Reader Moonmac argues the case that we are in a recession, in a rejoinder my paper “Recession since 2022? A Critique“:

McService Job Nation disagrees even though they’re employed. Gainfully is a different matter.

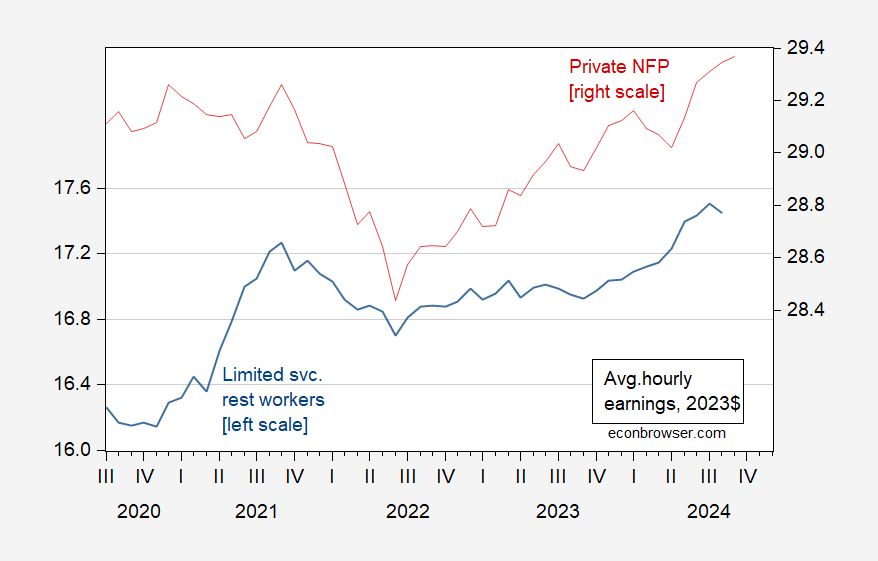

I think the data is suggests otherwise. While employment is growing at limited service restaurants (aka fast food restaurants), wages are growing both relative to average wages, and in real terms.

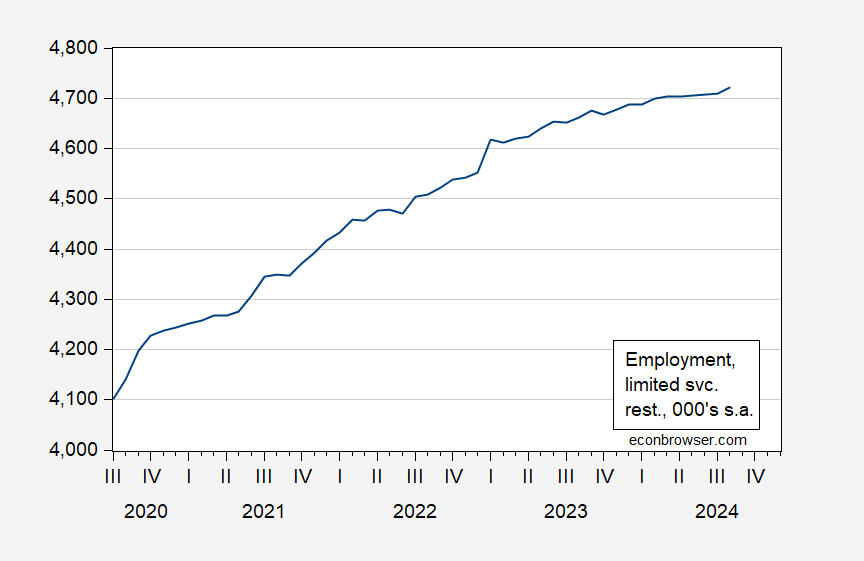

Figure 1: Employment in limited service restaurants, 000’s (blue). Source: BLS.

Figure 2: Average hourly wages in limited service restaurants (blue, left scale), in private nonfarm payroll sector (red, right scale), both in 2023$ (deflated using CPI-all urban). Source: BLS, and author’s calculations.

What is it about people that they don’t look at freely available data? Is it Excel-phobia, or they can’t do division even with a calculator?

Given how this new troll was incapable of clearly stating any real assertion – your ability to tease out a post taking down his rant was quite good.

All Employees: Leisure and Hospitality: Limited-Service Restaurants and Other Eating Places in California

https://fred.stlouisfed.org/series/SMU06000007072259001SA

Fred shows this sector’s employment for California alone. CALI has seen a big increase in its minimum wage which a lot of right wingers claimed would kill this sector in California. The actual employment data shows otherwise.

