Just a reminder – the budget balance is endogenous (as long as one believes in a fiscal multiplier).

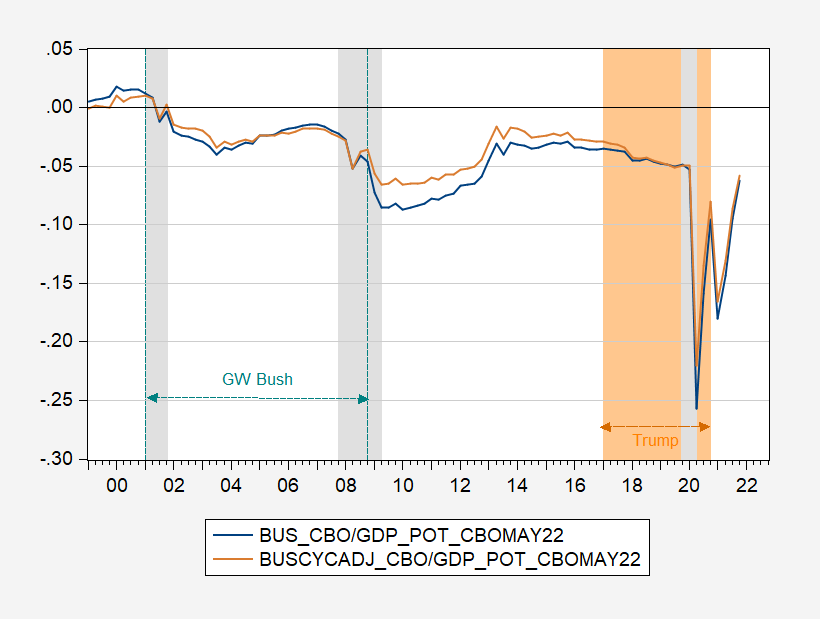

Figure 1: Federal budget balance to potential GDP (blue), and cyclically adjusted budget balance to potential GDP (tan). NBER defined peak-to-trough recession dates shaded gray. Orange shading denotes Trump administration. Source: CBO, NBER and author’s calculations.

This post prompted by a reader’s mendacious assertion that Trump was righting the fiscal ship before the pandemic (not that I expect him to understand what “endogenous” means).

Endogenous means the things that is specific to your dog themselves, like they got sick breaking into your skittles candies. They done did eat the skittles candies so the dog did it to themselves. That’s why it’s called DOG-enous. But EX-genous is like when your neighbor’s dog bites your dog and your dog got ill from the bite. They was friends before and sniffed each other’s heinie, but then after the neighbor’s dog bit your dog they became EX-friends. That’s why they did done call it EX-genous. That’s the way Sergeant King explained it to me. I reckon.

Food for thought.

I had to do a search.

http://www.investopedia.com/terms/e/endogenous-variable.asp

An endogenous variable is a variable in a statistical model that’s changed or determined by its relationship with other variables within the model. In other words, an endogenous variable is…

By ‘federal budget balance,’ do you mean expenditures/total outlays? What would be graph look with tax receipts to potential gdp lines added?

Anyhow Moses thanks for letting us know what you think of Prof Chinn’s graph.

That is a good description of the terms but give Moses some credit. He captured the same thing with a bit of humor.

like my f-16 has a laser designator on 3d gimbal which can ‘pitch, yaw, and roll’ independent of the ‘pitch, yaw and roll’ of the airplane, and effects the mission feedback of the airplane…..

The one you fly on your PS5 ???

I actually liked Professor Chinn’s graph. I also like “advocate journalism” and sometimes, similar to Paul Krugman I must say, I DO NOT think there are “two sides to every story”. Sometimes I think there is only truth. The sky is not deep purple at high noon in Maui, it is only blue. So there’s no reason to spend half of a newspaper article discussing the “other side” of the sky at high noon in Maui being deep purple. A problem in journalism even some of the reporters at NYT can’t seem to figure out.

Yes, I enjoy being silly (1 in 200 times my attempts of actually being funny succeed) and making references to “No Time For Sergeants” when I can. I also like to inject “Beavis and Butthead” references but those are harder to wedge into the blog here.

Just in case Brucie does not know what mendacious means – it is what he does best. LYING.

But at first I thought you were referring to how Princeton Steve keeps saying Biden gave us fiscal restraint is on the order of 7% of GDP.

1.

