In this Marketplace piece (with Justin Ho), one of the main points is the disjuncture between the evolution of consumption and inflation rate for services vs. all else. Here’re some pictures.

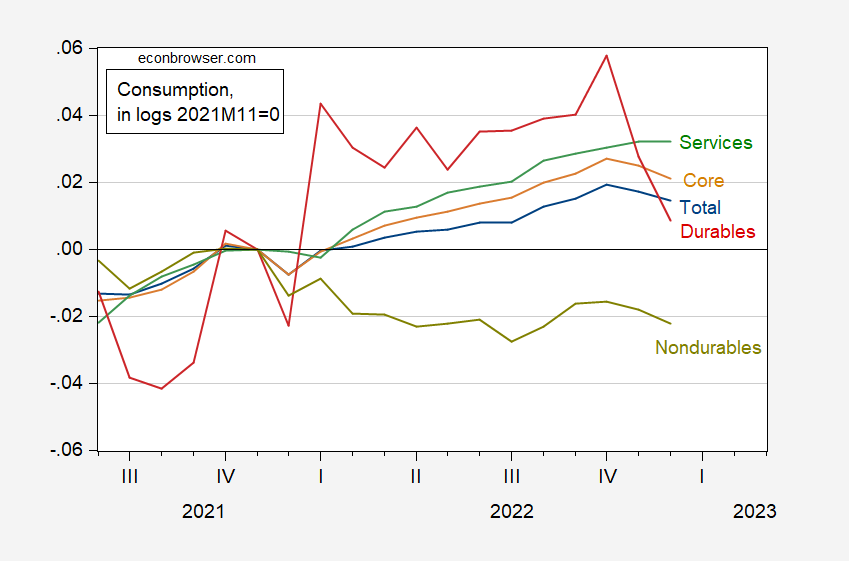

Figure 1: Total personal consumption expenditures (blue), core (tan), services (green), durables (red), and nondurables (chartreuse), all in Ch.2012$, logs 2021M11=0. Source: BEA via FRED, and author’s calculations.

Durable consumption expenditures are dropping fast, as is expected given interest rate increases — although they remain above the pre-pandemic trend. Nondurables expenditures have been falling from the 2021M11 peak and are about at pre-pandemic trend.

Interestingly, services are continuing to rise through December, at 0.5% m/m (not annualized). Taking the permanent income hypothesis at face value, this suggests households are assuming income over the next few years are still likely to rise. Now, consumption behavior is better modeled using some rule-of-thumb consumers (i.e., households that consume all of disposable income), with the share ranging between 0.2-0.5. Real disposable income rose 0.2% in December, so I’d say that consumption is staying strong partly because perceived income prospects over the next few years have not collapsed.

What about inflation?

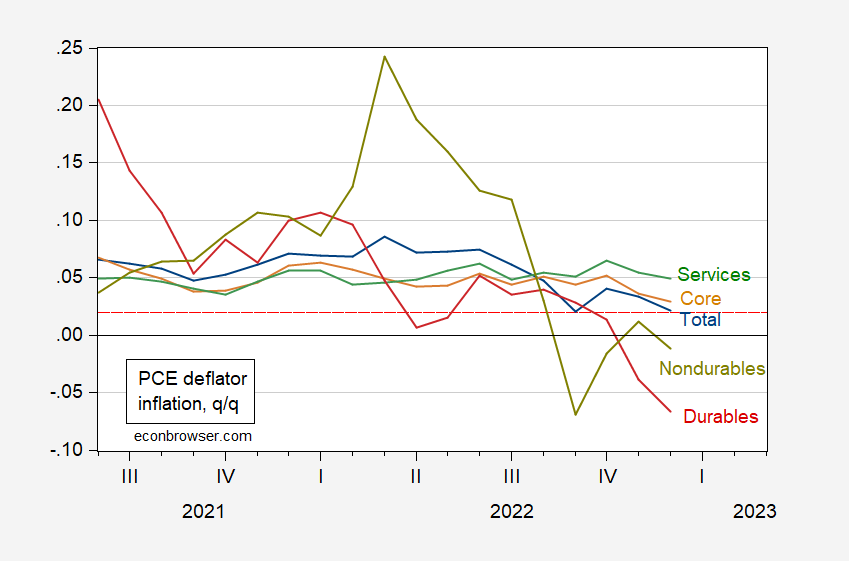

Figure 2: Quarter-on-quarter inflation rate for personal consumption expenditure deflator (blue), core deflator (tan), services deflator (green), durables deflator (red), and nondurables deflator (chartreuse). Red dashed line at 2%. Source: BEA via FRED, and author’s calculations.

