Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its June 2024 meeting and, in the Summary of Economic Projections (SEP), projected one ¼ percent rate cut with a range for the FFR between 5.0 and 5.25 percent by the end of 2024. Futures markets summarized by the CME FedWatch Tool after the meeting predicted two rate cuts with a range for the FFR between 4.75 – 5.0 percent by the end of 2024. Comparing prescriptions of inertial policy rules where the FOMC smooths rate increases when inflation rises to projections from the SEP, the FOMC went from “on track” in March to “higher for longer” in June.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. In this post, we analyze four policy rules that are relevant for the future path of the FFR, update the policy rule prescriptions through the June 2024 SEP, and include futures market predictions.

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

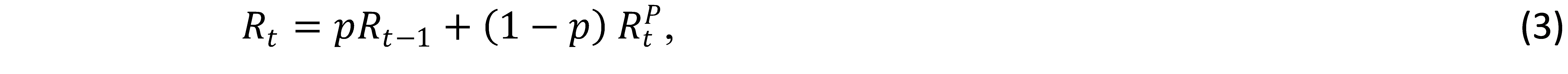

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to June 2024 and the projected FFR for September 2024 to December 2026 from the June 2024 SEP. Figure 1 also depicts policy rule prescriptions. Between September 2020 and June 2024, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between September 2024 and December 2026, we use inflation and unemployment projections from the June 2024 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are much higher than the FFR in 2022 and 2023 and are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. In contrast, the policy rule prescriptions for 2024 through 2026 from the June 2024 SEP are consistently lower than the FFR projections. The inertial rules in Panel B prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022.

Looking forward, the policy rule prescriptions from the June 2024 SEP are below the FFR projections through September 2025 and are close to the FFR projections through December 2026. While the current and projected FFR is generally in accord with prescriptions from inertial policy rules, the gaps are larger for 2024 than in the March SEP because the FOMC projected three ¼ percent rate cuts in March and one ¼ percent rate cut in June. The results for the March 2024 SEP in this and the following two paragraphs are shown in our Econbrowser post.