Many folks have a shocking capacity

For deception and lies — sheer mendacity.

They will lie to the max,

Spurring violent attacks

On those guilty of naught but veracity.

http://www.madkane.com/madness/category/political-limericks/

2.

Redruth

A lisping old man from Redruth

Always struggled to tell the truth.

When asked, ‘Why mendacity?’

He replied, ‘With veracity

One should always play fast and looth!’

E.E.Murray

3.

Mendacity

In court a young lawyer, named Horatius,

was renowned for defences loquacious.

But I’m sad to say,

there once came a day,

when deplorably he became quite mendacious.

https://allpoetry.com/poem/3752482-Mendacity-by-Shenton

I’ll stop now.

: ) Love it.

Fiscal Policy in the ‘Thirties: A Reappraisal

E. Cary Brown

The American Economic Review

Vol. 46, No. 5 (Dec., 1956), pp. 857-879

This is the classic publication on this which we have many times asked both Brucie and Princeton Steve to read. Judging from their incessant ill informed comments on this basic concept, it is clear neither of them have read this classic piece. Which should disqualify both of them from ever commenting on fiscal policy again. j

Just in case Brucie and Stevie protest that they do not know who E. Cary Brown was – here is a bio:

https://news.mit.edu/2007/obit-brown-0627

In particular:

E. Cary Brown, a leading expert on fiscal policy and the economics of taxation and a member of the MIT economics faculty for more than 60 years, passed away on June 8. He was 91. As a professor of economics at MIT, Brown taught a wide range of graduate and undergraduate courses on tax policy design, statistical methods for economics and the economics of fiscal policy … Brown was also an expert on broader issues of fiscal policy. His 1956 paper on “Fiscal Policy in the Thirties: A Reappraisal” was one of the first applications of the full-employment budget deficit concept. In contrast to the then-prevailing wisdom, the study suggested that fiscal policy had not been particularly expansionary through much of this period, thereby calling into question the extent to which fiscal policy could have contributed to the U.S. economy’s recovery from the depths of the Great Depression.

I repeat – anyone who has not read his paper on fiscal policy is not qualified to comment on this issue.

A little closed economy Keynesian multiplier model might prove helpful to our dimwitted trolls.

Let consumption (C) depend on after-tax income (Y – T) with a marginal propensity to consume (c) = 0.9.

Let investment (I) depend on income (Y) with a marginal propensity to invest (v) = 0.17.

Let the deficit = government purchases (G) – net taxes (T) where T = t(Y) where t = 0.3.

The overall marginal propensity to spend = c(1 -t) + v = 0.8 so the multiplier = 5.

If G rises by $100 billion, Y rises by $500 billion so T rises ENDOGEOUSLY by $150 million.

Smart people like E. Cary Brown would see this as an example of fiscal stimulus rising by $100 billion. Princeton Steve in his utter ignorance of basic macroeconomics would see the deficit falling by $50 million and start his usual yapping over supposed fiscal restraint even though my little parable is taught in week one of a freshman course in macroeconomics.

Four comments and it’s not lunch time.

This economist finally has a good excuse for being wrong.

I make fewer comments than you do but then I make substantive points. You do not.

You’re thinking me and my other twin brothers, Anonymous, are one.

I don’t know anyone but you who switches between their regular pseudonym and “Anonymous”. Fortunately you’re so incredibly dumb we can still tell exactly who you are. I wonder if this has ever been done online before without the help of plagiarism software?? You may have done a first.

Let’s talk Russian budget numbers

Steven Kopits: Why? BOFIT reports 2021 0.4 ppt of GDP suprlus to 2022 2.3 ppt deficit, even w/1 ppt of GDP Gazprom boost.

“With fading revenues and increased spending, the small federal budget surplus (0.4 % of GDP) in 2021 transformed in 2022 in a larger-than-expected deficit (2.3 % of GDP – even with Gazprom’s tax boost equivalent to nearly 1 % of GDP).”

The increased spending should be considered fiscal stimulus but the fall in tax revenues should not. Now that Stevie has been reminded of E. Cary Brown’s work, let’s see if he can provide this first ever sensible estimate of fiscal impact!

“Federal budget spending already accelerated in the months around the invasion of Ukraine and was boosted in the final months of 2022 to about 40 % y-o-y. The dramatic increase in spending on fixed investment points to a sharp rise in defence spending (which was already up by nearly 40 % y-o-y in January-April).”

