From a just-published article in Foreign Affairs:

The story of the dollar is, ultimately, less about the United States’ strength than about the rest of the world’s weaknesses. Until that disparity changes, and seemingly no matter how badly the United States plays its cards, don’t expect the dollar to decline.

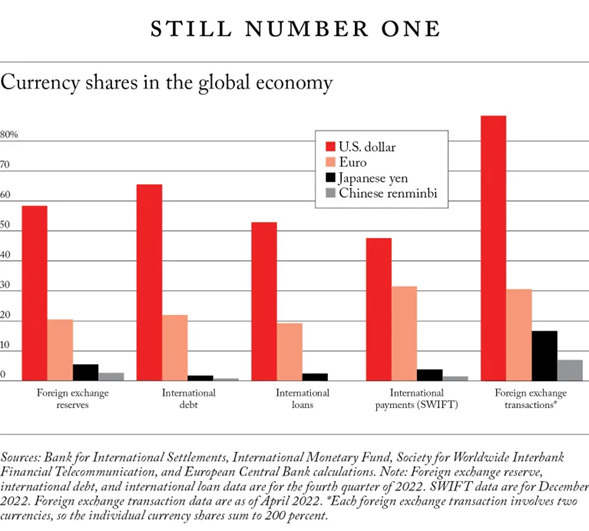

A summary graph:

Eswar Prasad also wrote “The Dollar Trap”, as well as 2022 Finance & Development article. Also, re: digital currencies etc., see “The Future of Money”.

Off topic – rents up y/y, multi-unit permits down y/y – a lot:

https://fred.stlouisfed.org/graph/?g=1piyB

This is far, far from a simple demand curve/supply curve/price/quantity market. Fixing the housing shortage is going to require a heckofalot more effort than is going into it right now.

With all the immigrants getting good paying jobs, one would think there’d be a housing boom. Of course Powell’s refusal to lower interest rates is not helping.

Can’t decide if this post is mentally/emotionally comforting or just means America came in first place in the losers’ bracket.

Fair warning – I’m grumpy.

I’m not a fan of Prasad’s framing of the issue. He recites a list of perceived U.S. weaknesses and then writes this:

“It would be no surprise, then, if the dollar were rapidly losing its power. But in fact the opposite is happening: the trends that would be expected to weaken the dollar, many of them driven by U.S. policy, are only strengthening its global dominance.”

It “would be no surprise” and “would be expected” only if the weaknesses listed were central to the issue of a currency’s role in international trade and finance.

If things don’t work as “would be expected”, you probably have the wrong model. Prasad kinda seems to know there’s a bad model hehind his “would be expected”, but kind of doesn’t. He never really gets around to saying. Heck, know it’s the wrong model, and I’m not a college prof writing for “Foreign Affairs”.

I understand that readers of “Foreign Affairs” are not all sophisticated consumers of economics and finance, so the details of Prasad’s story have value, the same as details in any story do. He falls short, though, on the big picture.

There is tremendous inertia in financial behavior – pricing conventions, contracts, liquidity, transaction costs, habits of mind and many other factors all combine to induce that inertia. Overcoming gthat inertia requires more than policy statements and some new agreements. A government unwilling to create many trillions of dollars (that’s US$s) worth of collateral, turnover, reserves, contracts, accounts, credit lines, all out of its own resources, enough to make transaction in some non-US$ currency cheaper, safer, more liquid and more reliable than transacting in dollars, that government is a flyspeck in global markets. It doesn’t matter one bit that its leaders yearn for greater insulation from the U.S. dollar and the U.S. government, or that a bunch of oh-so-clever chatterers have predicted the dollar’s demise. Not one bit.

In the end, Prasad’s conclusions read too much like a smart guy waving away a conundrum, too little like a clear explanation of how the world works. Start with “market participants determine market outcomes”. Then there is no conundrum.

It all gets back to trust and honesty on the currency. People want to know the currency will hold value over and extended time (multiple years) and they want to know the government will not abscond with it. Is America’s government 100% honest?? Obviously not. But it’s the best game in town. When you park your money in RMB do you know it won’t lose a high percentage of value over the next 6 months or that Xi Jinping’s hand-picked cronies won’t run off with it?? Good luck. That’s why anyone with a brain would rather hold Japanese Yuan, Canadian dollars, etc.

I agree with you Macroduck and yet I don’t. I don’t think Prasad is claiming to say anything revelatory, just something that in fact many people still aren’t “getting”.

I think the other issue is trust that you can get the money back. US has a long history of protecting the property rights of individuals and businesses. Most rich people from all over the world want substantial assets parked in the US because of that. It makes sense to have transactions conducted in a currency where you want to park your assets. A second Trump term could change that, since he has been talking about “bankruptcy” and other crazy things that may frighten entities from placing their assets in the US. The Euro is the only currency big enough to take over from the $US.

*Japanese Yen. That was a pretty huge mistake on my part. I guess my slowly degrading brain got it mixed up because similar pronunciation. A little embarrassing. Apologies.

The time to criticize Eichengreen, Prasad etc, would have been around 2011–2012. Saying shocking things to get attention, possibly to sell books, create fear among lesser financially educated Americans, for something you had to think they knew when they said it was a steaming pile of crap. That Chinese communists would relinquish control of their currency and to their own domestic power to international investors was a humongously stupid claim. That is/was borderline hilarious and should make both men grimace every time they think about themselves saying it.

Summers, Trump Swap Arguments on Proposal for Widespread Tariffs

https://www.msn.com/en-us/money/markets/summers-trump-swap-arguments-on-proposal-for-widespread-tariffs/ar-BB1oEIXT?ocid=msedgdhp&pc=U531&cvid=d352f36c1d9843d7a3fe3082b5f621b0&ei=6

Dr. Summers lowers himself to debate Donald the Moron Trump over trade policy? Did I miss the fight between Mike Tyson and some six year old kid?

