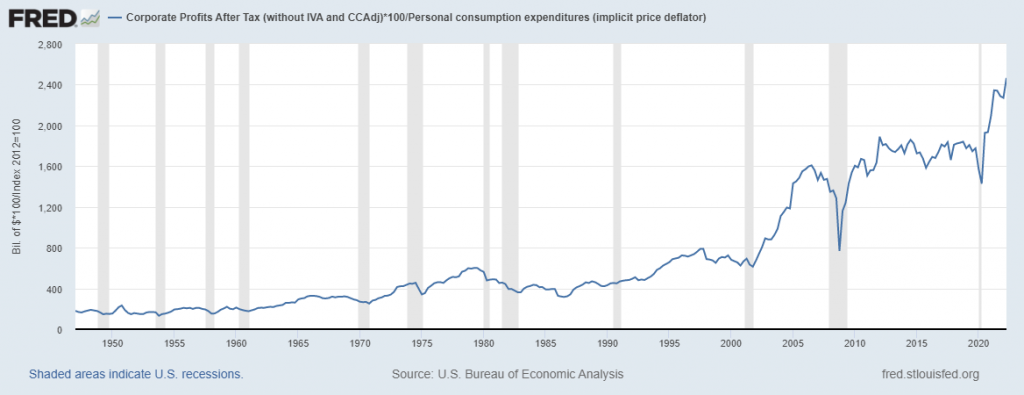

A (conspiracy-minded) reader writes: “Where is this being reported? Heck FRED doesn’t even graph real corporate profit growth. Shhhhh!”. But all one has to do is search for “corporate profits” (5 seconds) and then an appropriate deflator. I use the PCE deflator, and I get the following graph in FRED, which I download:

The URL for this graph is here.

Let me just say, FRED is unambiguously awesome.

By the way, this same commentator earlier asserted the government did not present median real wage or income data in a timely and/or accurate manner.

https://fred.stlouisfed.org/graph/?g=mQUa

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2000-2018

(Indexed to 2000)

Decline in labor share of income:

93.5 – 100 = – 6.5%

Increase in real profits:

270.2 – 100 = 170.2%

https://fred.stlouisfed.org/graph/?g=sC7n

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2007-2018

(Indexed to 2007)

Decline in labor share of income:

99.2 – 100 = – 0.8%

Increase in real profits:

165.2 – 100 = 65.2%

https://fred.stlouisfed.org/graph/?g=EqSq

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate

Profits, 2017-2018

(Indexed to 2017)

Increase in labor share of income:

105.1 – 100 = 5.1%

Increase in real profits:

123.5 – 100 = 23.5%

Definitely thread worthy!!! Phenomenal insights from Menzie!

Econned,

Wow! You have nailed egomaniac Menzie yet again. How dare he humiliate commentators by showing just how supremely idiotic things they post here are, how dare he?!?!

“Barkley Rosser”,

Agreed!

Are you that dumb? He was mocking you – for obvious reasons.

Yes, it does appear that he is that dumb.

My lack of respect for “Econned” is well documented here. Utter worthless scum.

Sorry, “Econned,” boy. You are far beyond any redemption or excuse for your totally worthless posts here.

Either make actually substantial comments here, or just get lost, and I mean for good. You are totally worthless garbage, as far as I am concerned..

You folks are hilarious. 😉

CoRev

September 24, 2022 at 4:42 am

OK – I will admit Econned is not nearly as dumb and worthless as CoRev. Hey CoRev – did you have a point? Oh never mind, you never do.

“Barkley Rosser”,

The lack of respect is 100% reciprocal. It’s strange that you’re so infatuated with me.

Either make actually substantial comments here, or just get lost, and I mean for good. You are totally worthless garbage, as far as I am concerned..

As far as I am concerned, encouraging readers to find direct sources of data, instead of counting on TV, radio and half-a$$ed news reporting to spoonfeed them is very post upload worthy. Verifying accurate info and doing your own homework is a large part of being a responsible citizen/voter. Why bother getting a college education if all you’re going to do is reflexively believe everything Sheryl Attkisson tells you this week??

Good point. My history with Econned got started when I asked this arrogant but worthless troll to do a better job at noting his souirces of data. My Lord how he went off at such a simple request. But yea – he is a professional jerk.

Have you ever read a single comment from the Village Idiot named JohnH? You certainly have not pointed out that he clearly is a MORON. Then again – you are dumb enough to think he has a point.

