I’ve wondered about what a “soft landing” entails, and whether we are are headed toward one (see discussion of diverging forecasts, in current issue of the Economist) This is despite findings that, based on historical correlations, just about any term spread based regression will predict a recession by around mid-2024.

Booker and Wessel discuss the issue of soft landings, and cite this table adapted from Blinder.

Source: Boocker and Wessel (2023).

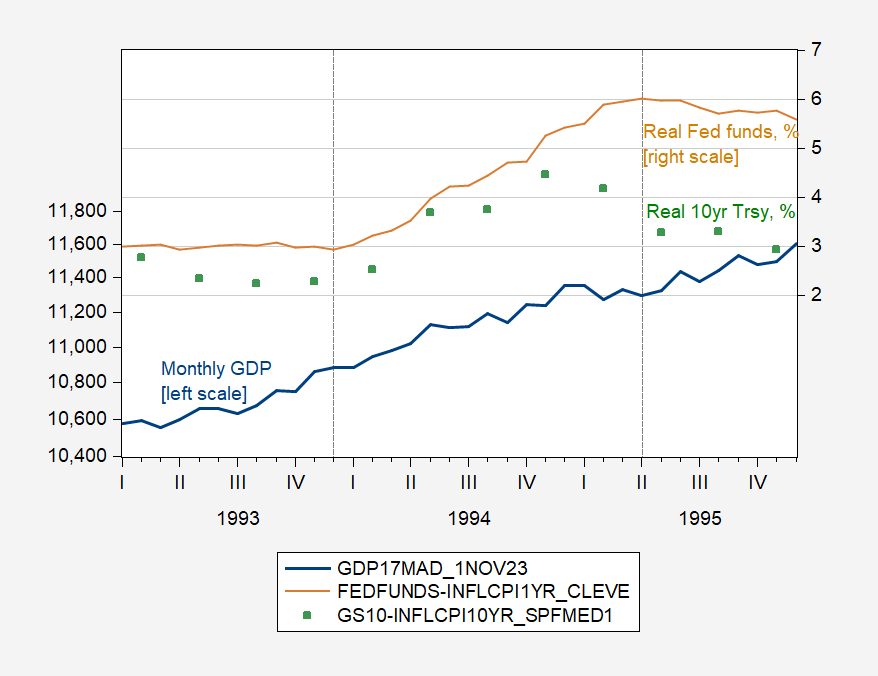

I’d only been familiar with the 1993-95 and 1999-2000 episodes. I think it of interest to compare the 1993-95 episode to the current, in terms of real rates and GDP. First, 1993-95:

Figure 1: Monthly GDP in bn.Ch.2017$ SAAR (blue, left log scale), Fed funds adjusted by Cleveland Fed 1 year expected inflation, % (tan, right scale), and ten year Treasury yield adjusted by SPF 10 year median expected inflation, % (blue, right scale). Dashed lines at Boocker-Wessel-Blinder soft land start/end. Source: SPGMI, Federal Reserve Board and Treasury via FRED, Cleveland Fed, Philadelphia Fed, and author’s calculations.

