The CBO released an updated Economic Outlook yesterday. Projected PCE inflation is higher, as are budget deficits. First drop in Fed funds rate in 2025Q1. For me, most interesting are the GDP projections, including with respect to potential GDP.

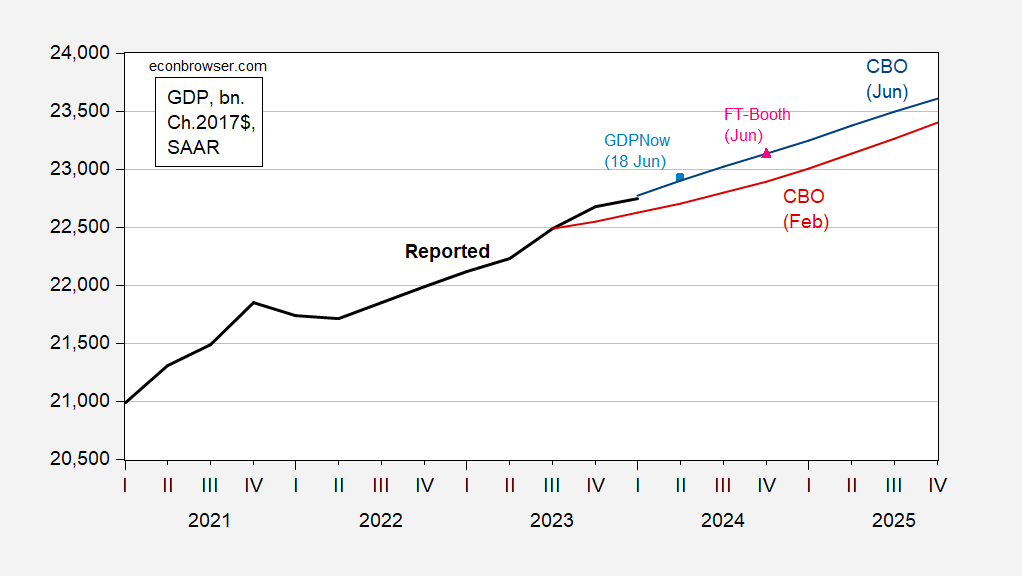

Here’s the GDP projection as of June, and as of February.

Figure 1: GDP as reported (bold black), February CBO (red), June CBO (blue), FT-Booth median (scarlet triangle), GDPNow as of 18 Jun (light blue square), all in bn.Ch.2017$ SAAR. Source: BEA (2024Q1 2nd release, CBO February Budget and Economic Outlook, CBO June Economic Outlook update, June Booth macroeconomist survey, Atlanta Fed.

The CBO projections are based on data available as of May 2nd. The latest CBO projection is substantially above the February projection (see discussion here), largely due to the intervening upside GDP surprises. It’s currently in line with the FT-Booth June median forecast, and the slightly below (for Q2) the Atlanta Fed nowcast. (It’s slightly above the May median Survey of Professional Forecasters estimate).

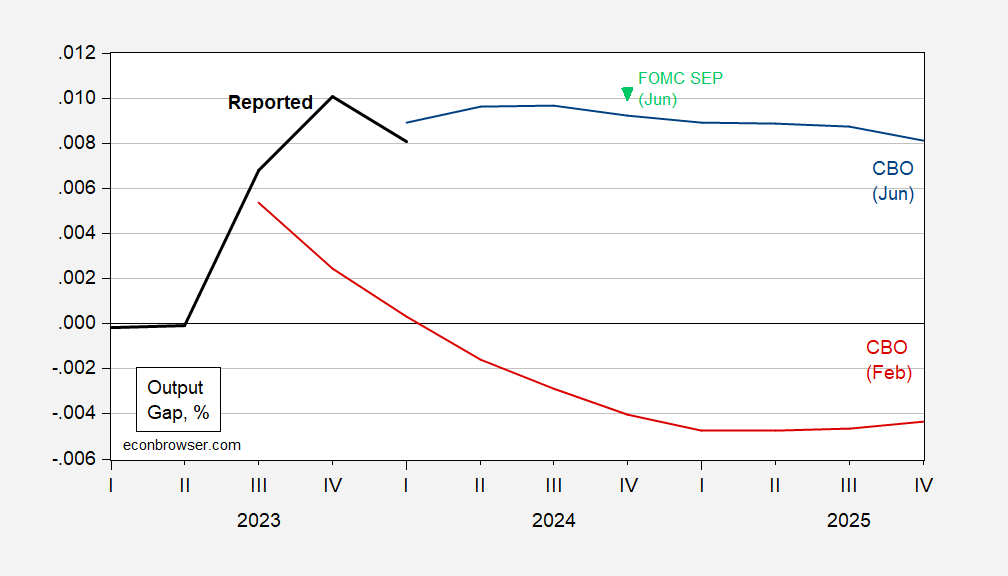

While the revised q/q growth rate projections are higher in the short term, relative to February forecast (based on data available as of January 6), then decelerate to slower rates by end 2025, implying reversion to potential. That being said, the current implicit CBO projection of the output gap is dramatically different than reported in the February Economic Outlook. [Update: As suggested by Paweł Skrzypczyński, the implied output gap is even larger using SEP and CBO potential. However, we don’t know what the FOMC’s view on potential GDP is, although the Green Book must have an estimate.]

