Today, we present a guest post written by Charles Engel, Donald D. Hester Distinguished Chair in Economics at UW Madison and Steve Pak Yeung Wu, Assistant Professor of Economics at UCSD.

It is generally believed that standard macroeconomic empirical models of foreign exchange rates do not fit the data well. (See for example, Meese and Rogoff (1983), Cheung, et al. (2005), and Itskhoki and Mukhin (2021).) However, we find that these models fit very well for the U.S. dollar in the 21st century. A “standard” model that includes real interest rates and a measure of expected inflation for the U.S. and the foreign country, the U.S. comprehensive trade balance, and measures of global risk and liquidity demand is well-supported in the data for the U.S. against other G10 currencies. The “monetary variables” (that is, real interest rates and expected inflation) and non-monetary variables play equally important roles in explaining exchange rate movements. In the 1970s – early 1990s, the fit of the model was poor, but the model performance has improved steadily to the present day. We make the case that it is better monetary policy (inflation targeting) that has led to the improvement, as the scope for self-fulfilling expectations has disappeared. We provide a variety of evidence that links changes in monetary policy to the performance of the exchange-rate model.

The link to the working paper is here. This note leaves out the technical details and references to the literature, which are in the paper. We examine the determinants of the dollar relative to the euro, the U.K. pound, the Canadian dollar, the Australian dollar, the New Zealand dollar, the Norwegian krone, and the Swedish krona. The Japanese yen and Swiss franc are special cases which we address separately.

The empirical model links changes in bilateral monthly exchange rates to:

- Real interest rates in the U.S. and the “foreign” country. Most macro models of exchange rates posit that a higher real interest rate induces a stronger currency. An increase in the U.S. real interest rate leads the dollar to appreciate, and a higher foreign real interest rate is associated with a dollar depreciation.

- Inflation. Perhaps paradoxically, higher inflation in the U.S. should lead to a dollar appreciation (and higher foreign inflation to a dollar depreciation.) This is the conclusion of the New Keynesian macroeconomic paradigm when monetary policy is credible. Higher inflation (over the past year) leads central banks that target inflation to tighten. Since we already control for real interest rates, which are determined by the current stance of monetary policy, this channel captures expectations of future monetary policy actions.

- Trade balance on goods and services in the U.S. As the trade deficit increases, the U.S. net foreign asset position deteriorates. Especially in the early 21st century, markets became concerned that policies would be undertaken to weaken the dollar to reduce the value of external debt, so higher trade deficits are associated with a depreciating dollar.

- Global risk. The dollar is considered a “safe-haven” currency. During times when global risk is high (as measured here by bond market spreads), the dollar strengthens.

- Liquidity. Also, during times of global stress, markets increase demand for dollar liquid assets. As that demand rises, the “convenience yield” on U.S. Treasury assets increases, and the dollar appreciates.

- Purchasing Power Parity. When the relative purchasing power of the dollar is very misaligned, there is a (weak) tendency to return to the PPP level.

