National Income and Product Accounts numbers that is.

I was prepping for macro lecture on Monday, which covers open economy macro. One topic I planned to cover is evaluation of the Trump trade war. We know the Phase 1 trade deal with China was a miserable failure, and was failing miserably even before Covid-19 struck the US.

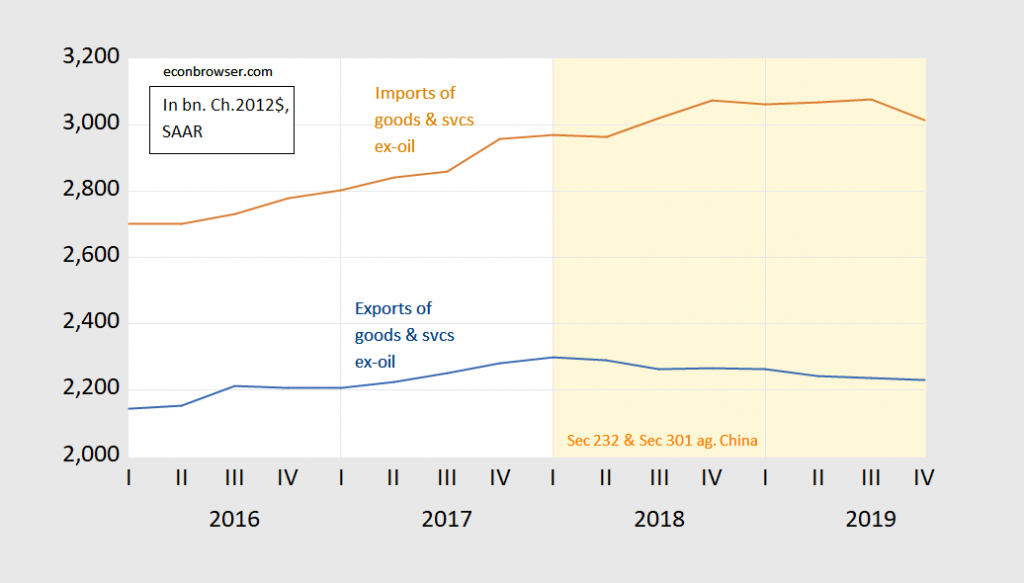

What about the US trade balance overall? As any decent macroeconomist knows, the trade balance is not a particularly useful measure of economic performance in the absence of context, but Mr. Trump has made it a key metric. So, here are US exports, imports, in real terms.

Figure 1: Exports of goods and services ex-oil (blue), imports of goods and services ex oil (brown), both SAAR, bn.Ch.2012$. Orange shading denotes the trade war, dated from Trump’s White House statement of intent on Section 232. Sums approximated by simple addition/subtraction. Source: BEA, 2020Q3 2nd release, author’s calculations.

I exclude oil to the extent that trade policy doesn’t really impact here, but the results do not change substantively even if oil is included. Even before Covid-19 struck, US real imports were up, and US real exports were down relative to 2018Q1, when I date the trade war starting. (Including oil means that exports were static, up about 1 (one) billion Ch.2012$ (non-annualized).

For those interested, imports were higher in 2019Q4 than when Mr. Trump took office. Exports were a bit higher (23 bn. Ch.12$). Net exports in total were down $6.2 billion.