And I thought the US spent a lot during the Korean and Vietnam Wars.

https://www.upstreamonline.com/production/russia-slaps-higher-taxes-on-oil-and-gas-concerns/2-1-1352870

The lower chamber of the Russian Duma has approved amendments to the country’s Tax Code to impose a higher levy on Novatek-led Yamal LNG, state-run gas giant Gazprom and others. The decision comes as Moscow looks to increase military spending to support the war in Ukraine but faces a potential reduction of budget revenues as a result of international sanctions. Russia’s budget deficit is expected to widen to about 3 trillion roubles ($50 billion) in 2023, against an expected 1.3 trillion roubles this year. At the same time, Russian oil producers face potential difficulties in selling their oil to international markets after 5 December, when the G7 group of countries and Australia will introduce a price cap on Russian shipments.

The first tax amendment will raise the corporate rate for the Novatek-led Yamal LNG projects to 34%. The current rate is 20%. The measure will generate about 200 billion roubles of additional budget revenues next year, according to the country’s finance ministry. In October, Novatek executive board chairman Leonid Mikhelson said that Russia’s largest independent gas producer had been informed about the proposed corporate tax increase and discussed it with the finance ministry. Mikhelson said Novatek’s Arctic LNG 2 project will be exempt from paying the increased rate. All the company’s liquefied natural gas projects are expected to continue to enjoy an exemption from paying an export tax on LNG. The higher tax rate does not contradict guarantees the Russian government issued earlier to Yamal LNG’s foreign shareholders China National Petroleum Corp and the Silk Road Fund, according to Mikhelson.

What’s this – a higher tax on oil profits for some but not for all? It’s like Mitch McConnell is managing Russian tax policy!

Understanding the Russian budget is essential to understanding its ability to wage war. We assume during wartime that Russia’s fiscal numbers may well be deliberately distorted, so we would look for clues to try to confirm or refute those numbers. For macroeconomists dealing with fiscal policy in emerging or opaque markets, the nature of Russian statistics generation is a good exercise for looking behind published numbers.

In addition, a good bit of Russian revenues have been one-offs, including a large dividend from Gazprom and draws from the country’s sovereign wealth fund. How long can those go on? In what quantity? What are the short and long term implications?

I would note that Russia’s official GDP was down a bit over 2% in 2022. But so what? That includes Q1, mostly not war. And Q2 mostly is high oil price. My analysis of BOFIT Q3 numbers looked like Russia was running a structural deficit of 10% of GDP for the quarter. But maybe I am reading the numbers wrong.

Further, I have not fund the actual budget numbers, line by line, in English, with commentary, on BOFIT’s site. Certainly not in excel form. Nor can I access the official Russian sites from my computer.

In addition, I have to ask how much I trust BOFIT. How much are they leaning on official numbers? How much are they inferring? I cannot easily tell from their weekly summaries, so I am struggling to sense check their work.

And then, finally, I have not seen an independent forecast of Russia’s budget, line by line, in English in excel form that allows some scenario analysis of, say, rising or falling oil prices and / or exports. I would add that a fiscal analysis would also consider policy choices, for example, reducing social spending or infrastructure spending, raising taxes, printing money, etc.

All of these are essential to understanding Russia’s internal stresses, Putin’s room for fiscal maneuver, likely societal push back, ability to re-arm, etc.

To put it all together, we are seeing a real-time, wartime exercise in fiscal policy. If I were teaching macro, I would want to work through this with my students, at least those interested in fiscal policy and winning the war.

Not GDP down, but budget deficit, which was 2.3% of GDP, as pgl points out.

“Understanding the Russian budget is essential to understanding its ability to wage war”

You keep assuming Putin is a reasonable leader of his own people. Which is why you will never understand what drives this mad man.

BTW the topic of this post was the US macroeconomy – something you clearly do not understand.

I assume that, under duress, Putin is a classical liberal in that he seeks to maximize his own utility. (And I am alone in that here, I think.) That’s the objective function, although as I point out, all people — including leaders — experience ongoing tensions between liberal and conservative objective functions, that is, between optimizing their own utility and meeting their social obligations in their accepted roles, in Putin’s case, as leader of Russia and the Russian people.

However, for those who are unprincipled — and I think we can put Putin in that box — fealty to duty melts away under pressure. I think Putin is willing to fight to the last Russian to preserve his job. For Russia, that’s irrational. For Putin, it makes lots of sense.