Figure 2 [updated 1pm CT]: Log output gap, in % (bold black), February CBO projection (red), Jun CBO projection (blue), FOMC June Summary of Economic Projections (inverted light green triangle). Reported is based on reported GDP and Jun CBO estimated potential GDP. Source: BEA (2024Q1 2nd release, CBO February Budget and Economic Outlook, CBO June Economic Outlook update, Federal Reserve, and author’s calculations.

This means the CBO is projecting a positive output gap for the next year and half, under current law. For perspective, the pre-pandemic peak output gap was 0.9 ppts, while the highest in recent history is 2.4% in 2000Q2.

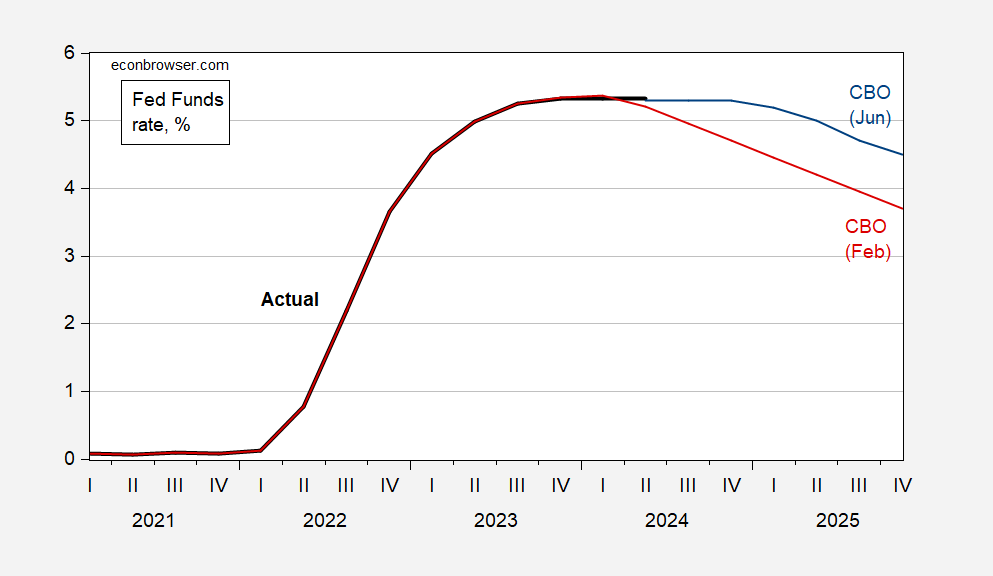

It’s interesting to note that the CBO projection is based on an assumption the Fed first starts reducing the Fed Funds rate in 2025Q1; this contrasts with projected rate reduction by about 60 bps (on average) by end of 2024 in the February projection.

Figure 3: Fed funds rate (bold black), February CBO projection (red), June CBO projection (blue), all in %, period average. Source: Federal Reserve, CBO February Budget and Economic Outlook, CBO June Economic Outlook update.

“In CBO’s projections, real potential GDP grows at an average rate of 2.1 percent a year from 2024 to 2029—slightly higher than the average rate since the business cycle peak in 2007—and then slows to an average growth rate of 1.8 percent a year from 2030 to 2034. The higher projected growth rate of potential GDP over the next five years stems mostly from rapid growth in the potential labor force, which reflects a higher rate of net immigration from 2021 to 2026 than in earlier years.”

2.1% per year is a very strong growth rate for potential GDP. Current GDP is actually just above potential GDP already and is expected to continue to grow so the forecasts seem to be that we will not be below full employment for a while.

But in MAGA moron world, the Biden economy really sucks. In fact they have their chief stooge Bruce Hall wondering why we cannot grow at a 4% per annum rate for the next several years. After all China does and Brucie actually thinks the Chinese and US economies are “comparable”. Like I said – MAGA moron world.

😉 Still living in your head.

I think you meant you are still trying to add 2 plus 2. Or do you always decide not to live up to your incessant errors?

@ Bruce Hall

Your personal hero in life has a spiritual advisor who molested and sexually abused a 12 year old. Then after he abused the 12 year old sexually referred to the 12 year old child as “a Jezebel”. Any thoughts Bruce??

https://www.theguardian.com/us-news/article/2024/jun/18/pastor-ex-trump-adviser-resigns-sexual-abuse

Your deeply revered hero in life, The Great Orange One, sure does attract a lot of “great conservatives” to his inner circle Bruce. Hope you sleep well at nights knowing the man you hold up as an American hero loves to hang with pedophiles. Gaetz, Epstein, Robert Morris. Your hero really knows how to pick his buddies Bruce. Birds of a feather flock together

Everyone knew as early as 1987 that this slime had an inappropriate sexual encounter with a “young lady” but no biggie? WTF? Oh wait – the lady was very young. Now that’s different!

And Matt Gaetz has no problem doing a 17 year old prostitute as long as some one else pays the “young lady”. The party of “family values”!

So Roger Stone expects Biden to win at the polls in November!

https://www.rollingstone.com/politics/politics-features/roger-stone-plan-trump-win-lawyers-judges-technology-1235041650/

IF THERE’S ANYTHING more alarming than Donald Trump and his allies’ plans to wreak havoc on the 2024 election, it’s how comfortable they are telling anyone who asks exactly what they plan to do. In an undercover recording obtained by liberal journalist Lauren Windsor, longtime Trump consultant and professional electoral agitator Roger Stone brags that the former president and his cadre are on “offensive footing” ahead of the election, and are better prepared to challenge election results in November than they were in 2020. “At least this time when they do it, you have a lawyer and a judge — his home phone number standing by — so you can stop it,” Stone says at one point. “We made no preparations last time, none … There are technical, legal steps that we have to take to try and have a more honest election. We’re not there yet, but there’s things that can be done.”