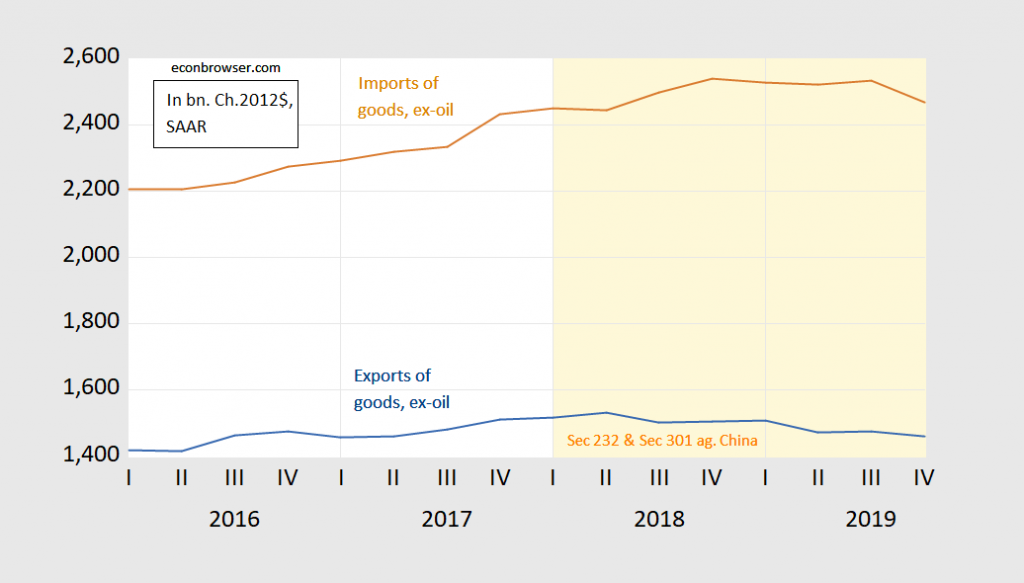

Mr. Trump has often dismissed services imports and exports as irrelevant (in this sense, Mr. Trump is remarkably “Marxian” in the old sense of the word). So, let’s take a look at the ex-services flows.

Figure 1: Exports of goods ex-oil (blue), imports of goods ex oil (brown), both SAAR, bn.Ch.2012$. Orange shading denotes the trade war, dated from Trump’s White House statement of intent on Section 232. Sums approximated by simple addition/subtraction. Source: BEA, 2020Q3 2nd release, author’s calculations.

Exports of goods were down, while imports of goods up slightly.

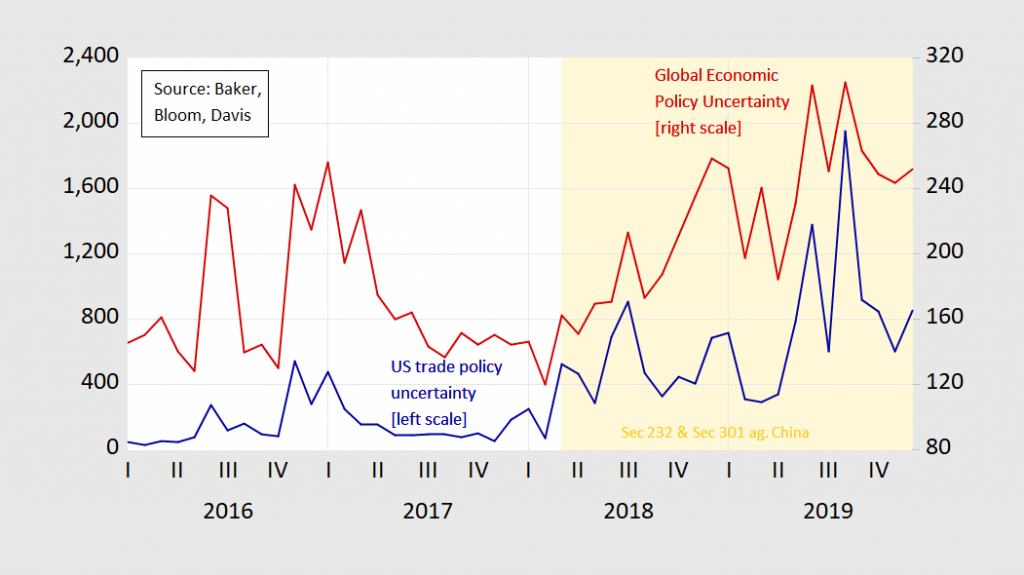

Why was Trump’s trade war unsuccessful, even on terms he set? Any decent macroeconomist will tell you, but I’ll just quote Blanchard (Macroeconomics, 8th edition): (1) “To the extent that it triggered a tariff war, and other countries responded by raising tariffs on US goods, US exports might decrease in line with the decrease in US imports..) (2) To the extent that the US economy was close to potential, as was indeed the case in 2018, an increase in output might lead to overheating and thus force the Fed to increase the interest rate. This in turn would lead to a dollar appreciation… (3) Even if the Fed did not increase the interest rate, expectations of a lower trade deficit and thus smaller need for foreign borrowing, now and in the future, may lead to an appreciation of the dollar… (4) Finally, while it was increasing tariffs, the Trump administration also implemented a tax reform passed in 2017, which led to a large increase in the fiscal deficit in 2018…” (page 408).

