Reader Bruce Hall writes:

The interesting thing is that since the PCE runs consistently 2pp below CPI.

This struck me as a surprising stylized fact, at variance with what I knew from various analyses I’d conducted. I wrote that the difference was about 0.45 ppts over 1986-2019. Mr. Hall then cited a MorningStar report notes:

at its peak in the summer of 2022, CPI inflation was almost 2 full percentage points higher than PCE inflation (9.0% vs. 7.1%).

Well I certainly can’t deny this is the case. However, then one has to wonder about the statement:

The interesting thing is that since the PCE runs consistently 2pp below CPI.

I do not think one month of inflation differential at 1.87 ppts constitutes “consistently”.

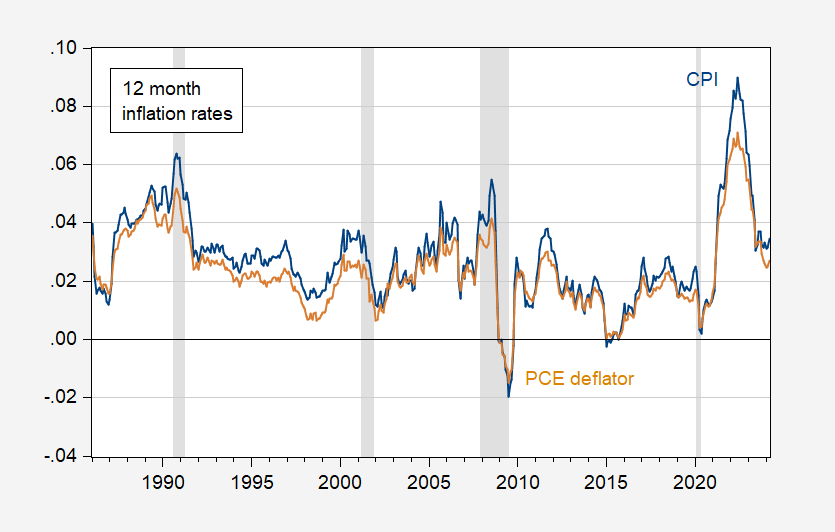

To confirm, here are 12 month inflation rates, 1986-2024 (Great Moderation onward):

Figure 1: CPI 12 month inflation rate (blue), PCE deflator (tan). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS via FRED, NBER, and author’s calculations.

Doesn’t look like “consistent” is the appropriate adjective to me. By the way, the difference is 1.87 ppts at maximum (one month). It’s 1.83 the subsequent month.

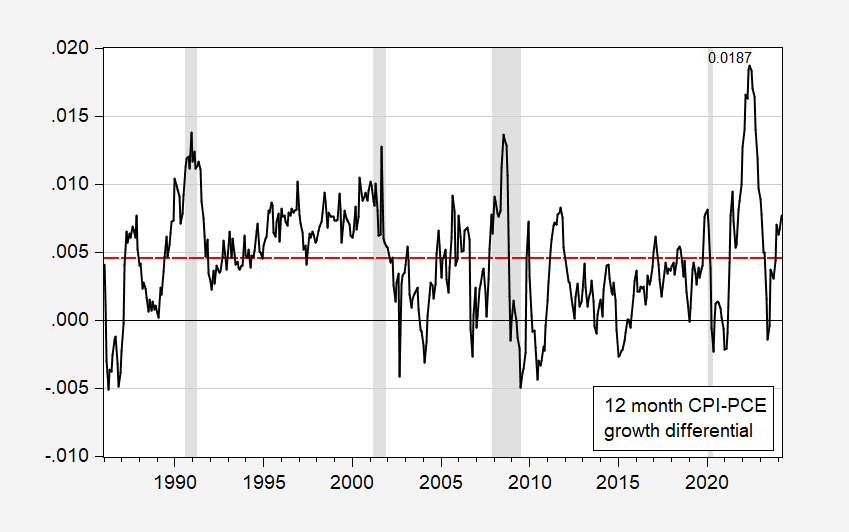

What does the differential look like over time? This is shown in Figure 2, with a red dashed line at the (average) differential value for 1986-2024M03. The red dashed line is obtained using a regression of the CPI inflation rate minus PCE deflator inflation rate.

Figure 2: CPI-PCE deflator 12 month differential (black). Red dashed line at average value for 19986-2024M03. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA, NBER and author’s calculations.

Now, is it true that CPI is a “better” measure of consumer goods and services costs? Yes, probably for the costs that consumers face, as opposed to the cost of goods and services households consume (keeping in mind that for some things, e.g., health care, the consumer does not face all the costs). On the other hand, we know that CPI is quasi-Laspeyres (while PCE deflator is chain-weighted). This base-weight issues is somewhat minimized as CPI has gone to annual changes in some weights, making it closer to the chain-weighted CPI.

Anyway, this recap is slightly dated but mostly applicable (except for frequency of CPI weight changes).

“probably for the costs that consumers face, as opposed to the cost of goods and services households consume (keeping in mind that for some things, e.g., health care, the consumer does not face all the costs).”

