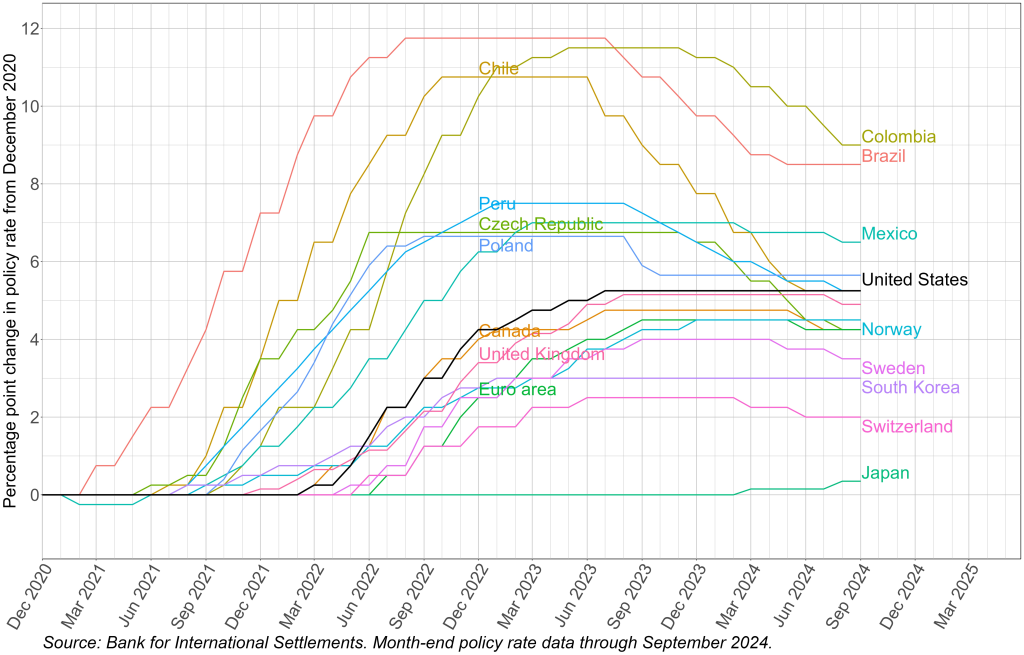

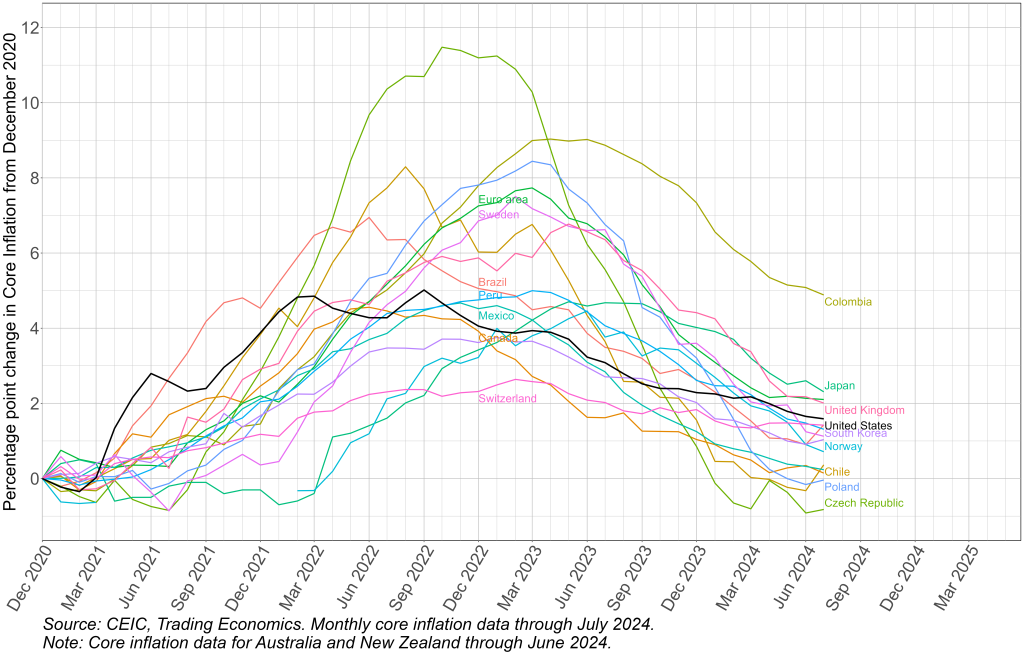

From the article (published 9/10), two key graphs:

So…

…with inflation nearly down to target levels while signs of economic slowing mount, the Fed can afford to start reversing its exceptional monetary tightening.