“It’s interesting to note that the CBO projection is based on an assumption the Fed first starts reducing the Fed Funds rate in 2025Q1; this contrasts with projected rate reduction by about 60 bps (on average) by end of 2024 in the February projection.”

All President Biden would need to do is just openly insult Powell as a useless idiot (ironically true in this case) and started a masochistic trade war, and he could have had the FFR dropped 3 times in this calendar year.

https://www.cnbc.com/2019/10/31/trump-rails-against-powell-day-after-fed-cuts-rates-for-a-third-time-this-year.html

Subtext from Powell: “Want White House friendly interest rate policy from me?? Start an ill-advised trade war. Then we can be lovers. Just be gentle with the bullwhip”

“Trump wants the Fed to push interest rates down to zero or even into negative territory. Trump argues that the current rates put the U.S. at a competitive disadvantage to other countries”

That was late October 2019. US 10-year government bond rates at the time were a mere 1.75% whereas German 10-year government bonds were 2% lower. How does that compare today? US rates are near 4.25% and German rates are about 2% lower.

I’ll leave it to our host to rebut Trump’s BS that this puts the U.S. at some competitive disadvantage. I’ll just note the relative interest rate position today under Biden is the same as it was when Trump went off on his stupid rant back in late 2019.

BTW – the US real interest rate back in late 2018 was negative but r* was estimated to be 0.5% back then. Of course modern macroeconomics is not something that MAGA morons ever understood.

Fauci: Trump got hydroxychloroquine treatment idea from Laura Ingraham

https://www.msn.com/en-us/health/other/fauci-trump-got-hydroxychloroquine-treatment-idea-from-laura-ingraham/ar-BB1owXKt?ocid=msedgdhp&pc=U531&cvid=31de7fb5437e4879a94d674a5981e84d&ei=14

“I believe he wanted so badly for this to go away the way influenza goes away, and when he saw it was not going away, then he was hoping for some magical solution, and he even used those words, ‘It’s going to go away like magic,’” Fauci said during an interview Tuesday on MSNBC. “And then when that didn’t work, then we had to have these miracle cures like hydroxychloroquine, which he got from Laura Ingraham on Fox News.”

Gee – I bet Bruce Hall spends his evenings watching Faux News for that excellent medical advice ala Dr. Laura Ingraham

For Trump credible sources are those who tell him what he wants to hear.

The Committee to Unleash Prosperity is run by the lowest snake oil sales people ever. Their mission statement highlights this trash:

https://www.amazon.com/JFK-Reagan-Revolution-American-Prosperity/dp/1595231145

JFK and the Reagan Revolution: A Secret History of American Prosperity Hardcover – September 6, 2016

by Lawrence Kudlow (Author), Brian Domitrovic (Author)

The fascinating, suppressed history of how JFK pioneered supply-side economics. John F. Kennedy was the first president since the 1920s to slash tax rates across-the-board, becoming one of the earliest supply-siders.

Oh please – the 1963 tax cut was promoted by Keynesian concerns that we were short of full employment. Some 40 years ago Paul Craig Roberts (who became a VDARE racist POS) tried to pull this kudlow sleight of hand at a conference on the Reagan tax cuts. The real economists there pointed out that everyone of Roberts quotes from the Kennedy CEA was talking about multipliers and not supply side stupidity.

Kudlow knows this because he was there. But Kudlow is nothing more than a lying little moron. Does Kudlow not get that by late 1965 the CEA was worried about excess fiscal stimulus? Does Kudlow not get that the FED’s tight money that gave us the 1982 recession was a reaction to Reagan’s ill advised fiscal stimulus?

Oh wait – Kudlow as Trump’s economic advisor promoted excess fiscal stimulus. Never mind.

“Revenues total $4.9 trillion, or 17.2 percent of GDP, in 2024. They rise to 18.0 percent of GDP by 2027, in part because of the scheduled expiration of provisions of the 2017 tax act, and remain near that level through 2034.”

And Trump wants to keep taxes on the rich at the low levels that led to this massive increase in the Federal debt? Anyone serious about fiscal responsibility would want revenues to rise to at least 20% of GDP but those MAGA morons are hell bent to lower this ratio to less than 17%.

I just finished my FWIW forecast of PCE inflation for May 2024.

I am showing zero percent M/M change for PCE, FRED series, PCEPI.

I am showing 0.2 percent M/M change for core PCE, FRED series, PCEPILFE.

This is one of those weird things in economics, making a “forecast” for a number that estimates a prior month. Very common in actuality, slightly mind-bending if you stop to think about it. But I’m a linear thinker, not much useful in the year 2024, if it ever was.

Hi Moses,

Thanks for the response.

Unfortunately, PCE results for May 2024 will not be released until June 28, 2024. I guess we need to know where we are before we can forecast a future month.

Me thinks Bruce Hall should ask Sabine Hossenfelder out on a hot date as she has this little cartoon Brucie would love:

https://www.realclearscience.com/video/2024/06/10/the_benefits_of_climate_change_1036944.html

(via Sabine Hossenfelder) Climate change is bad — we hear this a lot. But this isn’t the full story. Climate change also has benefits. And I think we need to talk about those too. Some regions of this planet will see milder climate and better conditions from agriculture. We’ll see fewer people freeze to death, and, yes, some plants actually benefit from carbon dioxide.

And you thought those Trump rallies were dumb!

