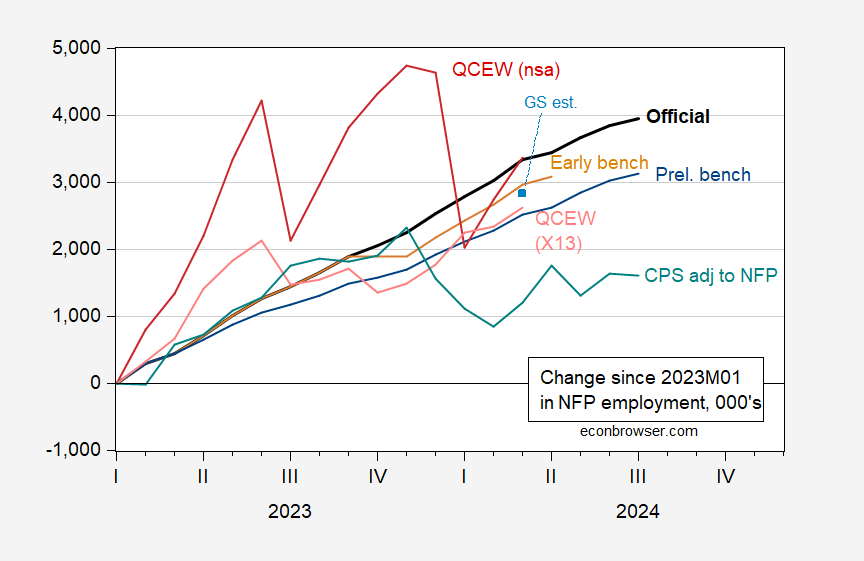

All show gains since January 2023, save the CPS based.

Figure 1: Cumulative change in NFP employment according to CES (bold black), implied preliminary benchmark (blue), early benchmark (tan), Goldman Sachs estimate (light blue square), CPS adjusted to NFP concept (teal), QCEW total covered, nsa (dark red), and QCEW seasonally adjusted by author using X-13 (in logs) (salmon), all in 000’s. Source: BLS via FRED, BLS, Philadelphia Fed, and author’s calculations.

Note that the CPS series adjusted to NFP will be downwardly biased if the overall CPS series is downwardly biased. This is likely the case, as discussed here.

so… not yet time to panic about recession, at least by NFP employment figures.

From that Dallas FED paper:

The current U.S. immigration surge is unprecedented. The influx flew under the radar for some time, dismissed simply as pent-up immigration from when the borders essentially closed during the pandemic. But this year’s Congressional Budget Office (CBO) budget and economic outlook brought new attention to the migrant inflow and its expected economic effects. By incorporating previously unavailable data on migration along the southwest border into the government’s economic and fiscal outlook, the macroeconomic implications of such high levels of migration come into focus. The labor force in 2033 will be larger by 5.2 million people, mostly because of higher net immigration, according to CBO estimates. As a result of the immigration surge, GDP will be higher by about $8.9 trillion and federal government tax revenues by $1.2 trillion over the 2024-34 period. Deficits will be lower by $900 billion.

It’s funny how people of Faux News cherry pick numbers. Team Trump wants to pretend immigration is huge. But they want to cite labor growth figures that ignores all of that. And of course any benefits to real GDP and tax revenues cannot be from BROWN people taking jobs but they can be due to giving billionaires more tax cuts.

[ Golf gallery applause to Orrenius and to Menzie for guiding us to the deeper insight ]

Hmmm…… Seems there IS a reason they hand out those PhDs so sparingly. OK, who is going to break the news to Kopits and Stryker??

Damnded-durnded Puh-huds!!!!

Good news regarding rents and anti-trust enforcement:

DOJ alleges RealPage, landlords coordinated to raise millions of rents

https://www.msn.com/en-us/news/us/doj-alleges-realpage-landlords-coordinated-to-raise-millions-of-rents/ar-AA1pjXE3?ocid=msedgdhp&pc=U531&cvid=03a13bcb523c4aa2857c46067974512e&ei=8

The Justice Department and attorneys general from eight states filed a lawsuit Friday alleging a Dallas company, RealPage, collected sensitive information from landlords nationwide that allegedly made it easier for them to coordinate and raise prices for millions of renters nationwide. RealPage provides software to landlords to help manage 16 million rental units nationwide, largely in the Sun Belt and South. The federal lawsuit filed in North Carolina alleges RealPage holds a monopoly in what is called “revenue management software” for landlords because the company controls 80% of the market nationwide. The lawsuit contends that by sharing sensitive information from landlords about rents, leases and vacancy rates, RealPage helps them collude to avoid competition and raise prices. Without RealPage’s information and recommendations about the rents that competitors are charging and the vacancies that are available, landlords are able to charge higher prices or avoid offering concessions such as a month without rent, according to the lawsuit.

