Expected inflation inferred from the Treasury-TIPS spread is tainted by risk and liquidity premia. The difference between expected future short rates and current short rates is also obscured by risk premia. Here are adjusted spreads:

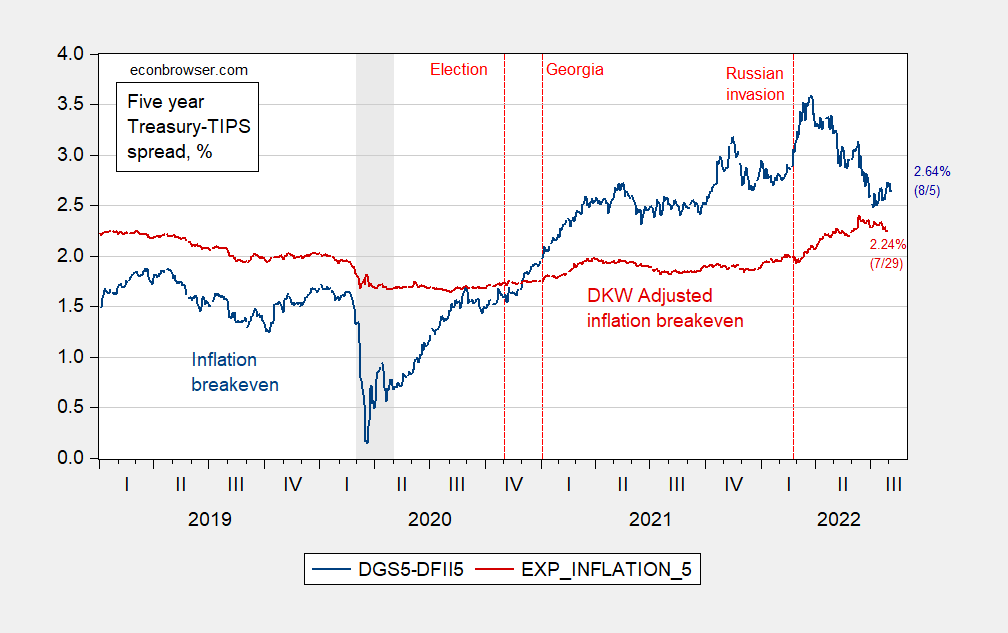

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

The adjusted series suggests an upward movement in expected inflation with the expanded Russian invasion of Ukraine, but less than that indicated by the simple Treasury-TIPS spread (and no downward movement recently).

