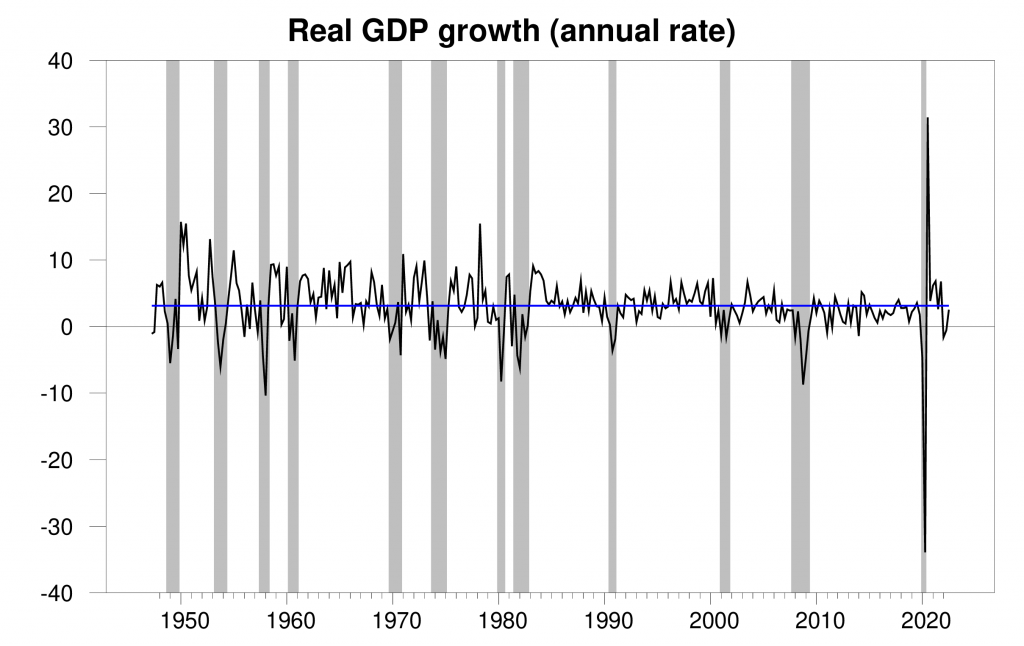

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.6% annual rate in the third quarter. That’s close to the historical average (3.1%), and is a welcome sequel to the two quarters of falling GDP with which we started the year.

Real GDP growth at an annual rate, 1947:Q2-2022:Q3, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

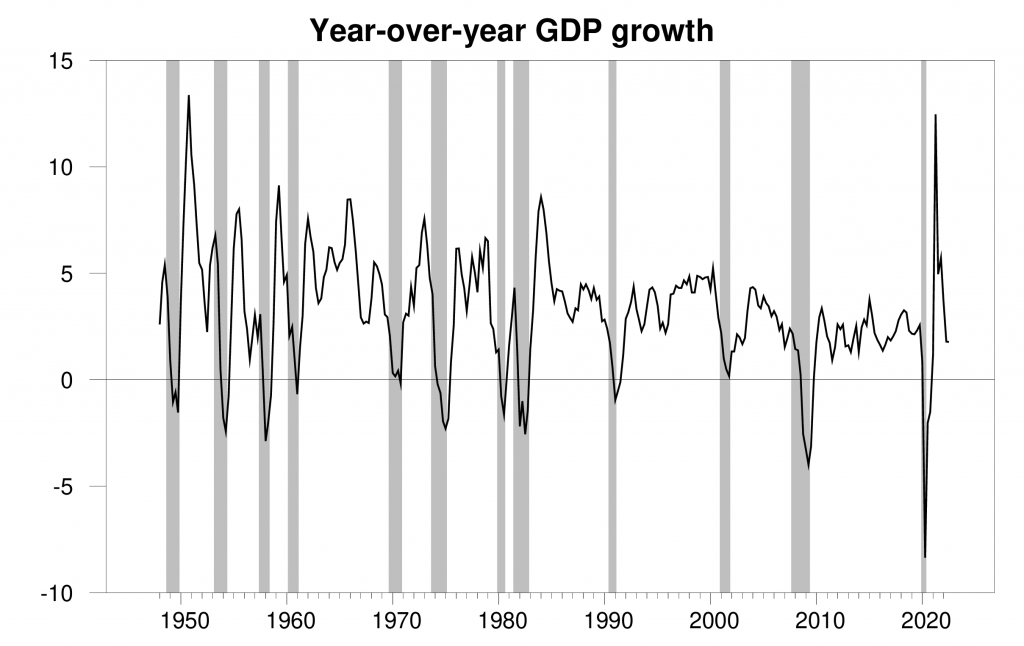

Here’s what the data look like when plotted as year-over-year growth rates.

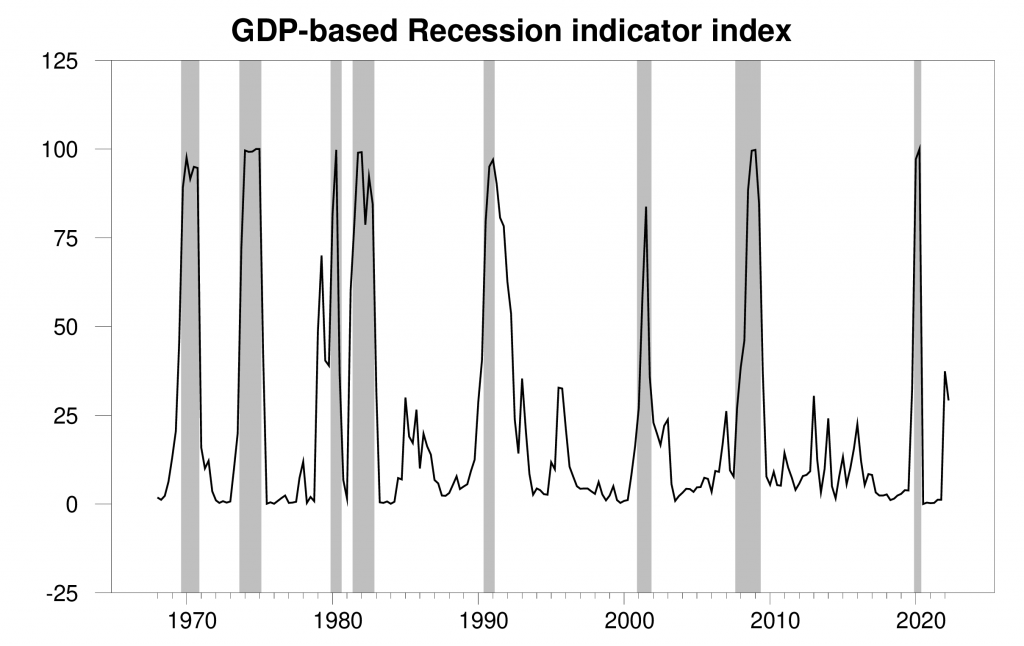

The new data helped the Econbrowser recession indicator index to ease down a little to 29.2%. This is an assessment of the situation of the economy in the previous quarter (namely 2022:Q2). The index takes into account the fact that the Q3 growth was positive to refine the assessment of where the economy was last quarter. When Marcelle Chauvet and I first developed this index 17 years ago, we announced that we would only declare a recession to have started when the index rises to 65% (see pages 14-15 in our original paper).

