With US HICP out today:

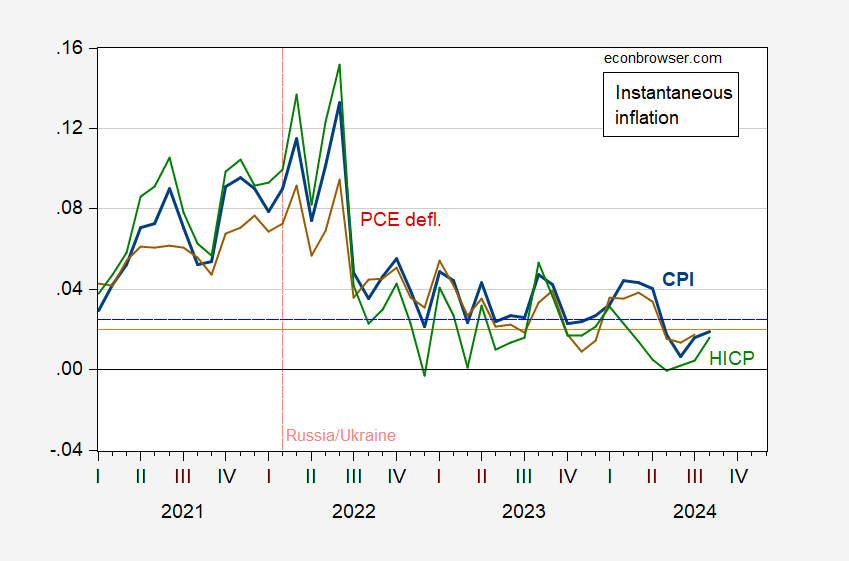

Figure 1: Instantaneous inflation (T=12, a=4) for CPI (bold blue), PCE deflator (brown), and HICP (green), per Eeckhout (2023). Tan dashed horizontal line at 2% target for PCE deflator, blue dashed line corresponding target for CPI, HICP, assuming 0.5 ppts difference. Source: BLS, BEA, Economic Commission, and author’s calculations.

A key difference between US CPI and US HICP is that the latter does not include cost of shelter.

FED cuts rate 0.5%! YEA!

Why Do Workers Dislike Inflation? Wage Erosion and Conflict Costs

Joao Guerreiro, Jonathon Hazell, Chen Lian & Christina Patterson

https://www.nber.org/papers/w32956

How costly is inflation to workers? Answers to this question have focused on the path of real wages during inflationary periods. We argue that workers must take costly actions (“conflict”) to have nominal wages catch up with inflation, meaning there are welfare costs even if real wages do not fall as inflation rises. We study a menu-cost style model, where workers choose whether to engage in conflict with employers to secure a wage increase. We show that, following a rise in inflation, wage catchup resulting from more frequent conflict does not raise welfare. Instead, the impact of inflation on worker welfare is determined by what we term “wage erosion”—how inflation would lower real wages if workers’ conflict decisions did not respond to inflation. As a result, measuring welfare using observed wage growth understates the costs of inflation. We conduct a survey showing that workers are willing to sacrifice 1.75% of their wages to avoid conflict. Calibrating the model to the survey data, the aggregate costs of inflation incorporating conflict more than double the costs of inflation via falling real wages alone.

Brought to us by Tyler Cowen of course. Kevin Drum had an interesting retort which I will share in a bit.

https://jabberwocking.com/wages-have-been-outpacing-inflation-for-five-years/

Wages have been outpacing inflation for five years

You may wonder how Kevin Drum came up with this title but he explains his graph even as he explains his misgivings of the message Cowen tried to point:

‘After the pandemic, wages outpaced inflation substantially. Inflation later clawed back some of the increase, but wages never fell behind CPI. And thanks to a tight labor market, after 2022 wages quickly started outpacing inflation again. There was never any wage erosion. In any case, I’d offer a different and more obvious explanation for dislike of inflation: rising prices stare you in the face but rising wages are quickly forgotten. Plus people are bad at math. And higher wages always seem like the well-deserved fruits of hard work, while higher prices are the demons constantly trying to take them away.

NOTE: I’m using the Atlanta Fed Wage Tracker for wages because it’s more accurate than the usual BLS numbers, which suffered in the early stages of the pandemic from composition effects (i.e., low-wage workers were laid off more, which removed them from the average and made it look like wages were spiking upward). The Atlanta tracker compares the same workers from year to year, and also provides median figures, which eliminates outlier effects.”

One of our host’s recent posts had a slight misgiving re BLS data on these matters during the pandemic. It seems the Atlanta Fed Wage Tracker was not as thrown off. as much.