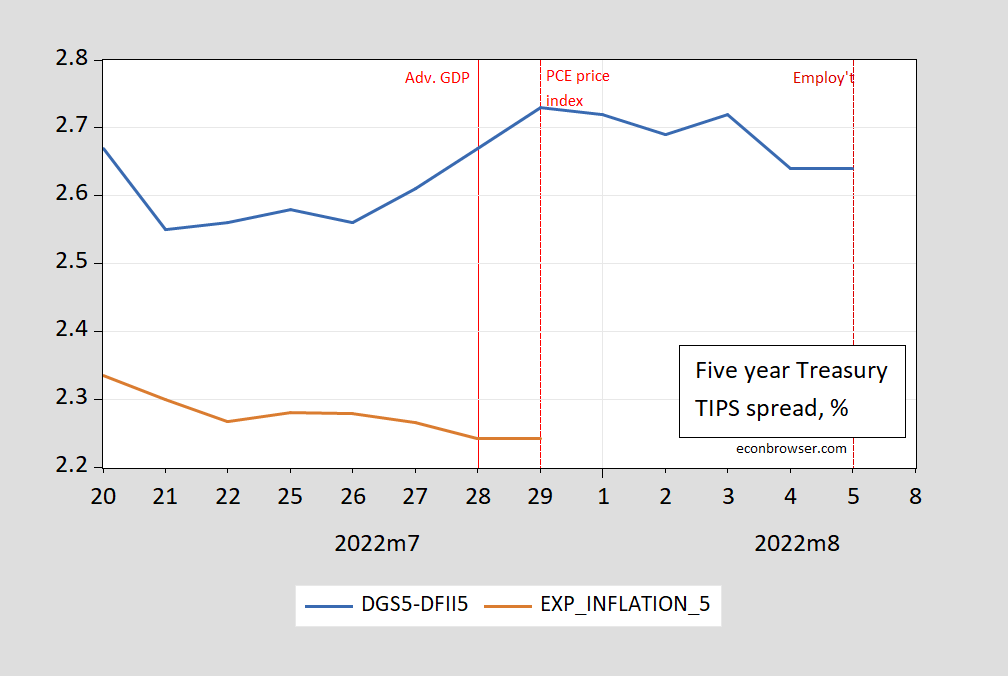

How have recent releases affected inflation expectations? Figure 2 presents a detail.

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

The inflation breakeven rises with the GDP advance and PCE deflator releases, but stays constant with today’s employment numbers (strangely). However, to the extent that the Treasury-TIPS spread mismeasures expectations, we should be a bit wary of this result (inflation expectations do drop with the GDP release with the adjusted measure).

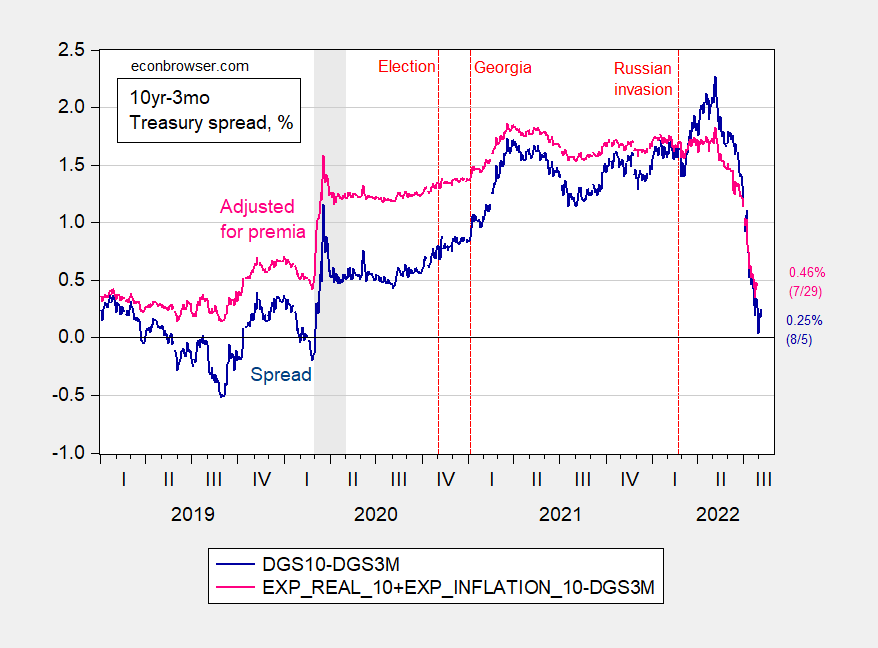

What about the 10yr-3mo spread? The unadjusted has taken a big dive in recent weeks, coming close to inversion.

Figure 3: 10 year-3 month Treasury spread (dark blue), and implied future nominal rates over next ten years (pink), both in %. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

The gap between 10yr-3mo went negative in 2019, and again with the onset of the pandemic. The yield curve steepened sharply with the Georgia special election outcomes, and then counterintuitively rose again with the Russian expanded incursion into Ukraine. The spread dropped sharply from May 6th onward.

The spread incorporates a inflation risk premium so that on average, the yield curve slopes up. Hence, the standard 10yr-3mo spread does not necessarily equal the difference between 3 month yields over the next 10 years vs the current 3 month yield. I show the sum of the future 3 month real yields and future 3 month inflation rates over the next ten years as the pink line in Figure 2. This line probably better shows the heightened expectations of growth in 2021Q1-Q2, as well as the dropoff in perceived growth prospects in May.

