IGM-FTmid -September survey:

“This installment of the FTxIGM US Macroeconomists Survey discusses the likelihood of the Fed raising and sustaining a higher interest rate. It also examines the the possibility of a recession to occur earlier than expected.”

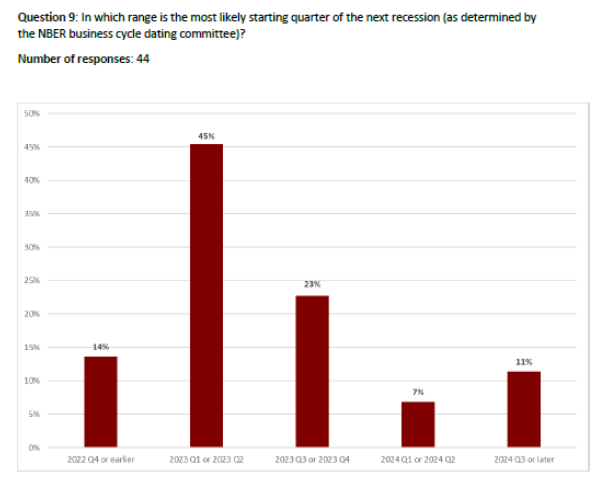

The modal response for US recession start is 2023Q1-Q2. Only 14% believe that a recession has already started or will begin by 2022Q4.

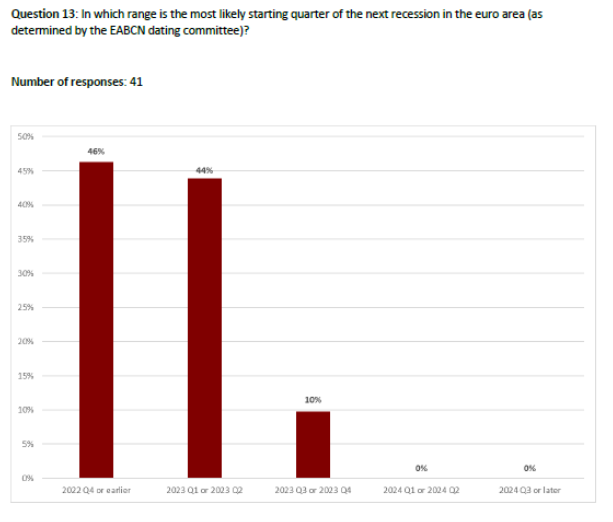

In contrast, the modal response for the Euro area is for a recession to start by year’s end.

Somewhat worrying is that the modal estimate for the onset of U.S. recession is H1 of 2023, while the modal estimate for the first Fed rate cut is H1 2024.

It’s pretty easy to tell a story which explains this expected delay in easing, based on answers to question 7, which find falling inflation more likely than labor market weakness as the trigger for a pause in rate hikes. In a textbook cycle, the labor market leads inflation. Assuming we are in such a cycle, the story is that the Fed will not behave in a forward-looking manner. It will wait for labor market weakness to cause disinflation before easing. I hope the Fed remains true to its own claims of balancing employment and price stability and of making forward-looking policy.

500% agree with you on forward-looking policy. But you knew I would say that.

Recession in 2Q2023? Ha!

The equally likely event is WWIII in 4Q2022.

BTW, you guys are a major cause for UFOs refusals to communicate with Earthlings.

Why??~~did a Martian holler something at your back window recently?? I kind of suspected you were a Martian commenting here anonymously. Should I leave a trail of M&Ms leading to Menzie’s office space and he’ll let us know if my suspicion you are a Korblockian is accurate??

I would hope the FED begins easing off its tight money now but then I have always been an inflation dove.

Though we may reasonably disagree with apparent Fed policy, I’m not sure why we would *not* call it forward-looking. This is about a month old now, but here’s Powell at Jackson Hole:

https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy. Committee participants’ most recent individual projections from the June SEP showed the median federal funds rate running slightly below 4 percent through the end of 2023. Participants will update their projections at the September meeting.

Our monetary policy deliberations and decisions build on what we have learned about inflation dynamics both from the high and volatile inflation of the 1970s and 1980s, and from the low and stable inflation of the past quarter-century. In particular, we are drawing on three important lessons.

The first lesson is that central banks can and should take responsibility for delivering low and stable inflation. It may seem strange now that central bankers and others once needed convincing on these two fronts, but as former Chairman Ben Bernanke has shown, both propositions were widely questioned during the Great Inflation period.1 Today, we regard these questions as settled. Our responsibility to deliver price stability is unconditional. It is true that the current high inflation is a global phenomenon, and that many economies around the world face inflation as high or higher than seen here in the United States. It is also true, in my view, that the current high inflation in the United States is the product of strong demand and constrained supply, and that the Fed’s tools work principally on aggregate demand. None of this diminishes the Federal Reserve’s responsibility to carry out our assigned task of achieving price stability. There is clearly a job to do in moderating demand to better align with supply. We are committed to doing that job.

The second lesson is that the public’s expectations about future inflation can play an important role in setting the path of inflation over time. Today, by many measures, longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency, with inflation having run well above our goal for some time.

If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Unfortunately, the same is true of expectations of high and volatile inflation. During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decisionmaking of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, “Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations.”

One useful insight into how actual inflation may affect expectations about its future path is based in the concept of “rational inattention.” When inflation is persistently high, households and businesses must pay close attention and incorporate inflation into their economic decisions. When inflation is low and stable, they are freer to focus their attention elsewhere. Former Chairman Alan Greenspan put it this way: “For all practical purposes, price stability means that expected changes in the average price level are small enough and gradual enough that they do not materially enter business and household financial decisions.”

Of course, inflation has just about everyone’s attention right now, which highlights a particular risk today: The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.

That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

Andrew,

Two things –

“Though we may reasonably disagree with apparent Fed policy, I’m not sure why we would *not* call it forward-looking.”

The point I made had to do with the future policy choices implied by survey results, not current policy. You seem to be discussing current policy. We will not know whether Fed policy is forward looking in the face of a weakening labor market until the labor market weakens.

Second, Powell’s speech is about policy but is not, itself, policy. We cannot tell from his speech whether policy is forward-looking. In fact, to the extent that “keep at it until the job is done” means a focus on current inflation rather than the drivers of future inflation, Powell has discribed something other than forward-looking policy.

I believe Powell is talking tough and invoking Volcker, despite substantial differences between Volcker’s time and now, not because he sees the two periods as similar, but rather to keep financial conditions tight in the near term. I believe Powell will urge policy moderation when the labor market cools, contrary to what is implied in the median survey response. He just doesn’t want market participants to anticipate that moderation. Hope I’m right,

>> to the extent that “keep at it until the job is done” means a focus on current inflation rather than the drivers of future inflation

I really don’t think that’s what he’s saying. He’s explicitly talking about the possibility of current inflation *as a driver of future inflation* despite what forward rates are telling us. Previously perma-dove Paul Krugman seems to agree.

Also, I’m no monetary policy expert, but forward guidance sounds like policy to me, even if it’s not rates or balance sheet.

I see what you mean about the possibility of a hawkish signal with low commitment. Sort of the upside down version of what Krugman used to say about “credibly signaling being irresponsible” by having a temporary hike in the inflation target when stuck at the ZLB – but maybe without the credibility. The survey respondents seem to believe it — your point. Maybe he *is* faking right. But the counterfactual world where the fake doesn’t take, risking inflation being more ingrained in decision-making, is potentially unpleasant. Not following through could be a very conspicuous blow to credibility, and next time the fake won’t work – perhaps requiring even more hawkish policy beyond open-mouth operations, the very trap he addresses in this speech.

And I’m going to be really, really annoying now and post an entire article (almost), which is relevant:

OPINION

PAUL KRUGMAN

Who’s Afraid of the Consumer Price Index?

Sept. 15, 2022

After a benign consumer price report last month, some people — including, apparently, a number of investors — had begun to hope for a fairy-tale ending to the 2021-22 inflation surge. This month’s report pretty much dashed those hopes (which, as it happens, I haven’t shared for a long time).