I am sorry j zanfino, but once again it is not clear. are you attempting humor or not?

Econned: Thank you! I appreciate your comment, as you are aware that your approbation is very important to me. Thank you, once again, for your insightful and useful comment.

Menzie Chinn,

Your comment is certainly ample acknowledgement proving out that you do, in fact, care about my comments. As always, I’m happy to help keep your ego in check and I appreciate your acknowledgment of my efforts.

j zanfino, this one must certainly be your attempt at humor. nobody would be stoopid enough to actually believe what you wrote, right?

Econned,

Once again you show what a piece of worthless garbage you are.

So, boy, just how big is your ego? It is a truism that something people accuse others of is their problem. So, boy, just how big is your ego?

Of course we all understand that in fact you have nothing to back up all your complaints about Menzie, The worthless “Rick Stryker” at least claims to have produced “models” that have made money for corporations. Can you make such a claim?

Of course I am sure you cannot produce what some of us here who actually go by our own names do, which is to have, yeah well , how boring, you know the academic bottom line, which I was reminded of by an academic committee meeting earlier today, you know, those darned Google Scholar Citations. Some of us here, who are here under own names, have them, even poor old beaten-up-on Steven Kopits, although he has only a small number, I think like less than 100. But Jim Hamilton, and Menzie, and even me, well behind them, have like thousands of those bottom line suckers..

How many Google Scholar citations do you have “Econned,”? I suspect the answer is ZERO. Go away, you worthless hypocritical scum.

“Barkley Rosser”,

There is no denying Menzie’s ego and you have certainly provided zero meaningful support of any claim that Menzie’s posts aren’t driven by is ego. Your lack of reason an objective commentary is absolute garbage. It is quite simple – no one who is a marginally decent ‘teacher’ would create the posts that Menzie thrives upon. He could simply correct the comment in the thread using a basic link. That’s the proper approach. I can only assume Menzie is a horrible instructor – his public persona doesn’t provide any evidence otherwise.

Sorry, Econned, but are you a teacher? Do you know anything about it? I doubt it, along with, of course, having zero publications and zero GS citations. You are a worthless zero.

I know Menzie and so that is how I know he is not an egomaniac, and as already stated, I am one so I know who is one. He is not.

How about commenting on substance of threads here rather than continuing with this personalistic garbage? What a worthless sicko.

econned, ie j zanfino, why do you have such jealously of prof chinn? your arguments against him are speculation, not supported by any factual evidence. in fact, the evidence is strong that prof chinn is a very valued educator. perhaps you have simply been miseducated on the topic? as you have demonstrated repeatedly here, you are miseducated on other topics as well. why do you continuously come onto this blog to try and tear down somebody else? why do you continue to seek such attention? your public persona indicates you are a sad and lonely person searching for attention. you even create multiple personalities on this blog in order to further your agenda. sad.

Uh oh. Menzie has now given you an excuse for making further comments here?

Actually, you are not a complete idiot. You are way more intelligent than say CoRev or “Anonymous,” who is so stupid he adopted that as his fake name, sheez, duh. You have on occasion made serious intellectual comments here, although by my estimate those have amounted to about 10% of your posts, give or take a couple of percents.

Sorry, “Econned,” but Menzie is being nice, or at least diplomatic with you. For about the umpteenth time I shall note that I actually know the guy, and for the umpteenth time, I shall reiterate that he is not an egomaniac, for from it. I am an egomaniac, as has been pointed out by such “experts” as Moses Herzog, and so as they say it takes one to know one; So I can say Menzie is not one.

Really, Econned, I think you could make positive contributions here. I do not think you are the “extremist far right” person that Moses Herzog claims you are, although you are probably more on the right side of the political spectrum than the left, la de da. I get you are a bit more complicated and even maybe “sophisticated” than say how Moses views you. So, how about you show us that side of you, the intelligent and knowledgeable side, rather than the far below third rate “psychologist” making your false claims about Menzie’s supposed ego, which every post you make on this makes you look like a totally worthless moron, which you may be, although I continue to think that maybe somewhere hidden beneath your so many utterly disgusting and idiotic posts there may be someone who might actually be able to make some worthwhile comments here that might actually enhance understanding of the difficult issues we face in this world, other than degrading yourself with your misguided and lost attempts to somehow “correct” Menzie for his supposedly excessive “ego.”