Sabine missed her true calling, She should have majored in “Marketing, with Specialization in Marketing to the Functionally Illiterate”. She could be the head of major D1 uni Marketing dept now, with enough tenure to tell everyone that nuclear bombs are healthy for children.

“Marketing, with Specialization in Marketing to the Functionally Illiterate” – I am totally going to steal that. So many opportunities!

I understand that irregular heart beats can be cured by potassium cyanide. You can’t have an irregular heart beat if the heart doesn’t beat anymore.

You ought to stick to your version of economics. Perhaps Menzie can explain a few things when (if) he is done with his summer reading.

Brucie seems to be in a bad mood. I guess Sabine turned down Brucie’s advances.

@ Bruce Hall

You should dream you did “summer reading” like Menzie does. That doesn’t mean your usual readings of Beetle Bailey cartoons or Scott Adams’ invective on Black people.

CBO is assuming no recession, which is entirely conventional. From that assumption flow forecasts of a wider output gap and, presumably, that rapid pace of rise in potential GDP.

That assumption is not entirely safe. The output gap can remain positive for several quarters, but a positive output gap typically precedes recession:

https://fred.stlouisfed.org/graph/?g=1pe8K

As I hope is obvious from the picture, the Fed has a hand in causing recession to follow positive output gaps. We now have both a positive output gap and a high real funds rate, a combination which typically leads to recession.

By the way, the half decade of negative output gap between 1983 and 1988 is the Fed’s argument for keeping inflation firmly in check. The loss of output (welfare) during Volcker’s inflation fight was very large.

By the way, it is fairly obvious that the output gap led inflation prior to the Great Moderation, but not all that obvious since:

https://fred.stlouisfed.org/graph/?g=1pebe

It’s not at all clear that the output gap led inflation during the post-Covid expansion. At best, one might try to argue that the output gap is accommodating continued inflation. One might try, but strong demand for goods relative to services, compared to greater persistence of service-sector inflation relative to goods, says otherwise. So does the recent moderation of inflation in the face of a widening output gap.

Forced fiscal restraint in the EU?

EU states facing legal action over excessive debt

https://www.msn.com/en-us/money/companies/eu-states-facing-legal-action-over-excessive-debt/ar-BB1ouCQZ?ocid=msedgdhp&pc=U531&cvid=8bc3a0304df7478987125d14ad56dd58&ei=7

‘Nearly 10 EU member states including France, Italy and Belgium could by hit with legal action accumulation of debt. The European Union on Wednesday is expected to take nearly 10 member states to task over excessive spending. The assessments of the 27 EU states’ budgets and economies will be published by the European Commission on Wednesday. with France, Italy and Belgium among the member states that could be slapped with legal action over their accumulated excessive new debt. The EU suspended debt and deficit regulations to help countries cope with the economic fallout of the COVID-19 pandemic and Russia’s invasion of Ukraine. The rules are now back in place and now any EU country going over debt and deficit limits run the risk of legal action.

The EU’s golden rules on debt

According to the reformed rules, an EU member states debt may not exceed 60% of gross domestic product (GDP). Highly indebted EU countries with debt levels over 90% of GDP have to reduce their debt ratio by one percentage point annually, countries

Additionally, the general government deficit — the shortfall between government revenue and spending — must be kept below 3%. According to the commission’s economic forecast, France is at -5.5%, Italy is at -4.4% and Belgium is at -4.4% and will breach this deficit limit in 2024. Austria, Finland, Estonia, Hungary, Malta, Poland, Romania and Slovakia also have deficits that are too high according to the rules. Spain is at exactly -3.0%.’

Maybe it is time to end these insane EU rules and for some of these nations to abandon the Euro. Else – these fiscal straight jackets may lead to recessions.

Menzie says: However, we don’t know what the FOMC’s view on potential GDP is, although the Green Book must have an estimate.

Forgive me Menzie if I am giving you data you already know about and/or where to find. But possibly potential GDP data is in this link or one of these files??

https://www.cbo.gov/system/files/2024-06/55022-2024-06-Historical-Economic-Data.zip

I am pretty certain it is there.

Moses Herzog: That’s CBO’s version, which is incorporated in Figure 2. The Fed has its own estimate

The Tealbook right?? Or will it be the Mauvebook next week??

“By rule, the projections from the Tealbook/Greenbook are released to the public with a lag of five years.”

Would you mind telling one of the joe six pack morons out here in the great unwashed land, what exactly is the Fed’s reason in delaying release of the data/estimate??

Must be some of Alan Greenspan’s remainder minions wandering around the Fed “No, no, nope Jerome, we don’t release this for 5 years. You’re only allowed to share it with an unpaid female fed intern while trying to impress her. This is the “special information” for either pillow talk with interns or envelopes stuffed with cash from private equity funds, you’ll get it Jerome, you did study law after all”.

This issue pales beside the cowardly delay in providing weapons to Ukraine,but it ain’t nothin’:

https://www.reuters.com/markets/europe/ukraine-bondholder-group-unable-reach-deal-formal-20-bln-debt-talks-2024-06-17/

Forcing a default on Ukraine’s debt won’t get any creditors paid sooner or more fully. Current bond-holder-committee proposals don’t comply with IMF rules, which seems counterproductive. (Committee members hold about 20% of Ukraine’s debt.) A default would please Putin, but that doesn’t seem to be the goal. Money up front, and more of it, is what committee members are asking – same as always.

Trump keeps asking if we are better off than we were 4 years ago. Let’s see:

Unemployment Rate

https://fred.stlouisfed.org/series/UNRATE/

April 2000: 14.8%

April 2024: 3.8%

Yes – much better off! Hey Donald – thanks for asking!

