From Saraiva/Bloomberg:

Goldman Sachs Group Inc. and Wells Fargo & Co. economists expect the government’s preliminary benchmark revisions on Wednesday to show payrolls growth in the year through March was at least 600,000 weaker than currently estimated — about 50,000 a month.

While JPMorgan Chase & Co. forecasters see a decline of about 360,000, Goldman Sachs indicates it could be as large as a million.

There are a number of caveats in the preliminary figure, but a downward revision to employment of more than 501,000 would be the largest in 15 years and suggest the labor market has been cooling for longer — and perhaps more so — than originally thought.

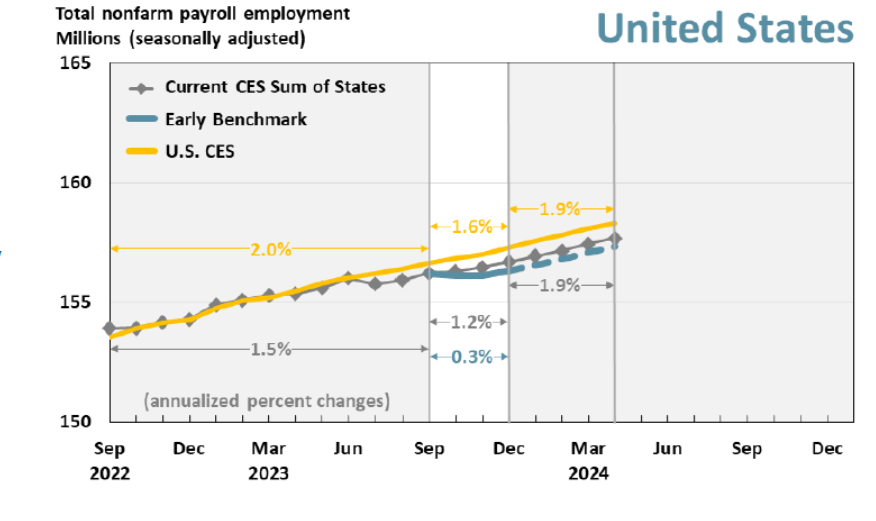

The Philadelphia Fed has an early benchmark series which uses QCEW and other data to do early benchmarks. The sum-of-states at the CES or early benchmark series do not necessarily equal the national CES NFP, but the Philadelphia Fed calculates the following:

Source: Philadelphia Fed.

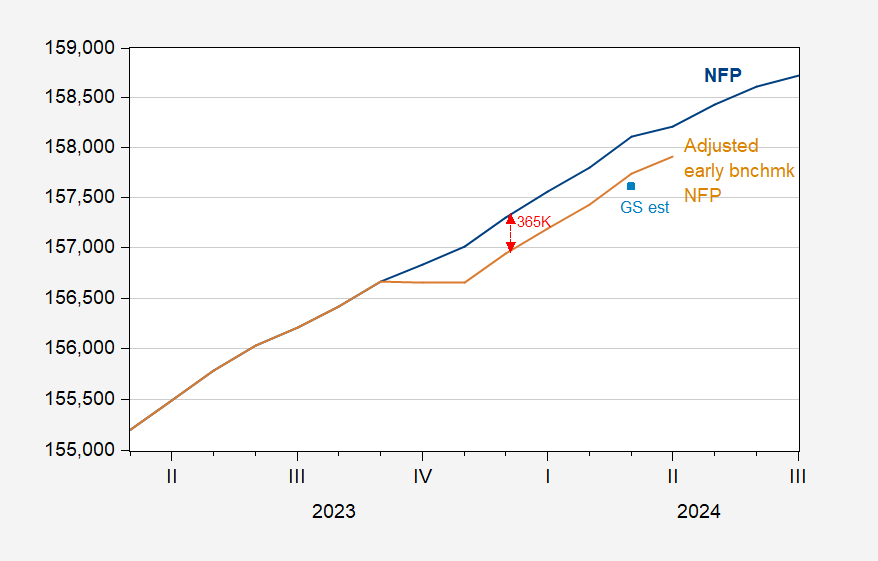

The Philadelphia Fed does not report the time series for EB NFP. I do my ad hoc adjustment using the ratio of CES sum of states to national, to generate an pseudo-national CES early benchmark.

Figure 1: Level of nonfarm payroll employment from CES (blue), from Philadelphia early benchmark (tan), Goldman Sachs estimate of preliminary revision (light blue). Early benchmark calculated using ratio of sum-of-states early benchmark to sum-of-states. Source: BLS, Philadelphia Fed, and author’s calculations.

The gap at December 2023 (the last available QCEW data) is 365K, and hence March 2024 is 365K (the early benchmark uses the reported increases in employment from January 2024-onwward).

The implied benchmark revision will “wedge in” the change in employment from the preliminary benchmark revision to the previous final revision (i.e., March 2022 to March 2023), and use the reported changes from April 2024 to through July 2024.

Will the Fed then revise the funds rate for the past year downward?

It’s just the nature of sampling and surveying.

https://paulvanderlaken.com/wp-content/uploads/2019/06/sampling_error_10.gif

I think I read about some politician saying up is not down and down is not up and we are up with getting on down to up… or something like that. So I guess down is not really down, it’s just not up up.

Goldman Sachs gets the gold star. House of Morgan gets whatever medal the Australian breakdancer did.

Downward revision of 818,000. The Fed has officially broken things now. 50bp reduction in September has to be the absolute minimum demanded by the peanut gallery at this point.