It’s important, however, to understand what the report did and didn’t show.

If you still believed that we might be able to bring inflation down to an acceptable level without any pain — specifically, without a rise in the unemployment rate — Tuesday’s report made it even harder to sustain that belief than it already was. There will, alas, be pain. But the report gave little indication, one way or the other, of how much pain will be needed, or how long it will have to last.

Economists often discuss these issues in terms of what’s happening to underlying or “core” inflation, then argue about the best measure of core inflation to use, to the bemusement of everyone else. So I was very taken with an alternative formulation by the economist Joseph Politano, who suggests that we distinguish between “immaculate disinflation” — a fall in the inflation rate that will happen more or less automatically as recent disruptions from the pandemic, the Ukraine war, etc. subside — and the “intentional disinflation” the Fed is trying to produce by raising interest rates.

And let’s not be antiseptic here: Intentional disinflation is very likely to involve lost jobs. For the purpose of Fed rate hikes is to reduce overall spending, almost surely leading to higher unemployment.

Now, immaculate disinflation isn’t a myth; it has in fact been happening lately. Overall consumer price inflation on a monthly basis slowed sharply this summer, largely thanks to the switch from rising to falling gasoline prices.

But a look under the hood of the numbers makes it clear that immaculate disinflation won’t be enough. I’d like to believe otherwise; a year ago I did, indeed, think that inflation might largely cure itself. At this point, however, whatever your preferred measure of underlying inflation — inflation that won’t go away by itself — may be, it’s still running too high, and it shows no clear sign of coming down.

Although this revelation seems to have shocked financial markets, it shouldn’t have come as a big surprise. While interest rates have risen a lot this year, they haven’t yet had much effect on the real economy. Never mind claims that we’re in a recession; the reality is that unemployment is still near a historic low, and other measures, like the number of job vacancies, suggest that the economy in general and the labor market in particular are still running very hot. And we won’t get inflation down to an acceptable rate until things cool off.

An optimistic scenario might look like this: The Fed’s rate hikes cause the unemployment rate to rise, but only to 4-point-something percent, which is still pretty low by historical standards — and that’s enough to bring inflation down to 2 or 3 percent. The odds for that scenario are improved by evidence — like that New York Fed report I cited — that 2022 isn’t like 1980. Back then everyone expected high inflation to persist, so the economy had to be put through the wringer to squeeze those expectations out. Recent inflation expectations, especially for the medium term, have been low and falling.

Pessimists argue, however, that the high rate of job vacancies implies that inflation control requires much higher unemployment than in the past; and (for reasons I don’t fully understand) they wave away the good news about expectations. So they end up arguing that unemployment will have to rise much higher, perhaps above 6 percent.

As you might guess, I favor the optimistic scenario. I take the expectations data seriously, and I view high vacancy rates as being, at least in part, a temporary phenomenon in an economy still adjusting to the effects of the Covid-19 pandemic.

But the truth is that nobody knows for sure, and the fact that a hot economy is still producing heated inflation does nothing to settle the debate.

The good news, sort of, is that the Fed seems to know what it doesn’t know. It’s talking tough on inflation, as it must to retain credibility, but it’s also talking about looking at the “totality of the incoming data,” which means that it’s prepared to ease off if and when inflation is clearly coming down.

I like Krugman a lot particularly because he is enough of pro to acknowledge his mistakes and learn from them. Unfortunately, here he seems to think that the mistake is to have predicted that inflation would solve itself. No his mistake was to not understand that inflation was/is indeed slowly solving itself – then we were hit with another, separate, major inflationary event. So the first model was and continue to be perfectly good – its just that you had to add another equation to the first (and that second equation overcame the trend from the first). Well at least he will eat his own words again when the overreach of the Fed dunks us into deflation and economic contraction.

@ Ivan

100% agree. You can’t claim the original call on no inflation is incorrect after a war creating huge supply chain issues starts up~~and/or Xi Jinping keeps doing major shutdowns every half-week. Very few people foresaw that, at least until the war games on the Belarus southern border. Even Krugman is so braindead now or suffering from mental exhaustion, he’s now scarfing down Fox News cola from the NYT office vending machine. Again, the zillionth example of why guys like Mitch McConnell have that involuntary shit eating grin while stepping on liberals’ face. He knows liberals just can’t get enough. Why doesn’t Krugman ask for his gagball from Kudlow at this point??

“In a textbook cycle, the labor market leads inflation. Assuming we are in such a cycle”

That is exactly what the Fed gets so catastrophically wrong. Powell want to play big bad Volcker, but the situation is very different. Current price increases are not driven by a “higher prices-higher wages-higher prices….” spiral. They are driven by one-time events in vulnerable supply lines combined with a separate one-time event draining labor supply. Those two two things do not directly connect and, therefore, cannot feed on each other in a spiral. These two issues continue to slowly resolve themselves with nothing the Fed can, or should, do about it. However, Russia started a war that caused an explosion in (volatile) food and hydrocarbon prices. Although this is also something that is slowly solving itself, it does become additive to the Covid related inflation – and has driven combined inflation up to high single digits (but slowly falling).

This is exactly the situation where the Fed should be extremely cautious or even sit on its hands. All of the drivers of inflation are one time events so there are no spiraling or vicious cycles to be worried about here. Time will heal those problems and it will be back to normal in due time, with some pain for asset holders and minimum pain for the rest (and government debt being payed off by inflation rather than by taxes). However, when these jolts of price push are in the rear view mirror we will face deflation (as prices slowly stall or even sink down towards normal). So the Fed will have created a stagnating economy by its useless and excessive rate hikes, and we will face deflation by the normalization of those abnormal events that raised prices in the first place. So the deadly combination of stagnating economy and deflation – well THANKS Jerome, what tools do you have to fix that?

Hey, hey. Trump’s lawyers drop a novel argument on the 11th Circuit Court.

Recall that previously keyboard lawyer Rick “quite knowledgeable about legal matters actually” Stryker advances the brilliant legal loophole of wrapping a bag of cocaine in your tax return so that you can claim the evidence it “tainted” and must be thrown out. In Trump’s case, he claims to have stored his stolen Top Secret documents in the same box as privileged documents so the FBI has to give them all back.

Today the Trump lawyers have gone one step farther. They argued before the court that Trump had written privileged comments on the Top Secret documents so the FBI must give them all back. So here is the new legal loophole. Just write a note to your lawyer with a Sharpie on your bag of cocaine and you are home free.

I guess you get what you pay for, and in Trump’s case it is well known that he never pays his lawyers.

“They argued before the court that Trump had written privileged comments on the Top Secret documents so the FBI must give them all back. So here is the new legal loophole. Just write a note to your lawyer with a Sharpie on your bag of cocaine and you are home free.”

Most real lawyers are either laughing themselves silly at this stupidity or fretting that Team Trump has already destroyed our legal system.

My PC had been in the hands of the Geek Squad for a couple of days so just catching up. The adults at this Appeals Court just demolished that bimbo judge as well as all the BS from Ricky the incompetent TV lawyer.

In response to

Question 11: How likely do you think it is that the Fed will announce outright sales of mortgage backed

securities in 2022 or 2023?

over 50% of respondents indicated that it was unlikely. (21% Very unlikely; 42% Somewhat unlikely)

Odd. I would have thought that the Fed would want to radically trim the balance sheet. If for no other reason than to be ready for the next unanticipated economic downturn that calls for radically lower borrowing costs.

There is a widely touted view of monetary policy which holds that higher rates (smaller balance sheet) gives a central bank “room”, so that hiking rates (selling assets) or holding rates high in the initial phase of a slowdown is a good idea. I’m pretty sure Fed folk don’t believe that. Shrinking the balance sheet is a Fed goal because a large balance sheet isn’t part of “normal” policy. There is always room for balance sheet expansion as long as buying assets isn’t disruptive to market operation.