Btw, I am happy to hear your view of the US macroeconomy. Should the Fed cut interest rates, or raise them? Why?

Steven Kopits

January 30, 2023 at 1:38 pm

I assume that, under duress, Putin is a classical liberal in that he seeks to maximize his own utility.

Good God – stop pretending you are smart. No – you type big sounding words in a way that makes us think a monkey took over your keyboard.

“I am happy to hear your view of the US macroeconomy. Should the Fed cut interest rates, or raise them?”

I have stated over and over that it is time for the FED to lower interest rates. And yes the US macroeconomy is the topic here. But no – no one wants to hear your stupid babble on this topic. So just STFU.

Was Kopits asking if Elvira Nabiullina still had her job as head of Russia’s Central Bank?? Or if Nabiullina’s husband was still breathing?? I happen to know the answer to that question. Unless somebody here has some “insider reports” that even the insiders themselves NEVER saw.

https://www.ft.com/content/42b53987-8280-469e-8014-9ddb0c98463b

Nearly every human being in this big bad world desires attention. I suggest, each of us as individuals, search out attention for the right reasons and not for producing more garbage for to float into the ether,

I am happy for attention, but right now I’d like a nice spreadsheet with the Russian fiscal numbers.

As Elvira Nabiullina, best I can tell, she’s a decent central banker. But that’s not the issue. The issue is what the Russian central bank is allowed to publish, and I sincerely doubt they can issue numbers without the Kremlin’s approval. At least that’s my working assumption.

Finally, we know that Russians lie about just about everything, so why would I think their central statistics and official budget numbers are true?

“I am happy for attention”

Awww – the folks at Fox and Friends have not called little Stevie back in weeks.

“I am happy for attention”

Really?!?!?! But you seem so shy and reserved.

Gee Stevie – your discussions of the US economy have been a total embarrassment so you want to change the subject? Go figure~!

@ pgl

And to think, I was deeply deeply afraid we would have a void of “Russian experts” on the blog now…….. The question enters my mind…….. should we be actively searching out those who label themselves as “a complete fool about Russia” just so we can know what the hell is actually going on in Russia?? At this point it seems the right tactic.

Two decades of budget deficits?

Well, nobody will accuse US political elites of blindly following conservative Keynesian macroeconomic policy recipes.

Then there is that pesky literature drawing a link between fiscal health and military strength. What is the tentative conclusion here? American voters are happy to accelerate US hegemonic decline? Translation: Foreign policy goals are always ‘better’ when they are more expensive and far harder to reach.

Or perhaps it simply boils down to the same old, same old: American Exceptionalism implies an automatic dismissal of ‘expert opinion’.

Well Bush43 was allowed to be President in 2001. And he “got things done” – all sorts of really bad things. Obama tried to clean up the mess but after 8 years he was replaced by the human wrecking ball called Donald Trump. So in a way we are lucky not to be Yeltsin’s Russia 25 years ago.

Shall I open myself up to mass attack, ridicule, and scorn, by saying I would take 1993–’96 Boris Yeltsin over any version of donald trump?? Because If donald trump was our President now (he’s obviously not) and I could magically replace him with circa 1993—’96 Yeltsin, I’d do it in a heartbeat.

Thanks for elucidating the issue. It would appear that the any budget constraints on the Federal government are simply foolishness and that the idea of ever increasing deficits being bad and reducing/restraining Federal debt should be abandoned, and that for enduring and massive prosperity, the government should just spend increasing amounts regardless of revenue (taxes) so that the multiplier just keeps multiplying increasingly without limits. We all know that increasing the Federal debt doesn’t increase the Federal deficit, right?

New motto: Abandon the Debt Ceiling and Spend All You Can for More Prosperity because Deficits Don’t Matter.

