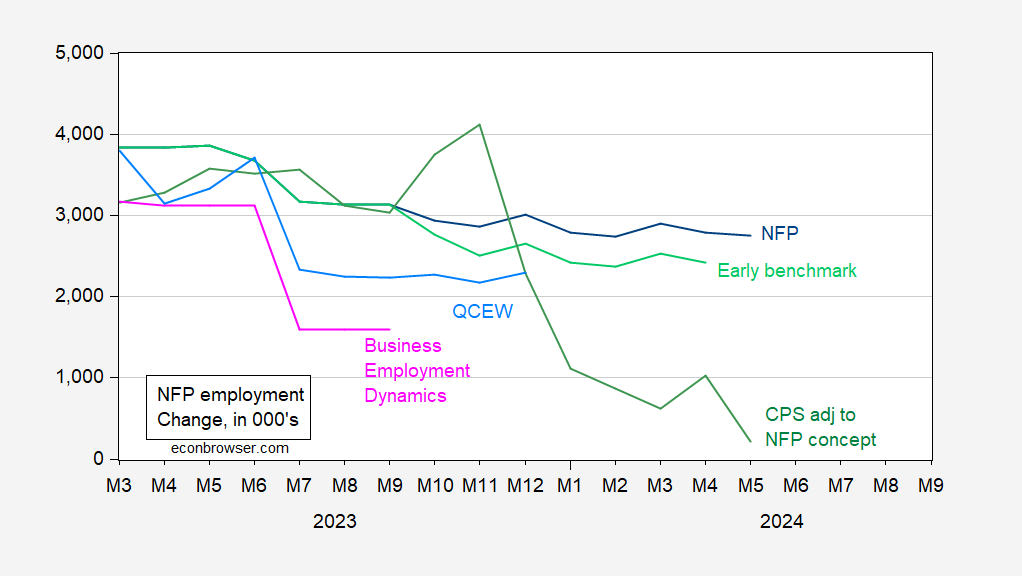

With the release of the Philadelphia Fed early benchmark, we have the following 12 month changes in employment (000’s) from different sources:

From April 2023 to April 2024, according to the Philadelphia Fed early benchmark nonfarm payroll employment grew only 2.4 mn rather than 2.8 mn as reported by CES.

Figure 1: Nonfarm payroll employment from CES (blue), QCEW adjusted by geometric moving average by author (light blue), Business Employment Dynamics (pink), and Philadelphia Fed early benchmark (light green), all in logs, 2023M05=0. Philadelphia Fed series is official CES adjusted by ratio of early benchmark sum of states to CES sum of states ratio. Source: BLS via FRED, BLS, QCEW/BLS, BED/BLS, Philadelphia Fed and author’s calculations.

Hence that the Philadelphia Fed measure implies a reduction in NFP employment growth relative to official by about 400,000. Does it change our view of the trajectory of the employment measures? Figure 2 shows in logs the series relative to May 2023.