The index itself is never revised, though each quarter’s updates and revisions to GDP allow an improved assessment of the economic conditions several quarters earlier as well the value of the index that we announce in real time based on the initial GDP report. If subsequent data send the real-time indicator above 65%, we would use the full range of revised historical data available at that date to announce the date at which the recession likely started. Here at Econbrowser we’ve followed that procedure to the letter as the data were released in real time over the last 17 years, successfully dating the beginning and end of the two recessions since we started this blog.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

The recent hikes in interest rates have brought the U.S. housing market down quite quickly. The drop in new home construction subtracted 1.4% from the 2022:Q3 annualized GDP growth rate.

Another channel by which higher interest rates can slow GDP growth is through a stronger dollar, which discourages U.S. exports and encourages U.S. imports. But surprisingly, exports increased and imports decreased in Q3, between them adding +2.8% to the annual GDP growth rate. Nearly half of the rise in exports came from petroleum and products, as the U.S. stepped into the gap created by disruptions in Russian shipments. Supply-chain issues may have contributed to the decline in imports. With the headwinds from a strong dollar, it’s hard to see a big positive contribution from trade continuing.

Mild weather has eased some of the challenges Europe was facing with natural gas cut-offs from Russia, at least for now. But Europe’s energy situation will still be rough in 2023 and will be a drag on Europe and the world economy. China’s ongoing efforts to curtail COVID are another very serious headwind to global economic growth. When added to the continuing effects of the monetary contraction, a recession within the next year is a distinct possibility.

So while the Q3 GDP growth is welcome, our Little Econ Watcher remains very worried.

“Another channel by which higher interest rates can slow GDP growth is through a stronger dollar, which discourages U.S. exports and encourages U.S. imports. But surprisingly, exports increased and imports decreased in Q3, between them adding +2.8% to the annual GDP growth rate. Nearly half of the rise in exports came from petroleum and products, as the U.S. stepped into the gap created by disruptions in Russian shipments. Supply-chain issues may have contributed to the decline in imports. With the headwinds from a strong dollar, it’s hard to see a big positive contribution from trade continuing.”

Dean Baker had a similar comment. If the high interest rate continue to depress investment demand and if net exports start to make a negative contribution, the growth in consumption and government purchases will not be enough to avoid a recession.

Of course some of us have been hoping that the FED backs off on its tight monetary policy.

Or investment increases. Interest rates don’t depress investment. They increase the cost of core money. But the release of money from government into investment vehicles can boost core investment lifting real nondebt based growth.

WTF? You do know that US private investment fell as Dr. Hamilton said. And of course we have seen significantly higher interest rates. Sorry dude but reality is bearing out the standard model. Now if you are advocating some large public investment program – I would support that but talk to Manchin.

Not only has the Fed enegineered a persistent decline in resdential construction, but quarterly data also show that inflation has turned the corner:

“The price index for gross domestic purchases increased 4.6 percent in the third quarter, compared with an increase of 8.5 percent in the second quarter (table 4). The PCE price index increased 4.2 percent, compared with an increase of 7.3 percent. Excluding food and energy prices, the PCE price index increased 4.5 percent, compared with an increase of 4.7 percent.”

Worryingly, the saving rate for the past three quarters is the lowest since mortgage equity withdrawal was a fad prior to the housing crash:

“Personal saving was $626.1 billion in the third quarter, compared with $629.0 billion in the second quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 3.3 percent in the third quarter, compared with 3.4 percent in the second quarter.”

https://www.bea.gov/news/2022/gross-domestic-product-third-quarter-2022-advance-estimate

Business investment produces an odd picture, but not a surprising one:

https://fred.stlouisfed.org/graph/?g=Vket

The Fed can’t do much to help non-residential construction, but it could certainly put a dent in equipment spending – not a great choice when dealing with supply problems.

And if the troll choir really cared about economics, this is the issue they’d squawk about:

https://fred.stlouisfed.org/graph/?g=VkgN

Trade gave a big lift to GDP in Q3, maskng weakness in domestc demand. The nonsense about recession in H1 was pure partsan politics. Weakness in real final domestic sales is a big issue, but not conveniently timed for the choir. Final demand in Q4 depends heavily on holiday sales, which are by now mostly baked in. The first quarter of 2023 is consderably influenced by inventory carry-over from Q4. The Fed needs to be thinking about Q2 and beyond. The pattern of real final domestic sales is not encouraging.

Dean Baker on the savings rate:

https://cepr.net/gdp-2022-10/

Saving Rate Fell, but Main Factor is Higher Capital Gains Taxes

The saving rate edged lower in the quarter to 3.3 percent of disposable income from 3.4 percent in the second quarter. That compares to a saving rate of 8.8 percent of disposable income in 2019 before the pandemic. This has been generally portrayed as people spending down the savings they accumulated during the pandemic. While this is true to some extent, the biggest factor is that people are paying more taxes, presumably capital gains taxes on stocks they sold in the last year. (Capital gains are not counted as income.)

But the capital gains crowd accounts for about 40% of spending…

Of course, it’s the wealth effect, more than the tax, that has cut i to high-end spending.

“Trade gave a big lift to GDP in Q3, maskng weakness in domestc demand.”

Another point made by Dean Baker as well as by Dr. Hamilton. Going forward one would think US net exports will fall. So the need to get domestic demand back on track is rather urgent, which should be telling the FED to stop raising interest rates.

“The nonsense about recession in H1 was pure partsan politics. Weakness in real final domestic sales is a big issue, but not conveniently timed for the choir.”

It does seem those RECESSION CHEERLEADERS (e.g. Bruce Hall, CoRev, and Princeton Steve) have been ducking this news so far.

Yes, the whole discussion about recession was pure partisan politics, which is what led to the flurry of posts refuting the notion that 2 quarters of decline was tantamount to a recession. A less partisan discussion would have acknowledged that what was being debated was essentially the difference between a D- and an F, a difference that a non-partisan observer would have found to be so trivial as to not merit more than a passing observation.

It was certainly enlightening and amusing to watch very serious people, under the banner of “the truth,” argue about such a trivial distinction while totally overlooking declining real incomes and the nameless recession that the average American is experiencing due to those declining incomes.

JohnH,

Oh, is this you admitting that you have engaged in “pure politics”? Or is it only other people?