I’ve mentioned each one of these (save 3) in previous posts. To these, let me add that the slapdash and unprecedented nature of the trade policy approach led to really high levels of economic policy uncertainty — both at home, particularly with respect to trade policy, and abroad — that further appreciated the US dollar, crowding out net exports further.

As of November 2019, Blanchard indicated that it was “too early to make strong conclusions” about the trade war’s outcome. I think with an additional year’s data, we can conclude that — on Mr. Trump’s own terms — Trump was a loser.

Postscript: Before I forget, the war was a loser on employment, consumer costs, etc. too…

Manufacturing Employment, Hours and Output and the Trade War, Pre-Covid-19

Guest Contribution: “The Trade War Has Cost 175,000 Manufacturing Jobs and Counting”

The US-China Trade War/Soybean Front: Home before the (Next Batch of) Leaves Fall

Chinny,

you do not understand you are suinf fake numbers. It was a great win or is that Grate win.

Stupid is as stupid does

Some impressive information. In case you have not seen this but Paul Krugman has some interesting notes on why Trump’s trade war failed:

https://www.gc.cuny.edu/CUNY_GC/media/CUNY-Graduate-Center/PDF/Programs/Economics/Other%20docs/tradewarfail.pdf

China approved Trade War. Setting the stage of independence from the US and going their own way. Everything the Administration does is related to Trumpco debt owners.

The Rage,

You are notorious for making a lot of dumb remarks, but this is really up there. What on earth do you mean by “China approved trade war”? It only takes one side to start a war, and that was Trump. Do you mean that they responded to his attack? If they had done nothing or just gone along with his demands would that have constituted “China disapproves trade war”? Gag.

Israel attacked Iran. I guess they think Iran cannot respond. Yea right!

China wants reserve currency status. It’s coming.

The Rage: Maybe. See http://www.ssc.wisc.edu/~mchinn/chinn_rescurr_OER2015.pdf

Menzie, any idea when the Politburo Standing Committee and Yi Gang will be making a group field trip to the Vatican to confess their sin of wanting reserve currency status for Renminbi??

All goofball jokes brushed aside, I believe this will take longer than even some American “experts” may think. Allowing the easy flow of capital in and out of China means the Chinese Communist Party will have to forfeit some power. In case some people haven’t noticed, the Chinese Communist Party isn’t real enthusiastic about abrogating power.

Moses Herzog: I think most American experts think it’ll take a really long time for the RMB to achieve major reserve currency status, although its use in invoicing, FX trading might increase faster. Eichengreen is a believer that it won’t be long for it to achieve regional reserve currency status (and this is also separate from the question of what currency East Asian currencies might peg or quasi-peg to).

You must think we took out the Taliban before 9/11/2001. Like I have said – stop writing this insultingly stupid $hit.

As of November 2019, Blanchard indicated that it was “too early to make strong conclusions” about the trade war’s outcome.

But now it’s November 2020, and to put the matter a little more poetically, “The owl of Minerva spreads its wings only at dusk.” It’s dusk and now we know.

Did Blanchard skip the lecture on effective rate of protection? Read that Krugman piece to see why this concept matters. Of course our host had a post on the effective rate of protection and this trade war early on.

pgl: Blanchard is a macroeconomist, and — although I’m sure he recognizes ERP — I think he believes macro factors are first order.

Olivier Blanchard does not know what is he talking about. he was dead wrong on the Greek austerity while he was working at the IMF He only comes up give validation to his paymasters.

@ oee

There is a lot of truth in what you said. The IMF failed in Greece, and they should be called out on it. Of course people in this stratosphere don’t like to be told they’ve failed, and they respond accordingly.

https://www.bruegel.org/2015/07/professor-blanchard-writes-a-greek-tragedy/

Blanchard may be a good economist, and a well-intentioned man. That doesn’t absolve him from admitting he F’ed-up when he F’ed-up.

Punch, David Ricardo, Punch

http://ia800207.us.archive.org/11/items/short_story_027_0804_librivox/shortstory027_punchbrotherpunch_twain_pc.mp3