Forget about the unemployment rate and not being able to pay housing rent and mortgages, don’t you think low income people who could still find/keep their jobs had a real great time finding caretakers for their children, some of them with no siblings, sitting at home alone?? I mean, those were real fun MAGA times!!! The golden age of MAGA child care.

The Biden admin deserves to be ‘hammered’ on its spending: Judy Shelton

Panelists Judy Shelton and Douglas Holtz-Eakin discuss how former President Trump connects with voters who are suffering under President Biden’s policies on ‘The Evening Edit.’

https://www.foxbusiness.com/video/6355253852112

Question for Judy Shelton – do you even know spending under your boy Trump was higher than it is now?

Question for Douglas Holtz-Eakin? When did you decide to rip up your degree in economics?

A couple interesting links, with other links in the links:

https://www.cbpp.org/research/economy/real-time-estimates-of-potential-gdp-should-the-fed-really-be-hitting-the-brakes

https://www.econlowdown.org/v3/public/minding-the-output-gap-what-is-potential-gdp-and-why-does-it-matter

If we took Friedman seriously, there’s be no such thing as a positive output gap. Deviations from potential GDP would all be downward. No need to step on the brakes just because output is strong.

When the output gap doesn’t lead inflation – as it hasn’t seemed to since ’83 – Friedman’s view seems reasonable.

https://www.bruegel.org/blog-post/plucking-model-recessions-and-recoveries

(I think Bruegel is simplistic in drawing implications from the plucking model, but Thoma gets a mention, so I chose this link.)

Rifts seem to appear between Israel’s political and military leadership over conduct of the Gaza war

https://www.latimes.com/world-nation/story/2024-06-19/rifts-seem-to-appear-between-israels-political-and-military-leadership-over-conduct-of-the-gaza-war

The Israeli army’s chief spokesman on Wednesday appeared to question the stated goal of destroying the Hamas militant group in Gaza in a rare public rift between the country’s political and military leadership. Prime Minister Benjamin Netanyahu has insisted Israel will pursue the fight against Hamas, the group running the besieged Gaza Strip, until its military and governing capabilities in the Palestinian territory are eliminated. But with the war now in its ninth month, frustration has been mounting with no clear end or postwar plan in sight. “This business of destroying Hamas, making Hamas disappear — it’s simply throwing sand in the eyes of the public,” Rear Adm. Daniel Hagari, the military spokesperson, told Israel’s Channel 13 TV. “Hamas is an idea, Hamas is a party. It’s rooted in the hearts of the people — whoever thinks we can eliminate Hamas is wrong.”

Hagari is correct. Maybe the IDF should refuse to fight under Netanyahu resigns.

Hamas is the inevitable result of Israels right wing policies towards Palestine and its people. The only way to destroy Hamas, is to destroy the right wing in Israel. Otherwise even the killing of all current “Hamas” “members” in Gaza will simply seed the regrowth of Hamas – or another organization so bad that Israel will wish itself back to the good old days when it was Hamas they were fighting. I hate to say it but Israel is stuck in a right wing circling down the drain dance with extremists in Palestine – and Israelis are the only ones with the power to put a plug in it.

MAGA morons like Bruce Hall never criticize Trump’s tariffs but then spin in circles claiming Biden’s tariffs are just awful. I guess the goal is to suggest Biden and Trump are equally bad at trade policy. Thank goodness we have smart people like Janet Yellen to explain reality to the MAGA morons:

https://www.msn.com/en-us/news/world/yellen-says-biden-s-china-tariffs-are-strategic-trump-s-would-raise-costs/ar-BB1oAKpn?ocid=msedgdhp&pc=U531&cvid=3ee52026aad346babb90080c64415b08&ei=26

U.S. Treasury Secretary Janet Yellen on Thursday defended President Joe Biden’s increased tariffs on certain Chinese goods as highly strategic but said Republican presidential candidate Donald Trump’s tariff proposals would be much broader and raise costs for consumers.

Yellen told a news briefing in Atlanta that Biden’s new tariffs are aimed at protecting electric vehicles, solar energy products and semiconductors from excess Chinese capacity created by Beijing’s over-investment. The administration refuses to allow U.S. firms in these sectors “to be put out of business” by coordinated Chinese dumping of exports, she said.

Other countries are taking similar actions, Yellen said, noting this month’s G7 leaders statement opposing China’s industrial and business policies.

But Biden’s tariff announcement last month left in place punitive duties of up to 25% on hundreds of billions of dollars’ worth of other Chinese imports, from toys to internet routers, which were imposed by Trump in 2018 and 2019 under a “Section 301” investigation into China’s misappropriation of U.S. intellectual property.

“Given that China has not done anything, really, to address those concerns, we thought it was inappropriate to remove those tariffs,” Yellen said.

Asked about Trump’s proposals to impose a 10% tariff on all goods imports into the U.S., and 60% or more on Chinese goods, Yellen said they “would affect all of our trade partners and all of our trade.”

“And I believe that is a substantial enough program that it would both raise costs to consumers broadly on all the imports they buy, and harm American businesses, many of whom rely on imported goods for their supply chains,” she said. “It would significantly raise their costs.”

Clear to see the difference between the incompetence of Trump and competence of the Biden administration.

Tariffs has a number of negatives:

1. It increases the price of products subjected to them. For end products that increases inflation and for raw material it also decreases competitiveness of export industries.