That would be a much smarter move than the rate hikes—but see, Erik, maybe you missed something important. Trimming down of Fed balance sheets is much harder on broker/dealer bankers than it is on “Joe Six-Pack”. So that tool is off the table from the get go. Georgetown Jerome still needs his revolving door job once he leaves the Fed. So that discussion of trimming the Fed balance sheet magically vanishes into the ether. Even at the perfect time to use that tool~~and pause/moderate rate hikes.

The recent noise about the potential for a Treasury liquidity shock suggests you are right. For example{

https://www.bloomberg.com/opinion/articles/2022-09-19/the-24-trillion-treasury-market-needs-more-than-just-clearing

https://markets.businessinsider.com/news/stocks/biggest-stock-market-risk-declining-liquidity-us-treasuries-housing-bubble-2022-9

Now, think about the combined effect of reduced liquidity and high rates on financial sector activity. Getting into trouble is easier. Getting out of trouble is more expensive. Loss fo colateral value in H1 was huge; nobody currently living has been through a decline in the value of safe assets or tonhe cost of funding on the scale experienced in H1, making mdeling and human judgement poor guides to risk.

The FOMC went ahead with a 75 bp hike today, with the median estimate for the terminal funds rate among policy makers noe 4.6% vs 3.8% at the June meeting. Market pricing was centered on a slightly lower termial rate ahead of today’s announcement, and still isn’t quite in agreement.

Today’s Fed Summary of Economic Projections (https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220921.htm) anticipated a peak in the inflation adjusted fed funds rate of 1.5% (based on the core PCE deflator). That is higher than in most of the period since the Great Recession.

The peak in the funds rate, nominal and inflation adjusted, is anticipated in 2023. The median unemployment rate estimate for 2023 is 4.4%, up from 3.8% for 2022. That strongly suggest that policy makers intend to continue hiking rates as the unemployment rate rises; in other words, policy will not be “forward looking”. In fact, the 0.6% rise anticipated in the jobless rate means, according to the Saym Rule, that policy makers anticipate recession while the Fed continues to hike rates.

The median 2024 estimates for the funds rate and core CPI imply an inflation-adjusted funds rate of 1.7%, with the nominal rate at 3.9%. In other words, the SEP suggest that policy will ease superficially, but tighten on an inflation-adjusted basis, through a recession.

I doubt the SEP represent the actual future of inflation or rates, but they do show policy makers willing to put aside forward looking policy and balance in pursuit of the 2% inflation target.

Reading the last part of the Business Insider article, an easily confused person such as myself might construe it as Bank of America arguing for socialism for private banks. If the American taxpayer told Bank of America and other TBTF banks “No, we will not provide you with welfare” would B of A tell us this was the demon version of their prior saintly “red lining”??

“We believe such an entity should be formed before a crisis requires it. A dealer of last resort could make markets in a wide range of cash securities, futures, swaps, equities, bonds, foreign exchange, commodities, just like large international dealers do today,” BofA said, adding that it should be structured as a government sponsored enterprise.”

Not only do B of A and TBTF bankers want an unlimited credit card from Daddy, they want Daddy to be a “government sponsored enterprise” so when they go on daily unlimited spending sprees they can blame Daddy, because Daddy= big government sponsored enterprise.

Moses, in the spirit of “risk adjusted return”, if the public pays to reduce risk for financial firms, the public ought to receive returns in excess of some risk-adjusted norm ..er.. in return. The argument for the public sector reducing financial sector risk must be that the public, not financial firms, benefits. That’s what financial firms argue, but they never include the part about paying the public for reducing risk to the firm.

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

All while Revolving Door Jerome sells his longterm inflation house of mirrors fears to the village idiots.

Wolf Richter: “The Fed Stopped Buying MBS…The Fed has said many times over the years that it wants to get rid of its MBS entirely, and that it wants only Treasury securities as assets. So if everything goes according to plan, the MBS balances will go to zero. And this might require that the Fed starts selling MBS outright later in the process to supplement the pass-through principal payments. The Fed has already put this option on the table.”

https://wolfstreet.com/2022/09/16/the-fed-stopped-buying-mbs-today/

The Russians are going to hold a referendum this weekend in occupied regions on whether those regions want to become officially Russian.

https://www.bbc.com/news/world-europe-62965998

That would seem like a silly thing to do, but to me it indicate that Putin finally has realized how problematic his situation is in Ukraine. He cannot get nearly enough people to go fight there no matter how many incentives, so he is losing more ground by the day. If the areas where they fight becomes “Russian”, then the story (in Russia) can move from “special military operation” to an attack on the Russian Motherland by Ukraine. That sounds insane, but think about the warped reality Fox news can install in the minds of their minions (and they have access to real fact-based news). That switch in narrative would make a partial or full general mobilization a lot more acceptable – almost mandatory. Putin must have realized that it is the only way to avoid a humiliating defeat – he needs massive amounts of troops.

I think Putin expect that winter will soon come and freeze the front lines where they are. Then he can use a general mobilization to make massive numbers of mobilized troops ready for battle over the winter, and then deploy them in the spring. The Duma has just passed new punishments for evading military service, disobeying orders, surrendering, etc – and also punishment for industry that fail to fulfill contracts for the military. Sounds like a “full speed ahead” on making military equipment and soldiers that are a little more than just warm bodies. Question is whether the West will help Ukraine match this winter buildup on the quality side (I doubt Ukraine can mobilize the same number of soldiers as Russia can). If this conflict continues then Ukraine will need to have weaponry that can match Russias in quantity and quality by spring.

Putin was supposed to give a talk on national TV – then in the last minute didn’t. This is like Trump level of disorganization and incompetence. Somethings happening.

“He cannot get nearly enough people to go fight there no matter how many incentives, so he is losing more ground by the day.”

True, but that seems like only part of the problem. Terrible and degrading training, logistics, equipment and command are *each* as much a problem, and they’re getting worse. Not that I disagree about how much we need to arm Ukraine. I’m just doubtful massive amounts of troops are actually enough to make gains. And pretty good bet they’ll only have massive amounts of troops on paper!

And that’s not even mentioning the political precariousness of anything that even looks like a general mobilization. Putin’s in terrible shape either way. He can’t please the ultra-right-wing that he’s whipped up, and if he tries, he’ll just piss off everyone else …

Things in turmoil there. Russian stock market fell over 9% today (now yesterday).

I’m curious if the U.S. State Dept has given any thought to who takes over the merry-go-round if Putin is shoved aside, how a leadership transition effects stability, and how it effects security of Russia’s nuclear arsenal. The obvious reply from State Dept officials might be “It couldn’t get any worse than Putin” to which my reply would be “wanna bet??”

I am not stating the Biden policy has been wrong, only the Biden State Dept. better be game-planning pretty hard here. Nothing “much”, just like 20 chess moves ahead and a mic/mole on every Kremlin floor.

Moses,

I have no inside info on this, but I would bet both CIA and DIA are working at least as hard as the State Dept on these possible alternatives. There certainly are at least some media commentators over there making really unpleasant super hawkish noises.

Two items I have just heard out of Moscow that I have seen nothing on in western media are 1) Supposedly there is a very large natural gas field in the Donbas that supposedly a contract was let with Shell and BP to develop under Yanukovich, but that is in the middle of areas of combat, a complicating factor in the combat, and 2) Also reportedly Tokayev in Kazakhstan has blocked several trains with stuff reexported from China for Russia so as not to violate sanctions, confirming that indeed Tokayev is super ticked off at Putin as several of us had reported in contrast with claims made by the infamous JohnH. Yes, this is a report out of Moscow.

Good news is that Biden is a long-term foreign policy expert so he is almost certainly playing out all possible scenarios (and a few crazy ones) with the standard “war-game” approach of “we do this, they do that, then we do …….”. That is why Biden is currently so careful and slow with giving Ukraine what they want. Probably every scenario where Ukraine beat the s*** out of Russia ends in a big boom. Further problems is that so far Putin has neither been rational nor competent – so he is much harder to predict than expected.

At ISW they suggested that the fake referendums, and soon to come declaration of eastern Ukraine to be part of Russia, is as much as anything, an attempt to get the Russian forces/people more enthusiastic about the war. It also removes some of the lawful restriction on Putin to mobilize and use forces that have not volunteered to go there.