Do not be surprised when Steve Koptis defends this abuse of “revenue management software” the same way he defended price collusion in the oil sector. And of course Bruce Hall will tell us rents are not very high. MAGA!

Justice Department Sues RealPage for Algorithmic Pricing Scheme that Harms Millions of American Renters

https://www.justice.gov/opa/pr/justice-department-sues-realpage-algorithmic-pricing-scheme-harms-millions-american-renters

RealPage’s Pricing Algorithm Violates Antitrust Laws

The Justice Department, together with the Attorneys General of North Carolina, California, Colorado, Connecticut, Minnesota, Oregon, Tennessee, and Washington, filed a civil antitrust lawsuit today against RealPage Inc. for its unlawful scheme to decrease competition among landlords in apartment pricing and to monopolize the market for commercial revenue management software that landlords use to price apartments. RealPage’s alleged conduct deprives renters of the benefits of competition on apartment leasing terms and harms millions of Americans. The lawsuit was filed today in the U.S. District Court for the Middle District of North Carolina and alleges that RealPage violated Sections 1 and 2 of the Sherman Act.

The complaint alleges that RealPage contracts with competing landlords who agree to share with RealPage nonpublic, competitively sensitive information about their apartment rental rates and other lease terms to train and run RealPage’s algorithmic pricing software. This software then generates recommendations, including on apartment rental pricing and other terms, for participating landlords based on their and their rivals’ competitively sensitive information. The complaint further alleges that in a free market, these landlords would otherwise be competing independently to attract renters based on pricing, discounts, concessions, lease terms, and other dimensions of apartment leasing. RealPage also uses this scheme and its substantial data trove to maintain a monopoly in the market for commercial revenue management software. The complaint seeks to end RealPage’s illegal conduct and restore competition for the benefit of renters in states across the country.

“Americans should not have to pay more in rent because a company has found a new way to scheme with landlords to break the law,” said Attorney General Merrick B. Garland. “We allege that RealPage’s pricing algorithm enables landlords to share confidential, competitively sensitive information and align their rents. Using software as the sharing mechanism does not immunize this scheme from Sherman Act liability, and the Justice Department will continue to aggressively enforce the antitrust laws and protect the American people from those who violate them.”

“Today’s complaint against RealPage illustrates our corporate enforcement strategy in action. We identify the most serious wrongdoers, whether individuals or companies, and focus our full energy on holding them accountable,” said Deputy Attorney General Lisa Monaco. “By feeding sensitive data into a sophisticated algorithm powered by artificial intelligence, RealPage has found a modern way to violate a century-old law through systematic coordination of rental housing prices — undermining competition and fairness for consumers in the process. Training a machine to break the law is still breaking the law. Today’s action makes clear that we will use all our legal tools to ensure accountability for technology-fueled anticompetitive conduct.”

“RealPage’s egregious, anticompetitive conduct allows landlords to undermine fair pricing and limit housing options while stifling necessary competition,” said Acting Associate Attorney General Benjamin C. Mizer. “The Department remains committed to rooting out illegal schemes and practices aimed at empowering corporate interests at the expense of consumers.”

“As Americans struggle to afford housing, RealPage is making it easier for landlords to coordinate to increase rents,” said Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division. “Today, we filed an antitrust suit against RealPage to make housing more affordable for millions of people across the country. Competition – not RealPage – should determine what Americans pay to rent their homes.”

The complaint cites internal documents and sworn testimony from RealPage and commercial landlords that make plain RealPage’s and landlords’ objective to maximize rental pricing and profitability at the expense of renters. For example:

RealPage acknowledged that its software is aimed at maximizing prices for landlords, referring to its products as “driving every possible opportunity to increase price,” “avoid[ing] the race to the bottom in down markets,” and “a rising tide raises all ships.”

A RealPage executive observed that its products help landlords avoid competing on the merits, noting that “there is greater good in everybody succeeding versus essentially trying to compete against one another in a way that actually keeps the entire industry down.”

A RealPage executive explained to a landlord that using competitor data can help identify situations where the landlord “may have a $50 increase instead of a $10 increase for the day.”

Another landlord commented about RealPage’s product, “I always liked this product because your algorithm uses proprietary data from other subscribers to suggest rents and term. That’s classic price fixing…”

The complaint alleges that RealPage’s agreements and conduct harm the competitive process in local rental markets for multi-family dwellings across the United States. Armed with competing landlords’ data, RealPage also encourages loyalty to the algorithm’s recommendations through, among other measures, “auto accept” functionality and pricing advisors who monitor landlords’ compliance. As a result, RealPage’s software tends to maximize price increases, minimize price decreases, and maximize landlords’ pricing power. RealPage also trained landlords to limit concessions (e.g., free month(s) of rent) and other discounts to renters. The complaint also cites internal documents from RealPage and landlords touting the fact that landlords have responded by reducing renter concessions.