Model Estimation

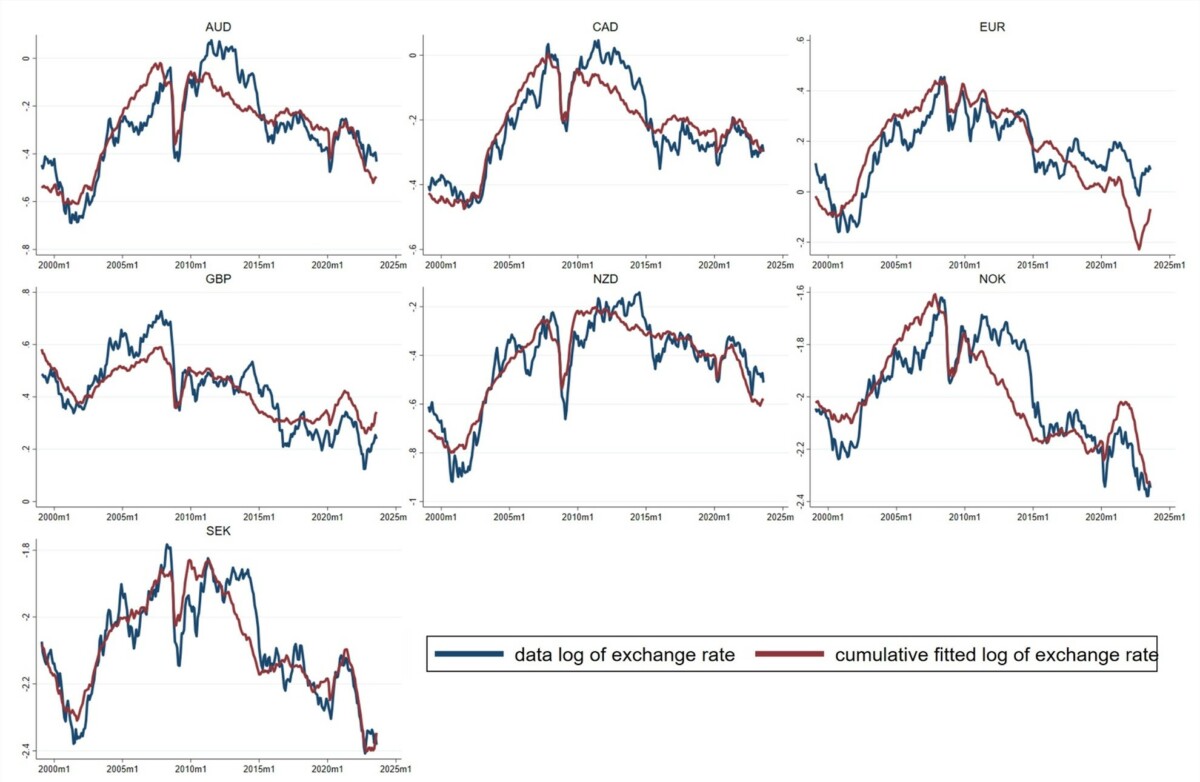

The model is estimated currency-by-currency and also jointly by panel estimation. The macro variables generally have the sign and magnitude consistent with economic theory and are usually quite statistically significant when estimated over the January 1999 to August 2023 period. (The starting point here is chosen because it corresponds to the advent of the euro.) Figure A shown here plots the “fitted values” of the model against the actual exchange rate.

Specifically, since the model is estimated for the monthly change in the exchange rate, the fitted value for the levels that is plotted here cumulates the model’s estimated change each month to produce the model’s fit for the level of the (log of) the exchange rate. The initial value in the cumulation is chosen to make the overall average of the fitted values equal the overall average in the data.

One thing to be very clear about here is that we are not forecasting exchange rates. The empirical model uses data from, for example, January 2000 to explain the January 2000 exchange rate. Even if the macroeconomic models of exchange rates are good models, they probably are not useful models for forecasting. Mostly, exchange rates change from month to month because of unanticipated changes in explanatory variables. But these unanticipated changes cannot, by definition, be forecast, so forecasting the change in exchange rates becomes very difficult even with the best model in hand.

The Model Fits

Turning to Figure A, taking the euro exchange rate as an example, the fitted values reproduce well the initial appreciation of the U.S. dollar from 1999-2000, followed by the depreciation of the U.S. dollar from 2001 to 2008. The fitted series also matches the sharp appreciation of the U.S. dollar in 2008, 2010, and 2013. Both the data and the fitted series exhibit an appreciation of the dollar from 2013 onwards. The model- implied series also fits the pattern post-2020 very well, mimicking the V-shape from 2021 to 2023. The close correspondence between the red line and the blue lines holds for all other currencies in different sub-periods between 1999 and 2023.

Figure A: Comparing data and model implied exchange rates

The Fit has Improved over Time

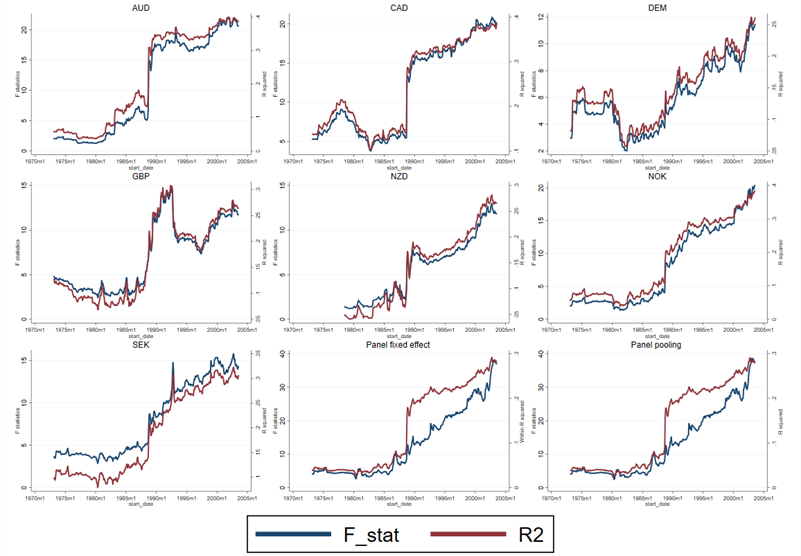

But the model did not fit over earlier samples. We document this by estimating the model over 20-year rolling samples beginning in 1973. In the earlier samples, the fit was poor – the variables are usually statistically insignificant; sometimes when they are significant, they have the wrong sign; and the R-squared values are low. F-tests of the joint significance of the explanatory variables fail to reject the null. But there is a near-monotonic increase in the F-statistics and R2s as the samples progress in time, and these statistics essentially reach their maximum in the final 20-year sample. Figure B plots the R-squared and F statistics over time from these rolling regressions. It shows that the models fit poorly in the early samples, but that the fit has steadily improved.