2. The retaliatory tariffs in the tit-for-tat dance with foreign governments will hurt export industries.

3. Loss of export will cost jobs and reduce GDP.

The only time tariffs are an acceptable tool is when the negatives are clearly outweighed by positives. Positives could be things like protection against or retaliation for predatory trade or currency policies. The need to retain strategic production capabilities can either be addressed by using tariffs or by exclusive “Made in America” rules applied to government purchases of “strategic products”.

Tariffs support of domestic industries may retain jobs and increase GDP, but it comes at the cost of letting expensive and uncompetitive producers off the hook, rather than forcing them to become more effective and productive – hurting the economy.

Supreme Court Refuses To Upend The Tax Code In Ruling On Unrealized Gains

https://www.msn.com/en-us/money/markets/supreme-court-refuses-to-upend-the-tax-code-in-ruling-on-unrealized-gains/ar-BB1oAmLh?ocid=msedgdhp&pc=U531&cvid=8f509da4616c490686ee38840d04897b&ei=13

The Supreme Court declined to overturn a tax policy Thursday that critics warned could have had broad implications on federal tax policy and the U.S. economy, ruling against a couple who claimed they should not have been taxed on money they invested but hadn’t made a profit on. After being taxed on an investment they had in an Indian company, couple Charles and Kathleen Moore asked the Supreme Court to overturn what’s known as the “mandatory repatriation tax” (MRT), a provision of the GOP’s 2017 tax law that imposed a one-time tax on U.S. individuals and companies who have a significant stake in foreign corporations controlled by Americans. The court ruled 7-2 to uphold the MRT, ruling it does not exceed Congress’ authority. The Moores argued they shouldn’t have been taxed on “unrealized gains,” meaning investments that they haven’t actually made a profit on; money earned from investments or assets is generally taxed after they’ve been sold at a profit, meaning those gains are “realized.” Striking down the MRT could have benefitted corporations, as the Institute on Taxation and Economic Policy predicted 400 multinational corporations could receive $271 billion in tax relief from the policy being overturned, as well as impact Democrats’ proposals for a wealth tax on the richest Americans. The Moores also argued the court should weigh in on taxing unrealized gains because Democrats’ proposals for a wealth tax on the richest Americans would tax those earnings—but the court’s ruling did not address that, with Justice Brett Kavanaugh noting for the court it’s a “narrow” opinion that doesn’t address whether realization is needed for taxes on income.

“Unrealized” capital gains is income so should be taxed as such. But fat cat tax lawyers play this game for their ultra rich clients. Thankfully the courts THIS time ignored their disgusting spin.

Should taxpayers be able to deduct unlimited unrealized capital losses beyond any offset against gains?

This is an interesting precedent for future “wealth tax” proposals. Unrealized gains, wherever they are made, amount to wealth. One can jump through hoops to argue that a taxable thing is an untaxable thing, as tax lawyers are paid to do, but now that a particular form of unrealized gain – aka “wealth” – is taxable, a particular line of argument seems to have been cut off.

Let’s start with financial assets over some arbitrary figure – say $5 million. That would provide a wide enough base to bringing substantial revenue. Ramp up the rate over five years to avoid a big shock to collateral.

For financial mortals taxing unrealized gains may not be a problem if one’s investments are mutual funds that pay dividends and capital gains at year-end. Most of the realized gains are recognized. A wealth tax on unrealized gains may drastically affect index mutual funds which for example mirror the SP500. The SP500 mutual funds pay a small dividend, but do not distribute capital gains.

There may also be a drastic effect on the buy and hold strategy for individual stock buyers. Investors may miss-out on outsized gains on securities such as LLY or NVDA. Not much dividend but dramatic gains that may cause investors to sell to pay taxes prior to the big gains.

Another problem is the valuation of personal residences, along with collectibles. During certain periods, a homeowner may be forced to borrow on a home to pay taxes or sell collectibles. Fairness it seems should allow full deduction of unrealized losses, which will be a problem for the IRS, especially for residences and collectibles. Perhaps personal residences under a certain market value will be exempted.

If we are going to impose a wealth tax, perhaps it should be integrated with estate taxes and perhaps have the same floor as the inheritance tax.

AS,

You use the expression “another problem”. Sure, if you want to see it as a problem. We tax labor income, and just look at that labor shortage! What a problem! Another way of seeing it is that raising revenue is a solution to the problem of financing government activity.

All taxes are distortionate. If we set tax policy according to which taxes cause the least distortion, then we’d want to know how much turnover of assets would be induced by a wealth tax. In general, we mostly just give lip service to tax efficiency; no fair excusing only some people from some taxes on efficiency grounds.

In the end, a wealth tax has the virtue of taxing “rents”, which was pretty fundamental to economic thinking before the days of neo-liberalism. Accumulation of wealth means a positive return, which at some level reflects economic rents.

Tax the lucky.

I am not for expanding tax laws. Eventually we will all be considered among the “lucky”. The alternate minimum was designed to tax a few real estate moguls and eventually was extended to millions of non-mogul taxpayers.

Enforce the laws we have first. If the uber wealthy are tax frauds, enforce the laws.

Yes, that extra $1.9 trillion budget shortfall has to come from somewhere (well, they could just keep borrowing it) to pay for all that extra spending. Seems like a good test run. If the government can tax income that isn’t income yet for these “unrealized gains”, eventually it could apply that principle for everyone. Pay your taxes with your cash or sell your house to pay for the unrealized gains on your house. Sure, that’s not going to happen.

Inch… mile.

Oh, that’s different. Yup, just like that original 5% maximum income tax rate would never go higher.

