Paul Krugman reminds me why “expected” inflation doesn’t necessarily translate into one-for-one actual inflation, because of nominal rigidities like staggered contracts. He also brings my attention to costs that firms expect (as opposed to prices they expect), as measured by the Atlanta Fed’s “Business Inflation Expectations”. Here’s how those expectations stack up against others, and actual evolution of costs.

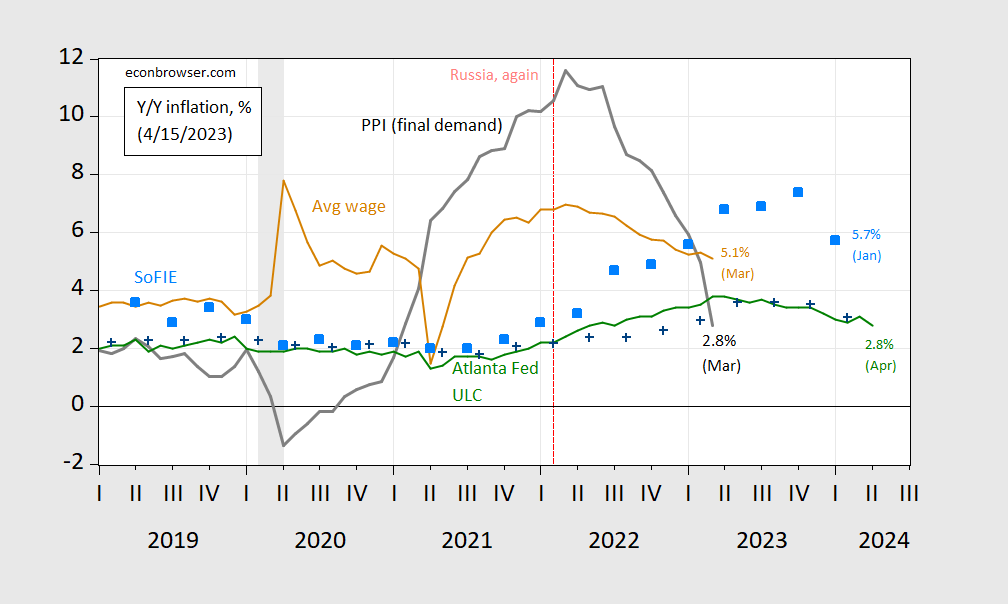

Figure 1: Year-on-year PPI for final demand goods and services (black), in average hourly earnings for production workers and nonsupervisory workers (tan), unit labor costs (green), and inflation from Survey of Firms Inflation Expectations (sky blue squares), and Survey of Professional Forecasters median (blue +). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED (FRED series PPIFIS, AHETPI), Atlanta Fed, Coibion-Gorodnichenko SoFIE, Philadelphia Fed,NBER, and author’s calculations.

It’s interesting to me to observe (as anticipated) unit labor costs don’t move one-for-one with expected inflation as measured by the Coibion-Gorodnichenko SoFIE median. One shouldn’t take too much from the gap between the average wage and unit labor costs, given strong compositional effects during the pandemic.

For the various CPI inflation measures, see this post.

I’m a bit confused by unit labor costs extending to Q2, 2024. Spread sheet problem?

Macroduck: *Forecasts* extend to 2024M04. These are 1 year ahead expectations as of 2023M04.

Thanks.

Krugman is making a point about what decisions cause inflation and how those decisions work. Along similar lines, Brad DeLong has gathered a list of reasons from a list of economists mostly arguing that inflation is going to persist and perhaps become entrenched. Each has his (strictly “his”) own view of how inflation is generated:

https://braddelong.substack.com/p/my-inflation-outlook-as-of-2022-04

First on the list is Lars Feld (U. Freiburg), who directly contradicts Krugman by insisting that inflation is fundamentally macro-driven. Feld doesn’t explain why his view does such a bad job of explaining the 1990-2022 inflation record.

Fourth on the list is Nouriel Roubini (NYU), who makes a political economy argument. He thinks voters will demand more services and refuse any tax increase to pay for them (which amounts to a macro view) and that war will impose more supply shock (micro). I’m agnostic on political economy, other than to say that acrimonious political divisions would seem to make fiscal pandering more likely and that militarization is bad for productivity.

Micheal Spense (needs no introduction) argues that secular changes in demographics, labor markets, climate change and geopolitics make for a secular increase in inflation (mostly micro). Can’t argue with that.