Really, “Econned,” you have an opportunity here, as I think you actually have some intelligence and knowledge, in contrast to some of our other regulars here, to make some serious commentary on actual world historically important issues, as opposed to fako psycho “analysis.”

.

“Barkley Rosser”,

I’m impressed you’re able to keep a faculty position. Your incoherent ramblings remind me of an serial killer. Your manifesto will be interesting- not to me or 99.99% of the populace but to those concerned with the ailing elderly senile population. We should really provide better support to your kind. All the best!!!

Econned,

Ah yes, joining Moses again in the Barkley Rosser is senile meme. Sorry, but in fact I have recently taken to writing a column for the local newspaper in Harrisonburg. Lots of people seem to like it, and nobody is asking me to leave my position. You are in fantasy land.

I remind you that you were invited to participate in the seminar that Menzie Chinn presented last spring at JMU that I hosted, as well as that by Nobel Prize winner Vernon Smith. I even noted that you could show up to inform everybody about how I am senile and should not hold my position. But you declined to do so, preferring to make your charges here behind your stupid fake name.

I have John List coming in as seminar speaker in a few weeks. Want to show up then and inform everybody of your great and brillians insights here, Mr. Fake Psychologist? I am sure John will be really impressed.

“Barkley Rosser”,

Economist. Newspaper. Harrisonburg. Nobel.

Hahahahahhaa, and on top of your hilarious Trump-like attempt to save face, you’re name dropping yet again???You make it far too easy. Thanks for the entertainment.

“Barkley Rosser”,

Are you getting yuuuge numbers on that column? I’m sure all the best people like your column. The words you write are probably the best words. Only the best laureates come to your seminars. And the best List to top all of the lists.

Keep ‘em coming, “Barkley”!!!!

Look, Econned boy, I can drop the names legitimately. Do you know any Nobel Prize winning economists well enough to invite them to present a seminar and have them accept the invitation.

No, I did not thinks so. What a loser.

“Barkley Rosser”,

Here’s your daily test… Please Repeat after me: “Economist. Seminar. Nobel. Invitation.” In that order.

😉 Yup! You’re included, Menzie. You folks are hilarious.

WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER!

Just more barking from the dog chasing its own tail!!!!

Yeah, CoRev really is dumber than Econned. The latter is just more screwed up and sick.

Yup! Still laughing out loud.

https://fred.stlouisfed.org/graph/?g=mlWp

January 15, 2018

Real Median Weekly Earnings, * 2000-2022

* All full time wage and salary workers

(Percent change)

https://fred.stlouisfed.org/graph/?g=mlWs

January 15, 2018

Real Median Weekly Earnings, * 2000-2022

* All full time wage and salary workers

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=rAbi

January 15, 2018

Real Median Weekly Earnings for men and women, * 2000-2022

* Full time wage and salary workers

https://fred.stlouisfed.org/graph/?g=T82W

January 15, 2018

Real Median Weekly Earnings for White, Black and Hispanic, * 2000-2022

* Full time wage and salary workers

It’s apparently a mystery to at least one commenter here that FRED publishes existing data series, rather than making up data series by mixing and matching. Mixing and matching is left to users, depending, of course, on the user’s own level of knowledge and initiative.

I doubt, though, that Johnny ever cares whether his criticism is valid. His goal is to criticize, without regard to the truth. His masters in Moskow sowed racial nonsense during the 2016 election. Now, we are presented with propaganda aimed at making us resent out government (very Trumpy, so very Pooty-Poot) and resent the sacrifices of supporting Ukraine against Russia’s invasions.

Johnny wrote:

“Real annual income growth of about 0.3% this century.”

That’s wrong by an order of magnitude:

https://fred.stlouisfed.org/graph/?g=U49t

And “Meanwhile real annual corporate profits (adjusted by CPI) have grown about 5% this century.”

Not really decipherable. A total of 5%? Then “annual” is superfluous. And 5% is wrong. An average of 5% per year? Still wrong. Badly wrong. Here are the two series needed to make the calculation. The chart is presented as full-year % change in profit minus full-year % change in CPI, but curious individuals can mess with it any way they please.

