From the Employment Situation Release:

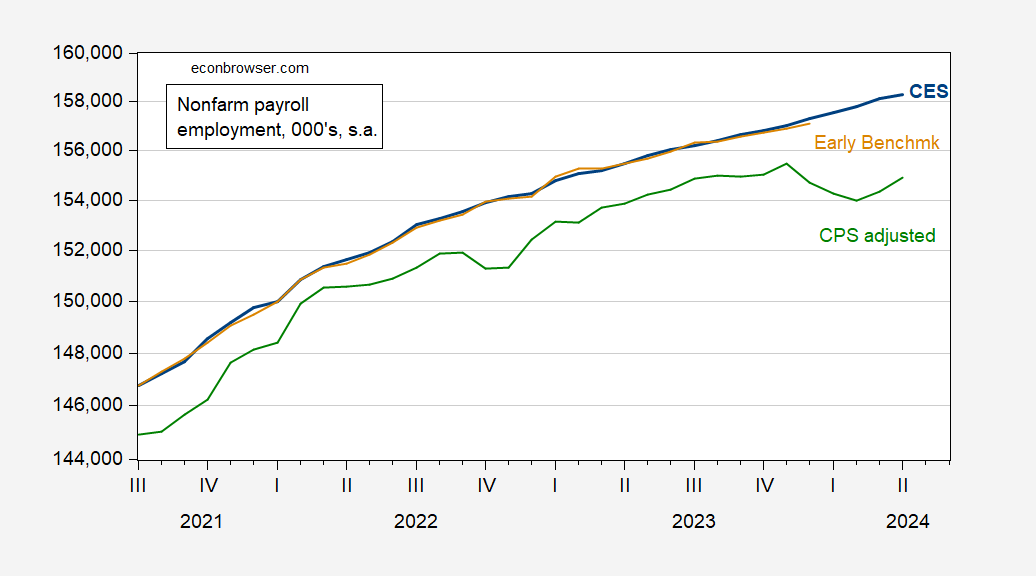

Figure 1: Nonfarm payroll employment (blue), NFP early benchmark (tan), and CPS employment adjusted to NFP concept (green), all in 1000’s, s.a.. Philadelphia Fed NFP early benchmark calculated by applying early benchmark sum of states level ratio to post-benchmark sum of states level to CES national level NFP. Source: BLS via FRED, Philadelphia Fed, and author’s calculations.

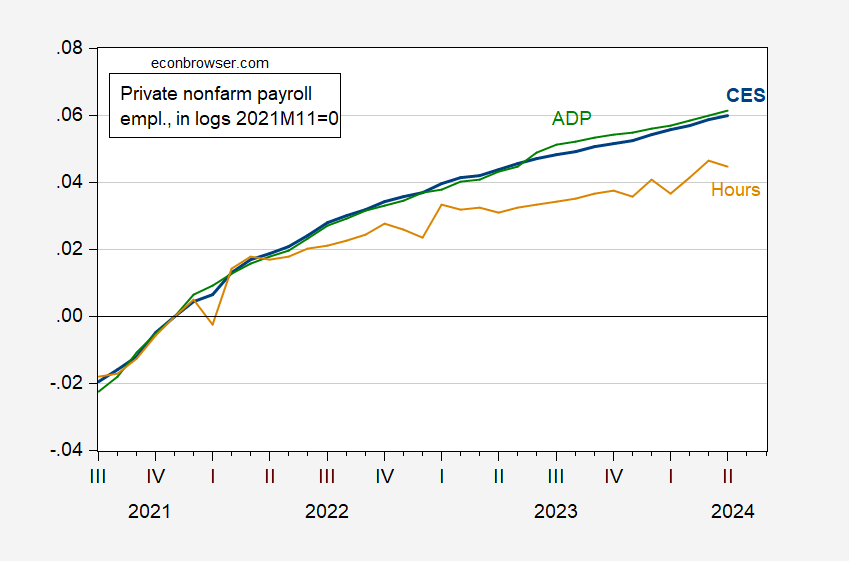

Figure 2: Private nonfarm payroll employment from CES (blue), from ADP (green), and aggregate weekly hours for private nonfarm (tan), all in logs, 2021M11=0. Source: BLS, ADP via FRED.