What could go wrong? After all, multipliers. Good thing there is no impact to servicing an increasing debt, especially when interest rates increase. Print money! Yea….

https://www.npr.org/2019/07/17/742255158/this-economic-theory-could-be-used-to-pay-for-the-green-new-deal

https://www.msn.com/en-us/news/politics/democrats-push-to-eliminate-the-debt-ceiling-allow-unlimited-government-borrowing/ar-AA16EESc

One tiny voice of caution:

https://cafehayek.com/2012/01/somebody-doesnt-understand-debt.html

https://cafehayek.com/2021/10/the-amount-of-government-spending-is-not-independent-of-the-means-of-financing.html

No one would ever think that borrowing from future generations is this:

https://www.investor.gov/protect-your-investments/fraud/types-fraud/ponzi-scheme

“It would appear that the any budget constraints on the Federal government are simply foolishness and that the idea of ever increasing deficits being bad and reducing/restraining Federal debt should be abandoned, and that for enduring and massive prosperity, the government should just spend increasing amounts regardless of revenue (taxes) so that the multiplier just keeps multiplying increasingly without limits. We all know that increasing the Federal debt doesn’t increase the Federal deficit, right?”

This has to be the dumbest thing ever written. Why do you insist on misrepresenting what Dr. Chinn has to say? Oh yea – you are nothing more than a rightwing lying troll.

https://www.msn.com/en-us/news/politics/democrats-push-to-eliminate-the-debt-ceiling-allow-unlimited-government-borrowing/ar-AA16EESc

Don’t know who this messenger is, but claims this chart is from CBO projections.

https://www.pgpf.org/sites/default/files/Interest-national-debt-july-2022-chart-3.jpg

Dec 14, 2022

The growth in interest costs presents a significant challenge in the long-term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.

Yup, just keep spending for massive prosperity. Multipliers!

You do not know who Pete Peterson is? But you cite him anyway? Damn Brucie – you are dumb as a rock!

Donald J. Boudreaux: When government spends money, resources that would otherwise have been used to produce valuable private-sector outputs are instead used to produce public-sector outputs. The values of these foregone private-sector outputs are a genuine cost of government projects regardless of government’s funding method, regardless of the merits of the government projects, and regardless of the nationalities of government’s creditors…It’s discouraging that Mr. Krugman seems to be unfamiliar with Buchanan’s contributions.

Well gee whiz – Buchanan was assuming we are always at full employment. But golly gee Brucie – the entire point of cyclically adjusting comes from the Keynesian notion that economies sometimes fall below full employment. I guess Boudreaux never heard of Keynes.

Which is why only a lying right wing troll would ever bother to read the BS from Boudreaux. Oh wait – you are a lying right wing troll. Never mind.

LOL! Come on, man. You can do better than that. Buchanan assuming we are always at full employment. Geez.

He is. That you did not know that only proves what an effing moron you really are. Come on Brucie – your mommy is down on her knees begging you to stop embarrassing her this way.

“Bruce Hall

January 30, 2023 at 1:28 pm

LOL! Come on, man. You can do better than that. Buchanan assuming we are always at full employment.”

Anyone who read what Buchanan wrote in Brucie’s link knows Buchanan’s comment was predicated on a full employment economy. For Brucie to find my comment funny and off point only shows Brucie has no clue, no clue at all. But you all have known that for years. Hey Brucie – look up classical crowding out before writing another imbecile comment.

@ Brucey Baby

Everyone here is so glad, that whenever a Democrat inhabits the White House, all you MAGA Republicans suddenly become concerned about the budget deficit:

https://www.propublica.org/article/national-debt-trump

The orange abomination told you he was the “King of Personal Debt” for decades and went bankrupt more than once. And you rushed to the polls to vote for the orange bastard. Now you sit here with your crocodile tears over the debt. You really are as dumb as CoRev and sammy and Ed Hanson, and overly long blog comments don’t disguise your vapidity.

Hey, Moses. What happened in 2020? Oh, nothing unusual.

https://www.nytimes.com/2020/03/16/business/economy/coronavirus-us-economy-shutdown.html

Yeah, income and corporate taxes just kept rolling in.

What was the case between 2017-19?

Oh, the deficit as % of GDP barely moved. Yes, absolute debt went up, but so did the economy at about the same pace.

What happened during the Obama years? Oh, yeah, up 28 pp. deficit as % of GDP

https://fred.stlouisfed.org/series/GFDEGDQ188S

Scuse me… debt, not deficit as % GDP. My wife is talking on the phone next to me so I got a bit distracted.

Your wife has not left you yet? Wow she does tolerate a lot of embarrassment.

God you are dumb. You have been reminded over and over that Trump’s fiscal fiasco was in full force before 2020. And you think that he botched the efforts to address the pandemic absovles him of his fiscal disaster? Wow!

What happened during the Obama years?

First term he had to clean up the Bush43 mess. Same way Biden had to clean up Trump’s mess. Come on Brucie – you need to stop as that wife of yours is already calling a divorce attorney.