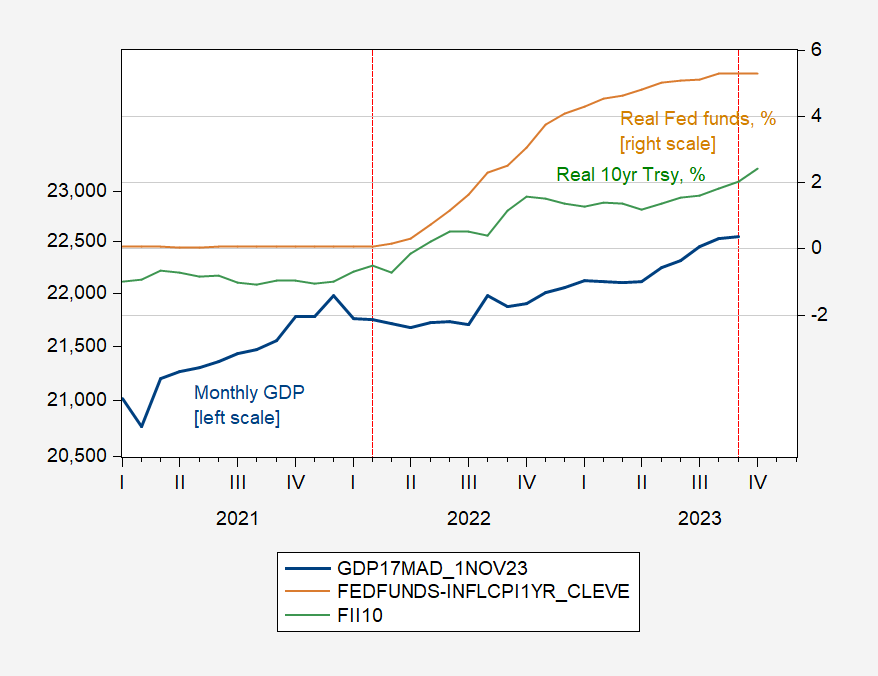

And here’s the current episode of some sort of landing, yet to be determined…

Figure 2: Monthly GDP in bn.Ch.2017$ SAAR (blue, left log scale), Fed funds adjusted by Cleveland Fed 1 year expected inflation, % (tan, right scale), and ten year TIPS, % (blue, right scale). Dashed lines soft land start/end as determined by author. Source: SPGMI, Federal Reserve Board and Treasury via FRED, Cleveland Fed, and author’s calculations.

The recent episode has witnessed a larger jump in real Fed funds rate (over 4.5% vs. 3%), a similar increase in the real 10 year Treasury, while output actually decreased when the Fed funds rose (in 2022Q2) while it continued to rise in 1994. Also in contrast, by the end of the soft landing as defined by Blinder, the 10 year real rate was declining, while in the current episode, that rate continues to rise.

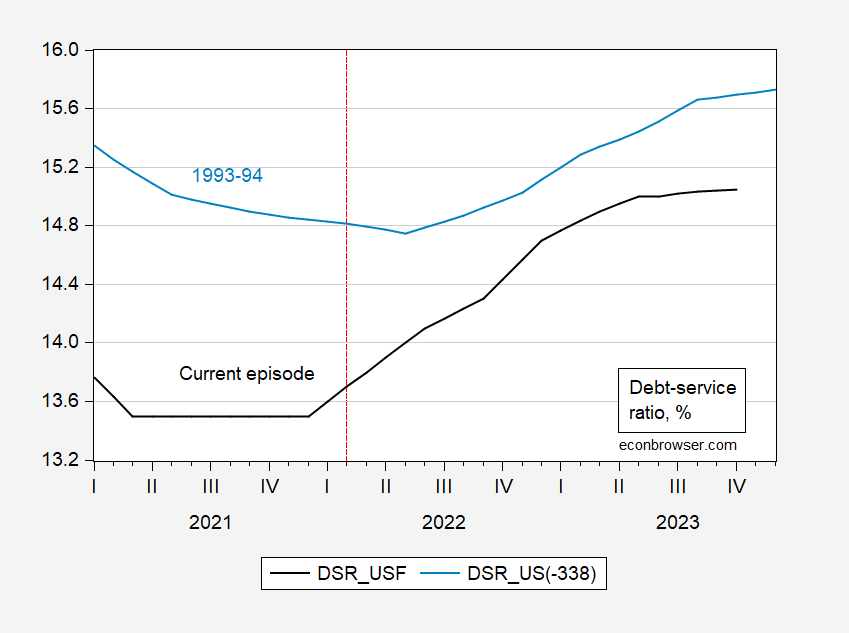

The debt service ratio has risen more, as a consequence of the larger interest rate increase.

Figure 3: Debt service ratio for private nonfinancial sector now, in % (black), in 1993-95 in % (light blue). 2023M04-10 period extrapolated using 3 month interest rate in first differences. Source: BIS, and author’s calculations.

According to my guesstimates, the debt service ratio trajectory has flattened (actual data only extends up to 2023M03), but at a level substantially higher than existed before tightening began.