Why can’t Johnny do economics? ‘Cause Johnny can’t do math. (Or internet searches, or logic, or honesty…)

https://fred.stlouisfed.org/graph/?g=U4b0

Menzie, would you at least grant him that those profit numbers are pretty high when TV media keep telling us inflation is closely related to input costs, and that TV and other news media have been lacking in reporting the profit numbers which don’t jive with their tie-in to input costs being the main culprit in end-product price hikes??

They are indeed very high even in real terms as Menzie’s graph shows. Funny thing – JohnH actually wrote that they have increased by 5% since the beginning of the century. Not 5% per year – just 5% period. He really does need to THINK before writing.

Moses,

If one were to look at the growth of labor costs, nonlabor costs and profits during the covid inflationay period, labor cost growth comes in last:

https://fred.stlouisfed.org/graph/?g=U4e1

Kinda like you figured, right? Just remember, the way to bring down nonlabor cost is to bring down labor cost. And the way to bring down labor cost is, well, you know…

OK, Menzie. As far as I can tell, you had to supply the deflator. Not hard to do. I did exactly the same thing, only using the CPI as the deflator.

For many data series, FRED shows the real (deflated) numbers (real GDP, real wages, etc.). But, strangely, it does not do that for corporate profits. Why do you suppose that is?

JohnH: I’m just sayin’ FRED provides all the data you need. Now, why didn’t FRED do it automatically? I guess in part because it’s not clear what the appropriate deflator is. I’m using PCE which is as if consumers were evaluating. Maybe I should use GDP deflator?

” I did exactly the same thing, only using the CPI as the deflator.”

You did? I did not see your work. Which would be interesting since you wrote profits have risen by a mere 5% since 2000.

You had to use that advanced tool known as Excel to draw that awesome graph. Now Johnny boy has to take his shoes off to count past 10 I guess.

Now looking at the graph it is clear that inflation adjusted profits have grown by more than 5% since 2000. But JohnH actually claimed they grew by only 5%. Yea – he never learned to write either.

It is a riot that JohnH wanted to compare the growth of real GDP to the growth of real profits but when someone pointed out that his claims were just dumb, he accused people of saying profits and GDP were the same thing. No one did that but basic arithmetic principles still apply even if JohnH has clearly flunked preK arithmetic.

BTW the graph Menzie posted seems to show nominal numbers, not deflated ones.

Nominal numbers: https://fred.stlouisfed.org/series/CP/

If that is correct. it becomes obvious that the process is not exactly as simple and straightforward as advertised.

Which begs the question: why doesn’t FRED just do the calculation and make the information automatically available, like it does for so many other data series?

JohnH: Can…you…read…title…for..the…y…axis? If…you…divide…a…number…expressed…in…billions…$’s…by…an…index…taking…on…a…value…of…100…in…2012,…and…then…multiply…by…100,…you…get…a…number…expressed…in…billions…of…2012$.

I guess JohnH failed to click on the URL which had a graph clearly marked:

Corporate Profits After Tax (without IVA and CCAdj)*100/Personal consumption expenditures (implicit price deflator)

People, people, people. Try READING before criticizing!

It’s hard to see why Johnny is kicking up a fuss about inflation-adjusted profit data. He can’t tell the difference.

You’re gonna need to speak slower than that.

Boy – your reading skills SUCK!

https://www.nytimes.com/2022/09/23/world/europe/uk-tax-cuts-economy.html

September 23, 2022

U.K. Government Goes Full Tilt on Tax Cuts and Free-Market Economics

The new administration’s plans are a break from the Boris Johnson era and represent a turn toward Thatcherism. The negative reaction from financial markets underscored the extent of the gamble.

By Stephen Castle and Eshe Nelson

LONDON — Prime Minister Liz Truss of Britain on Friday gambled that a hefty dose of tax cuts, deregulation and free-market economics could reignite growth before the next general election as her government unveiled a package of measures that is likely to determine its electoral success or failure.

Breaking sharply with the era of the previous prime minister, Boris Johnson, the new chancellor of the Exchequer, Kwasi Kwarteng, promised the dawn of a new age of lower taxation, with the scrapping of one planned tax rise and the reduction of levies on home purchases to try to fire up the real estate market.

But the negative reaction from financial markets — the value of British stocks, bonds and the pound dropped — underscored the risk the government is taking. Mr. Kwarteng abandoned a proposed rise in corporate taxation and, in a surprise move, abolished the top rate of 45 percent of income tax applied to those earning more than 150,000 pounds, or about $169,000, a year. He also cut the basic rate for lower earners.