Brucey Baby, Does it give you ANY clue at all what your dealing with, when Republicans’ lead candidate for 2024 has just officially announced his candidacy and many members of the Republican party are literally wishing that the orange creature/abomination would just PLEASE DIE.

https://www.theatlantic.com/politics/archive/2023/01/2024-republican-primary-donald-trump-deus-ex-machina/672888/

I know your political antenna are weak Brucey, but I want you to think about that one for awhile, gnaw on that for awhile inside your brain, chew on that one, in that thing you call your mind, like a thick piece of beef jerky and see if any light bulbs appear above your head in some kind of cartoon word bubble.

You hope to persuade with this stuff? Or you just want all the kids to get off Menzie’s lawn? Wow…

I love how Brucie begins with “Thanks for elucidating the issue.”

Does he even know that elucidate means to provide a clear explanation. So why then did Brucie go from dumb and dumber to the stupidest rant ever written in the history of mankind?

“Milton Friedman’s insistence that “the true tax” is “how much government is spending.” You quote Friedman further: “If you’re not paying for it in the form of explicit taxes, you’re paying for it indirectly in the form of inflation or in the form of borrowing.”

Friedman gets the long-run government restraint. George W. Bush did not. Which is why when Bush invites Friedman to the White House, Dr. Friedman cursed Bush out over the 2001 tax cut. Alas Dr. Friedman was not alive during Trump’s fiscally irresponsible regime. Which is the issue Dr. Chinn called out over your mendacious praise.

You do know Brucie that Milton Friedman would be calling out your serially stupid rants. I trust. Maybe not.

@ pgl

Where did you read that Milton Friedman “cursed Bush out over the 2001 tax cut”. Because I am having a hell of a time finding any factual/journalistic support for your assertion on this.

https://www.hoover.org/research/friedman-surplus

I’m kind of presuming if you had argued this point with someone we had known from Virginia, Menzie would have already called you out on this lie, or maybe told you that your geography knowledge was bad and no one really argues about which nation the land of Kashmir belongs to, or what that land is named, but my brain is a bizarre thing I guess.

Interesting interview. I loved this:

ROBINSON: So Bush is wrong? Cutting taxes would not stimulate the economy?

FRIEDMAN: No, it would not stimulate the economy.

Friedman just called Greg Mankiw a liar. Yea Friedman wanted a much smaller government but we did not get that under Bush43 at all.

You are right – there was no press coverage of what Friedman told Bush at lunch for good reason. I heard it from someone who was there but under condition I never revealed his told me. Friedman could be brutally honest in private but he always wanted to be seen as the uberconservative in the public domain.

I’ll take you at your word. My apologies.

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. But in many Ponzi schemes, the fraudsters do not invest the money. Instead, they use it to pay those who invested earlier and may keep some for themselves. With little or no legitimate earnings, Ponzi schemes require a constant flow of new money to survive. When it becomes hard to recruit new investors, or when large numbers of existing investors cash out, these schemes tend to collapse.

Brucie’s little link was the perfect description for Trump’s business adventures. Brucie – I hate to tell you this but Kelly Anne Conway will notify you tonight that “You’re fired”.

‘the multiplier just keeps multiplying increasingly without limits’

Seriously troll? Dr. Chinn has reminded us of a concept called potential GDP. I guess Brucie never reads those posts either?

Seriously Bruce – why are you even here? You never make the slightest attempt at understanding basic economics. Your devotion to MAGA lies has you writing the dumbest things over and over again. And you are routinely mocked for your incessant stupidity and mendacity. So what’s the point little boy? Oh yea – the other kiddies at kindergarten don’t like you either.

From the ProPublica article, that is assumably above Bruce Hall’s 3rd grade reading level:

“The national debt has risen by almost $7.8 trillion during Trump’s time in office. That’s nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.”

The article continues on:

“The growth in the annual deficit under Trump ranks as the third-biggest increase, relative to the size of the economy, of any U.S. presidential administration, according to a calculation by a leading Washington budget maven, Eugene Steuerle, co-founder of the Urban-Brookings Tax Policy Center. And unlike George W. Bush and Abraham Lincoln, who oversaw the larger relative increases in deficits, Trump did not launch two foreign conflicts or have to pay for a civil war.”

