level (and there’s no reason it should), the adjusted for premia breakeven would be about 1.9%.

Sorry but this Trumpian stupidity has hit a new high (or low):

https://www.nbcnews.com/tech/tech-news/covid-vaccine-mandates-push-holdouts-get-shot-detox-rcna4859

So some anti-vaxxers are finally getting their vaccines but then they return home and consume lots of baking soda to detox and flush the vaccine out of their system. OK – no flushing occurs and maybe no serious damage is done by the baking soda. But how stupid are these clowns?

Baking Soda over NAC shows they aren’t true naturopaths.

Opinions of inflation differ. But come on – pass BBB.

BBB is designed to be close to revenue neutral — and spread over 10 years. To a first order approximation it should have nothing to do with inflation.

But then Sinema and Manchin are not good faith negotiators. They will seize on any imaginary pretext to protect their donors.

But you cannot pass the senate without them. They hold the advantage and will dictate terms. The longer the delay, the less they are likely to support.

iirc cbo has not ‘priced’ the bbb……

whose 1st order approx matter?

paddy kivlin: Well, CRFB would be one source. There is a tool called “the google”.

I am having an epiphany.

I walked in darkness and now I see a great light.

Hi Menzie.

The view that “risky assets should be up because reals (TIPS) are plumbing new lows” seems incorrect if the DKW estimates are correct.

E.g, market commentators seem to suggest that nominal yields – BE’s (which is just saying real rate = TIPS yield) is leading to deeper and deeper negatives, as expected inflation (the BE’s) rises, and nominal yields don’t rise by as much (or in the 10 year, decline somewhat, as the curve flattens).

However, if the DKW estimates are correct, the current market interpretation is somewhat wrong, and hence real yields are overstated by about 1% (the diff b/w BE’s and the DKW expected inflation), and as such, a key “market narrative” appears to be misguided.

I was curious about your thoughts on this?

So all forecasts got today’s rate at least 100% wrong?

Why not present a portfolio that hedges inflation, and judge your performance the way markets do, on profit & loss?

Is it because economists eschew accountability?

“Why not present a portfolio that hedges inflation”

What would that be rsm? GOLD as in that insanely insulting commercials from the Gold Foundation? Are you the jerk making those ads that insult our intelligence? BTW – gold does have a value as that hot woman is a gold digger. Good luck getting a date with her. Snicker.

BTW – I have worked with a lot of accountants and not one of these bean counters has a clue about forecasting inflation.

rsm,

Yet again you are right! ALL economists “eschew acccountability,” in between when they are failing Economic Logic 101 and Basic Statistics, also numbered 101 somehow. So, sure, when they make these forecasts of inflation, they should go to the Chicago Board of Trade and use its well-known futures market on inflation so as to hedge their forecasts. Simply astounding why none of them have done so before! Your proposal is sheer genius, rsm.

Or are you thinking that this “hedging” should involve something like gold or cryptocurrencies or maybe even, dare I say it, oil?

Kevin Drum’s latest post on how some are misrepresenting food price inflation is a must read:

https://jabberwocking.com/yet-another-tedious-gripe-about-food-inflation-reporting/

I think a mandate should be imposed on Princeton Steve that he is not allowed to have another bagel until he carefully reads what Kevin notes.

If I am interpreting the graph correctly, none of consumers, the various Feds, nor professional forecasters are able to anticipate a material change in the inflation rate.

And your forecasting record when it comes to inflation? Give me a break – your forecasts of oil prices are a pathetic joke so who are you to criticize forecasters of a concept you clearly do not get.

Unless I’ve missed it, the various forecasters were completely unable to anticipate the inflation surge. That doesn’t make them bad people, but it suggests that forecasts of future inflation may be all but useless.