Did anyone else see this news? I was curious about the financials for my favorite publicly traded microbrew in light of some story about how Carlsberg may have to raise prices as its profit margins have fallen a bit. Boston Beer (Sam Adams) suffered a sizeable decline in its 2021 profit margin from the rise in input prices while they kept the price of their beer reasonable. But cannabis tea?

https://www.nbcboston.com/boston-business-journal/boston-beer-to-launch-first-cannabis-beverage-in-canada/2728444/

The Boston Beer Company is launching a new line of cannabis-infused iced teas that will become available in select Canadian provinces beginning in July while the company awaits further progress on U.S. marijuana regulations.

The company (NYSE: SAM), known for making Samuel Adams, Truly Hard Seltzer and Twisted Tea products, told the Boston Business Journal that it’s developing a product pipeline in Canada in the meantime, where cannabis is federally regulated.

Housing is freezed. Labor market is a key to watch now, if it bends to much, consumer spending breaks. If this is the trajecrory, probably Q4 might occur to be an NBER peak. Hope it is not the case! Good thing is that there are not really much disequilibria in the economy now (debt-to-DPI, savings, corporate profits, money markets working good etc.)

@ Pawel

From your mouth to God’s ears.

But I am pulling for Poland’s economic strength and happiness of the Polish citizenry, for being Heroes to immigrant women and children of Ukraine. Most of America’s problems we bring on ourselves. Poland deserves the good things more than America does, in this moment. God bless all of you in Poland for trying to help the Ukrainian immigrants~~and indeed helping a lot of them.

government spending is ‘war supplying’ and stimmies.

fuel exports are occur bc gasoline demand depressed, and crude imports running low, another impact of war processing.

domestic crude supply is up while stock is down

core pce index down .2,

we need tomorrow pce print report for revision and detail.

not optimist for war time gdp print at + 2.6

Could you stop your incessant garbage? Like the trolling from Princeton Steve, CoRev, Bruce Hall, and JohnH is not bad enough. GEESH!

US LNG exports are up by 64% in the last year. But pgl doesn’t think that they contributed to improvement in 3Q net exports.

https://www.forbes.com/sites/kenroberts/2022/10/08/us-lng-exports-to-france-croatia-poland-up-more-than-1000/?sh=781a3c1761bd

Of course, pgl rarely does his homework before he blurts out his nonsense…

“My analysis shows that while natural gas exports to France are up 421% through the first eight months of 2022, the value increased 1,094 percent in August alone. A similar story can be told for Croatia, where imports are up 281% through August but 1,195% in August; Poland, which is up 505% YTD and 817,000% in August; and the United Kingdom, up 216% YTD and 6,797% in August.”

A 1000% percentage increase to nothing is still nothing. Hey Johnny boy – show us your superior analytical skills and figure out how these small absolute increases translate into percentages of GDP. Until you do – you have no point.

We’ll wait as we know you need to take off your shoes to count past 10.

exports could have been even higher, if we had not had unexpected shotdowns. lng exports are a more recent phenomenon, based on construction of facilities.

Sam adams?

Really? That’s odd. When I look at the tables in special stimulus programs, the Net Federal Saving line reads “……….”. So you’re claiming to know something the government itself doesn’t yet know. Wow.

Another thing I note when looking at the special stimulus programs table is the steady rise in (decline in a negative) the size of the net saving impact in recent quarters. If that pattern persists, what you call “stimmies” will have been at their lowest level in Q3 since Covid “stimmies” began. And the entire defense spending entry amounted to 0.17% of the 2.6% rise in GDP. Not Ukraine aid, the entire military budget.

You see, we aren’t at war. Ukraine and Russia are at war. Calling Q3 “war time” is a really uninformed error, and comparib Q3 GDP to war-time GDP during war time is disingenuous.

You’re doin’ what econimists call “making stuff up”.

Find data here:

https://www.bea.gov/data/gdp/gross-domestic-product

Exactly. As much as people are talking about what we are giving to Ukraine – that amount is barely a rounding error in the Federal budget and barely amounts to 1/1000 of US annual GDP. The real influence of the war in this country has been on energy prices.

Ivan stumbles on a TRUTH! “The real influence of the war in this country has been on energy prices.” Is there a list anywhere of products NOT AFFECTED by energy prices at some point in its life cycle?

On an economics blog can any of the willfully ignorant claim Biden’s energy policies have NOT AFFECTED inflation? Of course the virtue signalling of planet saving policies are complementary.

The voters know!

Oh please. Your obsession with drill baby drill would have no impact on today’s energy prices. We have been over this before and your partisan, dishonest, and stupid claim that high energy prices are Biden’s fault may be the dumbest thing you have ever said. Then again – you say a lot of really stupid things.

energy prices have been driven by the war in Ukraine. no war, less of an energy price issue. perhaps trump could have been more proactive in arming the Ukrainians, rather than blackmailing them like a mob boss?

Off course Biden’s release of oil from the strategic reserves (and pushing EU to do the same) has reduced energy prices and helped keep inflation in single digits.

CoRev So what’s your point? Would you rather NATO not support Ukraine?

A prime example of being willfully ignorant: “Yes there are lots of big collateral benefits from the Biden energy policies.” After completely missing the point that Biden’s energy policies, which are following the European policies, are largely responsible for a large portion of the world’s inflation and soon conversion to recession.

It’s fascinating that on an economics blog when asked to list products NOT IMPACTED by energy policies that no such list is forthcoming. But after pointing out that: “On an economics blog can any of the willfully ignorant claim Biden’s energy policies have NOT AFFECTED inflation? Of course the virtue signalling of planet saving policies are complementary.” Cognitive dissonance is a more technical term for being willfully ignorant.

Changing the impact of Biden’s energy policies to the sole focus of the Ukrainian war is another prime example of being willfully ignorant/suffering cognitive dissonance of those who wish us to believe they are the superior thinkers.

The voters will show who are the superior thinkers.

“After completely missing the point that Biden’s energy policies, which are following the European policies, are largely responsible for a large portion of the world’s inflation and soon conversion to recession.”

Amazing – everything you just said is false. You can’t be bothered to: (1) identify the European policies, (2) compare them to “Biden’s energy policies”, or (3) tell us why they were responsible for the world’s inflation. I bet you do not even know what the “world’s inflation” even is. But nice job of being Steno Sue for Kelly Anne Conway.

“completely missing the point that Biden’s energy policies, which are following the European policies, are largely responsible for a large portion of the world’s inflation and soon conversion to recession”

Or should we call it recognizing the idiocy of that postulate and ignoring it. Which Biden “energy policy” is supposed to be “largely responsible” for the increase in oil prices?

I know that right wing idiots whine all the time that there are certain places that are off limit for drilling, but the fact is that there are plenty of permits already given that the oil companies are not using. So if US oil drillers wanted to make more oil they have permits to do so. Another fact of relevance is that Saudi Arabia and friends just cut production by 2 million bpd. That is not an amount that the little US mouse can match – and even if they could that cartel would just cut even more.

BTW, compared to the impact of Biden’s energy and planet saving policies on the economyc his Ukraine polices are barely measurable.