The just declared partial mobilization will in theory be able to double the number of Russian soldiers in Ukraine. The big problem is that they may not really be effective as soldiers and it’s not clear that they can be equipped and trained as effective units. However, previously trained and discharged conscripts will be more effective than people taken from jails or kidnapped off the streets. The con-game of promising large sums for 3 months of non-combat service, then sending people to the front line and not paying them, is running out of steam.

A rational strategy would be for Putin to send enough of the reactivated soldiers to stop the loss of territory and dig in at current frontlines for the winter. Then use the winter break to train the rest of them into effective and well equipped units over the next 4 months. Unfortunately for him, the training “schools” have been sending most of their “faculty” to Ukraine, so its not clear how effective a retraining program they can establish. Even worse, he has been alienated from the professional Generals in the military and is now more likely to listen to right wing armchair generals and mercenaries from private corporate forces.

The west appears to be preparing to give Ukraine more modern western weapon systems and would be able to train them in effective use of these systems by the spring. So we will likely end up with a more bloody stalemate. Putin is expecting the West to fold when the winter begins to bite. That is another big mistake. He is a sociopath so he doesn’t understand how much the rape, plunder and torture of civilians motivate Europeans to make whatever sacrifices it takes to help put him back in his box. He is a classic racist – he overestimates his own people and underestimates those “low-life undermenschen” that oppose him. That de-nazification campaign of his may need to be turned 180 degrees.

Give me a break Rosser. It’s not like Tokayev has suddenly become a card carrying neocon, like you.

Report on Tokayev meeting with Putin in Sochi last month: “ The two leaders voiced solid optimism about the development of bilateral relations. According to Tokayev, the two countries “have every reason to be satisfied with the way the cooperation is developing.”

“Indeed, Kazakhstan and Russia have a strategic partnership. This year we celebrate a very big date – the 30th anniversary of the establishment of diplomatic relations,” said Tokayev during the meeting that lasted two and half hours.

https://theasiatoday.org/news/central-asia/president-tokayev-meets-vladimir-putin-in-sochi-to-intensify-bilateral-ties/

That said, Tokayev is in an awkward situation, what with Chevron being Kazakhstan’s largest foreign investor. And we know how oil companies behave overseas…

http://www.businessfor2030.org/blog/2020/10/26/chevrons-partnership-with-kazakhstan-fuels-economic-growth-and-community-development

Biden and talking heads using term “imperial” about Putin Russia

last night Putin made several references to usa/neocon plans to nation build 7 or 8 states out of imperial Russia

more nebulous than powell’s q&a

but with nukes

So, Russian stock market dropped another 10% after the announcement of the partial mobilization. Ruble down some also, although not dramatically so.

A detail not in the western media. Apparentlhy it had been announced Putin was going to speak for three hours, but in the end his speech was only 10 minutes, although Defense Minister Shjoigu’s followup with details of the mbiliation and assuming the referenda will all go Putin’s way took longer. But in fact Russian radio played Putin’s speech over and over many times, interrupting regular programming every 20 minutes or so to play it again. This is really like some bad old days.

There is so little in his speech that is defensible, but the ultimate hypocrisy has got to be his claim that the maeanie Ukrainians want to get back nuclear weapons that they gave up back in the early 90s, although there has been zero action on that front, just some whining by them about how they gave them up. But in fact this is or should be a flaiming reminder of how Russia is in total violation of the Budapest Accord that Russia signed along with Ukraine, the US, and the UK when Ukraine gave up its nuclear weapons. Yeah, Russia was supposed to respect the independence and territorial integrity of Uktaine for Ukraine giving up its nuclear weapons. Putin’s idiiotic claim is a flaming reminder of his total violation of that Accord.

Moses,

Curious thing – insiders often do worry that the next guy could be worse, no matter how bad the current guy is. Churchill passed on at least one opportunity to assassinate Hitler on that basis (Zigzag). “Better the devil we know” turns out to be a very strong strain of thought among those who have to deal with foreign leaders on a daily basis.

Intelligence agencies maintain extensive biographic data on foreign figures, major and minor, against the day when any one of them may occupy leadership positions. That way, if spooks get the succession wrong, at least they (hope to) know how to adjust quickly. There is a hard rule in diplomacy which aims at preparing for leadership change: stay in with the outs. “Kremlin watching” has many facets. So I’m pretty sure you’re getting your wish regarding preparation for Putin’s departure.

All of which reminds me of a wise line from “Casablanca”. Strasser tells Rick “We have a dossier on you.” Rick takes a look and responds “Are my eyes really blue?” All those biographical files serve little purpose if they don’t give policy makers a useful understanding of the subject.

@Ivan,

I agree strongly with everything — except what you say about Gramps. Let’s just say he has a mixed record when it comes to foreign policy. (Iraq War anyone? Afghanistan withdrawal before Sept 11th?) Though I very much appreciate that at least he’s trying to think constructively about American security and international peace, and has done a pretty good job with Ukraine.

@ Andrew G

Lets evaluate Biden on his performance as President. He got us out of Afghanistan on a disastrous surrender declaration and zero preparations left to him by Trump. He managed to get the pull out date moved to just before the Afghan winter. At that point he could either go for reoccupying Afghanistan or pull out of there. Anybody who want to argue for not leaving on the extended agreed upon date? He managed to get us out of there with only losing a mere 12 soldiers to a single incident by terrorists not under the command of Taliban. Anybody want to compare to the loses in the last 2 weeks of any other pulling out from a major occupation? Biden has done brilliantly as president in any and all foreign policy situation – in spite of all the sh** that Faux news is pumping out. Are there problems he cannot fix because of you know the constitution – sure he is President not dictator.

Ivan,

Speaking of Biden’s foreign polcy chops, his decision to reduce ambiguity regarding the U.S. position on Taiwan – stating outright that the U.S. would defend Taiwan from Chinese invasion – has produced the intended result. Ma Xiaoguang, Chana’s spokesman on Taiwan, has said China intends to re-unite with Taiwan through peaceful means. That may not represent a change in actual inent, but it is at least an improvement over recent Chinese saber-rattling.

JohnH

September 21, 2022 at 12:35 pm

tries to school someone (Barkley I think) with

“Tokayev is in an awkward situation, what with Chevron being Kazakhstan’s largest foreign investor. And we know how oil companies behave overseas”

But did he read the article he linked to. It seems Chevron owned only 50% of the oil company which may not be a controlling interest. And the article suggested that Chevron’s investment has benefited Kazakhstan. So WTF was the comment about how oil companies behave overseas?

Of course JohnH sort of embarrassed himself with claims about the Iraqi oil sector post 2003 have read only some reporters speculation in 2004, which she later rehashed at CNN.

I asked JohnH to read a couple of actual research papers which noted American oil multinationals did not get the great deals that Bush and Cheney told them they would.

Simple points: (a) nations can fight back against those greedy multinationals if they try; and (b) JohnH once again spouts off without doing real research.

“has said China intends to re-unite with Taiwan through peaceful means. ”

of course, this implies that they were once united. even ltr agrees that Taiwan is independent of mainland china. it would not re a re-unite. it would be an occupation of an independent nation.

JohnH,

You are out of date again, so give us all a break with your mirepresentations.

Since that Sochi meeting on Aug. 27, Kazakhstan has ceased all arms exports. That is a direct hit on Russia and Putin.

I doubt that Russia is capable of a ‘winter buildup’. They will be drained dry trying to support the existing troops on location, let alone training and supplying another 300,000 – if they can even get those. The very last thing Russia should want is to go into a winter in the predicament they are now in.

I think the strength of Putin’s personal power-through-intimidation will soon be severely tested. He may survive, but the type of pressure that we are accustomed to see in the western countries – open public and political protest – is not how it works in Russia. There, it will be behind the scenes until it suddenly breaks out.