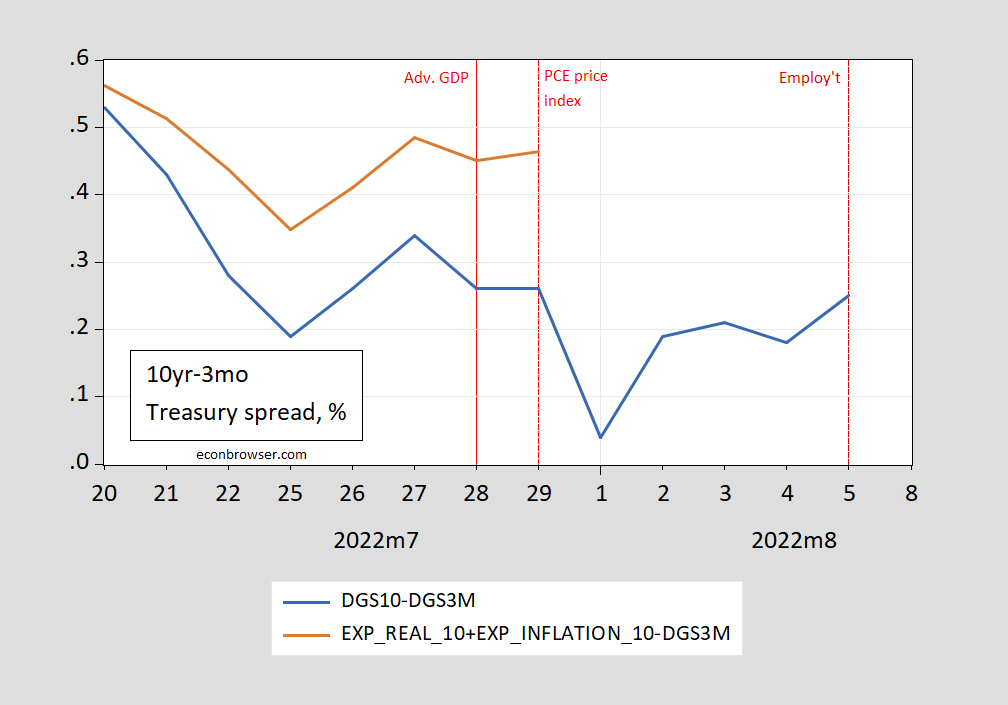

The detail suggests the expected asset price responses to the recent releases as well.

Figure 4: 10 year-3 month Treasury spread (dark blue), and implied future nominal rates over next ten years (pink), both in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

ltr treated us to a Paul Krugman discussion of how gasoline and food prices are actually falling. Your graph could be interpreted as having expected inflation being near 2.5%. It seems the INFLATION freaks are almost off base as the RECESSION cheerleaders. MAGA!

In related news –

Front-month wheat futures are nearly down to the prices seen a year ago:

https://www.wsj.com/market-data/quotes/futures/W00

What happended? Aside from one grain cargo coming out of Odessa, U.S. and Chinese crop forecasts have improved. Farmers in both countries got off to a slow start planting due to weather, but both have made up for lost time. Both are now expected to improve on last year’s harvest. A knock-on effect from that news is, according to the WSJ, an exit of speculative longs from the market:

https://www.wsj.com/articles/speculators-exit-agricultural-markets-intensifying-crop-selloff-11659559808

These are dollar prices. The rest of the world still faces higher wheat prices.

Meanwhile, Brent finished the week down 9%, and down 16% from 3 months ago. Gasoline at the pump is down 60 to 70 cents from a month ago.

Oh, and mortgages are back down to April rates, still hard to swallow, but down about 0.66 ppt on conventional 15s.

And since economics apparently only matters as a political club, Biden’s approval rating is rising with the decline in gasoline prices:

https://www.newsweek.com/biden-approval-rating-boosted-ahead-midterms-poll-1731291

Generic House candidate polls remain tied. Give ’em time…

The one thing Biden could do was releases from the strategic reserves. He did and got our allies to do the same. That has been a part of the fall in oil prices.

There’s some stuff here to be happy about, for a change. Will look at WSJ wheat story tomorrow (I only have access to hardcopy version).