“We will focus on growth, even when that means taking difficult decisions,” Mr. Kwarteng told a packed House of Commons on Friday. “None of this is going to happen overnight, but today we are publishing our growth plan that sets out a new approach for this new era.”

The focus on tax cuts to expand the economy “is how we will turn this vicious cycle of stagnation into a virtuous cycle of growth,” he added.

There had been high expectations that the announcement would finally bring some certainty about Britain’s economic path after a long party leadership campaign over the summer and the death of Queen Elizabeth II, which, for nearly two weeks, stopped most parliamentary business.

But few had anticipated the size of the tax cuts, costing £45 billion over the next five years — the largest compared with any budget since 1972, according to the Institute for Fiscal Studies, a London think tank….

https://fred.stlouisfed.org/graph/?g=JxaF

January 30, 2018

Real private weekly earnings for United Kingdom and United States, 2007-2022

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=U3Ib

January 30, 2018

Real Hourly Earnings in Manufacturing for United Kingdom and United States, 2007-2022

(Indexed to 2007)

The “free-market economics” isn’t what rattled markets. (What a bizarre way to frame it.) It’s the insanely reckless fiscal and monetary policy in the context of skyrocketing inflation. It’s Reagan, but 10x stupider. Tax cuts are inflationary. A declining pound sterling means energy will get more expensive for UK consumers, not cheaper.

It’s a good time to start a betting pool on whether there will be yet another currency crisis in the UK due entirely to idiotic Conservative policy. Smart money is on the affirmative. And anonymous betting is a great time to pretend the blockchain has practical uses!

JohnH is even as much of a conspiracy-minded reader as Princeton Steve (his new BFF apparently). But note JohnH had the gall to say Barkley was guilty of this conspiracy-minded nonsense. Why – because Barkley had the temerity of noting that gross domestic income has been growing faster than measured gross domestic product – an important fact that has been widely noted here.

But of course JohnH thinks bringing up GDI (which is reported by BEA) is trying to put down the BEA reporting of GDP.

Now one might think this is JohnH is being stupid here. But it is worse than that – JohnH is dishonestly attacking anyone who dares challenge his serial nonsense.

pgl: However, to Steven Kopits’s credit, he has ceased sharing his thoughts on this weblog.

@ Professor Chinn

You know I am an SOB in some ways and I like to poke you in the lower ribs intermittently. I gotta take these chances where I can ‘cuz I know you gonna body slam me on anything involving math. Uuuuuuuhh, does “hasn’t commented recently” mean the same thing as “ceased”?? Don’t be selling me any fantasy dreams now, I’m getting too old for these major disappointments.

Stevie has an interst in self-promotion. In a literal, business sense. Being hacked to pieces in plain view, day after day, doesn’t serve that interest. Trolls are different. For them, being wrong is part of the deal.

Stevie is BAAAACK! He tells us that 30 year mortgage rate are now 6.7%. “Incredible” he says. Odd, FRED (Freddie Mac) is reporting 6.29%.

Does Stevie even know what Bill McBride uses as a source? He never said even though McBride actually labels his graph. Mortgage Daily News? Is that like Gas Buddies? Stevie has no clue. INCREDIBLE!

He has. Now if Econned could only follow his lead.

Why deflate profits?

Why not just compare nominal profits to … nominal GDP ?

That would work but I guess it is too easy for JohnH!

Are you sure about that?? Because if we’re looking at absolute numbers rather than percentages increase of inflation (and even then) I’m having a hell of a time figuring out how excluding inflation gives those numbers much meaning??

I don’t think he means to exclude inflation. He is just saying the numerator and denominator have the same inflation effect so the ratio of nominal A/nominal B is similar to real A/real B.

Maybe I’m being slow, but if I divide 1980 by 2000 numbers and then…… 2015 by 2020 numbers…. is that the same deal??? by definition aren’t normative different from “real”?? It seems I’m lost in this conversation,

Moses Herzog: You are exactly right if the deflators are the same — that is use GDP deflator for profits and for GDP. But if you deflate profits by PCE deflator and GDP by GDP deflator, that would not give you the same number as nominal profits divided by nominal GDP. (I’m not advocating that you do the latter – I’m just pointing out when you can get something different.)