Inch… mile.

What? Reduce government spending? C’mon, man! That would reduce GDP growth.

Bruce Hall: Wonder where we’d be without that TCJA of 2017.

Brucie’s snide comment about taxing unrealized gains only shows he failed to read the decision written by Brett (I like beer) Kavanaugh which is a shame as his discussion of the history of our tax laws on this point was quite good.

But you know – this is typical for Brucie boy. He often spouts off on topics he does not understand failing to read the recent wisdom from people who do get the issue at hand.

Well your boy Trump did raise spending a whole lot. But he paid for it with massive tax cuts for the rich I gess.

https://finance.yahoo.com/quote/DJT/

Your snide and stupid comment about unrealized capital gains had me going to the stock price for Trump Media. Oh my – it has fallen quite a bit which means Brucie Boy has suffered a huge unrealized capital loss. Come on Brucie – ask your corrupt tax attorney if you can get a tax refund!

“What? Reduce government spending? C’mon, man! That would reduce GDP growth.”

Does it? Maybe according to that new book on Advanced Macroeconomics that you are writing with Nobel Prize winner Steven Koptis. Now I get that suppression model of his is dumber than a retarded rock (but smarter than Brucie boy) but some governments have combined fiscal austerity with lowering interest rates to keep the economy near full employment.

But don’t let me interrupt your incoherent babbling with actual economics as Stevie boy needs Brucie boy’s little contribution to their book!

“Slippery slope” arguments are soooo easy, with the “slope” one sees depending on one’s point of view. Republican tax cuts have proven to be pretty slopey, but I don’t see you complaining about them. And those tax cuts account for a huge part of the deficit and debt.

Meanwhile, federal outlays as a share of GDP rose before they fell under Reagan, rose the fell under Bush, fell under Clinton, rose under Shrub, fell under Obama, held steady under Trump until Covid, and have fallen under Biden:

https://fred.stlouisfed.org/series/FYONGDA188S

So if your concern is that spending is to high, you should vote for…come on, you can get this one. It’s pretty obvious if you just think about it.

Biden leads Trump in new faux news poll:

https://www.foxnews.com/official-polls/fox-news-poll-three-point-shift-biden-trump-matchup-since-may

Trump is apoplectic.

Looks like Wells Fargo has its own version of “endless shrimp”:

https://archive.ph/bem2Q

Losing money on credit cards? Ten million a month is chump change, but still.

Trump’s Campaign Message About Inflation Has the Facts Wrong

https://www.msn.com/en-us/money/markets/trump-s-campaign-message-about-inflation-has-the-facts-wrong/ar-BB1oBuue?ocid=msedgdhp&pc=U531&cvid=27badcbf9cd9439b83e5481410e7e7b3&ei=4

‘On the campaign trail, Donald Trump has been hammering away at President Joe Biden for the “nightmare” of “disastrous inflation.” He has made inflation one of his key attacks against the incumbent President, even blaming Biden for food prices increasing by up to 50% or 60%. (They have not.)’

Now we know what Bruce Hall has been up to lately – helping Trump with his parade of lies. Even Josh Hawley limited his stupid claims to some suggestion that food prices have risen by 40% since Biden took office. As I noted earlier, the actual increase was half of that. Now Hawley did try to tell us nominal wages have declined even though they have risen by more than food prices have.

The article noting Trump’s lies on inflation did have a link to:

https://www.nber.org/system/files/working_papers/w31417/w31417.pdf

What Caused the US Pandemic-Era Inflation? Olivier J. Blanchard and Ben S. Bernanke

NBER Working Paper No. 31417, June 2023

We answer the question posed by the title by specifying and estimating a simple dynamic model of prices, wages, and short-run and long-run inflation expectations. The estimated model allows us to analyze the direct and indirect effects of product-market and labor-market shocks on prices and nominal wages and to quantify the sources of U.S. pandemic-era inflation and wage growth. We find that, contrary to early concerns that inflation would be spurred by overheated labor markets, most of the inflation surge that began in 2021 was the result of shocks to prices given wages. These shocks included sharp increases in commodity prices, reflecting strong aggregate demand, and sectoral price spikes, resulting from changes in the level and sectoral composition of demand together with constraints on sectoral supply. However, although tight labor markets have thus far not been the primary driver of inflation, we find that the effects of overheated labor markets on nominal wage growth and inflation are more persistent than the effects of product market shocks. Controlling inflation will thus ultimately require achieving a better balance between labor demand and labor supply.

The analysis of data seems fine. In response to the more speculative “but we know what’s GOING to happen” part about labor-market tightness and wages feeding inflation, I refer the authors to this:

https://fred.stlouisfed.org/graph/?g=1pebe

Their speculative argument isn’t supported by the facts since the Great Moderation.

A very good article on the Supreme Court ruling in this Moore tax case:

https://slate.com/news-and-politics/2024/06/supreme-court-opinions-brett-kavanaugh-fake-tax-case.html

Why Brett Kavanaugh Shot Down a Fake Case That Would Have Blown Up the Tax Code

‘On Thursday, the Supreme Court passed up an opportunity to implode the United State tax code on the basis of bogus facts. By a 7–2 vote, the court sided with the government in Moore v. U.S., a case that conservative activists engineered to preemptively kill an Elizabeth Warren–style “wealth tax.” Moore, however, does not mean that a future federal tax on exorbitant wealth will survive SCOTUS. Rather, it seems to stand for the proposition that even this very conservative court has limited patience for oligarchical policy demands dressed up in the shaggy pretext of a fake legal controversy.