Why the Model Didn’t Work in the Old Days

What accounts for the poor fit of the models in the earlier period, and the excellent fit now? We argue that a change in monetary regime may explain this. As we show, economic theory implies that when central banks do not follow a credible inflation-targeting policy, there is scope for self-fulfilling expectations to influence variables in the economy, including inflation, output, and exchange rates. Intuitively, suppose markets conjure up a belief that inflation will be higher. If central banks do not respond forcefully enough to this change in expectations, real interest rates will fall. That will stimulate aggregate demand, lead to inflation and a weaker currency. We contend that as credibility increased, this phenomenon decreased, and the fit of the standard model improved. When monetary policy is credible, an expectation of inflation whipped up out of thin air will not be sustained because tighter monetary policy will quickly be seen to eliminate the likelihood of future inflation.

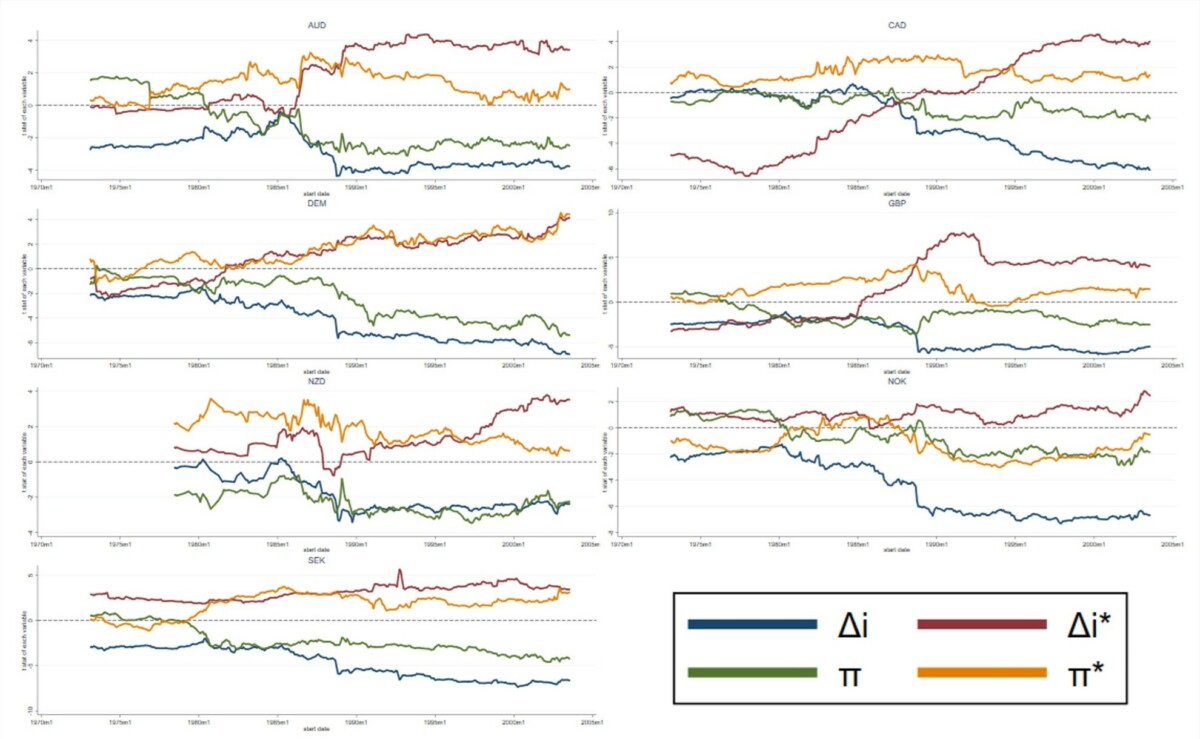

That the improvement in fit is related to the monetary variables is evident in Figure C, which plots the t-statistics for the real interest rate variables (Δi, Δi*) and the measures of inflation (π and π*) from rolling 20-year regressions. The t-statistic measures the contribution of the variable (the estimated regression coefficient) scaled by the precision of the estimate (the inverse of the standard error of the estimate), so it gives us a good idea of how important each variable is in explaining exchange rate movements. In these graphs, if the theory is correct, the t-statistics should be negative for the U.S. interest-rate and inflation variables and positive for the foreign variables. Values that are above roughly 2.0 are statistically significant. We can see from Figure C, with a few exceptions, that the variables were rarely significant in the early part of the sample and often had the wrong sign, but in the later samples, they have the right sign and are significant.

