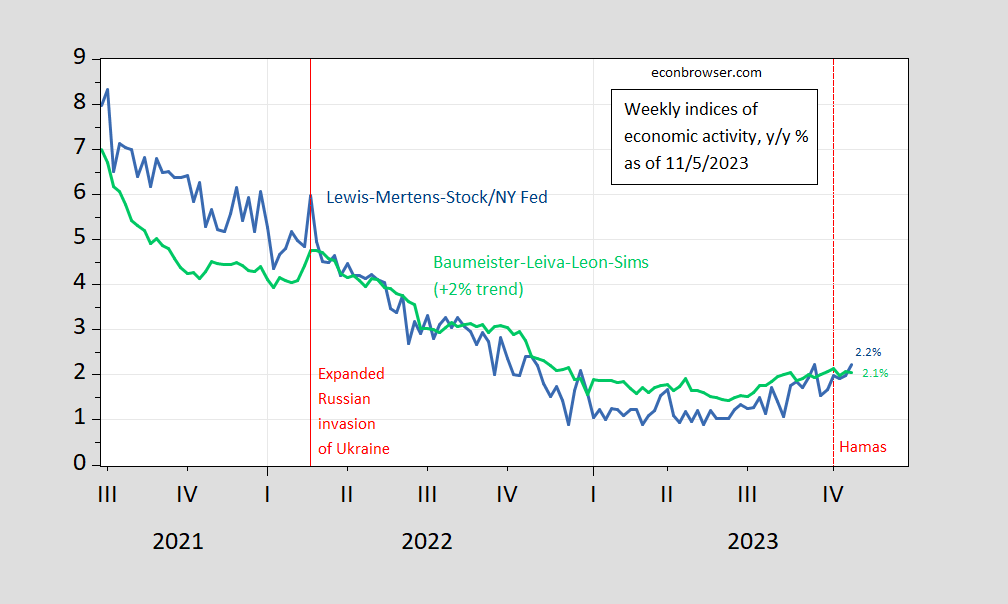

Through the year’s end, Year-on-Year growth is accelerating modestly, according to the WEI.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 1/4, and author’s calculations.

The WECI+2% thru 12/30 is (2.13%), while WEI reading is 2.44%. The latter is interpretable as a y/y quarter growth of 2.23% if the 2.44% reading were to persist for an entire quarter. The Baumeister et al. reading of +0.13% is interpreted as a 0.13% growth rate above the long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.13% growth rate for the year ending 12/30.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model.

When added to the monthly indicators and nowcasts shown in yesterday’s post on business cycle measures followed by the NBER BCDC, it’s hard to see the recession as having occurred in 2023.

Once the primaries are over, odds are tax policy will be part of the presidential campaign. Here’s a recent look at tax policy from The Hamilton Project:

https://www.hamiltonproject.org/publication/paper/look-beyond-gdp-tax-reform/

The gist is, tax policy has not proven to have influence over trend growth, even though faster growth tends to be the main selling point for tax cuts. Where tax policy does have effect is in distribution of income, changing behavior (efficiency, resources use, etc.) and government revenue and the budget balance. The effects that tax policy can have are ignored, while tax policy is sold as having an effect it doesn’t have.

In broad strokes, tax reform has the potential to have long-term effects on the economy through three principal channels: (1) changing the amount of tax revenue collected by the federal government, (2) altering incentives to improve economic efficiency or better align behavior with societal goals, and (3) redistributing income. All three types of effects can affect—positively or negatively—long-term gross domestic product (GDP). Nonetheless, the major tax reforms enacted in recent decades historically have had extremely small effects on long-term aggregate output.

Let’s translate into policy statements the average Joe can understand. We need more tax revenues to cover Medicare/Social Security (see 1) and we should tax the average Joe less and the billionaires more (see 3). Add to this we need a carbon tax (see 2). Oh wait – this is Biden’s position. We need to shout this from the mountain tops.

Now I get the Republicans will go onto Faux News and scream that this SOCIALISM will hurt economic growth. But of course Faux News has a reputation for spewing lies 24/7 and this report confirms this.

Dare I infer that pgl might welcome a discussion of the ways in which raising taxes on the wealthy and very affluent might have macroeconomic benefits, as I have pointed out in the past? If so, well then, shiver me timbers!!! In the past, when I did this, pgl decompensated into a hissy fit, even to the point of falsely claiming that I wanted to cut taxes!!!

Oh well, even in the unlikely event that the macroeconomic benefits of raising taxes on the wealthy do manage to get discussed here, you can rest assured that neither of the Evils running for President nor the duopoly that backs them will allow a broad public debate!