But remember, donald trump promised, in an interview with WaPo (which was recorded for posterity and can be listened to any time, I have a copy of the CD in my house now) that in “just 8 years” he would pay all of the U.S. national debt by doing “trade deals”. How’d that work out Bruce??

Wait – was the plan to pay for all of Trump’s increased spending with tax cuts for the rich? That was certainly the plan under St. Reagan. What could go wrong?

Brucie’s little links that to spend is to tax has been presented on the false premise that Democrats want to massively increase government spending whereas his Republican heroes want to reign in government spending. But of course Brucie cannot be bothered to present how real government purchases have evolved since 2000. So permit me to turn to FRED:

https://fred.stlouisfed.org/series/GCEC1

Real Government Consumption Expenditures and Gross Investment

Huh! Government purchases sort of exploded under Bush43. Obama reversed this upward spiral of government spending. But then we got Brucie’s hero Donald Trump and government purchases started to take off again. Now since Biden the SOCIALIST became President, government purchases have started to go down.

Now I doubt any of the grown ups here are surprised in the least that the facts bit lying Bruce Hall in the rear end. They always do!

Oh, well, nothing to see here:

https://fred.stlouisfed.org/series/A091RC1Q027SBEA

or here:

https://www.cnn.com/2022/11/01/economy/inflation-fed-debt-military/index.html

or here:

https://www.cbo.gov/publication/58147

So all is well with Sir Spendalot at the helm. Just ignore that inconvenient interest bill.

You are now measuring fiscal policy by nominal interest payments. I guess concepts like real v. nominal mean nothing to the dumbest troll ever. But keep trolling for your usual misleading statistics. We will keep reminding you that basic economics is way over your head.

Federal government current expenditures: Interest payments

Just wow. How many things can you get wrong here Brucie:

(1) the right metric is real interest payment not nominal. Unless inflation was always zero. Do you really believe we never had any inflation over this period?

(2) the right metric would take these figures relative to GDP. Of course a moron like you might not only think CPI has not risen, that population has not risen, and real income per capita has not increased over this period of time. Do you believe all three of these premises? If not – your graph is almost as stupid as you are.

‘The Federal Reserve’s war on inflation isn’t just painful for home buyers and people with credit card debt. Uncle Sam is getting squeezed by higher borrowing costs, too. The cost to finance America’s growing mountain of debt is rising rapidly as the Fed scrambles to put out the inflation fire by raising interest rates and shrinking its nearly $9 trillion balance sheet.’

This stupidity is why I never watch CNN. This almost as dumb as Bruce Hall moron starts off by telling us inflation is high and then reports nominal interest expenses rather than real interest expenses? Seriously? The level of economic education among business reporters is dismal. But of course Know Nothings like Bruce Hall and JohnH rely on reporters that are dumber than rocks.

China’s wonderful gift to the world – crumbling construction:

https://www.wsj.com/articles/china-global-mega-projects-infrastructure-falling-apart-11674166180

Israel attacks Iran? During Blinken’s visit?

https://www.nytimes.com/2023/01/29/world/middleeast/iran-drone-strike-israel.html

https://www.wsj.com/articles/iran-ammunition-factory-hit-by-blast-11674951968?mod=article_inline

Wonder what they talked about.

@ Macroduck

I don’t think they are related for the most part (the visit to the strike). Maybe the coinciding timing is a cute move by Israel to imply unspoken U.S. approval of such strikes?? But everyone knows that anyway, so. I don’t know. I like Israel but I hate the Netanyahu government so it’s hard for me to decipher these things, if they are good or bad. Probably the strike is a beneficial move for world security, but Netanyahu likes to instill fear into Israelis and then present himself as the only real defender of Israel, similar to donald trump’s “I am the only one who can blablabla”, so…….

Blowing up the oil-for-nukes deal was among the worst things Trump did. One cannot turn back the clock, but Ukraine’s allies might have been able to dissuade Iran from selling drones to Russia under better circumstances. Certainly, increased economic sanctions encouraged Iran to accelerate its drone program; drone development and sales are now part of Iran’s industrial policy. Iran has to sell to somebody and Russia is the biggest client in town. Heck, Turkey sells to Ukraine.

Iran sees drone sales to Russia as part of its resistance to the U.S. Meanwhile, efforts to resurrect the oil-for-nukes program have stalled with Russia’s renewed war on Ukraine. So it’s a new ballgame. Israel poking at Iran’s military-industrial infractructure fits into the context created by Russia’s war.