DeLong relies on bond market prices to argue that the best guess is lower inflation ahead. Yes, but that’s more agnosticism than I’m willing to accept, given the points offered by Spense. Spense is arguing secular change, while DeLong’s point is implicitly cyclical; not at odds so much as DeLong ignoring some really interesting issues.

MD finally make sense: “Krugman is making a point about what decisions cause inflation and how those decisions work.” No shite Sherlock, and then MD confirms that thought with:

” I’m agnostic on political economy, other than to say that acrimonious political divisions would seem to make fiscal pandering more likely and that militarization is bad for productivity.” and

“argues that secular changes in demographics, labor markets, climate change (and the ensuing energy polices) and geopolitics make for a secular increase in inflation (mostly micro). Can’t argue with that. ” Not really agnostic then, but still refuses to list the Biden successful policies or those which can be traced to the current inflation. Y’ano like climate change (and the ensuing energy polices).

Liberals’ anger have ratcheted up dramatically. Now that they can see the truth of what the conservatives predicted would be the results from them. Inflation is the economic side of those predictions, but additional deaths is the human cost. See Texas 2021 Winter storm.

Somethings are so obvious even the dumb as rocks Democrats can see it. And yet, you folks want to make this the norm world-wide.

Funny you put “climate change” in bold. Oh yea – you need to remind us about the single topic you lie like a dog every time you get the chance. Hey CoRev – we all get you are a worthless troll so just run along.

Aw, CoVid just can’t help himself. He’s trying to conflate climate change with political economy. Climate change is physics. I’m not agnostic about physics.

Aside from that bizarre bit, everything else is the same old CoVid, mouthing the same old Republican howling points. You can smell the desperation. The right wing has chained itself to guns, voter suppression, limiting women’s rights enriching the rich – not a winning combination. So they ban books and drag shows as a distraction from important issue, because they’re on the wrong side of important issues. Sununu was right when he told his fellow NRA attendees they need to do something more than reflexively claiim that every Biden policy is wrong; Republicans need to tell voters what they’re for. But they can’t, because they’re for voter suppression and limiting women’s rights and enriching the rich and guns in schools, child labor and low wagws, cutting Social Security and keeping health care expensive.

MD just can not admit the obvious: “MD finally make sense: “… what decisions cause inflation and how those decisions work.” No shite Sherlock, …” MD never mentioned inflation nor the decisions behind Biden’s version of it.

He’s unsuccessfully trying to ignore climate change and the ensuing energy policies with Biden’s inflation. Past arguments have been inflation is world-wide which actually doubles down on climate change (and its ensuing energy policies) causing inflation, even though that is exactly what he said: ““argues that secular changes in demographics, labor markets, climate change (and the ensuing energy polices) and geopolitics make for a secular increase in inflation (mostly micro). Can’t argue with that. ”

So which of his arguments does he believe? Just more cognitive dissonance! Liberal minds are an amazement.

Is there any real point to your long winded babbling? Didn’t think so. Memo to the crew – skip all babbling from either Princeton Steve or CoRev as both of them just write trash 24/7.

Why the racist comment?

What if they are all correct – each having their own small or large piece of the truth?

The problem with complicated issues is that our little monkey brains are build to desire simple yes or no answers – demanding to understand THE cause of a problem not the variable weight of each of many causes. When the true answer gets longer than two sentences most lay people get frustrated and stop listening.

I always shake my head when these lawmakers at hearing demand a yes or no answer. I wish that one day someone would answer: “I know your little monkey brain require a yes of no answer, but reality is refusing to deliver it”.

Expectations and the Rate of Inflation

Iván Werning, July 2022

https://www.nber.org/papers/w30260

Definitely worth the read.

There are things that are readily moved about the country; energy, mortgages, etc.

And other things, including office space physical infrastructure, water treatment plants, and Colleges Each of the latter groups will have a different rate of inflation

First seen in oil well fracking and completion there is a new practice; making ownership and liability difficult to pin down. See recent plastics recycling fires this upends a clean conclusion regarding specific inflation

It’s laudable that the Atlanta Fed has taken the initiative to ask “business executives” about their inflation expectations. However, I believe that past research has shown that the average business executive has no particular insights on inflation.

The real key is to ask finance managers, who run the pricing approval process, how much their company plans to increase prices. Aggregating the data from a representative, random sample of business should give a pretty good idea of what to expect.

“the average business executive has no particular insights on inflation”? No insights maybe but more than you ever had. And of course you have no idea which business executive they asked. So once again – Jonny makes a totally worthless comment.