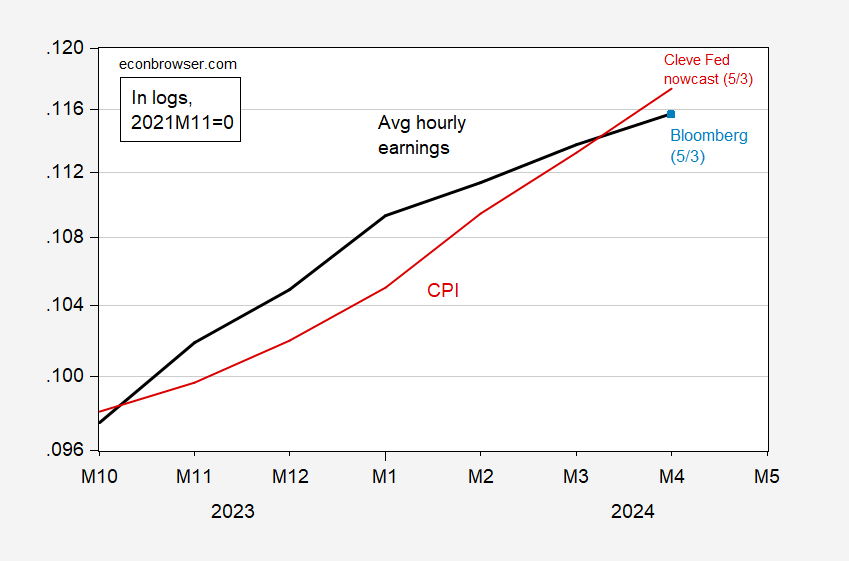

Figure 3: Average hourly earnings for private nonfarm (black), Bloomberg consensus y/y (light blue square), and CPI (dark red), all 2021M11=0. April CPI based on Cleveland Fed nowcast of 5/3. Source: BLS, Bloomberg, Cleveland Fed and author’s calculations.

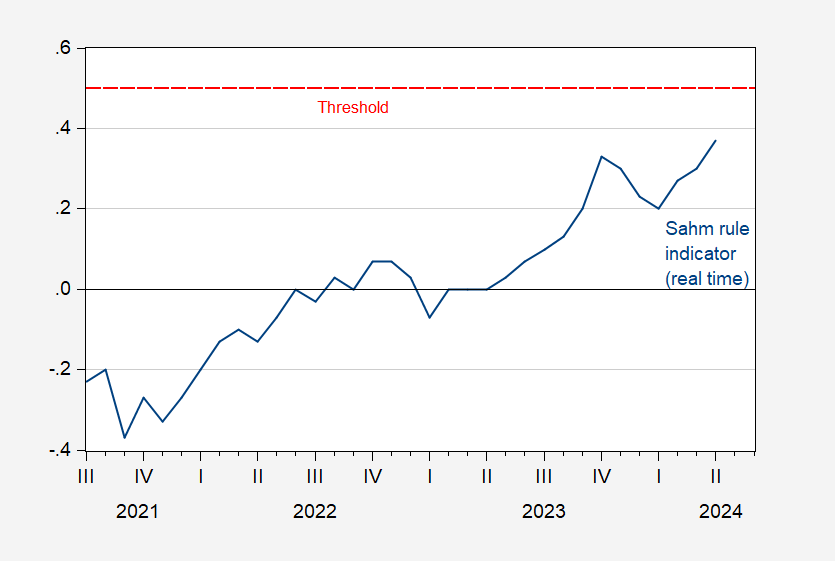

Figure 4: Sahm rule real-time indicator (dark blue), and 0.50% threshold (dashed red line). Source: FRED.

A year ago the unemployment rate was 3.4%. Today BLS reports this rate at 3.9%. But here’s the funny thing. The employment to population ratio has not exactly declined. No – the labor force participation rate has increased. So we are not talking about weak employment growth at all. I do not know why the labor force participation rate has been increasing but all the talk about immigration might give us a clue. Invite for adults only (sorry Brucie and Stevie pooh but no one wants to hear from you) – please add what you might know that would explain this data.

Here’s what I’ve got:

https://fred.stlouisfed.org/graph/?g=1mEex

These series are not seasonally adjusted, so can’t answer questions about short-term effects of participation, but

the divergence between foreign-born women and everyone else seem like it might matter.

