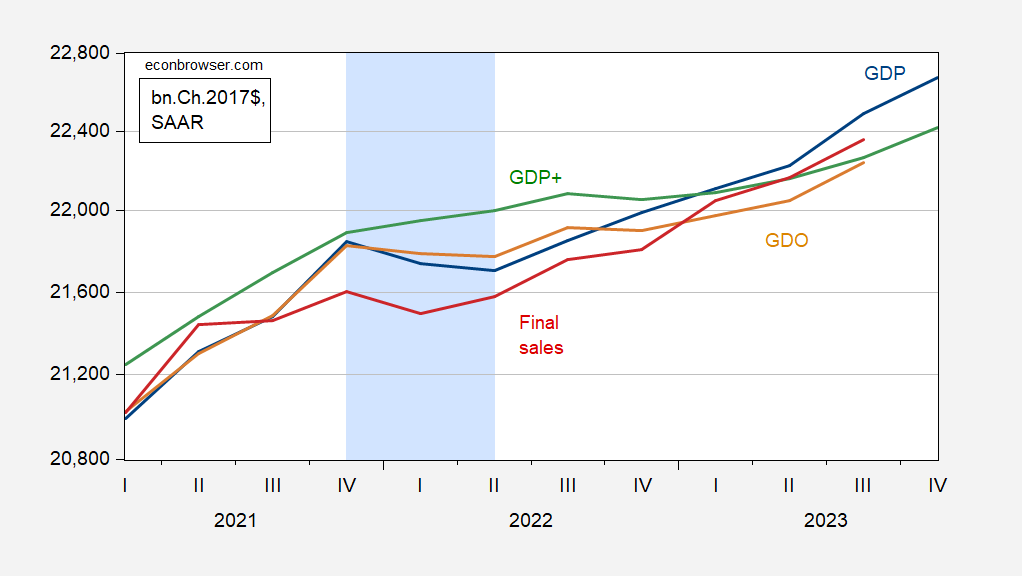

Or, Why We Don’t Use GDP Alone to Determine Business Cycle Dates. First, consider our various measures of output.

Figure 1: GDP (blue), GDO (tan), and GDP+ (green), final sales (red), all in bn.Ch.2017$ SAAR. GDP+ assumes 2019Q4 GDP+ equals GDP. Hypothesized 2022H1 recession shaded light blue. Source: BEA 2023Q4 advance estimate, Philadelphia Fed, and author’s calculations.

While GDP and GDO decline in 2022H1, GDP+ which is aimed to hitting the eventual level of GDP grows consistently over the 2022H1. Final sales (GDP ex-inventory accumulation) only shows one quarter of decline. I might note that GDO in 2022Q2 is only 0.26 percentage points below 2021Q4 levels…

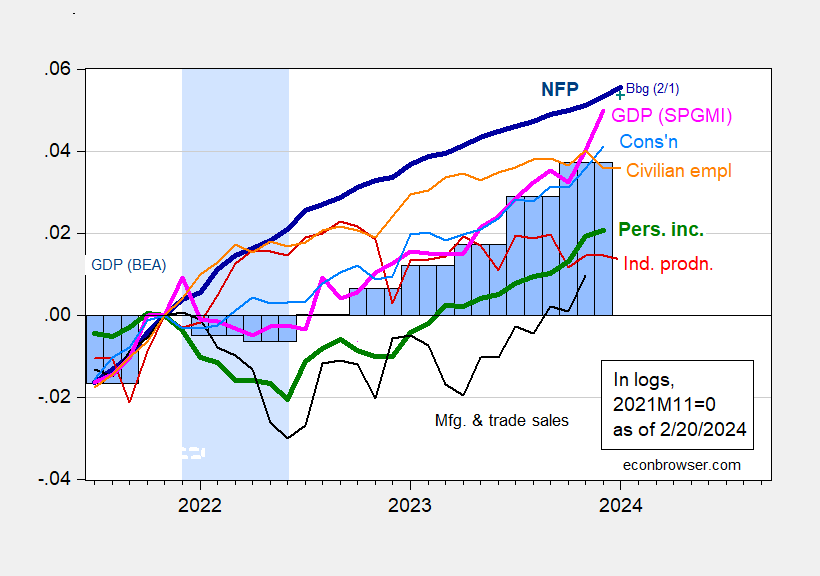

Second, consider other — more timely — measures of economic activity. NBER’s Business Cycle Dating Committee relies upon a series of variables, chief among them in recent times nonfarm payroll employment and personal income excluding current transfers. These are shown in Figure 2 below, with monthly GDP and official quarterly GDP added in.