Kevin Drum covers the dishonesty of one Cathy Latham who reminds me of our Usual Suspects. Yea – they lie to and then waste our time arguing over and over either it was the rest of us who are lying or blaming their lying on Joe Biden.

https://jabberwocking.com/election-fraud-its-always-republicans/

A Georgia Republican Party official named Cathy Latham, one of the “alternate” electors for Donald Trump, has testified that she had nothing to do with a bunch of tech experts hired by Big Lie lawyers who copied data from voting machines in Coffee County. Surveillance footage suggests otherwise, and new surveillance footage suggests really, really otherwise:

A Post examination found that elements of the account Latham gave in her deposition on the events of Jan. 6 and 7, 2021, appear to diverge from the footage and other evidence, including depositions and text messages.

In other words, she lied. Right? In response to questions from The Post, Latham’s lawyers said,

“Failing to accurately remember the details of events from almost two years ago is not lying.” They have said she did not take part in the copying or in anything improper or illegal. Latham says she was in the foyer of the Coffee County elections office for a few minutes and chatted with a couple of people. Surveillance footage shows that she visited twice, spent about four hours total, visited every part of the office, and finally took a selfie with one of the forensics experts.

That’s quite a memory lapse, no? You can make up your own mind, but if I were a juror in her inevitable perjury case, I’m pretty sure I’d go with “lie.”

Wolf Richter: “The Fed Stopped Buying MBS…The Fed has said many times over the years that it wants to get rid of its MBS entirely, and that it wants only Treasury securities as assets. So if everything goes according to plan, the MBS balances will go to zero. And this might require that the Fed starts selling MBS outright later in the process to supplement the pass-through principal payments. The Fed has already put this option on the table.”

https://wolfstreet.com/2022/09/16/the-fed-stopped-buying-mbs-today/

GDPNow: “Latest estimate: 0.3 percent — September 20, 2022”

https://www.atlantafed.org/cqer/research/gdpnow

At this point in the second quarter it was 0.0 percent. The latest BEA revision showed 2Q GDP at -0.6%

Not a big margin of error there. You have to admit that the probability of three consecutive quarters of negative growth in getting higher.

What will Biden-supporting economists do? I expect to see a flurry of positive numbers, largely disregarding the negative ones, Fortunately for them the first BEA estimate won’t come until days before the midterm elections, probably too late to affect the result. Saved by the bell?

Isn’t it amazing what happens when people feel a need to discredit a heretofore sacrosanct economic measure.

Your BFF Princeton Steve made a fool out of himself being a RECESSION CHEERLEADER so I guess you have to be one too. Oh well – maybe the two of you can start dating.

As I’ve said before, it doesn’t matter to me whether GDP growth is -0.5% or +0.5%. It’s all pretty much the same…pretty pathetic.

But I do enjoy watching the reaction of some economists, who just can’t seem to accept that it is what it is.

JohnH,

Meanwhile, private sector employment is at an all time high, and there are still about twice as many jobs available as unemployed, in short as hot a job market as we have ever seen. But you keep rattling on about “recession.”

Yeah, maybe next year, especially if Fed overdoes it. But we are back to GDP not measuring important parts of what is going on, even if you think it is super important. Voters will not, although they are upset about inflation. But that is a different ball game, even if you want to have them both going on.

Yeah, people like Rosser cherry pick the numbers to try to convince us “don’t worry, be happy.”

But the GDPNow numbers are what they are. And it’s very entertaining to watch “impartial scientists” constantly spin the numbers.

The bottom line is that the 3Q numbers may yet turn out to be positive…barely. And the “don’t worry, be happy” crowd will consider that to be a great success, when in fact it’s nothing to cheer.

https://www.bloomberg.com/news/articles/2022-08-25/key-us-growth-measures-diverge-complicating-recession-debate?leadSource=uverify%20wall

the professionals use the average of gdp and gdi when determining recession. those measurements may be positive for the last three quarters. and those measurements have been used for years. why does this information not impact you, comrade john? you have a kremlin narrative you would like to push?

JohnH,

Gross domestic output has been growing strongly. I think you are the on “cherry picking” numbers that are not all that important. People vote on employment, not inventory changes.

Yeah, right, Rosser. I cite GDPNow, so what you’re saying is that GDPNow cherry picks unimportant numbers!

In any case, what is happening is that you are trying to discredit the main economic growth measure that people refer to. Well, it’s just part of a broad trend to undermine the creditability of government statistics and government in general. Good job!

“Meanwhile, private sector employment is at an all time high, and there are still about twice as many jobs available as unemployed, in short as hot a job market as we have ever seen. ”

Well, we can’t have that, now can we? Next thing you know, people at the bottom will be wanting a living wage and we certainly can’t be having that, either, ‘cuz then we’ll all be stuck paying for it. The best thing here is to administer public pain and continue the beatings until morale improves – which is to say: until those upstarts lose those crazy ideas. Oh, sure, the stock market will drop but we all know that will rise again, wink, wink. A health-restoring recession is the thing – the Fed is the new doctor: and “A bleeding in spring is physik for a King”.

JohnH

September 21, 2022 at 5:13 am

Yeah, people like Rosser cherry pick the numbers to try to convince us “don’t worry, be happy.”

Sorry that I did not have the PC for a couple of days but JohnH has just told us some GDP forecast is more reliable than the actual GDP reporting. Yes – he has taken cherry picking to a whole new level.

Yet another JohnH moment: he’s incensed that Dr. Rosser’s comments are “…just part of a broad trend to undermine the credibility of government statistics and government in general.”

This from the same guy who said—in numerous posts — you can’t trust the media to show the truth, nor can you believe what the government says!

(While, of course when considering military information, actually advising we should always wait for verification from, who else, the Pentagon!).

Yes. Sun still rise in East. JohnH still speak with forked tongue.

noneconomist–as I have said repeatedly. It doesn’t really matter to me if GDP is barely positive or barely negative. And I don’t think most Americans care about it either. But for some reason unbeknownst to me, the recession deniers here are totally obsessed by it.

And I find it very amusing.

And, yes, I am doubtful of much of what the media and government report, particularly when it comes to foreign affairs. But I am not yet ready to cast doubt on statistics that government publishes…unlike the recession deniers here.

” It doesn’t really matter to me if GDP is barely positive or barely negative. And I don’t think most Americans care about it either.”

john, if that were true, then why do you constantly harp about negative numbers and recession?

Which means little. This data is made by by GDPnow and ignores important components like capex/real deflation impact in boosting purchases. Lets note actual GDP revisions are going to be larger than normal because of poor data inputs from 2020. In reality, GDP much like jobless claims, is a mess. I am still laughing at the “mythical” 3.2 contraction in exports in the 1st quarter. Its just bad data. The jobless claims mess this summer should tell you something.

GDPnow is too credit sensitive. A real flawed measure.

Who would be stupid enough to do this?

https://www.msn.com/en-us/news/technology/stop-cooking-chicken-in-nyquil-fda-begs-in-response-to-social-media-trend/ar-AA123Ajb

The US Food and Drug Administration is taking a bizarre trend seriously. It may seem like cooking up raw chicken in cough syrup is the stuff of nightmares, but videos purporting to do just that have appeared on TikTok. Last week, the FDA issued a warning over the misuse of medicines as inspired by social media videos. Nyquil, an over-the-counter cough and cold medication, is made up of a combination of acetaminophen, dextromethorphan and doxylamine to treat a buffet of symptoms. It’s not to be confused with a marinade.

Now cooking chicken in Nyquil but remember those MAGA hatters a couple of years ago were taking bleach as a remedy against COVID19.

Bruce Hall had his mom pick up some chicken which he plans to marinade in Nyquil before baking. Sorry but I’m not dropping by for dinner.

“cooking up raw chicken in cough syrup” <<—–High correlation with MAGA voter rolls.

