The Harris Walz plan for reining in grocery prices appears to contain two components, one of which has attracted a lot of attention (stopping price gouging), while the second (antitrust against food processors) has garnered less criticism (see agenda here). While it might be the case that grocery store chains are exploiting some monopoly power, it’s not clear to me it’s the most important aspect of grocery price developments.

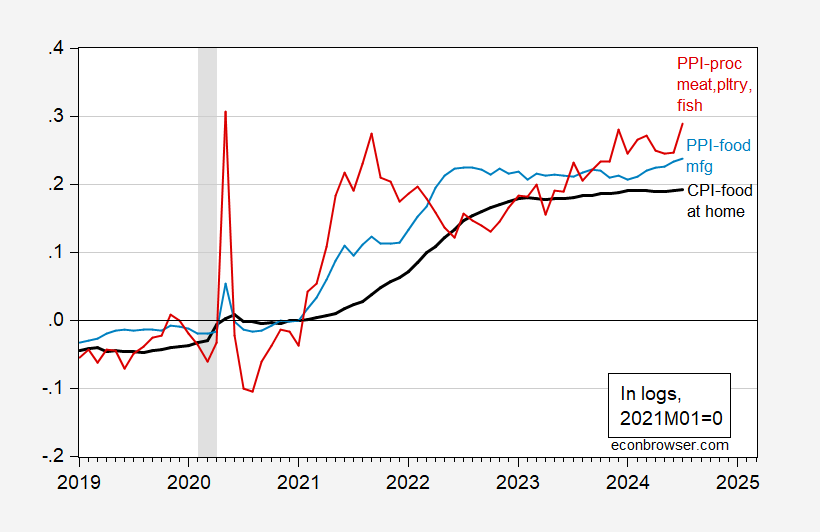

Here’s a picture of food-at-home retail prices vs. wholesale manufacturing food prices (as well as processed meat prices), all normalized in logs to 2021M01=0.

Figure 1: CPI food at home component (bold black), PPI food manufacturing (light blue), and PPI processed meats, poultry and fish (red), all in logs, 2021M01=0. NBER peak-to-trough recession dates shaded gray.

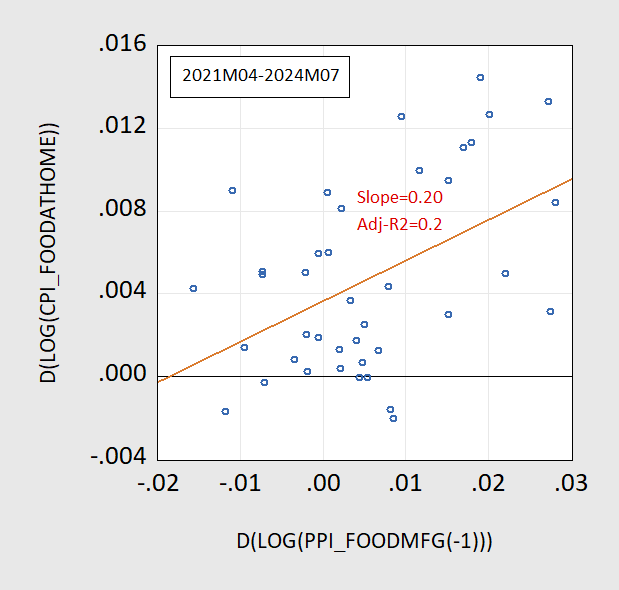

Note that processed meat prices jumped during the pandemic, partly because of the jump in wages (due in part to the pandemic induced constraints in labor supply). See how wages in food processing jumped as foreign born labor supply fell, here. Did the higher manufactured food prices “cause” the higher grocery prices? That’s a complicated question to answer. What one can say is that from the period a year after the NBER-defined trough, to 2024M07, a Granger causality test rejects the null hypothesis that changes in manufactured food prices don’t affect changes in the food-at-home component of the CPI at the 1% msl. The reverse fails to reject, at the 5% msl. Here’s a scatterplot of log first differences of CPI-food at home on lagged PPI-food mfg:

Figure 2: First log differences of CPI-food at home vs lagged PPI food mfg, and regression line.

Now, is the increasingly concentrated nature of the food processing at fault? As MacDonald, Dong and Fuglie, (2023) point out, it’s not clear, at least in the pre-pandemic period.