The interest rate and inflation variables are important because they indicate whether monetary policy exchange rates are responding to credible monetary policies. If policies are credible, higher real interest rates should make the currency stronger, and higher inflation should signal future policies will be tighter and also will appreciate the currency. That pattern does not hold in the earlier samples but does in the later samples.

Figure B: F-statistic and R-squared of 20-year rolling window regressions

Figure C: t statistics of 20-year rolling window regressions

Monetary policy for the U.S. began to shift during the Volcker era, so that Taylor rules estimated on data beginning in the mid-1980s offer support for monetary stability. The advanced countries in our sample adopted inflation targeting a few years later: New Zealand in 1990, Canada in 1991, the U.K. in 1992, Sweden and Australia in 1993, Norway in 2001. One of the pillars of European Central Bank policy, beginning in 1999, is inflation targeting. Germany formally adopted inflation targeting in 1992 before the advent of the euro, though targeting inflation was always at the core of Bundesbank policy.

The paper produces further evidence to support the shift in monetary policy in these countries and its gradual increasing credibility. The important contribution here is that the success of the empirical model does not depend entirely on the risk and liquidity variables, which are important in tracking the movements of the dollar during times of global financial stress. The variables that represent the stance of monetary policy in the U.S. and the other countries are key to accounting for the good fit of the model today and its poor fit in the past. It is natural to attribute this change over time to the changing nature of monetary policy.

Empirical Exchange Rate Models are Better than You Think

Obviously, the fit of the model is not perfect. There may indeed be other factors driving exchange rates, including non-market “noise trading” that has been emphasized in some recent studies. However, it is likely that a major reason the fit is not perfect is because economists cannot perfectly measure the variables that theory says should drive the exchange rate: the stance of monetary policy, the level of global risk, the demand for liquidity, etc. Figure A certainly shows that the empirical model is able to capture major factors driving dollar exchange rates.

This post written by Charles Engel and Steve Pak Yeung Wu.

I’m happy if vs models have improved, but that’s not what caught my attention.

The internet, TV, “influencers” and other denizens of the intellectual wasteland share a marketing trick. They assume ignorance on our part, and pretend to know the exact state of that ignorance:

“What everybody gets wrong when they file their fingernails.”

“You’re eating pizza wrong.”

“What nobody understands about sharpening chop sticks.”

“What you’re doing wrong when buttoning a shirt.”

“Why 98% of flute repairs don’t last.”

“The absurd error all of you morons make but that I don’t make when opening milk cartons because I’m the Einstein of mundane tasks!”

Bad enough they do it. Now academics are doing it, too. The authors don’t know what I think about exchange rate models.

End of rant.

Most phenomena are “able to be captured” after the fact. When an economics prof can do this predicting currency movements before the fact, I’ll be happy to read the screed, however long and unwinding off the scroll. Otherwise……..

“Yesterday lunchtime was sunny…… after much concentrated and protracted contemplation, we deem it was because time of day, and lack of clouds”

Thanks Biffy.

Methinks that while the authors have declined to forecast using their model, they have provided a forecasting tool to others.

Everybody and his coon dog publishes economic and financial forecasts. Using those forecasts as inputs, this model should allow exchange rate forecasts that are consistent with the inputs. That’s often what’s done anyway, and if this model is a better explanation of exchange rate determination, it’s probably an improvement over current practice for many forecasters.

Problem is, an exchange rate forecast based on other forecasts is only as good as the other forecasts.

Off-topic, with apologies to the post authors

Reading today’s hardcopy WSJ They have an early list for Harris’s White House staff contenders. Not impressed with nearly the ENTIRE list with the exception of Sally Yates. Neera Tanden for HHS Secretary?!?!?!!? Are you F**king kidding me!!?!?!?!? We’ve seen that film before and how it ends. Does she think Bernie Sanders is going to forget her violence (literal physical violence) to his staff?? Her own party doesn’t even like her. Please Kamala please, prove to me you are even more shallow/slow-witted than I think you are and nominate Neera Tanden for HHS head. I wanna watch this house of horrors go down in the Senate AGAIN. A person cannot have enough laughs really can they??? C-Span, you’re gonna soon be my new favorite channel when they nominate Neera “Troll Nightmare” Tanden. I can’t wait.

https://www.businessinsider.com/biden-neera-tanden-omb-cap-sexual-harassment-punched-reporter-2020-11

Tanden is very much a part of the Democratic Leadership Council, legacy neo-liberal crowd among Democratic Party insiders. She has declined to support a minimum wage increase, suggested reducing Social Security benefits and has a questionable record on organized labor.