I suspect Mark Meadows created this new cuisine while foraging in the White House kitchen in early November 2020, after donald trump threw the last half contents of a KFC bucket against the wall.

https://www.cnbc.com/2022/04/13/trump-white-house-aide-mark-meadows-removed-from-north-carolina-vote-rolls.html

Team Trump may have wanted Judge Raymond Dearie to be the Special Master but this is not going the way they had hoped:

https://www.msn.com/en-us/news/politics/special-master-expresses-skepticism-with-trump-team-s-assertions/ar-AA12274l?ocid=msedgdhp&pc=U531&cvid=9112b717cd464c6eb7616327a3ae7548

Judge Raymond Dearie pushed Trump’s lawyers repeatedly for refusing to back up the former president’s claim that he declassified the highly sensitive national security-related records discovered in his residence. “You can’t have your cake and eat it,” said Dearie, the “special master” picked by U.S. District Court Judge Aileen Cannon to vet Trump’s effort to reclaim the materials taken by federal investigators. Trump has argued that the 11,000 documents taken from Mar-a-Lago were rightfully in his possession, including about 100 bearing classification markings that suggest they contain some of the nation’s most closely guarded intelligence. But Dearie bristled at the effort by Trump’s lawyers to resist his request for proof that Trump actually attempted to declassify any of the 100 documents that the Justice Department recovered from his estate. Without evidence from Trump, Dearie said his only basis to judge the classification level of the records was the fact that they all bear markings designating them as highly sensitive national security secrets — including some that indicate they contain intelligence derived from human sources and foreign intercepts.

Calling Ricky Stryker. He needs to come to Brooklyn and argue the case. Not that he would do any better but I would pay money to watch Dearie trashed this pretend lawyer too.

Indeed, where is Rick Stryker, brother of Marvel villain Reverend/Colonel William Stryker? Genuinely curious about his take on this. I thought claimed declassification wasn’t going to feature prominently in Trump’s arguments?

pg13,

For once, we are in agreement. Trump’s lawyers really could use my help.

Unfortunately, Trump’s lawyers are making a losing argument. The whole point of Navy v Egan is that the court will not get involved in matters of classification unless there is a statute involved. If Trump’s lawyers are not willing to make an argument that the docs aren’t currently classified, Deary is forced by precedent to defer to the current Administration on what is classified or not. The current Administration says the docs are classified. Judge Deary’s position is correct in my view.

Since AndrewG asked for my learned opinion, let me give it. That Trump’s lawyers are not willing to assert de-classification at this point tells us something–it’s not a simple clear cut de-classification case. If, for example, the classified docs were Trump’s schedule when he met with Kim, that would have been highly classified at the time but de-classified now in essence (if not in fact) because his schedule is now common knowledge. Or if the classified info were Crossfire Hurricane or related docs, that would be easy too: Trump very publicly de-classified them. So, given that Trump’s lawyers don’t want to make an argument at this point, the docs must be something else and the legal argument must be more complicated. I think Trump’s team is right not to reveal that argument to the DOJ at this point.

So what should Trump’s lawyers be doing? I think they need to give Deary something he can rule on, and more importantly, something that can be appealed if Deary rules against them. To get around Navy v Egan and its requirement for a statute, they should bring up the PRA and the precedent set by Judicial Watch v NARA. The PRA does not distinguish between classified and unclassified docs and is unenforceable. Trump’s lawyers should argue that a former President is different from every other citizen in that he is covered by the PRA and is therefore permitted to keep copies of his records, classified or not. As Judicial Watch v NARA showed, Congress provided no enforcement mechanism to override a President’s decision on what he wants to keep. Morever, classification is a red herring since the statutes that the government used to seize Trump’s docs do not mention classified docs. That’s a legal position that Deary would have to consider and rule on.

Deary may well rule against Trump. He is a national security judge after all who signed one of the Carter Page warrants. But Trump’s lawyers have to also understand that the politics is more important than the law in this case. Trump’s goal should be to raise all the novel legal questions the DOJ raid raised and then keep appealing and keep delaying, until Trump announces his run for President and becomes the nominee. Trump’s announced campaign strategy is to reign in the deep state, which he argues has run amok. Trump can then dare the Biden Administration to indict their political opponent whose message is that the deep state is out of control.

The DOJ is in a hurry, because if the are going to indict Trump, they need to do it before he announces. But once Trump is the nominee, if the DOJ attempts to strike Trump down with an indictment, he will become more powerful than they can possibly imagine.

Rick, I don’t care what anyone says, you would have made a better lawyer for Jeffrey Epstein than Alan Dershowitz. Certainly your moral compass is in the right range.

Rick,

On Lawrence O’Donnell this evening, Laurence Tribe, made a forecast that in fact as a result of the day’s proceedings over classification, It is now almost inevitable that Garland will indict Trump on the Espipnage Act, which, it should be noted, was invoked in the original search warrant, with Dearie apparently making a fuss over why this matter was sent to him rather than being dealt with in Reinhart’s court where the search warrant was issued.

But but but Ricky wants us to believe this is only about PRA.. yea his whole is based on lying

Barkley,

I don’t believe you can trust anything Tribe says about Trump. Remember Tribe claimed on CNN that Trump was guilty of attempted murder of Pence. When pressed by the CNN host whether Garland would charge Trump with that crime he said no. Why not though? If Trump is so clearly guilty as Tribe alleged, why wouldn’t Trump be charged. Tribe knows why—because it’s an absurd charge and Tribe knows it.

Tribe is unhinged where Trump is concerned. If they charge Trump at all, it will be an obstruction charge.

“John Marshall,

So, you admit Tribe was accurate that Garland woulf not indict Trump for attempting to murder Pence, which there is a pretty strong case that he did, much as that may annoy you.

This is the first time Tribe has outright said Garland will indict, and indeed it is on the item you keep ignoring, his massive violation of the Espionage Act. Yeah, he is in violation of the PRA, but you are right there is no punishment for breaking that one. But that really sets him up on the Espionage Act, especially given that he pretty clearly never declassified any of that stuff when he legally could have.

You trust Trump and his team of lying scumbag lawyers but not Tribe? I would pay for a podcast of you debating Tribe on these matters. He would mop the floor within the first 2 minutes.

You finally got Navy v Egan.. About time

5 long paragraphs without a single substantive point whatsoever. Amazing

More powerful than they can possibly imagine…

Seig heil, mine fueher?

Followed by a rousing rendition of “Deutschland, Deutschland”

Have you considered changing your name to nonculturallyliterate? I’ve never seen anyone miss this allusion. Maybe you’ve been off the grid for the last half century?

Hit a nerve, did I? Please, while I continue chuckling at your increasingly exposed vanity, give me advice on names.

You fancy yourself to be Obi One? Oh come dude – you could not make it in the porn sector.

“Since AndrewG asked for my learned opinion, let me give it. That Trump’s lawyers are not willing to assert de-classification at this point tells us something–it’s not a simple clear cut de-classification case.”

While I appreciate your thorough response, I am having a hard time buying that assessment. What about the Israeli nuclear program falls under any of the categories you mention? Do you really think Trump and his staff are careful enough to have chosen *just* the documents with a cover page that just happen to be in this legal grey area? And why would they do that anyway? What is the reasonable, non-illegal story about why Trump would have any of these documents in the first place even if they *were* in the legal grey area?

There’s a much easier story, one hinted at by Deary: If Trump’s lawyers assert declassification, they’re screwed, because there is zero evidence of declassification, and Trump is simply guilty.

You throw shade at anyone who has even sneezed in the direction of Trump, typical of someone who thinks the world is divided perfectly into pro-Trump and anti-Trump camps. But you never seem to consider Trump’s long and very public record of baseness, criminality and stupidity, things very obvious to *everyone who is not a Trump die-hard.* (Trump University? Blackmailing Zelenskyy? Pressuring election officials to cough up fake votes? Does none of this ring a bell?)

Is it not possible that he’s simply guilty of stealing secret documents, as seems highly plausible on the face of things?

Here’s the problem. You are focusing on facts. It seems in Ricky MAGA legal LALA land, facts do not matter.

I haven’t read all of this, but have a feeling there are excerpts of this that are frightening. I’m gonna be curious to see if Professor Chinn will have anything to share with us on this in the future via personal experiences.

https://www.wsj.com/articles/in-wisconsin-election-skeptics-deploy-as-poll-watchers-for-midterms-11663579802?mod=hp_listc_pos1

Thanks JohnH.