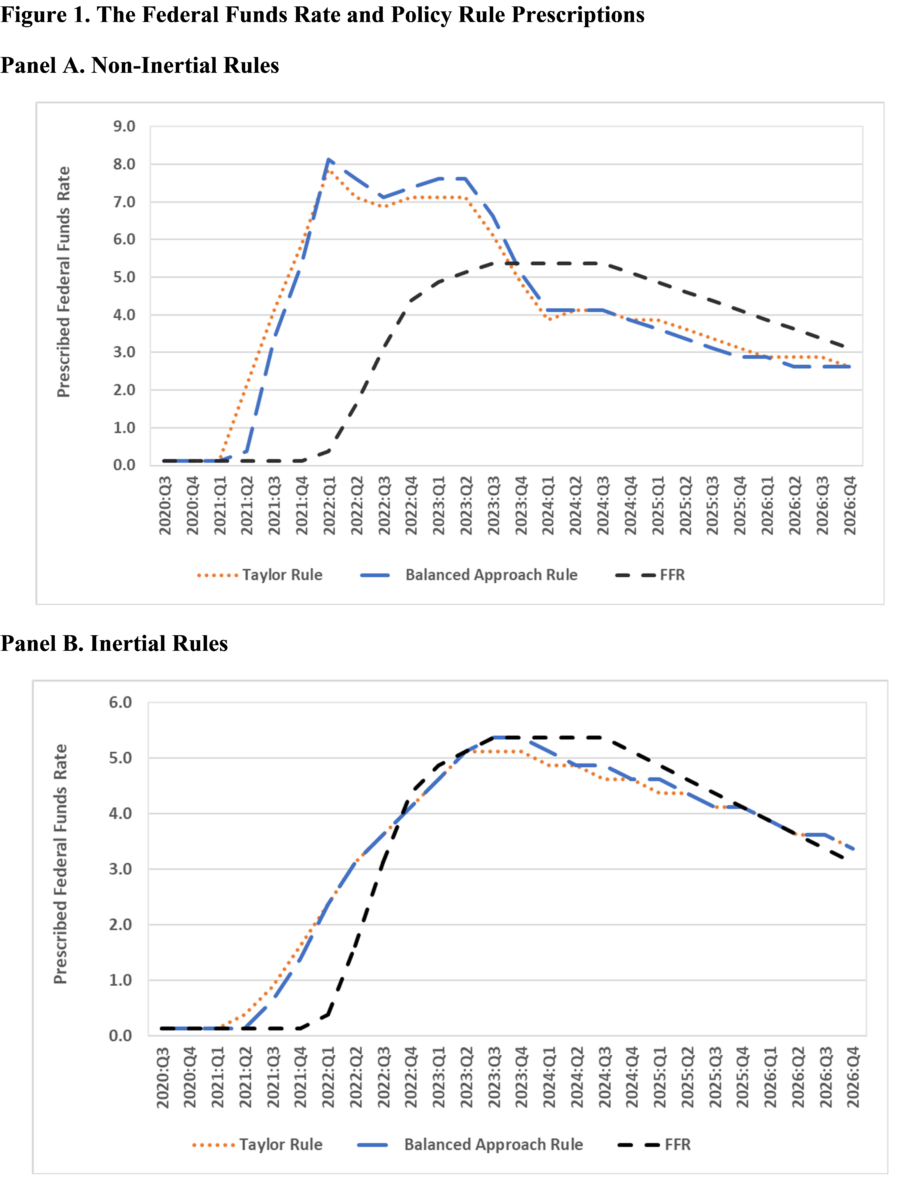

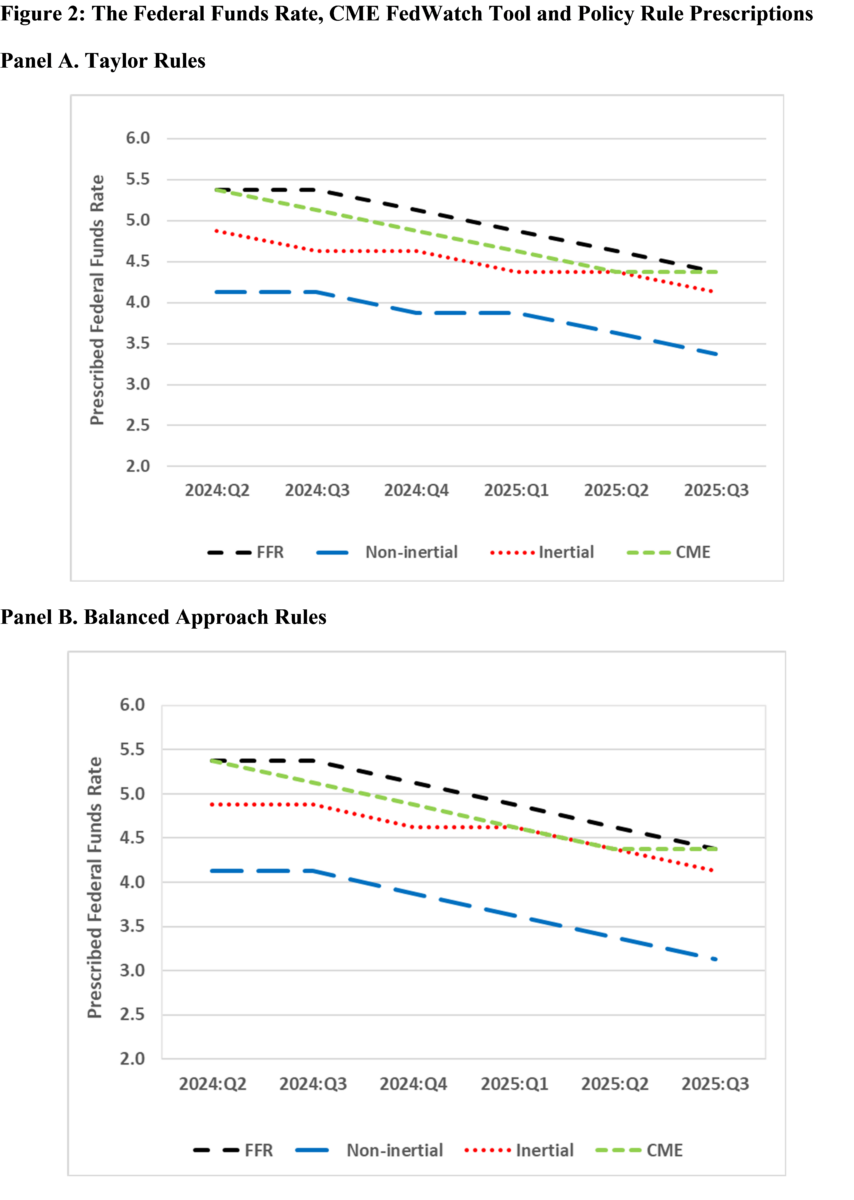

Figure 2 depicts the median predictions from futures markets described in the CME FedWatch Tool following the June 2024 FOMC Meeting through the end of the CME prediction horizon in September 2025. The futures market predictions are ¼ percent below the FOMC projections before converging at the end because futures markets predict two rate cuts while the FOMC projects one rate cut in 2014. The pattern of lower futures market predictions than FOMC projections is consistent with December 2023 but not with March 2024, where the predictions and projections were identical.

We add to this discussion by including prescriptions from policy rules. Figure 2 shows that, for both the Taylor and balanced approach rules, the prescriptions from the inertial policy rules for June 2024 through December 2025 are generally below both the CME predictions and the FOMC projections but are closer to the CME predictions than the FOMC projections. In addition, the gap between the inertial policy rule prescriptions and the CME predictions widens between March and June of 2024. The prescriptions from both non-inertial policy rules are considerably below the FOMC projections and CME predictions for the same period. Comparison between futures market predictions and policy rule prescriptions depends more on the choice between inertial and non-inertial rules than on the choice between Taylor and balanced approach rules.

This post written by David Papell and Ruxandra Prodan-Boul.

Off topic but revealing in this Make America White Again mania. I just saw a bunch of MAGA types at some Detroit Trump rally goes wild over a flag that read White Boy Summer:

https://www.adl.org/resources/blog/white-boy-summer-meme-mobilization