Justice Brett Kavanaugh’s majority opinion in Moore recounts the facts as Charles and Kathleen Moore (the plaintiffs) and Andrew Grossman and David Rivkin (their lawyers) presented them. By this account, the Moores beneficently invested just $40,000 in KisanKraft, an American-owned corporation that manufactures farm equipment in India. They received a 13 percent ownership share but no immediate distribution of its income, even as the company made a great deal of money. So they were shocked to discover that they owed $14,729 in “income” on federal taxes after Donald Trump signed the 2017 tax cuts. It turns out that bill included a one-time, “backward-looking” tax on American shareholders of American-owned corporations located oversees that accumulated undistributed income. This provision marked an attempt to encourage Americans to reinvest that money domestically. Rather than accept this obligation, the Moores sued the government, alleging that the new tax was unconstitutional. This theory was cooked up by BakerHostetler attorneys Grossman and Rivkin, the latter of whom is a good friend of Justice Samuel Alito. These lawyers argued that their clients were caught up in a grossly unfair scheme that penalized magnanimous Americans who tried to assist overseas corporations through investments. In this telling, the new tax punished U.S. citizens, like the Moores, who had little to no direct involvement with these companies, attributing to them a falsely heightened level of control over their operations. Grossman and Rivkin therefore claimed that the tax violated the 16th Amendment, which authorized federal “taxes on income, from whatever source derived.” They insisted that the amendment is implicitly limited to “realized” income, meaning money that’s been paid out to individuals.

There are three problems with the case, best taken in reverse order. First: The 16th Amendment does not include a “realization” requirement. Congress has taxed unrealized gains since long before the 16th Amendment was ratified, and its drafters made an affirmative choice not to impose this limitation. Second: If the plaintiffs’ theory is correct, then “vast swaths” of the modern-day tax code are unconstitutional, as Kavanaugh pointed out. Myriad corporations and partnerships are “taxed on a pass-through basis”; that means the entity’s owners, typically shareholders or partners, pay taxes rather than the entity itself. And these owners pay taxes “on the income of the entity,” Kavanaugh wrote, “even if the entity has not distributed any money or property to them.” … Which brings us to the third flaw in Moore, unmentioned by the court but lurking, perhaps, in its highly skeptical analysis: The plaintiffs made up the facts of this case, stretching the truth far past its breaking point.’

Shady lawyers for rich people LYING in order to help their clients cheat on taxes? What will we tell the children?

Bruce Hall

June 20, 2024 at 2:49 pm

Ever notice how Brucie makes snide remarks to put forth incredibly dishonest claims. Yep the MAGA crowd wants us to believe spending under Biden has exploded. Well they are off by just one Administration. As of 2017QI, Trump inherited a Federal spending to GDP ratio of 21.74%. Four years later he left us with a Federal spending to GDP ratio = 36.15%. Facts you can look up using FRED even if Faux News and Bruce Hall routinely lie about this.

Three years later this ratio is back down to 23.35%. Maybe too high but a lot better than the disaster known as Trump fiscal policy. MAGA!

Mike Bloomberg gives $20 million to help Biden beat Trump

https://www.msn.com/en-us/news/politics/mike-bloomberg-gives-20-million-to-help-biden-beat-trump/ar-BB1oBKwU?ocid=msedgdhp&pc=U531&cvid=f4f286164ca54ba3b34d2c76cd5ec09b&ei=8

Former New York mayor Mike Bloomberg, the billionaire entrepreneur and former Democratic presidential candidate, has given nearly $20 million to help President Biden’s reelection effort, according to people familiar with the donations….Bloomberg, 82, who served three terms as the mayor of New York City, is the 15th wealthiest person in the world, according to Forbes magazine, with about $106 billion in assets, mostly through his privately-held financial services company, Bloomberg LP.

Bloomberg governed NYC as a moderate Republican who really favored the elite of Manhattan but other than that he was a decent mayor. Bloomberg as mayor of NYC knows Trump as well as anyone and he utterly despises the Orange Jesus. Of course any moral person with a brain would despise Trump.

David Kamin understands tax law – little Brucie Hall does not:

https://x.com/davidckamin/status/1803809971714630001

The Supreme Court today avoided undermining the income tax and rightly ruled against the Moores and a radical legal theory that could have handed corporations and high-income Americans a giant tax cut that Congress never legislated.

Kamin has more tweets on this ruling – not that a MAGA moron like Bruce Hall will bother to read them.

The barely veiled message from the Supremes in the mifepristone and Moore decisions is “Stop asking us to embarrass ourselves, you egotistical jerks!”

Terrible legal theory and scholarship from the Moores, no standing from the doctors in the mifepristone case. “Hand us a win because we’re special snowflakes” is symptomatic of the attitude in the echo chamber.

I dunno. Clarence Thomas embarrasses himself in such cases. Today the Supremes sensibly voted 8-1 that someone who routinely beats his wife or girlfriend could lose his right to own a gun. The one dissent? You guess it – Thomas!

AS: “Should taxpayers be able to deduct unlimited unrealized capital losses beyond any offset against gains?

This isn’t the problem you think it is. Most investors realize their capital losses all the time in order to reduce taxes. For many, it is standard practice to sell your losers at the end of the year or whenever there is a sharp market drop. So the current asymmetry is that investors do not realize their capital gains in order to avoid or defer taxes but readily realize their capital losses to reduce taxes. Taxing unrealized gains would even the score so that both gains and losses are accounted for contemporaneously.