I do remember the stated intention to get rid of all the MBS. More reason to find the survey forecast that the Fed was unlikely to announce sales of MBS odd.

————————–

Moses: Thanks. I shake my head in disbelief that the Fed was growing the balance sheet up until April of this year. Is this the corrosive and risky employment mandate at work, or is the Fed far more politicized than most of us would care to recognize?

@ Erik Poole

Well as a “more well-versed than typical Joe Six-Pack” but non-expert, my thought on it is thus~~the Fed gets “locked into” their LSAPs “pre-announced schedules” in the name of (the purpose) being predictable to the broad market. I think this is a mistake. I think one way they could fight inflation and keep rates more steady is by doing “portfolio runoff”.

It’s my opinion that the Fed (currently) is not very “politicized” but perhaps most Fed Reserve officials are too cozy with the big bankers broker/dealers. It’s my personal belief, that regulatory capture is a much bigger problem for the Federal Reserve, than “politicization” (if we are defining “politicization” along left/right party lines.)

I suspect Erik, you are more to the right politically and more “pro-rate hikes” than I am (currently). But we can save that quarrel for another day.

Yes. A thousand times.

“…the corrosive and risky employment mandate…”

Question begging in all it’s glory. Assumes facts not in evidence.

How, exactly is the employment mandate corrosive or risky? Not some theory or other. What evidence is there of the employment mandate corroding anything or creating undue risk in the past 30 years?

Actually looking at the Feds actions it appears that they have always been a lot more aggressive with their inflation mandate than their employment mandate. I can think of no other time in the past 50 years where you could argue that they had favored employment over inflation control. I would not blame them for having been cautious with a deadly pandemic shock and a unpredictable huge war in Europe – that they have not been able to balance the mandates well. For those Wall Street types who want the Fed to be exclusively in their service and let the little people suffer from unemployment so their own portfolios will not be “threatened” by a few years of high single digit inflation – I suggest their self serving self-pity should be taken for what it is. A couple of years of 5-10% inflation combined with labor shortages is exactly what their country need to grow the consumer class and the economy.

It’s just more complicated than that – and your conspiracy theory about “Wall Street types” doesn’t help understanding at all. (High inflation hurts the poor more than anyone. All one has to do to realize this is consider the fraction of their income spent on necessities.)

If the Fed were indeed biased in favor of the inflation part of their two-part mandate, might we not have that bias to thank in part for the Great Moderation (low inflation *and* higher growth)? Or do you think the Great Moderation would have been *even better* with a greater emphasis on employment (also a reasonable suggestion)?

“they have always been a lot more aggressive with their inflation mandate”

The Fed board of 2021, including the doves, disagrees with you. If they could go back and be more hawkish, they would. And “always” most certainly doesn’t include the 60’s and 70’s.

And while I would hardly consider the employment part of the dual mandate “corrosive”, there is an argument – also reasonable in my opinion – that central banks can focus on inflation targets without considering employment explicitly (or while subordinating employment), and still provide many if not all the benefits of the Great Moderation. Inflation contains important information about the health of the economy, and high inflation is highly corrosive to economic wellbeing – yes, for everyone. High inflation also risks becoming self-catalyzing.

Could it hurt to add explicit consideration about employment? I don’t think so personally, but it may not help as much as you suggest. The Bank of England’s mandate on employment and growth is a recent addition (AFAIK since the GFC) and is of secondary, not primary, importance. Japan and the ECB also don’t have a dual mandate. Reasonable people can disagree about whether they’re interpreting the inflation signals correctly.

High inflation with stagnating wages is bad for the poor. High inflation with even higher wage increases is good.

If the measures to “contain” inflation are suppressive for wages then higher inflation can quickly become the lesser of two evils. It is always about the differential between inflation and wage increases.

Sure Wall Street has always pretended that their concern about inflation is because they care about the little guy – that is just pure BS. They love inflation fighting because it depress wages and increase profits.

systems engineer would ask: between employment and price stability which is an object to be maximized as employment, or minimized as to inflation? a which is a constraint to the objective.

the choice effects the decisions

jpowell continues to signal the object is minimize inflation

and the subject to is expendable

central bankers are not engineers, but jpowell seems to know when a constraint is not sacred

can the fed retire $30b in mbs each month

if so no need for auctioning them

Stryker: “The DOJ is in a hurry, because if the are going to indict Trump, they need to do it before he announces.”

Rick “quite knowledgeable about legal matters actually” Stryker has come up with yet another novel defense. The “you-can”t-touch-me-cause-I’m-a candidate” loophole.

So all the other defenses fail and they’ve got you dead to rights with the bag of cocaine but you declare “Freeze tag! I’m running for mayor” and it all goes away. Brilliant!

worked for hunter biden laptop

The “loophole” also requires a very convoluted theory of politics: if a candidate gets indicted, that’s a *good* thing. Zero reference to GOP candidates scrubbing their campaign of Trump in light of the FBI warrant execution. Gee, maybe the story is simpler than that?

https://www.nytimes.com/2022/09/20/us/politics/covid-data-outbreaks.html

September 20, 2022

‘Very Harmful’ Lack of Data Blunts U.S. Response to Outbreaks

Major data gaps, the result of decades of underinvestment in public health, have undercut the government response to the coronavirus and now to monkeypox.

By Sharon LaFraniere

ANCHORAGE — After a middle-aged woman tested positive for Covid-19 in January at her workplace in Fairbanks, public health workers sought answers to questions vital to understanding how the virus was spreading in Alaska’s rugged interior.

The woman, they learned, had underlying conditions and had not been vaccinated. She had been hospitalized but had recovered. Alaska and many other states have routinely collected that kind of information about people who test positive for the virus. Part of the goal is to paint a detailed picture of how one of the worst scourges in American history evolves and continues to kill hundreds of people daily, despite determined efforts to stop it.

But most of the information about the Fairbanks woman — and tens of millions more infected Americans — remains effectively lost to state and federal epidemiologists. Decades of underinvestment in public health information systems has crippled efforts to understand the pandemic, stranding crucial data in incompatible data systems so outmoded that information often must be repeatedly typed in by hand. The data failure, a salient lesson of a pandemic that has killed more than one million Americans, will be expensive and time-consuming to fix.

The precise cost in needless illness and death cannot be quantified. The nation’s comparatively low vaccination rate is clearly a major factor in why the United States has recorded the highest Covid death rate among large, wealthy nations. But federal experts are certain that the lack of comprehensive, timely data has also exacted a heavy toll.

“It has been very harmful to our response,” said Dr. Ashish K. Jha, who leads the White House effort to control the pandemic. “It’s made it much harder to respond quickly.”

Details of the Fairbanks woman’s case were scattered among multiple state databases, none of which connect easily to the others, much less to the Centers for Disease Control and Prevention, the federal agency in charge of tracking the virus. Nine months after she fell ill, her information was largely useless to epidemiologists because it was impossible to synthesize most of it with data on the roughly 300,000 other Alaskans and the 95 million-plus other Americans who have gotten Covid.

Those same antiquated data systems are now hampering the response to the monkeypox outbreak. Once again, state and federal officials are losing time trying to retrieve information from a digital pipeline riddled with huge holes and obstacles.

“We can’t be in a position where we have to do this for every disease and every outbreak,” Dr. Rochelle P. Walensky, the C.D.C. director, said in an interview. “If we have to reinvent the wheel every time we have an outbreak, we will always be months behind.”

A Covid Data Pipeline Riddled With Holes and Obstacles …

America BAD

https://www.nytimes.com/2022/09/19/us/politics/biden-covid-pandemic-over.html

September 20, 2022

Biden Says the Pandemic Is Over. But at Least 400 People Are Dying Daily.

The president made the remark in an interview that aired on CBS’s “60 Minutes” on Sunday night. By Monday, the backlash was in full swing.

By Sheryl Gay Stolberg

WASHINGTON — With 400 to 500 Americans still dying every day of Covid-19, President Biden has declared that “the pandemic is over.”