Figure 2: Nonfarm Payroll employment (bold dark blue), Bloomberg consensus of 2/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2023Q4 advance release (blue bars), all log normalized to 2021M11=0. Hypothesized 2022H1 recession shaded light blue. Source: BEA, BLS via FRED, Federal Reserve, 2023Q4 advance release,, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/1/2024 release), and author’s calculations.

It’s hard to make out a consistent story with different variables going different directions. One way to circumvent this problem is to summarize the information in these series in one series. A principal component analysis is one approach, as suggested by Atkinson et al. at the Dallas Fed (2022). Figure 3 shows the first principal component of the above series (ex-monthly GDP, and official GDP).

Figure 3: First principal component of nonfarm payroll employment, industrial production, personal income ex-current transfers, manufacturing and trade industry sales, consumption, civilian employment in logs, 2007M01-2023M11. Hypothesized 2022H1 recession shaded light blue. Source: author’s calculations.

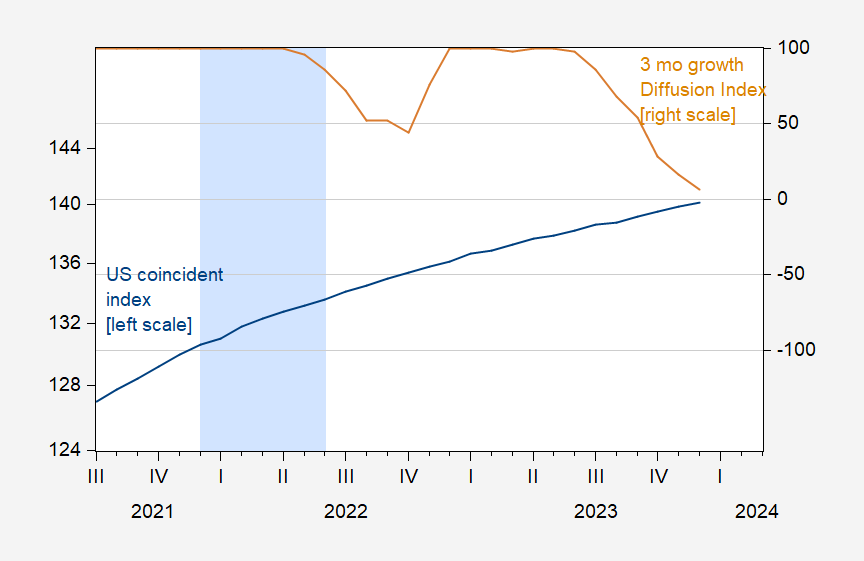

Philadelphia Fed calculates a coincident index for states and the United States overall, which is based primarily on labor market data. This series is shown in Figure 4 below as the consistently rising series in blue. Relatedly, one possibility is to examine a geographically-defined diffusion index, based on the Philadelphia Fed’s coincident indexes, as suggested by Picerno (2024).

Figure 4: Coincident index for US (blue, left scale), and 3 month growth diffusion index (tan, right scale). +100 diffusion index means all states growing; -100 means all states contracting. Hypothesized 2022H1 recession shaded light blue. Source: Philadelphia Fed.

Note that the coincident index shows no declines over the conjectured recession period in 2022H1. In fact, a diffusion index based on number of states experiencing expansion/contraction shows a little dip in 2022H2, down to 86. For comparison sake, the diffusion index was 16 in 2001M04 when the recession is dated to have begun (NBER peak at 2001M03).

Finally, one can look to the labor market conditions as summarized by the unemployment rate. The Sahm rule (real time) indicator — the three month moving average relative to the minimum unemployment rate in the previous year — is displayed in Figure 5. The threshold for a recession onset is +0.5 ppts. The indicator was below zero for the 2022H1.

Figure 5: Sahm rule, in % (blue), and recession threshold (red dashed line). Source: FRED.