Yea – they would not ask little Jonny boy as the janitor who gets the bagels is not someone they likely talked to.

Question, Johnny: Aren’t finance managers business execs?

Another question: Got any links to this research you mention?

And while you’re at it, where do you get this idea that finance managers are somehow uniquely empowered to make pricing decisions? It’s a big world, and you know so little about it. You can understand my reluctance to take your word for how it works.

Why, thank you for asking about executives inflation forecasting abilities, Ducky!

“Introducing a new survey of U.S. firms’ inflation expectations, we document key stylized

facts involving what U.S. firms know and expect about inflation and monetary policy. The

resulting time series of firms’ inflation expectations displays unique dynamics, distinct from

those of households and professional forecasters. By any typical definition of “anchored”

expectations, the inflation expectations of U.S. managers appear far from anchored, much

like those of households. And like households, U.S. managers are largely uninformed about

recent aggregate inflation dynamics or monetary policy. These results complement existing

evidence on firms’ inflation expectations from other countries and confirm that inattention

to inflation and monetary policy is pervasive among U.S. firms as well.”

https://docs.iza.org/dp14378.pdf

Johnny is having a 3-tantrum day! So touchy.

A quote from a research paper responding to a request by Ducky is a tantrum?

Wow! English must be Ducky’s third language.

Oh, and Johnny, Krugman made no claim about business execs knowledge of monetary policy. His claim had to do with pricing. The more you write, the more you demonstrate your poor understanding of, well, everything. Your Dunning keeps tripping over your Kruger

“The more you write, the more you demonstrate your poor understanding of, well, everything.”

Jonny boy and Princeton Steve are so much alike in this way.

Krugman’s tweets were all about this paper:

Expectations and the Rate of Inflation

Iván Werning, July 2022

https://www.nber.org/papers/w30260

Now I read it but once again little Jonny decided not to before little Jonny boy went babbling.

OK, the economic modeling Werning noted started with the Phelp-Friedman model from the 1960’s, the Lucas approach, and then moves onto Taylor contracting modeling and Calvo’s ground breaking modeling. All fundamental stuff if one wants to talk about modern macroeconomics.

And of course NONE of this is something little Jonny boy ever bothered to read. Even if he did – it is all over his little head.

So give Jonny a break – all is his good for is bringing the bagels to the board room and taking out the trash. Expecting anything else from this mental midget is asking way too much.

” U.S. managers are largely uninformed about recent aggregate inflation dynamics or monetary policy.”

Gee – these managers are almost as incredibly stupid as JohnH. And yet little Jonny boy pretends he knows all about monetary policy and inflation. Snicker!

Ducky reveals his total ignorance about how corporations work: “Aren’t finance managers business execs?”

Of course finance managers are business execs, but not all business execs are finance managers. Got it, Ducky? Atlanta Fed surveys executives, but doesn’t indicate what proportion are finance managers.

Finance managers are uniquely situated to be aware of their firms pricing plans. They are responsible for running the numbers on pricing proposals as part of the approval process. Yes, there is an approval process, operations managers don’t just wake up one morning and say, “We’re going to raise prices today.” Doubtful that Ducky knew that… If you want to understand how much a company is going to increase prices, you ask the finance manager. It’s his job to know.

Financial managers are also responsible for setting inflation assumptions to be used in the budgeting and long term planning processes. In order to set these assumptions, they read the news and consult with outside experts, who would be aware of the same inflation forecasts followed by this blog.

Other managers have different responsibilities that do not require them to be aware of inflation. Surveying primarily these executives would yield the results in the link I provided above.

I may not have an MBA but finance types typically do debt v. equity decisions not procurement of components, marketing research, and all the other things most of us think about when firms set prices. But what do we know as we did not help a Fortune 200 company go bankrupt which is your only shining star.

As long as we’re on the subject, Ducky might be interested in knowing how well his beloved consumers’ expectations forecast inflation.

“Notice that the year-earlier forecast [of consumer expectations] (blue line) and the CPI inflation rate (orange line) do not track each other very well. Indeed, the correlation between these two is negligible, about 0.08. ”

https://www.stlouisfed.org/on-the-economy/2021/march/well-consumers-forecast-inflation

The notion of that consumer expectations drive inflation is just magical thinking. I mean, what would the transmission mechanism be? Wage negotiations? LOL!!! Who gets to negotiate wages besides celebrities, executives, superstars, and a few unionized workers? What per cent of the work force does that amount to? 10%?? The vast majority of employees have to take whatever their boss deigns to give them. Yet economists blithely assume that most workers actually have the power to influence their own take home pay!!! What planet do these economists live on?