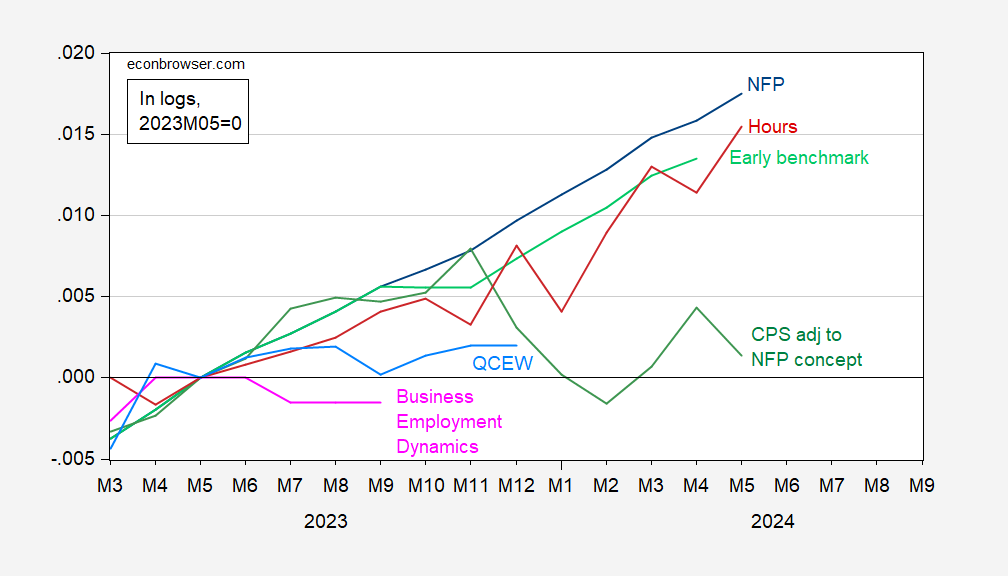

Figure 2: Nonfarm payroll employment from CES (blue), CES hours (red), QCEW adjusted by geometric moving average by author (light blue), Business Employment Dynamics (pink), and Philadelphia Fed early benchmark (light green), all in logs, 2023M05=0. Philadelphia Fed series is official CES adjusted by ratio of early benchmark sum of states to CES sum of states ratio. Source: BLS via FRED, BLS, QCEW/BLS, BED/BLS, Philadelphia Fed and author’s calculations.

Hence, utilizing the Philadelphia Fed measure which incorporates QCEW information, instead of rising 1.58% by April 2024 vs May 2023, NFP has risen by 1.35%

By the way, the CPS series adjusted to match the CES NFP concept should be viewed with particular wariness, given that it is based on the civilian employment series which incorporates new population controls.

So it’s likely that the actual trajectory of employment is depressed relative to official, not sufficiently to call a recession, but perhaps to strengthen the case for loosening monetary policy.

https://www.msn.com/en-us/money/markets/trump-tax-cuts-juiced-economic-growth-steve-moore/vi-BB1ndq2R?ocid=msedgdhp&pc=U531&cvid=732fe91fbf0148d6a82616a2cbcd8cb4&ei=7

Laffer and Moore on Faux Business again. Laffer mentioned going to Vegas and drinking a lot. Based on the gibberish he spewed, Laffer was very drunk. Moore kissed up to Laffer mentioning his worthless curve.

Faux News played along by noting the increase in NOMINAL tax revenues over a 5-year period. I guess Faux News realizes their audience are all utter morons!

Follow-up on that Laffer-Moore clown show on Faux Business:

Federal government current tax receipts

https://fred.stlouisfed.org/series/W006RC1Q027SBEA

It does seem nominal Federal revenues were 47% higher as of 2024QI as compared to 2017QIV but notice almost all of this nominal increase happened under Biden with Federal nominal revenues flat under Trump.

So of course anyone with half a brain would want to express this series in real terms. Feel free to do so as it would show how real revenues FELL during the three years after the Trump tax cut. Of course if you think the viewers of Faux News are smart enough to expect an honest discussion – you are sadly mistaken.

Wow. I never knew Geddy Lee was jewish. Surprised but un-surprised. God shares the best ones with us. Just mostly the cream of the crop.

Here’s my best take on the sharp divergence between the Household Survey’s near-recessionary growth in the employment rate, and the Establishment Survey’s still strong employment growth (even accepting that nonfarm payrolls are likely to get revised substantially downward for H2 of 2023 based on the QCEW).

On average in the decade before the pandemic, the US saw something like 0.5% annual population growth. Call it 1.7 million to be generous. But after slumping during the pandemic, beginning in 2022 and additional 2 million immigrants entered the U.S. over their pre-pandemic average.

This has added something like an additional 3+ million prime employment age adults to the population over and above the usual previous level beginning in 2022.

And, parting from orthodoxy to state that the “‘lump of labor’ fallacy” is itself a fallacy over the short term (say, in the 12 to 36 months range): the US economy simply could not handle that big an influx once the initial white hot recovery of 2021-22 began to cool off. This has increased the number of unemployed, and the unemployment rate, even as the economy has continued to grow.

Since these unemployed new arrivals did not previously hold jobs, it also explains why the unemployment rate rose even as initial jobless claims declined and continuing claims remained stable.

It is also supported by the fact that the unemployment rate for Hispanics fell especially fast in 2021, but has risen almost as fast as the Black unemployment rate beginning in 2023.