@ Mr. O’Rear

Probably because rates of inflation vary based on “periods” of time. If you have very high rates of inflation, it could possibly make the profits look larger than they are. Personally, I don’t think input costs are rising enough to rationalize these level of end-product price hikes. But I’m not certain and I don’t want to be kicked in the side by pseudonym name in a blog post.

Mr Herzog,

And, deflating by … something or other … does exactly what to the problem of profits being inflated by … something or other ?

Because, as I explained, “that number” is different, depending on periods chosen to look at. So if we’re looking at “absolute numbers” or “whole numbers” or however you want to express it, rather than say percentage or adjusted numbers, there’s no “reference point” for the profit numbers, whether the profit numbers are a meaningful increased compared to GDP or whatever. I mean if I am explaining this wrong or poorly I encourage Menzie to correct me.

Let me kind of put this in a retarded way for simple minds. Let’s say your profit on a can of beans in the year 1800 was 10 cents. Now your profit on a can of beans in 2020 was 10 cents. Do you think if we looked at that in terms of a “basket of goods” of a nation’s economy, accounting for inflation might tell us something~~~vs saying “Well we don’t need to inflate or deflate here, the profit to the typical bean producing firm was 10 cents, why would we use a deflator etc??” Don’t you think that’s pretty stupid??

I just had Mexican for dinner so doing this in beans is cool. But alas we are doing much ado about very thing. So where is my Modelo, which is still reasonably price (at least for now)?

BTW I get buying Goya black beans is sort of bad as the CEO is rather Trumpian. But damn it – the Brooklyn grocery stores sell nothing else that is even close. And when one used to get a pound of beans for only $1, seeing prices at $1.75 sort of ticked me off. But I am now able to buy the same can for $1.25. So life is getting back to tolerable unless one has to buy bagels at Cape Cod.

I have moments of stupidity, I am overly-sensitive sometimes, but I welcome being corrected here if I’m thinking about it wrong. I mean shorter time frame would mean “normative” is ok?? I’m not trying to be a jerk about it. But in this context of very high inflation I would think it should be accounted for, happy if Professor Chinn or Prof Frankel wants to tell me I am wrong on this. Or anyone smart really

Bark, bark, cor to enlighten us regarding the relevance of your last 2 comments? Other than ego, a common theme in this thread, they have no value. 😉

Yup! You continue to make me laugh.

JohnH

September 23, 2022 at 10:11 am

Real annual income growth of about 0.3% this century.

He actually wrote this. Real GDP in 2021 was almost 49% higher than real GDP in 2000. Now this strikes me as a lot higher growth rate than 0.3% per annum. Calling Bill Gates – you sent JohnH a defective version of Excel.

“Let me just say, FRED is unambiguously awesome.” -MC

Hear! Hear! Totally impressed. Still figuring out how to use it….. but that is me, not FRED.

National statistical agencies should do the same.

“National statistical agencies should do the same.”

100% yes. The ONS (in the UK) has gotten better, but are still way behind FRED.

https://fred.stlouisfed.org/graph/?g=U3Rj

January 30, 2018

Real per capita Gross Domestic Product and Real Median Family Income for United States, 1960-2021

(Indexed to 1960)

https://fred.stlouisfed.org/graph/?g=U3RR

January 30, 2018

Real per capita Gross Domestic Product and Real Median Family Income for United States, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=U3PV

January 30, 2018

Real per capita Gross Domestic Product and Real Median Family Income for United States, 1953-2021

(Indexed to 1953)

[ Notice that real per capita GDP and median family income run roughly together from 1953 to 1980. Then per capita GDP increases significantly faster than median family income. ]

《 Elon Musk said that Starlink would seek exemption from Iranian sanctions. This was in response to @Erfankasraie who asked if Elon could provide Starlink to the Iranian people. “It could be a game changer for the future.” Elon also responded, “OK,” to @agusantonetti who asked if he could do the same for other countries under a dictatorship such as Cuba.》

Didn’t I predict this months ago? Why not beam in free uncensored internet to Russia, China, North Korea, etc.?

Re FRED data, where is it coming from? What is the reporting rate? Where are the error bars?

1) Who cares?

2 ) As if you actually care. If you want to know, click the link and find out.

Anybody notice what the BoJ has been up to? Standing pat on negative rates, then intervening to shore up the yen. That’s the first intervention in nearly a quarter century. Meanwhile, Koruda is getting that inflation he’s been waiting for.

https://tradingeconomics.com/japan/core-inflation-rate

My understanding is that Kuroda is pretty sharp. I bet even Kuroda can’t believe it.