Whenever I read an article by an economist talking about inflation having to do with workers negotiating wage increases, my BS monitor goes to red alert.

“Ducky might be interested in knowing how well his beloved consumers’ expectations forecast inflation.”

Lying about what he said again? No it was you that thought consumers were better at this than economists. Jonny boy – lies about what Jonny said, lies about what everyone else may have sold. Damn – you are the best liar ever.

pgl is a compulsive liar…I never claimed that consumer expectations are a reliable forecast of inflation. He forgets the tantrums he threw when I cited Jeremy Rudd’s paper about consumer expectations: “ Economists and economic policymakers believe that households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.” https://www.federalreserve.gov/econres/feds/files/2021062pap.pdf

The St. Louis Fed paper illustrates how poorly consumer expectations forecast inflation, but for some reason economists insist on using them.

JohnH

April 17, 2023 at 8:31 am

pgl is a compulsive liar…I never claimed that consumer expectations are a reliable forecast of inflation.

Neither did Macroduck. So yea you lied.

“The St. Louis Fed paper illustrates how poorly consumer expectations forecast inflation, but for some reason economists insist on using them.”

Now at least try to be honest. I noted back then that you have no clue what Rudd was saying. But that is par for the course as you never have a clue.

BTW reporting on a survey is not the same thing as saying it is right. That is why real economists use their own modeling not some survey of people almost as dumb as Jonny boy.

Dude – you are WAY over your head here. Then again you are over your head when your mommy wants you to tie your shoe laces.

Claudia Sahm, who worked alongside Rudd at the Fed elucidates us in language that maybe even pgl can understand:

“ [Rudd] does not offer up the Holy Grail, “What the hell is driving inflation?” Instead, he carefully argues that mainstream macroeconomists and central bankers don’t know the answer, though most think they do. Moreover, our blithe ignorance could bite us in the butt when doing monetary policy, harming all Americans.” https://stayathomemacro.substack.com/p/what-to-expect-when-youre-expecting

Got that, pgl? “ mainstream macroeconomists and central bankers don’t know the answer, though most think they do.”

Sadly, it seems that most mainstream economists don’t care enough about what’s driving inflation to study those who have the means, the motive, and the opportunity to raise prices faster than costs, and then blame on labor and government!

JohnH

April 17, 2023 at 4:55 pm

Just take a look at this whing. Boy little Jonny gets no respect – no respect at all. Yes Jonny knows everything and we mortals know nothing.

Seriously? Having a dialogue with little Jonny boy is less productive than go out back and having a conversation with the dead tree.

“You can understand my reluctance to take your word for how it works.”

Now if “it” means decisions made in the Kremlin – who else knows more than Putin’s little pet poodle?

“It’s laudable that the Atlanta Fed has taken the initiative to ask “business executives” about their inflation expectations.”

Jonny boy acts like the Atlanta FED just started to do this. No – they have been doing this for over a decade but little Jonny does not know this.

https://finance.yahoo.com/news/atlanta-fed-business-inflation-expectations-130008720.html

A discussion of this dating back to Feb. 2014! BTW – the Atlanta FED has told us how they conduct their survey but little Jonny boy just ignores what they said as he tries to mansplain to the Atlanta FED how little Jonny boy would conduct the survey. After all his fellow janitors come in early in the morning.

Speaking of multi-tantrum days, up pops Ole Bark, bark showing us his immature anger, prejudice and hatred.

Normally, I would tsk, tsk and say you can do better, but after 20+ years I know better of you.

Did your master forget to feed little CoRev puppy dog? Awwww!

after 20+ years?

My first Angrybear post was in 2005. So unless you have been stalking me in person, you’re an idiot. But we all knew that for a long time.

BTW my posts on various economic issues got a lot of praise from conservative economists. Then again – you are not like Bruce Bartlett or Andrew Samwick. After all – they have brains as well as at least try to be honest.

And your flair for bitter, angry and hateful comments got you banned.

And I guess it just feels like 20+ angry, hate filled years.

And your 1st article was not after having in earlier years of comment?

Oh gee – I need to apologize to JohnH. Now his comments are worthless nonsense but nothing is as bad as this little whining from CoRev. Nothing. BTW CoRev – calling you a pointless troll is not racist. But if you need to have a pity party – be my guest.

Ole bark bark claims: “… calling you a pointless troll is not racist.” Notice he never refuted the fact he was banned at AB for just his angry, prejudiced, defnsive and immature commenting.