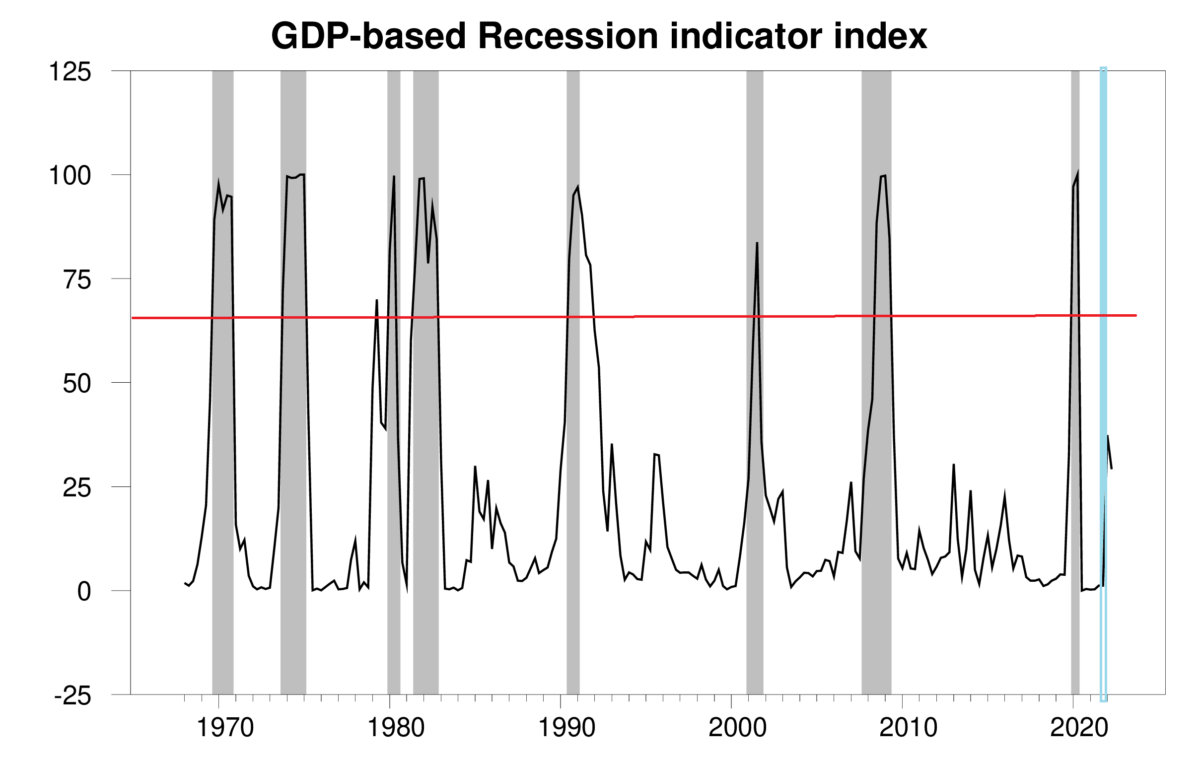

Now, suppose one wanted to use GDP — specifically GDP growth — as a means of determining whether one was in a recession. Jim Hamilton has exactly that methodology (you can access the probabilities on FRED here). Below, I post his estimated probabilities through 2022Q1, using the advance release of GDP for 2022Q2 in July 2022, with the graph annotated to include a posited recession in 2022H1, and the 65% threshold.

Source: Hamilton (2022a). Notes: Hamilton recession probabilities (black) and NBER defined recession dates shaded gray. Hypothesized 2022H1 recession shaded light blue. 65% threshold red line.

When the 2022Q3 advance release came out, Jim posted this graph (which I have annotated to include the posited 2022H1 recession).

Source: Hamilton (2022b). Notes: Hamilton recession probabilities (black) and NBER defined recession dates shaded gray. Hypothesized 2022H1 recession shaded light blue. 65% threshold red line.

Additional description of NBER definition of recession in these slides.

One reason to rely on a committee, which relies in turn on a range of economic indicators, to identify recessions is to avoid unnecessary drama over false positives. The problem for policy makers is that, if we want to employ couter-cyclical economic policies, we need to know that we’re in a slowdown while we’re in the slowdown, and the NBER’s approach isn’t much help.

It’s unnecessarily finicky when considering counter-cyclical policy to worry whether the economy is in recession. If output is below potential, the costs and risk of expansionary policy are low – something Summers got right, perhaps because DeLong talked him into it.

Claudia Sahm had the good sense to recognize the need for a reliable recession-identifying tool and the skill to create it.

So we have a formal system that takes its time and makes good use of both data and expertise in identifying recessions for posterity. We also have a reliable coincident indicator of recession that can be used to guide policy, assuming we care about such things.

The issue that the NBER, Sahm and the non-partisan public face is that avoiding unnecessary drama isn’t in everyone’s interest. Chicken Little was probably either a political hack or a journalistic hack.