In March 2021, Chet Hanks, son of actor Tom Hanks, published a series of social media posts critiquing white men’s attire and behavior, culminating a month later with the release of his song, “White Boy Summer.” A play on Megan Thee Stallion’s 2019 hit song, “Hot Girl Summer,” “White Boy Summer” has taken the internet and meme culture by storm. And while “White Boy Summer” was not initially intended to be hateful, white supremacists have adopted the slogan and leveraged it for their own purposes.

This is not the first time white supremacists have co-opted an innocuous slogan by layering on exclusionary messaging and using it as a call for action. The phrase “White Boy Summer” or WBS, now in evidence on Telegram, Discord, 4Chan, Gab, Parler, and Twitter, shows extremists using a popular cultural trend to infiltrate mainstream conversations and disguise their racist beliefs as irony or jest. It should be noted that non-extremists also continue to use the phrase, but in largely non-hateful contexts.

“White Boy Summer” (WBS) has shown up in extremist channels and rhetoric in three distinct ways: general “shitposting,” racist and misogynistic tropes and explicitly white supremacist propaganda. Many memes on extremist channels have strategically adopted aesthetically pleasing imagery to disguise or distract from their real messages; layers of these seemingly playful images of summer fun can be peeled away to expose messages of hatred and calls to action.

Market participants are splitting the difference between Taylor rule results and the SEP median forecast. Seems a reasonable thing to do.

A good bit of the breezy, “common folk” press coverage of the Fed notes the difference between market pricing and the SEP, but leaves out the Taylor rule, though there is mention that policy is tight.

I do have questions for the authors about this:

“…the ½ percent neutral real interest rate from the current SEP.”

The latest SEP has a long-run nominal funds rate median estimate of 2.8%, up from 2.6% in March, with the long-run inflation estimate still at 2.0%. The March SEP rounds down to a 1/2 percent r*; the June SEP doesn’t. What was the neutral real rate you used, in decimals? How much difference does the increased r* estimate make in your results, if any?