Thanks!

Labor Force Characteristics of Foreign-born Workers Summary

https://www.bls.gov/news.release/forbrn.nr0.htm

From May 18, 2023 but very informative.

Off topic – Ukraine’s quest for peace:

International discussion of a peace deal for Ukraine is scheduled for mid-June. Some reports indicate that Russia has refused to attend:

https://www.reuters.com/world/europe/switzerland-says-russia-not-invited-at-this-stage-ukraine-peace-talks-2024-05-02/

Others report that Russia hasn’t been invited:

https://www.politico.eu/article/volodymyr-zelenskyy-vladimir-putin-ukraine-ready-peace-russia-war/

The host country, Switzerland, intends to base discussions on UN rules and international law, which Russia finds problematic. China has refused to join in if Russia doesn’t attend.

Of course, the six-month U.S. delay in delivering assistance to Ukraine, thanks to the “heroic” dithering of Speaker Johnson, has given Russia a battlefield advantage. That may or may not explain Russia’s refusal to engage in peace discussions.

Hopefully Ukraine will hold on and get a few victories on the battle field.

What Moscow Majorie and the other GOP traitors did, for Putin, to Ukraine is just unforgivable. However, the basic math has not changed and in the long run its advantage Ukraine, provided that EU steps up to the plate faster. Russia has pretty much maxed out their war machine. EU still has a lot of resources to mobilize. The main hiccup was in a much slower increase in shell production than anticipated. But those kinks are being ironed out. F16s are also on finally belatedly on their way. Putin will overplay his hand as he always has.

Art Laffer: I’ve never heard of an economy being taxed into prosperity

https://www.msn.com/en-us/news/politics/art-laffer-i-ve-never-heard-of-an-economy-being-taxed-into-prosperity/vi-AA1o3vBv?ocid=msedgdhp&pc=U531&cvid=88e341ac99254e67ae6f6d5f777b3bf1&ei=16#

Kudlow the Klown invites Kevin 36000 Hassett and yea – ART LAFFER – to lie about the economy. Based on Laffer’s little quip, he never heard of the US economy in the 1990’s.

Off topic – Given the interest forecasting the election prediction shown here, I offer the following:

U.S. historian Allan Lichtman and Russian geophysicist Vladimir Keilis-Borok (R.I.P.) long ago devised a method to forecast presidential election outcomes based on Keilis-Borok’s earthquake prediction model (of all things). Their method is called “The Keys to the White House”:

https://en.m.wikipedia.org/w/index.php?title=The_Keys_to_the_White_House&wprov=rarw1

Other than the 2000, election, decided by the Supreme Court rather than the electoral system, their method has correctly predicted the outcome of every presidential election from 1984 through 2020.

Lichtman says it’s too early to call this year’s election results, but as of now, Biden has the advantage. If the incumbent party’s nominee has fewer than six strikes against him or her among a list of 13 tests, the incumbent party wins (barring interference). Lichtman identifies “incumbent charisma” as a strike against Biden and social unrest as a potential strike, should campus protests spread and persist.

Only one of the inputs to the forecast, having to do with third-party candidates, involves polling, and so far Kennedy’s numbers aren’t strong enough to count.

Litchman’s forecasting method strikes me as a good test of any claim that political polarization changes everything. If Lichtman’s eventual prediction turns out to be wrong, that would suggest structural change.

Lichtman receives only a modicum of attention from second-tier news outlets, and I can’t find much from the big ones, so I thought I’d let y’all know.

Off topic some more – Xi masquerading as Deng:

Back in March, Xinhua ran a puff piece about China’s Xi – quelle surprise. What’s notable is that the puffs are an effort to claim that Xi is an economic reformer of the same stripe as Deng Xiaoping.

https://english.news.cn/20240312/29818f0675c3425e89894c40355087cc/c.html

Xi’s departure from Deng’s economic liberalization effort makes the article particularly hypocritical, but also particularly interesting. Of all the implausible claims to make, why this one?

Here’s one guy arguing that it’s an effort to reassure foreign investors that Xi is actually a business-friendly modernizer:

https://substack.com/@dexter/note/c-51861262

If we assume Dexter Robert is onto something, then this is just another Xi-style effort to tell people to think something that’s contrary to what they know. It’s a habit authoritarians get into, and can’t seem to shake when they lack coercive authority.