I’m not going to give the name, but it is a chain fastfood restaurant where I live. “Regional” you could describe it, not really national. Semi-popular. I do not know “for a fact”, but I strongly suspect they make more than McD’s workers and I also suspect their management program (a kind of internal career advancement tool or “carrot”) is better because I see much less turnover of their workers than at local McDonalds. Me and a friend had breakfast there this morning. A LARGE “Spanish burrito”, medium coke, biscuits and gravy (two biscuits with WAY too much gravy), and a medium coffee, with 3 creams and sugar. $9.06 (that’s $9.06 WITH tax included). i.e. TWO people eating a large breakfast for $4.53 per person. People can avoid much of inflation (and really eliminate it entirely) if they use their brains when consuming products/services. Now…… if they are semi-illiterate, like Bruce Hall, maybe not.

Another choice is buying breakfast biscuits at the grocers for about $1.25 a piece to pop into the microwave and fix coffee at home for pennies a large cup.

Instead of KFC, supermarket chicken $5.99 for a WHOLE chicken pre-cooked/done rotisserie style. People can do what they want. Just don’t expect us to cry for the Bruce-ies’ of the world who can’t use their brain when consuming products.

it is quite obvious moonmac is interested in making a political statement on the economy, not an educated statement. moonmac is not very intelligent.

Imagine, if you will, that political futures markets are a hedging tool. If so, then which ever political outcome is most costly to one’s firm is the outcome one would buy in futures markets.

Over at Vox, there is analysis suggesting that a Trump win would be more costly to business than a Harris win:

https://cepr.org/voxeu/columns/what-financial-markets-say-about-economic-implications-potential-trump-election

That should mean a stronger bid for Trump in political futures markets, which is what we see recently:

https://www.predictit.org/markets/detail/7456/Who-will-win-the-2024-US-presidential-election

https://kalshi.com/live/trump-v-harris

This hedging idea is also consistent with the recent divergence between pools and betting markets.

The problem with this analysis is my priors. I agree that a Trump presidency would be bad for the economy, and I don’t want the recent increase in betting odds in favor of a Trump win to reflect a pure bet on the election outcome.

That said, there is a potential here for positive feedback. Let’s assume the Vox analysis is correct – the general expectation among market participants is that a Trump win would be bad for the economy. That would lead to bidding up the price of Trump election futures. The rise in betting market odds for a Trump win could give the impression that a Trump win is likely, inducing a stronger bid for Trump in betting markets. And so on.

Similarly, we pay attention to betting market prices on the outcome of the election in part because polls have been pretty badly wrong in recent elections, but to some extent, polling results drive betting market prices.

Currently, polling and most election models give Harris a slight edge over Trump, while betting markets give Trump a substantial edge:

https://www.270towin.com/

That is consistent with the notion that betting markets are being used as a hedge; firms have less need to hedge a Harris win than a Trump win.

If Harris wins, I’ll be reminding y’all of this notion, because it would explain the direction of divergence between polling and market pricing and the failure of markets to predict the outcome. It Trump wins, it will instead reinforce the superiority of betting markets over polling and punditry.

This should be a very interesting month for nonfarm payroll. Bloomberg shows a forecasted increase of 111K as of 10/28/2024. Econoday shows a range of 57K to 180K, with a median of 125K. Trading Economics shows a forecast of 180K. Using a trend model with a break, I calculate a forecast of 117K, but using a log difference model, I show a forecast of 173K. When comparing the accuracy of the trend model and the log difference model, the trend model is favored. Using a detail model, I show a forecast of around 200K.

I don’t see any mention in your model description of the Boeing strike or hurricanes. Assuming your forecast doesn’t account for those factors, then let’s take your estimates as a starting point and do some math.

The BLS strike report says 44,000 workers were on strike around the time of the October survey. That gives us 73,000 or 126,000 or 156,000. The hurricanes’ effects are less certain. Goldman says they’ll reduce employment by 40,000-50,000. Goldman doesn’t know much more than the rest of us, but let’s say 45,000. We’re down to 28,000, or 81,000 or 155,000, for an average of 91,333.

ADP data are due Wednesday, but probably shouldn’t be used to adjust forecasts for BLS data, especially for October. The impact of weather on BLS and ADP data collection could be quite different.

Correct me if I’m wrong about your forecasts accounting for strikes and weather.

Good points. I did not include the strike or hurricane statistics.

https://fred.stlouisfed.org/series/BAA

Moody’s Seasoned Baa Corporate Bond Yield

Over the weekend I shared that incredibly dishonest Trump closing ad on the economy knocking down his lies on net wealth and employment but I was at a loss to figure out WTF this lying clown came up with interest rates rose from 2% to 10%. I still don’t know unless he is talking about that NY business litigation where he paid 2% on his debt even though the expert witness said the market rate on his junk bonds should have been 10%.

I thought just now maybe he was talking about the interest rate on long-term corporate bonds with Baa credit ratings. Odd – even at the depth of his weak 2020 economic this rate was 3.16% but is now 5.5% under the strong Biden economy. Is that his closing message – he can get interest rates lower by tanking the economy one more time. MAGA.

