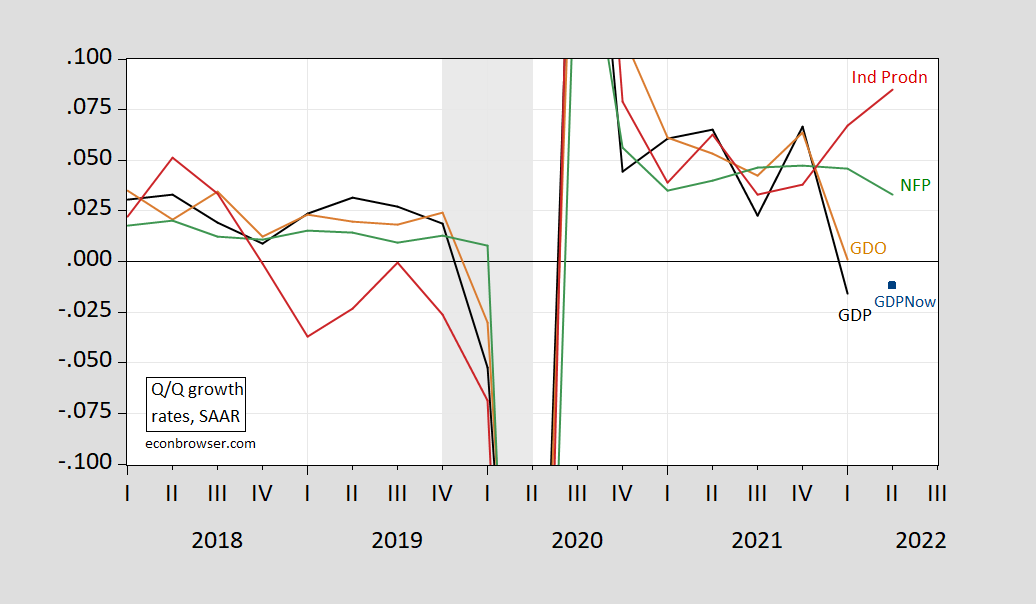

First, look at nonfarm payroll employment and industrial production, as compared to GDP (and GDO):

Figure 1: Annualized quarter-on-quarter growth rate of real GDP (black), GDPNow nowcast of 7/8 (blue square), real GDO (tan), nonfarm payroll employment (green) and industrial production (red), all calculated using log differences. 2022Q2 industrial production is for April, May. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS and Federal Reserve via FRED, Atlanta Fed, NBER, and author’s calculations.

Simply put, both employment and industrial production are growing much faster than reported GDP. If one estimates the relationship between (first log differences) of GDP on one hand and nonfarm payroll employment and industrial production on the other, (1986-2022Q1, adj.R2 = 0.83), one finds that the predicted GDP in Q1 is 1.8 ppts higher than actual reported in the 3rd release. A similar number applies to the GDPNow figure for Q2 as of 7/8.

Note that the mean absolute revision between the 3rd release and the final vintage in SAAR growth rates over the period ending 2018 is 1.23 ppts (BEA (2021)).

It would be lovely to live in a culture in which this sort of honest, dispassionate observation could be met with similarly honest, dispassionate responses. Sadly, we are in a Harry Frankfurt world, surrounded by the creatures Professor Frankfurt found under various rocks. So, brace yourselves.

Too many TV babies?? Said the guy who watched Dukes of Hazard. Enos, The Hulk, BJ and the Bear. The Phoenix, Buck Rogers, Benny Hill, It’s Your Move, Knight Rider. the A-Team, Beavis and Butthead, Seinfeld, House MD……. Did I leave any degeneracy out?? Oh yeah The Fall Guy, and Misadventures of Sheriff Lobo.

Why do I still feel like I’m missing some?? Oh yeah Georgia Championship Wrestling on TBS. What else?? Jeremy Brett’s Sherlock Holmes….. hmmmmm……

Miami Vice, wow how did I forget that one?? Edward Woodward’s “The Equalizer”. Does anyone mind if I hijack this entire comment thread?? Simon and Simon, Riptide…. uuuuuhh Beverly Hills Buntz…… One of the reasons I know I am forgetting a lot, it’s like most restaurants/shops I like. Once I like a TV show it’s near doomed to last only one season. It’s an absolute miracle of the last 2 centuries combined that “Seinfeld” lasted more than the initial 4 episodes after I decided I loved the show. very weird. My best friend in China went to Austria less than a year after I got to China. I mean I knew before she was probably going to Europe. it’s just weird/

Why I Suspect Q1 GDP Will Eventually Be Revised Up

I would agree:

https://fred.stlouisfed.org/graph/?g=RBAV

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 2021-2022

(Percent change, quarter to quarter)

https://fred.stlouisfed.org/graph/?g=RwGj

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 2007-2022

[ Gross domestic income is an alternative way of measuring the nation’s economy, by counting the incomes earned and costs incurred in production. In theory, GDI should equal gross domestic product, but the different source data yield different results. The difference between the two measures is known as the “statistical discrepancy.” BEA considers GDP more reliable because it’s based on timelier, more expansive data. ]

Nice graph showing how GDI growth of late has been outpacing reported GDP growth. Kevin Drum had an entire post on this and James Bullard pointed out what Dr. Chinn noted.