There’s also a bit of excuse making, to paper over the poor performance of the economy under Xi:

‘In 2012, when Xi was elected general secretary of the Communist Party of China (CPC) Central Committee, China had become the world’s second-largest economy, with a per-capita GDP of over 6,000 dollars. But growth was shifting gears and many advantages, including the once-low labor costs, had started to diminish.

Instead of resting on the laurels of his predecessors, Xi was committed to carrying on the reform, and he knew how hard it would be.

‘”The easy part of the job has been done to the satisfaction of all. What is left are tough bones that are hard to chew,” he said.’

In short, Deng was a lightweight; Xi is the real deal. The fact that Xi has shifted focus from improving domestic welfare to strengthening the Party’s grip at home and imposing hegemony abroad have nothing to do with it.

If Xi is, in fact, worried about his and China’s image among foreign investors, that’s good. Can’t fix a problem if you refuse to recognize it. Xi has moved from denial to anger, and now appears to be in transition to bargaining – not yet ready to give up on anger. Can’t guess how long till he goes through depression to arrive at acceptance.

As a person who takes some things related to China and the Chinese people deep to heart, this could be kind of sardonically humorous to me or extremely sad depending on how I look at it in any moment (preferably with adult drinks handy). The irony of this, not just what you’ve astutely pointed out above, but in the entire situation, is that Deng Xioaping left them a masterful “playbook” in which to give China the greatness it has supposedly pursued over decades. It’s people genuinely pursue this greatness, but the leaders do not actually pursue this global greatness. This gets back to the point I have made many times, kind of following Menzie’s lead. China could have one of the top 5 currencies in the world, But becoming one of the top 5 currencies in the world means allowing freedom of capital both intra-China and to foreign lands. But freedom of capital means that Beijing cedes power from “the party”. This is why Deng’s policy “playbook” for China to become the greatest and strongest nation of the world is intentionally and knowingly ignored.

Both Putin and Xi (and other dictators) are running into the problem that investors do not like putting money into countries where they have no real certainty that they will not be robbed. Basically the law and the courts have to be above political robber barons – or a real fat profit has to be dangled in front of investors noses. Creators and inventors are similarly reluctant to stay in countries where they are very uncertain that they can harvest the fruits of their talents. Both Putin and Xi has flexed their authoritarian muscles a little too much for most foreigners (and many of their citizens) to feel comfortable about doing business and building something there. You are also right that a lot of them are looking at other Asian countries and asking: why not here instead?

OK, this is actually on topic, particularly as regards aggregate hours. Just be patient.

CNBC thinks it has found a pattern in earnings reports from large restaurant chains:

https://www.cnbc.com/2024/05/01/starbucks-mcdonalds-yum-earnings-show-consumers-pulling-back.html

It’s the “long-predicted consumer pullback”. In fact, retail sales at eating and drinking establishments in Q1 experienced the first drop since Q4 2020. However, grocery store purchases also fell in Q1, which argues against households substituting food at home for restaurant meals as a response to high prices. In addition, overall retail sales were nearly flat in Q1, so it ain’t just restaurants:

https://fred.stlouisfed.org/graph/?g=1mQty

It’s also notable that sales at eating and drinking establishments had been growing considerably faster than overall retail sales or grocery sales until Q1; sounds like restaurant chain execs are having a pity party and the reporter fell for it.

CNBC’s assertion that higher prices and higher interest rates account for the slowdown in sales may be half right; sales are in nominal terms, so higher prices result in HIGHER sales, unless something stands in the way. Could that something be interest rates? Plausible.

It could also be that slower income growth among households with tight budgets has slowed retail sales growth. That’s what I see when I compare growth in payrolls (aggregate hours X average hourly earnings) to retail sales:

https://fred.stlouisfed.org/graph/?g=1mQyk

As for interest rates driving the slowdown in retail sales growth, one could argue that rate hikes have slowed hiring and so have slowed income growth.

“How Come Everything the Republican Party Stands for Involves Other People Dying?”