So in today’s post, Kamin makes the case for 0.5% cut:

If the economy is close to balance and inflation likely to decline further, then interest rates should also be at normal levels. Economists refer to these as “neutral” rates, which means “the short-term interest rate that would prevail when the economy is at full employment and stable inflation.” Neutral interest rates cannot be directly observed, but reasonable estimates would center around three percent: two percent to compensate investors for inflation and an additional one percent to reflect real returns to capital. In fact, in the projections last released in June, Fed officials put that rate at 2.8 percent.

So, with inflation largely contained and the economy essentially in balance, interest rates should be closer to three percent than five percent. And even if there is greater strength in the economy than most economists judge, or if neutral interest rates are higher, there is still a very sizeable cushion between where interest rates are and where they need to be. This means that even a 0.5 percent rate cut can be made with little risk of re-igniting inflation.

From Kamin’s lips to the FOMC’s ears. But when the Fed has the tightest policy stance of any developed-economy central bank, and third tightest of any central bank considered by Kamin, “can afford to start” seems tepid. In terms of real, inflation-adjusted rates, the Fed has been tightening policy recently. A 25 basis-point cut now would merely reverse some of the tightening in real rates since the Fed stopped raising the nominal target rate.

Hawkish, indeed.

Not in the habit of agreeing with anyone from AEI but yea – I think a 0.5% rate cut is called for.

His cross-national comparisons of how hawkish the FED is relative to other Central Banks relies on inflation but does not seem to consider where GDP is relative to potential GDP. Is it the case that the US economy has been near full employment for quite a while?

Shall we nickname Steve Kamin “the one smart guy at AEI” ?? That’s really how I think of Mr Kamin (I’m pretty certain Mr Kamin has other great qualities, I apologize for “selling him short”/

I have only read those two pieces Dr. Chinn highlighted and both represented good economics.

I’m still drinking this afternoon, but I think we can label Mr Kamin as pretty “solid/dependable”. Or my name isn’t “uncle weirdo’s in the drink again”

Good point! I have done a lot of experimenting with different measures of the output gap to see if that helps explain the Fed’s relative hawkishness. It turns out that none of those measures explain why the Fed kept rates so high, and most of them don’t even have the right sign in a regression. My conjecture is that the strength of the US economy has indeed been an important factor in the Fed’s tight monetary policy, but that other central banks paid less attention to their economies’ weakness in their desire to quash inflation.

Trump media cheated an early investor? Nah, really?:

http://www.cnbc.com/amp/2024/09/17/djt-trump-media-stock-lawsuit-lockup.html

Wonder whether that will affect the price just before lock-up ends. It implies dilution.

Oh, and:

https://www.google.com/amp/s/www.marketwatch.com/amp/story/donald-trump-could-sell-his-djt-stock-after-saying-he-wont-but-that-might-spark-lawsuits-98e91c14

Seems like I’m not the only one who thinks Trump is legally bound by his public declaration he won’t sell shares.

“Donald Trump could sell his ‘DJT’ stock after saying he won’t — but that might spark lawsuits”

Even if he were not legally bound – that declaration would be a clear pump and dump scheme which itself it is illegal.

Now I have been saying shareholders should sue this turkey for many months.

“Fed policymakers have faced a deeply asymmetric challenge: A moderate recession would be viewed as an acceptable price to pay for getting inflation back under control, but continued high inflation that led to a de-anchoring of inflation expectations and eventual stagflation”

I have heard this claim from others but if the late James Tobin had seen the idea that moderate recessions were ever “acceptable” he would set the person making that assertion straight.

Recessions do more harm, especially to those first fired and last hired, than does moderate inflation. Kamin’s passive construction – “would be viewed” – doesn’t tell us who holds this view, for obvious reason; it’s Kamin’s view and that of his employer.

Remember when Joseph went on and on and on over his pointless charge that our host should talk about those “Biden” tariffs. Well maybe Joseph should read this:

Rubio leads call to reimpose Trump steel tariffs on Mexico

https://www.msn.com/en-us/news/politics/rubio-leads-call-to-reimpose-trump-steel-tariffs-on-mexico/ar-AA1qIDnJ?ocid=msedgntp&pc=U531&cvid=f13981cdd5494d9f86551d9e79552f51&ei=17

‘A bipartisan group of senators is calling on President Biden to reinstate duties on Mexican steel to guard against Chinese backdoor access to the U.S. market. In a letter led by Sen. Marco Rubio (R-Fla.), the lawmakers ask Biden to set a 25 percent tariff on all Mexican steel imports, following a 2019 agreement that slashed those tariffs but left the option open to reimpose them if one country’s production surged.’