That’s my best guess anyway.

5-star comment (note, I grade hard now)

JOE BIDEN IS THE GREATEST OIL TRADER EVER by Daniel Dicker

https://dandicker.com/we_newsletters/joe-biden-is-the-greatest-oil-trader-ever/

How did we miss this article from October 2022? Fun reading unless you are a MAGA moron such as Bruce Hall!

Agree, great reading (have I mentioned I’m a HUGE fan of political cartoons??) Thanks for the share. Outstanding.

A follow up on those high crack spreads (OK refinery margins) in 2022. Here’s a handy source:

https://www.eia.gov/petroleum/gasdiesel/gaspump_hist.php

Note in June 2022 gasoline prices were reported as $4.93 per gallon. The refinery margin jumped to 27.3% which translates into a refinery margin = $1.35 per gallon. Normally this margin is only $0.35 per gallon. So we were paying an extra $1 per gallon for just the refinery.

Biden noted this problem and he got a lot of stupid flack from MAGA morons like Bruce Hall for doing so. Yea these morons were doing their usual drill baby drill which is not a cure for obscene refinery margins. Like I said earlier – these morons are all on crack.

pgl, you are absolutely correct about the 2022 spike in refinery margin… something that has never happened before. We need to shut down those refineries.

https://fingfx.thomsonreuters.com/gfx/ce/gkplgkynlvb/US%20REFINING%20MARGINS.pdf

However, one reason for higher 2021 (yes I know that’s 2021) margins was the rising cost of compliance with the US Environmental Protection Agency’s Renewable Fuel Standard included as a component in the margin as calculated by Platts Analytics.

The price of RINs, Renewable Identification Numbers credits used by obligated parties to meet their Renewable Volume Obligations under the RFS, reached record highs in 2021, due in part market uncertainty resulting from the delayed mandated volume release by the EPA to adjust volumes lower to account for the coronavirus impact on demand in 2020 and 2021.

RINs accounted for $4.80/b of WTI MEH cracking margin in 2021, compared with $1.75/b and 85 cents/b in 2020 and 2019, respectively, which meant 2021 USGC WTI MEH USGC RIN-less margins averaged $8.36/b, below the 2019 average of $9.63/b.

And RFS compliance is expected to get more expensive in 2022.

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/010322-refinery-margin-tracker-us-margins-end-2021-on-high-note-as-omicron-variant-looms

Damn greedy refineries.

The gross margin from turning 3 barrels of crude into 2 barrels of gasoline and 1 barrel of diesel, known as the 3-2-1 crack spread, has averaged $24 per barrel so far in June down from $31 in March.

The inflation-adjusted 3-2-1 crack spread is now exactly in line with the average for the 10 years before the pandemic, indicating the fuel market is comfortably supplied.

https://www.reuters.com/markets/commodities/us-refining-margins-slump-fuel-stocks-climb-2024-06-13/

I don’t see why those greedy refineries don’t jack up prices now to keep margins high. Very strange.

“We need to shut down those refineries.”

Second sentence in your MAGA rant and you are already misrepresenting what others have said. Come on Brucie – we have been over this before. BTW – if you looked at your links (something you fail to do often) you might have noticed that this spike is a lot higher than the previous ones.

Which means I will have to clear your stupidity out of my brain before I can tolerate the rest of your usual trash. ,

pgl doth protest too much, methinks.

First of all, there is no indication that the $ margins shown historically have been adjusted for inflation. Perhaps the data was; perhaps not.

Secondly, it was expected that after global supply issues were resolved, refinery margins would gradually return to “normal” (those greedy refiners couldn’t help it).

Thirdly, glad you recognize that supply and demand imbalance can affect pricing, not just dirty refiners greed.

Fourthly, you cite and article that is from 2/23 by whine if I cite something older than a few months old (goose/gander)

Fifthly, old uncle Joe “made” $4 billion from the sale of SPR oil (if you disregard the fact that he has depleted the SPR levels from 640 to 370 million barrels so maybe it’s a lot less “strategic”).

But I’m glad I still live in your head.

Besides, your comment which started this exchange (Biden greatest oil trader :-)…) had anything to do with Menzie’s post.