The complaint separately alleges that RealPage has unlawfully maintained its monopoly over commercial revenue management software for multi-family dwellings in the United States, in which RealPage commands approximately 80% market share. Landlords agree to share their competitively sensitive data with RealPage in return for pricing recommendations and decisions that are the result of combining and analyzing competitors’ sensitive data. This creates a self-reinforcing feedback loop that strengthens RealPage’s grip on the market and makes it harder for honest businesses to compete on the merits.

RealPage Inc., is a property management software company headquartered in Richardson, Texas.

Grocery Price Inflation Has Cooled Substantially

https://www.whitehouse.gov/cea/written-materials/2024/06/20/update-grocery-price-inflation-has-cooled-substantially/

Interesting post from June 20 especially figure 1:

To assess the pressure of high grocery prices on family budgets, we examine their magnitude relative to household paychecks. Figure 1 shows how many hours of work it takes for an average, non-managerial worker to buy a typical week’s worth of groceries. Because real wages have been rising as grocery inflation has been falling, this measure is down over the past year and is roughly back to the number of hours it took in 2019 (3.6 hours), and still a bit below the 2015-2019 average.

The last paragraph of that June 20 CEA blog post on grocery prices:

‘as shown in the last figure, markups in the grocery sector—the prices charged above operating expenses—rose after COVID and have remained high whereas other retailers’ margins have reverted back down to pre-pandemic levels. As the economy continues to normalize after COVID, there is still room for margins in this sector to recede, and for those lower markups to be passed along to consumers in the form of further grocery price relief for American households.’

I was trying to understand what this figure 4 was showing and it hit me that this is a use of what transfer pricing geeks called the Berry ratio. Defenders of grocery stores will try to tell you they get between 1 cents to 2 cents on the dollar, which is their operating margin. Gross profits cover operating expenses plus operating profits. Most grocery stores tend to have operating expenses near 25% of sales so a 1% to 2% operating margin translates into gross margins between 26% to 27%. Or in terms of markups over operating expenses, we are in the 4% to 8% range.

Yea not that complicated even if we are now WAY over Bruce Hall’s little brain. I would have Steve Koptis explain this to Brucie since little Stevie claims he worked for Deloitte-Hungary. But we have seen his writings and this is over his head too. But I digress.

It turns that Safeway had an operating margin near 1.5% in the years before Kroger bought them out, which is akin to a 6% markup over operating expenses. Now this giant set of chains publicly traded as Kroger had $150 billion in annual sales with an operating margin near 2.5%. And it is trying to merge with Albertson whose operating margin has been over 2.9% over the 2021 to 2023. No wonder the FTC wants to prevent this merger. Of course, the Tree Stooges known as Donald Luskin, Bruce Hall, and Steve Koptis see no problem with anti-competitive mergers and high prices for groceries. MAGA!

Someone gets the Harris plan to control food prices!

https://abcnews.go.com/Business/harris-plans-tackle-inflation-economists-fight/story?id=112944307

While acknowledging the difficulty of achieving overall price decreases, some economists noted a potential for price reductions in certain industries, especially the food and grocery sector targeted by Harris’ proposals. Harris points to the market power of large corporations in the grocery industry as a key cause of rapid price increases for food, saying companies use their outsized role to raise prices without fear of a competitor offering a comparable product at a more affordable price. Consumers, the Harris campaign says, are left with nowhere to turn. “Extreme consolidation in the food industry has led to higher prices that account for a large part of higher grocery bills,” the campaign said in a statement on Friday.

Dan Scheitrum, a professor of agribusiness at California Polytechnic State University, San Luis Obispo, said Harris’ plan to crack down on potential anti-competitive practices within the food sector could end up lowering prices for some household staples. “If price fixing is taking place and it gets addressed, I expect that could undo some of the price increases,” Scheitrum said.

But weren’t we being told by the Johnny “Grumpy” Cuckrants of the world that landlords were like “small businessmen” and there was no way local landlords could be colluding with one another to set market prices??? Gosh, Johnny Cuckrant isn’t lying to his readers/students is he?!?!?! Naaaaaaahh!!!!!

Well RealPage says it was the local landlords who set prices, not RealPage. The landlords were just paying RealPage to know if the AFC or the NFC was going to win the Pro Bowl this year, not manipulate the market price together. Geez, can’t American landlords even play fantasy football?? Johnny Cuckrant says we’re going back to late 3rd century Rome and Diocletian coins if we do this, Cuckrant did a matrix that shows if we stop market collusion America has to switch to Diocletian coins, and stuff. Can’t you people see that?!?!?