Everybody at her level has both political and policy skills. Her strong suit appears to be politics, and by choice. She judges policy according to political expediency, rather than seeing politics as a means to good policy. It’s an understandable posture to adopt, one sometimes chosen by, for instance, Larry Summers. By contrast, ya don’t see Lina Khan leaning that way.

It’s Wall Street Journal – they will say whatever makes people upset with Kamala. She has not made any choices except vice President at this point in time. WSJ is just pulling your chains uncle Moses.

Possibly. I will concede that is a possibility I am having my chain yanked (not terribly hard to do on certain topics).

But I think WSJ’s journalism is miles ahead of their editorial page. And I don’t think they pulled those names out of thin air. How much of this is true “the talk around the campfire” and how much is it folks in the White House pushing their own friends/cronies?? I would guess 60/40. But you know Machiavelli warned leaders to avoid flatterers. And most politicians are horrible at avoiding flatterers. Hillary Clinton is in this group. Biden is in this group (I would argue to a lesser degree, hence his forgoing the race). And Harris is in this group (high staff turnover for her, since she was made a fool of on the immigrant problem). Harris loves flattery. that’s how Neera Tanden’s name keeps popping up, though she has ZERO accomplishments other than fundraising from Saudis and other odorous tribes. She is an exceptional butt-sniffer.

Possibly. I will concede that is a possibility I am having my chain yanked (not terribly hard to do on certain topics).

But I think WSJ’s journalism is miles ahead of their editorial page. And I don’t think they pulled those names out of thin air. How much of this is true “the talk around the campfire” and how much is it folks in the White House pushing their own friends/cronies?? I would guess 60/40. But you know Machiavelli warned leaders to avoid flatterers. And most politicians are horrible at avoiding flatterers. Hillary Clinton is in this group. Biden is in this group (I would argue to a lesser degree, hence his forgoing the race). And Harris is in this group (high staff turnover for her, since she was made a fool of on the immigrant problem). Harris loves flattery. that’s how Neera Tanden’s name keeps popping up, though she has ZERO accomplishments other than fundraising from Saudis and other odorous tribes. She is an exceptional butt-sniffer.

Robert Kennedy Jr. has quit his campaign and endorsed Trump. Other Kennedys have called this a betrayal of their family legacy.

Kennedy has averaged a 4.6% voter share in recent polling, according to 538. Harris leads Trump in recent polls by an average of 3.7%. If all of Kennedy’s supporters were to vote for Trump, it could easily swing the election. Odds are very much against all of Kennedy’s supporters voting for Trump, since part of Kennedy’s appeal was that he isn’t Trump.

Couple of points about recent polls, as tracked by 538. Many of them don’t include Kennedy. Among those that do, since August 18, adding Kennedy’s share to Trump’s is never enough to give Trump a higher share than Harris. Harris has been gaining against Trump in polling since the 18th.

Polling results are all in a very large cocked hat these days, so what I’ve written here suggests unrealistic precision. What’s obvious is that Kennedy has given Trump a slight lift, that this is probably going to be treated as good news for Trump in the press, which also a lift for Trump, and that the election remains too close to call.

I don’t mean to imply I sat there 6 hours hunting. But I gave the site a pretty good run-through, nowhere on the site can I find a compiling (are readers supposed to add it up themselves candidate-by-candidate??) of where 538 sees Senate majority going after November??? R or D??

Here ya go:

https://www.270towin.com/2024-senate-election-predictions/

Currently 59 R, 48 D.

Sounds about right.

Now, I hope that it’s wrong, but how do they think the 2nd running up the flagpole of Tanden is apt to go??

3 stooges comedy will ensue, and they’ll run Harris over hot coals. And she’ll deserve it if she pulls that one. Pure idiocy.

Aaaaaaw, brings back sweet memories of some foolish submissive Mormon licking someone’s loafers.

https://images.app.goo.gl/aec65ZRHDtwaxzWm7

Still didn’t get that Secretary of State job did he?? And RFK Junior thinks what?? Hoffa said his dad was a piece of crap. Apple didn’t fall very far from the tree, did it??

Powell at Jackson Hole:

“The time has come…”

“We will do everything we can to support a strong labor market as we make further progress toward price stability.”

Futures have priced in modest downward adjustment to expected fed funds rates, but not enough to change the central estimate for any meeting this year.

Ten year Treasury yield are down 7 basis points on the day.

Back to transitory inflation.

As in the past the federal reserve is for “stability” going in to November, every four years.

Running the economy like an F-16, fly by wire always on the brink of losing control.