“First of all, there is no indication that the $ margins shown historically have been adjusted for inflation. Perhaps the data was; perhaps not.”

WTF? I made no claim about nominal v. real but you seem to think I get. BTW – a margin is a percentage so your attempt at a faux distinction does not come to play here.

Come on Brucie – we get you are an utter moron but DAMN!

“Fifthly, old uncle Joe “made” $4 billion from the sale of SPR oil”

Yea – old Joe is a wise fox unlike your fearless hero who could not even remember his own doctor’s name. But hey – he avoided being electracuted by that shark!

I guess Bruce Hall had to display his ignorance again when I said a few things about the high crack spreads in June 2022 given his recent chirping about data Brucie never understood. After he spewed a bunch of incoherent tidbits that I took down, Brucie replied in an even more incoherent was which including some strange notion the refinery margins needed to be “inflation adjusted”. Yea Brucie who presents nominal data over long periods of time finally decides to lecture us on inflation adjusting data. Progress but wait – a gross margin does not need inflation adjusting even as a crack spread would.

Since Brucie has trouble even tying his own shoe laces, let me give a simple example that even a two year old would understand. Let’s say that oil prices were $64 dollars a barrel 10 years ago but are $80 a barrel now. Since the general price levels is 125% of what it was 10 years ago, we have the same real price for oil. Let’s also assume that refinery prices were $80 for each barrel of oil converted to gasoline or diesel products but are now $100 now. A 25% nominal increase in that nominal price as well so in inflation adjusted terms, no real change.

OK a few definitions. The crack spread is the difference in terms of dollars/barrel, which would be $16 per barrel in 2014 but $20 per barrel now. Inflation adjusted these are the same thing. But a margin is the dollar spread divided by the dollar prices charged to distributors of these products. The margin in 2014 would be 20% back then and 20% now. But little Brucie wants to inflation adjust these margins as little Brucie has no clue what any of this even means.

JOHN KEMP

REUTERS

10 May 2022

Over a year old Brucie – come on dude. I trust you know margins have fallen over the past two years. Which makes this statement look stupid:

However, one reason for higher 2021 margins was the rising cost of compliance with the US Environmental Protection Agency’s Renewable Fuel Standard included as a component in the margin as calculated by Platts Analytics.

Why did they say “however”. Oh yea – the main reason they listed first was the rise in the demand for gasoline. Damn Brucie – you can’t bother to properly cite your own link again? Amazing!

BTW – you failed to tell us how much of the rise in the margin was from the EPA’s Renewable Fuel Standard. I bet it is not much and we know you are too stupid to ask the good folks at Platts.

Yea once again little Brucie boy emerges from his little sandbox to rant and rave in an adult conversation only to prove little Brucie boy is about as incompetent as it gets.

Folks – I was not going to comment any more on these refinery crack spreads but the way Bruce Hall misrepresented some 2 year old story that Brucie never understood had me looking for something that is actually economics and not MAGA stupidity:

2 Oil Refiners Posting Record Margins: Can the Trend Continue?

https://www.nasdaq.com/articles/2-oil-refiners-posting-record-margins:-can-the-trend-continue

Oil refining stocks posted record-high profits in 2022, thanks to the wide margin between the cost of crude oil and refined products. Despite a decline in crude oil prices since the summer of 2022, refiners are bullish on their 2023 profitability. Oil refiners convert crude oil into valuable products like gasoline, diesel, and jet fuel, which they then sell to gas stations, airports, and other distributors. Refiners profit from the spread between the cost of crude oil and the market price of refined products, commonly known as the “crack spread,” named after the “cracking” process refiners use to break down crude oil. These spreads give investors a rough idea of refining profitability. When spreads are high, refiners make big profits. When spreads are low, refiners struggle to break even, making these spreads a critical component to analyzing the oil refiner sector. Today, the benchmark crack spread is $35, far above the historical average of $10.50. Based on today’s prices, a refiner makes $35 in gross margins per barrel of refined crude oil.

Now I get operating profits must deduct operating expenses from gross profits but there is no evidence that EPA has raised those operating expenses even if Brucie boy wants us to believe that. BTW these gross margins have declined in the last year which sort of devastates Brucie’s attempt to blame Biden. But hey – his MAGA hat still fits.