From the paper (p.36):

Meat and poultry processing industries were transformed as packers built large plants to achieve economies of scale. Processors also formed tighter linkages with a reorganized livestock production sector to assure a dependable supply of livestock to keep plants at near-full capacity. Those transformations led to striking increases in concentration, particularly in slow-growing pork and beef industries, while also leading to lower costs in livestock production and slaughter. However, while there were some significant mergers among processors, much of the growth in concentration came about from the construction of new, or the expansion of, existing plants by the large processors, rather than from mergers among rivals. Despite high levels of concentration, studies of cattle market pricing prior to 2010 found limited evidence of packer market power. Lower processing costs appeared to be largely passed to consumers, and the resulting increased demand for beef in turn led to higher cattle demand and prices. There have been fewer studies of poultry or pork markets, but those studies found only small or local effects from concentration on prices in those industries. However, developments since 2010, which show rising spreads between processor prices paid for livestock and received for meat, as well as new entrants to the industry, suggest that meatpackers now have been able to exercise greater market power over livestock prices than in earlier decades. New entry, and plant expansion among incumbent producers, will determine whether such market power can be maintained.

The offsetting effects from exploiting greater economies of scale vs. greater price power could lead to small increases or even net decreases in output prices. However, the imposition of tightly binding constraints from limited labor supply could change that balance.

Anti-trust actions are much less likely to have distortionary effects on food markets than outright price controls. In any case, it’s unclear to me that outright price controls are what the Harris-Walz campaign has in mind.

Opening paragraph spot on. Evidence – very informative. Closing – exactly right. Now if those lame reporters, lazy economists, and MAGA morons would try reading this post!

“However, developments since 2010, which show rising spreads between processor prices paid for livestock and received for meat, as well as new entrants to the industry, suggest that meatpackers now have been able to exercise greater market power over livestock prices than in earlier decades.”

Important. The impact of this market power was evident even before the greed inflation episode. I noted an interesting paper on this that was published in 2020. So this problem was known even when Trump was President but of course he had no interest in addressing it. Harris clearly does.

“…it’s unclear to me that outright price controls are what the Harris-Walz campaign has in mind.”

Yup. Which is what is so stupid about the Washington Post, CNN and company, launching criticism against a policy which doesn’t exist.

We have anti-gouging laws in a number of states already. Have we seen a flood of analysis regarding the burdens and benefits of these laws? Not really.

And we know the argument that sudden increases in margins represent a hedge against future increases in input costs. If that argument is legitimate, shouldn’t there be symmetry in the performance of margins? Shouldn’t retailers, wholesalers, whoever, sometimes err on the side of market share? If margins pretty much always rise in the face of supply problems, without a similar loss after the supply problem resolves, I think we have prema facie evidence of gouging.

Surely, unbiased observers would want to see full details before squealing “price cap”.

Look – Trump called her proposals price ceilings. Lying or just a simple minded dork? And if Trump said so – the sheep just fall in line. Never mind the economic literature have noted the market power of the food processing sector for a long time. Who reads economics in the first place?

“the argument that sudden increases in margins represent a hedge against future increases in input costs.”

John Cochrane in this 3rd long winded rant finally got around to actual economics trying to make this argument. Which is why I went back to the pre-pandemic period to check on his precious cost of capital excuse for profit margins. The cost of capital for food processing is estimated to be near 8% whereas the average return to assets for Tyson Foods is near 40%. Hey Johny boy – justify that!

Shawn Fain of the UAW had the best shirt last night:

Trump is a scab.

Dutch reagan used to say “as long as they spel my name right”

Hey troll – who let you out of your dungeon.

Grocery inflation is over

https://jabberwocking.com/grocery-inflation-is-over/

Kevin Drum tracks the prices of certain grocery items over the past 18 months. Some prices up slightly – some down. Something else you will not hear on Faux News.

They are trapping the inflation and food price increases issues by the ..neck. They use the anti-Wall Street anger to tap into a populist sentiment. This one will have legs politically regardless of its connection to economic reality. Much better than Trumps xenophobic tariff tropes. I look at this and think “that is brilliant”. Much like I look at Ukraine’s current move to entrap large numbers of Russian troops between the Sejm river and their border and thinking “man that is brilliant”.

Apparently, if you are growing apples, no one gets upset about your high profit margins.

https://www.macrotrends.net/stocks/charts/AAPL/apple/net-profit-margin

If one compares that to the meat processing industry.

https://www.meatinstitute.org/press/harris-proposal-price-gouging-misses-mark

But, hey, Apples are good for you; meat is bad for you… or so some would argue.

Look weasel. You have not read that paper I provided. You have not been honest in the least about this discussion where you do stupid and whiny hit and runs. And you want us to read even more of your worthless trash You are a lazy stupid joke. Your typical MAGA moron.

We all knew you were an utter moron but the profit margins of a company that may be called Apple but makes expensive smart phones? You win Brucie – dumbest troll ever!