Back on August 3, New Deal Democrat mentioned Robert Dieli’s “enhanced aggregate spread” recession prediction model in response to a question about a low jobless rate warning of recession. The model is the ten-year/fed funds spread plus (the inflation rate minus the short-term unemployment rate). The term in parentheses is the “enhancement” to the yield curve as a recession-prediction tool. Sort of a “how hot is the economy?” term, or “how much farther will the Fed go?” term. NDD remembered correctly that 200 basis points was Dieli’s magic number. Crossing 200 on the way down, says Dieli, predicts recession within 9 months. Crossing 200 on the way up predicts recovery within 9 months.

I found a good bit of commentary suggesting Dieli’s model is the best thing since avacado toast, so I cobbled together a copy of the model in FRED:

https://fred.stlouisfed.org/graph/?g=Sw85

Problem is, 200 is apparently no longer magic. More like 290 to 360, depending on the cycle. That much variability means no avacado toast. Timing suggests the Great Moderation robbed the “enhancement” of its magic, and that was a long time ago.

Anybody see a problem with my math?

By the way, the current reading is 405, assuming my math is right.

Somebody else noticed the Dieli model losing its mojo, so by fixed it with a trend-line:

https://imarketsignals.com/2016/the-dynamic-linearly-detrended-aggregate-spread-a-long-leading-recession-indicator/

That makes it “science”, I guess.

You’re a little sharper than me (I know, shocking admission on my part) I find Dieli model fascinating but kinda makes my head go into vertigo. Are you saying it’s worth pursuing and reading into or do you view it mostly cynically??

Hey Moses, sorry for the late reply.

The Dieli model worked until it didn’t; structural changes is a bitch.

NDD’s point was correct – there is information in the jobless rate which is counter-intuitive. Dieli’s enhancement to term spread as a recession signal stopped working after the Great Moderation, but that doesn’t mean the jobless rate no longer contains information. Just means we can no longer get at that information through Dieli’s model.

This thread/story is from mid-June, but I think it still applies to now:

https://twitter.com/propublica/status/1544456082981982208?cxt=HHwWgMCo1fynge8qAAAA

https://www.propublica.org/article/ocean-freight-shipping-costs-inflation

I’ve been wondering for the damndest long time, which town in Michigan it was that Bruce Hall resided in. Finally the location has been revealed:

https://www.theguardian.com/books/2022/aug/05/michigan-library-book-bans-lgbtq-authors

First, I was promised a return to 1970’s style stagflation– with soaring energy prices, ineffectual presidents, a braindead Fed, and a collapse in morality. It doesn’t look like it’s going to happen and I feel betrayed.

Now, it looks like we might get a repeat of the 1990’s. I just hope that Putin gets a coup and I hope that Xi doesn’t invade Taiwan.

I don’t think they will. It’s called “risk-aversion”, and the communist party is very risk-averse. It’s MUCH more challenging than Hong Kong was. Hong Kong was relinquished on a silver platter. “Suicide by computer chips” is something China risks by invading Taiwan which would cause world-wide problems, and a global unpopularity similar or worse than what Putin is experiencing right now. This is just an exhibitionist baby fit to keep citizens’ minds off domestic problems.

Alex Jones is a lot like Donald Trump especially when it comes to accounting schemes to steal other people’s money:

https://www.msn.com/en-us/money/other/alex-jones-moved-money-into-shell-company-after-being-held-liable-in-court-case/ar-AA10m40a?ocid=msedgdhp&pc=U531&cvid=0b753ee64adb441e9b8b0db3dc5db35c

Alex Jones moved money into shell company after being held liable in court case

Alex Jones set up shell companies to move money after being held liable by default in a case involving families of the Sandy Hook victims last year, a witness said Friday. Bernard Pettingill, a witness for the Sandy Hook families and an economic consultant and former professor of economics at the Florida Institute of Technology, said Jones began moving $11,000 a day into shell companies in Septe mber 2021 after being held liable for the cases involving defamation surrounding the shooting. Pettingill also testified that the net revenue of InfoWars, Jones’s company, in 2021 was $64 million and downplayed the effect Jones’s company being removed from several platforms, including Facebook, had on his income.The witness testified Jones and Free Speech Systems, InfoWars’s parent company, have a net worth between $135 million and $270 million. Jones’s company filed for bankruptcy last week.