Both sides can cast blame on the Fed.

Aug 22 report, balance sheet reduced by $35 billion.

Kevin Philip is annoyed!

https://www.nationalreview.com/corner/trumps-abandonment-of-pro-lifers-is-complete/

Trump’s Abandonment of Pro-Lifers Is Complete

“The latest Truth Social post is different. The idea that his administration would be “great” for “reproductive rights” is hard to interpret in any other way than as an affirmatively pro-choice statement. By the common usage of the term, if you support reproductive rights it means you want broader access to abortion.”

Relax Kevin – he is lying! Those of us who are pro choice know that he’s lying and his pathetic attempt to win our vote will fail. But please continue.

“In addition to being a moral abomination, it’s unclear what this does for him politically. With this post, Trump will further alienate pro-lifers and divide his own party while doing absolutely zero to win over anybody pro-choice.”

I hope the pro-lifers turn on Trump and decide not to vote for him. Oh wait – this is why Kevin is so upset. Sorry Kevin but we are all laughing AT you.

GOP carefully build up a block of voters who were too dumb to get much of anything policy/politics, but who were absolutely sure that they wanted to vote against “baby murder” in any and all its shades. To hold on to those single issue voters the GOP needed to have a supreme court that was always just one vote away from getting rid of Roe vs Wade. Then they could ask those one issue voters to show up and vote GOP in order to save those poor little innocent babies.

Trump didn’t get or understand that ploy and appointed justices who also were too stupid to get it. Now an issue that was a sure winner for GOP, has become a sure loser, as the impracticality of abortion bans are on full display after they are no longer blocked by the SCOTUS. It’s the dog that caught the car, and the backlash has been harsh.

However, any abandonment of pro-life by GOP, will face an equally harsh backlash from those single issue morons they build up to a frenzy about “baby murder”. It will be the abandonment of “protecting babies from being murdered”. No matter how the GOP try to slice this pie, they are likely to lose more pro-life voters than they will gain pro-choice or middle ground voters. After all those year of radical rhetoric GOP will have little credibility from moderating themselves 3 months before an election.

A real pro-life policy is to keep abortion legal, safe and rare – but that is actually the democratic position.

Trump has clarified his position in enforcement of the Comstock Act to prevent interstate shipment of pharmaceuticals. He says he won’t do it. The anti-abortion (birth control?) crowd sees the Comstock Act is a way to stop drug-induced abortion without further legislation.

The Comstock Act, and it’s author, hold a special place in the hearts of eugenicists, birth control and abortion opponents, white supremacist and paternalists.

Forgive me for going back to Bruce Hall’s latest obsession with proving the obvious – that he is dumber than a dead tree. After all Bruce is shocked that Apple Computers has a high profit margin as Brucie thinks this company produces apples. But let’s take a moment to look at

Consumer Price Index for All Urban Consumers: Fruits and Vegetables in U.S. City Average

https://fred.stlouisfed.org/series/CUSR0000SAF113

Over the past 3.5 years, this price index has increased by only 13.5%. Lower than the general increase in price levels. So the inflation adjusted price of fruits and vegetables has declined.

Oh wait – Bruce Hall hates it when people eat healthy. Which is why he consumes glass of bleach each morning instead of apple juice!

Isn’t Apple the Godzilla of monopolistic competition? Certainly not a proce taker. Above-market returns.

Not the example I’d choose to argue that market structure is irrelevant, which is what Brucie is doing, whether he knows it or not.

You are right – which is why DOJ has filed an anti-trust action. Something else Brucie ignores.

Similar to how Trump complains about immigration but went out of his way to kill that Langford bill to reduce it …

Bruce Hall whines about high beef prices but when Harris decides to use competition to offset the market power of food processors, little Brucie boy goes out of his way to deny there is a problem.

Two faced dishonest and extreme stupidity all rolled into one!

Just kinda random thinking here on a Friday. The mental thoughts version of blathering.

Democrats often seem “weak” on military issues. Alot of that perception of “weakness” on military or foreign affairs is created by false rhetoric from FOX news and Republicans. But the perception IS there. And women leaders are often assumed to be less apt to be good war-time leaders (fairly or unfairly). One way Harris could differentiate herself is to come out publicly and say “I am for Ukraine being able to use long-range ATACMS missiles to defend themselves against Russia.” It would be a semi eye-popping announcement, and something donald trump would be caught flat-footed on if asked if he supports the same foreign policy stance. Frankly I think it would be a stroke of genius politically if she flew that one up the flagpole.

List of states with price gouging laws – look who lead the list!

https://www.findlaw.com/consumer/consumer-transactions/price-gouging-laws-by-state.html

The Alabama Unconscionable Pricing Act

Look closely at any Lynard Skynard concert and you will see the fans carrying copies of Das Kapital along with their Confederate flags.

