Just heard Wilbur Ross say on Bloomberg (roughly 3:35 ET) “The President was serious about fixing the balance of payments problem of the US”. I laughed and laughed and laughed. Maybe he was determined, but he had, like Peter Navarro, no clue about how to do it.

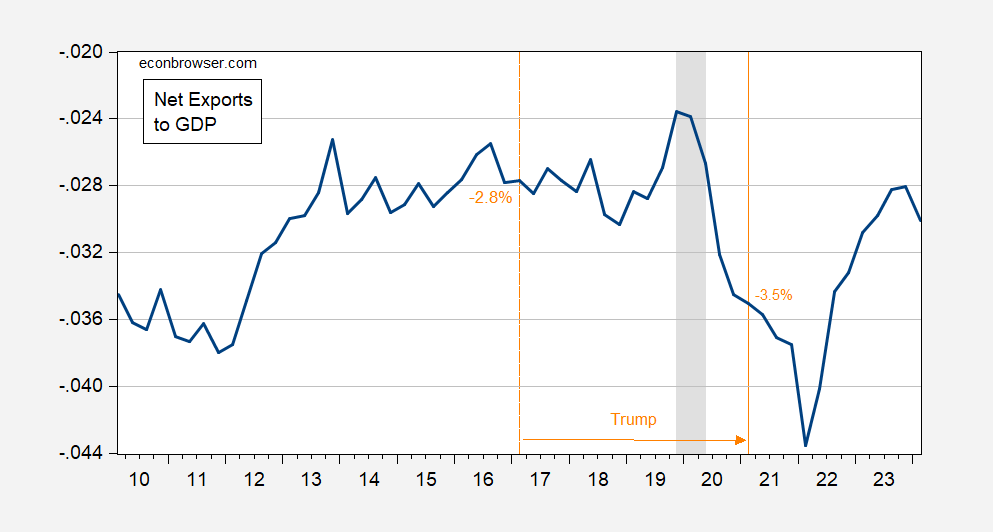

Here’s the US trade balance defined using NIPA data.

Figure 1: US Net Exports to GDP (blue), s.a. NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2024Q1 2nd release, and author’s calculations.

I got tired of “winning” (as defined by Trump) long ago – but for a recollection of the horrors of Trump economic policymaking, see this post.

Couple of things. Here’s the FT’s Katie Martin on the shakey thinking behind the notion that the dollar is going to quickly lose place in international trade and finance:

https://www.ft.com/content/8051019a-c1e4-4457-95c4-324711422b0c

Dollar strength is partly an outgrowth of the dollar’s dominance in trade and finance, and that makes balancing the trade deficit a tough climb.

The other point, which I’ve made in comments here before, is that reserve status requires generating enough financial assets to meet demand for reserve assets. Turns out, this is a part ot the “Triffin Dilemma”:

“This dilemma was identified in the 1960s by Belgian-American economist Robert Triffin, who noted how the country whose currency is the global reserve currency, that foreign nations wish to hold as foreign exchange (FX) reserves, must be willing to supply the world with an extra supply of its currency in order to fulfill world demand for these FX reserves, leading to a trade deficit.”

https://en.m.wikipedia.org/wiki/Triffin_dilemma

If the “king of debt” plans to balance U.S. trade with the rest of the world, he needs to get ready for a sharp rise in interest rates, as reserve demand (and everything that accompanies reserve demand) is withdrawn.

Why hadI never heard of Triffin before? The Trouble with Triffin.

https://www.ft.com/content/8051019a-c1e4-4457-95c4-324711422b0c

Appetite for the renminbi, meanwhile, “has soured”, OMFIF’s researchers said, and 12 per cent of managers are looking to cut back on holdings in the Chinese currency. This is quite a change of heart. In 2021 and 2022, nearly one-third were looking to raise their renminbi holdings.

“This is partly due to relative pessimism on the near-term economic outlook in China, but the vast majority also mentioned market transparency and geopolitics as deterrents . . . ” the think-tank’s report stated.

Gee gosh golly, and after Xi had the flunky interns cart of the elderly Hu Jintao on live TV so Xi’s mistress would stop screaming Hu’s name mid-orgasm, I was ready to put a major bet by exchanging dollars for physical holdings of RMB. Damn…… this currency exchange stuff is confusing.

Years ago, I don’t remember how many, there was an article on ‘Conversable Econ’ posted about the odd obscurity of the Triffin Dilemma.

Maybe Wilbur and Donald thought we were not running large enough deficits. The King of Debt after all.

Trump Likes Tariffs as a ‘Revenue Source,’ Wilbur Ross Says

https://www.bloomberg.com/news/articles/2024-06-13/trump-likes-tariffs-as-revenue-source-wilbur-ross-says

Gee Wilbur – do you really think tariffs can replace our income tax? Your moron boss said that. Did he get this stupidity from you Wilbur?