Johnny, if you ever actually made a case for higher taxes on the rich, so what? If you’ve actually gotten one right among the endless times you gotten economics wrong, that’s hardly reason for anyone to cheer. pgl does actual economics for a living, you do fake economics as a troll for Putin.

The fact that you claim to have made the argument for higher taxes in the rich doesn’t mean you have. You lie about all kinds of things.

Here’s an idea: Since your pall Putin is quite possibly the richest man in the world, how about you advocate loudly for taxing him down to mere billionare status? Maybe you could write a series of repetitious, poorly argued comments about how Putin enriched himself hrough corruption, enabled by he failure of the rule of law in Russia. I wouldn’t expect to learn anything, but it would be a welcome relief from you repetition of the same old economic nonsense.

You can always count on pgl’s doppelgänger to pinch hit for him…yet have nothing to say about macroeconomic benefits of raising taxes on the wealthy. (You can’t advocate things when your paycheck depends on your NOT advocating them!)

FYI, pgl long pitched a VAT while denying its regressive nature. Of course, he could have advocated a progressive consumption tax which could address inflation and income inequality, among its other benefits. But instead, he chose not to mention a progressive consumption tax at all. Go figure!

And sure, go ahead and tax Putin all you want…and then tell me how you did it. But maybe, just maybe, it would be far easier to start by figuring out how to raise taxes on American oligarchs. It would certainly be highly beneficial to the US economy and to US democracy to tax American oligarchs.

Damn – my mentally retarded stalker just makes $hit up as he goes:

‘pgl long pitched a VAT while denying its regressive nature. Of course, he could have advocated a progressive consumption tax which could address inflation and income inequality, among its other benefits. But instead, he chose not to mention a progressive consumption tax at all.’

If one reads what I have written over at Angrybear and Econospeak, one would see I have never been a fan of the standard VAT as I have noted replacing a progressive income tax with a regressive sales tax is reverse Robin Hoodism. Now I have praised David Bradford for trying ot get a progressive sales tax system.

Of course my mentally retarded stalker has no effinr clue who Bradford is. But he sure a lies a lot. The point of his incessant lies? Who the hell knows.

It is beyond time that Jonny boy got banned from the blog. Hey – he lies about issues. He does not understand economics. But of course there are others in the same boat.

But this BS of falsely accusing people like you, Paul Krugman, or even me for being corporate homies or whatever garbage lying little Jonny boy decides to cook up has gone on far too long.

He is too stupid to say a damn thing worthy of note. But why on earth does anyone want to endure the pure slanders that are utterly pointless. PeakTrader got banned, ltr got banned. CoRev got banned. And for far less than this pointless pathetic lying little troll.

Jonny boy has serious mental issues and he needs to stop writing trash and seek professional help.

pgl: “As I have stated before, a US VAT to expand the social safety net would be a good thing.”

http://economistsview.typepad.com/economistsview/2017/01/us-tariffs-are-an-arbitrary-and-regressive-tax.html#comments

I responded by saying: “Nothing like a REGRESSIVE tax to expand the social safety net. Worse, a regressive tax that shields the ultra-rich from taxes on much of their income, because they only spend a portion of their income and little of their wealth on VAT-taxable goods.

Today pgl is trying to wriggle out of his predicament via personal attacks.” Today he’s doing exactly that.

Jonny boy tries to take credit for an old Mark Thoma post entitled:

US Tariffs are an Arbitrary and Regressive Tax

Now I did read the comments back then from Jonny boy. Your usual stupid BS. But now he just makes up what I supposedly said. Seriously Jonny? Why not go back to the 1st Congress and misrepresent what the Founding Fathers said. Yea Jonny boy is that pathetically dishonest.

BTW if one reads the latest on China you will see where incorporated China’s 2% inflation rate into the discussion of Chinese wages which Jonny boy has gotten totally wrong. But this lying moron now says I have no idea what their inflation rate was? After I told this moron? Oh wait Jonny boy never learned to count to two. Never mind.

The context of my comment over at Thoma’s place:

New Deal democrat said in reply to New Deal democrat…

I should add that if I recall correctly most European countries use the revenues from their VAT collections to fund the social welfare state.

ReplyThursday, January 12, 2017 at 09:44 AM

pgl said in reply to New Deal democrat…

As I have stated before, a US VAT to expand the social safety net would be a good thing. The Paul Ryan plan however is to use consumption taxes to give up completely on corporate profits taxes. Not a good thing.