Here is another chart showing recessions.

https://fred.stlouisfed.org/series/fedfunds

Bruce Hall: You do realize the those (NBER) recession dates are the same as the ones I show regularly in my graphs, except mine are peak-to-trough and FRED shows after-peak-to-trough.

Of course, I was using this chart because of the visual relationship between the fed funds rate changes and past recessions. The current pattern seems very similar to past rate increases, followed by recessions.

Gee Brucie…claims that high interest rates are the same e as a recession is not going to make JohnH like you. Besides the fact that’s stupid

Tell JohnH.

All this is fine, Menzie. But had Trump been president, I am sure you would have deemed it a recession.

Why would anyone make such a dishonest and insulting claim. Dude you are disgusting little moron

Small-minded much?

Menzie relies on data and on the judgements of a committee of experts. How, exactly, does that allow for “deeming”.

You want to claim that Menzie is like you, making assertions based on his own biases rather than on objective criteria. The evidence says your wrong. Amazing how often that happens.

unlike the maga crowd, most democrats do not hope for economic and military failure to help promote their agenda. wishing for recession? wishing for Ukraine defeat? wishing for nato breakup? that line of thinking is strictly a maga hatter way of thinking. such behavior is not symmetric Steven.

Here is my landing page at the Kyiv Post. I am sure it will help you better understand my views towards the war.

https://www.kyivpost.com/authors/715

So Trump is claiming AG James violated the 8th Amendment because the fines – which covered only the damages his fraud – were “excessive”. Now one would think most lawyers would be falling on the floor laughing but Trump has support from three left wing well respect lawyers I guess: John Yoo, Jonathan Turley, and Andew McCarthy. Trump hires only the “best” lawyers.

Trump hires only the best; available. Unfortunately for him the best are not available. He is a disaster of a client so nobody want him unless they cannot find any other work anywhere.

I have to confess that some of Morning Joe’s guests make me cringe – especially that clown known as Steve “I have charts so I’m an economist”. His topic today was how the sanctions on Russia are not working with his first chart being an international comparison of 2023 GDP growth rates. I started to wonder if Steve outsourced this one to JohnH.

But then Steve showed some Russian stock market index which had fallen by 25% as the war started but more than full recovered showing a net gain. No we know little Jonny boy hates it when the US stock market does well but the Russian stock market feeds all those Putin cronies. Which means more dog food for Putin’s pet poodle. Little Jonny must be wagging his tail with joy.

So Brucie boy sees gray bars on the FRED graph of the Federal Funds rate and go all recession cheerleader again as Brucie boy is too dumb that FRED graphs always had gray bars. OK our host has noted that – but Brucie boy wants a Biden recessioi\++n so bad he claims the increases in the Federal Funds rate always leads to recession.

Come on Brucie – are you blind? Look at this rate from the time Trump came into office until mid 2019. I guess Brucie is telling us we would have had a Trump recession even with COVID.

Brucie – Kelly Anne Conway is calling you. Don’t pick up the phone unless you want to hear “you’re fired”.

Initial jobless claims dropped to the second lowest level in a year….and the 4 week moving average is below what it was for most of the last year. https://www.advisorperspectives.com/dshort/updates/2024/02/22/unemployment-claims-down-12k-lower-than-expected

But let’s ignore the good news. Based on pgl’s crystal ball of future worker suffering, it’s a great time to cut rates!

if rates are above the natural rate, it will be a problem. are you saying you know what that rate is? if inflation is dropping, then you are probably above the natural rate. that will be a drag on the economy.

remember, Ponzi Johnny is the guy who believes that a 16% rate in Russia is a sign of a strong and healthy economy. its economy is “hot” because it is building munitions to explode as fast as possible. not sure how that helps an economy in the long term, when you blow up everything you have made. but Russia has lost a million young men during its illegal invasion of Ukraine. those losses will haunt its future, as a generation of young men have disappeared from the country, forever. and it is literally blowing up all of its production.

Thanks. I’m tired of doung Johnny

clean-up and your arguments are good.

You don’t think that the current high economic growth rate combined with high interest rates and very low unemployment are making a mockery of the natural rate? From what I can see, economists love to make up “laws” that often don’t survive the test of reality….but they’re certainly scurry to rationalize it all!

And, of course, neither baffling nor Ducky nor pgl will acknowledge effect of interest rates on asset prices and wealth inequality. After all, why would they bother to quantify or even acknowledge the effects of one of monetary policy’s major means of transmission? The incuriosity is mind boggling!