By the way, Powell was asked about r* in the post-meeting press conference. He got a little snippy and didn’t answer.

Powell Has Already Hinted at Where He Stands on ‘Neutral’

by Jonathan Levin of Bloomberg News, 8/24/23

https://www.advisorperspectives.com/articles/2023/08/24/powell-already-hinted-where-stands-on-neutral#:~:text=It%E2%80%99s%20the%20inflation-adjusted%20rate%20that%20should%20prevail%20when,to%20stimulate%20the%20economy%20and%20foment%20job%20creation.

Not sure if there has been anything since this August 24 discussion where Powell hinted where he stood with hint being the operative term.

The reality is the Fed/ or Fed Chair does whatever the hell they want. In a pragmatic sense in terms of what works and in a pragmatic sense in terms of politics. Bureaucratic job security talks, bullshit [equation] walks.

More policy from the Trump team – no Marines anywhere but Asia:

https://www.foreignaffairs.com/united-states/return-peace-strength-trump-obrien

O’Brien’s only experience in national security is in Trump’s administration. Otherwise, he’s just a corporate lawyer. So we should listen to him, right?

Much of O’Brien’s text is MAGA emotional claptrap – Trump is strong, everyone else is wrong. On substance, well, judge for yourselves.

This guy is a lying idiot:

Just in the final 16 months of his administration, the United States facilitated the Abraham Accords, bringing peace to Israel and three of its neighbors in the Middle East plus Sudan; Serbia and Kosovo agreed to U.S.-brokered economic normalization; Washington successfully pushed Egypt and key Gulf states to settle their rift with Qatar and end their blockade of the emirate; and the United States entered into an agreement with the Taliban that prevented any American combat deaths in Afghanistan for nearly the entire final year of the Trump administration.

The Afghan sell out was beyond belief but hey the disaster was delayed until they could blame it on Biden. Ask the Palestinians about those Abraham Accords. And of course no one in Ukraine would buy this trash about keeping Putin at bay. As stupid as the trash from Stevie Koptis can be – it’s not as bad as this intellectual garbage.

O’Brien represented S&P in this?

https://www.justice.gov/opa/pr/justice-department-and-state-partners-secure-1375-billion-settlement-sp-defrauding-investors#:~:text=Attorney%20General%20Eric%20Holder%20announced%20today%20that%20the,Mortgage-Backed%20Securities%20%28RMBS%29%20and%20Collateralized%20Debt%20Obligations%20%28CDOs%29.

Justice Department and State Partners Secure $1.375 Billion Settlement with S&P for Defrauding Investors in the Lead Up to the Financial Crisis

Attorney General Eric Holder announced today that the Department of Justice and 19 states and the District of Columbia have entered into a $1.375 billion settlement agreement with the rating agency Standard & Poor’s Financial Services LLC, along with its parent corporation McGraw Hill Financial Inc., to resolve allegations that S&P had engaged in a scheme to defraud investors in structured financial products known as Residential Mortgage-Backed Securities (RMBS) and Collateralized Debt Obligations (CDOs). The agreement resolves the department’s 2013 lawsuit against S&P, along with the suits of 19 states and the District of Columbia. Each of the lawsuits allege that investors incurred substantial losses on RMBS and CDOs for which S&P issued inflated ratings that misrepresented the securities’ true credit risks. Other allegations assert that S&P falsely represented that its ratings were objective, independent and uninfluenced by S&P’s business relationships with the investment banks that issued the securities. The settlement announced today is comprised of several elements. In addition to the payment of $1.375 billion, S&P has acknowledged conduct associated with its ratings of RMBS and CDOs during 2004 to 2007 in an agreed statement of facts. It has further agreed to formally retract an allegation that the United States’ lawsuit was filed in retaliation for the defendant’s decisions with regard to the credit of the United States. Finally, S&P has agreed to comply with the consumer protection statutes of each of the settling states and the District of Columbia, and to respond, in good faith, to requests from any of the states and the District of Columbia for information or material concerning any possible violation of those laws. “On more than one occasion, the company’s leadership ignored senior analysts who warned that the company had given top ratings to financial products that were failing to perform as advertised,” said Attorney General Holder. “As S&P admits under this settlement, company executives complained that the company declined to downgrade underperforming assets because it was worried that doing so would hurt the company’s business. While this strategy may have helped S&P avoid disappointing its clients, it did major harm to the larger economy, contributing to the worst financial crisis since the Great Depression.”