@ pgl OK, that last sentence, I’m calling out as bullshit (hahahahahahahaha!!!!!!!!)

You’re getting to be a better comedy writer than most of Jimmy Fallon’s staff. Not a high standard, but still……

Just when I thought our lame press could not get dumber, I have to endure stupidity like this:

A necessary step or government overreach? Economists are divided over Kamala Harris’ plan to clamp down on food inflation

https://www.msn.com/en-us/money/markets/a-necessary-step-or-government-overreach-economists-are-divided-over-kamala-harris-plan-to-clamp-down-on-food-inflation/ar-AA1pmrNJ?ocid=msedgdhp&pc=U531&cvid=d7af97a45bbf4dab8490d7c6ebb9d10e&ei=19

Who are these economists? Someone tell the moron who wrote this trash that Stephen Moore is not an economist. OK Kenneth Rogoff is but his specialty is international macroeconomics not agricultural economics. Which I guess why the story’s focus is the retail sector. But that’s not the issue. It is more upstream.

And I see the story calling Cal-Maine as a distributor? Could this idiot reporter read their 10-K filing. Cal-Maine produces eggs.

Look – we have to endure a lot of lies from Team Trump. We have endure never ending stupidity from Bruce Hall. Could we please get just one reporter who has a damn brain?

https://www.worldgovernmentbonds.com/bond-historical-data/united-states/10-years/#title-historical-data

10 months ago the 10-year US government bond rate was almost 5%. Now it is just shy of 3.8%. We need to lower this a bit further.

This is going to make Trump very angry.

https://www.cnn.com/kamala-harris-dnc-ratings-trump-beyonce/index.html

DNC had higher ratings than RNC – AND Harris beat Trump by half a million viewers. I am sure he will demand a recount.

MSNBC has the re-count!

https://www.msn.com/en-us/news/politics/the-dnc-outperformed-the-rnc-in-a-category-that-will-probably-vex-trump/ar-AA1pn426?ocid=msedgdhp&pc=U531&cvid=e1d67f6e5349433a881cbfeedde30f4d&ei=9

As Democrats made the case for their presidential nominee this week, an average of 21.8 million viewers tuned in over four days to watch the events in Chicago, according to Nielsen data. Viewership numbers for the Democratic National Convention eclipsed the Republican National Convention’s 19.1 million average viewers in July. And, per Nielsen, the final night of the DNC, which featured Harris’ acceptance speech, drew 26.2 million viewers, slightly higher than the 25.3 million people who watched the last night of the Republican convention. Part of that may be due to the length of the nominees’ speeches: Harris’ clocked in at a relatively brief 38 minutes, while Trump’s went on for 92 minutes — the longest nomination acceptance speech on record.

Election prediction oddity: North Carolina’s Republican governor is polling 14 points behind his Democratic challenger:

https://thehill.com/homenews/campaign/4845247-north-carolina-governor-poll-mark-robinson-josh-stein/?tbref=hp

Recent polling shows North Carolina as a toss-up in the presidential race, and the polls+pundits map at 270-to-win show NC leaning toward Trump. This seems at odds with polling in the governor’s race, unless there is going to be ticket sitting on a massive scale.

NC has 16 electoral votes.

By the way, PredictIt’s Harris/Trump pricing has narrowed to 55/48. The initial narrowing was coincident with the news that JFK Jr. was about to drop out.

“The initial narrowing was coincident with the news that JFK Jr. was about to drop out.”

I thought so. Of course Jr. is a certified nutcase. Spread the word.

@ pgl Go on Youtube, look for a vlog/channel called “scaredketchup”,

Then search out this video title:

“Woke DNC Day 3 Exposed by Trump & Lauren Boebert”

Maybe best laugh I’ve had since discovering the silly Lip-sync videos.

@ pgl Apologies, this is the video I meant to link to, because it includes RFK Jr, same YT channel but the video title is:

“RFK Jr. Endorses Trump: A Match Made in Hell + DNC Recap”

RFK Jr voice is the best part.

WEIRD! No one commented on Bobo trying to look hot?

OK, wildly off topic, but last one for this comments section, I promise – parole in place for immigrant spouses:

https://www.politico.com/news/2024/08/23/texas-immigrant-spouses-legal-status-00176233

The idea is that the U.S. will allow immigrants without permanent immigrant status who are married to legal U.S. residents to live legally in the U.S. Several Republican states have sued the federal government to block this policy.

Of course, there is already a program allowing a quick path to immigration and citizenship for the spouses of U.S. citizens. There is also a fiancé visa which allows future spouses of U.S. citizens to move to the U.S. So all this suit aims to do is keep legal immigrants from having treatment similar to U.S. citizens.