It’s good to know that the Biden Administration is doing something.

https://gregmankiw.blogspot.com/2022/08/the-inflation-impact-of-inflation.html

Huh – your Republican masters have told us this bill would increase inflation. Mankiw and the CBO have shot down another one of your LIES.

BTW – the claim it will lead to a recession is another debunked lie.

But it will lower health care costs, reduce climate change. and lower the deficit. I know – you think all of that is so EVIL.

Barking Bierka – the Disgusting NYC Jerk claims: ” reduce climate change”??? Not knowing the difference between weather and climate is a guarantee that this is an ignorant claim. Using his definition we should see a measurable reduction in weather events THAT ARE DIRECTLY ATTRIBUTABLE to this bill.

Instead of that happening, I will predict that REAL electricity prices will go up in the next presidential administration, unless, the bill’s impact is changed by the next Congress.

Gee – have you scored this for the CBO? Oh wait – you do economic analysis for Alex Jones. Never mind.

ltr provided us a text of Krugman’s latest which I hope she can do again since the NYTimes fire wall is flaring up (I do not subscribe):

https://www.nytimes.com/2022/08/05/opinion/inflation-declining-gas-prices.html

I make this request given the spew of blatant LIE after another Bruce Hall is inflicting the comment section with again. One of his little stories has something to do with cattle prices. Now I’m getting lower beef prices but Bruce’s little story said something about a drought, which of course was all Biden’s fault.

Krugman was nothing how food prices have been fallen. Brucie of course wants us to believe food prices are soaring. Yea – we all get who is actual economist v. who is a professional liar. But the text of Krugman’s latest would be most appreciated.

Krugman also points out that the dimple brain Dr. Oz simply states that gas prices are rising – in direct contradiction of the facts. The Faux school of politics has proven that you can indeed state that up is down and down is up as long as you say it with great conviction. Half of those listening will not know how to fact-check, the other half will believe that any source claiming the opposite must be lying and/or part of a conspiracy. They know how to maneuver the post-fact world – they created it.

The good news is Oz is the worst performing GOP Senate candidate right now. Vance is up there too according to the last polling averages I saw.

I also love how Fetterman’s campaign (he’s the one running against Oz) is basically, “Get a load of this rich phony over here” in a NJ Italian-American accent.

It does have the virtue of being 100% true. (Except the accent.)

I have friends in NJ. They do not want Dr. Oz to move back.

@ AndrewG

Haven’t you ever heard Hillary Clinton’s Chicago suburbs raised Arkansas accent?? She almost won 1980 B-actress of The Year award.

Yes, and she put hot sauce in her purse. She could be a phony. I’d still vote for her.

You lose all the graphs but:

OPINION

Wonking Out: The Meaning of Falling Inflation

Aug. 5, 2022

Credit…Sarah Silbiger for The New York Times

Give this article

121

Paul Krugman

By Paul Krugman

You’re reading the Paul Krugman newsletter, for Times subscribers only. A guide to U.S. politics and the economy — from the mainstream to the wonkish. Get it in your inbox.

Inflation is coming down — fast.

Gas prices, defying predictions of a nightmare summer for motorists, are leading the parade:

Image

Less pain at the pump.

Less pain at the pump.Credit…Gasbuddy.com

The majority of gas stations in the United States are already charging less than $4 a gallon, and declining wholesale prices suggest that retail prices still have farther to fall.

Food prices are also coming down. Here’s the futures price for wheat:

Image

Wheat futures are way down.

Wheat futures are way down.Credit…Nasdaq

And business surveys are suggesting a broader decline in inflation. For example, the widely cited Institute of Supply Management survey of purchasing managers shows that prices paid for raw materials are still rising, but at a slower rate than they have in many months:

Image

Purchasing managers see much less inflation.