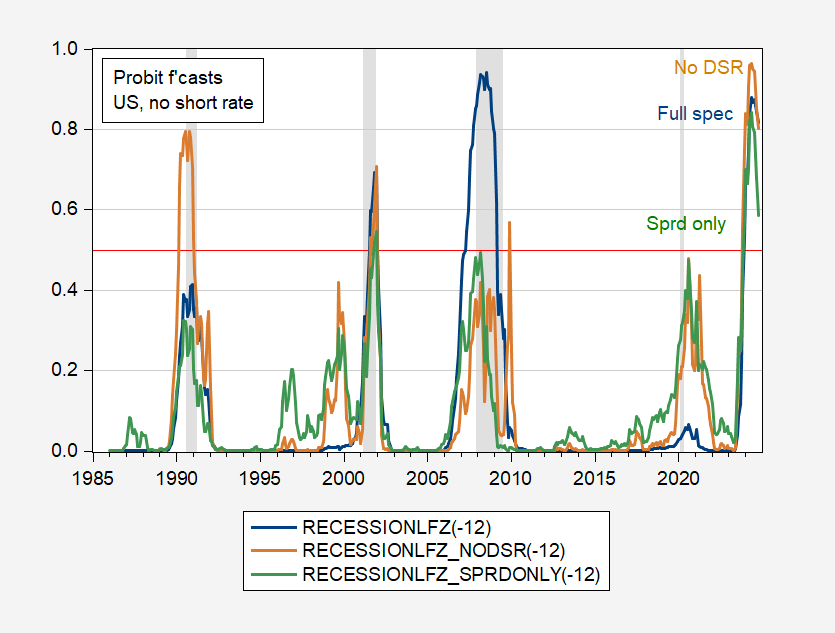

As the soft landing calls continue, it’s useful to recall that if historical correlations hold, recession probabilities from spread-based probit models breach the 50% threshold around November-December of this year, and peak around May-June 2024.

Figure 4: Recession probability from probit model with only 10yr-3mo spread (green), spread, NFCI, foreign term spread (tan), and spread, NFCI, debt-service ratio, foreign term spread (blue). NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations, NBER.

The important caveat is that historical correlations hold.

In my view – U.S. economy depends in large measure on housing. Please Fed Chair Powell have we endured enough pain from the Larry Summers/1970s view of what is causing inflation? Can you please lower rates so younger folks can afford to buy houses from the Boomers who will be downsizing – going into long-term care facilities and trying to fund their long-term care https://markets.businessinsider.com/news/commodities/housing-market-home-mortgage-unaffordable-rates-fed-prices-investors-finance-2023-11?op=1 Speaking of the care giver crisis – the real crisis is not the made up GOP crisis at the border but the lack of care givers for our aging Boomers https://www.nytimes.com/2023/11/14/health/long-term-care-facilities-costs.html And I feel a bit like Cato for saying this over and again – WIGOP take the federal Medicaid expansion money! And spend that WI state budget surplus on care giving and child care providers rather than trying to cook up a tax break for your wealthy donors.

Yes the same dumb old asses that currently are in panic that “the brown people are coming” will be desperate to have someone come change their dirty diapers in 5-10 years. However, by then the racism and xenophobia whipped up by GOPsters to get elected, will have made US a much less attractive destination for the brown people. It will stink to be a retired boomer.

I’m pretty sure your readers want to learn whether wealth concentrations in the United States can change their lives. It happens that Billionaires’ accumulations of wealth have a large impact on all of us.

My recent paper ‘The Captured State: Selected Statistics Show Harms of Wealth Concentration to American Life’ addresses that question. I am willing and able to answer your questions on request.

see paper here: https://econoak.org/?page_id=1048

Mike P. McKeever

Prof. Economics, Ret, City College of San Francisco

Email: mckeever.mp@gmail.com

Cell: 415 816 2982

Recession or suppression?

If normal business cycle dynamics hold, then we’re already in a recession. On the other hand, if we’re coming off a suppression, then recession does not necessarily follow.

Lord you are a boring troll. Suppression? Come on man – even Webster and Urban Dictionary has refused to coin your stupid term. And if you think we are in a recession you are dumber than a rock. Please stop making comments as they are as dumb as it gets,

Menzie Chinn,

You didn’t answer: pee-can or puh-kahn?