” on the economyc his Ukraine polices”

Good God – we knew you were incapable of being honest about anything but please learn to WRITE coherently.

I knew you would eventually come to your senses – nobody can stay that ignorant, for that long.

Yes there are lots of big collateral benefits from the Biden energy policies.

what Biden says abt sacrifice

and govt wrote a lot more checks in sep 2022

“Mild weather has eased some of the challenges Europe was facing with natural gas cut-offs from Russia, at least for now. But Europe’s energy situation will still be rough in 2023 and will be a drag on Europe and the world economy. China’s ongoing efforts to curtail COVID are another very serious headwind to global economic growth. When added to the continuing effects of the monetary contraction, a recession within the next year is a distinct possibility.”

Yes. And that seems to me important context for this:

“Global developments play an important role for domestic inflation rates. Earlier literature has found that a substantial amount of the variation in a large set of national inflation rates can be explained by a single global factor. However, inflation volatility has been typically neglected, although it is clearly relevant both from a policy point of view and for structural analysis and forecasting. We study the evolution of inflation rates in several countries, using a novel model that allows for commonality in both levels and volatilities, in addition to country-specific components. We find that inflation volatility is indeed important, and a substantial fraction of it can be attributed to a global factor that is also driving inflation levels and their persistence.”

https://onlinelibrary.wiley.com/doi/abs/10.1002/jae.2896

If Europe and China will contribute less to global demand growth in coming periods, they are likely to contribute less to global inflation – rate, volatility and persistence. The dollar will add to that decrement. So will the ECB’s latest 75 basis point hike.

So the Fed should…

In Kevin Drum’s reporting on this report, he said something that did not sound right:

https://jabberwocking.com/chart-of-the-day-gdp-was-up-2-6-last-quarter/

‘It was driven mostly by final sales to consumers, not by inventories or exports. Sales of goods were down while sales of services were up.’

Well he got consumption right but I guess he did not notice the large impact from rising exports. Come on Kevin – you normally are better than that.

JohnH keeps saying economists are not talking about real wages. REALLY?

https://www.hks.harvard.edu/centers/mrcbg/programs/growthpolicy/even-hot-economy-wages-arent-keeping-inflation-jason-furman

Excerpt

April 12, 2022, Opinion: “The U.S. economy has been enjoying the fastest job growth in almost four decades. Unfortunately, inflation-adjusted wages are falling faster than they have in 40 years. Inflation ran 8.5% in the year ending last month, while nominal wages grew only 5.6%, a decline in inflation-adjusted wages of 2.7%. This presents a serious challenge to the “hot economy” thesis that tighter labor markets lead to rising real wages. This idea has never been as popular among academic economists as it is among Washington policy makers. A hot economy is surely better than a cold one, but the costs of an overheating economy might be larger than policy makers have appreciated.”

HKS Faculty Author – Jason Furman

This is one among many such discussions. Oh – Dr. Furman did not publish this at the NYTimes this week so it does not count. Ahem.

“This is one among many such discussions.” And pgl had to dig back to April 12–over six months ago–to find it.

Now compare this level of discussion to the level of discussion about whether the economy was in a recession or not.

And where are the esteemed economists who are pointing out that real median wages–in the midst of an economic expansion with tight labor markets–are back to where they were in 2019? Cat got their tongue?

But pgl still wants to assure us that the wellbeing of average Americans is top of mind for mainstream American economists!

Did I say Kevin Drum often comments on this? Just today he did:

https://jabberwocking.com/worker-comp-is-down-corporate-profits-are-up-imagine-that/

Hey Johnny boy – why don’t you go over to Kevin’s place with your incessant little whining? Funny thing – you have not once made a comment there. How come Johnny boy? Are you scared his smart readers will call you out for being the lying troll you really are? Grow a spine – make a comment there.

Kevin Drum is NOT an economist. Neither is Robert Reich. What does that tell you?

Um…that they aren’t economists?

Even so, they are able to grasp economics. Johnny, what does that tell you?

Kevin Drum admits he is not an economist but he is a lot smarter than you are. Now Reich says he is an economist. Heck he was Sec. of Labor. Now what does that tell Putin’s pet poodle?

Check out their creds, dudes. Maybe it’s because they’re NOT economists that they can talk about things like corporate America’s contribution to inflation and declining real wages?

IMF: “Globally, fossil fuel subsidies are were $5.9 trillion or 6.8 percent of GDP in 2020 and are expected to increase to 7.4 percent of GDP in 2025 as the share of fuel consumption in emerging markets (where price gaps are generally larger) continues to climb. Just 8 percent of the 2020 subsidy reflects undercharging for supply costs (explicit subsidies) and 92 percent for undercharging for environmental costs and foregone consumption taxes (implicit subsidies).”

https://www.imf.org/en/Topics/climate-change/energy-subsidies

I wonder if they factored in the cost of the US’ wars and “defense” activities designed to maintain the liberalized energy system where oil is traded in dollars (i.e.–rules based order.)

Take that one up with CoRev on your next hot date. He loves increasing negative externalities and I bet he would be a better BFF for you than Princeton Steve!

Paul Pelosi – husband of the Speaker of the House – violently attacked in their SF home:

https://www.msn.com/en-us/news/crime/nancy-pelosi-s-husband-violently-assaulted-in-home-suspect-in-custody/ar-AA13tSY6?ocid=msedgdhp&pc=U531&cvid=56611bd3a00040f28e0528f8b16326b2

‘Paul Pelosi, husband of House Speaker Nancy Pelosi, was “violently assaulted” by someone who broke into his San Francisco home early Friday, according to her spokesperson. The suspect is in custody, her spokesperson, Drew Hammill, said in a statement.’

This is disgusting. We do not know the motive yet but if this suspect is one of Trump’s minions, all those Trumpian Republicans who claim that only they care about reducing crime can go eff off.

The attacker does appear to be a MAGA hat nutcase after all. Let’s see if any Republicans condemn this terrorist.

he will be released w/o bail like the left wing terrorists in antifa?

“…left wing terrorists in antifa?”

Name some. Go in. Name anyone associated with antifa indicted for terrorism.

For that natter, Name someone in antifa.

The vile and violent lies from Trump and his Faux news bodies have consequences. We need a crack down on violent rhetoric – hold them responsible. All those threatening phone calls need to be investigated and punished. Fist time offenders get a hefty fine and lose the right to own or carry arms for 5 years. After that we get serious.

ivan,

truth will set you free.