Israel may not see its friction with Iran as an extension of the Ukraine war, and Iran may not see it that way, but Washington probably does for now.

It’s one of the revealing nuggets of this war that Russia has to buy drones from abroad and has sold more T90s (tanks, tank kits and licenses) to India than are in Russia’s own arsenal. Military-industrial money makes the world go around.

Russia also has to buy artillery shells from North Korea. Two of the world’s economic basket-cases are arms suppliers to Russia, and Germany sources anti-aircraft ammunition from a neutral country which won’t allow that ammunition to be used to defend Ukraine “because neutrality”? What a world.

Somewhat related here, thought I would share on the small chance you missed it. Some U.S. officials/legislators are saying they are afraid that there will be “a shortage” for Ukraine’s next series of offensives (Spring, or earlier??) and so they are wanting to bring more U.S. manufacturing capability “online” to handle any such shortages. Just have read the surface headline, but I’m guessing there is at least some truth that there is a legit threat of a shortage:

https://www.cnn.com/2023/01/18/politics/us-munitions-israel-ukraine/index.html

I really like the fact that Dean Baker emails me his pearls of wisdom. After all – we just endured more mendacious BS from Bruce Hall and more bloviating from Princeton Steve. So before you get the last stupidity from JohnH whose latest soap box is that the FED really never raised interest rates so is not responsible for the downturn in the housing market, let’s here from someone who has a brain:

https://cepr.net/after-fourth-quarter-gdp-economy-looks-solid-unless-fed-derails-economy/?emci=5b6f4112-c9a0-ed11-994c-00224832eb73&emdi=6234b159-caa0-ed11-994c-00224832eb73&ceid=4616197

Housing stands out here, and the drop in residential investment knocked 1.29 percentage points off the quarter’s growth, after lowering third-quarter growth by 1.42 percentage points.

The reason for thinking the hit to growth will be much smaller in future quarters is that housing has already fallen so far. The 1.38 million rate of starts in December is roughly the same as the pre-pandemic pace. The December figure was only a small drop from the November rate, so the rapid plunges of the summer and fall seem to be behind us for the moment. New home sales actually rose slightly in the last two months. And, with vacancy rates still near historic lows, it’s hard to envision builders cutting back on construction much further from what is already a slow pace of construction. In addition, mortgage interest rates have been falling in the last couple of months and are likely to fall further, barring a big hawkish turn by the Fed. Another bright spot for housing is that mortgage refinancing has fallen to almost zero. The costs associated with refinancing a mortgage count as residential investment. The plunge in refinancing and new mortgages accounted for 34.6 percent of the decline in residential investment over the last year.

It is true that the spike in interest rates has thankfully started to reverse. The 10-year government bond rate is back to 3.49% as compared to 1.85% a year ago. Now JohnH would tell us that 3.49% minus 1.85% is a mere 0.5% but then he like Bruce Hall flunked preK arithmetic.

contrived is a possible synonym for mendacious….

Saving Social Security? Manchin waited until Republicans hold the House to decide that raising the cap on FICA is a good idea, but at least he’s on record:

https://www.levernews.com/ending-the-social-security-tax-break-for-the-rich/

“When Sen. Joe Manchin (D-W.Va.) this weekend endorsed bolstering Social Security by ending a payroll tax exemption for the rich, he was backing a proposal pioneered by progressive lawmakers more than two decades ago.”

Oh no – Bill Gates might have to pay more in employment taxes. The world will come to an end! Oh well – at least Microsoft can still evade corporate profits taxes.

In the end, in a dirt poor state like WV, the question of cutting everybody’s benefits or increasing taxes specifically only on the high income group has just one political winner. Even Manchin can see that, so he is setting himself up to be on the winning side as the house GOP blindly walk towards the cliff (by bringing SS and Medicare into the debate). The thing about those SS/Medicare benefits and government spending is that it’s not just spending on those (lazy) “others” it is (hard earned) benefits to the old GOP voters. When push comes to shove they will be ready to increase taxes (on rich guys) rather than place hardship on themselves. McConnell kept himself and his millionaire friends dry by not rocking the boat – the GOP lunies don’t even know they are in a boat.

can anyone bring up cutting the pentagon.

no matter the deflator used $858billion is a lot of $$

and another $1.3 trillion on f-35 over next 20 odd years is not debated…..