Purchasing managers see much less inflation.Credit…Institute for Supply Management

All of this means that official data on consumer prices will almost certainly show much smaller increases over the next few months than the shocking numbers we’ve become accustomed to lately. But what will this improvement mean?

I’ll get to the implications for economic policy in just a bit. But give me a minute to savor the political implications.

Did you know you can share 10 gift articles a month, even with nonsubscribers?

Share this article.

Republican efforts to regain control of Congress have rested almost entirely on blaming Joe Biden for inflation — and gas prices in particular.

Did Donald Trump, who is still the dominant figure in the G.O.P., attempt to overturn a legitimate election? Gas is over $5 a gallon! Are Republican judges and state legislators taking away rights women have had for decades? Gas is $5 a gallon!

Now the party’s main election plank — pretty much their only election plank — is being sawed off at the base. I’ve been wondering what they’ll do. After spending many months doing all they can to dumb down the debate, Republicans will have a hard time suddenly pivoting to nuanced arguments about headline numbers versus underlying inflation.

So far, their main response seems to be to ignore the inflation slowdown and hope voters don’t notice. Here, for example, is Mehmet Oz, running to be a Pennsylvania senator, on Thursday:

Image

A man who clearly doesn’t fill his own tank.

A man who clearly doesn’t fill his own tank.Credit…Twitter

Has this man visited a gas station near his New Jersey home lately?

When — I’m pretty sure that’s a “when,” not an “if” — official data also shows a sharp decline in inflation, my guess is that we’ll see denial supplemented by conspiracy theories: claims that the Biden administration is faking the numbers or somehow manipulating the commodity markets.

Should Democrats emphasize the good news on inflation and mock their opponents’ doomsaying? Yes! Any Democratic politician who responds to falling energy and food prices with a discourse about transitory versus underlying inflation should be in a different business.

Policymakers, however — which in this case basically means the Federal Reserve — are in a different business, and they should respond to the good inflation news by keeping calm and carrying on.

Many fashionable economic concepts have failed the test of time, but the concept of core inflation — distinguishing between volatile prices, like food and energy, and slower-moving prices that have a lot of inertia — has been highly successful since the economist Robert Gordon introduced it in the 1970s. Time and again, the Fed has steered through crises by ignoring critics who wanted it to panic over blips in inflation caused by temporary jumps in commodity prices.

Now, defining core inflation has gotten harder in the Covid era, because just excluding food and energy seems inadequate at a time when wild swings in things like used car prices and shipping costs have also driven fluctuations in the rate of inflation. At the moment, however, every measure of underlying inflation I’m aware of, from traditional core to measures that exclude any large price changes and changes in labor costs, points to unacceptably high underlying inflation.

So why is inflation coming down? Biden administration policy — releasing oil from the Strategic Petroleum Reserve, urging gas stations to pass on declines in wholesale prices, efforts to unsnarl supply chains — may have contributed. But the main story is likely a global economic slowdown: America probably isn’t in a recession, but Europe probably is, China remains hobbled by its zero-Covid policy and so on.

All of which has remarkably little bearing on appropriate U.S. policy. The Fed’s strategy is to bring underlying inflation down by using interest rate hikes to cool off the economy. Despite Friday’s hot labor market report, I have no doubt that this strategy will eventually work. But the good news we’re about to get about short-term inflation isn’t evidence that the strategy has already worked, and alas (I’m usually a monetary dove), it offers no justification for a pivot toward easier money.

Does this mean that inflation is going to pop right back up again? Not necessarily. The Fed’s efforts probably will bring underlying inflation down over the next few months, so that by the time the transitory good news from gas prices fades out, it may be replaced by more permanent good news.

In any case, for the moment, inflation is headed down, no doubt to the great dismay of politicians who were counting on gas prices to deliver a red wave in November. Pass the popcorn.