That second link is such a pathetic joke. Yea – some lobbyist for JBS pulls this out “According to a New York University Study: net profit margins for food processors are a modest 6 percent”

I get that Bruce Hall is too dumb to realize that the website this pathetic lobbyist linked to was that of Aswath Damodaran but I rely on his data a lot. And this excellent finance professor would estimate that the cost of capital for this sector is near 8% whereas this 6% return to sales translates into a whopping 35 percent return to assets.

Now little Brucie needs to keep up with the conversation as Moses and I have been reading that trash from John Cochrane who in a lazy way framed this as a cost of capital issue. I did the hard work Cochrane refused to do properly using Damodaran’s excellent evidence to show that the companies in this sector make incredibly high returns to assets, which is a sign that they exploit market power.

Poor Brucie thinks he is refuting my case but if he had an IQ above the single digits, his pathetic link properly used makes me case in spades.

“Food prices continue to come down from the highs of the pandemic.”

And Bruce Hall along with his mentor Donald Trump have been telling us that these prices have quadrupled. Way to contradict your own spin Brucie.

Look – we’ve talked about this before. Your failure to read your own damn links is really embarrassing.

BTW – even if 2024 prices were lower than 2022 prices, that does not mean they are set competitively. But little Brucie would not know that as his knowledge of basic economics is ZERO.

“Food prices continue to come down from the highs of the pandemic.”

I read the USDA link and this is NOT what they said. It is true that the rate of change of food prices has moderated but is not zero. Confusion regards the price level v. the rate of change of the price level is something little Brucie boy has mastered so I can see why Brucie got all confused here.

” Contrast those low margins with the net profit margins of other industries like entertainment software, 20 percent, rail transportation, 23 percent and computers, 17.47 percent, just to name a few.”

Seriously – comparing the profit margins in the food sector to the profit margins for software and computers and capital intensive sectors like rail transportation? The only thing dumber would be confusing the high profit margin for Apple Computers and Smart Phones to the profit margins for fruit. Oh wait – Bruce Hall did that too!

I took a look at Damodaran’s income statement by sector and there are a host of issues with this lobbyist group’s 6% profit margin:

(1) First of all, it includes 82 companies which may not be a true reflection of the giant firms that dominate the market;

(2) The group reports net income/sales which deducts interest expenses and income taxes. Any reliable measure of pricing would focus on the operating margin which Damodaran reports as 10.79%. Big difference.

(3) Anyone with a brain (which excludes Bruce Hall) would realize that the asset to sales ratio for the food processing sector is very modest so what might appear to be a modest operating margin turns out to be a very high return to capital.

But this lobbyist group realized that the morons who would be citing their spin including Bruce Hall could be easily fooled. As Brucie was.

The race for the dumbest troll of 2024 has ended early. This comment seals the deal. Bruce Hall gets the GOLD!

Bruce Hall

August 20, 2024 at 6:14 am

Thanks little Brucie – you just made my day!!!

Poor little Bruce Hall thinks there are publicly traded companies that produce Apples whose operating margins are around 30% but our favorite MAGA moron produced a chart for the computer and smart phone company that happens to be called Apple. Yea – he is that dumb.

I tried to find publicly companies of fruits like apple but all I could find where cooperatives which are not publicly traded. Now the banana sector is dominated by a few very large multinationals such as Dole and this company. It does not look like to me that there profit margins are any where near 30%.

Fresh Del Monte Produce Operating Margin 2010-2024

https://www.macrotrends.net/stocks/charts/FDP/fresh-del-monte-produce/operating-margin#:~:text=Current%20and%20historical%20operating%20margin%20for%20Fresh%20Del,Produce%20as%20of%20June%2030%2C%202024%20is%202.25%25.

More fun facts from that Damodaran reporting of operating margins by sector which of course Bruce Hall cannot understand!

The operating margins for water utilities such as American Water Works are often higher than 30%. OMG Brucie – that is massive price exploitation – right? Oh wait this is a capital intensive sector where the tangible asset to sales ratio is often near 600%. Now everyone – let’s help little Brucie with the arithmetic and tell him if the return to capital is incredibly high.

BTW Brucie – Damodaran tells us that semiconductor companies often get nearly a 20% operating margin. Come on Brucie – are these capital intensive companies or not? Oh Brucie has no clue what I’m asking. Never mind!

Interesting link on “The Big Picture” to an article about how Reagan stopped enforce an anti-trust law and killed competition in capitalism.

https://pluralistic.net/2024/08/14/the-price-is-wright/#enforcement-priorities

No wonder that big money is trying to oust Lina Khan from the FTC (who is fighting to enforce anti-trust laws). The poor things may have to endure actual capitalism rather than just rake in the rewards of predatory capitalism.