No wonder Trump like this mouth piece for corporate criminals!

So this is what O’Brien put up on LinkedIn regarding his law practice:

‘His practice focuses on complex litigation and domestic and international arbitration. He has expertise in entertainment, intellectual property, oil and gas, contract and business tort matters. Robert has tried numerous cases to verdict in state and federal courts in both jury and bench trials as well as in domestic and international arbitral proceedings. In addition, he has been appointed chair and wing arbitrator in over 25 domestic and international arbitrations. Robert has been a federal court-appointed discovery master in several of the largest recent cases in the Central District of California, including MGA v. Mattel (“Barbie v. Bratz”) and United States v. Standard & Poors. He has been named one of the top 100 lawyers in California by the Daily Journal.’

Now settling any dispute between and Bratz must qualify one to settle all those little disputes between Russia and Ukraine or between Israel and Palestine. Right? At least his picture on LinkedIn is not as ugly as that picture of Steven Koptis!

Is this who donald trump was referring to when he said immigrants who are “rapists and murderers”??

https://www.wsj.com/us-news/law/luxury-real-estate-world-rocked-by-rape-allegations-against-star-broker-db3feb17?mod=hp_lead_pos7

I know he and his brother are “2nd generation”, but I mean the apple doesn’t fall far from the tree and his wife is Brazilian. Why didn’t donald trump protect us from these two criminals?? I feel afraid now. Can I still check my physical mail box 20 feet from my front door safely or drive to McDonalds?? This immigrant thing is really frightening now. Should I take one of those classes where I punch a dummy or blow up doll who is supposed to be a rapist??

Broker Tal Alexander Is Accused of Rape in New Lawsuit

https://www.curbed.com/article/broker-tal-alexander-rape-lawsuit-official.html

Tal Alexander, along with brothers Oren and Alon, has been accused of rape and sexual assault in a new lawsuit filed on Tuesday. The suit, which comes on the heels of two sexual-assault suits filed against twins Oren and Alon Alexander, is the first to name Tal, the oldest of the brothers and a co-founder of Official, the ultra-high-end brokerage that Oren was ousted from last week.

In the lawsuit, filed today in New York State Supreme Court, Alon and Tal Alexander are accused of rape and sexual assault in an incident in the fall of 2012. The assault was “planned and facilitated by Oren Alexander along with his brothers,” the suit claims. The woman who filed the suit claims that Oren invited her and a friend to visit his apartment at 543 Broadway, which he shared with his two brothers. When they arrived, per the suit, Alon and Oren offered them ecstasy, which they declined. The women were then offered drinks, which they accepted. The suit continues that the friend “became extremely uncomfortable and afraid” after Alon allegedly hit on and groped her, and she left the apartment. The suit then claims that after the friend left, the victim “was raped by Alon and Tal Alexander, together, in a coordinated sexual assault that was planned and facilitated by Oren Alexander along with his brothers.” The suit also alleges that “Tal attempted to penetrate Ms. Parker with his fingers, again against her will, and have vaginal sex with her.” The victim then fled.

The woman continued to run in the same social circles as the brothers and says they made defamatory statements about and harassed her, according to the lawsuit. “Years later, Tal barged in on” the woman “while she was alone in the guest room of a house where they were both at and attempted to sexually assault her again.” After she screamed, alerting others, the suit alleges, Tal called her the “‘king’s rat,’ because she got him thrown out of the home that night.”

The lawsuit also says that after the two lawsuits were filed last week, 30 additional women have contacted attorneys to report similar stories of group rape, going as far back as 2004, when the twins were in high school. The three recent lawsuits were filed in civil court just before the expiration of the Adult Survivors Act, an extension on the statue of limitations on civil sexual-assault cases in New York.