Thanks. This basically undermines weeks of Bruce Hall’s lies.

http://www.newyorker.com/magazine/1946/08/31/hiroshima

August 31, 1946

Hiroshima

By JOHN HERSEY

I—A NOISELESS FLASH

At exactly fifteen minutes past eight in the morning, on August 6, 1945, Japanese time, at the moment when the atomic bomb flashed above Hiroshima, Miss Toshiko Sasaki, a clerk in the personnel department of the East Asia Tin Works, had just sat down at her place in the plant office and was turning her head to speak to the girl at the next desk. At that same moment, Dr. Masakazu Fujii was settling down cross-legged to read the Osaka Asahi on the porch of his private hospital, overhanging one of the seven deltaic rivers which divide Hiroshima; Mrs. Hatsuyo Nakamura, a tailor’s widow, stood by the window of her kitchen, watching a neighbor tearing down his house because it lay in the path of an air-raid-defense fire lane; Father Wilhelm Kleinsorge, a German priest of the Society of Jesus, reclined in his underwear on a cot on the top floor of his order’s three-story mission house, reading a Jesuit magazine, Stimmen der Zeit; Dr. Terufumi Sasaki, a young member of the surgical staff of the city’s large, modern Red Cross Hospital, walked along one of the hospital corridors with a blood specimen for a Wassermann test in his hand; and the Reverend Mr. Kiyoshi Tanimoto, pastor of the Hiroshima Methodist Church, paused at the door of a rich man’s house in Koi, the city’s western suburb, and prepared to unload a handcart full of things he had evacuated from town in fear of the massive B-29 raid which everyone expected Hiroshima to suffer. A hundred thousand people were killed by the atomic bomb, and these six were among the survivors. They still wonder why they lived when so many others died. Each of them counts many small items of chance or volition—a step taken in time, a decision to go indoors, catching one streetcar instead of the next—that spared him. And now each knows that in the act of survival he lived a dozen lives and saw more death than he ever thought he would see. At the time, none of them knew anything.

The Reverend Mr. Tanimoto got up at five o’clock that morning. He was alone in the parsonage, because for some time his wife had been commuting with their year-old baby to spend nights with a friend in Ushida, a suburb to the north. Of all the important cities of Japan, only two, Kyoto and Hiroshima, had not been visited in strength by B-san, or Mr. B, as the Japanese, with a mixture of respect and unhappy familiarity, called the B-29; and Mr. Tanimoto, like all his neighbors and friends, was almost sick with anxiety. He had heard uncomfortably detailed accounts of mass raids on Kure, Iwakuni, Tokuyama, and other nearby towns; he was sure Hiroshima’s turn would come soon. He had slept badly the night before, because there had been several air-raid warnings. Hiroshima had been getting such warnings almost every night for weeks, for at that time the B-29s were using Lake Biwa, northeast of Hiroshima, as a rendez-vous point, and no matter what city the Americans planned to hit, the Super-fortresses streamed in over the coast near Hiroshima. The frequency of the warnings and the continued abstinence of Mr. B with respect to Hiroshima had made its citizens jittery; a rumor was going around that the Americans were saving something special for the city.

Mr. Tanimoto is a small man, quick to talk, laugh, and cry. He wears his black hair parted in the middle and rather long; the prominence of the frontal bones just above his eyebrows and the smallness of his mustache, mouth, and chin give him a strange, old-young look, boyish and yet wise, weak and yet fiery. He moves nervously and fast, but with a restraint which suggests that he is a cautious, thoughtful man. He showed, indeed, just those qualities in the uneasy days before the bomb fell. Besides having his wife spend the nights in Ushida, Mr. Tanimoto had been carrying all the portable things from his church, in the close-packed residential district called Nagaragawa, to a house that belonged to a rayon manufacturer in Koi, two miles from the center of town. The rayon man, a Mr. Matsui, had opened his then unoccupied estate to a large number of his friends and acquaintances, so that they might evacuate whatever they wished to a safe distance from the probable target area. Mr. Tanimoto had had no difficulty in moving chairs, hymnals, Bibles, altar gear, and church records by pushcart himself, but the organ console and an upright piano required some aid. A friend of his named Matsuo had, the day before, helped him get the piano out to Koi; in return, he had promised this day to assist Mr. Matsuo in hauling out a daughter’s belongings. That is why he had risen so early.