Let’s take medical costs since this was what drove that 2022 difference with medical costs falling relative the price of other goods (as your blog post noted CPI weight being a mere 6% v. PCE weight being 20% back in the day). It is established fact that we spend a LOT more on medical costs than 6% of income.

But let’s have a real world example since Brucie is having trouble even with the basics using a recent trip of his to the dentist to fix that nasty set of teeth he has. The dentist billed $500 in total (a bargain) but Brucie’s out of pocket was only $100 as his dental insurance covered the rest. Not the company did not do that bilking its shareholders on Brucie’s behalf. No – this was covered by his insurance premiums. Now if Brucie really thinks no one cares what they pay for health insurance, he has a job in Trump world.

Bruce Hall has said a lot of stupid things here and some very insulting things as well including accusing the good folks at BEA of being political hacks. But how did I miss the last 2 sentences of this obnoxious rant?

Bruce Hall

May 4, 2024 at 8:11 pm

Aw, c’mon man. You’re using some private bank economist as your expert. After all the times you’ve mocked what bank economists write. Be consistent, man. You could cite a Federal Reserve paper instead. I’ll wait. You accuse me of cherry picking and then you go do it. Admit it. Economists don’t agree because economics is not a science. But nice opinion.

We are talking about the proper presentation of data not economic theory. Getting the data right is not opinion unless one is wearing a MAGA hat too tightly.

But are we surprised that little Brucie boy does not know the difference? We have seen over and over that Brucie does not get even the basics of economics. Of course we all realize that Brucie never really cared about understanding economics. After all – that would get in the way of his Trump worshipping.

I’ll presume this was written before my comment:

CPI inflation generally runs about 0.4 percentage points higher than PCE inflation. However, at its peak in the summer of 2022, CPI inflation was almost 2 full percentage points higher than PCE inflation (9.0% vs. 7.1%). The “wedge” between the two indexes narrowed in the second half of 2023 as inflation fell dramatically, but it has since widened again to an average of 0.7 percentage points in December, January, and February.

https://www.morningstar.com/markets/whats-difference-between-cpi-pce

It was incorrect to state that PCE runs 2 pts. (1.9 to be exact) lower than CPI… except when inflation was running its hottest 2 years ago… and consumer perceptions of inflation were at its worst. As Bill Clinton once famous said, “It depends on what the meaning of the word ‘is’ is.”

But thanks for the explanation about the Fed.

This is what I wrote after your comment:

pgl

May 6, 2024 at 10:17 am

“However, at its peak in the summer of 2022, CPI inflation was almost 2 full percentage points higher than PCE inflation (9.0% vs. 7.1%).”

Oh the period where YOU claimed inflation was over 13%. Yea using NSA data for a 17 month period was a little sneaky of you.

BTW – we have told you MANY times why there was this difference – medical costs fell in relative terms and CPI severely underweights this factor. BTW the data I provided from that bank economist and the explanation of why this matters ala the CLEVELAND FED (2000) was also noted in Dr. Chinn’s blog post that he mentioned.

But I guess little Brucie was told by his MAGA masters to ignore all of that.

Brucie boy’s bloviating about the PCE deflator v. CPI had me thinking about something I used to ignore -SHADOWSTATS. I found this discussion which made me laugh in so many ways:

https://www.thestreet.com/economonitor/emerging-markets/deconstructing-shadowstats-why-is-it-so-loved-by-its-followers-but-scorned-by-economists

Ed Dolan made a lot of interesting statements with a few I’ll quote here:

‘ShadowStats is Williams’ attempt to provide an alternative to the official consumer price index (CPI), which he views as a flawed measure of what members of the general public have in mind when they think of the cost of living. Let me start by saying that although I share the skepticism of many economists about the specific numbers published on ShadowStats, I agree that the official data do not tell the whole story. I support Williams’ attempt to provide an alternative to the official consumer price index that more closely reflects public perceptions of inflation.’

Well – there is perception and then there is reality. ShadowStats wants us to believe inflation is higher than what CPI suggests whereas reality often indicates CPI overstates inflation. But I digress.

‘we refer to a cost of living index based on the changing cost of a fixed-proportion basket of goods that themselves remain unchanged over time as a Laspeyres index without quality adjustment. Williams is again correct when he says that the official CPI, following mainstream academic thinking, has gradually evolved away from the Laspeyres concept toward a measure of the cost of a changing basket of goods that gives equivalent satisfaction as the prices, quantities, and qualities of the goods that consumers buy change over time.’

On this one – Dolan notes why BLS is right and ShadowStats is being silly but again I digress.

‘Williams has a number of other criticisms of the CPI beyond the substitution and quality issues. In particular, he takes issue with the way the BLS measures housing prices and medical costs. Without going into detail, in both cases Williams favors an out-of-pocket approach to housing and medical costs as being more in tune with the general public’s concept of the cost of living.’

Huh – the big issue that Brucie boy keeps ducking. On this one – Williams has a point and it seems the good folks at the BEA are properly addressing this. Dolan continues by noting how ShadowStats cooks the data to greatly overstate the rate of inflation. Now Brucie boy’s political masters will instruct our favorite troll to adopt these ShadowStats tricks.