Of course, they’re not the only ones to blame…BEA’s NIPA calculations don’t even include unrealized capital gains as income, which means that the extent of income and wealth inequality get buried.

“You don’t think that the current high economic growth rate combined with high interest rates and very low unemployment are making a mockery of the natural rate?”

The fact that you would write this sentence proves you have no clue what he said as little Jonny boy has no idea what “natural rate” even means. Look Jonny boy – until you learn a little basic economics, maybe you should just SHUT THE EFF UP. After all – you have embarrassed your mother way too many times.

“BEA’s NIPA calculations don’t even include unrealized capital gains as income”.

This is rich from a moron who has no clue what the BEA reports. Come on Jonny – relax. We already get you are the dumbest troll ever. So stop trying so hard to prove the obvious.

“From what I can see, economists love to make up “laws” that often don’t survive the test of reality”

from what you can see? from what you can see, a 16% rate in Russia is indicative of a strong and healthy economy. why should anybody care “what you can see”, because “what you can see” is patently wrong ponzi Johnny.

I am very aware of interest rates on asset prices. I am also very aware of interest rates on debt cost. the average person has far more debt than assets. the median debt (excluding mortgages) is higher than the median savings in this country, by at least $5000 dollars. considering the interest rate on debt is much higher than the interest rate on savings, and the interest is compounded, high interest rates are damaging to the median household. something ponzi Johnny cannot accept.

As I’ve mentioned before, in different words, I don’t understand your point of view. Why do you think high real interest rates are better than real interest rates that, say, hover around the long-run median? Unless you’re a shill for rich people who prefer to hold bonds instead of stocks, real estate, etc., of whom I’m guessing there are, to a reasonable degree of approximation, zero in the U.S., I’m just not seeing it.

Ithaqua–it used to be (pre-2008) that high interest rates would alternate over the business cycle with stock appreciation, allowing benefits to cycle between savers and stock investors. Since 2008, the gains have gone almost exclusively to risk takers, who are to be found mostly in the top 10%. Isn’t it time to give positive real returns to people living on fixed incomes, saving for retirement, for their HSA health accounts, or for 529 education plans?

So far as I know, no commenter has been willing to address the question of why stock investors should get preference over lower risk savers over such an extended period.

Oh boy – Jonny boy makes another one of his patented assertions with neither any evidence to back it up AND without a clue what Jonny boy’s words even means.

Dude – you’re on a roll. Troll of the year 2024 guaranteed!!

“Since 2008, the gains have gone almost exclusively to risk takers…Isn’t it time to give positive real returns to people living on fixed incomes, saving for retirement, for their HSA health accounts, or for 529 education plans?”

once again, ponzi Johnny wants to have a high rate of return on a risk free asset. economic incompetence. while he will not admit it, ponzi Johnny simply does not believe in capitalism. he believes in socialism and communism. that is what he promotes on the blog, almost exclusively. history has shown that communism does not work. ussr? failed. Cuba? failed. Yugoslavia? failed. North Korea? failed.

baffling–exactly what economic theory supports your assertion that stockholders are entitled to receive all of the real returns on financial investments?

Ponzi johnny, the theory that higher risk can receive higher returns. That is the economic theory I subscribe to.

Ponzi johnny, what economic theory subscribes to the thought that higher returns go to risk free assets? Are you an economic illiterate?

I am going to berate you here, because what you advocate is not free market capitalism. You advocate for communism. And as I pointed out, it has a spectacular failure rate throughout history. The data doesn’t lie, even if your ideology does lie ponzi johnny. Own up to your position on this site. You are a communism advocate. Which is why you denigrate everything you can about a free market system. You don’t believe in the western world.

Pressure builds to seize Russian assets as war in Ukraine drags on

https://www.msn.com/en-us/news/other/pressure-builds-to-seize-russian-assets-as-war-in-ukraine-drags-on/ar-BB1iJbvF

Saturday will mark the two-year anniversary of Russia’s invasion of Ukraine, and there appears to be no end in sight to the conflict. At the beginning of the war, Western nations froze billions of dollars in Russian assets as a cudgel against Russian President Vladimir Putin. As the war’s third year approaches, pressure has been building for these nations to take the next step: the actual seizure of these assets, which would then be transferred to Ukraine to help its war effort. The Central Bank of Russia has previously confirmed that the value of these frozen assets totals about $300 billion. While the exact makeup of these assets remains ambiguous, the funds reportedly include “$207 billion in euro assets, $67 billion in U.S. dollar assets and $37 billion in British pound assets” which were “mainly invested in foreign securities, bank deposits and nostro correspondent accounts,” according to a review of the funds by Reuters. How should Western nations go about seizing these funds — or should they be seized at all? Some experts have cautioned against the legality of seizures. Still, most nations, including the United States, appear to now be of the mindset that seizing Russia’s assets is the best step to aid Ukraine.