Econned is peeing in can at Times Square?! OK – a lot of disgusting stuff happens there but Damn!

Econned is a sophomoric teenager. Probably raised as a bratty kid by a negligent mother. The attention seeking behavior gives it away. Normal adults don’t behave that way.

Bloomberg is doing its usual mix of journalism and opinion in trying to write about the inflation outlook:

https://www.bloomberg.com/news/newsletters/2023-11-28/world-economy-latest-us-disinflation-progress-seen-slowing-in-2024?cmpid=BBD112823_NEF

It boils down to the fact that reduction of inflation typically starts out fast, then slows, and that slower disinglation is expected in 2024 relative to 2023. Since inflation undershoot is symptomatic of recession, a reduced pace of disinflation as the inflation target is approached is a good thing.

The Fed remains a risk to the expansion, but the normal inflation glide path is well understood by Fed folk. They aren’t likely to panic in the face of slower disinflation.

Real-side or financial shocks are always a risk, and the slower growth is, the easier it is for a shock to induce recession. A big fiscal shock is an obvious possibility.

A week or so ago, Brad Setzer argued that China is not shifting away from holding dollar-denomunated assets, contrary to a good bit of recent nail-biting analysis:

https://www.cfr.org/blog/china-isnt-shifting-away-dollar-or-dollar-bonds

Seems like some pretty well-informed people now agree with him. From Bloomberg:

“What has seemed at times to be an exodus of major foreign investors out of the US government debt market is actually just not the case, according to Goldman Sachs Group Inc. analysis.

Monthly US Treasury data shows that many traditionally big buyers, including China, have curbed their appetite for Treasuries. Goldman analysts highlight, however, that the numbers are overstated because they are using current valuations — and the prices of Treasuries have dropped as yields climbed the past couple of years.

A number of countries also have been selling off some of their holdings in order to prop up their own depreciating exchange rates. What has been happening is “mostly just normal market adjustments and reserve management, not a concentrated effort to shed dollar investments,” Goldman analysts including Kamakshya Trivedi wrote in a note Friday.”

https://www.bloomberg.com/news/newsletters/2023-11-28/world-economy-latest-us-disinflation-progress-seen-slowing-in-2024?cmpid=BBD112823_NEF

Brad Setzer, lead steer.

I have heard china has moved from treasuries to mortgage backed securities. Not sure if true, but some have been speculating.

That’s part of what Setser’s work shows.

All the concern about China’s shifting away from dollar assets if a good indication of the leverage China has…maybe the US isn’t the only indispensable kid on the block any more…neocons’ nightmare!

JohnH: Once one takes into account custodial ownership of USTs and Chinese holdings of Agency debt, not sure there’s a shift.

I didn’t say that there was a shift–what I did say is that all this concern about a possible shift is indicative of China’s leverage.

or maybe the data shows your assertions are incorrect, johnny.

Well played!!

He makes a statement and then denies he made it. Same old two faced Jonny boy.

https://www.bea.gov/news/2023/gross-domestic-product-second-estimate-corporate-profits-preliminary-estimate-third

Gross Domestic Product (Second Estimate) Corporate Profits (Preliminary Estimate) Third Quarter 2023

Real gross domestic product (GDP) increased at an annual rate of 5.2 percent in the third quarter of 2023 (table 1), according to the “second” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1 percent.

OK real GDP growth is solid. Inflation?

The price index for gross domestic purchases increased 3.0 percent in the third quarter, the same as previously estimated (table 4). The PCE price index increased 2.8 percent, a downward revision of 0.1 percentage point. Excluding food and energy prices, the PCE price index increased 2.3 percent, a downward revision of 0.1 percentage point.

I noticed in table 1.10 that the decline in the corporate profits part of GDI had stopped falling so nominal profits have only partially recorded. FRED makes this a little easier:

National income: Corporate profits before tax (without IVA and CCAdj)

https://fred.stlouisfed.org/series/A053RC1Q027SBEA

From 2022Q3 to 2023Q3, NOMINAL corporate profits rose by 1.1% which of course less than the increase in the price level.

Now remember this the next time clueless and dishonest JohnH starts chirping about how soaring profits have led to soaring inflation.

