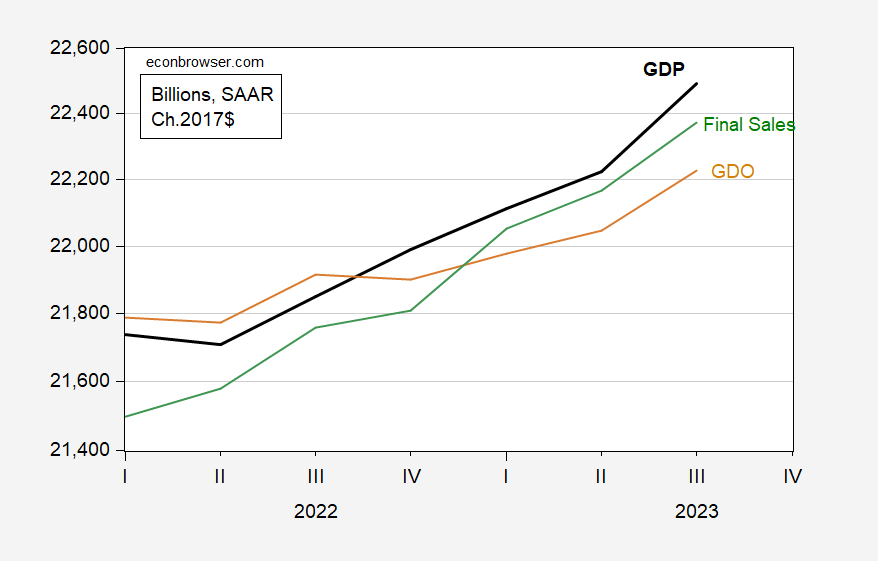

GDP up, but GDO growing slower than GDP.

Figure 1: GDP (bold black), GDO (tan), and final sales (green), all in billions Ch.2017$, SAAR. Source: BEA, 2023Q3 2nd release.

GDP was revised up from 4.9% (q/q SAAR), while GDO grew 3.3%. GDO growth is slightly less than what I guessed a month ago (3.5%), partly because real GDI grew at 1.5% instead of 2.1%.

It’s worth mentioning that real GDI has only grown by 0.6% in the entire last 7 quarters, and on a YoY basis has grown within +/-0.2% of zero for the last 4 quarters. Going back 75 years, it has never performed that poorly outside of recessions.

Also, the disparity between real GDP and real GDI as of Q3 is over 3% on a YoY basis. Again, there has never been so big a disparity in the past 75 years, and the only other disparity over 2% was in 2007 just before the Great Recession.

I’m not sure what the reason for the disparity is, but it seems noteworthy.

The biggest component of real GDI has gone through some pretty wild gyrations lately, so that caution should be exercised in drawing conclusions from either series:

https://fred.stlouisfed.org/graph/?g=1bWwj

The discrepancy between real GDP and real GDI is, on the GDP side, somewhere among real final sales to domestic purchasers components:

https://fred.stlouisfed.org/graph/?g=1bWwO

Which is to say, not in inventories or trade.

Thanks for the reply.

According to another forecaster I respect, the discrepancy likely has to do with how corporate profits are calculated. Indeed, when I back out corporate profits from GDI, the discrepancy for the past year largely disappears. But then earlier historical discrepancies pop up.

Good point which we have tried to get across to JohnH many times. Check real compensation of late – rising but Jonny boy says otherwise. Go figure!

There has been a good bit of back-and-forth about profits as a driver of inflation. Here’s one way of looking at the pair:

https://fred.stlouisfed.org/graph/?g=1bWtx

Couple of things to note. One is that profit tends to be more volatile than inflation; it’s normal for profit growth to outstrip inflation in some periods. Another thing to note is that the post-Covid-recession spike in profits was smaller in percentage terms, than following the Great Recession, but inflation after the Great Recession was quite tame; we cannot automatically assume that profits drive inflation, given the low pace of inflation following the Great Recession. Mathematically, there’s no getting around the contribution of profits to inflation, but causality is another matter.

I should also note that Johnny has lately begun slipping “neocon” into comments in response to me. I’m not aware that neoconservatives have a particular view of the causes of inflation, but perhaps someone more familiar with neoconservative thinking can shed some light. Johnny has also accused me of relying on “neocon data”, whatever that is. The data I’ve used here are all from government sources, via FRED. I suspect that Johnny, in his desperation, is simply trying out a new insult to distract from the facts.

Anyhow, other presentations of the data will highlight other facts, so feel free to fiddle.

Your chart clearly shows nominal profits have not kept pace with inflation but little Jonny boy is again tossing out a lot of ratios to suggest the opposite. Of course this moron does not realize that when profits/GDI has declined, that is not exactly supporting his little chirping.

I guess little Jonny boy calls anyone with an IQ above the teens a “neocon”.

pgl the corporate shill continues to deflect any responsibility for inflation from Corporate America, even though profits’ share of GDP is near a record high, as are profit margins, since 2021. It’s obviously more convenient for corporate friendly PR and economists to blame the victim–the consumer–for inflation, even though they have no demonstrable evidence of how consumer expectations translate into inflation, other than weak correlations, which, as we know, are far from causation.