JohnH totally took this out of context in attempt to smear me. This is what Jonny boy always does. Yea he is a serial liar who cannot be bothered to have an honest contribution to any debate. But you and everyone else knew that already.

For those who have never been exposed to the actual data n tax rates and growth, here’s he picture:

https://fred.stlouisfed.org/graph/?g=1dGwq

As the top ax rate has fallen, growth has slowed, not accelerated. And ths is not a new finding, nor is it difficult to see. If there is any oom for controversy over the claim that tax policy has little effect on trend growth, it is that lower tax rates appear to slow growth. A spurious correlation, perhaps, but there’s no room to squawk about tax cuts boosting growth.

Where’s Dale Coberly?

Inflation has subsided. Markets are signalling central bank overnight rate cuts as early as May.

Yield curves remain inverted.

The potential for additional negative supply shocks is still in place.

I give up. Should stick to tossing dried caribou shoulder blades onto the sand. Perhaps with the right marketing approach, a flourishing consulting business will emerge.

Just act like you never said something you said just two weeks ago. It works for Larry Summers.

https://en.wikipedia.org/wiki/Scapulimancy

The weekly indices of economic activity seem to correspond reasonably well with the stance of governmental fiscal policy:

https://www.brookings.edu/articles/hutchins-center-fiscal-impact-measure/

Under current law, fiscal policy will be a small drag this year and next. The goal of House Republicans is to create a larger fiscal drag – its an election year with a Democrat in the White House.

As noted in the above comment, trend GDP is not affected by tax rates (within reason). Cyclical performance is affected by taxes. So how about we raise taxes selectively in 2025, with the aim of improving resource use, income distribution and the fiscal balance?

How about taxing the wealthy at the onset of a recession to pay for economic stimulus? As is well known, the wealthy spend a relatively small share of their income compared to a well designed stimulus package in which 100% would be spent, thereby boosting domestic demand.

It was this proposal that caused pgl to decompensate into a hissy fit, during which he accused me of wanting to CUT taxes on the wealthy!!!

Link? Or lie? Show us the evidence or pipe down.

Robert Reich: “Taxes were far higher on top incomes in the three decades after World War II than they’ve been since. And the distribution of income was far more equal. Yet the American economy grew faster in those years than it’s grown since tax rates on the top were slashed in 1981.

This wasn’t a post-war aberration. Bill Clinton raised taxes on the wealthy in the 1990s, and the economy produced faster job growth and higher wages than it did after George W. Bush slashed taxes on the rich in his first term.

If you need more evidence, consider modern Germany, where taxes on the wealthy are much higher than they are here and the distribution of income is far more equal. But Germany’s average annual growth has been faster than that in the United States. [note: back then]

You see, higher taxes on the wealthy can finance more investments in infrastructure, education, and health care – which are vital to a productive workforce and to the economic prospects of the middle class.” https://robertreich.org/post/21157770369

Stiglitz has written about this, too.

A recession is precisely the time when you need more spending, not speculation on financial assets. The wealthy have a relatively low propensity consume. But government spends 100% of its revenue. Increases in taxes on the wealthy translates into economic stimulus. Funding sources like this are becoming increasingly critical as an alternative to borrowing at a time when the US has a $34 Trillion debt and is facing ever more budget deficits coupled with skyrocketing debt service costs.

But Tricky Ducky is obviously unfamiliar with what Stiglitz, Reich, and others have written…his paycheck depends on his not learning about the macroeconomic benefits of taxing the wealthy.

Where did Macroduck ever said he was opposed to raising taxes on the rich? He didn’t. I didn’t. You are a liar – pure and simple. And everyone who reads this blog has said so.

Look Jonny boy – you have zero friends. Which is no surprise as you clearly are a mental retard with serious emotional problems.

No – I did not throw a hissy fit on an idea that I put forward well before my mentally retarded stalker ever thought of it. Come on Jonny boy – why the lies? We get you are moron. We get you are incapable of telling the truth. So quit wasting our time with your trash.

Sigh…another of pgl’s lies that I could easily disprove by doing research at Economists View…when he accused me of wanting to cut taxes on the wealthy when I clearly explained how to fund economic stimulus and address inequality by RAISING taxes on the wealty.

I read Thoma’s blog post that you are now taking credit for. I read the comments. You are lying. But that is what you always do.

Look dude – this is no point to this. Everyone knows you are moron. Everyone here has stated over and over you are a disgusting little liar. Find another blog to pollute with your trash. You have zero friends here as everyone has come to realize what a disgusting little weasel you are.