“Off course Biden’s release of oil from the strategic reserves (and pushing EU to do the same) has reduced energy prices and helped keep inflation in single digits.”

single digit inflation: hypothesis not supported by evidence.

cumulative avg crude input to refineries is running 15,829 million barrels per day, up 5.7% y on y; the releases are roughly 1 million on long average, the price of release is market.

net import crude is replaced by the release from the reserves: latest cum net imports are: 2.9 million barrels per day down from 3.2 million a year ago.

usa crude supply is up to 11,9 million per day cum avg, up 8.2%

and usa export of finished petroleum fuels is up from net import in feb 2022 to exporting 4 million barrels per day report of 21 Oct 2022. replacing russian product on the world market.

export growth should prop gasoline prices, but….

i think the price of food and rent has more impact on gasoline price than the spr release which largely benefits foreign customers not buying russian fuel.

demand destruction!

but wait!

one major utility in the northeast is screaming about distillate shortages in the us which may cause rolling blackouts in the dead of winter.

so much for benefits of the granholm binder run toward lithium battery investments!

it ain’t all gasoline!

“…hypothesis not supported by evidence.”

You are one Venti-sized hypocrite. Since when have you cared about evidence?

What is ot that has drawn the vermin back out of the sewers? Johhny is rerunning his old nonsense about economists not caring about economics. CoVid spreading his his disinformation like a disease. ltr littering the sidewalks with political flyers dressed up as news. Brucey being Brucey. And there’s even someone who thinks antifa is a real thing. Or pretends to think, anyhow.

Whatever could it be that has driven them up from the dank reaches of their subterranean dens?

Not Halloween. That’s an entirely different kind of pretending. Colder weather? I’m out of ideas. Anybody?

https://www.msn.com/en-us/news/politics/trump-lawyer-writes-conspiratorial-post-questioning-paul-pelosi-hammer-assault/ar-AA13uk76?ocid=msedgdhp&pc=U531&cvid=0dbcb516677744b9b8cf0f25c193f290

Trump attorney Harmeet Dhillon on Friday posted a conspiratorial tweet where she insinuated that there was something suspicious about the alleged assault of Paul Pelosi, the husband of House Speaker Nancy Pelosi. Dhillon, who was hired by Trump earlier this month to help him litigate the House Select Committee’s subpoena, found it “odd” that Paul Pelosi would be vulnerable to being assaulted given the amount of security that normally surrounds the Pelosis.

Leave it to someone on Team Trump to write something so disgusting. Hey lady – you do know Nancy was not in SF I trust.

FoxConn Wisconsin déja vue all over again?

“Intel Corp. successfully pushed for congressional approval of a $76 billion subsidy for the chip industry. Now, it is laying off workers in an austerity regime while continuing to give shareholders massive payout…

The potential layoffs come only weeks after the company announced a shareholder dividend at the same rate as the previous few quarters — amounting to a total of about $6 billion in annual dividends.

The sequence of events confirms warnings about the so-called CHIPS Act from a vanishingly small number of critics who cautioned that without changes, the legislation would let companies use the money to finance payouts to wealthy investors, and would not obligate the companies to expand their investments in domestic jobs.

And yet, those critics were ignored by politicians and pundits of both parties eager to shovel federal money to a handful of powerful tech companies. Indeed, when Vermont senator Bernie Sanders attempted to attach conditions to those subsidies — including a ban on stock buybacks, a cap on executive pay, a government equity stake, and union neutrality provisions — he was thwarted by Democratic leaders.

At the time, Democrats blocking Sanders’s initiative were bolstered by Intel CEO Pat Gelsinger, who insisted that if the legislation did not pass immediately, the company could move factories overseas and hold up already-planned investments.

When lawmakers ultimately passed the bill in July, Intel abruptly began changing its rhetoric about new domestic investments: That very same day, the company announced it was CUTTING BACK ON CAPITAL SPENDING BY BILLIONS OF DOLLARS, but still intended to issue a “strong and growing dividend” for shareholders.”

https://jacobin.com/2022/10/intel-layoffs-corporate-subsidies-chip-manufacturing

What’s hilarious is that when I pointed out risk of chip subsidies repeating the fiasco of FoxConn Wisconsin, one commenter assured me that it would not happen because there was competent management. Yes indeed…if you classify competent management as the ability to milk the government in order to protect dividends!

I get you prefer to read left wing hit jobs over 10-Q filings. Then again you are too stupid to use http://www.sec.gov so permit me to educate you on what Intel’s latest has said. Sales for this company like the entire industry have slipped even for your vaunted TSMC. Then there is this statement:

We announced the Semiconductor Co-Investment Program (SCIP), a program which introduces a new funding model to the capital-intensive semiconductor industry. As part of this program, we signed a definitive agreement with Brookfield Asset Management (Brookfield). SCIP is an element of our Smart Capital approach, which aims to provide innovative ways to fund growth and accelerate our IDM 2.0 strategy. This arrangement represents an equity partnership whereby we and Brookfield will own 51% and 49%, respectively, of what will be a newly-formed entity, Arizona Fab LLC (Arizona Fab), which we will fully consolidate into our consolidated financial statements. We expect Arizona Fab will spend up to $30.0 billion of investments in expanded manufacturing infrastructure at our Ocotillo campus in Chandler, Arizona where we will be the sole operator of the two new chip factories, which will support long-term demand for our products and provide capacity for IFS customers. The definitive agreement includes provisions that require us to utilize these two new chip factories at specified minimum levels or be subject to penalties.

Oh wait – you have proven you have know what IDM 2.0 is about as you do not understand the difference between designing and contract manufacturing. But hey – the semiconductor sector is volatile so people who have no clue about the sector might confuse short term concerns and long-term developments.

BTW check out Micron which has decided New York is a better place to make investments than RonJon’s stupid state.

And pgl’s point is? IDM 2.0 is full of glitzy buzz words with little proven ability to deliver at internationally competitive prices.

Now what will happen to those governments subsidies that are being lavished on a speculative venture? Will it end up like the legendary $.57 screw driver that the Pentagon purchased for $76?

You just basically said Intel is lying to its own shareholders. Hey dude – start a shareholder lawsuit if you really believe that.

Hey, Dude. Corporations spin their message to their investors and to the government all the time. Glitzy buzz words about future prospects are SOP. What planet have you been living on? Oh, I forget…pgl never got out of his ivory tower, so he has no clue as to how business uses PR to shape perceptions and positive illusions.

And Intel sure did a heck of a job selling Democrats to get on the federal gravy train. Let’s all hope that there is more than smoke and mirrors behind the IDM 2.0 plan.

“JohnH

October 29, 2022 at 2:59 pm

Hey, Dude. Corporations spin their message to their investors and to the government all the time.”

Now we get why your former “Fortune 200” firm went bankrupt. The outside shareholders had to sue it.

If anybody’s having fun, the Fed’s job is not done.

Real personal consumption spending up 0.3% in September, following a 0.3% rise in August. That provides a healthy base for Q4. GDPNow hasn’t updated yet. Real income flat. Real income ex-transfers =0.1%. Real disposable income flat. Better than a lot of recent months, but not great.

Opening round for Q4 from the Atlanta Fed: 3.1%.

PCE contribution around 2.5% (big chance for variability in Q4), net exports seen as positive. Residential investment and inventories seen as the only drags.