Given Putin’s war crimes invading Ukraine this “legality of seizures” should just be dismissed. Use the assets to defend and rebuild Ukraine.

Right, pgl. Seizure of Russian central bank assets will send a loud and clear signal to any country with assets in a Western central bank could have their assets seized if the US deems that they are not conforming to the US’ “rules based order.” IOW if Russian assets are not safe , nobody’s assets are safe. It could be seized on a whim for whatever reason…just don’t look at Biden wrong at the next G20 meeting!

If that doesn’t motivate countries in the global south to set up alternative payment systems, I don’t know what would.

[The irony here is that I don’t see any erstwhile free trade fundamentalist economists commenting on the potentially devastating effects on globalization!]

Awww – Putin’s pet poodle is so scared that his dog food allowance will dry up. Seizing assets from the people who committed war crimes has a long history. But of course little doggies like you never studies history. Enjoy your daily dish of doggy treats.

“It could be seized on a whim for whatever reason”

it was not seized on a whim. if was seized AFTER Russia illegally invaded a sovereign state. and proceeded to commit murder and war crimes. and yet you have no issue with that ponzi Johnny? political hack.

Let’s take a look at this series over the last couple of years at jobless claims for two reasons:

https://fred.stlouisfed.org/series/ICSA

Initial Claims

(1) Little Jonny boy reads that this series is lower than it was four weeks. I guess little Jonny boy does not know it was even lower back in late 2022 when little Jonny boy said we were in a recession. OK little Jonny boy has malleable opinions and an IQ in the single digit.

(2) But yes the current state of the labor market is very strong – which I have been saying for a long time. I guess Jonny boy’s boyfriend Bruce Hall does not get this as Brucie boy is telling us we have to be entering a recession because he thinks the Federal funds rate has been raised too much. But Brucie forgets it rose a lot under his hero Donald Trump. Is Brucie telling us we were about to hit a recession back in the summer of 2019? Of course our host’s new post has taken little Brucie to the woodshed.

I recall pgl saying just in the last couple weeks that it is time for a rate cut…even though he now acknowledges that the labor market is very strong. If the Fed is fulfilling its maximum employment mandate and close to realizing its price stability mandate, Isn’t the Fed implementing the current neutral rate?

“The neutral rate of interest, previously called the natural rate of interest, is the real interest rate that supports the economy at full employment/maximum output while keeping inflation constant.” https://en.wikipedia.org/wiki/Neutral_rate_of_interest

Now what would motivate pgly and Ducky to champion a rate cut under these circumstances…unless they or their Wall Street bosses stand to gain from a rate cut?

How precious. Little Jonny boy finds a Wikipedia definition of a concept he still does not grasp. Of course this is after this lying know nothing lied about what I have said. Oh yes – my daily dose of garbage from my mentally retarded stalker.

I get Jonny boy has trouble reading past a paragraph or two but his own Wikipedia link (which Jonny does not even remotely understand sent us to this:

When the Facts Change…

May 14, 2019

John C. Williams, President and Chief Executive Officer

Williams was noting how what real economists call R-star (forgive me but it would take months to explain this to Jonny the moron) had fallen well below 2%. Now I get facts have changed again since 2019 but most estimates of R-star have this “neutral” real rate (to use Jonny boy’s preK languange) near 2.5%. But wait, the Federal funds rate is near 5.5% and expected inflation is 2.5% or less.

Now the 4 year olds at Jonny preK will have to do the arithmetic for Jonny boy as to which real rate is higher. Jonny boy is still trying to learn to tie his own shoe laces.

“while keeping inflation constant”

I pointed this out already, but apparently ponzi Johnny has a reading comprehension problem. inflation is not constant. it is decreasing in value. that means you are above the natural rate, just like the definition states. this is not rocket science ponzi Johnny. according to the definition YOU provided, along with the data, we currently are somewhere above the natural rate. and that means there will be a drag on the economy. you are denying this, is it because you are in a fantasy world or do not like to admit when you are wrong?