There are two pretend economists who clearly know nothing about market structures aka the economics of anti-trust. Cochrane of course but also Donald “I want to pay more for ice cream” Luskin.

Don’t forget to get your free copy of Johnny “Grumpy” Cuckrant’s latest book, before his publisher slaps your hand. That huge amount of unintentional and ironic humor is hard to find in a single book.

And don’t bother to correct Cuckrant’s errors in fact as you skim through. You’ll fall behind on 6 months worth of your TBR list

This article might be very eye-opening to those who falsely believe that Netanyahu puts any value at all to Israeli lives, when those Israeli lives conflict with Netanyahu continuing on with his corrupt government post:

https://www.nytimes.com/2024/08/22/world/middleeast/israeli-hostages-autopsies.html

Let’s go down to the sixth paragraph, shall we??:

“How and when the hostages died has been a matter of contention. Hamas has blamed the deaths on Israeli strikes, and the Israeli military has acknowledged some of them likely died while Israel was carrying out military operations in the area where they were found. Some Israel new outlets reported the hostages may have suffocated when the tunnel filled with toxins after an airstrike”

Aaawwwww, yes, Netanyahu “loves” the Jewish peoples. So dearly…….

Loved those Jews so much he gassed them.

I was kinda thinking that same thing, but…….. I guess the more accurate way to express it in my opinion would be, “How do your own citizens become collateral damage in an incited invasion??”

Even for Fox news and Maria this one is over the top.

https://www.mediamatters.org/fox-business/maria-bartiromos-wild-and-kind-racist-election-conspiracy-theory-collapses-immediately

Long lines at the DMV is standard everywhere. But presuming that the brown people there are “illegals” is very racist and a big problem for all brown skinned citizens of this country.

Adding to this are absurd postulates (without even attempting any kind of journalistic process of verification) that there were tents for “illegals” to be getting social security numbers and voter registration there too.

All of this made-up BS apparently came from the wife or a friend of a friend – classic news sources for classy news operations. But no surprise since the dominion lawsuit revealed that the threshold for a story getting on Fox is not verified facts, but whether it will spike up the ratings.

I really strongly dislike that woman. That’s all I’m gonna say right now or Menzie’s finally gonna get fed up with my vulgarity. I’m probably a millimeter short of getting banned as it is. I mean, I try to do it like David Letterman did/does it (now on The Barbara Gaines Show), just giving guff to people who deserve it.

“Others who saw Bartiromo’s initial X post did what she apparently failed to do and tried to confirm her story.”

Cardinal rule among real reporters. Confirm your story before running it. Maria Bimbo is not a real reporter even though she is a flaming racist.

After all the lies about what Kamala is going to do to keep corporations honest, it is nice to see at simple and truthful explanation of her proposal.

https://www.thebignewsletter.com/p/monopoly-round-up-price-gouging-vs

Would have been nice if this had been done by legacy media. But I guess they are not in the business of keeping people informed. Loved the suggestion that maybe a lot of economists are just angry that she busted into their club. Fact is she is just tightening up something that used to be tightened up but was allowed to run its own destructive path for too long.

Most of Matt Stoller’s writings are pretty good, that I remember anyway.

Stoller’s discussion is informed and honest with lots of links to useful information. I plan to read those links so thank you.

Now you might wonder how many of these links Bruce Hall will bother to read. That’s a simple question as the answer is zero.

His first link mentioned only two economists. I read what Rogoff wrote and noted it was a sad misunderstanding of the proposals. On Furman – it turns out back in the summer of 2018 he presented evidence to an OECD committee that suggested market power in the US had risen.

https://x.com/ernietedeschi/status/1824095352775213457

“One thing that’s been notable about grocery stores during the pandemic is that their earnings behavior has been empirically different from the rest of retail. Whereas margins in other retail popped fast then came back down, grocery margins slowly rose & have stayed stubbornly high”

His chart was also presented by the White House economist blog. Properly defined it is gross margin/operating expenses minus one aka a markup over operating expenses and not an operating margin. Sorry for this nit pick but come on people – learn to write.

“Two weeks ago, the Antitrust Division filed a complaint against a firm called Agri Stats, which sells data and consulting services to the processors that dominate the poultry, pork, and turkey industry. The claim in the case is that Agri Stats was a coordinator of pricing, serving as a clearinghouse where it would collect and share granular pricing, wage and production data for all major meatpackers. Agri Stats also sold consulting services, which one executive at Smithfield, a pork processor, summarized with four words: “Just raise your price.”

I did know that. It adds to the discussion regarding market power among the meat processors. Then again Bruce Hall has told us that he does not think returns to capital exceeding 30% is any sign of market power while Steve Koptis applauds such price collusion especially in the oil sector.