Menzie – thanks so much for this. One area that I am especially interested in is agriculture exports – I am always shocked that ag subsidizes play a huge role politically – and most ag subsidizes go to export crops (corn, soybean, cotton) but they contribute very little to export GDP. Another interesting item is that I think the Trump trade war was a big fat failure – but no one in the GOP talks about their numerous policy failures. Now – the GOP is on to dismantling Social Security and once again talking about growing the economy with tax cuts for rich people.

James,

This post is by Jim Hamilton, not Menzie. Jim shows up to post on these official quarterly reports.

Uh Oh:

https://www.reuters.com/world/china/chinese-cities-tighten-curbs-against-widening-covid-outbreaks-2022-10-27/

Now that Xi has aggrandized himself, economic reports have resumed and lock-downs are ramping up. Adjust global GDP estimates lower, inflation estimates higher.

Yes an out of control germaphobe as your dictator can really screw up a country. The current omicron variants cannot be controlled by lockdowns – even the extreme measures in China can only turn the flame of the pandemic down. That is the biology of those variants and of human basic needs. The dictator can make all kinds of dictates to his subjects, but cannot dictate biology. Xi will impose a lot of suffering on his subjects for a short delay of the inevitable.

whaddya do about out of control vaccophiles in cdc ‘recommending’ scantily (mouses) tested mrna vaxxes for kids over 5, and the fools in states tempting to require same for school attendance……

Apparently Pro-Publica and Vanity Fair have just published a report that there was some kind of mysterious but serious emergency at the Wuhan Virology Institue in November 2019 that got the attention of Xi Jinping. Various commentators are hyping this as new evidence of the lab leak origin of Covid-19, although the Science articles from earlier in the year still stand with their strong evidence leaning to a zoonotic origin, or very much that the Huanang Market was the epicenter of the distribution of the virus, whatever its ultimate origin. But whatever the emergency at the lab in November 2019 was, it may be that this is what at least partially lies behind Xi’s ongoing emphasis on using these lockdowns, although it may also be that they are effective means of engaging in serious social control, which it looks that he is increasingly into doing as he concentrates more and more powere into his own hands.

Kevin Drum addressed this on his blog noting how weak the new evidence is.

The origins of the virus is an idiotic side show originally used by Trump to distract from his catastrophically incompetent handling of the crisis – being more concerned about looking Presidential than preventing the death of potentially millions of Americans. It was part of this infantile “its wasn’t my fault” reflex that made him so incapable of even basic leadership.

Whether the virus transfer from bats to humans happened in a meat market (very likely) or a laboratory (very unlikely) does not change how we should fight the pandemic after “the horse is out of the barn” – figuratively speaking. It doesn’t even change how we should prevent the next pandemic. Both routes of transfer are potentially possible so they should both be prevented to any extend we can.

We MUST have research on emerging viruses or we could be defenseless next time they establish a pandemic. We currently have extremely good protocols for working with them safely in specialized facilities. However, any additional laboratory safety processes that can be developed are important progress to implement.

The meat markets were problematic and it appears that Xi at least has recognized that and implemented reforms. However, the exchange of viruses from animals to humans are not exclusive to Chinese meat markets – it happens all over the world and in many other settings than meat markets. Exposure of humans to nature will continue no matter what we do. We are developing a better understanding of why Bat viruses may be particularly problematic for humans (in large part due to the maligned laboratory in Wuhan). Provided that the paranoia about laboratory research on “dangerous viruses” doesn’t shut down this quest for critical knowledge – we may be able to target specific Bat/Virus populations in the future and reduce the risk of another pandemic emerging from the unpreventable exposure of humans to nature.

nature typically creates a new, possibly pandemic type virus, every 10 years or so. this was the case with mers, says, covid, etc. we should be prepared no matter what the source. which is why our nations response to this last episode was so demoralizing. what if sars had been the virus to spread instead? or a very contagious version of ebola? we need to take a biological threat more seriously.

Ivan,don’t forget: “… cannot dictate biology. Xi will impose a lot of suffering on his subjects for a short delay and time extension of the inevitable.”

Off topic, the 2024 election –

A question I hear from a good many Democrats: If Joe doesn’t run for re-election, who do we run in his place? Gavin Newsom has an answer to that question:

https://www.politico.com/news/2022/10/28/gavin-newsom-digital-fundraising-00063930

It’s an odd question. Historically, Democrats have used primary brawls to pick presidential candidates, while Republicans have anointed the next guy in line. Anointing Hillary didn’t work out. Trump’s brawl worked out for Trump, but not for the rest of us. The only obvious problem with Newsom is that he doesn’t bring extra electoral votes with him; just about any Democrat who runs will carry California. A Democrat from Florida or Ohio would shake up the math.

when I was a democrat I supported Bernie….

Real per capita income back to where is was in 2019.

https://fred.stlouisfed.org/series/A229RX0

If this is not a recession for the average American, then what word do economists have for it?

‘Real Disposable Personal Income: Per Capita’ (read the damn caption in the graph):

is not the same thing as real income per capita unless net taxes are zero. Yea – you are very STUPID!

One of the hallmarks of intelligence is the ability to discriminate between cases. Johnny thinks “recession” is this, that or the other economic thing. That’s what a lack of ability to discriminate between cases gets you – this, that and the other are all “recession” to Johnny.

That’s why Johnny can’t do economics.

I am curious why our top Putin-poodle is suddenly cluttering up comments with his poorly formed ideas again. Is this Johnny’s version of a dirty bomb? – not as powerful as the real deal, but it makes such a mess.

So, MacroDucky, what do YOU call it when real wages regress? We’re you even aware that they are back to 2029 levels?

Since economists seem unlikely to care enough about a decline in real wages to give the phenomenon a name, I’ll just take the liberty of saying that American workers are experiencing a recession when that happens. The shorter version is a wage recession,

Real wage decline. See? Simple.

If you were looking for a one-word name, maybe you should reflect on why you think that’s important. ‘Cause, ya know, lots of things are identified by strings of words.

I have younger brothers whom I describe as “younger brothers”. Two whole words. Nobody gets bent out of shape. I have a paring knife which I call a “paring knife” to distinguish it from, say, a butter knife. Again, more than one word, but easy enough to say. There’s this place called “Church Street Station” which is distinguished from other stations by its 3-word name. Sometimes, people shorten it to “Church Street”, but only if it is clear that they are talking about a subwaystation.

Johnny, you’re pretending that there are problems where none exist. In a world full of problems, that’s either a dumb thing to do, or just dishonest. Like pretending thereis lots of voter fraud in the U.S. or that Ukraine was a threat to Russia.

If you need a name for something – ask your BFF Princeton Steve. He makes up names all the time. But he will call this suppression.

BTW troll – recessions are business cycles which go up and down. I thought your little thesis was that real wages are lower over the long run. But who knows what you think as you told us UK real wages rose under Cameron and his fiscal austerity even though every smart UK economist knows they fell a lot.