6.70%. 30 year fixed mortgage. Incredible.

https://www.calculatedriskblog.com/2022/09/covid-sept-23-2022-update-on-cases.html

Oh, See, I knew it, Menzie misled me when he said “ceased”. (joking Menzie). Menzie hasn’t told me a lie this big since he said he thought I had the intelligence/fortitude to do regressions and OLS. #WhiteLies

Freddie Mac (captured by FRED) reports weekly and their latest reporting put this interest rate at 6.29%:

https://fred.stlouisfed.org/series/MORTGAGE30US/

OK Bill McBride clearly is using something called Mortgage Daily News. And of course the incompetent consultant who specializes in being vague about sources cannot SAY that. How come Stevie? Care to share with us why we should trust MND reporting over Freddie Mac reporting? Oh – you have no idea as usual. INCREDIBLE!

”

Menzie Chinn Post author

September 23, 2022 at 2:16 pm

pgl: However, to Steven Kopits’s credit, he has ceased sharing his thoughts on this weblog.”

Uh Huh! And then there’s those ole soybeans. 😉

You folks truly are hilarious. Picking straws in hope4s of covering for what is fast approaching the worst administration we’ve seen in recent history. Nope! The voters can/will not remember the difference in administrations’ economies.

CoRev – didn’t we ask you years ago to write your great economic article on the soybean market so the AER could publish it? So why haven’t you?

Oh wait – you did write it and send it to the editors. Who are still trying how anyone could write something so incredibly dumb.

But nice try!

CoRev,

Yes. worst administration ever. I mean look what they are doing to the US dollar? We haven’t seen it go this high since Ronald Reagan was president, and we know you think he was a total disaster. The end is clearly near as you again confirm yourself to be the stupidest regular commenter here, even making “Anonymous” look like he might be able to pass first grade.

CR: this from Rocket Mortgage on “Historical Mortgage Rates: 1971 To The Present”

“Interest rates reached their highest point in modern history in 1981 when the annual average was 16.63%, according to Freddie Mac data. Fixed rates declined from there, but they finished the decade around 10% (9.78%), The 1980’s werean expensive time to borrow money.”

Oh, the good old 80’s when we had a conservative President who came into office horrified that the national debt was approaching $1Trillion and left with the debt approaching $3 Trillion and mortgage rates about 33% above current levels. He also promised a balanced budget would cure all our economic ills.

Those were the days. Darn right. Real deal conservatives showed they know how to tame inflation and make it disappear fast. You bet.

Yes. YOU are truly hilarious. History much?

You’re Welcome!

— Your Awesome Inflation-Fightin’ Fed

Agree that it is a fantastic source of information – and it has a wonderful interface allowing regular people to create fact-based opinions. The weakness is with the human users. Many do not like fact-based opinions. They prefer narrative driven opinions. They know what is true and are going to let any facts get in the way of that. But it gives good entertainment to use facts as a way to point to weaknesses in their predetermined narratives.

Returning to the semiconductor shortage issue, it seems Intel is financing a lot of new fabrication facilities globally with the hope of setting one up in China. But the US government is getting in the way of Intel having a new Chinese affiliate:

https://www.tomshardware.com/news/intel-china-fab-expansion-nixed-by-white-house

One of Intel’s best hopes to quickly bring online semiconductor manufacturing capacity has seemingly bit the dust. Citing sources close to the situation, Bloomberg reports that the White House “strongly discouraged” an Intel-proposed plan to add manufacturing capacity. The issue? The factory is located in Chengdu, China. Despite the well-known ongoing shortages in the semiconductor industry, it seems there are some political lines that are not to be crossed. The Biden Administration is reported to have shown a strong negative sentiment towards any sort of semiconductor investment within China’s borders. The reasons for that would be many, and security concerns are certainly one of them. However, there’s also the matter of China’s increasing investment in semiconductor technologies. The country famously included “semiconductor sufficiency” in its 14th five-year plan (2021-2026). Besides heavily investing in state-sponsored semiconductor electronics companies and increasing internal chip output to more than 1 billion a day, China has also been strongly pursuing intellectual property registrations – which do include patents related to semiconductor manufacturing….The ongoing trade war between the countries does nothing to reduce the tension here. And since at least part of Intel’s investment in capacity expansion is being funded by the U.S. government itself, it’s understandable that other “solutions” would better be located in the U.S. or Europe. “Intel and the Biden administration share a goal to address the ongoing industrywide shortage of microchips, and we have explored a number of approaches with the U.S. government,” Intel said in a statement to Bloomberg. Bloomberg notes Intel said it currently has “no plans” to increase production in China after meeting with government officials, and that it will pursue “other solutions.”