They are actually not talking to each other. Trump is talking to the morons who would vote for him – and they want to hear about protectionism (yes they are ignorant enough to think it will help them). Summers is talking to the economists and smarter people in powerful positions (saying: see I can explain basic economics to the average moron).

I just figured out one “good thing” about Israel’s war in Gaza. Most countries have a hard time defining their “objectives” or “goals” or “success” in a war. Netanyahu’s policy is to murder as many women and children as he can, create more hate towards Jews (and therefor more future wars), and extend the mass murder of women and children in Gaza as long as he can. That’s a very very clearly defined Netanyahu objective. Israelis and American Jews must be so proud of this moment in their long history. Israelis used to hate genocide and people like Hitler. Now Israel has become what?? Hold your head high guys.

https://apnews.com/article/new-york-times-hamas-attack-israel-gaza-6088cad78f5e4153d671fe9b5b819308

‘The Times said Israeli officials were in possession of a 40-page battle plan, code-named “Jericho Wall,” that detailed a hypothetical Hamas attack on southern Israeli communities.’

And in early August 2001, Condi Rice handed President Bush a memo that noted Al Qaeda was about to attack the US homeland. Bush did nothing and Condi denied over and over what this memo said.

The realization during the second Iraq war was that the U.S. recruiting new jihadi fighters with every unwarranted killing. Now, Iraq is an ally (vassal state?) of Iran.

No reason to think this time is different, except maybe that the rulers of Saudi Arabia and Saudi vassal states are more interested in there own schemes that in Palestinian survival.

Very valid point. And of course Israeli conservatives keep mentioning America’s sins after 9/11. Now America has no “moral high ground” to stand on. I’m pretty certain you’d agree it doesn’t excuse random murder of women and children. We could extend the general argument and say Israel is acting worse here. I don’t recall women and children being randomly killed in Guantanamo Bay. But we/America did kill some families with the smart drones. Anyway you slice it two wrongs don’t make a right.

https://www.pbs.org/newshour/show/netanyahu-faces-doubts-from-israeli-military-leaders-over-war-in-gaza

Can the IDF remove Netanyahu from power? They should for the good of Israel.

“The dollar is hostage to politics in more ways than one. During former U.S. President Donald Trump’s term in office, the rule of law and the Federal Reserve’s independence—bulwarks of foreign investors’ belief in the stable long-term value of the dollar—took a beating. The U.S. system of checks and balances proved far too fragile and dependent on unwritten norms to maintain these investors’ confidence, prompting them to reevaluate their trust in the dollar and look for alternatives.”

People like Marjorie Taylor Greene applaud what Trump did here. And yet she is whining that the dollar may lose it dominance which according to her would destroy the US economy. OK – she’s a moron but she sure blames Biden for all of this. MAGA

Clarence Thomas Rails Against ‘Cheap’ Reasoning in Landmark Tax Case

https://www.msn.com/en-us/news/politics/clarence-thomas-rails-against-cheap-reasoning-in-landmark-tax-case/ar-BB1oDS99?ocid=msedgdhp&pc=U531&cvid=5b8186dfc2e54a81a72bdaa0c593c813&ei=5

I have not read Thomas’s dissent in the Moore case but this summary strikes me as Thomas saying that Congress is not allowed to tax his rich buddies.

Alvin Bragg Files Blistering Request to Extend Trump’s Gag Order

https://newrepublic.com/post/182974/manhattan-da-alvin-bragg-trump-gag-order

‘Bragg also called out Trump for lying, saying that his motion to drop the gag order “includes a number of categorically false assertions.”’

Read the entire story but I wanted to flag this portion. OK, OK – EVERYTHING Trump and his minions are lies. So what’s new?

On the issue of currency dominance, Elise Brizes has something to say:

“Do Financial Crises Differ Between Periods of Hegemony and Power Struggles?”

From the abstract:

“The historical record of the international power structure over the past 350 years discloses cycles featuring periods of a dominant nation-state exercising leadership and alternating with ‘struggle for power’ phases when no single state holds dominance, and many nations share similar levels of power.

“…hegemony is associated with ‘isolation’ periods, while ‘contagion’ tends to occur during phases of ‘struggle for power’. In consequence, during periods of ‘struggle for power’, financial contagion tends to occur, whereas hegemony fosters containment.

The second part of this paper delves into an explanation of this correlation, grounded in theories concerning a common good of the foreign reserves. This paper will show that in periods of crisis, containment results from the implementation of international global policies that prevent the propagation of crises in periods of an hegemonic power.”

https://archive.ph/o/F5Z3r/https://www.lse.ac.uk/Economic-History/Assets/Documents/Workshops/Financial-Crises-Cassis/Papers/Final-Brezis-financial-crisis-June-2024.pdf

So we can expect that there will be more and greater instances of financial contagion if the dollar loses dominance. Financial hegemony fosters containment of shocks.

Changes coming to China’s monetary policy implementation:

https://www.business-standard.com/world-news/xi-jinping-s-mystery-pboc-plans-surface-with-biggest-shift-in-years-124062100039_1.html

Another step in Israel’s ethnic cleansing of the West Bank:

https://www.theguardian.com/world/article/2024/jun/20/idf-transfers-powers-in-occupied-west-bank-to-pro-settler-civil-servants

Smotrich is Israel’s version of Putin combined with Stephen Miller. Racist POS who will make sure that Palestinians never have a homeland. If Israel wants to become pariah nation – they are doing a good job.