Oren and Alon Alexander have denied the rape allegations, with their former lawyer painting the accusations as “a shakedown.” The brothers’ new lawyer, Isabelle Kirshner of Clayman Rosenberg Kirshner & Linder of Manhattan, wrote in a statement that the Oren and Alon deny the allegations, “as they are pure fiction,” and that “we look forward to presenting the facts in court.” A representative for Tal told the Post that “it is unfortunate but fully expected that shakedown artists are going to line up given the allegations against Tal’s brothers.” The New York Times reported that Tal addressed the allegations against his brothers in a letter sent to colleagues on Sunday — before the latest suit naming him was filed: “I find the actions described in these news stories to be reprehensible, and I would never act or behave in such a manner. Any allegations to the contrary are simply untrue,” he said in the email. It also said, “I have little doubt that given my close relationship with my brothers, at some juncture, a lawyer or many lawyers will soon try to lump me in with the allegations against Alon and Oren.”

Official has not responded to the allegations against Tal Alexander, whom it said last week, “would continue to operate the businesses with Tal overseeing all matters pertaining to The Alexander Team,” and he remains listed as an agent and founder on the company’s website. Oren has been removed.

Retail sales up in May, but still looking squishy:

https://fred.stlouisfed.org/graph/?g=1pbZx

By the way, FRED has a CPI-adjusted series, so no math needed.

Stephen Moore failed basic macroeconomics. Dumbest discussions of fiscal policy ever and the most laughable ideas on monetary policy so why not follow in the footsteps of Steve Koptis – the world consultant ever – and prove one is incompetent at energy economics? This garbage is being featured on Faux News and of course the NY Post which is best used as liner for one’s bird cage:

https://www.msn.com/en-us/money/markets/biden-s-energy-idiocy-lost-us-150b-of-oil-and-gas-bringing-pain-at-the-pump/ar-BB1nHn54

Biden’s energy idiocy lost US $150B of oil and gas — bringing pain at the pump

Stephen Moore, June 5, 2024

Our new report from the Committee to Unleash Prosperity, which I co-authored with Casey Mulligan of the University of Chicago, finds that although US oil production has risen in the last two years to about 13 million barrels daily, America would be producing between two and three million more barrels per day if we had simply stuck with President Trump’s pro-oil and gas strategy — and if new ESG nuisance initiatives weren’t interfering with domestic drilling. Energy experts had predicted that US oil producers would be at 16 million barrels of domestic production each day by now, if the Trump administration’s policies had remained in place. The Biden war on American oil and gas has cost American motorists and the overall American economy dearly.

Links to this “report” available in the story. Read it for laughs as it is even dumber than your standard Bruce Hall comment.

My quick review of “The War on Oil and Gas has Cost America $250 Billion in Lost Output” By Stephen Moore and Casey B. Mulligan

“From 2021 through the end of 2023, that is at least a cumulative 2.4 billion barrels missing from oil markets, not to mention the lost natural gas output. Increased costs of oil and gas extraction are reducing cumulative GDP by about $250 billion over that same period.”

This early sentence if the head line grabber but it has tons of problems which we will note.

“According to EIA, in the second half of 2023, U.S. daily oil production averaged 13.2 million barrels, which is close to the peak reached under Trump.”

Fine but how do they get this 2.4 billion in lost barrels. Wait for it!

“But that is NOT the end of the story. The price of oil has been MUCH higher than the price when Trump was president. Adjusted for inflation, the average world price throughout Trump’s presidency was $54 a barrel, and rarely exceeded $65. During Biden’s presidency, the average was $72 through July 2023 and averaged $83 in 2022.”

Well yea – but more oil production would not have lowered this price. Demand/Supply – HELLO! Of course their own figure 2 shows inflation adjusted oil prices have come back down since the spike in 2022. Oh wait – here’s the usual supply-side kicker:

“Deregulation and tax cuts can also reduce extraction costs.”

And I thought it was technological progress – silly me. They babble on with more incoherent claims before turning to natural gas.

“in the summer of 2022 natural gas prices exploded to 10 times their “normal price,” according to the Financial Times. The country that has gained the most has been Russia. But the U.S. could easily be exporting more American natural gas to Europe at lucrative rates if we had more LNG terminals and more accommodative shipping rules.”