That Intel even proposed a solution in China may be a testament to how advantageous it would be compared to other, less politically sensitive options. It’s reported that the factory expansion would be complete by the end of 2022, and the investment would almost certainly see faster returns in China compared to any U.S. or Europe-based option. And remember: Intel went in with a plan.

It seems some additional relief for the stifled semiconductor industry may have been postponed just slightly longer, at least until Intel brings in a more appealing solution. Until then, shortages will likely continue to be a part of the marketplace.

https://fred.stlouisfed.org/graph/?g=qVRC

January 15, 2018

Thirty- and Fifteen-Year Fixed Rate Mortgage Average, 2017-2022

https://fred.stlouisfed.org/graph/?g=U5kQ

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2007-2022

https://fred.stlouisfed.org/graph/?g=QJHY

January 30, 2018

Case-Shiller National Home Price Index / Consumer Price Index, 1992-2022

(Indexed to 1992)

[ A distinctly unprecedented real home price index level, extending back to 1890. The question becomes whether real home prices can now indefinitely increase in a healthy economy. The same question need be asked in Britain. ]

6.70%. 30 year fixed mortgage.

[ The 30-year mortgage rate is currently 6.29% ]

Freddie Mac and MNS are reporting two different things. Of course Stevie boy is too lazy to even notice the difference.

Definitely thread worthy!!!

[ Surely so, since there is no science at all beyond what can be determined by data. Einstein imagined the bending of light traveling through the universe, a stunning vision but needing to be observed during an eclipse. This thread is terrific. ]

Someone needed to say – Trump is today’s Hitler:

https://www.huffpost.com/entry/hillary-clinton-trump-trump-hitler-interview_n_632ea630e4b00e36d1afbe06

In a stinging interview Friday one-time presidential candidate Hillary Clinton compared Donald Trump to Adolf Hitler, and his political rallies to Nazi gatherings. She zeroed in on Trump’s rally last week in Youngstown, Ohio, where members of the crowd raised a stiff-armed, one-finger QAnon salute to the former president in a gesture chillingly reminiscent of the “heil Hitler” salute. The QAnon gesture stands for WWG1WGA, or: “Where We Go One We Go All.”

Now expect the cowardly Republicans and the MAGA crowd to cry foul but Clinton is not alone:

Clinton was hardly the only one to see similarities between Trump and Hitler rallies. Retired four-star U.S. Army General Barry McCaffrey also compared Trump’s Ohio rally to a 1936 rally held by Hitler in Nuremberg, Germany. “The crowd is similar to a Nuremberg rally 1936,” McCaffrey tweeted after the rally. “A lawless Trump in office in [the] 2024 election would slide us into autocracy and deny our Constitutional safeguards. This is our greatest danger as a nation since 1860.”

How poorly are the Russian invaders trained?

https://www.businessinsider.nl/an-ex-us-army-general-who-witnessed-russias-basic-training-of-recruits-says-it-was-awful-and-the-newbies-being-drafted-face-disaster-on-the-front-line/

A former US Army general said that Russia’s announced mobilization of 300,000 reservists was a “jaw-dropping” sign of weakness.

Mark Hertling, who commanded the US Army Europe, explained in a Twitter thread that he has personally witnessed how the Russian army is “poorly led and poorly trained.” The poor training, coupled with the decision to draft in recruits with little experience, is likely to spell disaster for Russia, he said. “Mobilizing 300k “reservists” (after failing with depleted conventional forces, rag-tag militias.. recruiting prisoners & using paramilitaries like the Wagner group) will be extremely difficult,” Hertling said. “And placing “newbies” on a front line that has been mauled, has low morale & who don’t want to be portends more [Russian] disaster.”

Now this explains a lot but remember. We have been told by Putin’s pet poodle JohnH that we should never listen to someone for the US military. After all – an honest accessment of what is happening in Ukraine angers JohnH’s master. And it would be a shame if Putin stopped giving little Johnny dog his bones.