But don’t tell that to people like Debra McCoskey-Reisert, whose mother died in early August. Or Ben HsuBorger, who has chronic fatigue syndrome, a condition often brought on by viruses, including the coronavirus. Or Peter W. Goodman, whose wife died on Aug. 17.

“It’s not over for me,” said a tearful Mr. Goodman, 76, who is retired after working as a journalism professor at Hofstra University on Long Island. Both he and his wife, Debbie, 70, became sick with Covid-19 last month. He recovered. She did not.

The president made the remarks while speaking in an interview that aired on CBS’s “60 Minutes” on Sunday night. By Monday morning, the backlash was in full swing — as patients said the president was being insensitive at best, and some public health experts said his words were at odds with the science.

“We’ve had two million cases reported over the last 28 days, and we know underreporting is substantial,” said Dr. Michael T. Osterholm, an infectious-disease specialist at the University of Minnesota. Covid-19, he said, “continues to be the No. 4 cause of death in the country.”

In the “60 Minutes” interview, which was taped during the Detroit Auto Show last week, Mr. Biden did allow that “we still have a problem with Covid.” But he also gave a nod to the unmasked crowds at the show.

“The pandemic is over,” he said. “If you notice, no one’s wearing masks. Everybody seems to be in pretty good shape.” …

Wrong. It’s under 400 a day. At least be honest……and falling

America BAD, part deux.

https://www.nytimes.com/2022/09/19/us/politics/biden-covid-pandemic-over.html

September 20, 2022

Biden Says the Pandemic Is Over. But at Least 400 People Are Dying Daily.

The president made the remark in an interview that aired on CBS’s “60 Minutes” on Sunday night. By Monday, the backlash was in full swing.

By Sheryl Gay Stolberg

WASHINGTON — With 400 to 500 Americans still dying every day of Covid-19, President Biden has declared that “the pandemic is over.”

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

November 15, 2022

Change in Child COVID-19 Cases

60,299 child COVID-19 cases were reported the past week from 9/8/22-9/15/22 (14,622,533 to 14,682,832) and children represented 18.5% (60,299 / 325,243) of the weekly reported cases

American Academy of Pediatrics

Children’s Hospital Association

The decision to go with 75bp and a hawkish outlook has seriously increased the risk that the Fed will dump us below 0% growth in 1st quarter of 2023.

Now that you mention it, yes:

https://fred.stlouisfed.org/graph/?g=TXJv

Either way you look at it.

The implied risk in the rate spread is entirely understandable, but not welcome. We have a housing shortage. Inducing risk in the sector does nothing to cure the underlying problem. Given that housing is increasingly “the” source of inflation overshoot, a policy which will leave housing in short supply seems kinda counter-productive.

Unfortunately the Fed seem to use old models build for usual economic situations to try and develop policies for the very unusual economy we currently are suffering under. None of those old outdated models and economic correlations are at play today. Current inflation is driven by world wide broken supply chains and a war driven explosion in world wide hydrocarbon prices. Actions of the US Federal Reserve Bank will have minimal effects on these world wide problems (sorry US isn’t THAT big and important). What we are now observing is the Fed taking actions that will for certain stifle US economic growth (possibly dump us into a recession), but only have a marginal effect on the inflation problems that they use to justify such stupid actions. I guess it was too much to expect them to wait and not do something stupid.

Maybe, but as inflation keeps not growing, the feds political will be tested. Yry inflation will be pretty down by January. Cannot wait for Putin’s March-June to leave. Will inflation be positive at all??? You also have to ask, will real consumer spending accelerate due to the price drops???

I had argued for a 50 bp increase. my feeling is 75 or higher will result in negative economic performance. 50 bp would continue to buy time for supply chain issues without tanking the economy. I expect a recession in 2023. how severe will be up to the fed. this is why I asked if the fed has ever made rate changes between meetings. we skip October. action may be needed before the next fed meeting in November.

Yeah, right, Rosser. I cite GDPNow, so what you’re saying is that GDPNow cherry picks unimportant numbers!

In any case, what is happening is that you are trying to discredit the main economic growth measure that people refer to. Well, it’s just part of a broad trend to undermine the creditability of government statistics and government in general. Good job!

They do. It’s a guess. I never understood why that lark ever got respect by stats geeks.

There he goes again. Forecasts of an event are more reliable than actual observations of that event. As far as this charge:

it’s just part of a broad trend to undermine the creditability of government statistics and government in general.

Barkley is in no way doing that. But you do this all the time.

JohnH,

Sorry, but GDPNow is NOT “the main economic growth measure people refer to.” It is in fact quite obscure. Good for odd cherry picking by you.

OMG. The misrepresentation of what I say is astounding. I never said that GDPNow is the statistic that is the preeminent benchmark economic growth.

But GDP is traditionally the most important reference point. And what the recession deniers have been doing for the past few months is to cast doubt on its accuracy and relevance. Essentially they have been trying to move the goal posts by dragging up all sorts of other measures to show that there is no recession, that GDP is not the best measure.

Well, that’s exactly what Republicans want…for people to doubt government and the information is publishes.

gdi should equal gdp. and gdi has not shown a recession in the data. so either gdi is double counting income somewhere, or gdp is not counting product somewhere. which do you think is most likely occurring? I would guess gdp is where the miscalculation occurs. so this means gdp should be higher than what we see in the data, today. in light of this, John, you still want to stand with your gdp argument?

Why do you lie about your own damn comments. Barkley puts up the actual record (not forecasts) of national income and you try to mock him for downgrading GDPNow? You are not only a disgusting liar – you are a total waste of time. Look you pollute Mark Thoma’s place way too long and it disappeared. Are you trying to pollute this blog too? Well – you are doing just that.

Hysterical laughter after JohnH bemoans lack of trust in government and in government statistics.

Yes, same John H who has repeatedly said you can’t trust anything the government says or does.

I think JohnH wants to surpass Donald Trump in serial dishonesty.

The Federal Reserve’s SEP from its September meeting shows range of RGDP estimates for 2022 of 0.0%–0.5% and 2023 estimates range from -0.3%–1.9%. The details suggest a single participant expects the negative growth in 2023.

Your point?

Seriously? This thread is about forecasts of recession. That a Fed official is officially forecasting negative growth for 2023 Q4/Q4 real gdp isn’t germane? It isn’t surprising? If you’re unable to connect the dots you seriously should quack off, duck.

The problem is they are using flawed government data. 2020 is going to be a thorn in their side. Look at the jobless claims mess.

Econned

As a person on the extreme right you should be celebrating the Fed’s rate hikes~~they’re going to deliver a completely unnecessary recession to Republicans on a silver platter for them to campaign against President Biden on. Why don’t you just start dancing in the streets and skip boring us here.

If I were an extremist Republican like you “Econned” (I said IF), the most humorous part to me about this entire sh*tshow from the Federal Reserve would be watching left-leaning economists such as Krugman and Chinn making the most muted/dainty forms of protest against these brainless rate hikes, at the same time I imagine they are already trying to think up what rationalizations they will come up with 2023 for why Powell’s unnecessary rate hikes are/were “pure genius” so they can get their next free trip to Jackson Hole or “consultant” “visiting scholar” to the Fed subservient contractor’s fee.

You know, I’m sorry, it always makes me uncomfortable and awkward disagreeing with Menzie, but these rate hikes are asinine, and I’m not going to hide my feelings about it. Absolutely asinine

j zanfino, perhaps he simply mistook your comment for humor? sometimes you attempt it unsuccessfully here.

Could be. Glad I cleared it up. Thanks.

Your unwillingness to say what you actually mean strikes me as intellectual cowardice. You hint, rather than say, in order to maintain deniability. All I did was ask for clarification, and you threw a tantum. Can’t take the heat?

And no, it isn’t surprising. That forcast is within the range of professional forecasts. It would be surprising if no Fed policy maker was willing to forecast recession.

What the macroduck are you taking about??? That you couldn’t deduce the painfully obvious is intellectual failure on your part. “Maintain deniability” of what???? It isn’t my forecast. How’d I “throw a tantrum” by telling you that you need to quack off??? Talk about not being able to take the heat. Good grief, pal.