Got that Joseph? The tariffs were slashed back in 2019. Now I think they should not raise them to 25% but if they do, let’s call this the Rubio tariff.

Readers of the blog probably fell on the floor laughing when Bruce Hall said global warming had lots of benefits. Well – his hero said the same thing!

‘More ignorant than a 5 year old’: Trump mocked over why he says global warming is ‘a good thing’

https://www.msn.com/en-us/news/politics/more-ignorant-than-a-5-year-old-trump-mocked-over-why-he-says-global-warming-is-a-good-thing/ar-AA1qJXWK?ocid=msedgdhp&pc=U531&cvid=6c6e726b9730437698e71060ad275c59&ei=10

Former President Donald Trump said that global warming is “a good thing” because it will give Michigan residents more seafront property. Speaking during a Flint, Michigan town hall on Tuesday, “Nuclear power — when I hear these people talking about global warming — that’s the global warming that people have to worry about. Not that the ocean’s gonna rise in 400 years an eighth of an inch.” Trump continued, “And you’ll have more seafront property, right, if that happens. I said is that good or bad? I said isn’t that a good thing? If I have a little property on the ocean, I have a little bit more property, I have a little bit more ocean.

HEY! Brucie boy says he is from Michigan. Is he buying up places that will soon become seafront property?

Apparently the Trump handlers are almost in panic because Trumps most recent bed-warmer – the lunatic Laura Loomer – is putting all kinds of idiocies in his ears. As we all know there is no brain filter; its in the ear and out the mouth of Orange Jesus.

https://jabberwocking.com/raw-data-the-price-of-oil-2/

Raw data: The price of oil

Kevin Drum documents that the inflation adjusted price of oil over the past twenty years on average is much higher than it was before we invaded Iraq.

Odd – we never hear Republicans noting that. Or fake Ph.D. EJ Antoni. In fact Kudlow the Klown told us 20 years ago that this invasion would lower oil prices to $12 a barrel.

Vance says Ohio rumors come from locals. His ‘proof’ is from the internet.

https://www.msn.com/en-us/news/politics/vance-says-ohio-rumors-come-from-locals-his-proof-is-from-the-internet/ar-AA1qMzpu?ocid=msedgdhp&pc=U531&cvid=abe5af6786c845ae839f66465b81777d&ei=12

Little JD is a liar but not a very good one. This excuse for his vile racism is Bruce Hall level STOOOOPID!

https://www.msn.com/en-us/money/markets/pressed-on-grocery-prices-trump-struggles-to-answer-again/ar-AA1qMJj6?ocid=msedgdhp&pc=U531&cvid=d3075f69bee4467e86bb5eb8dfe5a193&ei=8

The Trump plan to lower grocery prices is to get rid of windmills? That would lower grocery prices by 50%? Trump also suggested putting tariffs on imported food products. Excuse me but I thought that raised the prices of imported food.

Did Trump learn economics from Bruce Hall or what?

pgl: “The tariffs were slashed back in 2019.

So you are saying that Trump slashed tariffs? So what exactly is your complaint about Trump.

And from your own article: “The Biden administration has kept most of his predecessor’s levies in place, and in May, raised some others on an additional $18 billion in Chinese imports, such as electric vehicles and semiconductors.”

So Biden has not only continued the remaining Trump tariffs, he has increased them.

Again, exactly what is your complaint about Trump? Does Biden just get a pass? You are sounding like a MAGA-hatter who can find no fault in his dear leader.

Still grinding? I used to look forward to your comments. But I guess you’ve turned troll. Fine – I’m done with your worthless rants.

You are unable to respond to your own citations which make you sound foolish. So you can only resort to “Nah, nah, nah. I can’t hear you.” When you are in a hole, stop digging.

Hey – I’m almost down to China! What? What? Put a tariff on my shovel?!

You two guys are on the same side, looking from different angles.

Come on, be nice to your neighbor (not being facetious) When uncle Moses drinks ~~~seeing two good peoples argue and get the knife out on each other makes Uncle sad. After about 2005 (???)) uncle doesn’t have much margin left in the tank for bad feelings. Straighten out now or you’re going to your room with no dark Jalapeno gravy on your biscuits. ON top of it your uncle will be near a stomach ulcer.

Explain to me how the damage of tariffs can be reversed by removing them again?

The loss of confidence in a stable trading system is gone for good. Investments to deal with the interruption from tariffs are money gone and will not be recovered by reversal of tariffs. You would actually have to reinvest additional money to get back to the old production patterns.