JohnH,

When it is due to rising prices, it is called “inflation,” perhaps something you have never heard of before apparently. As it is, indeed many people are aware of it, with polls suggesting that it is a major issue in the midterm elections, especially for people unhappy with the incumbent administration.

But real wages regressing sounds so much fancier. JohnH is reminding me a lot of his BFF Princeton Steve.

What’s your point Rosser? Inflation is not necessarily synonymous with declining real wages. In fact wages could easily exceed inflation without increasing the inflation rate if workers could capture part of productivity increases.

Why not just acknowledge that the average American is experiencing a recession while the economy is not. Focusing solely on the economy overlooks the welfare of those who make up the economy…and for whom “the economy” should work.

JohnH,

Wow, guess what? While we do not have data on wages for Q3, it looks that nominal income grew more rapidly than prices in Q3, leading to real per capita incomes rising, with the early indicators being that this is continuing into Q4. So, yes, declining real wages due to inflation outpacing nominal wages is a serious problem. But, sorry, it is not “recession” no matter how hard you try to pretend that it is.

Actually if you look over the past, we have seen episodes of declining real wages both during periods of high inflation and also in periods of recession. But declining real wages do not indicate that one is in a recession, no matter how much you want to redefine the term or add all kinds of modifiers to it. You are just making yourself look like a politically agitated fool.

“JohnH

October 29, 2022 at 2:49 pm

What’s your point Rosser? Inflation is not necessarily synonymous with declining real wages. In fact wages could easily exceed inflation without increasing the inflation rate if workers could capture part of productivity increases.”

Back in the EconomistView days anyone who said this would be accused by JohnH of being a corporate lackey. JohnH – the master of gullible positions!

Barkley, let me help with your inaccurate and incomplete thought: “…polls suggesting that it (inflation) is a major issue in the midterm elections, especially for overwhelming number of people unhappy with the incumbent administration.” Worse for your party is that overwhelming number of people unhappy with the incumbent administration have a name – VOTERS.

Maybe you should do as MD, focus on the 2024 election while conceding 2022. Please, please, please run Newsom or any farther left candidate for President.

My own thought is that 2022 will alter that response. Results from your current leftist policies is so obviously bad, as shown here, in Europe, Australia, Canada, etc. Also, please keep messing with energy reliability and supply, the basic production components of production.

CoREv,

Oh, reminding us once again that you are the stupidest commenter here. What “inaccurate and incomplete thought”? I state that inflation has voters upset and you somehow jump in to claim that I am not on top of what the situation is. You claim that somehow the inflation is due to “leftwing policies.”

There probably was some aggravation of it last year due to fiscal policy, but that fiscal stimulus ended quite some time ago, with Steven Koptis of all people earlier this year citing this fact as a supposed reason for why we were going into recession la de da. And indeed while rate of inflation remains higher than anybody would like, it is lower than in most other nations, and there is a pretty vigorous anti-inflationary policy going on that has produced among other things a solidly rising US dollar, which is substantially anti-inflationary.

And you think that somehow having the GOP running things will be more anti-inflationary? Just hoe out of your mind are you? The main policy they clearly want is to reimpose the Trump tax cuts for the rich, a policy proposal that in the current inflationary environ,ent led to a copllapsing currency and other markets in UK when the now deposed Liz Truss put one forward. Yeah.

Note US stock market now well above where it was when Biden took office, not to mention even higher compared to Election Day 2020 when Tramp predicted the election, which he seemed to recognize then he had lost, would lead to a massive collapse of the stock market, which has not been that low since..

As for 2024, let us worry about that after we get through this upcoming midterm election, whose outcome I am not at all remotely forecasting. Anything can happen in it.

CoRev,

Oh yes, I know one other not anti-inflationary policy we shall get if GOP wins a house of Congress: a lot of hearings about a laptop that belongs to somebody who is not and has not been a government official. This will certainly be salacious and will provide lots of opportunities for otherwise unproductive GOP pols to appear on endless Fox News shows with endless predictions of how the next witness they will have tomorrow will provide the definite answer that will show some sort of something about the president, with all this resembling in the end the 8 different hearings that went on for nearly two years costing millions of dollars on Benghazi that produced in the end….absolutely nothing but a lot of embarrassment for those who held those hearings.

when wages exceed price level we used think ‘cost pUsh’ inflation, but that is old school.

wage lag inflation is the modern form….

who benefits from eroding the middle class?

I would be interested in your interpretation of the US savings rate.

https://fred.stlouisfed.org/series/PSAVERT

I posted what Dean Baker said. Of course you cannot read so HEY!

Some of us read what Dean Baker said yesterday and even noted here. But of course Stevie could not be bothered with that:

https://cepr.net/gdp-2022-10/

Saving Rate Fell, but Main Factor is Higher Capital Gains Taxes

The saving rate edged lower in the quarter to 3.3 percent of disposable income from 3.4 percent in the second quarter. That compares to a saving rate of 8.8 percent of disposable income in 2019 before the pandemic.

This has been generally portrayed as people spending down the savings they accumulated during the pandemic. While this is true to some extent, the biggest factor is that people are paying more taxes, presumably capital gains taxes on stocks they sold in the last year. (Capital gains are not counted as income.)

The tax share of personal income rose from 11.8 percent in 2019 to 14.7 percent in the third quarter. If the tax share of personal income had remained constant, the saving rate would have been more than 3.0 percentage points higher in the third quarter.

From the good folks at BLS:

https://www.bls.gov/news.release/eci.nr0.htm

Compensation costs for civilian workers increased 1.2 percent, seasonally adjusted, for the 3-month period ending in September 2022, the U.S. Bureau of Labor Statistics reported today. Wages and salaries increased 1.3 percent and benefit costs increased 1.0 percent from June 2022. (See tables A, 1, 2, and 3.) Compensation costs for civilian workers increased 5.0 percent for the 12-month period ending in

September 2022 and increased 3.7 percent in September 2021. Wages and salaries increased 5.1 percent for the 12-month period ending in September 2022 and increased 4.2 percent for the 12-month period ending in September 2021. Benefit costs increased 4.9 percent over the year and increased 2.5 percent for the 12-month period ending in September 2021. (See tables A, 4, 8, and 12.)

As Kevin Drum routinely notes – nominal increases should be inflation adjusted. In real terms, compensation fell. Kevin often writes on this as do economists. Now JohnH keeps telling us that we do not but then JohnH is a serial liar.

I provided Johnny boy a link to Kevin’s latest asking him to have a spine and comment over at Kevin’s place. He never has before so do not expect this lying coward to do so now.

Great example, pgl…makes my day…there was no mention of “real” compensation in the BLS commentary. LOL!!!

And in his perpetual fog of misinformation, pgl couldn’t even remember to link to Kevin Drum! Now, even if Drum does talk about the average American being in a period of recession due to declining income, it only proves that there is at least an economist willing to buck the prevailing groupthink. But I already knew that…there are in fact a lonely few.