“RINs accounted for $4.80/b of WTI MEH cracking margin in 2021, compared with $1.75/b and 85 cents/b in 2020 and 2019”

Wait, wait. The cracking margin rose from around $14/barrel in 2019 to almost $54/barrel. And Brucie boy is so PROUD of his MAGA creds that he found a factor that accounts for only 10% of this increase?

Atta boy Brucie – now here’s your bone.

OCTOBER 24, 2023

Market prices for Renewable Fuel Standard credits are falling

https://www.eia.gov/todayinenergy/detail.php?id=60742#:~:text=As%20of%20October%2016%2C%20biomass-based%20diesel%20RINs%20%28D4,than%2040%20cents%20lower%20than%20on%20September%201.

The prices of ethanol (D6) and biomass-based diesel (D4) renewable identification number (RIN) credits—the compliance mechanism used for the Renewable Fuel Standard (RFS) program administered by the U.S. Environmental Protection Agency (EPA)—each fell by more than one third between September 1 and October 16, our data shows. As of October 16, biomass-based diesel RINs (D4 RINs) were $0.90, and ethanol RINs (D6 RINs) were $0.89; both prices were more than 40 cents lower than on September 1. D4 RIN prices have not been this low since 2020, when EPA granted several small refinery exemptions that reduced fuel blending requirements and RIN prices.

Gee Brucie – I did something you NEVER do. A little research with people who know WTF they are talking about. If the adults here want to know what your original comment addressed, the DOE is a good source. Bruce Hall – never a good source for an honest and intelligent discussion. Now I guess this little discovery of yours (which you have no clue what it really is) had seen prices for it falling. And my guess was correct.

So Brucie boy – what the eff was your point again? That you are a liar? We knew that already.

Off topic – file under “known unknowns:

https://thehill.com/policy/healthcare/4723753-former-cdc-director-predicts-bird-flu-pandemic/

Bird flu pandemic; just a question of “when”.

I’m cynical about this (in the sense of what Redfield is saying) because Redfield decided to make these comments on “NewsNation” which is a garbage source for news. But……… I do think there’s a very high chance we have another bird flew pandemic, say, before 2040, just based on semi-recent time patterns of viruses/pandemics.

I want to add this, it might “behoove” concerned parties, i.e. government, major corporations, Bill Gates “types” who pretend they predicted Covid, that if you are “predicting” another Covid/and or/pandemic, then YOU might prepare surgical masks and N–95 masks for said pandemic,

Just an idea/suggestion from the cheap seats here.

I just watched an interview with Dr. Fauci. Did you know that he turned down offers from Big Pharma for $5 million a year even though his job at the NIH paid only $125 thousand a year? A true American hero.

@ pgl

Interesting. It very obviously implies conditions attached to the higher salary. Any guesses on what they wanted Fauci to say?? All the while Rand Paul treats him like the men who killed Christ.

Indeed, there are people, even Americans, who see other goals in life than just making more money for themselves. He is indeed an exemplary man and it is disgusting to hear the right wing nutcases attack him.

READ as~~~suitable supplies for the MASSES/ USA population.

I am a bit less concerned because it is not enough that the virus binds to the human receptors, it has to overcome a lot of innate immunity obstacles to become a highly productive infection and also be able to spreed effectively from humans to humans. Then there is the issue of morbidity and mortality. Most viruses don’t want to kill the host or even make them very sick – its bad for spreading. So the evolutionary pressure is for mild infections. The reason SARS-CoV-2 was so bad, is that it developed in bats where the things that pushes virus evolution to become transmissible in bats, are the same things that makes them hard for humans to handle.

We could get a “bird flue” as bad as the regular new flue strains (usually coming out of China from bird and human flue strains recombining). However, there is no reason to think it would be as bad as SARS-CoV-2.

I’m still laughing at that Laffer-Moore claim on Faux Business that Federal revenues have surged in the 6 years past the 2017 Trump tax cut for rich. These lying scum are talking about nominal revenues.

Over this 6 year period, real GDP growth totaled only 14%. Not exactly a supply side miracle. But it gets better. In the Trump portion of this period, real GDP ended up only 4.2% higher. Over the next 3 years (Biden period), the increase was 9.4%.