It’s exactly the same PR process that blames labor for inflation, even though real wages barely keep pace with inflation and are generally catch-up in nature. In this case economists are fond of claiming that labor demands higher wages…but how many workers apart from those with CEOs, celebrities, and sports super have the bargaining power to demand anything from their employer?

New post up refuting your usual garbage. And yet your comments denies the facts all over again. Dude – stop posting on this as we already know you are both a liar and stupid.

I saw very little media coverage – of what seemed to me to be fairly noteworthy U.S. economic news – although we did get the commentary from someone in a nicely tailored suit and fancy wristwatch – talking about you 90% that drive GDP should not be asking for raises or anything https://digbysblog.net/2023/11/29/terrible-news-for-joe-biden/

Also Menzie – I saw this after our discussion of coal consumption – I would argue that helping to prevent 400,000+ deaths is a good reason to move away from coal as an energy source – https://www.scientificamerican.com/article/coal-power-kills-a-staggering-number-of-americans/

Ducky says, “Mathematically, there’s no getting around the contribution of profits to inflation, but causality is another matter.” The transmission method is simple and straightforward: Corporate America has the means and the motive to raise prices and profit. And with rising consumer expectations of higher prices, they also have the opportunity to raise prices faster than costs. Simple and straightforward, isn’t it? Nothing mysterious here–occum’s razor.

But somehow Ducky seems to think that Corporate America has no role in setting prices, or that oligopolies are price takers!!!

Obviously, Ducky has never heard of what marketing folks call WTP or Willingness to Pay. Businesses spend a lot of time on the pricing decision and conduct extensive research trying to determine WIP, particularly for new products. And when customer inflation expectations become unanchored, it’s like manna from heaven, because customers become confused about what’s a fair price, weakening resistance.

Now maybe Ducky could use as few words as I just did to simply and succinctly explain the standard economic theory of how consumer inflation expectations get translated into higher prices. Despite research on the subject, it’s convoluted enough and so poorly understood that I just dismiss it as magical thinking.

And BTW Ducky’s neocon foreign policy views dwell in an entirely separate part of his addled brain from his economic thinking.

You do write a lot of made up rubbish. TRANSMISSION mechanism? You have no idea what that even mean

The “neocons” here believe there should have been no war in Ukraine while you—a self styled heroic anti war protester—reject that view, having blasted media coverage, and questioned civilian death and injury reports, while proudly supporting Russian anti-Ukraine narratives. You’ve openly supported Putin’s push to supposedly “deNazify” the country with numerous posts slandering the Zelenskys and other members of the government.

And you talk of the “addled brain” of others.

Oh, and as long as I’m punching holes in Johnny’s rant, one more thing –

As I wrote earlier, Johnny is now tossing “neocon” around any time he runs into a foreign policy argument that he can’t deal with. The argument he’s having most trouble wth these days is “Russia attacked Ukranian. Ukranians are defending themselves. The U.S. is supporting Ukraine.” Johnny hates this, because its true, and it contradicts the “narrative” (aka “lie”) Johnny’s masters have ordered him to spread – that the U.S. is preventing peace in Ukraine. All the bad things happening in Ukraine, the killing, torture, rape and kidnapping of Ukrainians by Russian forces are because the U.S. is helping Ukranians defend themselves. The destruction of Ukrainian hospitals, schools, homes, harbors, railways and factories by Russian bombs is all because the U.S. is helping Ukranians defend themselves.

I disagree. I think all that bad stuff is happening because Russia invaded Ukraine -twice. I also think Ukranians have the right to defend themselves. So Johnny has picked out a label for me – “neocon”. Oooo, scary! Except that resisting Russian (and Soviet) aggression has been a point of agreement among mainstream U.S. foreign policy thinkers and politcians since Kennan’s Long Telegram in 1946. One needn’t be a neocon to support containment of aggression.

I’d be amused to have Johnny enlighten us as to the meaning of “neocon” in a non-sloppy, falsifiable way. I realize that’s a lot to ask of someone like Johnny, but he’s the one who brought it up.

Jphnny has again fallen back on pretending to know what zI think as a large part of his argument. Johnny doesn’t know what I yink beyond what I write in comments here and is ill-equipped to guess.

Johnny also answered my point about causality with supposition and hypothesis. Yeah, Johnny, everybody knows that firms aim to maximize profits in theory and something akin to profits in most real situations. You’ve substituted what they want to do for what they can do. That’s not evidence. It’s polemics.

Frankly, if Johnny had the intellectual gifts to deliver a real “gotcha”, he’d point out that I was among the first to note in comments here that profits were likely to be contributing to inflation. I didn’t need to link to writing that I barely understood the way Johnny has. I linked to the data. Data make the math of prices and profits clear. It takes more than simply staring at data, cherry-picked or otherwise, to demonstrate causality.

Johnny, incapable of demonstrating causality, tosses bunches words and taunts into the discussion, hoping to convince Innocent by-standers.

I do wish he would stop, because the issue of profits is central to the issue on business concentration, and that’s a big issue. But then, Johnny wouldn’t want to discuss that issue honestly, because his masters have ordered him to say “Democrats bad! Liberals bad!” and President Biden’s administration has taken more action against price fixing and monopoly/monopsony than any administration in decades. So Johnny just keeps pretending.