The Employment Cost report doesn’t have an inflation component, and rightly so, because it doesn’t have an output or consumption component to deflate. Without a related inflation series, THIS report doesn’t report an inflation adjusted compensation series. You can use other deflators to estimate a real compensation sries, like a grown-up. Or you can choose some other compensation series which has a related deflator, like a grown-up. Or you can continue acting like a child.

Anybody else notice how the average intelligence of commentary here varies inversely with the amount of Johnny comments?

No,as I have said repeatedly, it has been very entertaining to watch the efforts by some to prove that recession was a figment of some people’s imagination. IOW, two straight quarters of declining GDP deserved a D-, not an F.

I have voted for a major party candidate for President only once in the last 30 years, but watching supposedly non-partisan professionals argue about trivial distinctions and undermine confidence in major economic indicators is really quite revealing, both about hidden biases as well

You still think we are in a recession? We knew you were dumb but DAMN!

Oh, please, MacroDucky, the data in the report clearly shows the constant dollar changes. It was in the commentary where reference to constant dollar changes was missing.

Anybody else notice how the average intelligence of commentary here varies inversely with the amount of MacroDucky comments?

Sorry, JohnH, but an economy reaching lows of unemployment not seen in many decades is not a D-, even if GDP declined because of inventory changes while other measures of aggregate output rose. Obviously lots of peop[e were not happy with what was happening because indeed in those quarters inflation was high enough to damage real wages. But, sorry, not a recession, again, much as you want to say it was.

https://jabberwocking.com/core-pce-inflation-dropped-to-5-5-in-september-headline-inflation-came-in-at-4-1/

Kevin Drum’s latest on inflation notes it seems to be coming down a bit.

it is as easy to see the report:

https://www.bea.gov/news/2022/personal-income-and-outlays-september-2022

10 minutes if you read the notes.

what matters is what the fomc sees, and what they have from other sources.

eci is down from 1.3 to 1,2 in 2d qtr!! better than going up?

what the markets saw today is not what i see.

Update on the creep who attacked Paul Pelosi:

https://www.msn.com/en-us/news/us/alleged-paul-pelosi-attacker-posted-multiple-conspiracy-theories/ar-AA13uLaM?ocid=msedgdhp&pc=U531&cvid=8fa0d1b4e9b34e81805687d9227dfb9b

Last year, David DePape posted links on his Facebook page to multiple videos produced by My Pillow CEO Mike Lindell falsely alleging that the 2020 election was stolen. Other posts included transphobic images and linked to websites claiming Covid vaccines were deadly. “The death rates being promoted are what ever ‘THEY’ want to be promoted as the death rate,” one post read.

DePape also posted links to YouTube videos with titles like “Democrat FARCE Commission to Investigate January 6th Capitol Riot COLLAPSES in Congress!!!” and “Global Elites Plan To Take Control Of YOUR Money! (Revealed)”

Two days after former Minneapolis Police Officer Derek Chauvin was found guilty of killing George Floyd, DePape wrote that the trial was “a modern lynching,” falsely indicating that Floyd died of a drug overdose.

He also posted content about the “Great Reset”– the sprawling conspiracy theory that global elites are using coronavirus to usher in a new world order in which they gain more power and oppress the masses. And he complained that politicians making promises to try to win votes “are offering you bribes in exchange for your further enslavement.”

how the perp got past all that security?

A.,

There is not much security there when Nancy Pelosi is not there, and she was not there. This lack of security for family members of people in Congress is now being hotly discussed in Congress.

Or are you watching too many questionable Fox News shows again?

Fox News correspondent Peter Doocy pulled a Bruce Hall:

https://www.msn.com/en-us/news/politics/altered-video-of-exchange-between-white-house-press-secretary-and-reporter-on-gas-prices-goes-viral/ar-AA13urLM?ocid=msedgdhp&pc=U531&cvid=d7bfd709c1424f278390d8ca50416f31

In the edited clip, Jean-Pierre calls on Doocy, who says to her: “Thank you, Karine. So, you’re asking oil companies to further lower gas prices. What makes you think that they are going to listen to an administration that is ultimately trying to put them out of business?”

“How is the administration trying to put them out of business?” she asks in response. “Well, they produce fossil fuels, and this president says he wants to end fossil fuel,” Doocy replies.

The altered video then added a whistling sound effect while showing alternating clips of Jean-Pierre and Doocy appearing to stare at each other without saying a word. After what appeared to be a few seconds of awkward silence, Jean-Pierre is shown thanking everyone, closing her binder and then walking away from the podium.

But that’s not how the exchange between Jean-Pierre and Doocy ended. In the unedited video of the full press briefing, which was posted to the White House YouTube channel, Jean-Pierre answered Doocy’s question. She did not end the briefing until more than nine minutes later, after taking several more questions, including additional ones about gas prices and oil company profits that were asked by another reporter.

The Bruce Hall was Doocy’s pathetic question. The editing of what happened to make it appear that Jean-Pierre abruptly walked out is pulling a CoRev. Of course this entire Republican campaign for the upcoming elections is nothing more than this pathetic dishonesty. MAGA.

Off topic, trade spat warning –

France and Germany see U.S. efforts to rebuild domestic industry as a protectionism:

https://www.politico.eu/article/france-and-germany-find-ground-on-a-common-concern-u-s-protectionism/

“Macron also mentioned similar concerns about state-subsidized competition from China: “You have China that is protecting its industry, the U.S. that is protecting its industry and Europe that is an open house,” Macron said, adding: “[Scholz and I] have a real convergence to move forward on the topic, we had a very good conversation.”

Technically the US and China are in violation of at least the spirit of free trade and the WTO rules. But if Macron is suggesting the EU does not do the same thing – he has to know he is lying. I bet none of that food and wine they dined on came from sources outside the EU.

Looks like the grain deal is a gonner:

https://www.reuters.com/world/europe/russia-suspends-participation-deal-ukraine-grain-exports-tass-2022-10-29/

Probably antifa’s fault, right?

MD,

Yes, this is unfortunate, but it is also apparently the case that Putin had been squeezing the deal for some time and interfering with grain shipments as his military situation deteriorated in Ukraine. He has blamed the Ukrainians for attacking Black Sea fleet vessels for finally closing off the deal, but clearly he is just getting more desperate for any way to get at them as they continue to advance.

I suggested a while back that the US and the EU send some of their cargo ships to help move this vital grain. Now if Putin is stupid enough to interfere with the peaceful shipping of grain by Western ships, I’m sure there are enough NATO forces to take down the Russian interference. Call Putin’s bluff as he certainly does not a war with us.

Apparently Turkey has sent ships and managed to successfully escort some vessels with grain over the objections of Putin. He really cannot attack Turkish ships, part of NATO.

Now the GAP said they would stop selling their goods to Russia but it seems someone did not get the memo:

https://www.foxbusiness.com/retail/gap-says-russia-deliveries-stopped-march-but-clothing-kept-coming