A very provocative title maybe but the discussion is well worth the read:

https://www.dailykos.com/stories/2024/3/13/2229203/–How-Come-Everything-the-Republican-Party-Stands-for-Involves-Other-People-Dying?pm_campaign=front_page&pm_source=latest_community&pm_medium=web

A thought about government employment:

We’ve heard from the once-and-former president that he intends to drive federal workers from their jobs, and in budget debates, Republicans keep demanding discretionary spending cuts which strongly implies job cuts. Here’s a look at total government employment, both level and as a share of overall employment.

https://fred.stlouisfed.org/graph/?g=1n3wH

A couple of observations:

Government employment as a share of the total is on a slight rise in the past few quarters, but is otherwise lower than at any time since the late 1950s. Government employment is mostly service employment, and as we know, service production doesn’t allow for the same pace of productivity gain as goods production – thank you, Professor Baumol. Growth in population requires growth in government employment to maintain services at a given level per person.

Government employment as a share of the total jumps during recessions, because governments tend to cut jobs not in response to weak aggregate demand, but rather in response to budget constraints, which builds a lag into the response. That makes government jobs counter-cyclical, with a quirk; the quirk being that government jobs create a drag a few quarters into expansion, when there is still slack in the economy. That’s not ideal, but better than a pro-cyclical pattern.

Cutting government employment is thus bad policy both because it is not justified by the share of government employees and because it weakens an automatic stabilizer.

Kristi Noem Would Have Shot Commander Biden, Too

https://nymag.com/intelligencer/article/kristi-noem-would-have-shot-bidens-dog-commander-too.html

South Dakota governor Kristi Noem — still facing widespread backlash after admitting in a new memoir that she once shot and killed her own dog (and a goat) instead of coming up with a non-lethal solution to the dog’s lack of training — said Sunday that President Joe Biden’s bite-happy German shepherd, Commander, should have been killed as well.

OK – killing one’s own dog is sick enough but maybe Commander needs protection from this Trumpian crazy woman.

So telling about her personality. She wanted to show that she can “make the tough choices”. But she is a sociopath so she didn’t understand that was not how it looks to all of those who are normal feeling and responsible human beings.

A normal responsible human being would have made the “tough choice” of spending days and nights training that puppy to become “good enough” (14 months is still a puppy with potential for development). If that didn’t work maybe take the dog into the house and let it live as a house pet, rather than a “working” dog. If that wasn’t possible adopt it out to someone who needed a house pet. There are all kinds of “tough choices” that involve “taking responsibility” for your own mistake (of having gotten that puppy in the first place), and “being tough” on yourself when you find a remedy for that mistake.

But that is the thing about sociopaths, they are never even considering the choice of taking responsibility and being tough on themselves.

Sounds like inflation (greed-flation) is about to go down.

https://www.cnn.com/2024/05/05/business/retailers-cutting-prices/index.html

That would be good news for the economy.

It looks like PeakTrader, Sammie, and CoRev put another hex on my zip code again. I told PeakTrader I never said those derogatory words about his Mother but he still won’t believe me:

https://forecast.weather.gov/product.php?site=OUN&issuedby=OUN&product=AFD&format=CI&version=1&glossary=1

https://en.wikipedia.org/wiki/Cartomancy#/media/File:Michail_Alexandrowitsch_Wrubel_001.jpg

I knew the whole thing was going to go bad when I paid 200rmb to that palm reader in the mountains of Liaoning.

I heard something about flooding in your area. I hope you are OK.

The area I live in is on relatively high ground. So I rarely (thank God) have to worry about this. One thing my Dad taught me was to check flood zones or flood maps, flood “plains” before you purchase a house. Most cities have them for free, and I don’t know now but I think you used to be able to request them from your realtor back in the day. But certainly city records or some agency should have them. This time the big one hit Bartlesville. We’re not “in the clear” yet but each day we get into summer the true danger of tornadoes drops until about a 2 week segment in Autumn. Barnsdall also got hit hard.

I’ll show you how crazy Uncle Moses is in the head. Because of the NWS labeling the tornado event “high risk” which they give a pink color on the map, I went South on the interstate until I was in an area of low risk. Some people, maybe rightly, would deem this very odd behavior in that I have access to a very strong ABOVE ground shelter in my house. I’ll tell you this much. I slept like a baby that night. Sans alcohol. <<—not recommended for psychological reasons.

Kristi Noem want to kill Commander

https://www.cnn.com/2024/05/05/politics/kristi-noem-dog-commander-biden/index.html

Somebody take the guns away from that nutcase.