Natural gas prices in the EU were high. They were low here. Why? I guess these two mental midgets never figured out the cost of shipping natural gas across the Atlantic Ocean. But let’s return to the opening claim as read their Appendix titled “Petroleum Output and National GDP”:

“The blue curve in Figure 7 represents domestic oil production as a function of the world price. Without the war on oil and gas, that supply curve would have been further to the right, as illustrated by the red supply curve. Equivalently, without the war on oil and gas, U.S. oil and gas extraction would be cheaper. Figure 7 contains the components required to estimate the effect on national GDP. The daily revenue loss for U.S. petroleum industries is the product of the oil price and the reduced production. At $65 per barrel and 3 million barrels daily, respectively, that is $71 billion per year. It is represented in Figure 7 as the sum of areas B and C.”

So these two morons think the demand curve for oil is perfectly elastic? It’s not so higher production just might mean a lower price. But hey!

“Less production by itself frees up labor, capital, and other resources for the rest of the economy. That is the area B, which in 2023 are enough resources to add $56 billion annually to the GDP of non-oil industries.”

So shifting the economy along the production possibilities curve lowered GDP by $15 billion per year? Seriously?

“However, the production that does occur in the Biden economy costs more per barrel, which is why less is being produced compared to the alternative. These added costs are reflected in the area A, which subtracts about $36 billion annually from the GDP of non-oil industries (a net increase of $20 billion = $56b – $36b for the rest of the economy). The GDP of the entire economy is therefore reduced by A – C, which we estimate to be about $51 billion for 2023, in 2019 dollars. The same framework suggests GDP reductions of $27 billion for 2021 and $52 billion for 2022.”

This may be double counting if not triple counting. But hey – Exxon paid handsomely for these sleights of hand.

Look – we never expect an honest analysis from Stephen Moore but Casey Mulligan seriously needs to rip up his degree for this trash. Then again he did write You’re Hired!: Untold Successes and Failures of a Populist President

https://www.sourcewatch.org/index.php/Committee_to_Unleash_Prosperity

Excellent find. I’ll need to check it more but for now:

The organization also claims “there are five major factors needed to ‘unleash prosperity’ and thereby, achieve ‘universal opulence.'”:

Stable money (Moore is a gold bug after all)

Low, flat tax (Remember Steve Forbes and his FLAT TAX which means don’t tax rich people)

Repeal onerous regulations (Onerous means anything that puts our planet ahead of Exxon profits)

Low or no tariffs (Some one call Trump)

Rein in spending (Again – urgent call to Trump)

I just wanna know if CUP’s “universal opulence” has any connection to Kopits’ “suppression”.

Kudlow making “inappropriate comments about women and minority groups during phone conferences, saying that he would like to have “a three-way” with anchor Sandra Smith and that the reporter Susan Li had a “nice way about her”

Sandra Smith is married which raises the question who would be the 3rd person in Kudlow’s dream 3-way? Her husband? Now if Larry is as racist as Trump, I hope he realizes Susan Li is not a white chick.

https://economics.stackexchange.com/questions/16741/adam-smith-and-universal-opulence

Adam Smith seems to be saying that the goal of governing is “universal opulence which extends itself to the lowest ranks of the people,” which he appears to think achievable in capitalism with the minimalist government. Clearly, things did not work out the way he thought, prompting Karl Marx, 90 years later, to assert that state-protected capitalism is the legalization of thievery.

Water trouble in the Southern border:

https://edition.cnn.com/2024/06/17/climate/water-conflict-us-mexico-heat-drought/index.html

I suppose Mexico “delivers” water to the reservoirs by not using it. Mexico delivers water to the U.S. in the east, the U.S. to Mexico in the west, so tit-for-tat denial of water is not in either country’s interest, though regions in each country could benefit – and suffer- from abrogated of the treaty.

The drought is the problem. The treaty problem is just one more manifestation. No short-term resolution is going to fix that underlying problem.

“Forget it Jake…….. It’s the Rio Grande Valley”