Here’s a graph that I constructed, in preparing to teach the open economy component of Macro Policy:

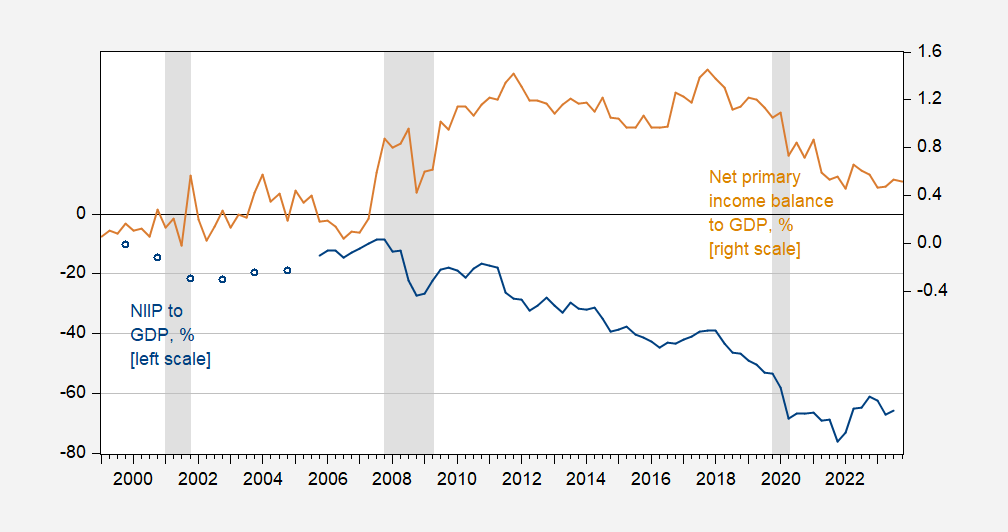

Figure 1: US Net International Investment Position as ratio to GDP (blue, left scale), Balance on Primary Income as ratio to GDP (tan, right scale), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: BEA via FRED, NBER, and author’s calculations.

For many years, the US has been a net debtor to the rest of the world (assets – liabilities < 0), and yet income from the rest of the world has exceeded payments to the rest of the world, consistently since 2007.

Either we’re mismeasuring net assets badly (Hausmann-Sturzenegger “dark matter”), or returns on our assets abroad are consistently much higher than foreign assets here (“exorbitant privilege”), or some combination of both. See a very clear and concise discussion in these slides by Schmitt-Grohe, Uribe and Woodford (slide 47 onward). Here’s a 2021 Econbrowser post.

Interestingly, the increasingly negative NIIP has seemingly finally caught up with primary income, as the latter is now coming down to zero.

Glad you linked to your earlier post. Interesting comment section. I will just add this which talks about transfer pricing using Disney as an illustration:

https://econospeak.blogspot.com/2017/01/disneys-transfer-pricing-and_8.html

I also included a link to China who had the inverse issue aka Anti Dark Matter!

Their slide 57:

The Flip Side of the NIIP-NII Paradox

If we divide the world into two groups, the United States (US) and the rest of the world (RW), then the rest of the world must display the flipped paradox—that is, a positive net foreign asset position and negative net investment income.

As I called it – Dark Anti Matter.

Their slide 58 specifically noted China. I need to go over their presentation more carefully as it is very well done!

I forgot Barkley Rosser’s obsession with saying “nothing new here” every other comment even though he was the jedi master of “nothing new here” style comments. That’s what happens with self navel-gazers. Someone flipped off the max aggravation switch of this blog around Jan. ’23.

Slide 58 was indeed interesting reminding me of what I wrote way back when

https://econospeak.blogspot.com/2015/05/chinas-dark-anti-matter.html

Yet again, there is a marked changed during and after the Covid recession.

Most U.S. assets held abroad are fixed income, and the effect of higher interest rates should be cumulative over time. In fact, the tan line representing payments stabilizes roughly around the time the Fed began hiking rates.

Since the issue here is that there’s a mystery, I don’t feel so bad about being confused.

Wait, if you’re the “blind man” what does that make me for following you?!?!?!?!? (Uncle Moses enjoying some drinkies now)

Is this somehow related to the fact that NIIP and Cumulative CA deviate in both China and the USA (and in different directions)? Thank you!!