Today Jamie Dimon says that we are going to have higher inflation — and a recession — and 7% Fed rates.

Somehow that all fits together, apparently.

I always said that “if you bend yourself into a pretzel you can put your head up your ass” – maybe that is true for Jamie

Kopits: “If normal business cycle dynamics hold, then we’re already in a recession.”

Perfect timing. Today the BEA issued their first revision for Q3 GDP — up from 4.9% to 5.2%.

Still waiting for oil to reach $200 a barrel as Princeton Steve predicted!

I think kopits called for a recession every quarter over the past two years. we just were not aware of it at the time.

Off topic, hopes for Gaza –

The extension of the pause in fighting in Gaza has some of us hoping for peace. Dumb, I guess. Anyhow, peace is not in the plans:

https://www.google.com/amp/s/www.forbes.com/sites/brianbushard/2023/11/29/netanyahu-vows-fighting-in-gaza-will-resume-after-hostages-released/amp/

https://www.ft.com/content/2366782b-c28c-4dee-bfa5-c8e821ed4869

https://www.timesofisrael.com/liveblog_entry/pm-lobbying-likud-mks-saying-only-he-can-prevent-a-palestinian-state-in-gaza-west-bank-report/

Netanyahu has spent is career preventing thetwo-state solution, so this third story, while not strictly true, is just what one would expect.

Haaretz (Aluf Benn) thinks Biden is standing between Netanyahu and further violence in Gaza:

https://www.haaretz.com/israel-news/2023-11-29/ty-article/.premium/trapped-between-biden-and-his-coalition-netanyahu-must-decide-the-future-of-the-gaza-war/0000018c-174f-d501-a58e-3f7fdcfd0000

Biden is also still calling for a Palestinian state:

https://www.hindustantimes.com/world-news/joe-biden-repeats-two-state-solution-call-amid-israeli-pm-netanyahus-hamas-elimination-plan-in-gaza-101701043054147.html

Corporate profit margins are still cooking–16.2% in 3Q23, the fifth highest margins ever, significantly above the 10-12% margins of the last decade.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

But pgl never tires of telling us how poorly Corporate America is being hurt by higher interest rates. And with consumers “expecting” ever more inflation, Corporate America will clearly oblige by raising prices at least as much as consumers “expect,” and then some probably. Market power is the goose that keeps laying golden eggs.

Meanwhile, GDI is virtually flat from a year ago. — could this be the soft landing?

https://fred.stlouisfed.org/series/a261rx1q020sbea

And real average hourly earnings are up less than 0.4% since Feb 2020, before the pandemic…the paltry fruits of mainstream economists’ much ballyhooed, extraordinarily tight labor market. https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

Of course, pgl and Ducky will insist that all these stats from FRED are just more of my lies, since they call any inconvenient information are just damned lies!

My retarded stalker did not notice I already reported on the recent profits data? Damn – you are dumb.

“But pgl never tires of telling us how poorly Corporate America is being hurt by higher interest rates.”

I think this is a stawman argument made by you, Johnny.

Well Jonny’s head is nothing besides straw so this is the best argument the fool can make.

Profits’ share of GDI have only been above 8% three times:

1929 – 8.9%

2021 – 8.8%

2022 – 8.5%

This should give pause even to the corporate stooges here.

Hey dumbass – the data for 2023QIII is out. I reported it already. Do try to keep up.

BTW – I guess you are too dumb to know these numbers are way lower than the statistic you like to highlight. I’d ask you to explain the difference but I get you are a mental retard.

2021 – 8.8%

2022 – 8.5%

In Jonny’s world 8.5% is greater than 8.9% but the rest of us know his little ratio (which he cannot even define) FELL in 2022.

Yea – little Jonny boy is really dumb.

BTW – I just checked and profits after taxes were 11.2% as of 2023Q3. Macroduck had a graph showing how profits before taxes have not kept pace with inflation over the last year.

Now we know how stupid you are but profits before taxes exceed profits after taxes. Which means those ratios you cite strike me as way too low. And yet you are dumb enough to think they are higher than ever?

Come on Jonny – even a retarded dog is smarter than you are.