One of the big stories of 2022 is the reversal in inflation rates in favor of services. This remains true, but it’s also important to note that services inflation is now falling as well, 4.9% q/q annualized.

This is leading to overall PCE inflation (q/q) declining to near the 2% target.

I’m surprised there hasn’t been more discussion recently about European energy inflation starting to moderate (or dissipate??). But I don’t have cable TV so maybe the convo has been there and I missed it.

Disaggregation is a many-splendored thing.

Seriously. Much can be learned simply by teasing aggregations apart. Egg-flation is not a monetary phenomenon. Administered prices (education, healthcare, etc) are mostly services. And so on.

It looks like Jan Eekhout also has a book he published in the last couple years. It looks awesome and I already requested it from my local public library.

“This is leading to overall PCE inflation (q/q) declining to near the 2% target.”

I’m not sure the PCE inflation target is currently 2%. The committee has been clear it no longer has a 2% target but rather seeks to achieve inflation that averages 2% over time. I don’t recall the committee ever clarifying how it considers timeframe(s) nor precisely explain how recent deviations above 2% should be addressed. Is the current short-run objective for PCE lower than 2% to offset recent overshooting? Or has recent overshooting been thought of as an offset to prior bouts of undershooting (e.g. mid-2010s and early-pandemic) leaving 2% as the current goal?

Econned: Well, you can call it FAIT of 2%, so we want a moving price level target that moves up at 2%. If we think of undershoot relative to FAIT beginning at NBER peak of 2007M12, then we’re just about right.

As you know my favorite current member at the Fed.

https://www.federalreserve.gov/newsevents/speech/brainard20230119a.htm

My personal/subjective favorite portion of her remarks:

“Retail markups in a number of sectors have seen material increases in what could be described as a price–price spiral, whereby final prices have risen by more than the increases in input prices. The compression of these markups as supply constraints ease, inventories rise, and demand cools could contribute to disinflationary pressures.”

That’s the closest thing to truth you’ll ever hear from the carnival clowns about realities of the freak show in the after hours when they pack up the tents. She continues on in a related footnote:

“11. Since the pandemic, significant supply and demand imbalances have coincided with large increases in retail trade margins in several sectors, increases that have exceeded the contemporaneous increase in wages paid to the workers in those sectors. For example, since the end of 2019, retail trade margins for food and grocery retailers increased by about 25 percent, outstripping the growth in average hourly earnings for workers in that sector, which was just under 19 percent. A similar gap exists between margin and wage increases for general merchandise retailers, which were 24 percent and 14 percent, respectively.”

Orthodox economists say from their regurgitated rote learning from corporate America who fund their dept Chairs: “Increased wages and a tight labor market cause inflation”—indeed…….. Anytime when the powers that be need to eliminate negotiating power for the working class of America—-by all means do your best.

Menzie Chinn,

That’s the problem – as I noted, the committee hasn’t been clear about the windows of reference for the new regime of FAIT. “We” can think of anything but that doesn’t mean the body responsible for policy is thinking of the same.

What did you think they should do with rates at the next meeting?? “I think the whole thing is a sham” (your usual modus operandi) is not an acceptable answer. You need to lay some of that Econned “genius” on us and tell us what you would do with rates at the next meeting.

Menzie Chinn,

Are you aware of clear language from any of the committee members regarding how they view this new regime? It seems obvious that FAIT is an improvement over the FOMC’s previous regime but I would prefer further clarity – maybe I’m missing something but I haven’t seen/heard it.