Mr. Tanimoto cooked his own breakfast. He felt awfully tired. The effort of moving the piano the day before, a sleepless night, weeks of worry and unbalanced diet, the cares of his parish—all combined to make him feel hardly adequate to the new day’s work. There was another thing, too: Mr. Tanimoto had studied theology at Emory College, in Atlanta, Georgia; he had graduated in 1940; he spoke excellent English; he dressed in American clothes; he had corresponded with many American friends right up to the time the war began; and among a people obsessed with a fear of being spied upon—perhaps almost obsessed himself—he found himself growing increasingly uneasy. The police had questioned him several times, and just a few days before, he had heard that an influential acquaintance, a Mr. Tanaka, a retired officer of the Toyo Kisen Kaisha steamship line, an anti-Christian, a man famous in Hiroshima for his showy philanthropies and notorious for his personal tyrannies, had been telling people that Tanimoto should not be trusted. In compensation, to show himself publicly a good Japanese, Mr. Tanimoto had taken on the chairmanship of his local tonarigumi, or Neighborhood Association, and to his other duties and concerns this position had added the business of organizing air-raid defense for about twenty families.

Before six o’clock that morning, Mr. Tanimoto started for Mr. Matsuo’s house….

That’s a very nice essay, but why won’t China speak out against Russia’s nuclear threats?

https://www.nytimes.com/2022/08/05/us/politics/medicare-drug-costs.html

August 5, 2022

Democrats’ Long-Sought Plan for Lowering Drug Costs Is at Hand

Empowering Medicare to negotiate prices directly with drug makers has been a Democratic goal for 30 years, one the pharmaceutical industry has fought ferociously.

By Sheryl Gay Stolberg and Rebecca Robbins

WASHINGTON — For decades, as prescription drug costs have soared, Democrats have battled with the pharmaceutical industry in pursuit of an elusive goal: legislation that could drive down prices by allowing Medicare to negotiate directly with drug makers.

Now they are on the verge of passing a broad budget bill that would do just that, and in the process deliver President Biden a political victory that he and his party can take to voters in November.

Empowering Medicare to negotiate prices for up to 10 drugs initially — and more later on — along with several other provisions aimed at lowering health care costs, would be the most substantial change to health policy since the Affordable Care Act became law in 2010, affecting a major swath of the population. It could save some older Americans thousands of dollars in medication costs each year.

The legislation would extend, for three years, the larger premium subsidies that low- and middle-income people have received during the coronavirus pandemic to get health coverage under the Affordable Care Act, and allow those with higher incomes who became eligible for such subsidies during the pandemic to keep them. It would also make drug makers absorb some of the cost of medicines whose prices rise faster than inflation.

Significantly, it also would limit how much Medicare recipients have to pay out of pocket for drugs at the pharmacy to $2,000 annually — a huge benefit for the 1.4 million beneficiaries who spend more than that each year, often on medicines for serious diseases like cancer and multiple sclerosis.

Lower prices would make a huge difference in the lives of people like Catherine Horine, 67, a retired secretary and lung recipient from Wheeling, Ill. She lives alone on a fixed income of about $24,000 a year. Her out-of-pocket drug costs are about $6,000 a year. She is digging into her savings, worried she will run out of money before long.

“Two years ago, I was $8,000 in the hole,” she said. “Last year, I was $15,000 in the hole. I expect to be more this year, because of inflation.”

Between 2009 and 2018, the average price more than doubled for a brand-name prescription drug in Medicare Part D, the program that covers products dispensed at the pharmacy, the Congressional Budget Office found. Between 2019 and 2020, price increases outpaced inflation for half of all drugs covered by Medicare, according to an analysis from the Kaiser Family Foundation.

The budget office estimates that the bill’s prescription drug provisions will save the federal government $288 billion over 10 years, in part by forcing the pharmaceutical industry to accept lower prices from Medicare for some of its big sellers.

Opponents argue that the measure would discourage innovation and cite a new C.B.O. analysis * that projects that it would actually lead to higher prices when drugs first come on the market.

* https://www.cbo.gov/system/files/2022-08/58355-Prescription-Drug.pdf