But no one at Faux News will admit this is they all lie 24/7 for that incompetent 45th President of our nation.

I am laffing all the time kndeed Moore often!

Very respectfully, if more was spreading this bullsh*t in your country, it wouldn’t be so humorous to you.

The Aussies are smart enough to know Moore is full of BS. A corporate tax rate = 30% with strong enforcement of transfer pricing from their tax authorities. Plus a tax on the economic rent of energy and mining companies. We should learn from them.

Don’t be complimenting the Aussies. Even if it’s true. I got enough problems keeping this Not Trampis guy from misbehaving.

*Moore

I just saw Lisa Desjardins’ interview Geddy Lee on PBS, and if you’re a “fanboy” of Lisa DesJardins and a “fanboy” of Rush/GeddyLee you will OD on watching two people you are a fanboy of, interacting with each other. So incredibly awesome.

PBS NewsHour “Rush frontman Geddy Lee reflects on his music and life in a new memoir”

Mark Redding: As the name indicates, QCEW is a *census*, i.e., an administrative count of all establishments covered, not a survey.

Yellen on Trump’s tariffs-taxes idea: It would ‘make life unaffordable’

https://www.msn.com/en-us/news/politics/yellen-on-trump-s-tariffs-taxes-idea-it-would-make-life-unaffordable/ar-BB1ojYaz?ocid=msedgdhp&pc=U531&cvid=4a000242590a44a1a027c7f59fda97fe&ei=4

Treasury Secretary Janet Yellen said former President Donald Trump’s plan to replace federal income taxes with tariffs would “make life unaffordable” on Sunday morning. “It would require tariffs well over 100%,” Yellen said when Jonathan Karl asked about the plan on ABC’s “This Week.” “The impact would be to make life unaffordable for working class Americans and would harm American businesses.”

Yellen is a brilliant economist but she can also talk in very plain English. She has to if her honest messages are to get across to the MAGA morons like Bruce Hall.

Yet another instance of MR dismissing a data series as problematic, without understanding the data series, or its use.

FRED currently lists 702956 data series when asked for “US”. How many will MR tell us he doesn’t like, based on his misunderstanding of the data, the economy, or both? Tune in next time…

I’m sure you think you wrote coherently. You didn’t.

Whatever it is you meant to write, what evidence do you have? The fact that you believe something doesn’t make it true.

These Ukrainian gains and successes could have been scored much earlier if American Republicans didn’t have their head up their ___ for months on end:

https://www.theguardian.com/world/article/2024/jun/16/russian-soldier-says-army-suffering-heavy-losses-in-kharkiv-offensive

Marjorie Taylor Greene Says BRICS Nations Are Moving To ‘Destroy America’s Economy’ By Moving Away From The Greenback

https://www.msn.com/en-us/money/markets/marjorie-taylor-greene-says-brics-nations-are-moving-to-destroy-america-s-economy-by-moving-away-from-the-greenback-but-is-the-petro-dollar-really-dead/ar-BB1olCw3?ocid=msedgdhp&pc=U531&cvid=8a9c91199a184d98ba8cca06886298dc&ei=8

Marjorie Taylor Greene has raised alarms about the potential economic consequences for America as she claimed BRICS nations plan to move away from the U.S. dollar. On Wednesday, Greene tweeted that this shift could “destroy America’s economy.” What Happened: The BRICS group, consisting of Brazil, Russia, India, China, and South Africa, is reportedly considering alternatives to the U.S. dollar in their transactions. Greene’s tweet reflects concerns over the impact such a move could have on the U.S. economy. Rep. Greene’s comments were made on Sunday on Trump-ally Steve Bannon’s podcast “War Room.” She said, “They are going to start using their own currencies or they may come up with an agreed upon currency — not the dollar that they will trade with.”

Marjorie Taylor Greene doing monetary economics on the Steve Bannon show! Yea – she’s an idiot but I bet Trump will say she should be the next Federal Reserve chairman!

She is so ignorant she doesn’t even know what she doesn’t know. Just blabbering out smart sounding words. But that’s not hurting her because the people electing her also have no clue.