Trump’s Puerto Rico fallout is ‘spreading like wildfire’ in Pennsylvania

https://www.msn.com/en-us/news/politics/trump-s-puerto-rico-fallout-is-spreading-like-wildfire-in-pennsylvania/ar-AA1t5Jjw?ocid=msedgdhp&pc=U531&cvid=2180138e65274e6288a4fd1a31280cd7&ei=7

The MSG Trump rally is costing him big time. Time to get Stephen Miller on the job demanding brown people cannot vote.

Calling Americans fascist is different than a joke on an island?

Trump is a fascist. John Kelly explained why. Oh wait you are Hitler. Never mind.

I know you are intentionally dishonest here. but let us clear up the wording. people are not calling Americans fascist. they are calling trump a fascist. trump, the convicted felon, rapist, fraud and generally disgusting human being. that is who they are calling a fascist.

Macroduck: “That is consistent with the notion that betting markets are being used as a hedge; firms have less need to hedge a Harris win than a Trump win.”

Oh, come on. This is embarrassing. A couple of weeks ago you were crowing about Harris’s lead in the prediction markets and now that it has turned around you have to invent corporate hedging as an excuse?

Exactly how big do you think these markets are? It’s absurd to think that multi-million or billion dollar companies could purchase a significant hedge that would be meaningful to their bottom line.

A simpler explanation is that a one or a few billionaires like Musk, for whom money is nothing, have pumped a few million into the prediction markets just to pump up Trump’s appearance. It’s the equivalent of stacking a Fox News internet poll and I think those prediction markets are about as reliable.

Are you referring to that whale? BTW – Trump is fatter than even the biggest whale.

You amaze me. Any time you don’t understand something, you assume it’s wrong. Big old brain on you, huh?

Remember when I explained how an increase in bond market volatility would mean higher yields, all else equal, because there’d be a volatility premium, and you thought I was recommending that people sell bonds? Remember when you lectured me on how liquidity couldn’t be a problem in U.S. markets? And here you go again.

So, let’s eview what I actually wrote here:

1) A sketch of how election futures markets might interact with business risk and polling. Not a claim that they do, only that they might.

2) AN ADMISSION OF MY PRIORS.

3) A discussion of what both a Harris win and a Trump win would mean for my little idea, including which outcome would be consistent with that idea.

Your response? Pointing out that I favor Harris; read point 2.

Now, try to figure out whether you’re capable of understanding 1) and 3) and let us know how that goes.

Why so triggered by things you don’t understand?

recent data suggests the betting markets are being influenced by a single foreign entity, located in France. around $30million spent, last time I heard. betting markets and partisan polls are being used to try and influence the election. neither may be accurate, but will be used as evidence for a fraudulent election.

the big picture is not if those betting markets really matter, it is that they will be used as evidence to try and overturn the election. that is the problem.

Oh, I understand your “little idea” perfectly. But it is silly and absurd in the real world. There simply does not exist enough hedging available to make your “little idea” practical to any corporation. The notion that that corporations are hedging the business risks of a Trump presidency by betting in the prediction markets is laughable.

Laughable to the guy who doesn’t understand volatility, doesn’t understand liquidity…doesn’t understand markets? I guess I’ll just rethink everything I ever…nah.

Oh, my. Someone is in a snit because their brilliant “little idea” was mocked.

From your reaction I can only guess you were that person in school who no one liked because you thought they were smarter than everyone else even though you were not. You should learn to get over it because it is only going to cause you misery in life.

Ad homenim – how like you. You’ve made up a response you’d like to believe I have, with no evidence. No evidence – also like you.

Interesting that about 3/4 of the Inflation Reduction Act spending is going to red districts and not a single Republican voted for it. (did MTG say “Thank you Joe Biden” for those battery manufacturing jobs in her district )

“But red districts have emerged as the climate law’s biggest winners. According to The Post’s analysis, congressional districts that favored Trump in the 2020 election received three times as much clean energy and manufacturing investments as those that leaned toward Biden.” https://wapo.st/3YsKHmP

Also – I would like to remind voters that Trump and the GOP keep saying the climate change is a hoax – but climate change really doesn’t care what Trump thinks and says and extreme weather events are set to get worse if we don’t start reducing our greenhouse gas emissions. Also astonishing to me that the corporate news media has completely ignored climate change as an issue although Harris/Walz keep talking about need to address it at rallies and Trump’s attempt at addressing climate change is to tell rambling stories about hydrogen cars and electric boats and how much he hates wind-generated electricity because he thinks the electric gird cuts out when the wind stops blowing. https://wapo.st/3NGHsTA

(Credit to the NY Times – they have published some articles on what a disaster a second Trump admin would be: https://www.nytimes.com/2024/10/22/opinion/trump-second-term-corruption.html and they did have enough journalistic fortitude to endorse Harris: “Kamala Harris has demonstrated care, competence and respect for the Constitution — the fundamental qualities necessary for high office.” https://www.nytimes.com/2024/09/30/opinion/editorials/kamala-harris-2024-endorsement.html )

Gift links to the WP – might as well use them before my subscription runs out at end of the month – I am now down to Bloomberg as my primary news source.