With the labor market release, we have a new read on real wage growth.

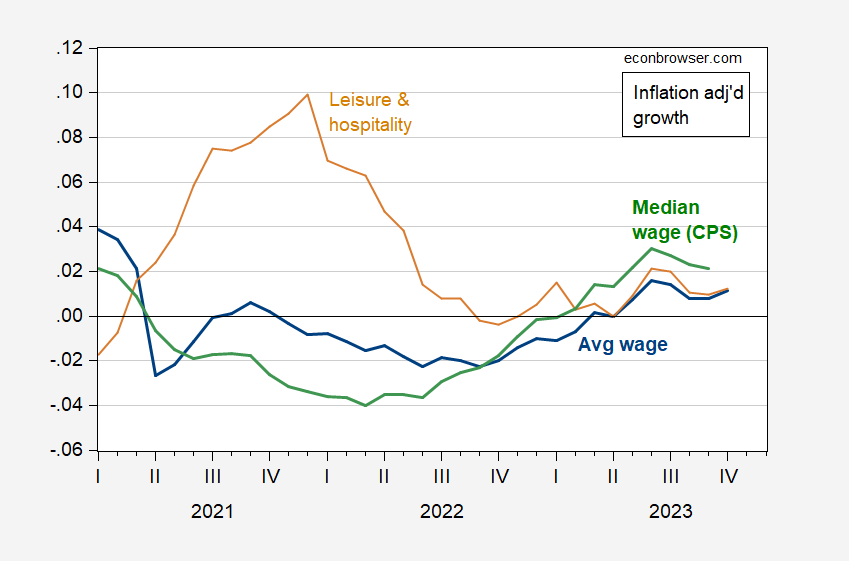

Figure 1: Year-on-Year growth rate of average hourly earnings for private sector production and nonsupervisory workers adjusted by CPI (blue), production and nonsupervisory workers in leisure and hospitality services (tan), median hourly earnings of all workers (green). October CPI is the Cleveland Fed m/m nowcast. Source: BLS, Atlanta Fed Wage Growth Tracker, Cleveland Fed inflation nowcast accessed 11/3/2023, and author’s calculations.

Real average wages are growing 1.1% y/y, -1.0% q/q annualized.

This implies lower inflation?? Kinda wild this post didn’t attract more comments. The services inflation seem to be dropping lately. Services prices have been, over the “medium term” inelastic I guess is the term?? I saw someone mention this in relation to Apple TV recently. People are mildly pissed about the $3 increase, but you can bet a lot of money they won’t drop their Apple TV.

People are funny. But I am guilty of this mental inconsistency also sometimes. We feel like we “have to have” some things that we can probably live without. Certainly shows how spoiled we are as Americans sometimes.