To note what Macroduck said – it is funny that Princeton Steve has gone silent ever since these realities have been highlighted.

Supposing that GDP growth has been stronger than so far recorded, which I find a reasonable assumption, then slowing growth to limit inflation will mean stronger action by the Federal Reserve and the concern then would be a recession in a year quite possibly influenced by a downturn in the housing market. The work of Robert Shiller suggests housing prices are far too high to sustain the current level of nonresidential investment as mortgage rates increase.

https://fred.stlouisfed.org/graph/?g=QKnA

January 30, 2018

Case-Shiller National Home Price Index / Consumer Price Index, 1994-2022

(Indexed to 1994)

Could real gdp go down due to higher inflation? Is industrial production adjusted for inflation?

Kirk: In a mechanical sense, if nominal GDP remains constant through revisions, and the price deflator turns out to be higher than it is reported to be now, then yes, real GDP will be lower.

Industrial production is in “real” terms already.

Thank you. I wonder if the relationship between these measures is more decoupled now due to the larger trade imbalance. Last report the biggest subtractor of gdp was net exports I believe.

Kirk,

Probably partly. The other big subractor in Q! was net changes in inventories, which dropped sharply. But all accounts they have expanded a lot in Q2, although it is unclear to me which of he various forecastign entities out there have been actually taking that into account.

That would make sense if you viewed the economy as supply constrained. Reduced inventories, high inflation, increased imports to sustain consumption and investment, and overall decrease in domestic output. Employment could stay elevated thru this especially if you view it as part of the supply constraint. Industrial production could reflect energy industry responding to higher prices, but overall a very tight market.

Menzie, I dunno if it revised upwards that it will be above negative territory.

BEA tells us: “Real DPI decreased 0.1 percent in May and Real PCE decreased 0.4 percent; goods decreased 1.6 percent and services increased 0.3 percent (tables 5 and 7). …” https://www.bea.gov/news/2022/personal-income-and-outlays-may-2022

The day before the BEA PCE announcement this article: https://www.nasdaq.com/articles/final-q1-gdp-1.6-whats-in-store-for-q2

said this: “Tomorrow, we see the full compliment of Personal Consumption Expenditure (PCE) numbers — well known as the Fed’s favorite inflation barometer — for the month of May. Last time around we saw year-over-year figures of +6.3% on headline, +4.9% on core. This core number is lower than the +5.2% we saw in March. Core PCE inflation month over month is expected to be +0.4% — higher than the previous month’s +0.3%.”

May was in fact lower at 4.7. So using the NASDAQ estimate Q2 GDP may be lower than Q1. If so, that may put a below zero ceiling on the any upward Q1 revisions.

Time will tell as we approach the announcement date.

CoRev: Notice that I was not referring to the revisions going from advance to second, and third. Rather I was referring to any one of these releases and the ensuing benchmark revisions. So, yes time, will tell — but in the case of the 2001 recession, it was something like 4 years; see discussion in this recent post.

“Menzie, I dunno if it revised upwards that it will be above negative territory.”

What do you mean by “it”? Dr. Chinn introduced a lot of measures. Let’s see payroll employment grew A LOT. Real GDI has been growing each quarter. So they are already “above negative territory”. Now if you meant real GDP – then SAY SO.

Come on CoRev – your preK teacher is trying very hard to teach you how to write. PAY ATTENTION.

Well someone had to say it – Tucker Carlson is a wimp:

https://www.msn.com/en-us/news/us/tucker-carlson-s-greatest-fear/ar-AAZpKDk?ocid=msedgdhp&pc=U531&cvid=a21c81f3de0d46d2897e51c324a97eb9

The point of this discussion is to note the things that make poor little Tucker scared with the item on the top of the list – strong women. Huh – that also described wimp in chief Donald Trump.

fwiw, the industrial production index, with the benchmark set for average 2017 production to equal to 100.0, fell from 104.6 in May to 104.4 in June, after the May reading for the IP index was revised down from 105.2 to 104.6, and the April index was revised down from 105.1 to 104.5, while the Indices for February and March were unrevised at 103.0, and 103.7 respectively….