This program is a legal means to unite families. This is what Republicans keep saying they want, but now they don’t? Why not? The complaint claims parole in place is politically motivated. I kinda think maybe this is another case of “every accusation an admission”. The lawsuit is itself political. Parole in place is good policy. It could normalize the status of half a million people and keep families together. It’s humane. It’s a small effort to do what legislation could have done, had Trump not told House Republicans to scuttle an immigration bill earlier this year.

Allowing this to go forward might mean bi-racial babies which of course offends Donald the Racist Trump.

Faux News interviewed Donald Luskin (yea that clown) on fiscal policy. Donnie boy tried to spin that the deficit spender was Biden and not Trump. I guess he missed the massive increase in the Federal debt under Trump’s term. No this lying supply sider tried to tell the Faux News sheep that the 2017 increased tax revenues.

Seriously – can anyone babble away on Faux News? I would say Steve Koptis send them his material but I think he already has.

I mention Luskin the Looney Tune as I found this classic stupidity on anti-trust:

The Emperors of Ice Cream By Donald L. Luskin, March 6, 2003

The FTC’s antitrust bureaucracy should be frozen in its tracks.

https://www.nationalreview.com/2003/03/emperors-ice-cream-donald-l-luskin/

“Take a look at the Federal Trade Commission’s decision this week to block the proposed merger of Nestlé Holdings and Dreyer’s Grand Ice Cream on antitrust grounds. The issues at stake are so simple that the injustice, arbitrariness, and sheer absurdity of American antitrust regulation jump out with breathtaking clarity.”

The issue is simple but it goes WAY over Luskin’s little brain.

The FTC believes “that the elimination of Dreyer’s would likely lead to anticompetitive effects in the market for superpremium ice cream.” Before this action, did you even know that there was something called a “market for superpremium ice cream”? … The diagram is titled “The Market for Food,” and the hierarchical scheme branches from there to include every possible food group. Now erase everything that isn’t under “The Market for Deserts,” and then erase everything that isn’t below “The Market for Frozen Deserts,” and then erase everything that isn’t beneath “The Market for Ice Cream.” Not much of the diagram remains (we’re already down to something the size of a postage stamp). But now erase “The Market for Cheap-o Ice Cream,” “The Market for Regular Ice Cream,” and “The Market for Premium Ice Cream.” What you have left is about the size of Abraham Lincoln’s nostril on a penny. This is “The Market for Superpremium Ice Cream.”

Luskin is basically saying the relevant market is not good ice cream but any old crappy desert. Like a Tootsie Roll is the same thing as Ben & Jerry’s. Now if you think Luskin is being dumb – you’d be right. But not as dumb as Bruce Hall who thinks iPhones are some sort of fruit.

Had the merger been allowed, the number of firms selling really good ice cream would be reduced from 3 to 2. But Luskin wants a duopoly. Why? Because this lying slime ball held stock in Dreyer’s and the FTC insisting on competition led to a stock loss for little Donnie boy.

If I understand correctly, the results say that the various variables interact according to some fx theory but forecasting is out of the equation. Given that, I see a lot reason for caution. First, on the technical side, monthly fx changes are pretty uninformative as they hide the largest parts of its variance. Second, and more importantly, this kind of analysis cannot discriminate between the direction of determination. In fact, it’s way more plausible that fx are exogenous and determine the other variables giving rise to the same results. Finally, there have been previous, flawed attempts by one of the authors to prove the same point ( https://s-e-i.ch/archive/ThePuzzleThatIsNot.htm ). Therefore, it is too early to share the conclusions of the authors.

Moses,

You linked to r** articles. Got me thinking.

I wonder if there is a short-term r**. The FT notes that long-term r** look like a sketchy concept, because estimated r** series seem to change after financial shocks, rather than to precipitate shocks.

The transition from actual low rates to high, and from high rates to low, induces financial shocks. Then r** changes. Think of Japan’s rate policy and the recent unwinding of carry trades – big pressure, but quickly resolved. It could have been worse. Think of the joint losses in stocks and bonds in 2022. That was worse.

The adjustment to new rates may be more shocking than the rates themselves, once arrived at. So a long-run r** might be hard to identify in the data because the short-term r**, and adjustments to short-term r**, obscure long-term r**. The rate at which finances are stable is the prevailing rate. The prevailing rate is short-term r**.

Wow. That’s not my best writing. Sorry.

It’s a fascinating topic. I still like reading WSJ, but FT often seems to “get into the weeds” on rates and that better than WSJ does.

The end of LIBOR doesn’t seem to be quite as rocky as some were predicting.